Since QuickBooks Self-Employed is no longer offered to new subscribers, this QuickBooks Online vs Self-Employed comparison is focused on whether current QuickBooks Self-Employed subscribers should convert to QuickBooks Online.

QuickBooks Online vs Self-Employed: Features & Differences

This article is part of a larger series on Accounting Software.

QuickBooks Online and QuickBooks Self-Employed are both accounting software solutions offered by Intuit, but they serve different types of users and have different feature sets. While QuickBooks Online is a full-featured double-entry bookkeeping system capable of tracking assets, liabilities, income, and expenses of Small and midsize businesses (SMBs) small and midsize businesses , QuickBooks Self Employed is a simple-to-use way for microbusinesses with no employees to track income and expenses.

- QuickBooks Online: Best for small businesses requiring payroll, inventory tracking, job costing, budgeting, or scalability

- QuickBooks Self-Employed: Best for freelancers and self-employed individuals seeking basic bookkeeping and federal tax support

Intuit now offers QuickBooks Solopreneur, which is part of the QuickBooks Online product lineup and builds on the success of QuickBooks Self-Employed. You can learn more in our QuickBooks Solopreneur review. If you currently have QuickBooks Self-Employed, you can continue your subscription, but Intuit no longer offers new ones.

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting platform for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface. We immerse ourselves in every system we review by exploring the features down to the finest nuances.

We have an extensive history of reviewing QuickBooks products, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study, helps us understand how the different QuickBooks products compare with each other and how they work in real-world scenarios.

QuickBooks Online vs Self-Employed At a Glance

Online | Self-Employed | Solopreneur | |

|---|---|---|---|

Monthly Pricing Plans | $30 to $200 | $15 to $35 | $20 |

Maximum Users | 25 | 1 | 1 |

Bank Reconciliation | ✓ | ✕ | ✕ |

Double-entry Accounting | ✓ | ✕ | ✕ |

Send Invoices & Track Collections | ✓ | Weak | ✓ |

Record & Track Expenses or Bills | ✓ | ✕ | ✓ (Expenses only) |

Make Bill Payments | ✓ | ✕ | ✓ |

Create Automatic Reminders | ✓ | ✕ | ✓ |

Create Estimates | ✓ | ✕ | ✓ |

Track Inventory | ✓ | ✕ | ✕ |

Capture & Organize Receipts | ✓ | ✓ | ✕ |

Manage 1099 Contractors | ✓ | ✕ | ✓ |

Time Tracking | ✓ | ✓ | ✓ |

Track Income & Expense By Project | ✓ | ✕ | ✕ |

Track Assets & Liabilities | ✓ | ✕ | ✕ |

Manage Payroll | Add-on | ✕ | ✕ |

QuickBooks Self-Employed is no longer offered to new subscribers |

Use Cases and Pros & Cons

User Reviews: Tie

Average Rating on Third-party Sites | ||

Users Like |

|

|

Users Dislike |

|

|

Although QuickBooks Self-Employed technically scored higher, the user reviews were too close to call one clear winner. We analyzed the reviews for each below.

Many users find QuickBooks Online user-friendly, especially for basic tasks like invoicing and expense tracking. They also appreciated its wide range of features including bank reconciliation, reporting, and its integration with other apps.

Some reviewers also mentioned that while it is competitively priced, many found that the costs added up as they needed more features. Also, while it’s generally considered easy to use, some mentioned a learning curve, especially for users coming from the desktop version.

QuickBooks Online earned the following average scores on popular review sites:

QuickBooks Self-Employed is generally well-regarded among freelancers and sole proprietors, but some limitations are worth noting. Features like mileage tracking and income/expense categorization resonate with self-employed users. They also appreciate features like estimated tax tracking and reports for tax time.

However, while it is good for basic needs, it likely won’t scale with growing businesses. Features like double-entry accounting are absent, and compared to free alternatives, some find the subscription fee a turnoff, especially for those with simple needs.

QuickBooks Self-Employed earned the following average scores on popular review sites:

Pricing: Tie

Monthly Pricing | $30 to $200 | $15 to $35 |

Number of Users | 1 to 25 | 1 |

Number of Billable Clients | Unlimited | Unlimited |

Free Trial | 30 days | None |

QuickBooks Self-Employed is no longer available to new subscribers |

It is difficult to compare QuickBooks Online vs Self-Employed across the board. This is because QuickBooks Online offers a range of subscription plans based on the number of users and features needed while QuickBooks Self-Employed offers plans that are bundled with or without tax filing options. Therefore, we call this category a tie.

QuickBooks Online has four pricing plans to choose from, each with its own set of features and allowed users. See below for more information about the features included with each plan.

- Simple Start: $30 per month for one user

- Essentials: $60 per month for up to three users

- Plus: $90 per month for up to five users

- Advanced: $200 per month for up to 25 users

In addition to the allowed users, the QuickBooks Online plans vary in the features included. Check out our QuickBooks Online plans comparison to learn about the features of each.

- Self-Employed: $15 per month for one user

- Self-Employed Tax Bundle: $25 per month, includes one federal and one state tax return filing through TurboTax plus the ability to pay quarterly estimated taxes online

- Self-Employed Live Tax Bundle: $35 per month, includes everything in the Self-Employed Tax Bundle plus access to a certified public accountant (CPA) who will do a final review of your tax return.

Features: QuickBooks Online Wins

QuickBooks Online Plus | QuickBooks Self-Employed | |

|---|---|---|

Monthly Pricing | $90 | $15 |

Create & Send Invoices | ✓ | ✓ |

Connect Bank Accounts | ✓ | ✓ |

Bank Connections | ✓ | ✓ |

Invite Accountant to Access Your Books | ✓ | ✓ |

Bank Reconciliation | ✓ | ✕ |

Track Assets & Liabilities | ✓ | ✕ |

Add Payroll | ✓ | ✕ |

QuickBooks Live (Add-on) | ✓ | ✕ |

Manage & Track Unpaid Bills | ✓ | ✕ |

Record Multicurrency Transactions | ✓ | ✕ |

Handle Inventory | ✓ | ✕ |

Track Job Profitability | ✓ | ✕ |

Many of the same features can be found in both QuickBooks Online and QuickBooks Self-Employed, but the major difference between QuickBooks Online and Self-Employed is that the latter doesn’t track assets and liabilities, so you can’t reconcile your bank accounts or manage and track unpaid bills. Because of that, QuickBooks Online takes the lead in this category.

Accounts Payable (A/P): QuickBooks Online Wins

QuickBooks Online Plus | QuickBooks Self-Employed | |

|---|---|---|

Manage & Track Unpaid Bills | ✓ | ✕ |

Pay Bills Directly From Software Using Bill Pay | ✓ | ✕ |

Capture Expense Receipts | ✓ | ✕ |

Create Recurring Payments | ✓ | ✕ |

Record Purchase Order (PO) | ✓ | ✕ |

Enter a Vendor Credit | ✓ | ✕ |

Pay an Independent Contractor | ✓ | ✕ |

QuickBooks Self-Employed does not track unpaid bills, usually referred to as A/P. With QuickBooks Online, you can track bills, manage vendor credits, and set up recurring payments. Therefore, QuickBooks Online is the clear winner in this category.

It even lets you pay bills directly from the software with QuickBooks Bill Pay, using automated clearing house (ACH) or check while you can only record payments made outside the software with QuickBooks Self-Employed. You can also track A/P aging with QuickBooks Online, so you can see which bills are outstanding and how much you owe each vendor.

Accounts Receivable (A/R): QuickBooks Online Wins

QuickBooks Online Plus | QuickBooks Self-Employed | |

|---|---|---|

Create & Send Invoices | ✓ | ✓ |

Customize Invoices With Logo | ✓ | ✓ |

Email & Print Invoices | ✓ | ✓ |

Choose From Different Invoice Templates | ✓ | ✕ |

Create Recurring Invoices | ✓ | ✕ |

QuickBooks Online also aces this category. While both platforms allow you to create and send invoices, the invoice customization options are limited with QuickBooks Self-Employed. QuickBooks Online allows you to send invoice reminders and create recurring invoices as well as create estimates and turn them into invoices once they are accepted by the customer—all features that QuickBooks Self-Employed lacks. You can also track A/R aging with QuickBooks Online, which is unavailable with QuickBooks Self-Employed.

There are a couple of major problems with the invoicing features of QuickBooks Self-Employed. First, creating and even receiving payment for an invoice does not record any income in your books. This means that it’s possible to properly record the receipt of an invoice payment, but not record the payment received as income.

The second problem is how the line-item descriptions, called product or service items, are managed. Once created, you can’t edit a product or service item when adding it to another invoice. The practical implication of this is that you’ll end up typing custom descriptions for every invoice you issue.

Reporting: QuickBooks Online Wins

QuickBooks Online Plus | QuickBooks Self-Employed | |

|---|---|---|

Balance Sheet | ✓ | ✕ |

Profit & Loss (P&L) Statement | ✓ | ✓ |

Statement of Cash Flows | ✓ | ✓ |

Mileage Log | ✓ | ✓ |

General Ledger (CL) | ✓ | ✓ |

Schedule C Worksheet | ✕ | ✓ |

A/R Aging | ✓ | ✕ |

A/P Aging | ✓ | ✕ |

Income/Loss by Month | ✓ | ✕ |

Income/Loss by Customer | ✓ | ✕ |

Income/Loss by Class | ✓ | ✕ |

Income/Loss by Project | ✓ | ✕ |

Unbilled Charges | ✓ | ✕ |

Unbilled Time | ✓ | ✕ |

Expenses by Vendor | ✓ | ✕ |

Trial Balance | ✓ | ✕ |

Receipts | ✕ | ✕ |

QuickBooks Online offers a wide variety of customizable reports, including a Balance Sheet. Since QuickBooks Self-Employed doesn’t track assets and liabilities, it cannot create a complete set of financial statements, which must include a Balance Sheet. This is one of the reasons why QuickBooks Online leads in this category.

QuickBooks Self-Employed’s available reports are limited to a profit and loss statement, mileage log, and general ledger. It also offers two reports that are unavailable with QuickBooks Online—a Schedule C worksheet and Quarterly Estimated Taxes.

Sales & Income Tax: QuickBooks Online Wins

QuickBooks Online Plus | QuickBooks Self-Employed | |

|---|---|---|

Add Sales Tax to Invoices | ✓ | ✓ |

Track Independent Contractors | ✓ | ✓ |

View Sales Tax Liabilities in Detail | ✓ | ✓ |

Estimate Quarterly Taxes and Make Payments | ✕ | ✓ |

Pay Sales Tax Liability | ✓ | ✕ |

File Sales Tax Returns | ✓ | ✕ |

Both allow you to add sales tax to invoices and track independent contractors. But the difference between QuickBooks Online and Self-Employed is that QuickBooks Online offers a robust set of sales and income tax features, including a sales tax center and tax forms that cater to the needs of large businesses, so we selected it as the winner. On the other hand, QuickBooks Self-Employed offers an efficient set of features focused on helping self-employed individuals manage their sales and income tax operations.

Ease of Use: Tie

QuickBooks Online Plus | QuickBooks Self-Employed | |

|---|---|---|

Accessibility | Cloud | Cloud |

Set Up in a Few Minutes | ✓ | ✓ |

Shortcut Buttons | ✓ | ✓ |

Unlimited Customer Support | ✓ | With purchase of Live Tax Bundle |

QuickBooks Online is more complex than QuickBooks Self-Employed and offers more features, which can make it more difficult for some users to learn and use the platform. However, it provides more flexibility and customization options.

QuickBooks Self-Employed is simpler and easier to use, making it the better choice for self-employed individuals and freelancers requiring basic accounting software that can handle their expense tracking, and tax management needs. We called this category a tie because each plan is specific to the needs of its intended users.

QuickBooks Online is a more comprehensive accounting software designed for SMBs. It has a more complex user interface than QuickBooks Self-Employed, but it offers more customization options and integrations with third-party apps.

The learning curve for QuickBooks Online can be steep for new users, but it provides plenty of resources, such as tutorials, forums, and customer support, to help you get started. Once you’re familiar with the software, it can be easy to use, especially for businesses with complex accounting needs.

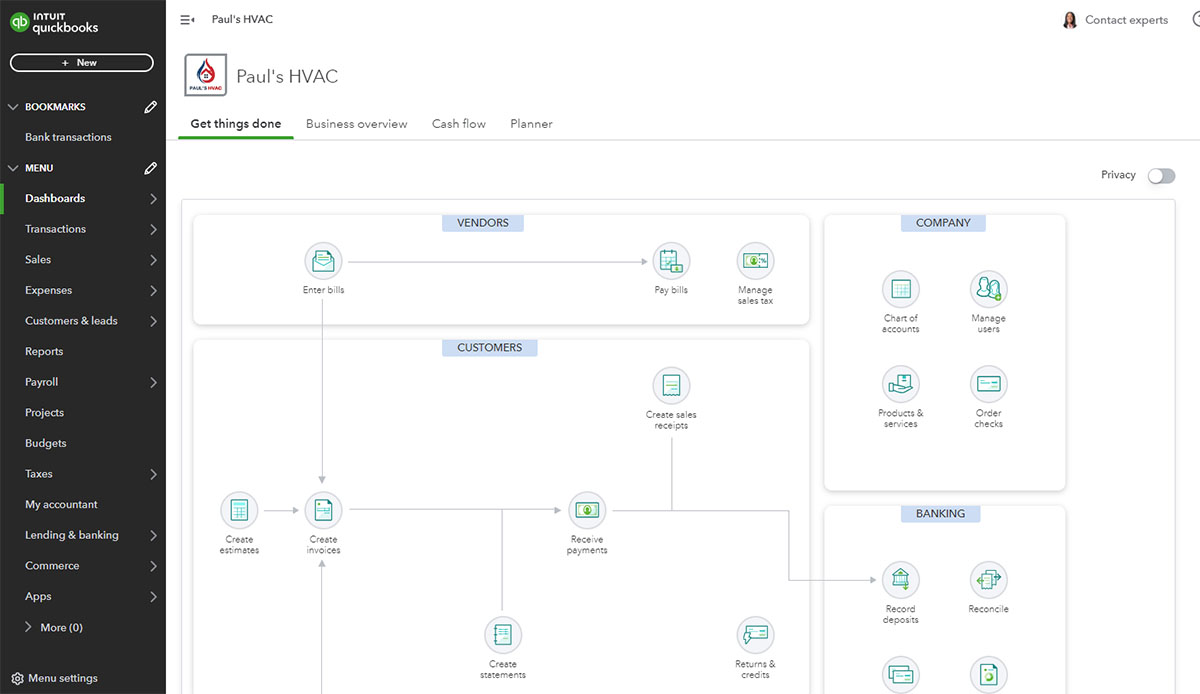

QuickBooks Online Dashboard

QuickBooks Self-Employed is designed specifically for self-employed individuals, freelancers, and independent contractors. It has a more streamlined feature set, focused primarily on invoicing, expense tracking, and tax management.

It has a simpler user interface than QuickBooks Online, with fewer options and features, and an intuitive navigation. It provides step-by-step guides and in-app prompts to help users navigate the software and complete tasks.

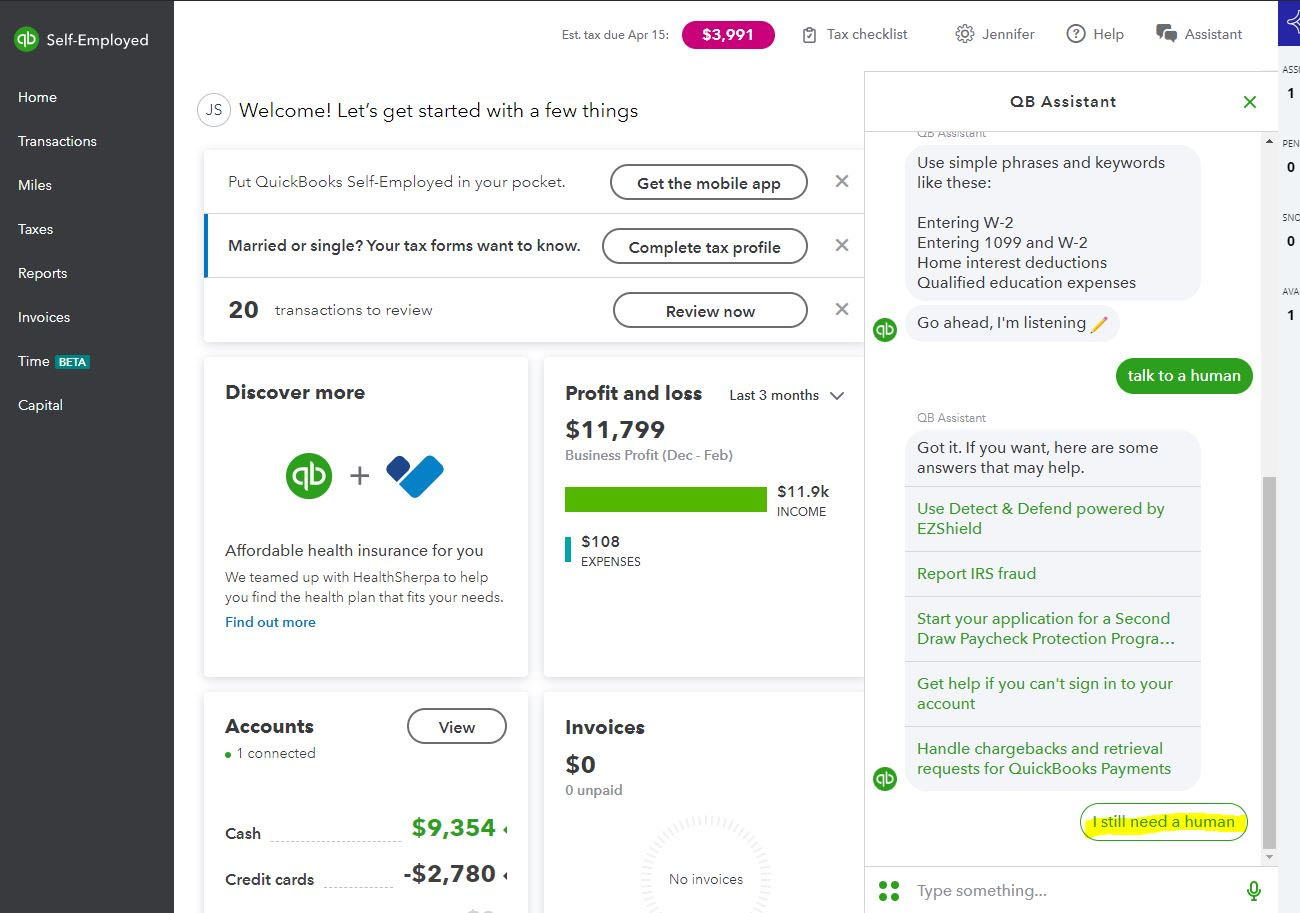

QuickBooks Self-Employed Dashboard

Assisted Bookkeeping: QuickBooks Online Wins

QuickBooks Online | QuickBooks Self-Employed | |

|---|---|---|

Assisted Bookkeeping Service | QuickBooks Live | Independent QuickBooks ProAdvisors |

Monthly Pricing | Starting at $200 | Varies |

Access to Experts | ✓ | ✓ |

Account Reconciliation | ✓ | ✓ |

Bookkeeping Advice | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✕ |

1099 Reporting & Preparation | ✕ | ✕ |

Accounting & Payroll Coaching | ✕ | ✕ |

For QuickBooks Online users, assisted bookkeeping is available in the form of QuickBooks Live, which is why it is the winner in this category. Starting at $200 per month, the service matches you with a certified QuickBooks ProAdvisor, who will help you connect your bank and credit card accounts, categorize your transactions, and reconcile your bank accounts. They are also available for telephone or one-way video calls, to answer questions and troubleshoot any bookkeeping issues.

However, QuickBooks Live bookkeepers cannot assist with 1099 reporting and preparation or payroll. It is unavailable to QuickBooks Self-Employed users—but they do have access to a network of QuickBooks ProAdvisors.

Read our review of QuickBooks Live to learn more about the service.

Integrations: QuickBooks Online Wins

QuickBooks Online integrates with a wide range of third-party software, with more than 700 apps across various categories, such as customer relationship management (CRM), ecommerce, time tracking, and project management. Some popular integrations include PayPal, Shopify, TSheets, Salesforce, HubSpot, Square, and Stripe. It also connects with thousands of apps through Zapier. Visit the QuickBooks Integrations page to learn more.

QuickBooks Self-Employed has fewer integrations than QuickBooks Online. However, it still offers a good selection that are relevant to self-employed individuals, such as TurboTax, PayPal, MileIQ, Etsy, and Stripe.

Mobile App: QuickBooks Online Wins

QuickBooks Online | QuickBooks Self-Employed | |

|---|---|---|

Issue Invoices | ✓ | ✓ |

Capture Expense Receipts | ✓ | ✓ |

Categorize Expenses From the Bank Feed | ✓ | ✓ |

View Reports | ✓ | ✓ |

Track Mileage | ✓ | ✓ |

Accept Payments | ✓ | ✕ |

Enter Bills | ✓ | ✕ |

Assign Expenses to Customer or Projects | ✓ | ✕ |

Enter Bill Payments | ✓ | ✕ |

Record Time Worked | ✓ | ✕ |

Assign Time Worked to a Customer or Project | ✓ | ✕ |

QuickBooks Online and QuickBooks Self-Employed have separate mobile apps. While the QuickBooks Online mobile app allows you to perform many of the same activities as the web-based version, the QuickBooks Self-Employed mobile app limits you to creating and sending invoices, categorizing expenses from the bank feed, tracking mileage and expense receipts, and viewing reports. Therefore, QuickBooks Online is a clear winner here.

Customer Support: Tie

Both QuickBooks Online and QuickBooks Self-Employed offer phone, chat, and email support options to their users, but QuickBooks Online offers a VIP service called QuickBooks Priority Circle to users with an Advanced plan. This service connects you with a dedicated account team, provides in-depth training, and 24/7 premium technical support. Although this is a valuable service, we still ruled this category a tie since the service is only available to Advanced users.

Meanwhile, QuickBooks Self-Employed offers phone support to all subscribers, and if you sign up for the Live Tax Bundle you’ll also receive access to a CPA for assistance with filing your income tax returns. Both platforms also provide online help centers with extensive resources and a community forum where users can connect and share knowledge.

Frequently Asked Questions (FAQs)

No, QuickBooks mobile apps are included with the software.

No, QuickBooks Self-Employed doesn’t allow you to manage bill payments. If this is an important feature, we suggest checking out QuickBooks Online.

QuickBooks Online ranges in price from $30 to $200 per month, depending on the subscription plan. These plans are priced based on the features and number of users included.

It is currently impossible to migrate data from QuickBooks Self-Employed to QuickBooks Solopreneur, but QuickBooks Solopreneur does have features to import data in spreadsheet format.

Bottom Line

QuickBooks Online is designed for small to mid-sized businesses and offers a powerful suite of accounting features, including invoicing, bill management, inventory tracking, payroll, and advanced reporting. QuickBooks Self-Employed is designed for microbusinesses that have more basic accounting needs. The best software for you depends on the size of your business and the features you’re seeking.

User review references:

[1] Capterra | QuickBooks Online

[2] G2.com | QuickBooks Online

[3] Software Advice | QuickBooks Self-Employed

[4] TrustRadius | QuickBooks Self-Employed