National Processing is a merchant services provider that offers affordable subscription-based fees with low-cost interchange-plus pricing rates. It has very transparent fees for a wide range of payment services. It also offers cash discounting, free hardware and equipment reprogramming, a native POS system, and even works with high-risk merchants.

However, National Processing requires a long-term commitment and imposes both chargeback and early cancellation fees not ideal for small merchants. So, instead, we recommend this provider for large-volume businesses that can benefit most from its subscription-based pricing method and are comfortable signing a long-term contract. It earned a score of 3.38 out of 5 in our evaluation of best merchant services.

National Processing at a Glance

Pros

- Transparent pricing

- Interchange-plus pricing

- 24/7 support

Cons

- Monthly fees

- Long-term contract

- Hefty cancellation fees

When To Use National Processing:

- For large-volume businesses: Offers subscription with 0% markup for businesses with large sales volume

- If you want to save on payment hardware: Provides free payment hardware and free reprogramming of existing hardware

When To Use an Alternative:

- Business on a budget: Consider alternatives offering free merchant accounts

- Low-volume ACH processing: Opt for providers with $0 monthly on ACH such as Helcim

Supported Business Types | Flexible Retail, professional services, ecommerce, non profits |

Standout Features |

|

Monthly Software Fees | Fair

|

Setup & Installation Fees | $0 |

Contract Length | At least 24 months, renewable |

Point-of-Sale (POS) Options |

|

Payment Processing Fees | Very competitive

|

Customer Support |

|

Looking for the lowest rates? The payment processing rates you will pay can vary based on your business’ size, type, and average order value. To find the most affordable option and compare multiple processing rates, read our guide on the cheapest credit card processing.

Best for | Small businesses and individuals | Nonprofits processing over $10,000/month | Business processing up to $21,000/month |

Monthly fee | $0 | $20–$25 | $79 |

Card present | 2.6% + 10 cents | Interchange + 0.15% + 8 cents | Interchange + 18 cents |

Card not present | 3.5% + 15 cents | Interchange + 0.15% + 8 cents | Interchange + 18 cents |

Ecommerce transaction fee | 2.9% + 30 cents | Interchange + 18 cents | Interchange + 18 cents |

National Processing is one of the more well-rounded merchant services providers that supports a wide range of industries, including high-risk merchants. Its subscription-based, interchange plus pricing is similar to Payment Depot and Stax, but with significantly lower monthly fees for low-volume merchants that start at $9.95.

That said, its long-term contract and expensive early cancellation fees make it difficult to recommend National Processing for small merchants. These same factors also prevented National Processing from landing a spot in most of our buyer’s guides, including the cheapest credit card processors and leading high-risk merchant account providers.

However, established businesses not concerned about long-term contracts and cancellation fees will find National Processing a great fit—especially for those looking to save on payment hardware. This provider offers free card readers and terminals and will even reprogram your existing payment devices for free.

If you are looking for free credit card processing, National Processing offers a cash discounting program. There is a $30 monthly service fee but it is free if you process at least $3,000/month. Learn more about free credit card processing.

National Processing Payments Calculator

Enter your current in-store and/or online sales volumes and average order values for an estimate on the monthly fees you would pay using National Processing.

As expected, National Processing struggled because contract length and terms weigh heavily for this criteria. The monthly fees, cancellation fees, chargeback fees, and long-term contract docked significant points from National Processing in this category

Payment Processing

Restaurant | Retail | Ecommerce | Subscription* | Subscription Plus* | |

|---|---|---|---|---|---|

Monthly Software Fees (Low-risk Merchants) | $9.95 per month | $9.95 per month | $9.95 per month | $59 per month | $199 per month |

Transaction Rate (Interchange +) | 0.14% + 7 cents | 0.18% + 10 cents | 0.29% + 15 cents | 0% + 9 cents | 0% + 5 cents |

Reprogram Existing Equipment | ✓ | ✓ | ✓ | ✓ | ✓ |

Gateway Setup | ✓ | ✓ | ✓ | ✓ | ✓ |

Free Mobile Reader | ✓ | ✓ | ✓ | ✓ | ✓ |

Free Terminal and PIN Pad | N/A | N/A | N/A | ✓ | ✓ |

Free Terminal Upgrades Every Two Years | N/A | N/A | N/A | N/A | ✓ |

24/7 Service | ✓ | ✓ | ✓ | ✓ | ✓ |

*Subscription plans are available for businesses processing over $200,000 per month

Additional card processing plans include:

- Nonprofit payment plan: $9.95/month, 0.12% + 6 cents transaction fee, includes free reprogram of existing equipment, gateway setup, mobile reader, and payment terminal

- ACH payment plan: $15/month, 0–1.5% + 48 cents, covers rates for one-time and recurring transactions, as well as fees for the use of virtual terminal and APIs

- Cash discount payment plan: $0/month, 0 transaction cost, with free reprogramming of existing equipment, mobile reader.

Hardware

National Processing has APIs to integrate with multiple POS systems but partners with Verifone, Ingenico, Poynt, and Clover for credit card processing terminals and POS hardware.

|  |  |  |

SwipeSimple B250 | SwipeSimple Terminals (A920, A80) | Dejavoo Terminals (Z9, Z11, Z8) | Verifone VX520 |

Best for mobile and virtual terminal sales | Best for in-store mobility | Best for countertop POS | Best for traditional countertop payments |

|

|

|

|

It sells Clover Go, Clover Flex, Clover Mini, and Clover Station, which are popular with payment processing companies as well as retailers and restaurants. It’s flexible, affordable, and user-friendly. Read our Clover review to learn more.

|  |  |  |

Clover Go | Clover Mini | Clover Flex | Clover Station |

Best for mobile and virtual terminal sales | Best countertop for small storefronts | Best for countertop POS | Best for full-service restaurants |

|

|

|

|

National Processing also sells all-in-one payments, POS software, and hardware bundles.

|  |  |

Startup + Tablet Bundle | Startup Bundle | Enterprise Bundle |

Best for startups requiring full POS setup | Best for those with their own tablet | Best for multilocation businesses |

|

|

|

Once you sign up, National Processing will help you reprogram your existing hardware or sell you Clover hardware. (The hardware is free with a Large Business Account.)

The following is a list of National Processing’s supported hardware:

Tablets: | iPad iOS 11 or higher, Android 8.0 and above |

Credit card terminals: | PAX A77, A80, A920, A920 Pro (Additional one-time fee of $40 per terminal for PIN Debit functionality) |

Thermal printers for receipts: | STAR Printer MC-PRINT3, STAR Printer MC-PRINT3 white, STAR Printer TSP143IIIW, STAR Printer TSP143IIILAN, STAR Printer TSP143IIIL-GRY, STAR Printer TSP143IIIBI BT |

Impact printers for KDS: | STAR Printer SP742ME-Auto Cut |

Cash drawers w/printers: | APG Cash Drawer 13X13 White, APG Cash Drawer 16X16 White, MMF 16X16 Cash Drawer White, STAR Cash Drawer 13X13 Black |

Bluetooth cash drawers w/printers: | STAR MPOP PRINTER-CASHDRWR WHT, STAR MPOP PRNT/CASH DRAWER BLK |

Barcode scanners: | SOCKET Barcode Scanner S700, STAR MPOP Handheld Barcode Scanner (Star mPOP Cash drawer required) |

Scales: | STAR SCALE mG-S8200 |

Contract & Terms of Service (TOS)

All National Processing accounts are tailored for specific business needs. The term length is 24 months (automatically renewed for another 24), but factors such as seasonality, payment types (in-person payments only or online-only service), and risk level (medium, low, brand-new business in a brand-new field) can determine the type of contract.

One point of contention among reviews for National Processing is its $595 early termination fee. To avoid this, you need to notify National Processing 90 days before the existing term ends. While National Processing is open about the cost, this is quite high compared to alternative providers like Dharma Merchant Services, which charges $49 for permanently closing your account. However, certain conditions can waive this fee:

- If you go out of business, or

- If you get better rates from a competitor, and National Processing is unable to offer you a better deal

We don’t normally recommend merchant accounts with hefty cancellation fees as many businesses are taken by surprise when they do decide to switch providers. However, National Processing is upfront about it, which makes some difference.

Fees listed within the TOS that were not mentioned elsewhere on their website are as follows:

- Payment Card Industry (PCI) non-compliance fee: $90/month

- Early termination fee: $595

- Chargeback fee: Up to $45

Note that there are also additional transaction fees of 2.35% and 10 cents of the total sales amount for card transactions that do not meet the best qualified interchange rate qualification criteria (often used for high-risk and some types of government transactions).

Setup & Application

The best way to apply for a National Processing merchant account is to give them a call (which you can do directly from their website) and talk to an account specialist. If you prefer a self-paced process, you can opt to fill out an online application. Whichever method you choose, National Processing’s website is easy to navigate and will only take you a few minutes to complete.

Make sure to ask for everything you need to know from National Processing’s account specialists. Consult any questions around the documents you plan to submit to get the best chances of being approved for a merchant account.

Standard approval time is anywhere from a couple of days to a couple of weeks, depending on the underwriting process required for your business type. But once you are approved, National Processing’s onboarding and customer support team will contact you to set up hardware, software, and payment processing tests.

Applying for a merchant account can be a challenging process—especially for first time business owners. Download our Merchant Account Application Guide and help take the guesswork out of applying for a merchant account.

National Processing did well in this criteria. It is one of the few merchant service providers that offer cash discounting and high-risk payment processing. However, it lost points for charging separate monthly fees for different payment types, such as ecommerce and ACH, which often come free with other payment processors.

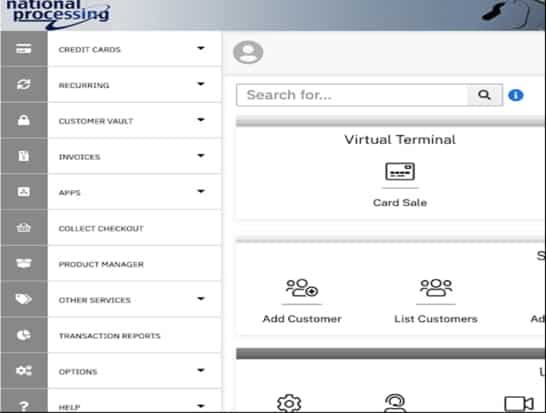

Payment Gateway

The payment gateway is the backbone of National Processing’s ecommerce feature. This includes both a virtual terminal and virtual POS tools for users wanting to subscribe to National Processing’s ecommerce plan. It allows merchants to securely accept manually keyed-in payments and create custom links to connect to online shopping carts. There’s also a customer vault (for securely storing customer contact information and payment details) and product manager tools (for creating and managing products and services). Easy-to-follow APIs are also available for developers wanting to create a more customized solution.

Overall, National Processing’s payment gateway tools are on par with top merchant providers in the industry. It supports shopping cart integrations which some alternatives, like Dharma Merchant Services, do not provide. Additionally, there’s no extra transaction cost for using this feature, and it charges a lower monthly maintenance fee compared to Authorize.net ($25/month).

National Processing’s payment gateway supports virtual terminals and virtual POS tools for ecommerce businesses. (Source: National Processing)

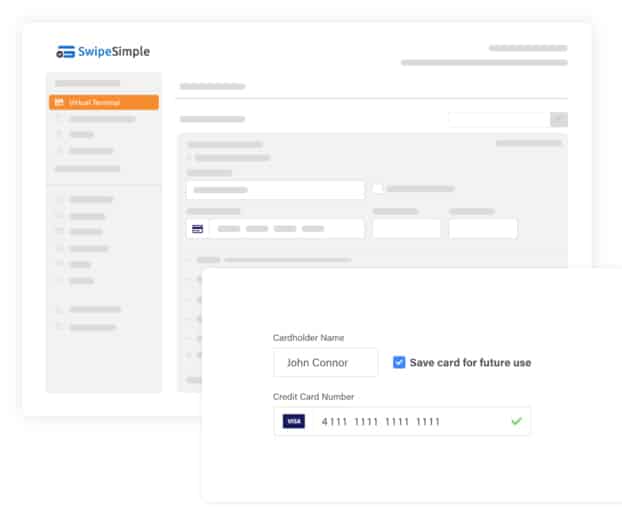

Virtual Terminal

National Processing’s payment gateway includes a virtual terminal that allows you to accept card-present and card-not-present payments, debit cards, gift cards, invoice payments, and NFC payments, among others. National Processing also works with SwipeSimple’s mobile card reader, which will then give you access to its own virtual terminal.

Only a handful of merchant account providers support processing online transactions for high-risk merchants, and National Processing is one. Naturally, you can expect higher fees and maybe even additional costs for access to its secure payment gateway (PaymentCloud charges an extra $15/month gateway fee). However, apart from providing assistance to its users to achieve PCI compliance, there’s not much information on payment security and fraud prevention tools on its website, so make sure to specifically ask about this before signing up.

National Processing’s ecommerce plan includes a free SwipeSimple mobile card reader, which also gives you access to its built-in virtual terminal. (Source: National Processing)

Mobile App

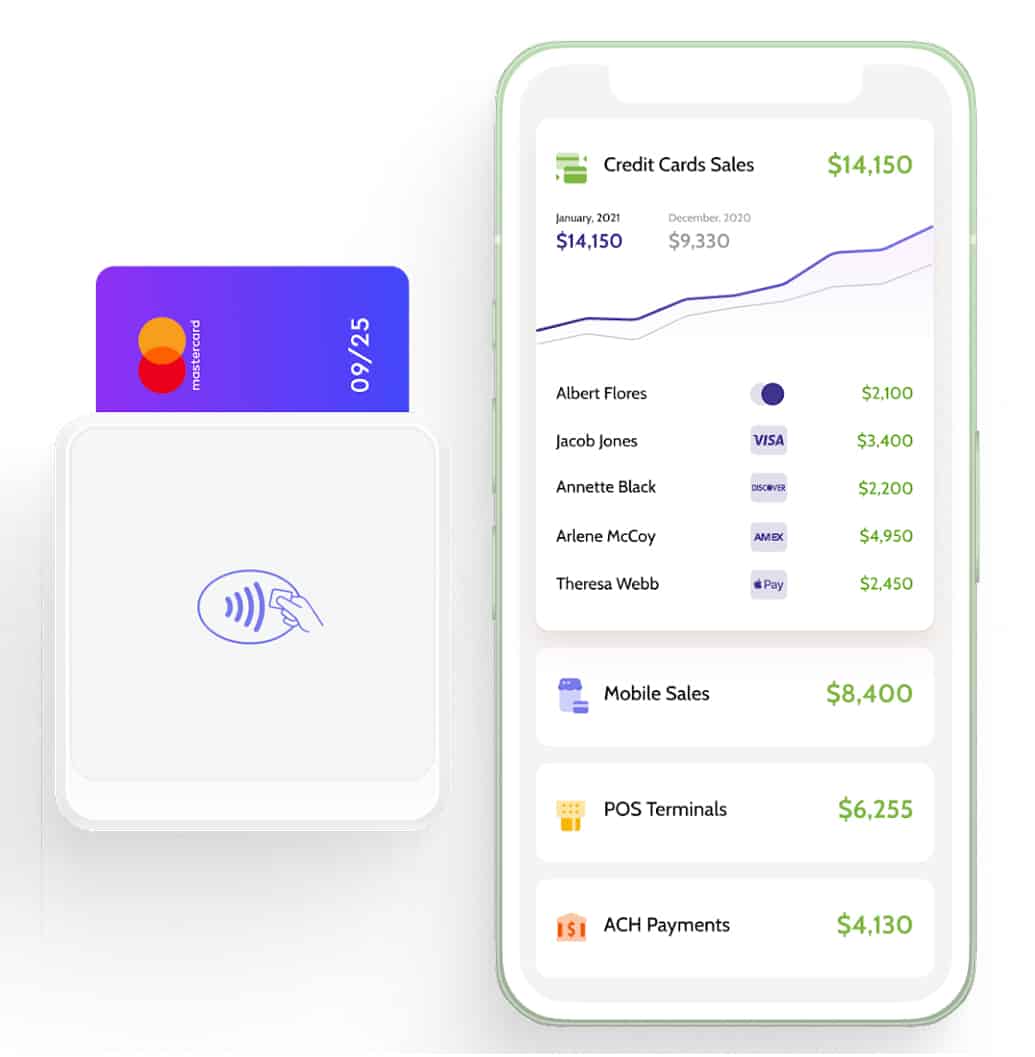

National Processing works with SwipeSimple to provide its users with a mobile app that lets you track sales, accept credit and debit card payments, manage staff time and attendance, and access reports while on the go. It syncs directly with your POS software, so you always get real-time data from your sales channels.

SwipeSimple’s mobile app works with some of the top mobile credit card payment processors, and comes with a free mobile card reader for every ecommerce merchant account plan. It has an offline payment processing feature and doesn’t charge extra fees for using its service. However, this might mean that you will have to contact SwipeSimple directly to get technical support, which is limited to business hours.

Each ecommerce merchant account plan includes a free SwipeSimple mobile card reader and access to its mobile app. (Source: National Processing)

High-Risk Payment Processing

National Processing also works with high-risk merchants and offers an all-in-one solution from online and offline sales to point-of-sale (POS) systems. Like other high-risk merchant account providers, it works with multiple financial institutions that have greater risk tolerance compared to traditional banks.

Flexible features also play a role. For its part, National Processing provides risk-mitigating tools such as chargeback management integration and fraud detection features, giving high-risk businesses a better chance of being approved for a merchant account.

Free hardware, free hardware reprogramming, and 24-hour customer support helped National Processing score well for this criteria. However, most of its business management tools are paid integrations, and free tools are limited. It also does not have an option for same-day funding.

POS Systems

National Processing offers its own POS software called NP POS. It comes with the ability to run point-based loyalty and rewards programs, and accept gift, loyalty, and store cards. The software also has built-in inventory and employee management features, along with reporting and multilocation management tools. NP POS also comes with a reservations system for restaurants and professional businesses.

Not all merchant account providers come with a proprietary POS system that’s comparable with big names in the POS industry like Square. National Processing offers advanced employee and loyalty management at no additional cost, while these are add-on features that will cost you more with Square. However, like Clover, pricing for this is customized and bundled with hardware, which usually means it’s likely more expensive. Although, unlike Clover, NP POS hardware can be reprogrammed. Incidentally, National Processing also integrates with Clover.

Integrations

National Processing integrates with a number of third-party solutions to provide enhanced tools for different businesses. While it has its own payment gateway, National Processing also integrates with Authorize.net and SwipeSimple’s virtual terminal. BigCommerce, WooCommerce, and Shopify also work with National Processing for website building, while you can integrate Ecwid and Opencart for creating shopping carts. QuickBooks is also available for bookkeeping, and Zendesk integrates with National Processing for customer management software.

Please note that third-party integrations may carry additional fees for account maintenance that can add to your total monthly cost.

Free Hardware & Software Setup

All merchant account plans include a free POS reprogramming and gateway setup. National Processing makes it easy to switch by helping you reprogram your existing POS hardware or set up your online payment gateways. Alternatively, it can sell you Clover POS hardware, which is among the best-rated in the industry.

Customer Support

There are no online guides that would help you understand further how each solution works, although the blog is full of helpful articles about the industry and best practices. And while National Processing is upfront with its transaction fees, you’ll need to speak to an account executive to learn about additional costs such as PCI non-compliance fees, retrieval fees, and costs for failed transactions.

Fortunately, customer support is live and 24/7, and real-world users say the agents are responsive and helpful. I reached out to National Processing through live chat and didn’t have to wait long to talk to a representative who was more than willing to take my call then and there to answer any questions. However, if you’re looking for assistance with your SwipeSimple hardware, you might have to speak to a SwipeSimple representative instead.

National Processing offers a lot of what we look for in a merchant services provider—transparent, interchange-plus pricing, free hardware, an easy-to-use system, a wide range of payment methods, and compatibility with high-risk merchants, among others. It’s compatible with popular hardware like Clover and even has its own POS system.

While these are all great features, National Processing’s conditions and terms of use make it a more ideal merchant account provider for larger businesses. Monthly fees, long-term contracts, and hefty fines for early termination and chargeback prevent it from being a sustainable option for startups, solopreneurs, and nonprofits.

This is not to say that National Processing does not have small merchant clients. In fact, National Processing has been promoting guaranteed price matching (or receive a $500 Amex gift card) on its website for years, so it’s likely that speaking with one of its accounts specialists can help get you a good deal. However, while this provider works with all types of business sizes, it’s important to note that their low rates are only guaranteed for merchants that process at least $10,000 in sales per month.

What Users Say in National Processing Reviews

When researching National Processing, it’s important not to confuse the company with other similarly named processors, including 1st National Payment Solutions and National Payment Processing, as these are different from National Processing and have many more negative user reviews.

That said, there is not a lot of feedback on National Processing from regular user review websites like G2. But we did find recent feedback from clients on other sites. Overall, users praise National Processing for its transparent pricing and responsive customer support.

- Consumer Affairs: 4.6 out of 5 based on around 390 reviews.

- Better Business Bureau: 2.44 out of 5 based on around 10 reviews

| Users Like | Users Don’t Like |

|---|---|

| Transparent pricing | Lengthy application process |

| Quick, responsive customer support | Closed accounts/ frozen funds |

| Easy setup | Miscommunication over transaction rates |

Methodology—How We Evaluated National Processing

We test each merchant account service provider ourselves to ensure an extensive review of the products. We compare pricing methods, identifying providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. We then further evaluate according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use―including account stability―popularity, and reputation among business owners and sites, such as the Better Business Bureau (BBB). Finally, we considered how well each system works with other popular small business software, such as accounting, POS, and ecommerce solutions.

National Processing Review Frequently Asked Questions (FAQs)

Is National Processing legitimate?

Yes, National Processing is based out of Utah and has been around for over 15 years, since September 2007, and incorporated a month later.

Is National Processing good for small businesses?

Unfortunately, National Processing’s terms of service make it difficult to recommend to small businesses, startups, and solopreneurs. It requires a long-term contract with a hefty early termination fee and separate monthly fees for ecommerce and ACH payment processing.

Consider alternatives that offer free merchant accounts and fast, easy setup so you can start accepting payments in minutes.

Is National Processing expensive?

In terms of transaction fees, National Processing actually has some of the cheapest rates—offering interchange-plus pricing to small merchants. However, note that this provider charges a monthly fee, and pricing is only guaranteed if you process at least $10,000 a month.

Check out our recommendations of the cheapest card processing companies for alternatives.

Bottom Line

National Processing is a merchant services provider that offers interchange-plus rates and transparent pricing. Its cancellation policy is fair, and the provider has excellent user reviews. We recommend it for retailers or restaurants looking for inexpensive merchant services. It says that if it can’t beat your current rates, it will give you $500. Contact National Processing for a quote today.