Learning how to do payroll in Oregon is more challenging than in some states because some municipalities levy local taxes, adding a layer of complexity to your work. Oregon also has state-specific forms, so you need to pay close attention to new hires and ensure you’re giving them federal and state forms.

Key Takeaways:

- State W-4: Oregon Form OR-W-4

- Oregon minimum wage varies by location and increases every July 1 based on inflation (currently ranging from $13.20–$15.45 per hour)

- Employers are not allowed to use a tip credit for tipped workers

- Oregon requires employers to offer paid leave under a brand-new leave program

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Step-by-Step Guide to Running Payroll in Oregon

Running payroll in Oregon requires your full attention to make sure you don’t miss any steps and face costly government fines. Here are your basic steps for running payroll in Oregon.

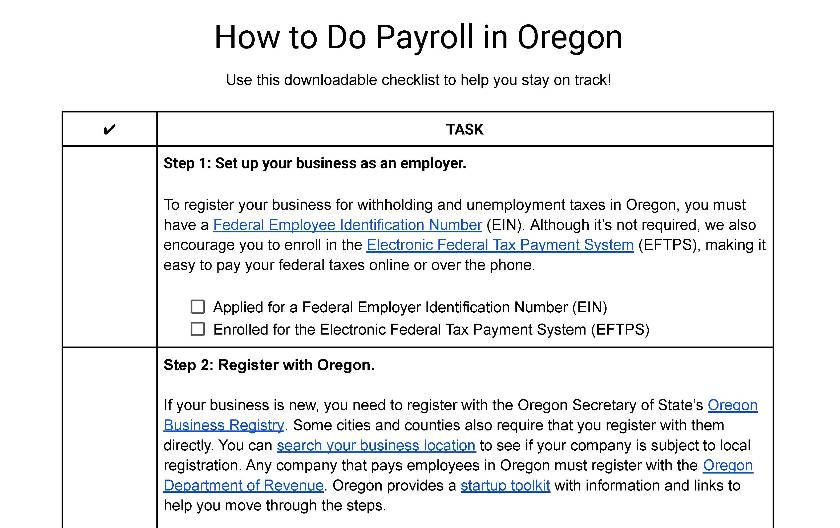

Step 1: Set up your business as an employer. If your company doesn’t already have one, you need to get a Federal Employer Identification Number (FEIN). This simple process can be completed online via Electronic Federal Tax Payment System (EFTPS). Your FEIN is required to pay federal taxes.

Step 2: Register with Oregon. If your business is new, you need to register with the Oregon Secretary of State’s Oregon Business Registry. Some cities and counties also require that you register with them directly. You can search your business location to see if your company is subject to local registration.

Any company that pays employees in Oregon must register with the Oregon Department of Revenue. The state also provides a startup toolkit with information and links to help you move through the steps.

Step 3: Set up your payroll process. An established business may have a payroll process you inherit. If it does, or if your company is brand-new, you may want to make some adjustments to the process to help you streamline your steps. Overall, you can opt to do payroll yourself manually (not recommended), set up an Excel payroll template, or sign up for a payroll service to help you handle your payroll.

Step 4: Have employees fill out relevant forms. During the onboarding of new hires, you must collect certain federal and state forms from your employees. Every employee must complete I-9 verification within the first three days on the job. New employees must also have a completed W-4 form on file. The state also requires employees to complete Oregon Form OR-W-4.

Step 5: Collect, review, and approve time sheets. Your payroll processing will begin several days before your payroll is due when you collect and review time sheets for your employees. Starting a few days early allows you to spot and address any issues and concerns in a timely manner. Whether you use paper time sheets or time and attendance software, it’s important to review time sheets for accuracy.

If your company uses paper time sheets, have your employees sign them before they submit them to you. That is verification that they agree to be paid based on the hours listed, and you do not have to try to chase them down later for verification. The benefit of using an electronic system is that there’s a built-in function to have your employees digitally sign their time sheets.

Step 6: Calculate employee gross pay and taxes. This is where things get complicated if you’re using pen and paper or manual spreadsheets to run payroll. Using payroll software would help standardize this process and make sure you don’t miss any steps or make any inaccurate calculations. You can also follow our guide on how to calculate payroll for good measure.

Oregon has one of the highest income taxes in the country—plus, some localities also levy taxes. The state’s tax is progressive, so the higher an employee’s salary, the higher the tax burden. Making these calculations by hand will be complex and may lead to costly mistakes. Payroll software can eliminate these mistakes.

Tax rate | Taxable income for single or married filing separately | Taxable income for married filing jointly |

|---|---|---|

4.75% | $0–$4,050 | $0–$8,100 |

6.75% | $4,051-$10,200 | $8,101-$20,400 |

8.75% | $10,201-$125,000 | $20,401-$250,000 |

9.90% | Over $125,000 | Over $250,000 |

Step 7: Pay employee wages, benefits, and taxes. The vast majority of companies and employees use direct deposit, but cash (not the best way) and paper checks are also options. Make sure you are paying your employees at least the Oregon minimum wage, which increases every year July 1, based on current inflation and varies based on where employees work (more detail on minimum wage further down).

You can pay your federal and Oregon state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 8: Save your payroll records. As with any business record, you want to ensure you keep a copy for at least several years. Oregon law requires companies to keep time sheets or time records for at least two years and all other payroll records for at least three years. These records may be kept electronically, so using payroll software will save you file cabinet space.

Step 9: File payroll taxes with the federal and state government. All Oregon state taxes must be paid to the applicable state agency on the schedule provided (usually quarterly), which you can do online at the Oregon Department of Revenue website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday, by the next Friday

Please note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule that you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 10: Complete year-end payroll reports. Every year, you will need to complete payroll reports, including all W-2 forms and 1099 forms. These forms must be in the hands of employees and contractors no later than Jan. 31 of the following year.

Download our free checklist to help you stay on track while working through these steps:

Learn more about doing payroll yourself in our guide on how to do payroll. It has a free checklist you can download to make sure you don’t miss any steps.

Oregon Payroll Laws, Taxes & Regulations

Oregon often mirrors federal regulations. To ensure that you maintain compliance with payroll regulations, review the ins and outs of doing payroll in Oregon below and consult with an employment law expert in your area.

Oregon Taxes

With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Beyond federal taxes, Oregon levies state taxes on businesses and employees. Some localities also levy taxes.

Employer Unemployment Taxes

All businesses in Oregon must pay State Unemployment Tax Act (SUTA) taxes. The current wage base is $50,900, and rates range from 0.7% to 5.4%. New employers have a standard rate of 2.1%. Businesses that pay SUTA in full and timely can claim a tax credit of up to 5.4% on your Federal Unemployment Tax Act (FUTA) taxes.

To learn more about FUTA requirements, check out our guide on FUTA and Form 940.

Workers’ Compensation

Oregon businesses with one or more employees must carry workers’ compensation insurance. Workers’ comp premiums will vary depending on the industry in which your company operates. Exceptions to this requirement include:

- Sole proprietors

- Casual labor (less than $500 in monthly payroll)

- Domestic workers

- Workers who live out of state

Income Taxes

Oregon employees who work out-of-state may get a tax credit for taxes paid outside of Oregon. If an employee lives in Oregon but works in another state, then they can receive a tax credit in Oregon for the taxes paid on their income in the other state—but only if that state does not provide a credit of its own.

For employees who live in Multnomah County or reside elsewhere and work in the county, they are subject to a 1.5% tax if they earn over $125,000 as an individual or $200,000 as a couple, plus an additional 1.5% on taxable income over $250,000 for individuals or $400,000 for joint filers. On Jan. 1, 2026, this rate will increase to 2.3%. This tax funds preschool services in Multnomah County.

Oregon also levies a transit tax statewide. The tax is 0.10% in wages and applies to both Oregon residents and nonresidents who work in the state.

There is another Oregon tax that helps fund TriMet, the public transit system in the Portland area. The tax rate is currently 0.8037% of wages paid by an employer for work performed within the TriMet boundary. You can check TriMet’s interactive map to see if your business is within the boundary.

Oregon Minimum Wage

Oregon’s minimum wage is complicated. Not only does the minimum wage go up each year on July 1 based on the Consumer Price Index inflation rate, but different areas of the state have different minimum wage rates too.

Minimum Wage Rate | Minimum Wage Zone |

|---|---|

$13.20 per hour | Non-Urban: Baker, Coos, Crook, Curry, Douglas, Gilliam, Grant, Harney, Jefferson, Klamath, Lake, Malheur, Morrow, Sherman, Union, Wallowa, and Wheeler Counties |

$14.20 per hour | Standard: Benton, Clatsop, Columbia, Deschutes, Hood River, Jackson, Josephine, Lane, Lincoln, Linn, Marion, Polk, Tillamook, Wasco, Yamhill, and parts of Clackamas, Multnomah, and Washington outside the urban growth boundary |

$15.45 per hour | Portland Metro: Within the urban growth boundary, including parts of Clackamas, Multnomah, and Washington Counties |

To make matters more confusing, if an employee works across multiple minimum wage zones, the employer must pay the minimum wage rate where the employee conducts the majority of their work.

An important note for tipped employees: Oregon law does not allow for tip credits, so employers of tipped workers cannot count the employee’s tips against the minimum wage. You can find more information on Oregon’s minimum wage website.

Calculating Overtime

Unlike some other states, Oregon’s overtime regulations are fairly straightforward. If you have employees eligible for overtime pay, you must calculate their overtime as 1.5 times their regular rate. An employee is eligible for overtime if they have worked over 40 hours in a workweek.

Paying Employees

Oregon law is less strict than most other states when it comes to pay frequency. It requires that employers pay employees at least once every 35 days regularly. Oregon also provides several options for paying your employees—cash, paper check, and direct deposit.

Pay Stub Laws

Oregon law mandates that you provide employees an itemized pay stub detailing the wages paid, deductions, and purpose of deductions. The pay stub can be a part of the paycheck or a separate document, delivered either by hand on paper, via email, or through payroll software.

Want to create your own pay stubs? Download our free pay stub template.

Oregon Paycheck Deductions

Besides the deductions listed above, Oregon law requires that employees consent in writing to any additional deductions. Employers can only withhold additional amounts for:

- Collective bargaining agreements

- Repayment of a loan to the employee

- Any other deduction allowed by the employee, so long as the company is not the recipient

Terminated Employee’s Final Paychecks

Oregon provides different rules for paying final pay to an employee based on the type of departure from your company and the notice given.

How Employment Ended | Date of Final Pay |

|---|---|

Termination and layoff | First business day after employee’s last working day |

Employee resignation with at least two business days’ notice | Employee’s last day |

Employee resignation without notice | Five business days or next scheduled payday, whichever is first |

Employee resignation without submitting final time sheet | Estimate wages and pay within five days after the employee quits, and pay any wages owed within five days after the employee submits final time sheet |

If you need to pay an employee right away and aren’t currently using a service, use one of our recommended ways to print a payroll check for free.

Oregon HR Laws That Affect Payroll

Many of Oregon’s HR laws go beyond federal minimum guidelines, so pay close attention to the distinctions to keep your business out of hot water.

Oregon New Hire Reporting

Your business must complete an Oregon New Hire Reporting Form for each new employee. This is used to enforce child support orders and must include the employee’s name, address, and Social Security number.

Breaks

Meal Breaks

Companies must provide employees with at least one 30-minute unpaid and uninterrupted meal break when the employee’s scheduled shift is more than eight hours. If an employee is required to work during their meal break, the entire break must be paid, even if the employee only worked a portion of the break.

Oregon also mandates when the employee should take a meal break:

- If an employee works seven hours or less, their meal break must start no earlier than their second hour of work and end no later than the end of their fifth hour of work

- If an employee works over seven hours, the meal break must start no earlier than the end of their third hour of work and end no later than the end of their sixth hour of work

Tipped employees can waive their meal break if the following conditions exist:

- The employee is paid to serve food and drink, receives tips, and reports tips to their employer

- The employee is at least 18-years-old

- The employee has worked for the employer for at least seven days

- The employee has signed a waiver form

- The employer retains the waiver form for at least six months after the employee no longer works for the employer

- The employer provides a reasonable opportunity for the employee to eat at any time during their shift

- The employer pays the employee for any meal breaks

- The employer does not coerce the employee to waive their right to a meal break

Shift Length | Numbers of Meal Breaks |

|---|---|

Up to 5h 59m | 0 |

6h to 13h 59m | 1 |

14h to 21h 59m | 2 |

22h to 24 | 3 |

Rest Breaks

Oregon mandates employers provide employees with two paid 10-minute breaks for every eight hours of work. If an employee is under the age of 18, the breaks must be 15 minutes for every four hours worked.

Shift Length | Numbers of Rest Breaks |

|---|---|

Up to 2h | 0 |

2h 1m to 6h | 1 |

6h 1m to 10h | 2 |

10h 1m to 14h | 3 |

14h 1m to 18h | 4 |

18h 1m to 22h | 5 |

22h 1m to 24 | 6 |

Lactation Breaks

Employers should provide nursing mothers at least 30 minutes of break time for every four hours worked to express milk. They are also required to provide a space that isn’t a bathroom. These breaks are unpaid, but an exception is if a nonexempt employee takes their lactation break during a paid rest period.

Time Off & Leave Requirements

Paid leave has arrived in Oregon. Effective Sept. 3, 2023, eligible employees can start taking paid leave for a qualifying reason for up to 12 weeks per year. Full-time and part-time employees—including employees working part time for more than one employer—are eligible. Self-employed and independent contractors are not automatically eligible but may apply for benefits too.

Family Leave

Oregon follows the Family and Medical Leave Act (FMLA). The Oregon Family Leave Act (OFLA) protects workers who need to take leave for a covered reason. The leave under the OFLA does not have to be paid, though it can be.

Under both OFLA and Paid Leave Oregon (the new program mentioned above), employees can take protected leave for the following reasons:

- Parental leave

- Serious health condition of the employee or family member

- Pregnancy leave

- Sick child leave

- Military family leave (OFLA only)

- Bereavement leave (OFLA only)

Paid Time Off

Oregon does not require employers to provide employees with paid vacation leave. Employers may create a policy if they wish.

Paid Sick Leave

The state does, however, require that employers with 10 or more employees—or six or more in Portland—provide paid sick leave. Employers with fewer than 10 employees must provide sick leave, but it can be unpaid. Employers must provide employees with at least one hour of paid sick leave for every 30 hours worked. Employers may also cap sick leave at 40 hours per year.

Voting Leave

Oregon has no requirement for employee voting leave.

Bereavement Leave

Oregon requires any employer with 25 or more employees to give paid bereavement leave, per the OFLA. Employers with fewer than 25 employees are not required to provide any bereavement leave, paid or unpaid.

Oregon Child Labor Laws

Oregon generally follows the Fair Labor Standards Act (FLSA) child labor laws. Under the FLSA, there are restrictions for workers under the age of 18.

Oregon allows for people as young as 14 to work up to eight hours per day and 40 hours per week. Stricter limitations exist around school days, where children ages 14 and 15 can work only from 7 a.m. to 7 p.m. and cannot work more than three hours per day and 18 hours per week. Children ages 16 and 17 can work up to 44 hours per week, regardless of whether school is in session.

Oregon Payroll Forms

Payroll forms can vary from state to state, and some have their own W-4, like Oregon. Fortunately, that’s the only one:

- OR-W-4: Employee withholding form

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Oregon Payroll Tax Resources

- Oregon Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- Tax withholdings often trip up employees processing payroll; reviewing Oregon’s comprehensive information may help you.

- For extensive information on how to get workers’ compensation coverage, Oregon’s Department of Labor offers guidance.

Bottom Line

Learning how to do payroll in Oregon can be more complex than for most states—but handling it is still simpler than in states like California. There is only one state-specific form, but there are multiple taxes you need to pay attention to and a brand-new paid leave program.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: