Doing payroll in Oklahoma involves more than paying employees. In addition to filing federal taxes, you must file state income and unemployment insurance taxes. There are exemptions for some workers, like military spouses, and the state has its own W-4 form (the document you’ll have new employees submit upon hire) with different withholdings than those for federal taxes.

Key Takeaways:

- In addition to Oklahoma’s W-4 form for state taxes, there are seven state-specific withholding forms you may need to complete payroll in Oklahoma depending on your business’s needs and your employees’ unique circumstances.

- Oklahoma follows the federal minimum wage of $7.25 per hour.

- Employers have up to 14 days to pay an employee’s final wages.

Running Payroll in Oklahoma—Step-by-Step Instructions

Doing payroll in Oklahoma requires some additional steps and paperwork. Below are the basics for federal and state compliance.

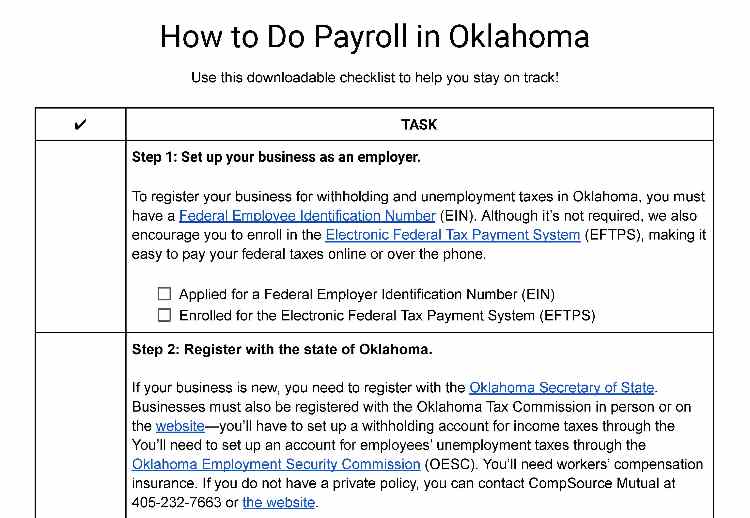

Step 1: Set up your business as an employer. You need an employer identification number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register your business with the state of Oklahoma. Register your business and keep it current such as if you change an address or ownership structure.

- Fill out the WHT10006 and file it through the Oklahoma Taxpayer Access Point (OKTAP).

- Create an account with EZ Tax Express to pay unemployment insurance.

- Fill out an OES-1 to get an Oklahoma Unemployment Insurance Tax Account Number.

Step 3: Set up your payroll process. If you work for an established business, you may have inherited a payroll process. But if your company is new, you may need to start your payroll process, which means deciding how often you’ll be paying employees (Oklahoma law states the employers must pay wages at least twice a calendar month), when you’ll pay them, how you’ll track and calculate hourly employees’ work time, etc. Overall, you can opt to do payroll by hand, set up an Excel payroll template, or sign up for a payroll service to help you handle your Oklahoma payroll.

Step 4: Collect employee payroll forms. Do this when onboarding new hires, and make sure employees know to give you updates when they have life changes, like getting married or having a new child. Forms include the Oklahoma W-4 Form and the federal version, I-9, and direct deposit information. If you have nonresident employees who want to be exempt from tax withholdings, have them fill out the form OW-11. If you have a worker who is a military spouse, they may want to fill out the OW-9 to be exempt from withholdings.

Step 5: Collect, review, and approve time sheets. This step is one you’ll do regularly, as keeping track of employees’ hours is essential for ensuring accurate payroll. Whether you use paper time sheets or time and attendance software, review all time sheets for accuracy and discuss any errors or issues with employees right away. Having employees sign their time sheets is a good idea, whether they do so electronically or by pen on paper.

Step 6: Calculate payroll and pay employees. Use the employee W-4 form and the Oklahoma Tax Tables found online to determine how much per employee you must withhold for income taxes.

Reimbursements for mileage and expenses are not counted as wages.

The vast majority of companies and employees use direct deposit, but cash (not the best way) and paper checks are also options. Make sure that you are paying your employees at least the Oklahoma minimum wage, which is currently $7.25 an hour.

Step 7: File payroll taxes with the federal and state governments. Follow the IRS instructions for federal taxes, including unemployment.

- For Oklahoma income tax withholdings: File electronically through OKTAP. Some payroll software services have free payroll tax calculators or build them into their programs. Be sure to use the state W-4 form when making calculations.

- In Oklahoma, you must report the number of employees paid, wages paid, and the sales tax withheld from wages each quarter. To remit withholdings, follow the schedule below.

If Your Average Monthly Payroll Is | You Must Pay | Must Be Filed and Paid By |

|---|---|---|

<$500 | Quarterly | April 20 (Q1), July 20 (Q2), Oct. 20 (Q3), Jan. 20 (Q4) |

$500 to $10,000 | Monthly | 20th of following month |

>$10,000 | Semiweekly | Follow the federal semiweekly schedule |

If, in the previous fiscal year, you withheld over $5,000 in taxes per month, on average, you must remit electronically.

- For Oklahoma unemployment insurance (UI) taxes: File electronically via EZ Tax Express. You can manually fill in the report or create a TXT document and upload it. Find the instructions on the OESC website.

Oklahoma state UI tax reports are due by the following dates:

For Wages Paid During | Calendar Quarter Ends | Must Be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

Step 8: Document and store your payroll records. It’s important to keep records for all employees, even those terminated, for several years. Learn more in our article on retaining payroll records.

Step 9: Do year-end payroll tax reports. These include the federal forms W-2 (for employees) and 1099 (for contractors). Employees and contractors must have these by Jan. 31 of the following year. You must also supply the state with your W-2/W-3 and 1099 via OKTAP. The W-2 and W-3 are due Jan. 31, and 1099s are due March 31.

Download our free checklist to help you stay on track while you’re working through these steps:

Oklahoma Payroll Laws, Taxes & Regulations

Doing payroll in Oklahoma isn’t particularly more complex than in most other states. You are required to withhold and pay income taxes and remit unemployment insurance taxes, but most of the regulations align with federal laws; this means you’re less likely to be confused with conflicting rules.

Oklahoma Payroll Taxes

The only Oklahoma payroll tax that employers are responsible for paying out of pocket is state unemployment taxes (SUTA). Social Security and Medicare (FICA) are a given, but they’re federal taxes that all employers pay, regardless of state. Oklahoma does charge a state income tax—no local or municipal taxes, though—so you must set up a system to withhold them from your employees’ paychecks so that you can send them to applicable tax agencies.

Unemployment Insurance Taxes

Oklahoma charges unemployment insurance taxes on income up to $27,000 per year. Tax rates for experienced employers range from 0.3% to 9.2%. The new employer rate is 1.5%.

Income Taxes

To determine how much you need to withhold in state income taxes from each employee’s paycheck, print and have each new hire complete Form OK-W-4. Current income tax rates range from 0.25% to 4.75%. To determine federal income tax withholding amounts, use Federal Form W-4.

In general, Oklahoma requires income tax withholdings for all employees in Oklahoma, with the following exceptions:

- Farmworkers earning less than $900 per month

- Domestic workers

- Payments for services not in the course of the employer’s trade or business, unless the payment is over $200 in a calendar quarter

- Nonresidents whose income in any calendar quarter is not more than $300

- Clergy

You must withhold state taxes for employees who are not residents of Oklahoma unless you are an LLC or S corporation (S-corp) and your employee applies for an exemption. If you have fewer than 100 members in your company, you automatically qualify for an exemption.

Withholdings must be filed quarterly, but if you are paying more than $500 in payroll per quarter, then you must remit withholdings monthly. These are due by the 20th of the month following the month of payment.

Oklahoma charges late fees of 10% of the amount of tax or 10% of the amount of underpayment of tax. If it’s not paid within 15 days after the due date, it’s considered delinquent. The state also charges interest at the rate of 1.25% per month on any overdue amounts.

Minimum Wage

Oklahoma sets its minimum wage at $7.25 an hour, which mirrors federal regulations. Exemptions include those covered under the federal Fair Labor Standards Act (FLSA) and the following:

- Those working in an executive, administrative, or professional capacity

- Outside salespersons

- Farmworkers

- Employees of any carrier subject to Part I of the Interstate Commerce Act

- Students under 22

- Workers under 18 who are not graduates of vocational or high school

- Part-time employees working less than 25 hours per week and not on permanent status

If you pay tipped employees—employees who receive at least $20 in tips monthly—you are eligible to pay them a tipped minimum wage; this will only work if their tips boost their total pay to align with minimum wage regulations. The maximum tip credit you can apply against the minimum wage is $5.12 per hour. Employers must pay tipped employees at least $2.13 per hour and should apply tip earnings toward the balance of the minimum wage obligation.

For more insight on tipped minimum wage, check out our article on tipped minimum wage by state.

Overtime

Oklahoma has no overtime laws. However, that does not exempt you from federal wage and hour laws, which state that nonexempt employees be paid 1.5 times their regular hourly pay rate for any hours worked over 40 in a seven-day workweek.

Different Ways to Pay Employees

In Oklahoma, you may pay employees electronically (via direct deposit or pay card, if the employee consents), by check, or in cash. If you opt to pay electronically, the employee must be able to access all of their wages without incurring any related deductions for withdrawals. So, for example, you cannot pay by pay card if it deducts a percentage per transaction from their paychecks—such as through PayPal, for example.

Oklahoma Pay Stub Laws

The federal government doesn’t regulate pay stubs, but most states have their own rules. Oklahoma is considered an Access State, which just means employers are required to provide employees with access to itemized pay statements. This doesn’t have to be printed or distributed with paper checks but can also be populated electronically, via an HR or payroll portal or even email.

Minimum Pay Frequency

You must pay employees at least twice each calendar month on regular paydays, which you designate in advance. No more than 11 days may elapse between the end of the work period and the regular payday.

Pay on time: An employer can be assessed a penalty of up to 2% liquidated damages for each day payment of wages is overdue, up to the amount owed to the employee. This includes contractors.

Paycheck Deduction Rules

Deductions include amounts withheld for FICA, federal or state income tax, SUTA, and garnishments. Other deductions must be agreed upon in writing and can include the following:

- Insurance premiums

- Deductions to pay off advances on wages

- Reimbursement for uniforms

- The employee’s share for benefits like health insurance

- Deferred compensation plans or investments provided by the employer for the employee

- Compensation for breakage, loss of merchandise, inventory shortage, or cash shortage caused by the employee

Final Paycheck Laws in Oklahoma

If an employee leaves for any reason, you must pay them their final wages by the next regular payday as usual or by certified mail if the employee requests it, or within 14 days, whichever is later. This is convenient compared with states that require a next-day turnaround or change expectations based on whether the employee quit or was fired.

If an employee dies, you are required to pay the surviving spouse or children all wages and benefits earned by the employee, up to $3,000.

Oklahoma HR Laws that Affect Payroll

Many of Oklahoma’s HR and labor laws mirror federal regulations. There are some specific rules governing how long minors can work and be paid for, but it’s nothing complicated. In addition, there is no requirement to provide state disability insurance—some states have laws requiring it.

Oklahoma New Hire Reporting

All newly hired employees must be reported to the Oklahoma Employment Security Commission (OESC) within 20 days of being hired if you are reporting by mail or fax. Employers who report electronically must report at least twice monthly, within at least 20 days of the person being hired. For the date started to work, use the first date the employee performs services for a wage.

The OESC prefers you to file online, but if that’s not possible, you can send the information by downloading the form and mailing it to this address:

Oklahoma New Hire Reporting Center

P.O. Box 52003

Oklahoma City, Oklahoma 73152-2004

Toll-Free FAX: 1-800-317-3786

Local FAX: (405) 557-5350

Breaks & Lunches

Oklahoma only requires breaks for children under 16, and federal law has related regulations. Ultimately, it’s up to company policy how to handle lunches and break times. If you set a standard break procedure in your employee handbook, the State of Oklahoma will enforce it, so be sure you’re following the rules you set.

Vacation & Sick Leave

Employers are not required to provide workers paid or unpaid PTO, including sick leave or holidays. However, if you set a policy, you must adhere to it.

Paid Family Leave

Paid family leave laws closely mimic federal law in the Family and Medical Leave Act (FMLA) and apply to businesses that have had 50 or more employees for at least 20 weeks in the current or previous year. Employees can take FMLA leaves if they:

- Have worked for the company for at least a year

- Worked 1,250 hours worked in the previous year

- Work at a location with at least 50 employees within a 75-mile radius

Qualified employees can take up to 12 weeks in a 12-month period to:

- Bond with a child (newborn, adopted, or fostered)

- Recuperate from a serious health condition

- Care for a family member with a serious medical condition

- Handle family emergencies arising from a family member’s military service

Employees can take up to 26 weeks of leave to care for a family member who suffered a serious injury while on active duty in the military. This is a per-injury, per-service-member entitlement, so they cannot take 26 weeks one year and 26 the next for the same injury.

You do not have to pay wages during FMLA leave, but you must continue health insurance. Employees can take accrued leave during FMLA leave.

Maternity Leave

Oklahoma does not have specific maternity leave laws, but incapacities due to pregnancy are covered under paid family leave. This includes severe morning sickness.

Jury Duty Leave

An employer is not required to pay an employee for time spent responding to a jury summons or serving on a jury unless the employee has used paid leave. Employers may not discharge or take adverse employment action against an employee because of the jury summons.

Voting Leave

Employers must provide employees with at least two hours to vote on election day or early voting days, provided that the employee gave their employer written or oral notice at least three days before the day the employee chooses to vote. The employer may choose the hours the employee can be absent from work to vote.

State Disability Insurance

Oklahoma does not require state disability insurance. However, providing such a policy makes you a more attractive employer to potential applicants and protects you and your employees.

Child Labor Laws

The minimum age for employment is 14, and child labor laws apply to children up to 16 years old. Children can work up to three hours on school days and eight hours on nonschool days, up to 18 hours in a school week or 40 hours in a nonschool week. They earn minimum wage and vacations like any other worker but also receive an hour lunch break every eight hours or a 30-minute lunch break every five hours.

Payroll Forms

As you learn how to do payroll in Oklahoma, you’ll find there are a plethora of forms, but not all are needed, and most are self-explanatory. Here are the ones most likely to affect payroll.

Oklahoma W-4 Form

Oklahoma has a W-4 form for employees to fill out. This allows them to claim different withholdings for their state taxes than for their federal taxes. This was introduced in 2018 in response to the changes in federal tax brackets. Employees are required to fill out this form.

Other Oklahoma Withholding Forms

- OW-9-MSE, Annual Withholding Tax Exemption Certification for Military Spouse: If you have employees claiming exemption under the Servicemembers Civil Relief Act.

- OW-11, Registration for Oklahoma Withholding for Nonresident Members

- OW-15, Nonresident Member Withholding Exemption Affidavit: If you are an LLC or S-corp with nonresident employees, you can use this form to have them request exemptions from withholding Oklahoma income tax. You only need to do this if you have over 100 members in your company.

- WTH10001, Oklahoma Quarterly Wage Withholding Tax Return: Use this to calculate the quarterly withholdings and enter them into the payment coupon. Due by the 20th of each month.

- WTH10004, Oklahoma Withholding Payment Coupon for Payors not Paying by EFT: To include with monthly payments of withholdings if you do not pay electronically.

- WTH10006, Online Oklahoma Wage Withholding Tax Application: Every business that is liable for tax withholdings must fill this out.

- OES-1, Application for Oklahoma UI Tax Account Number: You’ll use this when filing unemployment taxes. Fill it out, sign it, and submit it to the Oklahoma Employment Security Commission.

Federal Payroll Forms

Here’s a list of general payroll forms most small businesses need.

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: To report total annual wages earned (one per employee)

- W-3 Form: To report total wages and taxes for all employees

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- 1099 Forms: To provide nonemployee pay information that helps the IRS collect taxes on contract work

Oklahoma Payroll Tax Resources/Sources

- Oklahoma Tax Commission (OTC) Website: The OTC does not mail documents, so go here to download anything you need. It also includes information about payroll taxes, sales, and other taxes.

- Oklahoma Business Forms Page: Links to all the state business forms, and notes on whether they allow electronic filing.

- Oklahoma Employment Security Commission: Not only contains information and resources for unemployment taxes, but also for hiring employees and more.

- Oklahoma Department of Labor Wage Law: A downloadable PDF of labor laws for Oklahoma.

Also, check with your payroll software for resources and state-specific features.

Frequently Asked Questions About Oklahoma Payroll

Only if you have a policy or precedent of doing so. Oklahoma does not require employers to pay out accrued and unused vacation time.

Missing a payroll deadline can lead to penalties and fines. If you miss a payroll deadline, pay your employees as soon as possible and communicate with them about the issue. Also, speak with the Oklahoma Tax Commission to set up a payment plan for your late payroll taxes.

No. Several states have paid sick leave laws, but Oklahoma is not one of them. However, you should offer employees some amount of paid time off—including time away for illness and recovery—so you can maintain a healthy and happy workforce. If you’re on the fence, check out the recent statistics we compiled about paid leave benefits and how they impact employees.

Bottom Line

Oklahoma’s wage and employer tax laws are not complex, but there are quite a few withholding forms to consider. You must use the Oklahoma W-4 form for determining withholdings and may have additional forms for special cases, like spouses of military members. And stay abreast of changing payroll laws and regulations so that you don’t get penalized.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: