ACH payments transfer funds directly from the customers’ bank to the merchant’s bank. These are cheaper to process than credit card and debit card payments. The ACH payment method is particularly useful for recurring payments, invoicing, and B2B payments.

To start accepting these types of payments, you need to set up a business bank account and sign up for a merchant account that offers ACH payment services. This quick guide will show you how to accept ACH payments in five steps.

What is ACH? The Automated Clearing House (ACH) payment railway facilitates fund transfers from one bank account to another. ACH is the main computer-based network in the US used for processing electronic funds transfers. It works differently than how credit card payments are processed. To learn more, read our small business guide on ACH Payments.

Step 1: Make Sure ACH Payments Are Right for You

Before signing up, you need to make sure that ACH payments are right for your business. ACH payments are often used by high-volume businesses, B2Bs, and subscription businesses that earn from automated recurring transactions.

One major advantage of ACH payments is that it’s considerably cheaper than accepting credit cards. However, traditional ACH payments are not instant and take a few days to approve and process the transfer of funds. These also require more effort on the part of the customer, who will need to enter their bank account information.

This makes it less convenient for small, low-ticket transactions. For typical retail transactions, card payments are usually better.

How ACH Payments Work

Merchants use ACH debit for business transactions that are initiated by the receiver. The customer provides the merchant with their bank account information and the necessary authorization. Then, the merchant’s bank uses the information to request that the amount be transferred from the customer’s account to the merchant’s bank account.

If you intend to accept payment methods other than ACH, especially card payments, you will need a payment processor. Payment processors (also called merchant account services or payment services provider) will require you to have a US business bank account to provide you with a merchant account. Read our guide to learn more about merchant accounts.

Step 2: Set Up a Business Bank Account

As a general rule, merchants should always have a separate bank account for their business.

US-based businesses will need incorporation or LLC information, the EIN, and business contact details to open a business bank account (download our business bank account requirement checklist to help you make sure you have it all). You’ll also want to set aside some money to open the account; this can be as little as $5 but varies by bank. Check out our guide on how to open a business account.

If you do not have a US business bank account and a payment processor yet, consider Chase. Aside from being one of the best checking accounts for small businesses, Chase also makes our list of recommended payment processors. If you’re a new business looking to set up ACH payments, it has everything you need to get started.

Step 3: Choose an ACH Payment Processor

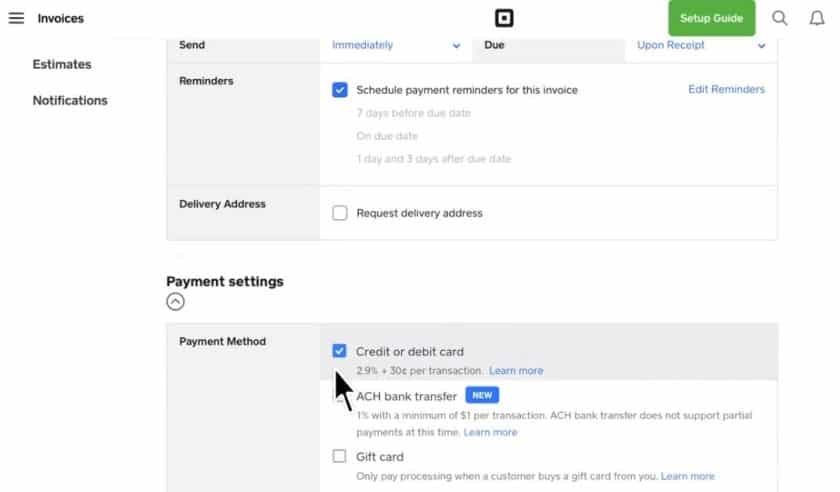

If you already have a payment processor for accepting credit card payments, see if it also handles ACH transactions. It could be as easy as adding the option to your invoices or checkouts. However, if you are new to payment processing, you will need to sign up for a merchant account and payment processor that handles both ACH and credit card payments.

Check out the following payment processors to help get you started.

Best Payment Processors for ACH Payments

Best for | Monthly fees | ACH fees (per transaction) | Payout speed | Learn More | ||

|---|---|---|---|---|---|---|

| Cross border transactions | $0 | 0.8% (capped at $5) | 2–4 business days | ||

Automated Discounts | $0 | 0.5% + 25 cents | 3–4 business days | |||

Mid-to High risk businesses | $10-$45 | Varies* | Within 24 hours | |||

Fast deposits** | $0 | 1% (capped at $25) | Same-day or real-time |

**Accepting ACH payments with Chase is only available via its virtual terminal, Orbital

As you make your decision, consider the following:

- Fees: Think about standard rates, transaction fees, monthly fees, monthly minimum requirements, maximum charges, penalties for returned checks, and extra fees. PayPal, for example, charges extra for its virtual terminal, whereas Helcim offers this for free.

- Your business type: High-risk businesses often need particular payment processors like PaymentCloud. Meanwhile, high-volume businesses may qualify for discounts or are better off with payment processors that charge a monthly fee but have interchange-plus pricing, such as Dharma Merchant Services.

- Tools: Be sure the payment processor provides the necessary tools. If you plan on accepting ACH payments using sales or ecommerce software, be sure the processor integrates with it.

Read more about our top choices for ACH payment processors.

Step 4: Enable ACH Payments

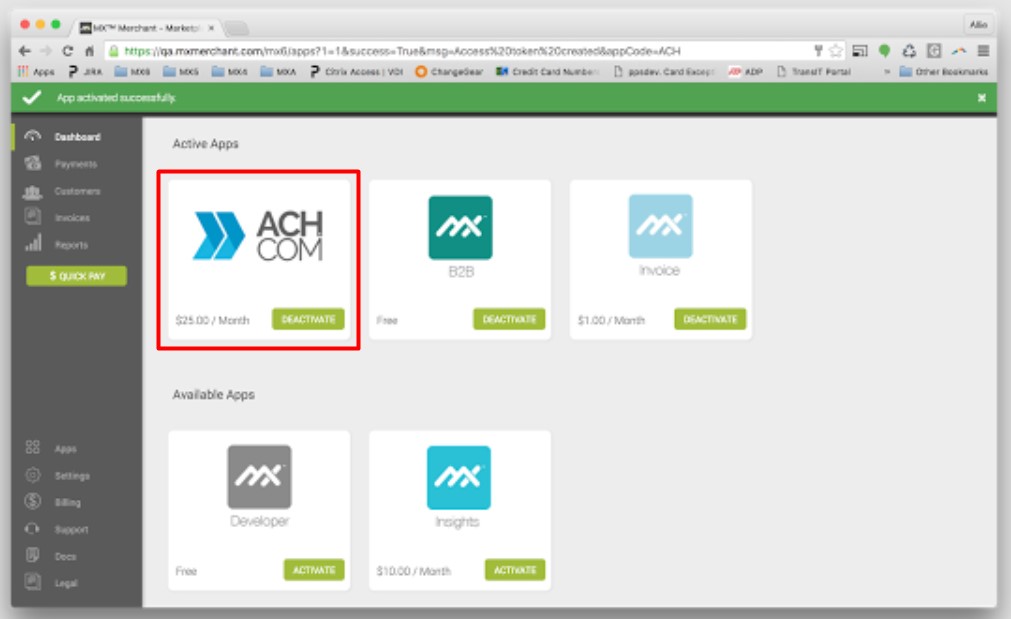

With a payment processor, enabling ACH payments on your application or through an invoice is often as simple as clicking a button to activate the option or configuring some settings in your account. Once it’s set up, your customer needs to provide their bank account information.

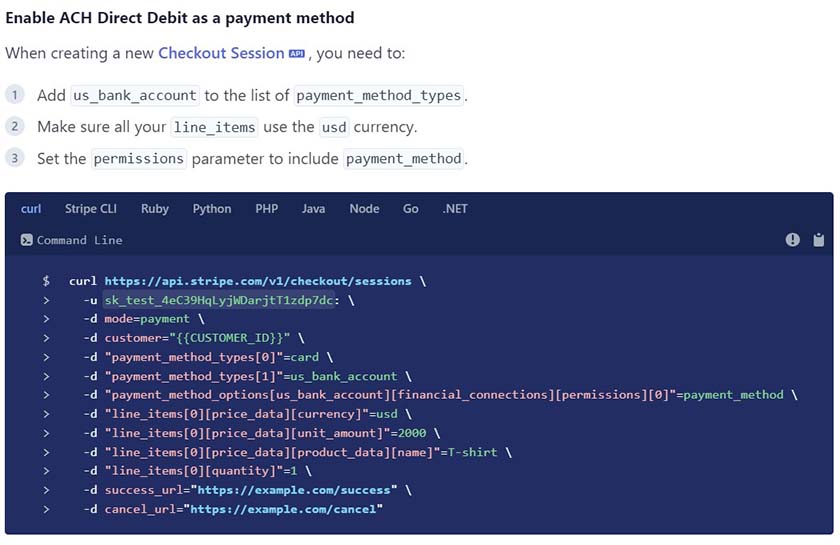

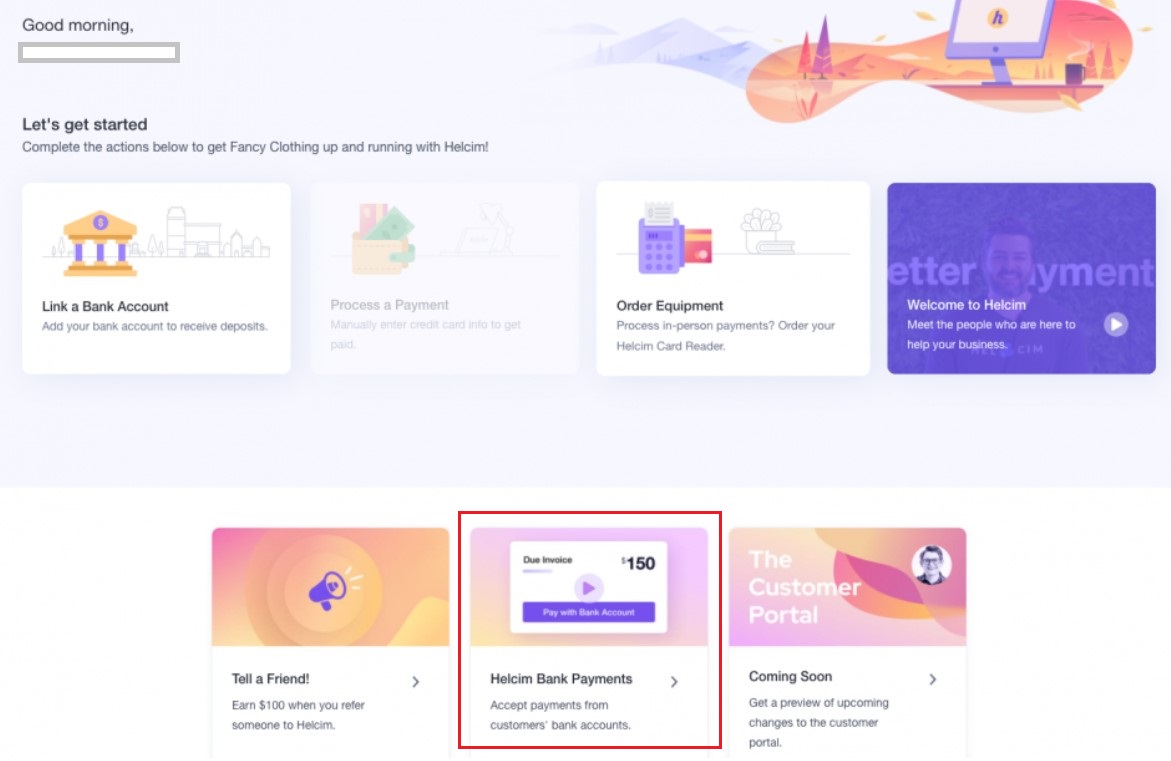

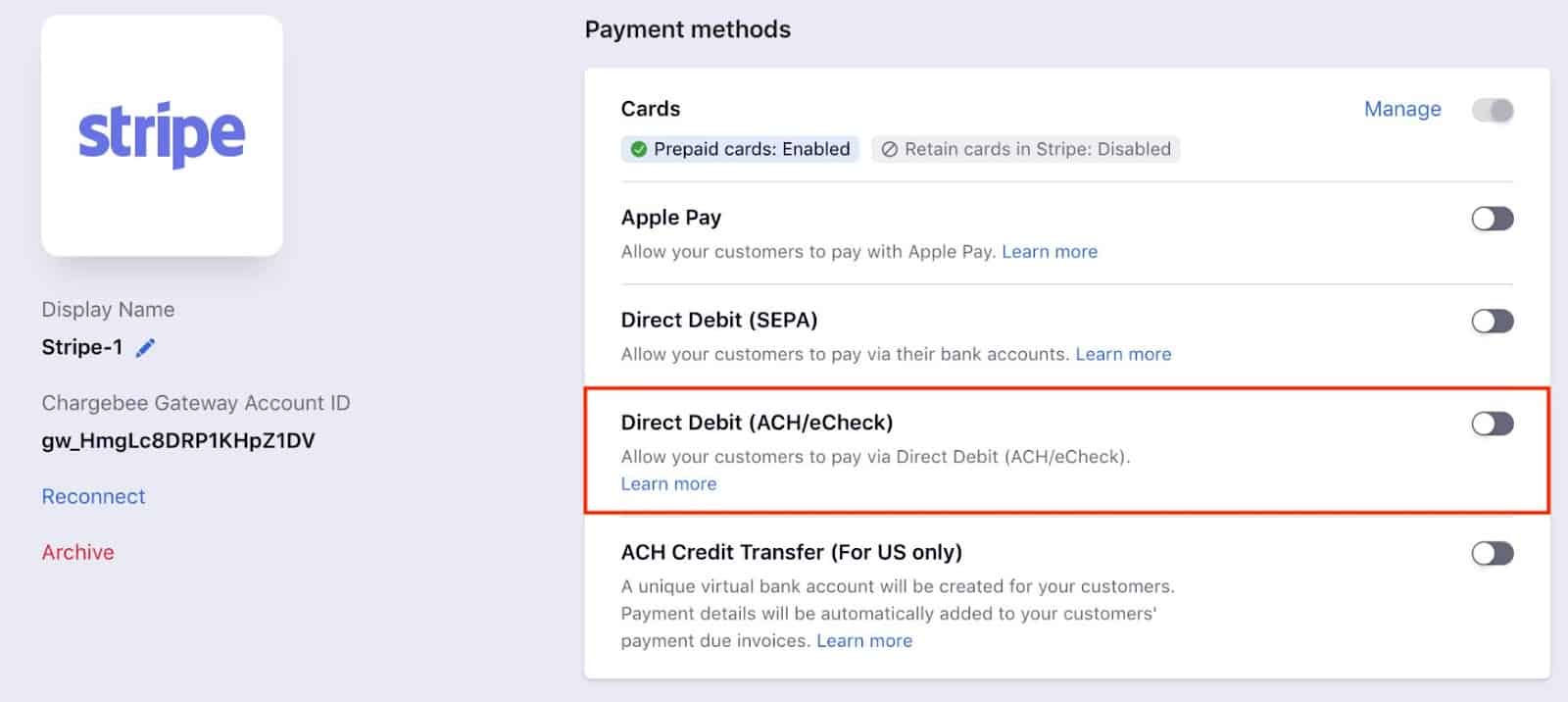

Some processors like Helcim will allow you to turn on ACH Payments with just a button or a toggle on your dashboard. There are others like Stripe that require more in-depth coding. Check your processor’s documentation if the ACH payment option is not readily available from your provider dashboard.

Step 5: Get Payment Details & Authorization From Your Customers

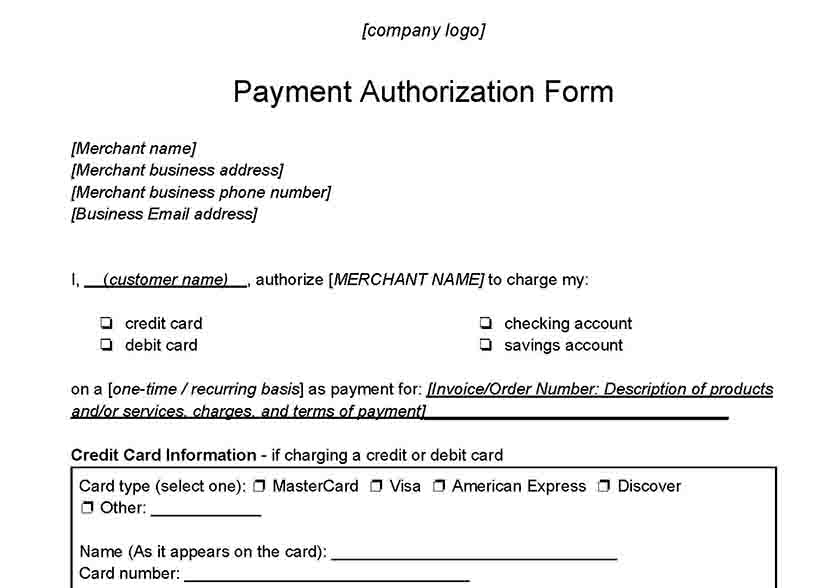

To start an ACH payment transaction, you will need to get your customer’s payment details and authorization. Have your customer fill out a payment authorization form that will ask for their payment details. You can attach the form when you send the invoice. Once this is provided, you can start initiating the request for payment using the virtual terminal.

Your payment processor will handle the transaction details for you by arranging the transfer. It sends the payment request to the customer’s bank for approval, takes the payment, and after processing, transfers the money to your business bank account (minus processing fees). It’s as easy as accepting credit card payments.

Here is a sample payment authorization form you can customize to help you get started.

Thank you for downloading!

Want a payment processor with credit card authorization tools and more already built-in? Visit Square to see why it is our top-recommended payment processor.

Consider providing some incentive to customers for choosing ACH payments. Some customers may balk at ACH payments, which require them to find their banking information. Compare this to the one-click ease of PayPal, for example. However, since it’s cheaper than PayPal or credit card processing, it might be worth offering a discount or a free month on a long-term subscription.

Cost of Accepting ACH Payments

Like with credit card processing, ACH processing fees vary from one payment processor to another. However, the usual ACH payment processing fee is 1%, with most providers putting a cap on the fees for each transaction. Add cross border/ currency conversion fees (usually 1%–3% charged by your payment processor, plus card network cross border fees when customers are paying via credit card) if you are accepting payments from other countries.

The prices listed in our chart above give a good idea of what to expect—but always check with your specific payment processor for details.

Overall, accepting ACH payments offers the best value among other payment methods. ACH payments are:

- Cheaper: Payment processors usually charge less for ACH transfers than credit card processing. (PayPal is an exception.)

- Becoming easier to process: With a payment processor and same-day/real-time funding options, ACH is becoming as convenient to use as a credit card.

- Great for recurring payments: Customers can set up recurring payments on their schedule, like on paydays, making it great for utility-type billings.

- Don’t expire: Unlike credit cards, which expire or get lost or stolen, ACH payments are bank-to-bank, so the only potential problems are insufficient funds or account closures.

ACH Payments Frequently Asked Questions

In general, ACH payment takes 2-5 business days—although the latest in payment technology is making it possible to offer same-day and real-time ACH processing. Contact your payment processor for more details.

Electronic fund transfers (EFTs) is a catch-all term for the transfer of funds electronically between banks, ACH, e-check, and wire transfers. ACH is a bank-to-bank transfer of funds through the Automated Clearing House. E-checks are a better option when accepting cross border payments. Wire transfers are real-time bank-to-bank transfers and are more expensive than ACH.

Nearly all merchant accounts include ACH and credit card processing. If yours does not, it may be a good time to switch to a payment processor that offers a wider range of payment method alternatives.

Bottom Line

ACH payment processing is ideal for those with recurring billing, invoicing, or B2B sales needs. Less expensive than credit card processing in most cases, it’s secure and easy for you and your customer. Most payment processors can handle ACH payments and include the function in their services. Contact your payment processor for details on how to set up ACH payments for your business.