Shop Pay is an accelerated online checkout service by Shopify that lets customers enjoy one-click payments. It securely saves and encrypts customer details such as email, credit card, shipping, and billing information. By allowing faster checkouts, Shop Pay can help reduce shopping cart abandonment.

Enabling Shop Pay on your online store is free and takes fewer than five minutes. Although it is easiest to activate Shop Pay if you already have a Shopify store and use Shopify Payments as your payment processor, you may also use it with third-party payment providers and on Facebook and Instagram shops.

Read further to learn about Shop Pay, along with its key features and how to activate it for your online store in our guide.

How Does Shop Pay Work?

Shop Pay works like most one-click checkout options—by taking customer information once then encrypting and saving it on PCI-compliant servers (meaning servers that meet industry standards for data security). Then, when a customer makes their next purchase, they can quickly complete the order by clicking the Shop Pay button at checkout, without reentering information.

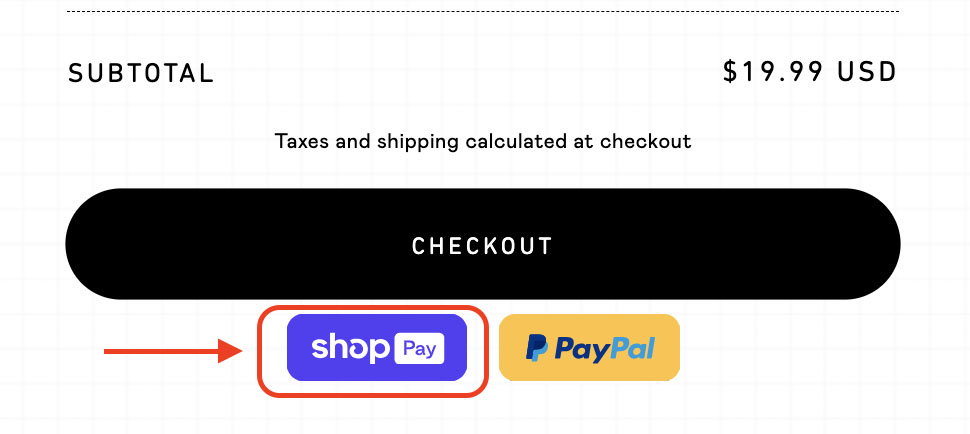

You will know there is a Shop Pay express checkout option on a store’s checkout page by its purple button.

Here’s how it works from the customer’s end:

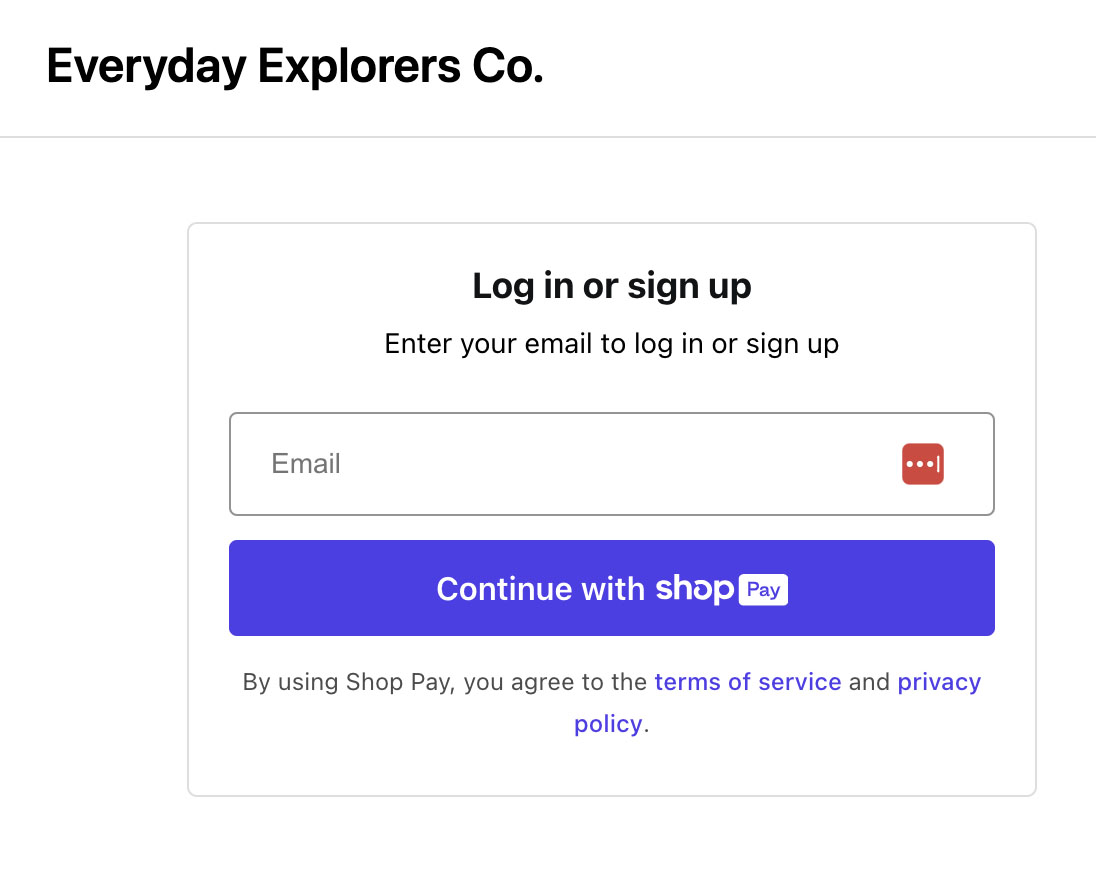

- When first-time customers click on the Shop Pay button on your checkout page, they will be invited to join by entering their email address (as shown in the image below).

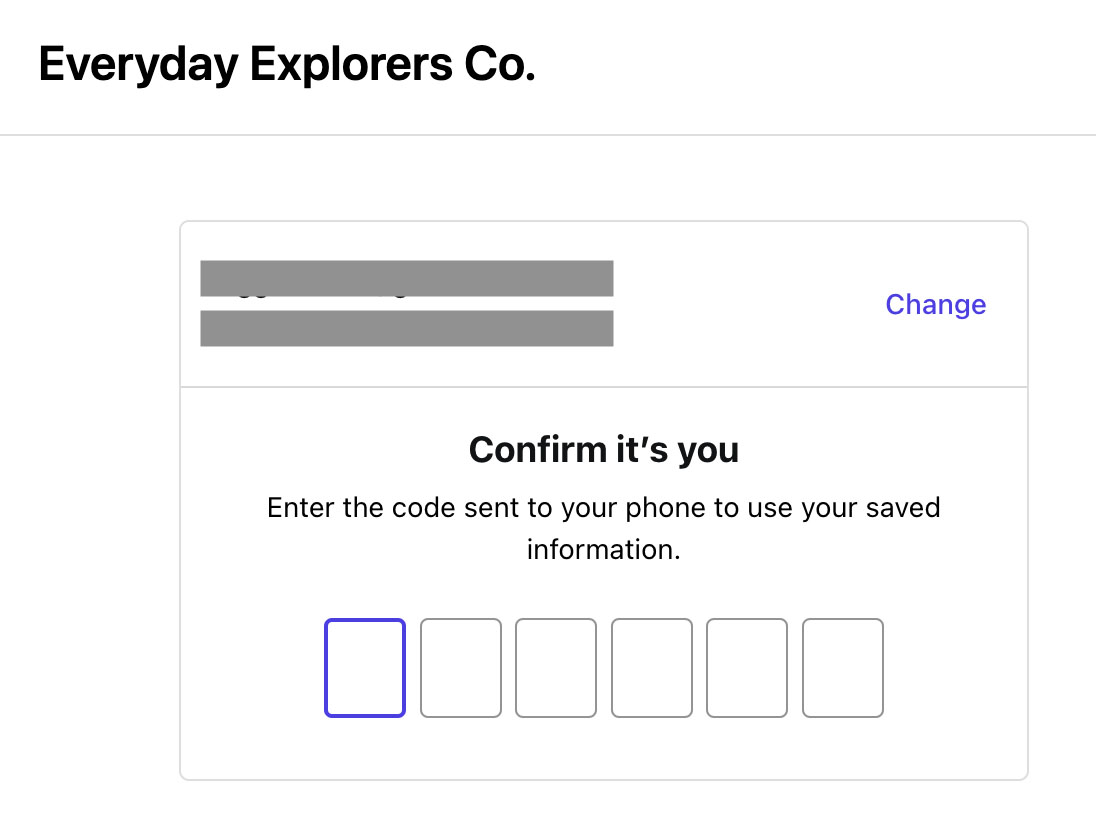

- They will be then asked to enter their phone number, where a six-digit code will be sent to verify their login or sign-up (pictured below). After they enter the code on the checkout page, they can then have their information saved, including contact information, credit card info, and delivery address.

- When customers make another purchase from a Shop Pay-enabled store using the same device, they can skip the verification and check out quickly. But the first time they use a new device, they’ll need to verify themselves again.

- If they use the Shop app, customers will be asked to verify their purchase on the app; otherwise, they receive a six-digit verification code via text. Once the purchase is verified, they can use the saved information to pay.

Watch the demo below to see how fast Shop Pay is when used at checkout.

This is a real demo of how fast a Shopify checkout with Shop Pay enabled looks like. (Source: Shopify)

Shop Pay can increase conversions by as much as 50% compared to a guest checkout when used—faster than other accelerated checkouts by at least 10%.

That’s how easy it is to use Shop Pay as a customer. Here are a few things to note:

- The following customer information is saved and securely encrypted for your future purchases: email, up to 20 shipping addresses, credit card details for up to 10 credit cards, including billing addresses, and mobile phone number.

- Customers are also given the option to pay in installments (if you have enabled Shop Pay Installments) and to have the item delivered or picked up in-store.

- Customers can change their information at any time through Shop Pay or opt out as desired.

- Shop Pay supports multiple languages—Chinese, Czech, Danish, Dutch, English, Finnish, French, German, Italian, Japanese, Korean, Norwegian, Polish, Portuguese, Spanish, Swedish, Thai, Turkish and Vietnamese.

- Shop Pay supports activated cards (credit or debit cards) that can be used for online purchases with a billing address matching the one indicated in their card information (ZIP code). Some prepaid cards aren’t supported. If the customer is using Shop Pay Installments, then Capital One cards aren’t accepted.

The process is equally easy for you, too. If you’ve enabled the Shop Pay app, then the option appears on the Express Checkout with any other express options you offer.

Shop Pay Key Features

2023 Shop Pay Updates:

- Shop Pay Installments on POS: Drive sales in-store with flexible buy now, pay later options in Shopify POS.

- Shop Pay Installments premium package: Offer interest-free payments and terms up to 24 months with qualified customers. Available to select businesses in the US.

| PROS | CONS |

|---|---|

| Quicker checkout—faster than other one-click checkout options | Does not work in every language or country supported by Shopify |

| Saves customer information across all Shopify stores | Higher fees for Shop Pay Installments |

| Secures and encrypts customer information | Mixed customer feedback in online reviews |

| Takes <5 minutes to set up | No support for digital payment methods like gift cards or crypto |

| Protects against fraudulent orders | Restrictions on payment types for Shopify Installments, such as Capital One or prepaid cards |

The selling points of Shop Pay are the ease of use for your customers and reducing shopping cart abandonment. According to Baymard Research, 17% of customers abandon their cart because the checkout process is too long or complicated. Another 18% leave because they don’t trust the site with their credit card information. With Shop Pay’s simple, secure checkout, you can nip these issues in the bud.

However, Shopify has included other valuable features to make shopping at your store with Shop Pay even better:

Easy Set Up

It takes only a few steps to set up Shop Pay, and it’s nearly as simple for your customers to set up an account—less than five minutes, in fact. After that, Shopify handles all the grunt work of creating the buttons and handling the transaction information.

Secure Checkout

All the information is encrypted end-to-end and stored on Shopify’s PCI-compliant servers. You don’t need to handle the responsibility—or liability—of securing your customer’s payment information yourself.

See also:

- PCI Compliance for Small Business: 2023 Guide

- Ecommerce Payment Security: 10 Small Business Best Practices

Verified Purchases

To use Shop Pay, customers need to verify purchases on the Shop app or with a texted code, helping ensure someone isn’t using their information for fraudulent purchases. This helps protect you against chargebacks.

Fraud Protection

Shop Pay has built-in free fraud protection called Shopify Protect. It covers the cost of the order and the chargeback fee on any eligible orders processed through Shop Pay that receive a fraudulent chargeback. The chargeback process is handled by Shopify and the chargeback amount and fee will be reimbursed. Learn more about Shopify Protect.

Local Pickup or Delivery

If your store has local pickup or delivery, you can let customers choose their option during checkout with Shop Pay.

Green Business

Each year, Shopify gives a certain percentage of its Shop Pay transactions to support companies that work toward reversing climate change through carbon removal projects. Among Shopify’s Sustainability Fund Partners are Climeworks, Carbon Engineering, Noya, and Sustaera. With 50% of consumers saying they are willing to pay a premium for sustainable brands, it’s a nice way to stand out.

Shop Pay Installments

If you choose, you can give Shop Pay customers the option of paying in multiple payments through Shop Pay Installments powered by Affirm.

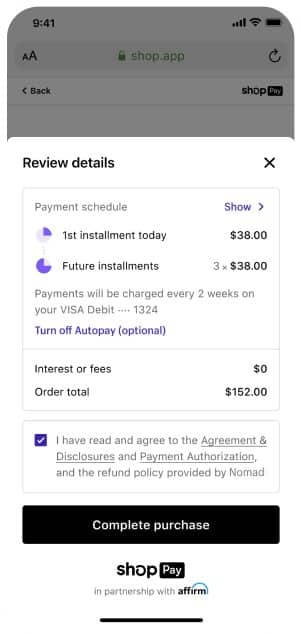

For orders between $50 and $999.99, your customer can pay in four interest-free biweekly installments, and for orders between $150 and $17,500, they can pay in up to 12 monthly installments with 10% to 30% annual percentage rate (APR).

With Shop Pay Installments, there are no hidden or late fees for your customers and you get paid in full upfront. However, Shop Pay Installments does have higher transaction rates than standard purchases—and these fees are not returned if you issue a refund. According to a Shopify representative, these are typically 5.9% + 30 cents.

Like PayPal’s Pay-in-Four program, Shop Pay Installments lets customers break payments into four installments. (Source: Shopify)

There are some limitations for Shop Pay Installments, however, including the following:

- Customers can’t pay for an order if their order includes currency in any form, like virtual and digital currency—for example, gift cards.

- Customers can’t pay through Shop Pay Installments if they are using Capital One cards, prepaid debit cards, or prepaid credit cards.

Related Reading: 24 Buy Now, Pay Later Statistics for 2023

Shop Pay vs Shopify Payments

Shopify Payments is not the same product as Shop Pay. Shopify Payments is the payment processing service Shopify provides retailers, while Shop Pay is the front-facing checkout customers use. Shopify Payments is a backend merchant service, and it can be used even without Shop Pay. Conversely, Shop Pay can be used without Shopify Payments.

Shop Pay | Shopify Payments |

|---|---|

Customer-facing checkout | Backend payment processing |

Saves buyer details | Lets seller offer multiple payment options |

Can work with Shopify Payments, third-party payment providers, and Facebook and Instagram shops | Works without Shop Pay |

Learn how to set up Shopify Payments, from signing up and configuring payments to getting paid and handling chargebacks.

Who Should Use Shop Pay

- All Shopify sellers and US-based Facebook and Instagram shops could benefit from enabling Shop Pay as a customer payment option. Shopify says that Shop Pay increases checkout speed by 4x, leading to a 1.72 times higher conversion rate, and is 70% more efficient than a standard checkout process.

- Businesses that primarily sell online because Shop Pay’s unique features, like fast checkout and remembering customer payment information, are more relevant to online sales.

- Businesses that have customers making frequent, repeat purchases could benefit from using Shop Pay because it can make online purchases easier and faster, build customer loyalty, and reduce abandoned carts.

When to Choose an Alternative

- Businesses that sell internationally may not be able to offer Shop Pay to customers in certain countries or in some languages.

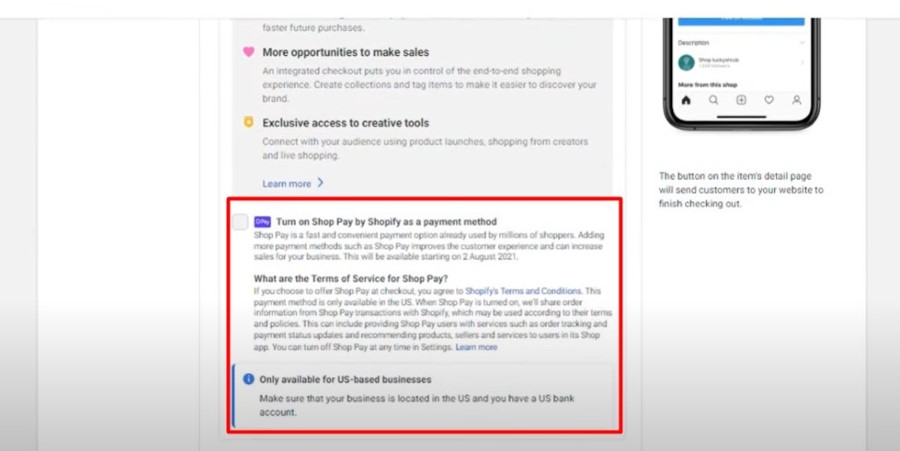

- Non-US-based businesses that sell on Facebook and Instagram Shops cannot use Shop Pay.

Check out our recommended Shop Pay alternatives below.

Shop Pay Alternatives

Monthly Fee | Online Processing Fee | Learn More | |

|---|---|---|---|

PayPal | $0 | 3.49% + 49 cents | |

Link with Stripe | $0 | 2.9% + 30 cents | |

Amazon Pay | $0 | 2.9% + 30 cents | |

Apple Pay | $0 | Depends on payment processor |

How to Add Shop Pay to Your Online Checkout

Before, Shop Pay was exclusive to stores using Shopify Payments. Now, it’s also compatible with third-party payment providers and can be added to your Facebook or Instagram shop. Here’s how to set it up:

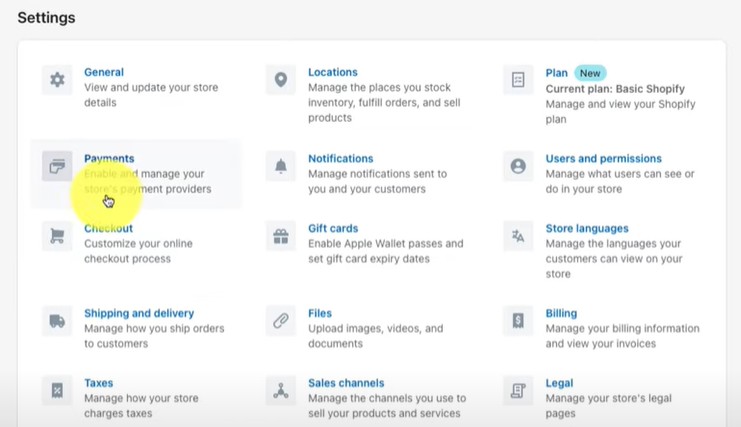

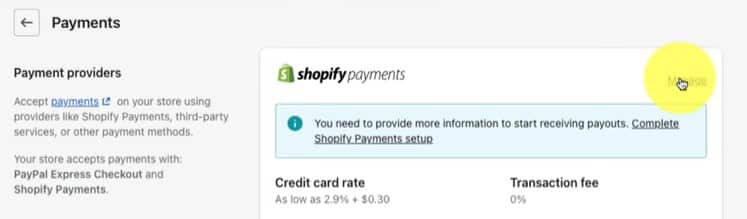

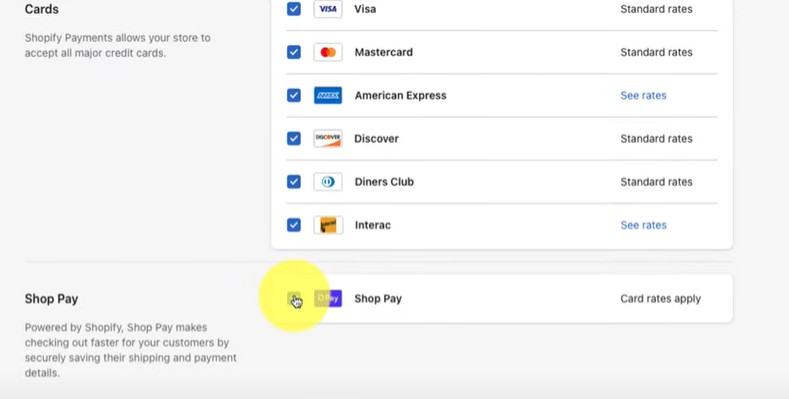

Activating Shop Pay for Shopify Payments

Once you have set up your Shopify store, adding Shop Pay to your store is very easy. If you are already using Shopify Payments, it may already be enabled. If not, or if you’re unsure, follow these steps.

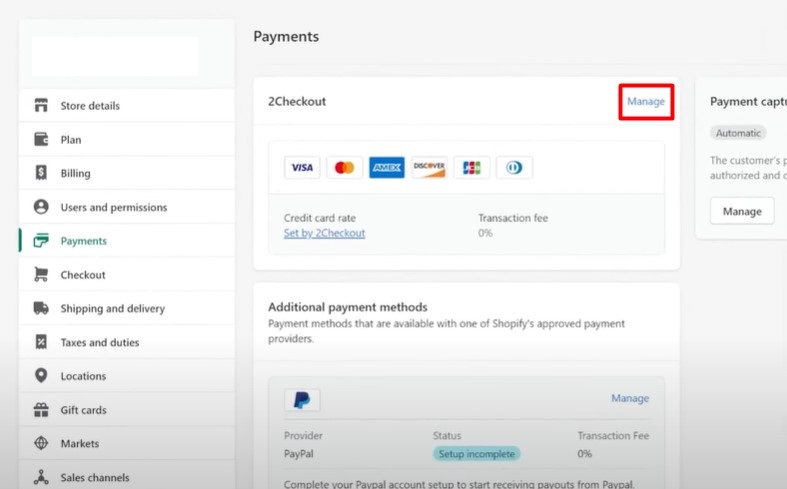

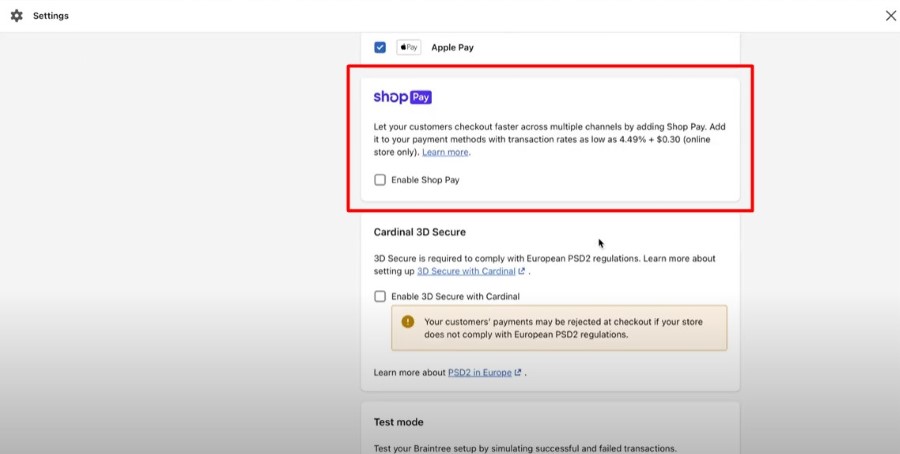

Activating Shop Pay for Third-party Payment Providers

Stores based in the US can use a third-party payment provider to activate Shop Pay. Check to see if you meet Shopify Payments requirements.

After activating Shop Pay, you will be asked for your business details and banking information to complete set up and receive payouts.

If you do not complete the setup when you enable Shop Pay, you need to submit the information within 21 days of receiving a payment via Shop Pay. Failure to do this within 21 days will result in the payment being refunded to your customer.

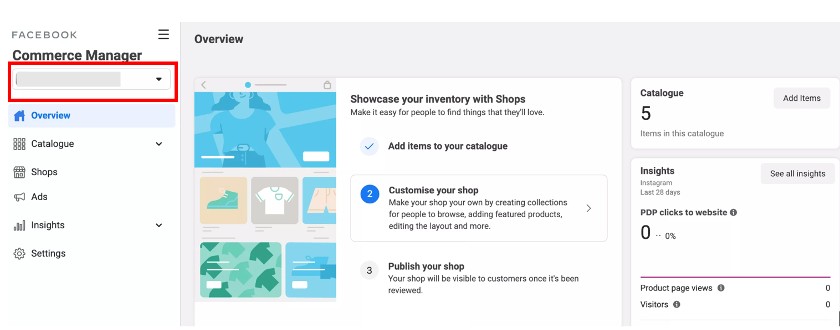

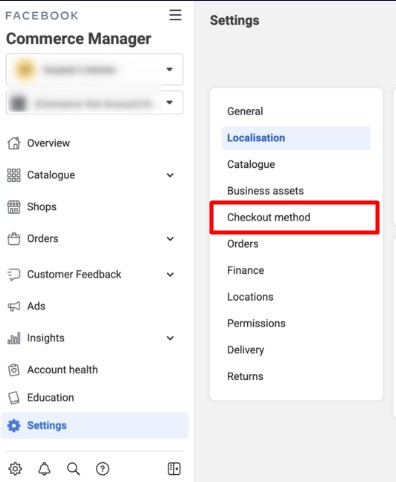

Activating Shop Pay for Facebook or Instagram Shops

Shop Pay is also available on a limited basis to Facebook and Instagram shops in the US. If you are setting up your shop for the first time, Shop Pay will be automatically turned on. Here’s how to turn it on if it’s not yet enabled on your shop:

Frequently Asked Questions (FAQs)

Want to know more about what is Shop Pay or how Shop Pay works? Click through the questions below to get answers to some frequently asked Shop Pay questions.

Yes, for US-based sellers, Shop Pay is also available for merchants with a Facebook or Instagram shop. If you don’t have these, then you will need a Shopify Store that accepts card transactions.

Shop is Shopify’s mobile shopping application. It lets customers shop in any Shopify store through one central application. Consumers can search for products, locations, and stores; select how they pay; track orders and receipts; and get recommendations. You can use the app to conduct analytics, manage what inventory is on your Shop app store, and run marketing campaigns.

Yes, it is. Shopify protects customer information with end-to-end encryption and stores it in its certified Level I PCI DSS-compliant servers. Shopify is also SOC 2 Type II and SOC 3 compliant, and GDPR and CCPA compliant. In short, it meets and exceeds industry standards.

Shopify protects merchants against fraud through Shopify Protect. This feature covers the cost of the order and the chargeback fee on any eligible orders processed through Shop Pay that receives a fraudulent chargeback

No. Shop Pay is an express checkout system, whereas Afterpay is a third-party BNPL service similar to Shop Pay Installments. (Square acquired Afterpay in October 2021.).

No, although Shop Pay does work like PayPal checkout in terms of speed. However, Shop Pay is unique to Shopify and can store any credit card information. The two can be offered alongside each other to give your customers a choice.

Bottom Line

If you have a Shopify store that accepts card payments online, then Shop Pay is a simple and free tool that gives your customers an easy, secure, and fast checkout experience. You could also start using it if you have a Facebook or Instagram shop. The ease of checkout Shop Pay provides your customers more time for shopping and reduces the frustration of filling out the same information again and again. This makes for a better customer experience, which promotes customer loyalty. It’s also more secure and lets customers select their local pickup or delivery preference.

To learn more about what Shop Pay is and how it works, log in to your Shopify account and activate it today—or learn how to set up a Shopify store.