Paying employees in Georgia is more straightforward than in more complex states like California. The primary difference is that the state requires employers to pay state income taxes. Understanding how to do payroll in Georgia requires understanding these nuances and other unique payroll laws of the state.

Key Takeaways:

- Georgia has just one state payroll form—the State of Georgia Employee’s Withholding Allowance Certificate (G-4)

- Employers must pay employees regularly, at least twice monthly

- Minimum wage and overtime laws mirror federal regulations

- No mandatory paid leave requirements for private employers

Step-by-Step Guide to Running Payroll in Georgia

Although doing Georgia payroll is fairly simple, there are special laws you need to pay attention to, especially on your first few payroll runs.

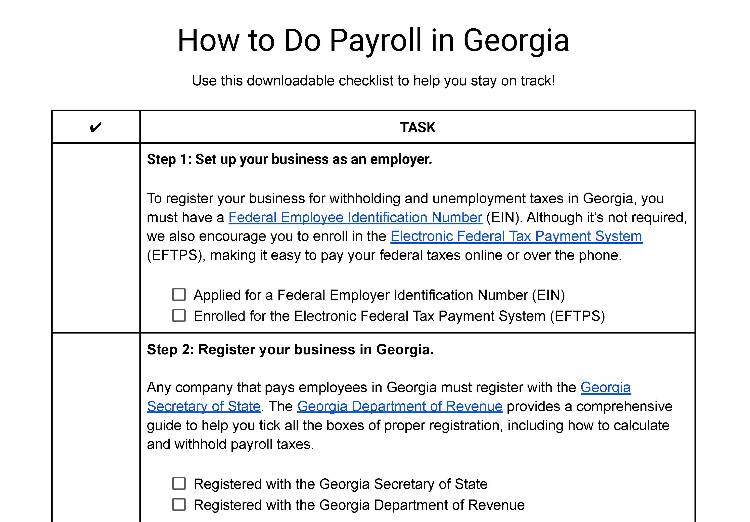

Step 1: Set up your business as an employer. If your company is brand-new, you may need to apply for a FEIN. This is a simple process completed entirely online via the Electronic Federal Tax Payment System (EFTPS). If your company already has one, keep the FEIN nearby, as it is required to pay federal taxes.

Step 2: Register your business in Georgia. Any company that pays employees in Georgia must register with the Georgia Secretary of State. The Georgia Department of Revenue provides a comprehensive guide to help you tick all the boxes of proper registration, including how to calculate and withhold payroll taxes.

Step 3: Set up your payroll process. This isn’t where you actually start running payroll, rather it’s the beginning of setting the process up. You will need to create a thorough process, so as not to miss any important steps. You can opt to do payroll yourself manually or set up an Excel payroll template. Your best bet to avoid problems, however, is to work with payroll software to help you handle your Georgia payroll.

Step 4: Collect employee payroll forms. Most efficiently done during onboarding, your employees need to complete various payroll and employment forms. All employees must complete I-9 verification no later than their third day on the job. You need to keep I-9s even after the employee no longer works for the company. Every employee must also have a completed W-4 form on file.

Unlike some states, Georgia requires a state-specific W-4, called the State of Georgia Employee’s Withholding Allowance Certificate (G-4). Employees must also provide you with direct deposit information.

Step 5: Collect, review, and approve time sheets. Companies record time in a variety of ways. Whether through time & attendance software or using paper time sheets, you need to collect, review, and approve them.

Georgia employers must pay employees regularly and at least twice monthly. So, you need to make sure you begin this process several days before the scheduled payday to make sure you have enough time. Having employees sign their time sheets is a good idea.

Step 6: Calculate your payroll, including taxes, and pay employees. Calculating every employee’s pay, the taxes owed by them and the company, and the deductions and withholdings required will be a huge challenge if you do it by hand, especially if you have more than a few employees. You can simplify the process and reduce mistakes if you use a standard process and payroll software to calculate pay automatically.

Step 7: Pay federal and state payroll taxes. At each regular payroll run, you must pay federal and state taxes. The IRS provides instructions on paying federal taxes, while the Georgia Department of Revenue provides instructions on paying state taxes.

Step 8: Save your payroll records. This step is often overlooked but is also one of the most important. It is vital that you keep detailed payroll records showing that you have regularly and correctly paid every employee, as well as state and federal taxes. Federal law requires you to maintain these records for three to four years—and Georgia’s law aligns for all private employers.

Step 9: Process annual payroll reports. Every employer, regardless of which state your business is in, will need to complete W-2 forms for all employees and 1099 forms for independent contractors. By law, you must provide all employees and contractors with their annual tax form no later than Jan. 31 of the following year.

Download our free checklist to help you stay on track while you’re working through these steps:

Learn more about doing payroll yourself in our guide on how to do payroll. It even has a free checklist you can download to make sure you don’t miss any steps.

Georgia Payroll Laws, Taxes & Regulations

Doing payroll in Georgia is very similar to doing payroll in other states. Most regulations follow federal payroll compliance laws, so you are less likely to get confused by conflicting rules. No municipalities or cities in Georgia charge additional taxes, simplifying the process even more.

Georgia Payroll Taxes

Beyond federal taxes, Georgia levies state taxes on businesses and employees. Businesses must calculate and withhold the correct amount of tax from both employers and employees.

Employer Unemployment Taxes

Georgia does not have state disability insurance, but it does have State Unemployment Tax Act (SUTA) taxes. The current rate for employers ranges from 0.06% to 8.10% on a wage base of $9,500. With few exceptions, every employer in Georgia must pay SUTA.

Workers’ Compensation

Any Georgia employer with three or more full-time, part-time, or seasonal employees must carry workers’ compensation insurance coverage. Depending on the industry in which your business operates, your premiums will vary.

Income Taxes

Georgia has a progressive income tax system, meaning that the more an employee makes, the more they are taxed. The state’s income tax has six brackets, ranging from 1% to 5.75%. Make sure that you are withholding the correct amount for each of your employees, especially as their salaries change over time.

Georgia Minimum Wage

Georgia’s minimum wage is currently $7.25 per hour, aligned with the federal minimum wage. Tipped minimum wage is $2.13 per hour. The tips the employees receive make up the difference, but if an employee’s tips do not get them to the $7.25 per hour minimum wage, the employer must make up the difference.

Calculating Overtime

Georgia’s overtime rate is time and a half. So, if an employee makes minimum wage, any overtime hours they work will be paid at $10.88 per hour. In Georgia, overtime pay is only required when an employee works over 40 hours in a single workweek.

Paying Employees

Georgia requires that employers pay employees at least twice per month. Companies are free to run payroll more frequently. Regardless of the pay schedule your company uses, you must have regular and consistent paydays. Employers in the farming, sawmill, and turpentine industries are not subject to this requirement and may pay employees just once per month.

Employers have several options for paying employees:

Check out our guide on ways to pay your employees to learn more.

Pay Stub Laws

Georgia does not require businesses to provide pay stubs to employees. Your business may choose to do so, and if you use payroll software, it may create one automatically.

If you’d like a template to make creating your own pay statements easier, then download one of our free pay stub templates. They’re already formatted—you can print and use them today.

Georgia Paycheck Deductions

Georgia does not specify what deductions can be taken out of an employee’s pay, aside from taxes. Because of this ambiguity, employers may be able to deduct the following, provided that it does not take the employee’s hourly pay below the minimum wage:

- Cash register shortage

- Damage or loss of employer property

- Uniform fee

- Tool or equipment fee

- Other items necessary for employment

Terminated Employee’s Final Paychecks

Georgia has no specific law or regulation detailing when or how an employer pays wages to a recently resigned, laid off, or terminated employee. To be safe, we recommend that you follow normal payroll practices and simply pay them their final paycheck during the next regular run; this aligns with federal regulations as well.

Georgia HR Laws That Affect Payroll

Many of Georgia’s HR and employment laws align with federal regulations. However, there are some additional employment laws and regulations you need to be aware of to make sure your company remains compliant.

If you’d like an in-depth, step-by-step guide on how to do payroll for your small business overall before you dive into state-specific details, check out our e-book on How to Do Payroll below:

Georgia New Hire Reporting

Employers are required by law to report all new hires to the Georgia New Hire Reporting Center. You must do this within 10 days of the employee’s start date. You must report new hires, rehires, and temporary employees. No business is exempt from this law.

Breaks

Georgia does not require employers to provide breaks, paid or unpaid, to employees. Businesses in the state are still required to follow federal law and may choose to provide paid breaks beyond that. So, at a minimum, companies in Georgia must pay employees for small breaks, around five to 20 minutes.

Georgia Child Labor Laws

Georgia does not restrict workers aged 16 and over. Employees under 16, however, are restricted from working more than:

- Four hours on a school day

- Eight hours on a non-school day

- Forty hours during a non-school week

In addition, workers under 16 cannot start work before 6 a.m. or finish work after 9 p.m. No workers under 16 can work during school hours.

See our guide on hiring minors for more information.

Time Off & Leave Requirements

Georgia doesn’t regulate paid time off (neither does the federal government). However, you will need to pay attention during voting season, as you are required to allow employees time off to cast their ballots.

Georgia does not have a law requiring employers to offer employees paid time off. Employers are free to create PTO policies as they see fit for their business.

Georgia has no law requiring private employers to give employees paid sick leave. Employers can do so on their own. Public employees in Georgia do get paid sick leave at a rate of 10 hours of sick leave per month worked.

Georgia law does not require employers to pay employees when taking time to vote, but companies may choose to do so. What Georgia does require, however, is that employers provide employees with at least two hours of leave to vote if the employee has given reasonable notice and the polls are not open for at least two hours before or after the employee’s shift begins.

Georgia follows the Family Medical Leave Act (FMLA). The FMLA provides for up to 12 weeks of unpaid leave for employees when they give birth or adopt a child. During these 12 weeks, their job is secure, and they may take any PTO benefits provided by their employer. State employees, however, do have access to up to 120 hours of paid parental leave each year.

Payroll Forms

Payroll forms can vary from state to state. Fortunately, the only state-specific form your employees need to worry about is the Georgia W-4. Two forms are applicable to Georgia employers:

- G-7: Required for businesses submitting quarterly tax returns and may be filed electronically

- DOL-4A: Only required if you’re a household employer, meaning you’re paying nannies, caregivers, and other staff who work at your home); you’ll use it to report quarterly tax and wage reports

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need:

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees

- Form 940: Used to calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Georgia Payroll Tax Resources

- The Georgia Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- Tax withholdings may be confusing, and reviewing Georgia’s Employer’s Tax Guide may help you.

- For extensive information on how to get workers’ compensation coverage, Georgia’s Department of Labor offers guidance.

Bottom Line

Learning how to do payroll in Georgia can seem complicated at first glance. However, the state follows federal regulations fairly closely, and you only need to concern yourself with less than a handful of state-specific forms.

Once you make sure your business has the proper registrations, completing regular payroll runs becomes routine. By keeping up with ever-changing employment laws and regulations, you can make sure you get your Georgia payroll right every time.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: