Arizona generally follows federal guidelines, making learning how to do payroll in Arizona straightforward. Arizona has only one state-specific payroll form, and for tax year 2023, it has moved to a flat income tax. It’s crucial that you note this transition for your payroll process so you’re withholding the right amount of tax for your employees.

Key Takeaways:

- Arizona Minimum Wage: $14.35 per hour for non-tipped employees, $11.35 per hour for tipped employees

- Arizona has a flat income tax rate of 2.5%

- Arizona requires that you pay employees at least twice a month

- Arizona has income tax reciprocity with California, Indiana, Oregon, and Virginia

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Running Payroll in Arizona: Step-by-Step Instructions

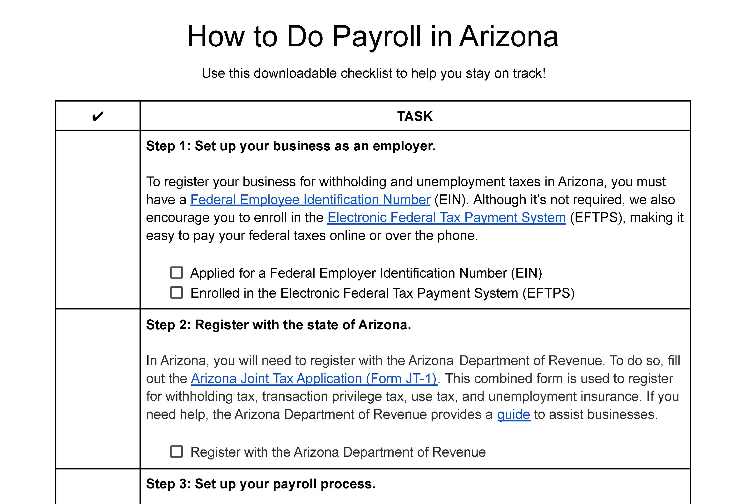

Step 1: Set up your business as an employer. At the federal level, you need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the state of Arizona. In Arizona, you will need to register with the Arizona Department of Revenue. To do so, fill out the Arizona Joint Tax Application (Form JT-1). This combined form is used to register for withholding tax, transaction privilege tax, use tax, and unemployment insurance. If you need help, the Arizona Department of Revenue provides a guide to assist businesses.

Step 3. Set up your payroll process. You’ll need to set up payroll and a pay schedule and determine how you plan to pay employees and process taxes and deductions, etc. You can do payroll yourself, use an Excel payroll template, or choose a payroll service. Each option comes with advantages and disadvantages.

Step 4: Collect employee payroll forms. The best time to collect payroll forms is during onboarding. Payroll forms include W-4, I-9, and Direct Deposit information. Arizona also requires you to submit form A-4.

Step 5: Collect, review, and approve time sheets. You have three options:

- Use a paper time sheet

- Use free or low-cost time and attendance software. We also offer a free time card calculator

- Use a payroll service that has a time and attendance system

Step 6: Calculate payroll and pay employees plus taxes. You can choose to pay employees in a variety of different ways (i.e., cash, check, direct deposit, pay cards). Federal taxes should be paid through the EFTPS.

Step 7: File payroll taxes with the state government. For Arizona state taxes, you must report withholding tax on an annual and a quarterly basis. For annual withholding tax reporting, you will use form A1-APR. For quarterly withholding reporting, you will use form A1-QRT. You can find these forms and instructions here.

While all businesses must report quarterly and annually, Arizona has different rules when it relates to paying withholding taxes to the state. This is based on the total amount of withholding taxes paid. Arizona uses the average previous four quarters in the calculation for existing business.

Arizona Withholding Tax Payment Schedule Rules

Tax Amount Paid | Payment Schedule |

|---|---|

Less than $200 with approval from Arizona Department of Revenue | Annual |

Greater than $200 but less than or equal to $1,500 | Quarterly |

Greater than $1,500 | Same as federal withholding deposit |

For businesses in the first year of operation, the following table applies on how to calculate your average for the previous table.

Arizona Withholding Tax Average Calculation

Quarter | Average Calculation |

|---|---|

1 | No calculation available, so remit quarterly |

2 | Use the amount withheld in the first quarter |

3 | Use the average of the first two quarters |

4 | Use the average of the first three quarters |

For state unemployment insurance taxes (SUTA), the Arizona Department of Economic Security uses the information that you include on the Arizona Joint Tax Application to determine whether you are required to pay.

Step 8: Document and store your payroll records. It is important to retain records for all employees for several years, including those no longer with your company. If you need help with which records to keep, please see our article on retaining payroll records.

Arizona requires that you maintain the following records for four years:

- All check stubs and canceled checks

- Cash receipts and disbursement records

- Accounting records (e.g., payroll journal, general journal, and general ledger)

- Copies of federal and state tax reports

- Copies of payroll filings (W-2s and W-3s)

- For each pay period:

- The beginning and ending dates of each pay period

- Total amount and date paid for each pay period

- The day in each week where the most employees worked and how many employees worked on that date

- For each worker, the:

- Biographical information (first and last name, Social Security number)

- Hire information (hire, rehire, and/or return to work dates)

- Termination information (termination date and reason)

- Amount paid to each employee for each pay period and quarterly

- Date and amount of supplemental payments (e.g., bonuses, gifts, and/or commissions)

- Work location

Step 9. File payroll taxes with the federal government. The IRS has forms and instructions on filing federal taxes, including unemployment. You can also order official tax forms from the IRS. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday by the following Friday

Please note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 10. Do year-end payroll tax reports. The federal forms that are required are W-2s (for employees) and 1099s (for contractors). These forms should be provided to employees and contractors by Jan. 31 of the following year. State W-2s are required for Arizona, and these forms are also due by Jan. 31.

Download our free checklist to help you stay on track while you’re working through these steps:

Thank you for downloading!

If you need help running your Montana payroll, consider using payroll software like QuickBooks Payroll. It files and pays your payroll taxes and covers any penalties you are charged if its reps make a mistake (it’ll cover your mistakes too if you opt for a premium plan). You can pay employees via direct deposit or check, and same-day payment options are available as well. Sign up for a free trial or discounted rate.

Arizona Payroll Laws, Taxes & Regulations

Federal law, of course, requires that you pay income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. Called FICA taxes, Social Security and Medicare are withheld from each employee’s paycheck at respective rates of 6.2% and 1.45%; you’ll also pay a matching amount out of your bank account. The FUTA rate is 6.0% on the first $7,000 that is paid to each employee in that year.

Arizona Taxes

Arizona has a few items that differ from federal regulations. It has state income taxes, as well as requirements relating to unemployment insurance, workers’ compensation, and minimum pay frequency.

Arizona has income tax reciprocity with California, Indiana, Oregon, and Virginia. For employees in these states, they may not have to pay or file income taxes in Arizona. See this Arizona Department of Revenue page for more information.

Arizona now has a flat tax of 2.5%. Your company now only needs to withhold a flat rate from each paycheck. If your company is withholding taxes at the old rates, stop now and immediately make adjustments.

Arizona’s unemployment tax rate is 2% for new employers that have been in business for two years or less. After year three, your rate is dependent on the taxes paid, unemployment benefits paid, and the size of your annual taxable payroll, ranging from 0.05% to 7.02%. The unemployment taxable wage base for 2024 is $8,000.

You are required to provide workers’ compensation for employees in Arizona. Workers’ compensation is no-fault insurance. This means that, unless a worker intentionally injured themself, they will be eligible for benefits under your company’s workers’ compensation policy.

The cost of workers’ compensation insurance is around 70 cents for each $100 payroll you processed. For example, a company that processes $500,000 of payroll can expect to pay around $3,500 in insurance.

Minimum Wage & Tips

Most jobs require you to pay at least minimum wage. If you need any assistance on the federal guidelines on exemptions, please use the following: Federal Exemptions for Minimum Wage.

Arizona’s current minimum wage is $14.35 per hour for non-tipped employees, and $11.35 per hour for tipped workers. State law allows employers in Arizona to take up to a $3.00 tip credit for tipped employees.

Note: Flagstaff has a higher minimum wage than the state. Its current minimum wage is $17.40 per hour. Keep your eye on legislation moving through the process, called the Arizona Minimum Wage Increase Initiative. If it becomes law, this would increase the state minimum wage to $18.00 per hour. This initiative may be on the November 2024 state ballot.

Overtime

Arizona follows federal guidelines regarding overtime. You’ll need to pay 1.5 times the regular hourly rate for any hours your employees work over 40 in a workweek.

Different Ways to Pay Employees

In Arizona, you are able to pay employees via standard payment options. These options include check, cash, pay cards, or direct deposit.

However, you are not required to pay any employees by check or cash. If your company chooses to pay all employees electronically, and the employee does not consent to providing direct deposit information, you can provide the employee with a pay card. The employee must be able to have one free withdrawal for each deposit, and all fees must be disclosed to the employee.

Check out our guide on how to pay employees for more in-depth information.

Minimum Pay Frequency

Arizona requires that you pay employees at least twice a month. These pay dates cannot be more than 16 days apart, which means you are allowed to pay employees twice monthly or every other week, but not monthly.

Pay Stub Laws

You must provide a written or digital statement of your employee’s earnings and withholdings in Arizona if their wages are paid by bank deposit or pay cards.

If you’d like a template for creating your own pay statements, download one of our free pay stub templates. They’re already formatted, so you can print and use them today.

Paycheck Deduction Rules

Arizona does not have any specific laws stating what can be deducted from an employee’s paycheck. Common deductions include:

- Taxes

- Garnishments and levies

- Benefits

- Reimbursements

Final Paycheck Laws

Arizona has different stipulations regarding final paychecks depending on whether the employee resigned (voluntary termination) or was terminated by the company (involuntary termination).

- Voluntary Termination: Must be paid on the next regularly scheduled pay period

- Involuntary Termination: Must be paid within seven business days or at the next regularly scheduled pay period, whichever comes first

If you find yourself needing to print a check for a terminated employee quickly, use one of our recommended free ways to print payroll checks online.

Arizona HR Laws That Affect Payroll

Arizona HR laws mostly follow federal guidelines, with the exception of sick leave and child labor laws.

Arizona New Hire Reporting

Arizona mandates that you report new hires within 20 days of the hire date. You can report using the Arizona New Hire Reporting Form.

Breaks, Lunches & Time-off Requirements

Arizona mandates sick leave for all employees regardless of if the employee works full- or part-time. Besides that, all other leave follows federal law.

- Breaks and Lunches: Arizona does not mandate employers to provide breaks to employees.

- Vacation and Sick Leave: Arizona does not have any vacation leave requirements. However, there are some requirements regarding sick leave. All employers are required to provide one hour of sick time for every 30 hours worked. If your company has more than 15 employees, you must provide at least 40 hours of sick time per year. If your company has fewer than 15 employees, you must provide at least 24 hours of sick time per year. These hours can be added in full at the beginning of the year, or they can be earned each pay period. These hours do not need to be paid out upon termination.

- Family Leave: Arizona does not have a separate state law regarding family leave. Employers must abide by the federal law in the Family and Medical Leave Act (FMLA). This law is for companies with more than 50 employees for 20 or more weeks in the current or previous year. Employees can take FMLA leave if they have worked at the company for at least a year, with 1,250 hours worked in the previous year, and if their physical work location has 50 or more employees in a 75-mile radius. To learn more about the Family and Medical Leave Act, please see the Department of Labor’s Guide to FMLA.

State Disability Insurance

Arizona does not have a state disability program and does not require companies to obtain disability insurance. However, it is prudent to have that for both your employees and yourself.

Child Labor Laws

Arizona limits the work hours of individuals under the age of 16. The restrictions are following:

Scenario | Daily Restriction | Weekly Restriction | Time Restriction |

|---|---|---|---|

School is in session | Cannot work more than 3 hours | Cannot work more than 18 hours | The hours have to be before or after school between the hours of 7 a.m. to 9:30 p.m. |

School is not in session | Cannot work more than 8 hours | Cannot work more than 40 hours | The hours worked have to be from 6 a.m. to 11 p.m. |

The one exception to the above table is that no individuals under the age of 16 can do door-to-door sales after 7 p.m.

Also, note that there are a couple of cases where federal law supersedes Arizona’s law. Federal law mandates that 14- and 15-year-olds cannot work more than 15 hours per week during the school year. It also mandates that 16-year-olds cannot work past 7 p.m. on school nights and 9 p.m. on non-school nights. If you need more information, please visit the Federal Wage and Hour Division of the Department of Labor or our article on hiring minors.

Payroll Forms

Listed below are some federal and state forms needed to produce accurate pay for employees and compliant payroll reporting and tax remittance for businesses.

Arizona Payroll Forms

- Arizona W-4 Form: Assists employers on calculating tax withholding for employees

- Arizona Quarterly Tax Report: Used for filing unemployment taxes

Federal Payroll Forms

- W-4 Form: Assists employers calculate withholding tax for employees

- W-2 Form: Reports total yearly wages earned (one per employee)

- W-3 Form: Reports total yearly wages and taxes for all employees

- Form 940: Calculates and reports unemployment taxes due to the IRS

- Form 941: Files quarterly income and FICA tax withholding

- Form 944: Reports annual income and FICA tax withholding

- 1099 Forms: Provides contractors with pay information and amounts that assist them in tax calculation

Arizona Payroll Tax Resources & Sources

- Arizona Department of Revenue: Retrieve and submit forms, view the latest regulations, and view information on all types of business taxes.

- Industrial Commissions of Arizona: Obtain information pertaining to Arizona’s workers’ compensation requirement as well as other laws and regulations relating to the welfare and protection of employees.

- Arizona New Hire Reporting Center: Complete new hire reporting and view FAQs relating to new hire compliance.

- Arizona Department of Economic Security: Find information relating to the calculation of unemployment taxes.

For more information on payroll laws, check out our payroll compliance guide.

Frequently Asked Questions (FAQs) About Arizona Payroll

Employers in Arizona must pay employees at least twice per month. Paydays must be static and not more than 16 days apart.

If you discover an error in your payroll taxes, it’s crucial to correct it promptly to avoid penalties and interest charges. If additional amounts are owed, pay them as soon as possible.

Yes, Arizona has income tax reciprocity with California, Indiana, Oregon, and Virginia. This income tax reciprocity allows your employees to receive a tax credit in their home state for income taxes paid in Arizona.

Bottom Line

Learning how to do Arizona payroll is fairly straightforward, but be sure you’re paying attention to the new flat tax and the appropriate minimum wage. Even with a flat tax, calculating your payroll by hand can be a challenge and lead to costly mistakes.

If you need help running your Arizona payroll, consider using payroll software like QuickBooks Payroll. It files and pays your payroll taxes and covers any penalties you are charged if its reps make a mistake (it’ll cover your mistakes too if you opt for a premium plan). You can pay employees via direct deposit, and same-day payment options are available as well. Sign up for a free trial or discounted rate today.