Learning how to do payroll in Connecticut requires more focus than many other states as Connecticut has a higher minimum wage, progressive income tax rates, and paid family leave. All this combines to create challenges for payroll processing. Following this guide will ensure you don’t miss any steps and complete your Connecticut payroll correctly each time.

Key Takeaways:

- Connecticut’s 2023 minimum wage is $15.00 per hour, which goes up each year based on inflation

- Connecticut paid family leave is funded by a 0.5% tax on employee wages

- Connecticut has no income tax reciprocity

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Running Payroll in Connecticut—Step-by-Step Instructions

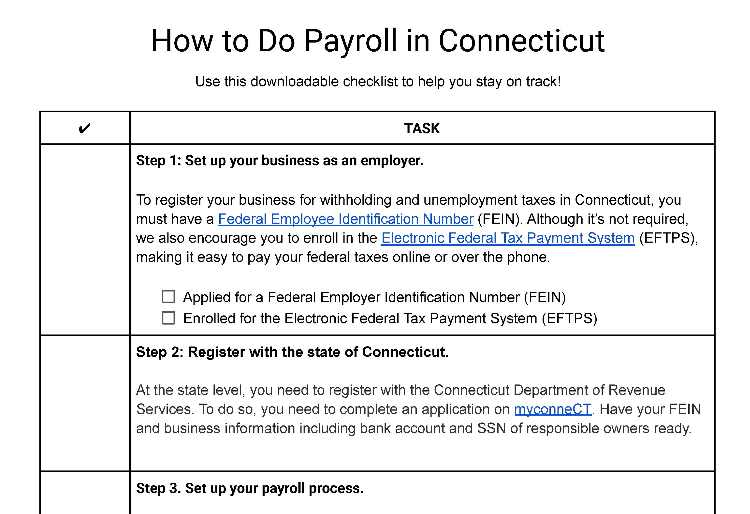

Step 1: Set up your business as an employer. At the federal level, you need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the State of Connecticut. In Connecticut, you will need to register with the Connecticut Department of Revenue Services. To register, you will need to complete the Business Taxes Registration Application online through myconneCT. This will allow you to register for various taxes including withholding tax, sales and use tax, and business entity tax.

Step 3. Set up your payroll process. You’ll need to set up systems to support your payroll process; this includes selecting a pay schedule and deciding how you’ll pay employees, how you’ll process taxes and deductions, and more.

Step 4: Collect employee payroll forms. The best time to collect payroll forms is during onboarding. Payroll forms include W-4, I-9, and direct deposit authorization information. Connecticut requires you to submit form CT-W4 as well.

Step 5: Collect, review, and approve time sheets. You’ll need to track time for hourly and other nonexempt employees to ensure you pay them for the time they worked. If you’re not using a time and attendance system, downloading one of our free time sheet templates will help you stay organized.

Step 6: Calculate payroll and pay employees. You can process payroll yourself, use an Excel payroll template, or select a payroll service. Each option comes with benefits and drawbacks. Normally you have the option to pay employees in a variety of ways including by cash, check, direct deposit, or pay cards.

Step 7: File payroll taxes with the federal and state governments. The IRS has forms and instructions on filing federal taxes, including unemployment. You can also order official tax forms from the IRS. For Connecticut state taxes, you remit your taxes on either a weekly, monthly, quarterly or annual basis depending on your employer classification. New employers (within the first calendar year of registering in Connecticut) should remit quarterly. Seasonal, household, and agricultural employers have their own schedules. For more information, please see the Connecticut Employer’s Tax Guide.

Please Note: If payday falls on a Saturday, Sunday, Monday, or Tuesday, the due date is the second Wednesday following the payday. For example, if payday falls Tuesday the ninth, the due date is Wed the 17th. If payday falls on a Wednesday, Thursday, or Friday, the due date is the Wednesday following the payday. So if payday falls Friday the fifth, the due date is Wednesday the 10th.

Step 8. Document and store your payroll records. It is important to retain records for all employees for several years (federal law requires three years for payroll documents and four for payroll tax records), including those who are no longer with your company.

Connecticut requires that you maintain the following employee information for three years:

- Name

- Address

- Job

- Daily and weekly hours worked (nearest 15-minute increment)

- Wage rate

- Overtime wages

- Deductions per pay period

- Additional payments per pay period

- Total wages per pay period

- Youth work certificates

In addition, you must keep these records at the place of employment unless you receive an exception from the Connecticut Labor Commissioner.

Step 9. Do year-end payroll tax reports. The federal forms that are required by law are W-2s (for employees) and 1099s (for contractors). These forms should be provided to employees and contractors by Jan. 31 of the following year. State W-2s are also required for Connecticut and these forms are due by Jan. 31 as well.

Download our free checklist to help you stay on track while you’re working through these steps:

If you want to learn more about doing payroll, applicable to businesses in all states, please see our general guide on how to do payroll.

Connecticut Payroll Laws, Taxes & Regulations

Federal law mandates that you pay income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. Called FICA taxes, Social Security and Medicare are withheld from each employee’s paycheck: Social Security at 6.2% and Medicare at 1.45%. You also have to pay a matching employer’s amount out of your bank account. FUTA is an employer-only tax that is 6% on the first $7,000 paid to each employee in that year.

For the most part, Connecticut payroll laws, taxes, and regulations provide more protection to employees than the federal law—in particular, the lowest-paid employees. Its state income tax is progressive with higher income individuals paying more. Connecticut also has a higher minimum wage, stricter requirements on final pay, and specific rules on paying employees via pay cards.

Since our last update: You’ll find fewer regulations than in past updates. We’ve included only those rules listed under Connecticut state regulations as found in eregulations.ct.gov, the official website for laws in the state of Connecticut.

Connecticut Income Taxes

Connecticut has a progressive income tax that taxes an employee’s income at a higher rate as their income goes up, which is similar to the federal income tax guidelines. If you’re not using a payroll provider, you’ll need to use Connecticut’s withholding tax table to determine how much to withhold from each employee’s paycheck. Connecticut income tax rates range from 3.0% to 6.99%.

Connecticut does not have income tax reciprocity with neighboring states. This means if you have an employee working in Connecticut but who lives in a neighboring state, they face double taxation.

State Unemployment Tax

Connecticut’s state unemployment tax (SUTA) rate is 2.8% for new employers. For established employers, the rate is based on your experience rate, which includes how many of your former employees applied for unemployment benefits and the fund balance tax rate, which is based on the solvency of Connecticut’s unemployment fund. In 2023, the rate can be anywhere between 1.7% and 6.6%. The percentages for both new and experienced employers are on the first $15,000 of taxable income per individual employee.

When you pay SUTA on time and in full, you may qualify for up to a 5.4% deduction on your FUTA taxes, potentially taking that rate down to 0.6%.

Workers’ Compensation

In Connecticut, you are required to provide workers’ compensation for all businesses with at least one employee with very few exceptions. These exceptions include employees who work occasionally or as-needed, domestic employers who work at a private home for no more than 26 hours weekly, and corporate executives who decline coverage. Connecticut is also a no-fault state, meaning that workers’ compensation claims can be covered regardless of the reason behind the workplace injury.

Employees are required to report any workplace injury immediately, and the employer and insurer has 28 days to start payment for lost wages or deny the employee’s claim.

The cost of workers’ compensation insurance is around $1.10 for each $100 payroll you processed. For example, a company that processes $500,000 of payroll can expect to pay around $5,500 in insurance.

Minimum Wage & Tips

Connecticut’s 2023 minimum wage is $15 per hour for non tipped employees (much higher than the $7.25 federal minimum wage). Starting Jan. 1, 2024, the state minimum wage will increase to $15.69 per hour. The state increases the minimum wage annually based on economic indicators. State law allows employers in Connecticut to take up to a $7.62 tip credit for hotel and restaurant workers and a $5.77 tip credit for bartenders, which puts the minimum cash wage that has to be paid by employers at $6.38 and $8.23 per hour, respectively.

Minimum Wage for Minors (first 90 days)

For the first 200 hours of employment, persons under 18, except for emancipated minors, may receive reduced wages. They cannot be less than 85% of fair wage (including minimum wage) or at least $12.75 per hour for the first 90 days of employment.

Overtime

Connecticut generally follows federal guidelines regarding overtime. You’ll need to pay 1.5 times the regular hourly rate for any hours your employees work over 40 in a workweek.

For help ensuring your overtime calculations are correct, please check out our guide on calculating overtime.

Different Ways to Pay Employees

In Connecticut, you are able to pay employees via standard payment options. These options include check, cash, pay cards, or direct deposit. Check out our guide on how to pay employees for more in-depth information.

Minimum Pay Frequency

Connecticut requires that you pay employees at least every two weeks. Payday cannot come more than eight days after the end of the pay period. Educational institutions may be exempted from this rule if negotiated with employees in a collective bargaining agreement. Executives, administrative, and professional employees may be paid less frequently by agreement. When you set a payroll schedule, you must not change the schedule frequently, keeping it consistent for employees.

If you pay an employee solely on commission, they must be paid weekly at least a minimum fair wage for each hour worked. Commissions must be settled monthly.

Pay Stub Laws

Connecticut requires employers to provide workers with a pay stub for each pay period. This pay stub must include the hours worked, gross earnings that separate base pay and overtime pay, net earnings, and itemized deductions. You can provide this pay stub via paper or electronically but only if you have the employee’s written permission.

If you’d like to create your own pay statements, then download one of our free pay stub templates. They’re already formatted, so you can print and provide them to employees today.

Paycheck Deduction Rules

Connecticut does not allow you to deduct the following from an employee’s paycheck:

- Shortage of cash

- Lost or damaged possessions of the company

- Equipment, supplies, or uniforms

- Bad checks

You are able to deduct these common items from an employee’s check:

- Taxes

- Garnishments and levies

- Benefits

- Reimbursements

- Apparel supplied for the course of employment; you can deduct up to $1.50 per week or the actual cost for maintenance and laundering

Final Paycheck Laws

When you terminate an employee, Connecticut requires you to issue their final paycheck no later than the next business day. If an employee quits, you don’t have to issue their final paycheck until the next regular payroll run.

If you find yourself needing to print a check for a terminated employee as soon as possible, use one of our recommended free ways to print payroll checks online.

Connecticut HR Laws That Affect Payroll

Connecticut has stricter time off requirements than the federal government for many Connecticut employees. It also has stricter laws on youth employment. However, it does not require employers to purchase disability insurance.

Hourly Computations

All time must be reckoned to the nearest unit of 15 minutes for hourly employees. So if you have an employee who clocks in at 8:05 a.m. and out at 4:58 p.m., you would round each of those times to the nearest 15 minute increment. In this case, that would look like clocking in at 8 a.m. and out at 5 p.m.

Connecticut New Hire Reporting

Connecticut requires that you report new hires within 20 days of the hire date. You can report new hires online through the Connecticut Department of Labor’s New Hire Reporting website.

Pay Transparency

Connecticut was one of the first states to enact a pay transparency law. This law requires all employers in Connecticut to provide a wage range for each position and to disclose such range to job applicants upon request or at the time of making a job offer.

Existing employees may also request not just their own position’s wage range, but also those of their colleagues without being subject to retaliation from their employer. The employer is not required to disclose the exact amount of wages to paid to any other employee, however, just the wage range for the position.

Breaks, Lunches & Time-Off Requirements

Connecticut does not mandate vacation leave. However, all other time-off requirements supersede federal law as they are more advantageous to Connecticut employees. There’s a special sick leave law and new requirements for offering state family leave.

Breaks & Lunches

In Connecticut, you are required to give a 30-minute break to employees who work at least seven and a half hours consecutively or provide paid rest breaks during the day that amount to 30 minutes for every work period of seven and a half hours.

Exceptions to this rule include

- When a break could pose a threat to public safety

- When fewer than five people are on a shift

- When the position can only be performed by the one employee

- The work is continuous (such as a research experiment)

Vacation Leave

Connecticut does not have any vacation leave requirements; however, if you do provide vacation leave, you must abide by the policy you set.

Sick Leave

Employers in Connecticut with more than 50 employees are required to provide paid sick leave for service workers at a rate of one hour of sick leave per every 40 hours worked up to 40 hours per year. Service workers are defined as nonexempt employees who directly work with the general public. Some jobs include cooks, crossing guards, and librarians. Exceptions to the law include manufacturing companies and nonprofit companies that provide recreation, educational, or childcare services.

To be eligible for sick leave time, employees must have worked at least 680 total hours and an average of 10 or more hours a week in the last quarter. Sick time can be used for taking care of the employee and immediate family members’ health and wellness needs. In 2023, the state expanded the reasons an employee can use sick leave, including for a mental health wellness day, to care for a family member who’s a victim of family violence or sexual assault, relocating due to family violence or sexual assault, and to participate in court proceedings related to family violence or sexual assault.

Employers are deemed to be in compliance if you offer vacation, sick, or PTO days that exceed the benefits provided in the paid sick leave law.

Family Leave

Under Connecticut Paid Leave, employees may take up to 12 weeks of paid leave to attend to the healthcare of their families or themselves. For serious health conditions during pregnancy, they can take an extra two weeks, and up to 26 weeks to care for an injured covered service member. This is the same as the federal Family and Medical Leave Act (FMLA).

Employees can apply for the Paid Leave Program for help with income replacement. The program is funded by an additional 0.5% of Connecticut employees’ checks. Companies are deemed to be in compliance if their healthcare benefits offer the same amount of benefits as the Connecticut Paid Leave Program.

If you are self-employed, you can voluntarily elect to join the paid family leave program by contributing 0.5% of your self-employment income to the Connecticut Paid Family Leave fund.

State Disability Insurance

There is no state disability program in Connecticut or a requirement for companies to purchase disability insurance. However, it is a good idea to have, both for your employees and yourself.

Child Labor Laws

Connecticut restricts the work hours of 16- and 17-year-olds. The rules are broken down by industry, school enrollment, and whether school is in session, so please make sure you review the Connecticut Department of Labor breakdown on employment of minors. In general, youth enrolled in school can only work under these guidelines when school is in session:

- Between the hours of 6 a.m.–10 p.m. (11 p.m. for some industries on non-school nights)

- A maximum of six hours per day (eight hours Friday, Saturday, Sunday)

- A maximum of 32 hours per week

When school is not in session, they can work:

- No more than eight hours a day

- No more than six days in a week

For youth who are not enrolled in school, they can work a maximum of six days in a week and 48 total hours.

Federal child labor laws restrict 14- and 15-year-olds from working more than 18 hours per week (three hours per day) when they’re in school and no more than 40 hours per week (eight hours per day) when school is out. In addition, they can only work between 7 a.m. and 7 p.m.

No minor is allowed to perform hazardous work such as mining.

For exceptions and more detail regarding your industry, please visit the Employment of Minors section on the Connecticut Department of Labor’s website.

Check out our guide to hiring minors for more insight into federal regulations.

Payroll Forms

Listed below are some federal and state forms needed to produce accurate pay for employees and compliant payroll reporting and tax remittance for businesses.

Connecticut Payroll Forms

- Connecticut W-4 Form (CT-W4): To help employers on calculating tax withholding for employees

- Connecticut Quarterly Reconciliation of Withholding (CT-941): For quarterly tax filing

- Connecticut W-3 form (CT-W3): For annual reconciliation of withholding

Need a different form? Connecticut has different forms for household employers and others. Find all those forms here. Connecticut also has other request and registration forms for payroll issues from tips statements to requesting authorizations for deductions. Find those here.

Federal Payroll Forms

- W-4 Form: Assists employers calculate withholding tax for employees

- W-2 Form: Reports total yearly wages earned (one per employee)

- W-3 Form: Reports total yearly wages and taxes for all employees

- Form 940: Calculates and reports unemployment taxes due to the IRS

- Form 941: Files quarterly income and FICA tax withholding

- Form 944: Reports annual income and FICA tax withholding

- 1099 Forms: Provides contractors with pay information and amounts that assist them in tax calculation

Connecticut Payroll Tax Resources & Sources

- myconneCT: Register, submit and file forms, and make payments.

- Connecticut Workers’ Compensation Commission: Find information pertaining to workers’ compensation requirements. It is also a place to refer employees for a step-by-step guide on what they need to do if they suffer an on-the-job injury.

- Connecticut New Hire Reporting: Complete new hire reporting and view FAQs relating to new hire compliance.

- Connecticut Department of Labor: Obtain information relating to the calculation of unemployment taxes, as well as other laws and regulations relating to the welfare and protection of employees.

- Connecticut Department of Revenue Services: Information on withholding tax, registering your business, forms, and more.

To learn more about payroll laws, check out our payroll compliance guide.

Bottom Line

Connecticut payroll differs from other states by the way it structures state income taxes, minimum wage, workers’ compensation requirements, timing on when employees should be paid, and child labor rules. Be sure to follow this guide to ensure your Connecticut payroll is accurate every time.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: