The best payroll software for accountants makes it easy to handle payroll for many clients. It should integrate with accounting software, have a dashboard to manage multiple clients, and offer benefits specific to the needs of certified public accountants (CPAs). Below are our seven top-recommended payroll software for accountants.

- QuickBooks Payroll for Accountants: Best overall payroll software for accountants

- Gusto for Accountants: Best for small business payroll and advertising accountant payroll services

- OnPay for Accountants: Best for no-cost data migration and client onboarding

- SurePayroll for Accountants: Best payroll accounting software for simple pay runs

- Justworks for Accountants: Best for employee benefits and payroll compliance

- Rippling for Accountants: Best all-in-one HR payroll software for accounting firms

- Patriot Payroll for Accountants: Best accountant payroll software for discount perks

Best Payroll Software for Accountants Compared

All the payroll systems we reviewed provide the essential tools that accountants need to process client payroll, such as salary calculations and deductions, direct deposit payments, and tax administration services. These providers also offer access to employee benefits plans (except Patriot Payroll), new hire onboarding, and employee self-service tools. Below are some of the key features, including basic pricing and accountant discount details.

QuickBooks Payroll: Best Overall Payroll Software for Accountants

Pros

- Unlimited pay runs

- Fast direct deposits with next- and same-day options

- Robust tax penalty protection

- Integrates seamlessly with QuickBooks Accounting

- Discounted payroll plans for clients plus free payroll software access for accounting firms (requires signing up for its free QuickBooks Online Accountant tool)

Cons

- Must use QuickBooks for accounting

- Basic human resources (HR) features only

- Tax penalty protection that covers tax filing errors regardless of who makes the mistake is only in the Elite plan

- Local tax payments and filings are not included in the basic Core tier

- Time tracking and same-day direct deposits are available in higher tiers

Overview

Who should use it:

If you use QuickBooks for your clients, then we highly recommend QuickBooks Payroll for Accountants. It lets you set client permissions, guarantees tax accuracy, includes 24/7 support, and allows you to pay workers via next- and same-day direct deposits.

Why we like it:

As a QuickBooks partner, you get a revenue share option and free access to QuickBooks Payroll Elite—which you can use to pay your employees. With its ProAdvisor program, you and your customers get preferential rates. Plus, its accounting and payroll modules sync seamlessly with each other, making it easy for you to manage your clients’ general ledgers.

Users also appreciate its efficient payroll tools as it helps simplify employee payments. However, its limited HR tools prevented it from getting a perfect overall rating because, unlike Gusto, Rippling, and Paychex, QuickBooks doesn’t have a suite of HR solutions for managing the entire employee lifecycle.

Your clients can choose from three plans:

- Payroll Core: $50 base fee + $6 per employee monthly

- Includes full-service payroll, next-day direct deposit, federal and state tax filings, and access to 401(k) plans and benefits

- Payroll Premium: $85 base fee + $9 per employee monthly

- Core + same-day direct deposit, tax filings in all levels, time tracking, workers’ comp administration, and HR support center

- Payroll Elite: $130 base fee + $11 per employee monthly

- Premium + project tracking, personal HR advisor, expert setup, and tax penalty protection up to $25,000 per year

QuickBooks also offers a package for paying contractors. However, this plan is available to small businesses that only pay 1099 workers.

- Contractor payments: $15 monthly for 20 workers; plus $2 for each additional contractor

- Includes next-day direct deposits, unlimited 1099 e-filings, and a self-setup solution for creating online contractor accounts

If you want to enjoy an ongoing ProAdvisor discount, you can choose to pay your clients’ monthly payroll software fees. You can also pass the discount to new customers through a Direct Discount option, but only for the first 12 months. QuickBooks will even send the billings directly to your clients, so you don’t have to worry about preparing this.

QuickBooks Payroll also has a revenue share program, wherein partner accounting firms or accountants—except those offering audit services—get a monthly payout for new client subscriptions (30% from base fees and 15% from per-worker fees). However, you can only collect the monthly payouts or revenue shares during your clients’ first 12 months of using QuickBooks Payroll via your firm. It even lets you pass along a client discount of 50% to new customers for their first three months (plus, they get one month of free payroll).

Regular Pricing ($/Month) | Revenue Share Client Discounts* ($/Month) | ProAdvisor Discounts for Accountants* ($/Month) | Direct Discounts for Clients* ($/Month) | |

|---|---|---|---|---|

Payroll Core | $45 base fee + $6 per employee | $22.50 base fee + $6 per employee | $31.50 base fee + $5.10 per employee | $31.50 base fee + $5.10 per employee |

Payroll Premium | $80 base fee + $8 per employee | $40 base fee + $8 per employee | $56 base fee + $6.80 per employee | $56 base fee + $6.80 per employee |

Payroll Elite | $125 base fee + $10 per employee | $62.50 base fee + $10 per employee | $87.50 base fee + $8.50 per employee | $87.50 base fee + $8.50 per employee |

*Discount rates may change at any time. Visit the provider’s website to view the latest promotions. | ||||

Note that local tax filing and payment services aren’t available in the Core package. You have to convince your clients to sign up for at least a Premium plan if they want tax filing services at all levels (federal, state, and local). And, while you get preferential pricing under the ProAdvisor program, its discounted Premium tier ($56 plus $6.80 per employee monthly) is still pricier than Patriot Payroll, which offers full-service payroll and automated tax filings for only $37 plus $4 per employee monthly.

As a partner, you get a free QuickBooks Online Accountant solution where you can access your clients’ QuickBooks accounts to check their books, edit transactions, and address payroll issues. These functionalities make managing both client payroll and bookkeeping easy for accountants. Apart from the ProAdvisor and client discounts, its partner program comes with training and certification programs to help improve your skills and grow your accounting business.

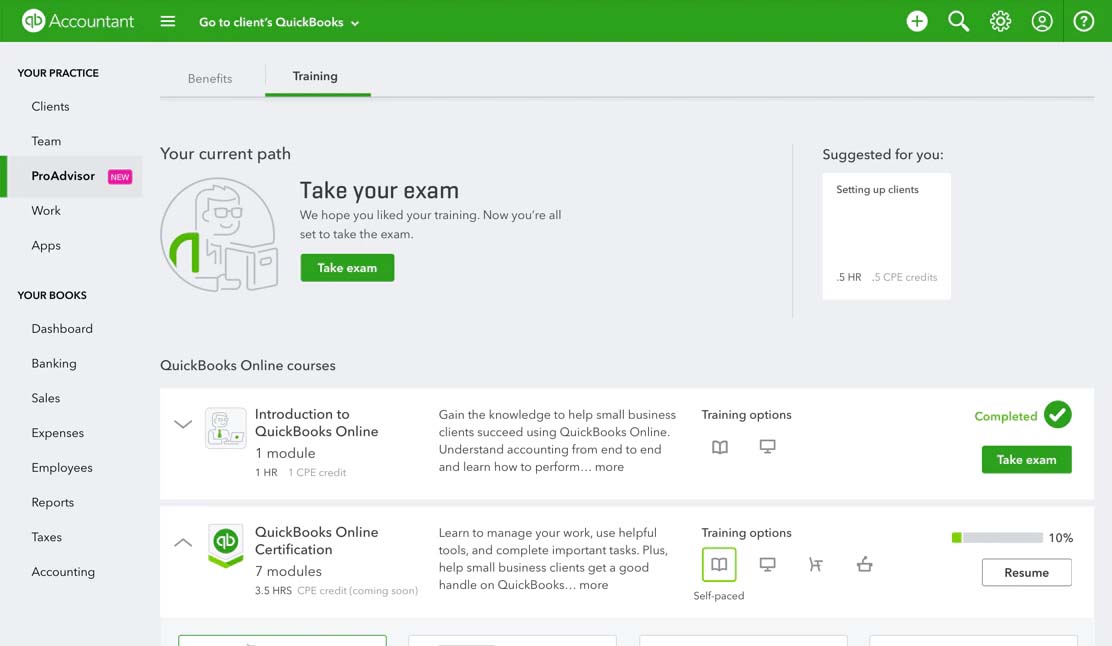

You can enroll in free QuickBooks Online Certification training programs to gain expertise in Intuit QuickBooks products like payroll and accounting. (Source: Intuit QuickBooks)

- Pay contractors, hourly workers, and salaried employees with just a few clicks.

- Payroll runs are unlimited and automatic, with salary payouts made through paychecks and via next-day and same-day direct deposits.

- On-the-go business owners can process payroll via the mobile web browsers of smartphones and tablets.

- Users are covered by a tax accuracy guarantee, where the provider will handle all tax filing penalties if its representatives are at fault. However, Elite plan holders also get a tax penalty guarantee, where QuickBooks will cover penalties of up to $25,000 per year—regardless of who made the tax filing error. The other accountants payroll software in this guide only offer a tax accuracy guarantee.

- In addition to pay-as-you-go workers’ compensation (via Next) and 401(k) plans (via Guideline), you are granted access to health insurance (via Allstate Health Solutions) that’s available in all states. This is unlike Patriot Payroll, which doesn’t offer benefits plans, and Gusto’s health benefits, which only cover 38 states and Washington, D.C.

Gusto: Best for Small Business Payroll & Advertising Payroll Services

Pros

- Unlimited and automatic pay runs

- Integrates with several accounting programs

- Access to free payroll (Gusto Plus plan for your firm), a dedicated account manager, and free marketing collateral to advertise your payroll services

- Has applicant tracking, job posting, and performance review tools

Cons

- Lacks an in-house accounting system

- Lacks special discounts for accountants (only offers discounts to pass to clients or keep as revenue share)

- Time tracking, multi-state pay processing, and next-day direct deposits available only in higher tiers

Overview

Who should use it:

Small to midsized businesses (SMBs) can rely on Gusto’s highly rated and popular payroll service that offers solid pay processing and HR tools. Its accountant partnership program goes beyond supplying client payroll, it includes certification programs and marketing materials to help you get more clients.

Why we like it:

Gusto may not have in-house accounting software like QuickBooks and Patriot, but it can integrate with accounting programs, such as Xero, FreshBooks, and QuickBooks. In addition to a feature-rich HR and payroll platform, you get a client dashboard, Gusto Pro, and tools to help you serve your customers well.

Users also love its efficient payroll and tax filing services, and they find its features robust given its price. However, multi-location businesses have to upgrade to at least its Plus plan to access Gusto’s multi-state pay runs. And, unlike the other online payroll software for accountants we reviewed (except Patriot Payroll), Gusto’s health insurance coverage is unavailable in Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, West Virginia, and Wyoming, as of this writing.

Gusto offers three plans:

- Simple: $49 per month + $6 per person per month

- Includes full-service payroll, tax filings, single state pay processing, two- and four-day direct deposits, employee benefits, offer letter templates, new hire reporting, onboarding, and basic support

- Plus: $80 base fee + $12 per employee monthly

- Simple + next-day direct deposits, time and paid time off (PTO) tracking, applicant tracking, basic job postings, multi-state payroll, and full support with extended support hours

- Premium: Call for a quote

- Plus plan with additional access to performance reviews, surveys, full-service payroll migration, HR advisers, a dedicated account manager, and a direct line for priority phone and email support

Similar to QuickBooks Payroll, it has a special package for small companies that only pay contract workers.

- Contractor-only plan: $35 base fee + $6 per contractor monthly

- Full-service payroll, four-day direct deposits, and state new hire reporting

Add-on solutions and services

- State payroll tax registration: Pricing varies per state

- International contractor payments: Pricing varies

- R&D tax credits: 15% of identified tax credits

- HR advisory services for Plus plan only: $8 per employee monthly (this is included for free in the Premium tier)

- Health and other benefits: Pricing varies by benefit

- Gusto Global: $699 per employee monthly

- Employer of record (EOR) solution for global recruiting and employee pay processing

When signing up for Gusto’s partner accountant program, you will be asked to choose one of its discount and incentive options:

- Gusto to bill your clients at discounted rates

- Gusto to bill your clients using advertised rates, but you’ll receive revenue shares

- Gusto to bill you at a discounted rate

The percentage of the discount or revenue share varies depending on the number of clients you have. Newly enrolled accountant partners are also required to run client payroll with Gusto within 30 days of signing up for the program to receive the resulting discount or revenue share.

Partner accountants get several perks, such as free payroll migration for your clients and free payroll software for your firm (provided you enroll one client with Gusto per year). You also get the chance to be People Advisory Certified and featured in the Gusto Partner Directory.

Starter | Bronze | Silver | Gold | |

|---|---|---|---|---|

Number of Gusto Clients | 1 to 2 | 3 to 14 | 15 to 49 | 50-plus |

Discount or Revenue Share Percentage | ✕ | 10% | 15% | 20% |

R&D Tax Credits for Clients | ✓ plus a 5% revenue share | ✓ plus a 10% revenue share | ✓ plus a 15% revenue share | ✓ plus a 20% revenue share |

Gusto Account Dashboard and Referral Tools | ✓ | ✓ | ✓ | ✓ |

Free Marketing Collateral | ✓ | ✓ | ✓ | ✓ |

Gusto Partner Badges and Featured Partner Listing | ✕ | ✓ | ✓ | ✓ |

Customer Support | Dedicated account rep | Dedicated account rep | Dedicated rep and VIP support | Dedicated rep and VIP support |

You need to have at least three clients with Gusto to enjoy discount perks. If you want to get preferential rates or plan to pass discounts to your customers without having to follow client limits, consider QuickBooks Payroll. Its ProAdvisor program offers the same discounts—30% and 15% off the monthly base and per-employee fees, respectively—regardless of the number of clients you have.

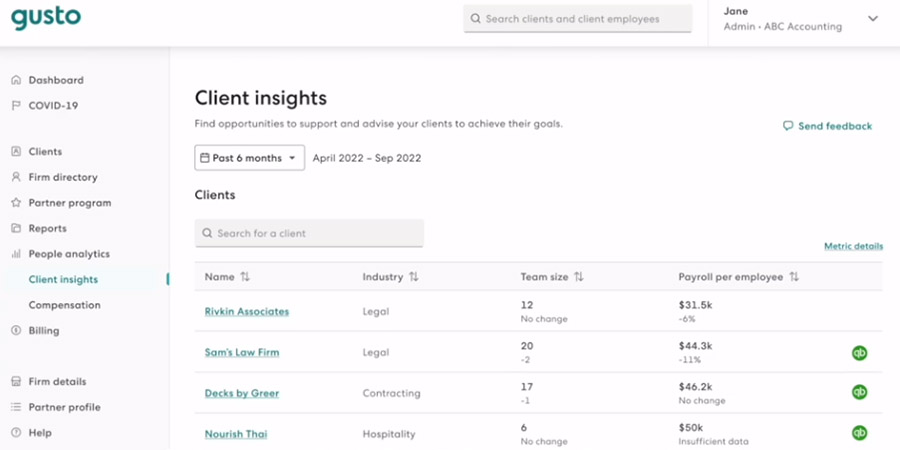

With its client dashboard, Gusto Pro, you can manage your customers’ payroll needs, track pay run deadlines, and spot issues like missed and blocked payrolls. It also includes access to helpful resources on maintaining revenue and regulatory changes, enabling you to provide personalized guidance to your clients.

All accountant partners get free Gusto marketing collateral, cobranded dashboards, and referral tools to help advertise payroll services to clients. As your client base grows, you get additional marketing resources—like inclusion in Gusto’s partner directory, Gusto partner badges you can add to your website, and a featured partner profile.

Gusto Pro’s analytics tool allows you to get the data and client payroll trends you need to manage customer accounts. (Source: Gusto)

- Unlike QuickBooks Payroll, all of Gusto’s plans include tax payment and filing services for federal, state, and local taxes. It also handles tax filings and year-end tax reporting.

- Gusto helps you manage time tracking, new hire reporting, onboarding, and workforce costing. It even has job posting tools to help you advertise open jobs, as well as a performance management solution for assessing your employees’ performance at work.

- Expert HR advisers are available, including an HR library that contains job description templates, sample policies, and HR guides.

- While its health insurance is available only in 38 states and Washington, D.C., Gusto offers a wide range of benefits options like pay-as-you-go workers’ comp, health reimbursement, 401(k), life and disability plans, health savings accounts (HSAs), flexible spending accounts (FSAs), and Dependent care FSAs.

- Gusto’s free financial management app, Gusto Wallet, has time tracking capabilities and a paycheck splitter option if you want to automatically transfer a portion of your payroll funds to a separate account as savings.

- EOR service helps you hire and pay global employees, while its international contractor payments allow you to pay contract workers in over 120 countries.

OnPay: Best for No-cost Data Migration and Client Onboarding

Pros

- User-friendly interface with unlimited pay runs

- Free payroll for your firm with no client minimums

- Partner program for accountants include discounts and revenue sharing options

- Has six levels of permissions for delegating payroll tasks and controlling system access

Cons

- Access to two- or four-day direct deposits depends on OnPay’s risk assessment

- Limited third-party software integrations

- Year-end tax report printing and mailing services cost extra (but you can print and mail these yourself at no cost)

- Lacks an in-house accounting solution

Features

Who should use it:

OnPay’s free data migration and onboarding support make it an ideal partner for those who want a stress-free implementation process for new clients. It can help set up your clients’ accounts, add their employees’ data, and input prior wages into the system. Like the other payroll for accountants solutions on our list, OnPay’s partner program offers a client dashboard and an incentive scheme that lets you choose between revenue sharing and discounted pricing.

Why we like it:

With OnPay, you get a free payroll system for your firm without meeting client limits or adding customers to your client base every year (like Patriot Payroll and Gusto). It also comes with essential HR tools and benefits options available in all 50 states. Its software has six levels of system permissions (more robust than the other providers in this guide), allowing you to manage client payroll and user access efficiently and delegate pay processing tasks, such as payroll approvals, to customers.

However, if you want to streamline HR tasks across multiple business software like accounting, consider Rippling, as it offers customizable workflow triggers that work with its 500-plus partner systems.

Unlike the other accountant payroll software in this guide, OnPay only offers one payroll plan. For a monthly fee of $40 plus $6 per employee, you are granted access to all of its payroll and HR features. Rippling may have a similar pricing scheme, but it lets you customize your package based on the HR, payroll, IT, and finance tools you need.

OnPay’s partner accountant perks include free account setup and data migration, marketing resources, free payroll for your firm, and options for either discount or revenue sharing. You can also pass the discount to your clients and have OnPay send billing statements to their offices. The incentives are based on the number of clients you have.

Member | Preferred | Advanced | Elite | |

|---|---|---|---|---|

Number of Clients | 1-2 | 3-19 | 20-49 | 50 and up |

Discount or Revenue Share Percentage | ✕ | 10% | 15% | 20% |

Free Payroll for Your Firm | ✓ | ✓ | ✓ | ✓ |

Free Client Setup | ✓ | ✓ | ✓ | ✓ |

Marketing Resources | ✓ | ✓ | ✓ | ✓ |

Cobranding | ✕ | ✕ | ✕ | ✓ |

You get free integration setup with QuickBooks or Xero, making it easy for you to sync payroll data with these accounting solutions. OnPay even offers custom item mapping setup with both software to help you create accurate general ledger entries. And, while you can choose to keep payroll processing control to yourself, OnPay’s six-level permission settings allow you to delegate payroll tasks to someone else from your firm or hand them off to clients.

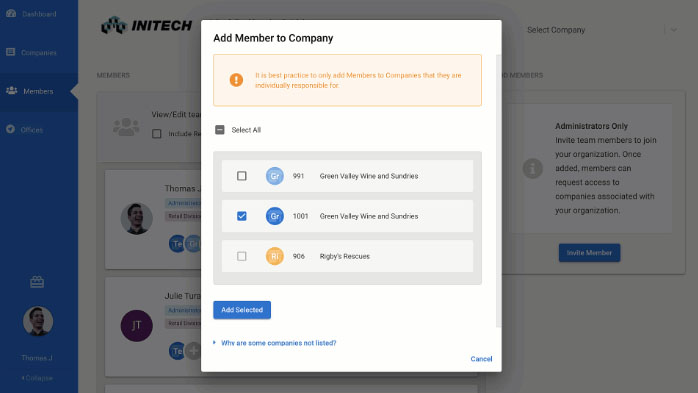

OnPay allows you to assign other accountants in your firm to access and manage the payroll customer accounts of specific clients. (Source: OnPay)

- OnPay offers unlimited pay runs, multiple pay rates and schedules, and multistate payrolls.

- Pay employees through checks, debit cards, and direct deposits. Note that you have to undergo OnPay’s risk assessment to identify whether you’re eligible for two- or four-day direct deposits. For fast direct deposits without the risk assessment, we recommend QuickBooks Payroll—it has next-day and same-day options.

- HR tools include employee onboarding, paid time off (PTO) management with in-app requests and approvals, offer letters, and state new hire reporting.

- Has built-in document templates, compliance alerts, online document storage, and an HR resource library.

- OnPay provides health insurance in all 50 states (unlike Gusto’s health plans, which only cover 38 states). Other benefits include disability, life, and retirement plans.

SurePayroll: Best Payroll Accounting Software for Simple Pay Runs

Pros

- Unlimited and automatic pay runs

- Revenue share or direct billing options

- Offers an online branded client portal

Cons

- Free payroll software perk is only available to those with at least 10 clients

- Revenue sharing has a monthly add-on fee

- Limited HR tools

Overview

Who should use it:

SurePayroll is a Paychex company and offers many of the same services, but it’s a simpler and less expensive software. This makes it perfect for accountants with small business clients whose payroll needs aren’t complicated.

Why we like it:

In addition to full-service payroll, tax filings, basic HR tools, and access to benefits options, it offers a partner program for accountants with a platform for managing clients, dedicated support, and wholesale pricing. For an additional fee, you can use its revenue share option to manage client billings. This allows you to set specific markup fees for each client and send them invoices. While it has efficient payroll and partner accountant tools, it doesn’t have a built-in time tracker, and its benefits options aren’t as robust as Justworks and Gusto’s benefits packages.

SurePayroll offers two plans, but to manage client payroll, consider getting the Full-Service option, as it includes tax filing services.

- Full-Service: $39 base fee + $7 per employee monthly

- Includes unlimited pay runs, payroll tax filings, year-end tax reporting, two-day direct deposits, online pay stubs, and new hire reporting

- No Tax Filing: $20 base fee + $4 per employee monthly

- Full-service plan but without payroll tax filing services—you have to handle this yourself

Add-on services and solutions

- Ohio and/or Pennsylvania local tax filing services: $9.99 per month

- Multiple state filings: $9.99 per month

- Time clock integration: $9.99 per month

- Accounting integration: $4.99 per month

SurePayroll’s partner accountant program includes free account setup, dedicated support, and free access to its payroll tool you can use for your firm—provided you have 10 clients. It comes with a white-label option to help boost brand exposure and your firm’s payroll services. Flexible billing options are also available.

- Direct billing: SurePayroll by Paychex will bill you its software costs, allowing you to set a markup rate when invoicing clients for payroll services.

- Revenue share billing: For an additional fee, SurePayroll by Paychex lets you handle all customer billing through its software. You can even specify markup rates for payroll services on a per-client basis.

SurePayroll is the only payroll software for accountants we reviewed that charges extra for revenue sharing. With Gusto, QuickBooks Payroll, and OnPay, you only have to sign up for its partner accountant program and either select revenue sharing as your incentive or earn dividends.

With SurePayroll, you get white-label branding tools so you can customize its client portal to match your company’s color scheme. It may not have an accounting solution like QuickBooks and Patriot, but its platform can connect with accounting software like Xero, Zoho Books, LessAccounting, Kashoo, QuickBooks, Sage 50, and AccountEdge. Aside from a client dashboard, you are granted free access to a library of marketing resources and case studies to help you grow your accounting practice.

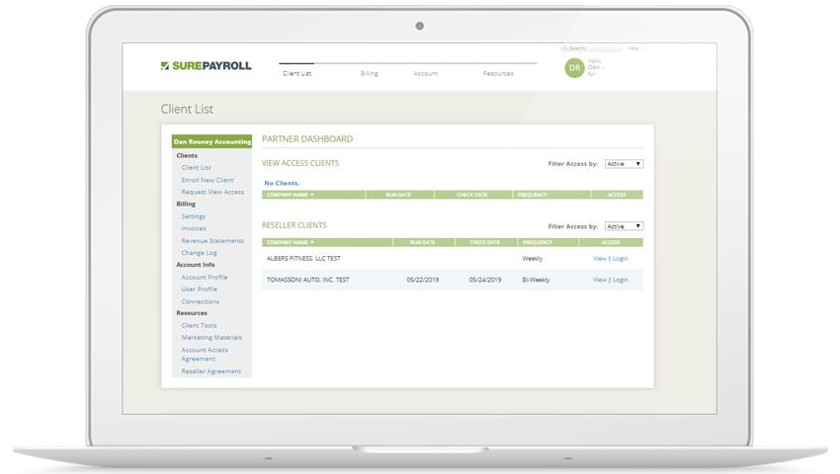

A snapshot of SurePayroll’s client dashboard for partner accountants (Source: SurePayroll)

- SurePayroll offers unlimited pay runs each month with payout options that include paper checks and two-day direct deposits.

- Similar to Patriot Payroll, it offers a full-service pay processing package with tax filing services and a do-it-yourself (DIY) plan, which is optimal for clients with a very small team—provided you’re willing to handle tax payments and filings yourself.

- New hire screening tools include background checks, drug screening, behavioral assessments, and skills testing.

- Benefits offerings include health insurance, 401(k) plans, and workers’ compensation. However, if your clients are looking for a financial management tool, consider Gusto.

Justworks: Best for Employee Benefits and Payroll Compliance

Pros

- Justworks-administered 401(k) program and enterprise-level benefits packages from major health insurance companies

- Unlimited pay runs

- User-friendly interface with good customer support

- Accountant partner program includes dedicated support and a client dashboard

Cons

- Medical, dental, vision, health savings account (HSA), and flexible savings account (FSA) are available only in the Plus plan

- Time tracking is a paid add-on

- Paydays must follow preset schedules (every other Friday for non-exempt salaried and hourly workers; every 15th/end of the month for exempt salaried employees)

Overview

Who should use it:

As a company that offers professional employer organization (PEO) services, Justworks is better equipped than most payroll software providers to handle payroll compliances given its team of HR-certified professionals. Teaming up with Justworks can help you keep clients compliant with ever-changing tax regulations and employment laws. Plus, it provides access to Fortune 500-level benefits at affordable rates that your customers can offer to their employees.

Why we like it:

With Justworks’ PEO services, your clients get efficient payroll and HR tools paired with solid compliance and customer support. Its benefits packages include standard and non-standard options. Aside from the usual health and retirement plans, it has mental health resources and fitness memberships, which your clients can use to support their workers’ mental health and fitness goals.

Similar to Gusto and Rippling, it can handle global contractor payments and offers an EOR solution for hiring and paying international employees. However, if your client has simple pay processing needs, consider SurePayroll.

Justworks offers two PEO packages:

- PEO Basic: $59 per employee monthly

- Includes full-service payroll, tax filings, contractor and vendor payments, expense reimbursements, PTO management, employee onboarding, basic timecards, customizable reporting, HR advisory services, and access to benefits plans

- PEO Plus: $109 per employee monthly

- PEO Basic + advanced analytics, COBRA administration, and access to additional employee benefits, such as mental health resources and medical, dental, and vision plans

It also offers a standalone payroll tool, which costs $50 plus $8 per employee monthly, which doesn’t include vendor payments and employee benefits plans (but can calculate and apply benefits deductions).

Add-on services and solutions

- Justworks Time Tracking: $8 per employee monthly

- International contractor payments: $39 per worker monthly

- Employer of Record: $599 per employee monthly

Instead of getting discounts, you can earn referral bonuses of up to $300 per employee. If providing client discounts is more important, you can waive your referral bonus and offer new clients up to three months of free admin fees. Note, however, that these perks are based on the number of PEO clients you have.

Bronze (Up to 4 PEO Clients) | Silver (5-9 PEO Clients) | Gold (10 and more PEO Clients) | |

|---|---|---|---|

Option 1 | $100 per employee | $200 per employee | $300 per employee |

Option 2 | Free admin fees for the first month | Free admin fees for the first two months | Free admin fees for the first three months |

With Justworks, you get a Partner Relationship Management tool to track and manage new referrals. Access to compliance resources, R&D tax credit assistance, and dedicated support are also available.

While its team of HR-certified professionals can help you navigate the complexities of managing compliances and employee issues, Justworks provides 24/7 support for you and your clients via Slack, phone, email, and chat.

- Automated and unlimited pay runs let you process payments for employees and contractors, including vendors (the other payroll software for accounting firms we reviewed only support employee and contractor payouts).

- HR tools integrated with its payroll module, allowing you to onboard/offboard workers and track employee attendance, including PTO.

- Select the best plan from a wide variety of standard and non-standard employee benefits options to help you attract and retain employees.

- Non-standard benefits include options to help employees manage mental health and financial resources. It also provides teleconsultation services (via One Medical and where available) and support for gynecological, fertility, and family-building (e.g., adoption and surrogacy) issues.

- Expert support with 24/7 access; plus, Justworks touts a 45-second average wait time for phone support and a customer satisfaction score of 4.8 out of 5.

Rippling: Best All-in-One HR Payroll Software for Accounting Firms

Pros

- Payroll, IT, expense management, and HR tools are modular—you can select solutions that you need

- Robust integration options with more than 500 apps

- Unlimited pay runs

- Partner program includes discounts for clients and a dedicated partner success manager

Cons

- You need to get its core Rippling platform before you can buy other solutions

- Pricing isn’t all transparent

- Purchasing all of its tools can get pricey

Overview

Who should use it:

Rippling allows you to provide clients with a wider range of solutions given its modular HR, payroll, benefits, and IT tools. This is great for accounting firms that want to handle more than client payroll and HR. With Rippling, you can manage business apps, company-assigned computers, expense claims, and even corporate cards for employees.

Why we like it:

What sets Rippling apart from the other payroll software for accountants in this guide is its feature-rich platform and customizable workflows that can automate processes across HR, payroll, IT, and expense management functions. Similar to Gusto and Justworks, Rippling offers global contractor payments and EOR services.

However, its partner accountant program isn’t as robust as QuickBooks, with its certification programs and preferential rates for accounting professionals. It also charges add-on fees for many of its HR solutions (like time tracking and HR advisory services).

Rippling Unity, Rippling’s base platform that all subscribers must purchase, is now called Rippling Platform.

While Rippling’s pricing page indicated that its monthly fees start at $8 per user, you have to call the provider to get a quote. It will work with you to build an HR payroll package with the solutions and services that your business needs.

In the quote we received, Rippling’s core platform with payroll, time tracking, onboarding/offboarding, and integration tools is priced at $35 plus $8 per employee monthly. Adding IT tools to manage apps and computer devices to its platform will cost you an additional per-employee of $8 monthly.

Here are some of its custom-priced add-on products:

- Recruiting

- Benefits administration

- Learning management

- PEO services

- EOR services

- Expense management

- Corporate cards

Rippling’s partner program provides accountants free access to payroll and HR solutions that you can use for your firm. You even get a dedicated partner success manager and partner enablement materials, so you can become a better payroll adviser to your clients.

For your new customers, it offers free white-glove payroll migrations to help your clients easily transition from their current payroll system to Rippling. Your clients can also enjoy discounts of up to 35%. However, if you want training perks, consider QuickBooks Payroll and Paychex since both include learning courses in their partner programs.

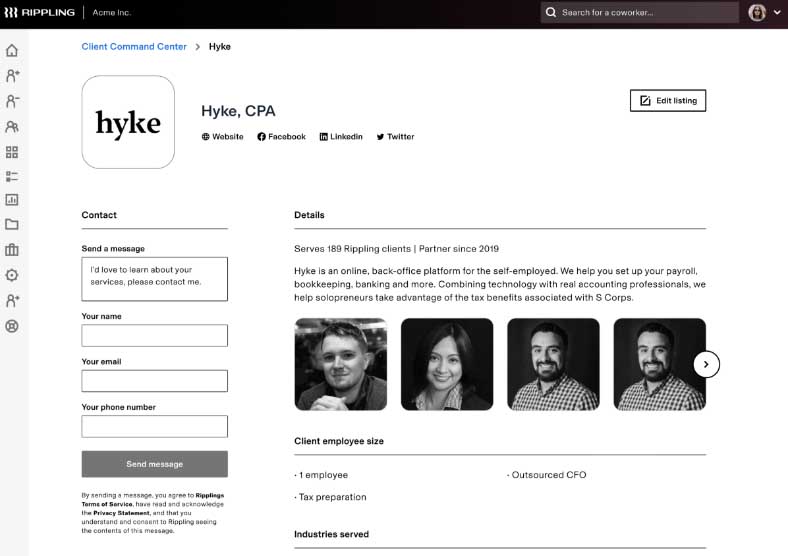

Unlike QuickBooks and Patriot, Rippling lacks an in-house accounting tool—although it can integrate with QuickBooks, Sage Intacct, and Xero. Keeping track of all of your customers’ payroll needs and timelines is also made easy with Rippling’s client command center. Plus, it assigns all partner accountants with a dedicated Rippling Advisor who will serve as their point person if they have inquiries about the platform’s features, the program’s marketing tools, and more.

With the online accountant partner directory, you can create a listing for your firm and market your services to Rippling customers. (Source: Rippling)

- Unlimited pay runs and auto-calculations of pay rates are just some of Rippling’s payroll features. You can pay both employees and contractors either through paychecks or direct deposits.

- Rippling flags errors and pay data discrepancies between your draft pay runs and processed payrolls.

- With Rippling, you only need to enter data once, and its software will automatically reflect the changes across its HR, IT, payroll, and expense management solutions. You also don’t have to worry about having to do employee attendance data uploads because its time tracking tool connects seamlessly with its payroll solution, making it easy for you to capture the actual hours worked for pay processing.

- Rippling makes assigning and deploying computer devices to new hires easy. You can even install the necessary apps on computer devices and restrict access for resigning employees.

- Rippling can connect with more than 500 business apps. None of the providers on this list have a partner network this extensive.

Patriot Payroll: Best Accountant Payroll Software for Discount Perks

Pros

- Affordably priced plans with unlimited pay runs

- Discounts of up to 20% or more, depending on the number of client accounts

- In-house accounting solution

- Free access to its payroll and accounting systems if you have six or more clients

- Cobranding throughout its software

Cons

- Limited HR tools; lacks self-onboarding tool for new hires

- Multistate filings cost extra

- No access to employee benefits plans (but offers free integration with its workers’ comp and retirement plan partners)

- Time tracking, online document management, and accounting solutions are paid add-ons

Overview

Who should use it:

Patriot Payroll made it on our list of best payroll processing software for accountants because of its affordability, solid accounting and pay processing tools, and competitive discount offers. Patriot even offers a 5% discount if you only have one client, whereas most of its competitors require at least three clients to get a discount.

Why we like it:

Aside from payroll, it has basic HR solutions for managing staff information and monitoring employee work hours and overtime. While these tools are paid add-ons, adding both to Patriot’s payroll platform makes it ideal for your clients who employ mostly hourly workers and want to accurately capture employee attendance.

In addition, running payroll with Patriot is easy. Plus, it integrates with QuickBooks and its in-house accounting software, Patriot Accounting. However, Patriot Payroll lacks onboarding, state new hire reporting, and benefits options. If you require these functionalities, consider any of the providers in this guide.

Patriot has two payroll plans: Basic and Full Service. Between the two plans, you should offer the Full Service option to your clients as this comes with tax payment and filing services. With the Basic plan, you may need to handle your customers’ tax filings yourself.

- Full Service: $37 base fee + $4 per employee monthly

- Unlimited payroll, tax filings, year-end tax reporting, multiple pay rates and schedules, PTO accruals, and free two-day direct deposits for qualified clients

- Basic: $17 base fee + $4 per employee monthly

- Full service plan but without tax filing services

Add-on solutions and services

- Multistate tax filings: $12 monthly for each additional state

- 1099 e-filings (for Basic subscribers only): $20 for up to five 1099 e-filings; an additional $2 per 1099 is required for six to 35 filings (no additional charge for 36 or more)

- HR software: Starts at $6 + $2 per employee monthly; includes employee data management and reporting tools

- Time and attendance: Starts at $6 base fee + $2 per employee monthly

- Accounting software: Can be purchased as a standalone tool or as an add-on solution

- $20 monthly for the Basic accounting package

- $30 monthly for the Premium package, which includes additional invoicing and account reconciliation features

Accounting firms that join Patriot Payroll’s partner program enjoy discounted rates based on the number of clients they have. For companies with up to 100 clients, discounts range anywhere from 5% to 20% for its payroll and accounting modules. Bigger discounts are available for those with 100 and more employees. And unlike Gusto and OnPay’s discount perks, which require at least three customers—with Patriot, you get 5% off even if you only have one client.

While you can’t pass the discount to your customers, paying Patriot Payroll’s subscription fees on behalf of your clients lets you set your own price for your services—regardless of the discount you enjoy. And if your clients require multi-state payroll, Patriot will only charge you $10 per additional state for payroll tax filings (instead of $12 per additional state). You can even use its payroll and accounting software for your firm at no cost, provided you have six or more active clients.

Silver | Gold | Platinum | Diamond | |

|---|---|---|---|---|

Number of Clients | 1-5 | 6-20 | 21-50 | 51-100* |

Discount | 5% per client | 10% per client | 15% per client | 20% per client |

Discounted Rate for Full Service Payroll Plan | $35.15 base fee + $3.80 per worker monthly | $33.30 base fee + $3.60 per worker monthly | $31.45 base fee + $3.40 per worker monthly | $29.60 base fee + $3.20 per worker monthly |

Discounted Rate for Accounting Premium Plan | $28.50 monthly | $27 monthly | $25.50 monthly | $24 monthly |

*If you have more than 100 clients, call Patriot to request a quote | ||||

With Patriot Payroll’s client dashboard, you can add and manage your customers’ payroll information with ease. A cobranding service is also available, where your firm’s branding will appear throughout its software. While it offers accounting software integration with QuickBooks Desktop and QuickBooks Online, Patriot has its own accounting solution that you can purchase for either $20 or $30 per month.

Patriot’s onboarding dashboard lets you monitor your client onboarding activities online. (Source: Patriot Payroll)

- Pay hourly and salaried employees with ease, including contractors. In addition to unlimited payroll, you can also set its system to run automatically—provided you have already processed a successful payroll and don’t expect any changes to it.

- In case your clients want to give employee bonuses, simply add the expected take-home amounts into Patriot, and its “Net to Gross Payroll” tool will automatically gross it up for taxes.

- Patriot allows you to change employee hourly pay rates while processing payroll without leaving the page or canceling the pay run. This helps you save time from having to switch between its payroll tool and employee database.

If you just want to recommend payroll software to your clients, then check out our guides on the best payroll software and leading payroll services. To help you select the ideal pay processing solution for your firm, read our finding a payroll software guide.

How We Evaluated the Best Payroll Software for Accountants

The first thing we looked for was payroll software with partner programs specific to accountants. The software also needed to provide more than discounted pricing, so we checked for client dashboards and benefits specifically for accountants. Then, we compared essential features, such as pay runs, tax filings, and HR tools. Finally, we considered the price for clients and accountants.

Click through the tabs below for a more detailed breakdown of our evaluation criteria.

20% of Overall Score

20% of Overall Score

We allotted the most points to providers that offer preferential rates to accountants. We also looked for partner perks like client discounts, revenue share options, branding features, and access to free payroll software. Extra points were given to payroll software providers with an in-house accounting solution and a client management dashboard.

25% of Overall Score

We gave priority to software with two-day direct deposits that handles all payroll tax payments and filings. We also looked for multiple payment options and a penalty-free guarantee.

15% of Overall Score

Access to expert support, including online onboarding and state new hire reporting, are the top HR features we looked for. We also check if there are time tracking tools, diverse benefits options, health insurance available across the US, and a self-service portal.

15% of Overall Score

Payroll service and software should be simple to set up, be customizable, and have a user-friendly interface. Aside from user reviews, we also looked at whether the provider offers live support and integration options with online tools that most SMBs use.

5% of Overall Score

Preference was given to software with built-in basic payroll reports, customization options, and the functionality to export reports into CSV file formats.

Accountant Payroll Software Frequently Asked Questions (FAQs)

Yes, they do. With a payroll system, accountants can efficiently and compliantly process their clients’ pay runs and tax filings. Some payroll software even have expense management tools to help accountants track and process employee business expense claims.

Apart from payroll and accounting systems, accountants may use expense management, invoicing, and billing solutions—if those functionalities aren’t included in the accounting software.

Pricing can vary, depending on the features included. An accountant payroll software with basic pay processing tools can cost anywhere from $40-$50 monthly for one employee. Those with advanced HR payroll tools are priced at around $80 to $100-plus for one employee monthly.

For accountants or accounting firms, it’s important to find an online system that can handle the payroll needs of your clients—from simple pay runs to processing multi-state payroll. Pricing, ease of use, compliance tools, and customer support are also important, as well as tax filing services (so you don’t need to handle these yourself). Consider the integration options offered and the HR tools included (such as time tracking, new hire reporting, and onboarding), as these can streamline processes.

Bottom Line

Finding payroll software that also offers an accounting solution is critical if you’re offering payroll accounting services. It makes bookkeeping easy and doesn’t require you to input payroll-related data manually into your books since its accounting and payroll tools integrate seamlessly with each other. If you have preferred accounting software, check if it offers payroll and vice-versa. Then, consider the needs of your clients and add-on solutions that would be helpful to you and your customers, such as basic HR and benefits options.

We find QuickBooks Payroll is the best payroll software for accountants managing small businesses because you can use its integrated payroll and accounting platform to transfer payroll data to the general ledger, saving you time from doing it yourself. It also offers free payroll for your company, a client dashboard, a revenue share option, and discounted rates for you and your clients.