Rippling and Paychex provide businesses with human resources (HR), tax, compliance, and payroll service support. Both help companies manage employees of all types, such as salaried, hourly, contract, remote, and foreign workers. However, Rippling has a wider suite of solutions and makes it easy for you to choose the HR, payroll, and information technology (IT) services you need (customizing a la carte style). Paychex, with its core Paychex Flex payroll software, focuses on offering a range of combined payroll and HR solutions.

Here are our recommendations to help you determine whether Rippling vs Paychex is the ideal HR software for you:

- Rippling: Best for small and midsize businesses (SMBs) that want an all-in-one HR, payroll, and IT platform with robust workflow automation and integration options

- Paychex: Best for startups and growing companies needing HR tools with solid payroll support

Rippling vs Paychex Compared

These two providers have many similar features, such as employee self-service tools, time tracking, paid time off (PTO) management, and full-service payroll with tax payment and filing services. Rippling and Paychex can also help you manage recruiting, training programs, and benefits plans.

Below are some of the standout features, including each provider’s basic pricing details.

Special Promotion* | New users get the first month free | New users get three months free payroll |

Starter Monthly Pricing | $8 per employee plus $35 base fee** (includes payroll and time tracking add-ons) | $5 per employee plus $39 base fee |

Unlimited & Automatic Pay Runs | ✓ | Automatic pay runs only |

Payment Options | Direct deposits and checks (self-print) | Direct deposits, pay cards, and checks (with signing and stuffing services) |

Employee Benefits | Standard options only (such as health and retirement insurance) | Standard options plus a financial wellness program (includes short-term loans) |

Performance Reviews | ✕ | ✓ |

Employer of Record (EOR) Services*** | ✓ | ✕ |

Professional Employer Organization (PEO) Services*** | ✓ Comes with an easy turn on/off option | ✓ |

IT Tools to Manage Business Apps and Laptops | ✓ | ✕ |

Expense Management and Corporate Cards | ✓ | ✕ |

Third-party Software Integrations | 500+ apps | More than 50 apps |

Customer Support | Live chat and email; paid HR support via phone and email | 24/7 live chat, phone, and email; assigns dedicated payroll specialists to clients |

*This can change at any time. Visit the providers' websites to view the latest promos on offer. **Pricing is based on a quote we received—includes payroll, time tracking, and access to Rippling’s core workforce management platform. | ||

NOTE: Paychex is offering 6 months of free payroll for new clients who sign up before 11/30/2023 and run their first payroll by 12/7/2023.

When to Use Rippling and Paychex

Unsure whether Rippling or Paychex is a good fit? See our other top recommendations in our best HR payroll software guide.

Alternatives to Paychex vs Rippling

| |||

|---|---|---|---|

Best For | Small businesses that want solid payroll and HR support at a reasonable price | QuickBooks users and those needing fast direct deposits | Businesses in highly regulated industries looking for solid compliance tools |

Starter Monthly Pricing | $6 per employee plus $40 base fee | $6 per employee plus $45 base fee | $16 per employee* |

*Includes payroll add-on ($6 per employee monthly); requires at least five employees. | |||

Looking for something else? Read our guide to the best payroll services and best payroll software for small businesses to find a service or software that’s right for your company.

Best in Pricing: Rippling

Free plan | None, but new users get the first month free* | None, but new users get three months free payroll* |

Monthly Pricing | $8 per employee + $35 base fee** (includes payroll and time tracking add-ons) | Essentials (up to 19 employees only): $5 per employee + $39 base fee Select: Custom-priced Pro: Custom-priced |

Special Payroll Plan | ✕ | Paychex Solo plan for solopreneurs and the self-employed: Custom-priced |

Setup Fees | ✕ | Custom-priced (for higher tiers) |

Employee Benefits | Benefits administration: Pricing varies, based on insurance broker selected Benefits administration using own broker: $0 to $5 per employee monthly (depending on broker)* | Paid add-on |

Applicant Tracking | Paid add-on | Paid add-on |

Time Tracking | Included in pricing quote** | Paid add-on |

Learning Management | Paid add-on | Included in Paychex Flex’s higher tiers |

Performance Reviews | ✕ | Paid add-on |

Global Payroll | $20 per employee monthly** | Paid add-on (via partner provider) |

App and Device Management | $8 per employee, per module monthly** | ✕ |

PEO and EOR Services | PEO: $65 per employee monthly EOR: $599 per employee monthly** | PEO only (paid add-on) |

Access to HR Advisers | Paid add-on | Paid add-on |

*This can end at any time. Visit the providers' websites to check the latest promos on offer. **Pricing is based on a quote we received | ||

Rippling is one of the few HR services that allow you to create a custom plan with the solutions you need—provided you get its core workforce management platform. This is great for businesses that want a mix of HR, IT, and payroll tools to streamline day-to-day processes. If you have business offices outside of the United States, Rippling can help you hire and pay international staff with its EOR and global payroll services. You only get international payroll with Paychex but through its partner, FMP Global.

However, as with most HR software, the cost will increase as you add more features and advanced support options. And while it lacks the solopreneur plan that Paychex offers to the self-employed, Rippling doesn’t charge setup fees and lets you run payroll as many times as you need in a month without having to pay extra (Paychex doesn’t offer unlimited pay runs).

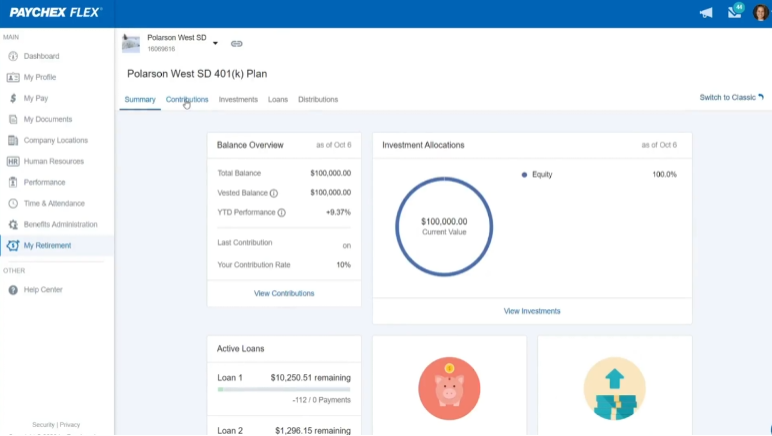

What’s great about Paychex is its flexible payroll packages, which are ideal for businesses with plans to scale. You can start from either its Paychex Solo or Paychex Flex Essential plan and then upgrade to higher packages or get additional Paychex products (like hiring, time tracking, and PEO services) as your HR needs grow.

Paychex Flex’s starter tier is also a more budget-friendly option for small businesses (up to 19 employees) that primarily want payroll tools. Let’s say you have to pay nine workers, Paychex will only charge you $84 monthly (computed as nine employees X $5 plus $39), whereas Rippling costs $107 monthly (computed as nine employees X $8 plus $35).

Note, however, that Rippling’s plan includes time tracking tools (based on the quote we received), which is a paid add-on with Paychex. If your business needs this feature, you may end up paying Paychex a little bit more than Rippling.

Pricing Calculator: Check Potential Costs

If you want to compare how much you would pay if you are considering Rippling vs Paychex, use our online calculator.

Best for Payroll: Rippling

Full-service Payroll | ✓ | ✓ |

Unlimited and Automatic Pay Runs | ✓ | Automatic pay runs only |

Tax Payment and Filing Services | ✓ | ✓ |

Year-end Tax Reports (W-2/1099s) | ✓ | Costs extra |

Direct Deposit Processing Time | Two days | Two days, with same-day ACH capability |

Manual Paychecks (Self-print option) | ✓ | ✓ Also offers check logo and signing services |

Pay Cards | ✕ | ✓ |

Global Payroll Capabilities | ✓ | Via FMP Global |

While both providers offer full-service payroll and can handle payments for contractors, hourly workers, and salaried employees, Rippling’s payroll tax administration services are more budget-friendly. It doesn’t charge additional fees for year-end tax reporting (this costs extra with Paychex).

It’s also great for businesses with employees working in different countries because its solid global payroll tools can help you pay them accurately and in their local currencies. It’s even one of our recommended international payroll services. With Paychex, you get similar tools but through its partner, FMP Global.

Rippling claims that it can process payroll for global employees and contractors in as fast as 90 seconds. (Source: Rippling)

When to Consider Paychex

If you want multiple payment options, Paychex can help you pay employees via same-day ACH, two-day direct deposits, manual checks, and pay cards. For employers who prefer to pay via manual checks, Paychex provides a self-print option, as well as check logo and signing services if you need them. Rippling only offers checks that you print yourself and direct deposit payments.

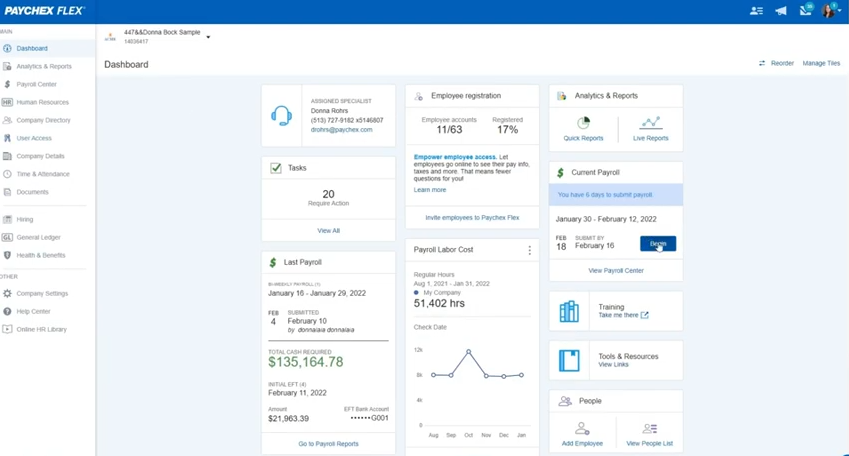

Paychex Flex’s payroll dashboard lets you run payroll, add employees, view labor costs, and more. (Source: Paychex)

Best for HR Features: Tie

Hiring Solutions | ✓ (with job posting tools) | ✓ (job postings via integrations) |

Online Onboarding & New Hire Reporting | ✓ | ✓ |

Time Tracking | ✓ | ✓ |

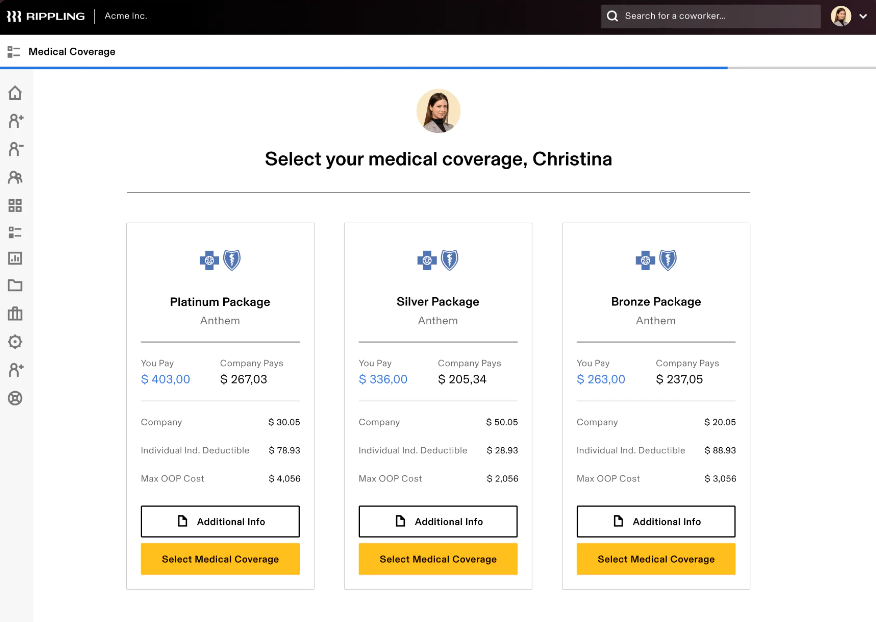

Benefits Options | Medical, dental, vision, 401(k), flexible spending account (FSA), health spending account (HSA), commuter benefits, and more | Medical, dental, vision, 401(k), FSA, HSA, and more |

Health Insurance Coverage | 50 states | 50 states |

Financial Wellness Program | ✕ | ✓ (with cashflow assistance for employees) |

Learning Management | ✓ (can prevent workers from clocking in if they don’t have the training certificate for the job) | ✓ (with access to more than 300 courses) |

Performance Reviews | ✕ | ✓ |

PEO Option | ✓ | ✓ |

EOR Service | ✓ | ✓ |

IT Tools for Provisioning and Deprovisioning Apps and Laptops | ✓ | ✕ |

Employee Self-service Tools | ✓ | ✓ |

It is difficult to compare Rippling vs Paychex in this criterion because while they have similar functionalities, the width and depth of HR solutions and services on offer vary slightly. As such, there may be instances where one is better than the other.

Click the tabs below to know when it’s best to use Rippling and Paychex for HR.

Best for Reporting: Tie

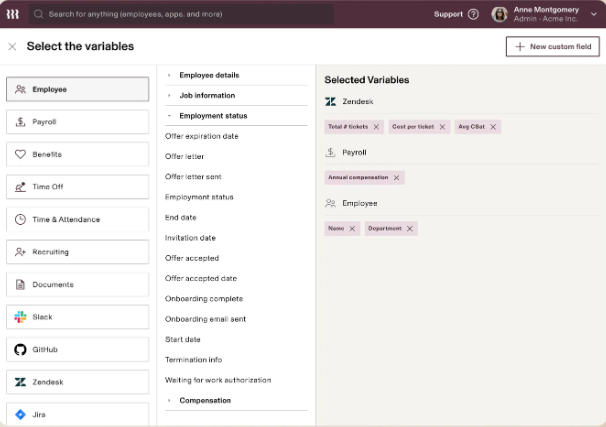

Basic Reports | ✓ | ✓ |

Report Customizations | ✓ | ✓ |

In the battle between Rippling vs Paychex for reporting, both offer standard payroll and HR reports, including customization options. However, if you want to know where these two providers shine in terms of reporting capabilities, click the tabs below.

Best for Ease of Use & Customer Support: Paychex

Learning Curve | Relatively easy | Relatively easy |

Ease of Use | Good | Good |

Customer Support | Chat and email (you can raise a meeting or call back request via chat) | 24/7 live chat, phone, and email support |

In-app Help | ✓ | ✓ |

Access to a Dedicated Payroll Specialist | ✕ | ✓ |

Online How-to Guides | ✓ | ✓ |

Software Integration Options | More than 500 | More than 50 |

Both providers have platforms that are intuitive, relatively easy to use, and come with online setup wizards. However, Paychex’s dedicated payroll specialist, guided system setup, and 24/7 chat, phone, and email support make it a better choice for users. With these features, small business owners can easily set up Paychex Flex (provided they get the starter tier) and get assistance in running payroll or navigating through its features.

Rippling may lack the live phone support and guided setup help that Paychex offers to its clients, but it does provide you with a more extensive network of third-party software integrations (more than 500 versus Paychex’s 50-plus options). This makes Rippling an ideal HR software for tech-heavy companies, as it’s highly likely that the business systems they typically use are included in the provider’s robust partner network.

Best for Popularity Among Users: Rippling

User Feedback | Mostly positive | Mostly positive |

Customer Service Quality Trend | Great overall | Fair to good |

Average User Ratings* | 4.85 out of 5 | 4.15 out of 5 |

Average Number of Reviews* | 2,300+ | 1,400+ |

*Data from third-party review sites like G2 and Capterra (as of this writing) | ||

To evaluate Rippling vs Paychex user popularity, we looked at each provider’s average number of user reviews and the average overall ratings on third-party review sites like G2 and Capterra. In terms of ratings from actual users, Rippling outscored Paychex (4.85 vs 4.15 out of 5).

Here’s what users have to say about both providers.

How We Evaluated Rippling vs Paychex

We compared Rippling vs Paychex by looking at both providers’ features—from pay processing and tax filings to HR tools and employee benefits options. We also considered other key criteria, such as ease of use, pricing, and customer support, including whether users have access to expert professionals who can provide HR and payroll advice.

Bottom Line

When selecting between Paychex vs Rippling, you’ll want to consider how much support you need and in which areas you require extra help. With Rippling, you get strong automation tools with integrated HR and payroll features, app and device management solutions, US-based PEO services, and global EOR support. These make it suitable for businesses looking for a robust platform to streamline a wide range of HR and IT processes.

Meanwhile, Paychex is optimal for growing businesses needing HR and payroll support, mainly because of its scalable plans and products that cater to different business sizes. If you have a handful of employees and only require basic payroll and HR tools, its Paychex Flex solution would likely be a better fit—plus, its starter tier is less expensive than Rippling.