Justworks is a highly affordable, IRS- and Employer Services Assurance Corporation (ESAC)-certified professional employer organization (PEO). As a PEO, it processes your payroll, files and pays your taxes, and manages your benefits. Aside from granting you access to enterprise-level health benefits packages from major insurers, it has HR consultants available to answer your questions and help you stay compliant. It even offers time tracking tools, global contractor payments, a standalone payroll solution The payroll services included in Justworks PEO cover all 50 states, but its standalone payroll tool is only available in Arizona, Arkansas, California, Colorado, Connecticut, DC, Florida, Georgia, Idaho, Illinois, Iowa, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Oklahoma, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, and Wisconsin (as of this writing). , and an employer of record (EOR) service for hiring and paying international workers.

Monthly fees for its PEO solution start at $59 per employee. In our evaluation of the best PEO companies, Justworks earned an overall score of 4.46 out of 5.

Justworks Overview

Pros

- Enterprise-level benefits packages from major health insurance companies

- Justworks-administered 401(k) program

- User-friendly interface with good customer support

- Has IRS, certified PEO (CPEO), and ESAC certifications

- Standalone payroll for those who don’t want full PEO services

- Global contractor payments in more than 30 countries; EOR services in over 100 countries

Cons

- Medical, dental, vision, health savings account (HSA) and flexible savings account (FSA) are available only in the Plus plan

- Time tracking is a paid add-on

- Paydays must follow preset schedules (every other Friday for nonexempt salaried and hourly workers; every 15th/end of the month for exempt salaried employees)

Justworks Deciding Factors

Supported Business Types | Small to midsized businesses (SMBs) that need an affordably-priced PEO solution and a feature-rich HR solution that can handle global employee payments |

Discounts | Justworks offers discounts for non-profit organizations (call for a quote) |

Pricing | Justworks PEO

Justworks Payroll (standalone tool)

Justworks EOR

Add-on solutions

|

Standout Features |

|

Ease of Use | Justworks’ platform is generally easy to learn and use, but having basic knowledge of how to do payroll will be helpful |

Customer Support | 24/7 customer support via phone, email, chat, Slack, and short message service (SMS) |

Justworks Is Best For

- Businesses looking for a PEO with transparent and affordable pricing: Unlike most PEOs, which require you to call and request a quote, Justworks’ pricing is readily available on its website. While some providers charge either a percentage of your total monthly payroll or per-employee fees that can cost more than $100 monthly, Justworks charges $59 per employee monthly.

- Small companies that want to offer high-quality benefit options: With Justworks handling benefits for its clients’ 70,000-plus employees, it has the purchasing power to negotiate rates and benefits coverages from leading carriers and insurance providers. Thus, it can offer you high-quality health insurance and medical plans from UnitedHealthcare, Kaiser, and Aetna.

- Employers who need to pay local and global contractors: Justworks PEO covers employee payroll, but it also lets you pay contractors and vendors at no extra cost. It even handles 1099 filings at year’s end. Plus, if you have global contract workers, its international contractor add-on can help you process payments in over 30 countries (as of this writing).

- Rapidly growing businesses with plans to expand to other countries: Justworks, which is one of our recommended online payroll services, will help take on the duties and responsibilities of your day-to-day HR, payroll, and benefits management both in the US and in other countries. You can start with its PEO services and then upgrade to its EOR product if you need help hiring global employees and paying an international workforce.

Justworks Is Not Ideal For

- Companies in high-risk industries or those with specific needs: Industries that need particular reports for compliance may not find what they need with Justworks’ reporting and analytics tools. For instance, trucking companies may be better suited to using trucking payroll solutions. Also, businesses in high-risk industries like construction may run into issues getting full liability coverage. If you belong to these two industries, read our best payroll software guides for trucking companies and construction businesses to find more suitable options.

- Large businesses: While Justworks can work with companies with more than 175 employees, its focus is on small businesses. If your business is bigger, Paychex or ADP may be a better fit, as they are both built to support large enterprises and have HR payroll software options plus a PEO. Read our review articles for Paychex Flex, ADP Run, and ADP TotalSource to know more about its HR payroll and PEO solutions.

- Expanding businesses needing local hiring tools: Justworks does not have recruiting and applicant tracking tools. If you need these solutions, check out some of our top HR software picks.

- Multi-location businesses needing straight payroll: Justworks may have a standalone payroll tool, but it isn’t available in all states (as of this writing). For payroll services that cover all US states, check out our best payroll software guide.

Justworks Alternatives

Best For | Starter Monthly Fees | IRS & ESAC Certified | Our Reviews | |

|---|---|---|---|---|

| Small companies that need a low-cost, high-functioning PEO | $59 per employee | ✓ | |

Businesses needing HR and IT management | Call for a quote | ✕ | ||

| Businesses looking for a PEO with robust benefits plans | Call for a quote | ✕ | No Review Yet |

| Growing companies that want the expertise of a big PEO | ✓ | ||

If you’ve narrowed your search for Justworks alternatives to a few payroll providers but still can’t decide, read our guide on choosing the best payroll solution for help.

One refreshing thing about the Justworks pricing matrix is that it’s fully transparent—you can easily find it on its website. Most PEOs require you to call for a quote. It also doesn’t impose setup fees, instead charging you per employee, unlike other PEOs that charge as a percentage of your payroll. As a result, Justworks got perfect marks for pricing.

For PEO services, Justworks offers two plans: Basic and Plus. Both have similar functionalities, although the Plus plan comes with advanced analytics and access to additional benefits options, such as medical, dental, vision, health savings account (HSA), and flexible spending account (FSA) plans.

Since our Last Update: Justworks has increased the monthly fees for its Plus plan (from $99 to $109 per employee). It also removed the step-down pricing for businesses with 50 or more employees.

Basic | Plus | |

|---|---|---|

Monthly Fees | $59 per employee | $109 per employee |

Unlimited Employee, Contractor, and Vendor Payments | ✓ | ✓ |

Payroll Tax Payments and Filings, Including Year-end Reporting | ✓ | ✓ |

Employee Onboarding and Offboarding | ✓ | ✓ |

Online Timecards and PTO Management | ✓ | ✓ |

Expense Management | ✓ | ✓ |

$8 per employee monthly | $8 per employee monthly | |

Harassment Prevention and Inclusion Training | ✓ | ✓ |

Workers’ Compensation, Life and Disability Insurance, and 401(k) Plans | With participation fees (Call for a quote) | With participation fees (Call for a quote) |

Fitness Memberships and Health and Wellness Perks | With participation fees (Call for a quote) | With participation fees (Call for a quote) |

Health Advocacy Services, COBRA Administration, and Access to One Medical (as Available) | ✕ | With participation fees (Call for a quote) |

Medical Insurance, HSA, FSA, Dental, and Vision Plans | ✕ | With participation fees (Call for a quote) |

Reporting Tools | ✓ | With advanced analytics |

Note that Justworks has a two-individual minimum to run payroll. One can be an unpaid owner, and the other must either be an hourly/salaried W-2 employee or a part-time W-2 staff member who works 20 or more hours and receives no less than minimum wage.

For companies with high hiring and turnover rates, Justworks’ plans are flexible enough to handle changes in your employee headcount. The provider will only charge you for the actual number of W-2 employees paid through its system. You can also upgrade or downgrade your subscription by informing Justworks (via Slack, chat, email, or phone) that you want to change your plan a month or more before the date when you’d like to make the switch.

Whether you’re on the Basic or Plus plan, Justworks will charge you $59 per worker monthly. You pay only for months that you have active part-timers. Its system is also flexible enough to determine how many part-time and full-time workers you have, enabling it to automatically bill you the applicable rates for both employee types.

Note that the provider considers workers as part-timers if they are not eligible for benefits and work, on average, fewer than 30 hours weekly. If your part-time employees are tagged as benefits-eligible in Justworks and work, on average, 30 or more hours per week, then they are considered full-time employees. This means that you will be charged Justworks’ regular rates.

Justworks Payroll is the provider’s standalone tool for small businesses that only require a pay processing tool. For $50 plus $8 per employee monthly, you can process employee and contractor payments, including off-cycle payouts. Onboarding, PTO management, and basic online timecards are also included, as well as integration with popular accounting software like Xero, NetSuite, and QuickBooks Online.

Unlike Justworks PEO, Justworks Payroll can process tip payments. It lacks expense reimbursement tools and doesn’t come with benefits plans—although it can handle benefits deductions or you can choose to sign up for Justworks health plans to automate the entire process. Further, as of this writing, Justworks Payroll is only available in the following states:

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- DC

- Florida

- Georgia

- Idaho

- Illinois

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New York

- North Carolina

- North Dakota

- Oklahoma

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Wisconsin

If you have a distributed workforce, Justworks offers two solutions for paying remote teams in various countries. One is a standalone EOR solution and the other is a contractor payments option, which is an add-on to either Justworks EOR or Justworks PEO.

- Contractor payments: $39 per contract worker monthly

- Includes contractor management, self-onboarding tools, and payments in 30 countries.

- Justworks EOR: $599 per employee monthly

- Includes global hiring, onboarding, and payroll services in over 100 countries

Justworks makes managing payroll and benefits easier, enabling you to focus more on growing your business. It got a perfect score for this criterion because it helps prepare year-end tax reports. Its online delivery, flexible payment schedules, and direct deposit option, as well as local and payroll tax handling (which includes calculating and filing them), also contributed to the score.

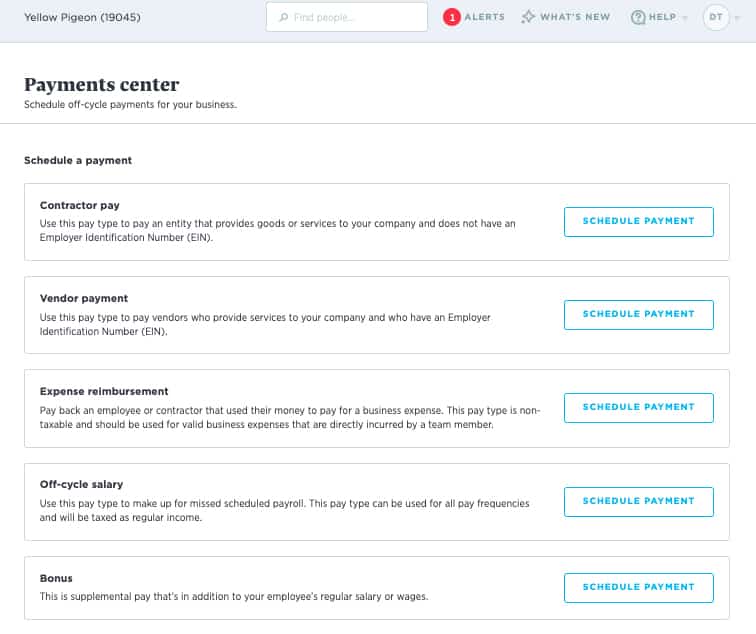

Justworks can handle different types of payments, from regular payroll to bonus payouts. (Source: Justworks)

Justworks features an online platform that handles employee and contractor payroll, including vendor payments. You can pay through paper checks, but you have to create and distribute them yourself. It also offers direct deposit payments and even lets your employees split their pay among multiple accounts. Note that if you’re paying via direct deposit, Justworks requires you to approve payroll four days before your designated payday.

In addition to multiple pay frequencies, Justworks supports off-cycle payments and wage garnishments. And, in case you receive a garnishment notice, Justworks will process it at no additional charge, but the order must go directly to Justworks and should have its employer identification number (EIN) listed on the notice.

Justworks handles all the calculations, filings, and payments for federal, state, and local taxes. Your job, then, is to ensure you give complete and accurate payroll information to Justworks (like cash tips and checks created outside its system).

Justworks offers an EOR product where it partners with local experts in over 100 countries to process payroll (and hire workers). However, if your employees are located in countries where Justworks has local entities, the provider will handle global payroll for you. As of this writing, it has local EOR entities in Brazil, Canada, Chile, Colombia, Costa Rica, Ireland, Mexico, the Netherlands, Portugal, Spain, and the United Kingdom.

For your global contractors, Justworks can process payments in over 30 countries, such as Australia, Canada, France, India, Mexico, Portugal, Spain, and Thailand. To see the full countries list, click here.

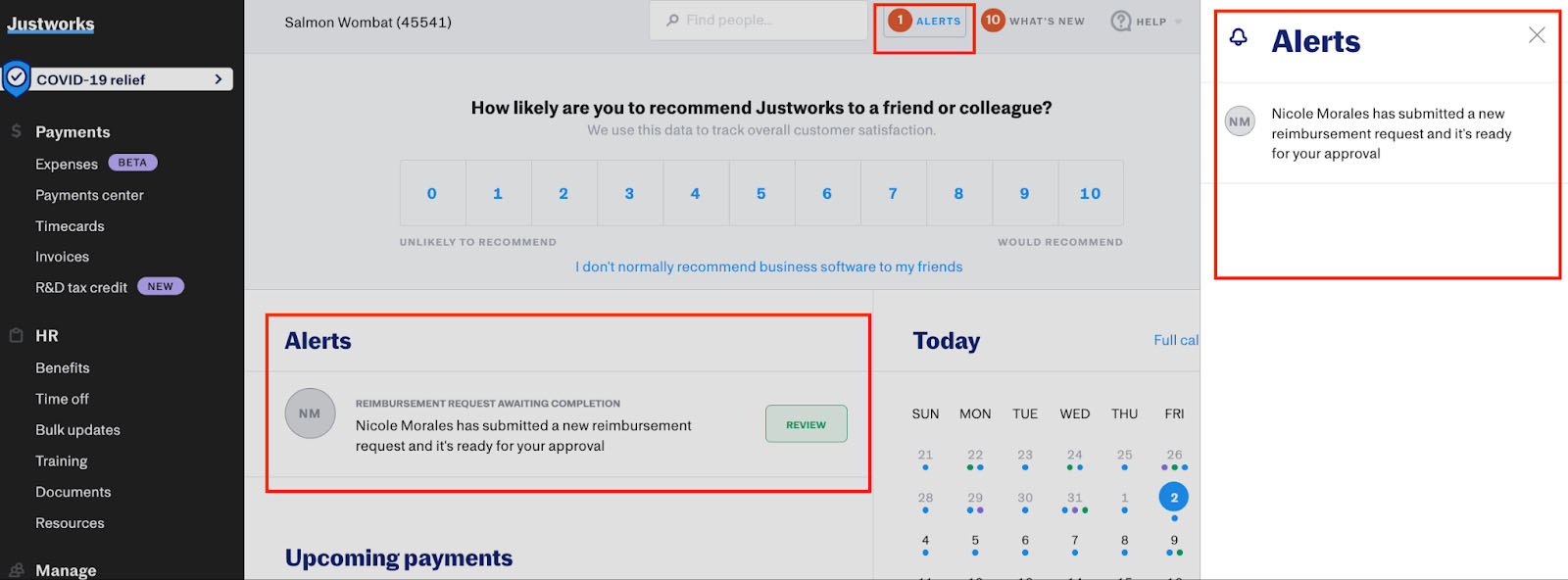

Justworks PEO plan holders can include expense claim reimbursements in their regular pay runs. Its expense management module comes with default categories (such as car and mileage, travel, and office expenses) but you can also create your own. It also lets you set up user roles (such as requesters and approvers) and create project codes, which you can add to expense categories to help you track expenses for specific projects.

Justworks will send alerts via email and through its platform to notify identified managers of expense reimbursements that need to be reviewed and approved. (Justworks)

Justworks got a perfect mark for HR administration tools. It offers all the features you need to manage HR, including onboarding and new hire enrollment, employee self-service portal, compliance issues tracking, and benefits administration. It also provides harassment prevention and inclusion training.

Employees can easily request time off from Justworks’ online portal and mobile app. (Source: Justworks)

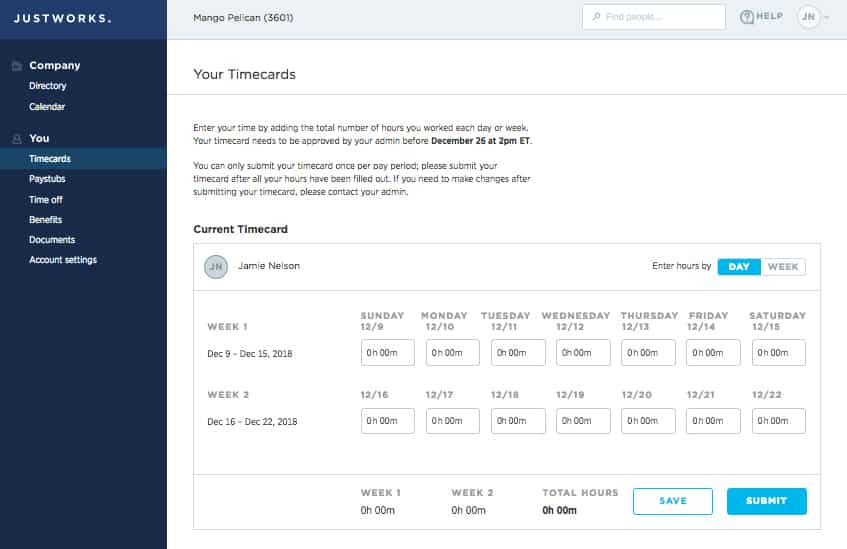

Justworks has a simple online timecard for viewing and editing employee time data. You can choose to have your employees complete the timecards themselves and send them for approval. However, if you’re a QuickBooks Time user, your staff’s actual hours worked can be imported into Justworks.

For seamless integration, consider getting its time and attendance solution, Justworks Time Tracking. Available as a paid add-on (priced at $8 per user monthly) to Justworks PEO and Justworks Payroll, it comes with overtime alerts, shift scheduling, geo-stamped timekeeping, and mobile apps (for iOS and Android devices) via which your employees can clock in and out.

When Justworks’ employee timecard entry is enabled, your staff can choose to input their hours either on a daily or weekly basis. (Source: Justworks)

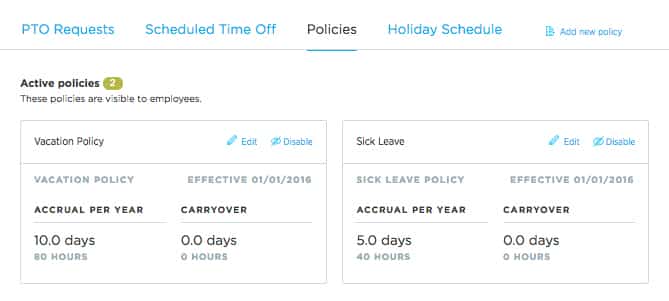

Once your company’s vacation and sick leave policies have been set up in Justworks, its system can track accruals and help manage PTO requests by notifying the applicable managers via email of transactions for approval. Managers can also view and approve/disapprove the requests they receive directly through its platform.

If you need to disable PTO policies in Justworks, click the “Disable” button located at the top-right corner of the policy. (Source: Justworks)

Incoming employees can complete new hire forms, provide direct deposit details, select health insurance plans, and take compliance training online. The system guides them through the different steps until they complete the onboarding process. This includes setting up multi-factor authentication (MFA) and their Justworks accounts.

If you’re a system administrator, Justworks offers a similar online wizard that guides you through the offboarding process. Its employee separation workflow will ask you to select the separation type: voluntary (such as resignation) and involuntary (such as termination). Depending on the option selected, additional data fields or an online questionnaire may appear to help Justworks collect and provide accurate information to specific state agencies for unemployment claims.

The offboarding wizard will also ask questions about the employees’ remaining payments (such as bonuses and commissions) that need to be included in the final pay computation. Justworks will even provide helpful links to applicable state-specific separation guides to help you remain compliant.

Documents like employment contracts and handbooks can be uploaded and stored in Justworks. It even has an electronic signature tool, allowing you to send documents that require e-signatures to approvers and identified signatories.

Employees can access important documents, from W-2s to company policies, through an online portal. Aside from viewing pay stubs and benefits information, they can request PTO via the portal, and an email will be sent to their manager, who can approve or disapprove the request. Similar functionalities are also available via the Justworks mobile app.

Justworks monitors changes in state and federal regulations and keeps you in the loop. It offers compliance reports, such as EEO-1, and even has built-in learning programs (powered by EVERFI) to help you stay within the law. This includes access to sexual harassment prevention training that your employees can watch online.

Justworks also provides compliance support for the following:

- New hire reporting

- Unemployment insurance

- Workers’ compensation

- ACA filings (1094-C and 1095-C)

As a PEO, Justworks folds the employees of all its client businesses under its own EIN for the purpose of providing competitive benefits. It can negotiate pricing and deals based on the strength of 70,000 employees rather than an individual company’s five or 20 workers, bringing you better prices and more comprehensive plans. It even manages and takes responsibility for a 401(k) program, making it possible for small businesses to offer this benefit to their employees.

In addition, Justworks lets you create an employee benefits program and choose the insurance plans you want. While you can mix and match plans, its system can detect whether or not the options you selected can be offered together. In case it sees that your plans’ pricing and coverage are too different from each other, Justworks will restrict you from choosing options that are incompatible with those you have already selected.

Justworks benefits options include:

- Medical, dental, and vision insurance (through Aetna, United HealthCare, and Kaiser)

- HSA and FSA

- Accidental death and disability insurance

- Life insurance

- 401(k) insurance

- Commuter benefits

- Medical advocacy services

- On-demand primary care services and Teladoc services

- Gym memberships

- Health and wellness perks

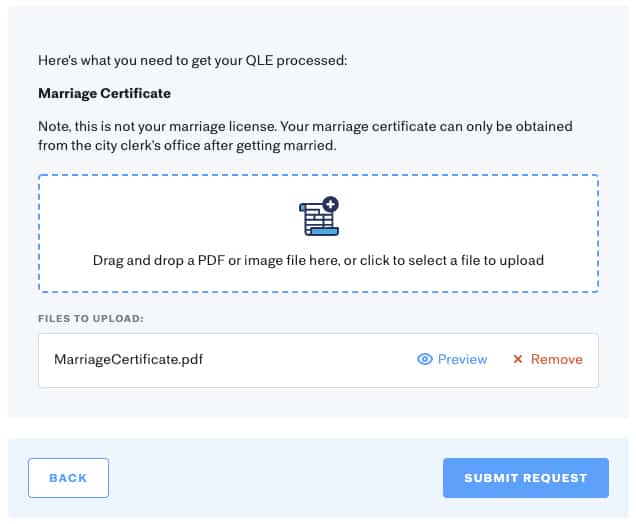

Employees only need to select benefits options during onboarding, and Justworks handles the rest. And while your staff can only change their plans during your company’s annual benefits enrollment period, those with a qualifying life event (QLE), such as marriage, the birth or adoption of a child, and legal separation/divorce, can make updates to their benefits coverage directly in Justworks. However, they need to submit proof of the QLE within 30 days of the event.

Employees can upload and submit proof of their QLE, such as a marriage or birth certificate, in Justworks. (Source: Justworks)

This criterion clearly lowered Jusworks’ overall score. While it offers training for new employees, it doesn’t have a learning management system; plus, its time tracking tool costs extra. Justworks also doesn’t offer a recruiting and applicant tracking system.

Justworks got a modest score of 3 out of 5 for this criterion. While it is IRS- and ESAC-certified, it only handles basic payroll and HR reports. Justworks lets users have access to its pre-built reports; however, you can’t request customized reports for your business’ unique needs. Its system does allow you to build a custom payroll report, but the options are very limited—you can only select data and date ranges.

The only thing that prevented Justworks from getting a perfect score for this criterion is the limited features in the mobile app for employers. Most of the app’s functionalities are for employees to access payslips, tax forms, benefits information, and PTO filing tools.

The good thing is that getting started with Justworks is easy. You’ll have an onboarding manager to help you through the process of activating your account, setting up your benefits, and getting your employees on the platform. As part of its PEO services, Justworks helps manage your employee benefits and automatically handles your workers’ compensation, payroll tax filings, and employer practices liability insurance (EPLI).

Here are the top things that make Justworks easy to use:

- Intuitive, easy-to-use interface

- Dedicated onboarding manager

- Access to HR consultants

- Compliance starter guides by state

- In-app help and explainer videos

- Help center with how-to articles

- Benefits management and compliance assistance

- 24/7 support via email, chat, phone, SMS, and Slack

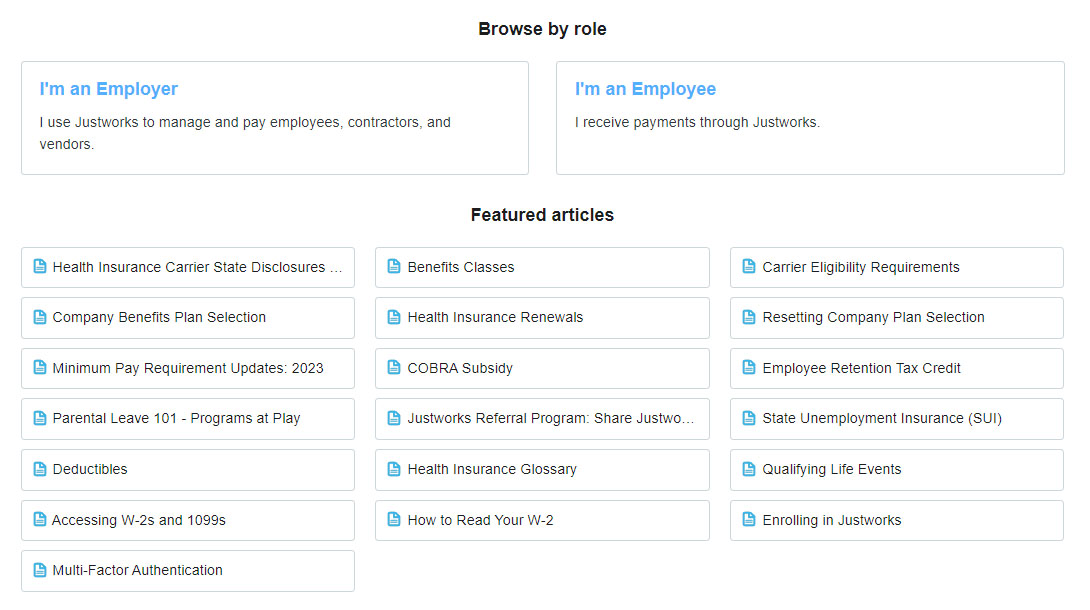

Justworks prides itself on creating software that is educational and useful. So, it’s loaded with links to helpful articles about points of law and compliance, including explanations of terms you or your employees might not be familiar with. It also has an online resource center that offers how-to articles and helpful guides about benefits and state regulations, among others.

Justworks online help center has separate how-to guides for employers and employees. (Source: Justworks)

You are granted access to certified HR professionals who can provide expert advice and best practices on how to manage your workforce. If you need assistance, Justworks has customer support representatives available 24/7, so you can contact someone in the United States anytime you need help.

For its global solutions, Justworks has local entities in 11 countries to help guide you through the complexities of hiring and paying international workers. In addition to its local entities, Justworks partners with local legal and HR experts to make global HR processes easier for you.

Justworks can integrate with popular accounting and HR tools. Its partner systems include:

- Accounting: NetSuite, QuickBooks Online, QuickBooks Desktop, Sage Intacct, and Xero

- HR: Greenhouse, Lever, and JazzHR

While the options are limited, you can ask Justworks to add an integration by submitting a request form. This can be done through the “Request an Integration” button located at the top right part of the system’s “Integrations” module.

We consider Justworks as an excellent PEO company due to its reliability. In our expert review, it received a high score because of its strong HR compliance features, quick implementation, and fuss-free opt-out policy. Plus, its software is easy to learn and explore, even for non-technical users.

Justworks Reviews from Users

| Users Like | Users Don’t Like |

|---|---|

| Excellent user interface—attractive and simple | Mobile app features are limited for employers |

| Easy to onboard; little training needed for managers | Pricing can be a bit costly for small businesses |

| Customer service responsive and helpful | Not enough integrations |

Users who left positive Justworks reviews online are satisfied with its system and services. They praised the ease of use of the interface and said that the benefits packages were top-rate, especially for small businesses. Several reviewers also commended its support team for providing good service. Most complaints were about needing more—more customizations, more integrations, and more tools for specific functions.

At the time of publication, Justworks earned the following scores on popular review sites:

- Capterra: 4.6 out of 5 based on more than 700 reviews

- G2: 4.6 out of 5 based on over 550 reviews

Methodology: How We Evaluated Justworks

When we evaluate PEO services, we look for essential HR and payroll tools small businesses need. We also consider pricing, ease of use, customer support, and user feedback. Then, we rated each function on a 5-star scale.

To see our full evaluation criteria for this Justworks review article, click through the tabs in the box below.

20% of Overall Score

We looked for providers with transparent pricing, zero setup fees, and charges on a per-employee basis.

20% of Overall Score

We looked for robust HR administrative support, from hiring to retiring, including assistance with employee career development, compliance tracking, and benefits offerings that are available across the US.

15% of Overall Score

We looked for automatic payroll runs, direct deposits, paper check options, W-2 reporting, and payroll tax processing (federal, state, and local taxes).

15% of Overall Score

In addition to having helpful features like how-to guides, dedicated representatives, and customer support options, we looked at user reviews from third-party sites like G2 and Capterra. Then, we averaged the ratings on a 5-star scale, wherein an average of 4-plus stars is ideal.

15% of Overall Score

While all the products on our list offer great features, this criterion looked at how well they worked for the needs of small businesses, especially those on a budget.

10% of Overall Score

We checked whether PEOs provide additional HR solutions, such as recruiting, applicant tracking, time and attendance, and learning management tools.

5% of Overall Score

The IRS and the Employer Services Assurance Corporation (ESAC) both certify PEOs for adherence to strict standards and ethical practices, so we checked whether these providers are certified. We also considered customized reports, as these are often for compliance issues.

Justworks Frequently Asked Questions (FAQs)

Justworks offers online solutions and services to help you handle HR administrative tasks—from employee onboarding/offboarding and time tracking to payroll and benefits management. It also offers contractor payment services for both local and international workers, including EOR services for hiring and paying global employees.

Yes, it is. Justworks is also ESAC-accredited, which means that it adheres to important financial, ethical, and operational standards.

Yes, it has an online timesheet where you can input employee attendance details. However, if you want Justworks to capture clock in/outs and track overtime, you can get its time tracking module, which is a paid add-on to its Justworks PEO and Justworks Payroll solutions.

Bottom Line

Justworks is an affordable and highly rated PEO for small businesses. Aside from its online solutions that make it easy to onboard employees, it provides HR, benefits, payroll, and compliance support to ensure that you abide by federal and state regulations. Unlike many PEO providers, Justworks has fully transparent pricing with plans that cater to businesses with fewer than 25 employees and those with more than 175 workers.

Sign up for a Justworks plan today and see how its PEO services, cloud-based tools, and global HR solutions can help streamline your HR and payroll processes.