Global online sales are set to more than double pre-pandemic levels by 2025. Now is the time to embrace international fulfillment for your business.

International Fulfillment: Guide to Finding the Best Method

This article is part of a larger series on Retail Management.

In an era where retail knows no borders, the opportunity for ecommerce stores to tap into global markets has never been more lucrative. Ecommerce sellers can offer global fulfillment for their international customers in two ways: cross-border international shipping and localized fulfillment. The differences between the two are storage location and fulfillment operations.

We generally recommend:

- Cross-border international shipping: Best for small businesses shipping internationally—startups and growing ecommerce businesses that ship a small percentage of orders globally and those testing international markets

- Localized fulfillment: Best for established ecommerce businesses with consistent international customer bases and well-established markets

International Order Fulfillment Options at a Glance

In cross-border international fulfillment, goods are stored and fulfilled in your country, then shipped per order to international customers.

In localized fulfillment, goods are shipped in bulk to be stored in a country or region near your international customers, then fulfilled per order from a local warehouse. This involves higher risk and more up-front spending.

Cross-border Shipping | Localized Fulfillment | |

|---|---|---|

Best For | Small businesses with few global shipments or those testing global markets | Established ecommerce businesses with a steady global customer base |

Types | In-house fulfillment Third-party fulfillment | Global Warehouse Network Region-specific Fulfillment |

Shipping Costs | Market-rate and discounted cross-border rates | Discounted local rates |

Delivery Speed* | 1–4 weeks | 2 days–2 weeks |

Recommended Solution |

*Delivery speed varies greatly by location, carrier, and shipping method.

International Fulfillment Using Cross-border Shipping

Cross-border fulfillment involves shipping orders from one country across borders to buyers in other countries. Cross-border shipping is the easiest and quickest way for most small-scale sellers to start shipping internationally as it lets you manage inventory and fulfillment via your usual process. The main changes involve the needed documents to ship and the carrier options you’ll have.

Cross-border fulfillment involves shipping orders from one country across borders to buyers in other countries. Cross-border shipping is the easiest and quickest way for most small-scale sellers to start shipping internationally as it lets you manage inventory and fulfillment via your usual process. The main changes involve the documents required to ship orders and the carrier options you’ll have.

Here are two ways you can cost-effectively work international orders into your business using cross-border shipping:

In-house Fulfillment | Third-party Fulfillment | |

|---|---|---|

Fulfillment location | Your home, office, warehouse, or ecommerce facility | Specialized fulfillment center(s) in your country |

Recommended for: |

|

|

Shipping costs | Market-rate cross-border shipping | Discounted cross-border rates |

Customs requirements | Documentation, duties, and taxes per order | Documentation, duties, and taxes per order |

Delivery speed* | 1–4 weeks | 1–4 weeks |

Labor involved |

|

|

Recommended Solution | Shipping software | Domestic fulfillment provider |

*Delivery speed varies greatly by location, carrier, and shipping method.

In-house Fulfillment

In-house international fulfillment has the lowest barrier to entry and allows your shipping strategy to be modified at any time. It usually costs more in the long run than outsourcing to a third-party provider, but it’s generally better for those building out their own dedicated in-house fulfillment operation or just testing the waters with international sales.

If you decide to go this route, start by learning about the best international shipping carriers and methods that serve the countries you’re selling to.

FedEx, UPS, USPS, and DHL are popular choices with a global reach. Each company has a convenient calculator tool to determine costs, options, and transit times on their website.

Consider these factors when choosing your carrier(s):

Consider these factors when choosing your carrier(s):

- Shipping speed

- Affordability

- Quality of service

- Insurance options

- Tracking capabilities

- Returns management

Some best practices to keep in mind when doing in-house cross-border shipping are:

- Make sure to check country- or territory-specific regulations that may affect your international shipments. These restrictions largely affect hazardous or dangerous goods, but some locales restrict broader categories as well. For example, used clothing cannot be shipped to Saudi Arabia from outside countries.

We suggest using UPS’ Import/Export Regulation tool, which provides area-specific information on product stipulations, necessary invoice requirements, documentation, exemptions, and weight/size/value limits.

- International shipments may require different packaging than domestic orders, mainly due to parcels going through many additional facilities and spending more time in transit. If your goods are susceptible to damage, include more dunnage or use sturdier boxes/mailers for international orders. To accommodate the cost of this, consider adding a handling fee to global orders.

For the most part, your usual order processing, picking, and packing method can stay the same when performing international shipping in-house—but your shipping label procedure will change since you need to create customs forms.

Customs is an agency responsible for collecting fees and controlling the flow of goods into and out of a country. We’ll cover customs in more detail later on.

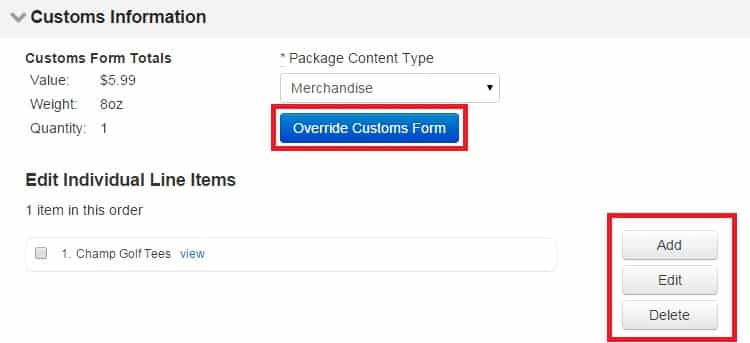

The simplicity of this task depends on the shipping software you use. Some programs print international customs forms and auto-populate customs fields for you, as shown in ShippingEasy’s Customs Information screen below.

If your shipping software supports customs forms, you can print the necessary documents from your usual system. If not—or if your shipping strategy doesn’t include the use of shipping software—you can use your carriers’ websites to get the job done. That said, adding this extra step breaks up the usual shipping workflow and requires more time to fulfill each order.

We recommend ShippingEasy to streamline international fulfillment and other shipping processes. It helps businesses save on time as well as transport rates with automated forms, carrier comparisons, and deep shipping discounts. Learn more in our ShippingEasy review.

Third-party Fulfillment

With cross-border fulfillment, your inventory is stored in your country, and a third-party logistics (3PL) provider handles the ins and outs of international shipping.

Similarly to the in-house method, each international order crosses borders and goes through customs, which entails applicable delivery duties and taxes. For most SMBs shipping a small, consistent percentage of sales abroad, third-party cross-border fulfillment is the easiest and most cost-effective way to handle international fulfillment.

Read our in-depth guide to third-party fulfillment companies and how they work.

Most US-based fulfillment providers offer international shipping, but be sure to confirm this service and clarify the details before partnering with a 3PL. Here are some of the top options for US-based fulfillment companies that offer robust international shipping services:

- ShipBob: Our top recommendation for small business fulfillment with nearly 40 US warehouse locations that can ship internationally. As global business scales, retailers can opt to store portions of their inventory in any of ShipBob’s nine non-US warehouse locations around the world. Learn more about ShipBob.

- Red Stag Fulfillment: Best at handling large, oversized, heavy, or fragile products—and optimizing these tricky shipping scenarios to be as safe and cost-effective as possible. The company’s two US warehouse locations can accommodate international orders. Read more about Red Stag Fulfillment.

- ShipHero: Specialized in Canadian expansion to help US-based brands reach new audiences and vice versa. ShipHero also offers global cross-border shipping from any of its eight warehouse locations.

What do I do if my current fulfillment company doesn’t handle international shipping?

You’re partnered with a 3PL that doesn’t do cross-border order fulfillment, you can still reach global customers by using additional fulfillment companies or methods. This approach allows you to work with a specialist in international shipping alongside your main provider, ensuring your orders are fulfilled worldwide without changing your entire setup.

You can route international orders from your main fulfillment company to a secondary provider for handling, which may add a little time and cost but keeps the process smooth. Alternatively, storing a portion of your inventory with a 3PL that specializes in international shipments can speed up deliveries at an extra cost. Handling international fulfillment yourself is also an option, offering direct control over the shipping process.

The hurdles of cross-border shipping individual orders may be draining if a sizable percentage of your sales come from abroad. Consider localized fulfillment to simplify the process and save on shipping and duty costs.

International Fulfillment Using Localized Warehousing

Localized fulfillment involves stocking a portion of your inventory in warehouses within the countries or regions you’re shipping to. These goods are fulfilled and shipped to your international customers by a third-party company.

Localized fulfillment works in much the same way as domestic third-party order fulfillment: You send inventory to your localized fulfillment partner, which stores it, and then processes, packs, and ships your orders to customers. The only difference is that your fulfillment partner’s warehouse is based in your destination country.

Localized international fulfillment is a highly cost-effective way to handle high volumes of international orders within specific global regions. This is because most customer orders don’t have to go through cross-border customs or be subject to certain import taxes. It also reduces shipping costs and increases delivery speed.

Here are two ways to do localized international fulfillment:

Global Warehouse Network | Region-specific Fulfillment | |

|---|---|---|

Fulfillment location | Multiple fulfillment centers in your country and abroad | Fulfillment center(s) in the country or region you serve |

Recommended for: |

|

|

Shipping costs | Discounted local rates | Discounted local rates |

Customs requirements | Documentation and duties per bulk shipment Sales taxes per order | Documentation and duties per bulk shipment Sales taxes per order |

Delivery speed* | 2 days–2 weeks | 2 - 6 days |

Labor involved |

|

|

Recommended Solution | International fulfillment provider | Region-specific fulfillment partner |

*Delivery speed varies greatly by location, carrier, and shipping method.

Global Warehouse Network

Some US-based fulfillment providers boast an international warehouse network in addition to domestic locations. This allows clients to strategically distribute inventory throughout the globe—keeping shipping costs, time in transit, and duties low.

Using a global warehouse network is the best choice for most small businesses. It provides the convenience and cost-effectiveness of standard outsourced logistics and allows for efficient and scalable international shipping.

Outsourcing fulfillment and shipping to a global 3PL also gives you the flexibility to redistribute inventory as demand increases in certain areas. Here are some of the options that small business owners have for outsourcing localized global fulfillment:

Fulfillment Company | Warehouse Locations |

|---|---|

ShipBob |

|

Flexport |

|

Shipwire |

|

ShipMonk |

|

Whiplash |

|

If you’re an Amazon seller expanding internationally is simple—just make your existing product listings available globally from the settings in your domestic Amazon account.

To fulfill international Amazon orders, choose from any of the options outlined in this article, or consider outsourcing fulfillment and shipping to Fulfillment by Amazon (FBA), which includes FBA Export for international sales at no extra charge to the merchant.

Region-specific Fulfillment

Using a region-specific fulfillment partner is best for retailers nurturing strong customer bases in targeted locations. If you are a retailer with consistent sales in specific regions or countries, you can choose to partner with a fulfillment company based in those locations.

A portion of your inventory is stored on-location, and orders are shipped to your international customers without crossing borders. The rest of your stock is kept in your country for domestic sales. This method can be combined with US-based third-party fulfillment or in-house shipping for other orders.

To find a region-specific fulfillment service, try searching for fulfillment companies in the countries you frequently serve and reach out for an individualized quote. Using brokerage services like WarehousingAndFulfillment.com can simplify the process at no extra cost.

International Fulfillment Customs

Before embarking on your international shipping strategy, consider one of the main differences between domestic and cross-border shipping: customs. Basically, this entails dealing with fees and documents.

Imported parcels have to go through the customs process, which applies to international ecommerce orders in the same way it does to all other shipments. To make sure your shipments arrive without delay, unnecessary cost, or legal penalty, you’ll need to be prepared for customs.

Fees

When you ship goods to another country, you (or the customer) may be asked to pay duties and taxes before the shipment is delivered. The purpose of these charges is for local governments to protect domestic companies from foreign competitors, control the flow of certain products, and raise additional revenue.

Did You Know? Not every shipment is taxed on import. If your shipment doesn’t exceed the destination country’s De Minimis Value—which is the minimum value required to apply customs duty and tax rates on imported goods—you’ll be exempt from most customs fees. Check with each country’s government website to find current De Minimis Value thresholds.

Here’s an overview of the fees you may encounter when doing international order fulfillment:

Duties

Duties are a type of tax charged on goods moving into or out of a country. These fees are separate from sales taxes and vary depending on your shipment’s country of origin and destination. They can include:

- Import duties, which are charged by the government of the destination country. This fee is assessed as a percentage of the shipment’s value, freight costs, insurance, and any additional costs.

- Export duties, which are charged by the government of the country in which the cross-border shipment originates. Many countries, including the US, do not charge export taxes.

- Tariffs, which are charged by the destination country to restrict the import of certain categories of goods that can be produced domestically.

- Anti-dumping duties, which are charged by the destination country. These fees are imposed on imports priced below the fair market value of similar goods in the domestic market.

Taxes

Taxes are government fees charged on purchased goods. They are assessed as a percentage of the goods’ value and vary by country.

You may need to register for tax identification depending on where your international sales take place (along with your sales turnover). Check with the country’s government site for detailed information.

Some governments apply different tax rates to different categories of goods. The types of sales taxes you may encounter include:

- VAT, or Value Added Tax, is applied at every step of the supply chain. It accounts for an added percentage of the goods’ intrinsic value.

- GST, or Goods and Services Tax, is a flat-rate percentage of a transaction’s value.

Documents

Making it through the customs process in international order fulfillment requires additional forms and documentation not used in domestic sales.

These requirements vary by destination, but most countries ask for:

- Commercial Invoice: This document is simply the bill for the shipped product from the seller to the buyer. It verifies ownership, contents, and accurate value. This is prepared by the exporter (i.e., your ecommerce business) and is necessary to be cleared through customs.

- Certificate of Origin: This is a document declaring where the products you’re shipping were manufactured. It is obtained from your local chamber of commerce.

- Packing List: A document that details the contents of your shipment, including a description of goods, weights, dimensions, and how the parcel is packed.

Check with your shipping carrier for exact information on the documentation you’ll need for your shipments.

Frequently Asked Questions (FAQ)

These are some commonly asked questions about international fulfillment.

Global fulfillment services are third-party providers that manage inventory storage, order processing, and parcel shipping for ecommerce businesses, facilitating seamless order fulfillment for international customers. These services can be either cross-border international shipping or localized fulfillment, each with its own benefits and considerations.

The best way to do international order fulfillment depends on your business size and model. Small businesses testing global markets may find cross-border shipping to be the best option, while established businesses with regular international sales may benefit more from localized fulfillment, storing goods closer to customers for efficiency and cost-effectiveness.

International shipping opens up new markets and customer bases, allowing your business to reach a global audience. By offering your products internationally, you can increase sales, expand brand recognition, and diversify your revenue streams. Additionally, catering to international customers can enhance customer loyalty and satisfaction, contributing to long-term business growth.

Bottom Line

Expanding internationally is a powerful way to grow your ecommerce business. International fulfillment is the trickiest part of global expansion due to customs requirements, shipping costs, delivery speed, and labor.

It’s possible to successfully incorporate the task into your fulfillment workflow by creating a well-developed shipping strategy. But, for retailers making a significant portion of their sales from international customers, outsourced fulfillment is the best way to send orders abroad.

ShipBob has a global network of fulfillment centers in the US and other popular markets. This makes it simple to achieve localized fulfillment by distributing inventory near to your domestic and international customers.