Payroll forms are important because they help employers comply with federal, state, and local tax laws. By accurately completing and submitting these forms, businesses can avoid penalties and legal issues arising from non-compliance. Additionally, payroll forms for employers help businesses maintain accurate records of their employees’ earnings, deductions, and tax withholdings.

Here’s a quick glance at the payroll forms you need and their respective due dates.

For an in-depth look at each of the main payroll forms you may need to operate your business, scroll through the section below or use the jump link buttons included in this list:

- W-4 Form: Jump to Section ↓

- W-2 Form: Jump to Section ↓

- W-3 Form: Jump to Section ↓

- Form 940: Jump to Section ↓

- Form 941: Jump to Section ↓

- Form 944: Jump to Section ↓

- Form 8027: Jump to Section ↓

- Schedule H: Jump to Section ↓

- WH-347: Jump to Section ↓

- Form 1042: Jump to Section ↓

- Form 943: Jump to Section ↓

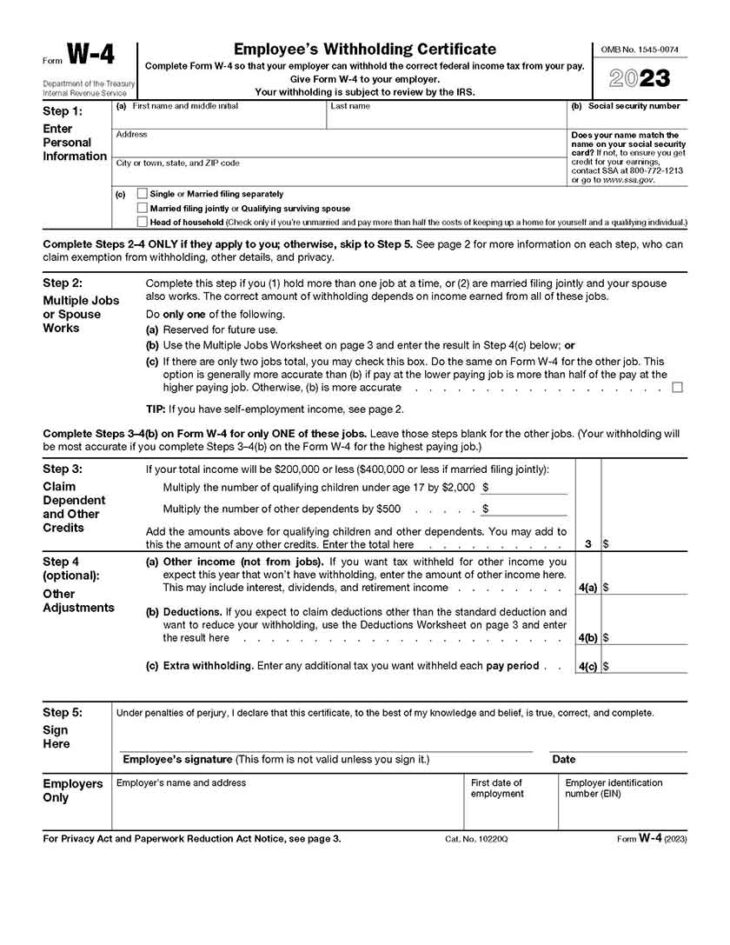

W-4 Form: Withholding Allowance Certificate

All employers need updated copies of Form W-4 to distribute to new hires, and employees should prioritize completing the form before or on their first day of work. You’ll need the information to determine how much to withhold for taxes from employee paychecks each pay period. The document provides space for employees to enter their personal information: name, address, marital status, and several dependents. Maintaining records of each completed W-4 Form simplifies W-2 Form preparation.

Did You Know? There is a difference between a federal W-4 and a state W-4. All US employees must fill out a federal Form W-4, but not all employees will need to fill out a state W-4. The state tax withholdings and form requirements depend on the state in which you live. You might want to read our in-depth article about what a W-4 form is for more information.

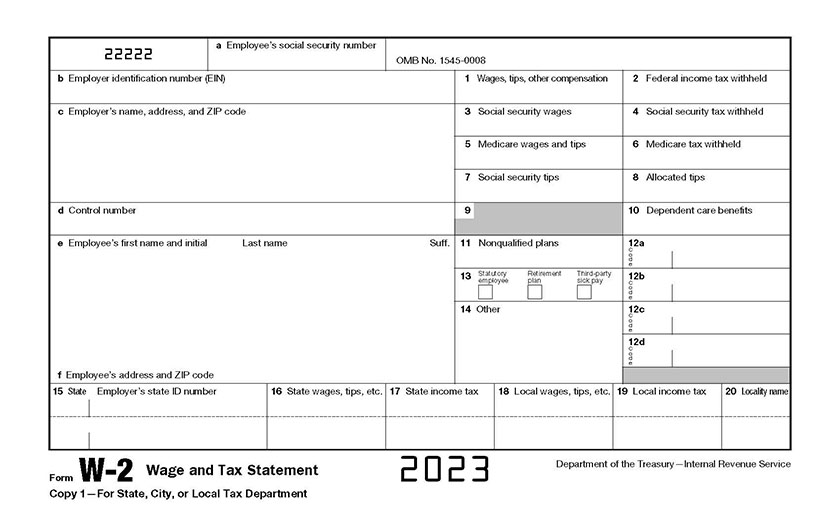

W-2 Form: Wage and Tax Statement

The W-2 is one of the essential payroll forms for employers. You’ll use it to report the total wages paid to employees throughout the calendar year. Also, you’ll include the total payroll taxes withheld (Social Security, Medicare, and income taxes) and other benefits.

You’ll give each employee a copy of their own form no later than Jan. 31 after the year for which you’re reporting. You’ll also be responsible for sending copies of the forms to the Social Security Administration (SSA) and your state, city, or local tax department.

Be sure to check that you have six versions of each W-2 Form you distribute. There should be one payroll form for the following:

- For your records

- For the employee’s records

- For the employee to submit with their federal tax return

- For the employee to file with their city, state, and/or local tax return

- For you to submit to the SSA

- For you to submit to the city, local, and/or state tax department

Employers are responsible for filling out the W-2, and employees should fill out the W-4. To find out more about their differences and when to use them, read our W-2 vs W-4 article. For directions on filling out this form, check out our step-by-step guide on how to fill out W-2 Form.

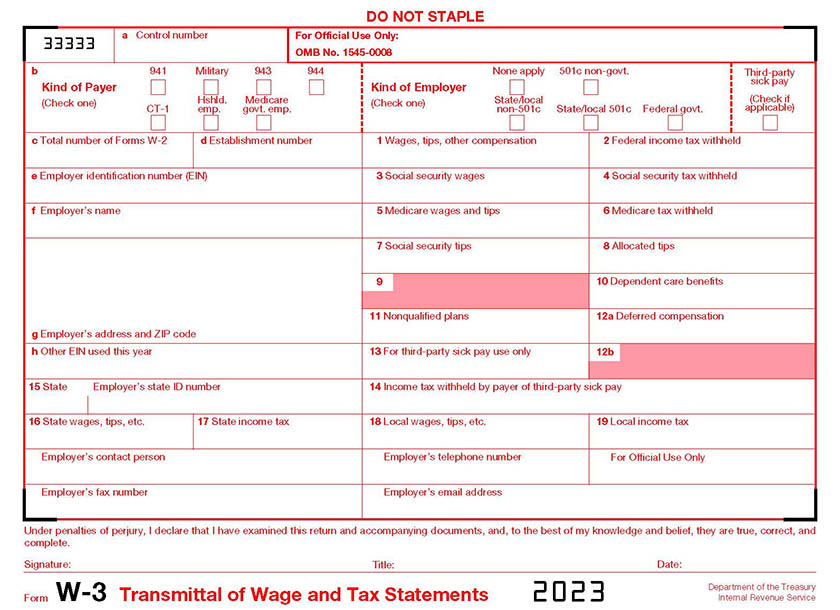

W-3 Form: Transmittal of Wage & Tax Statements

The W-3 Form is a summary of all W-2 Forms you are distributing for the year on one document; you’ll submit it to the IRS with copies of each W-2 Form. You’ll report the total salary and wage payments you made to all employees in addition to the total taxes and other benefit information.

To check all of the numbers you report on the W-3, compare the totals to the information reflected on the other payroll forms. For example, add all individual salary and wage totals reported on the W-2 Forms, and the sum should equal the total wage amount reflected on your W-3 Form.

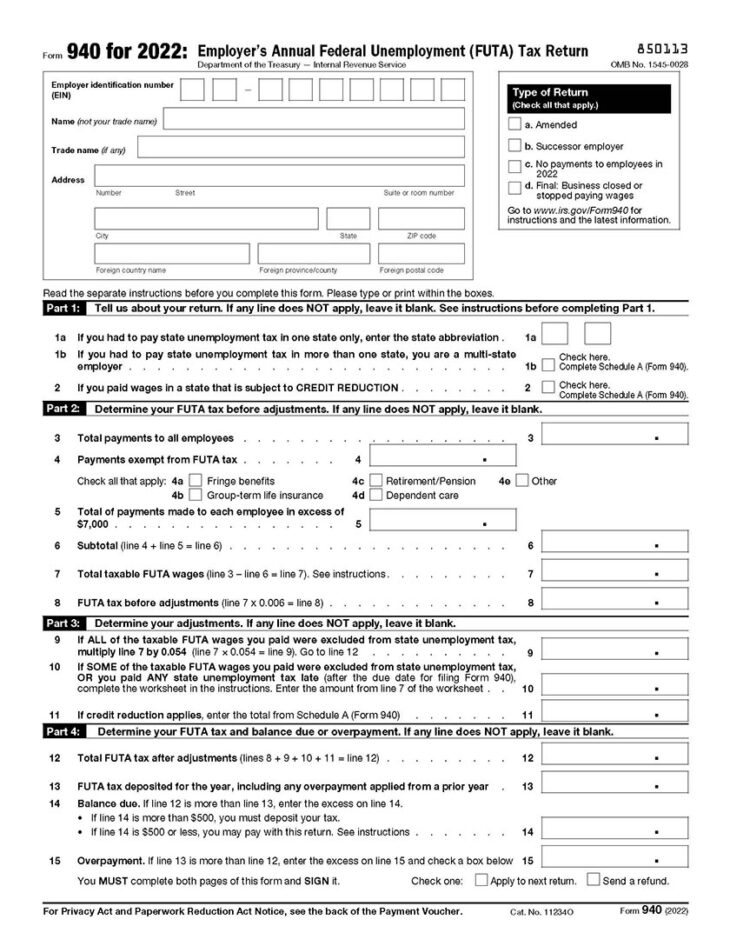

Form 940: Federal Unemployment Tax Reporting

Form 940 is one of the payroll tax forms that the IRS requires you to file on a yearly basis. This is used to report your annual Federal Unemployment Tax Act (FUTA). The form takes into account any payments made during the year to determine the total amount of FUTA taxes owed.

You need to report and pay the tax quarterly if you owe more than $500 for the year. The due date for filing this form is Jan. 31 of the following year. However, if you pay your FUTA taxes each quarter and are up-to-date by year-end, then you have until Feb. 10 of the following year (at the latest) to file.

Generally, you’re subject to the tax if your business:

- Paid or will pay over $1,500 to its employees in a calendar quarter

- Employed one or more employees for at least 20 weeks of the year

Be mindful that you will likely also owe a state unemployment tax and subsequently need to report the total due on a specific payroll form for your state. Check your state tax agency’s website to be sure.

To learn more about how FUTA tax is calculated, when it is due, when to file it, and more, read this in-depth article on FUTA taxes and Form 940.

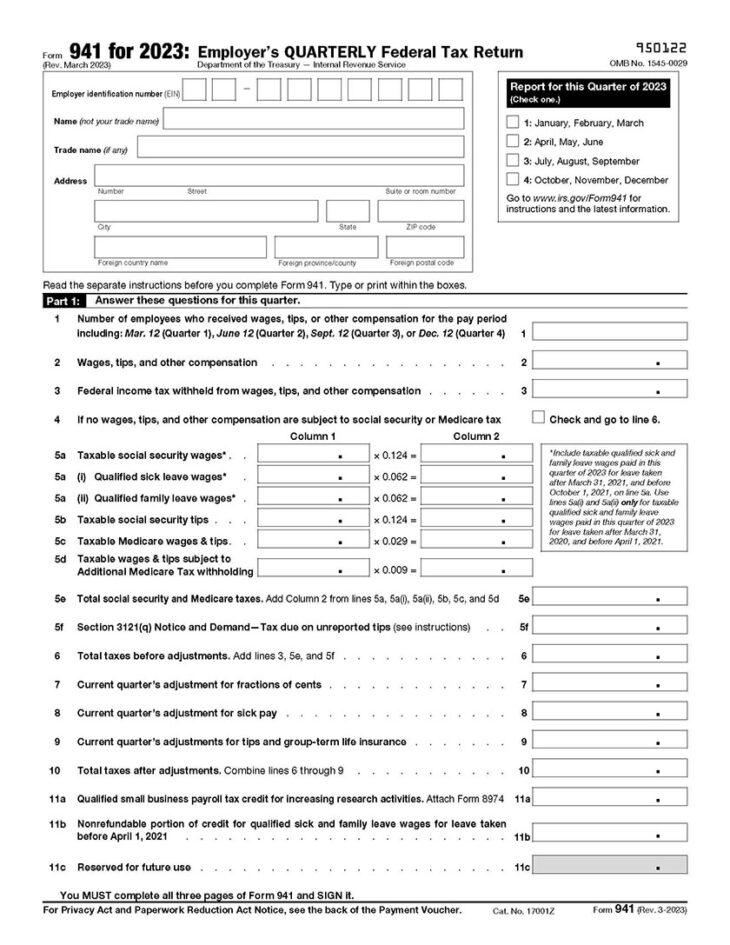

Form 941: Quarterly Federal Tax Return

Submit this form with your quarterly federal income tax payments. If you withhold income tax, Social Security, and Medicare (FICA) payments from your employees’ paychecks, you should submit Form 941 (or Form 944 if the payments are small). You’ll report the total amounts withheld. It will also help you verify and pay the amount of FICA taxes for which your business is responsible (the total matches what you should withhold from employee checks, ultimately around 15.3% of wages paid).

The deadlines are at the end of the following months: January (for October through December), April (for January through March), July (for April through June), and October (for July through September).

For more detailed information, including step-by-step instructions, check out our guide to filling out Form 941.

If you need to correct an error on Form 941, you must file Form 941-X within three years after the due date of the return for the quarter in which the error was made. You can file Form 941-X electronically or by mail.

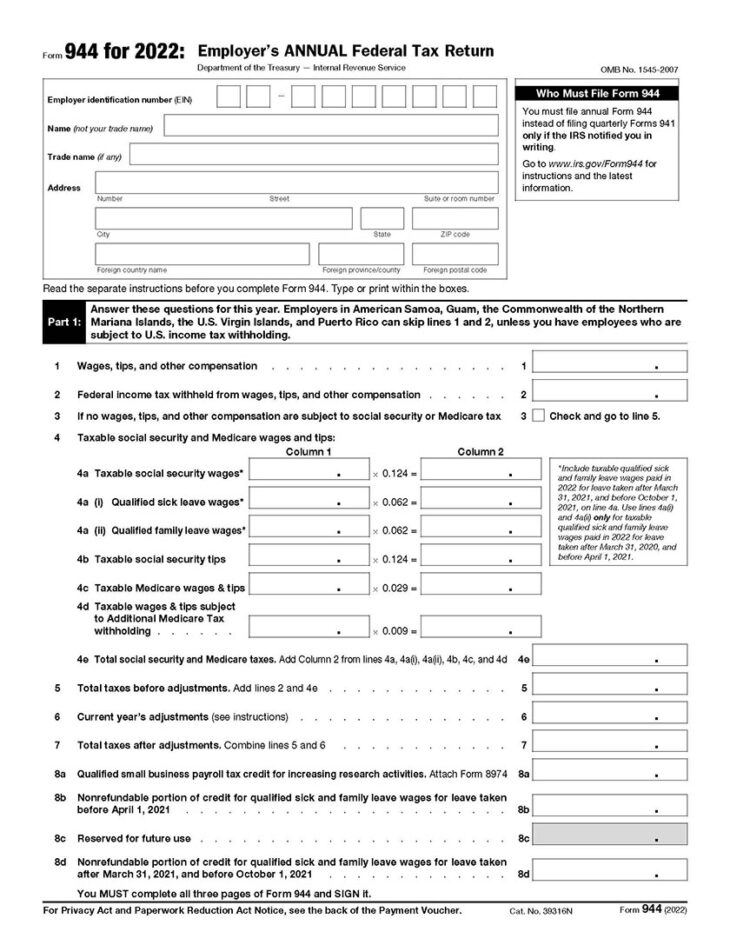

Form 944: Employer’s Annual Federal Tax Return

This is one of the IRS’ payroll forms for employers with very small businesses. Only those with an annual tax liability of less than $1,000 can use it. It’s a report of the total income and FICA taxes withheld (employees’ and employer’s share) throughout the year. It also enables eligible employers to make one payment annually (versus four quarterly payments).

Tax Form 944 fulfills the same purpose as Form 941 but is used less frequently. You submit this with your annual federal income tax payment. The due date is Jan. 31 of the following year, and the tax return must be filed by Feb.10.

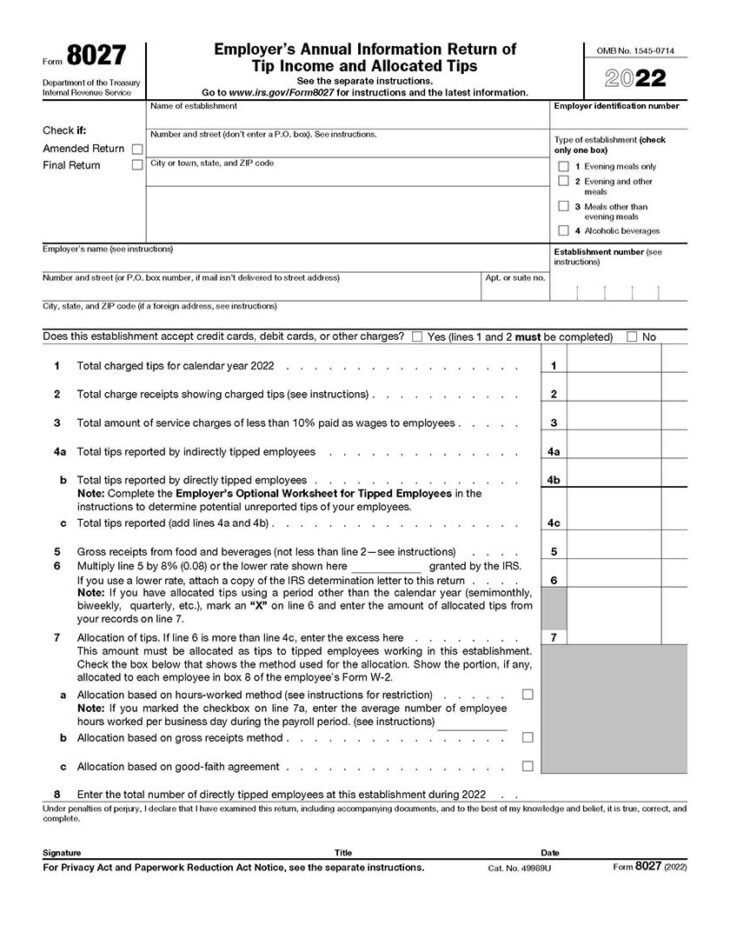

Form 8027: Annual Information Return of Tip Income

Form 8027 shows how reasonable your employees’ reported tip amounts are; you may be responsible for distributing more money if the total doesn’t meet IRS guidelines. Not all employers will use Form 8027—only large companies with workers who routinely receive tips (restaurants, bars, and companies in the hospitality industry). Read the instructions on how to fill out Form 8027.

For purposes of this form, the IRS defines “large companies” as companies that have more than 10 employees working on a typical business day. The main purpose of this form is to report the total tip income received within the establishment and to calculate allocated tip amounts (a component of some restaurant payroll processes) that employers are responsible for paying tipped employees.

Allocated tips are additional amounts some employers are required to pay out if their total reported tips appear to be too low according to the size of the business. Form 8027 helps to calculate any additional amounts due. The deadline to file a paper copy of the form is Feb. 28 and March 31 if you file electronically.

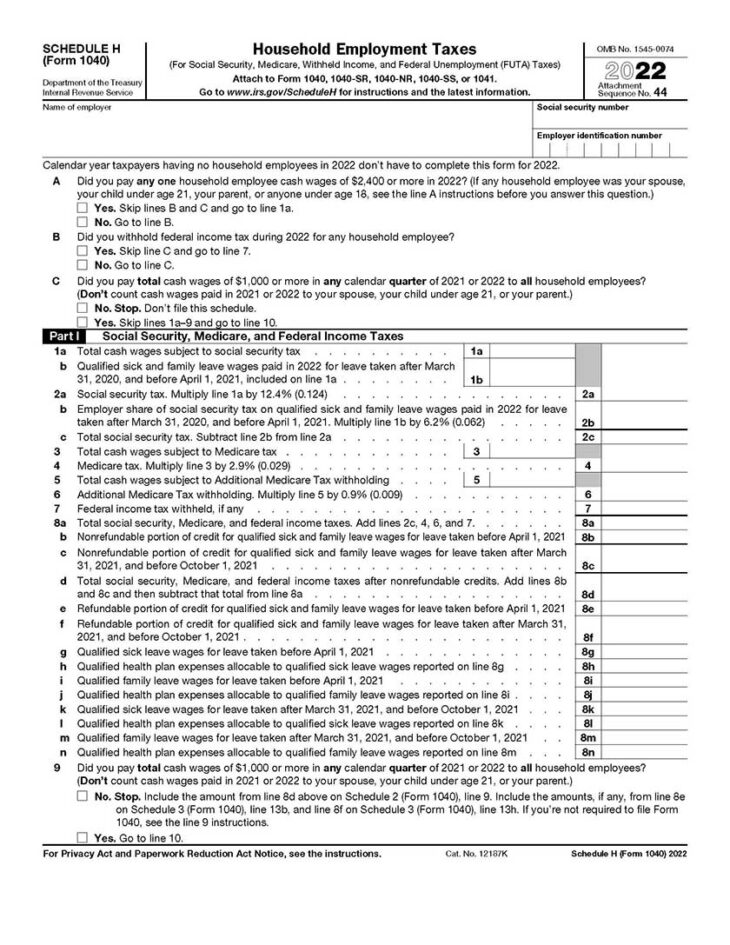

Schedule H (Form 1040)

Schedule H (Form 1040) helps ensure your household employees pay the appropriate amount of payroll taxes. You use Schedule H if you are paying cash wages to household employees such as nannies, caregivers, or babysitters. You’ll need to report the total wages paid along with taxes due (such as FICA and FUTA). The form has clear directions to help you calculate the amounts owed, so you don’t have to research it on your own.

Do you have to pay the nanny tax? Learn more about how and when to file it, and what else to include when filing them in this comprehensive guide on nanny taxes.

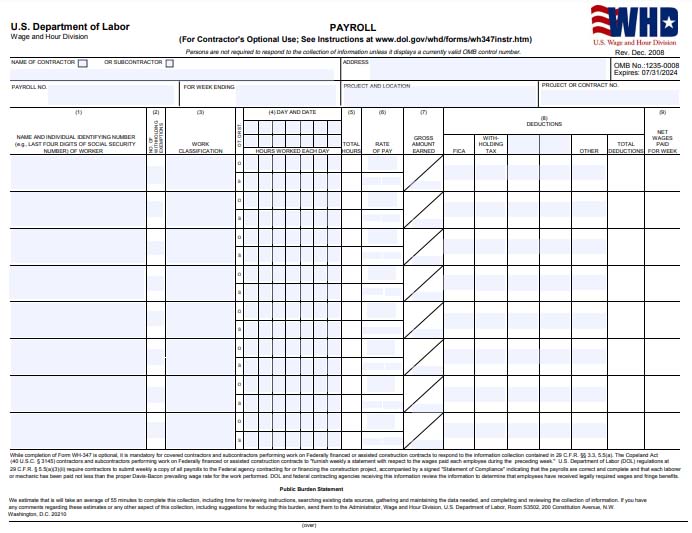

Form WH-347: Certified Payroll

This is a federal form contractors can use to meet their certified payroll reporting requirements; however, some states are stricter and have their own forms. Be sure to check yours.

The Certified Payroll Form is a document for employers who work on federal projects. To ensure the agency funding the project continues to pay, you have to fill it out with details about every worker involved in the project, like name, hours worked, project name, wages earned, benefits paid, and so on. It’s important to submit an updated copy to the agency weekly.

For more information on how to fill out Form WH-347 and how to make the calculations, read our Certified Payroll Form guide.

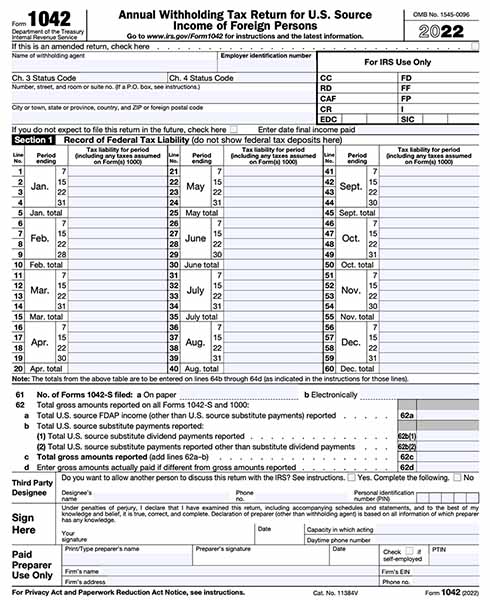

Form 1042: Annual Withholding Tax Return for US Source Income of Foreign Persons

Form 1042 is only for companies that work with a foreign entity on business that involves US transactions or those who have foreign workers earning US-sourced income. This form reports the taxes that you withheld from the income that foreign workers, entities, partnerships, estates, trusts, and companies received.

The due date for submitting Form 1042 to the IRS is March 15 of the following year. However, if you need more time to complete the form, you can file an Application for Extension of Time to File Certain Excise, Income, Information, and Other Returns—also known as Form 7004. To learn more about Form 1042 and how to fill it out, read our Form 1042 guide.

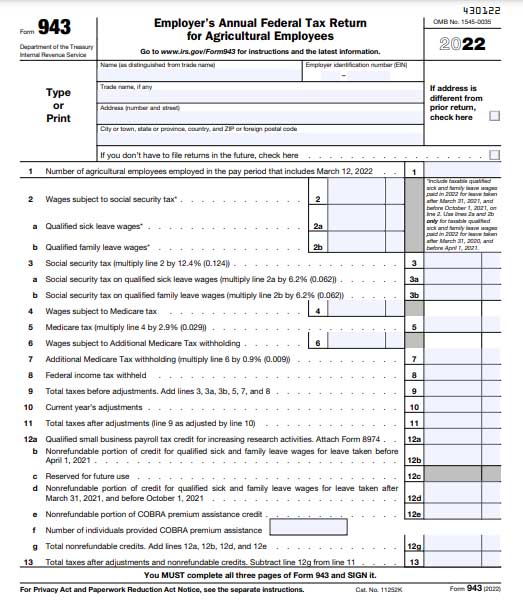

Form 943: Annual Federal Tax Return for Agricultural Employees

This is used to report the amount of taxes (such as federal income and FICA taxes) withheld from an agricultural worker’s pay. While Form 943 is only used by businesses engaged in farming or ranching, you should meet either of these two conditions to determine whether you need to file this payroll form:

- You pay a farm worker cash wages of $150 or more in a calendar year

- The total cash and noncash wages you pay to all farm workers in a calendar year is $2,500 or more

Even if you don’t meet the $2,500 requirement, the $150 rule will still apply. In case none of your farm workers meet the $150 rule, then the $2,500 condition will be followed.

Similar to Form 940, the deadline for filing Form 943 is Jan. 31 of the following year. However, if you pay your taxes each quarter and are up-to-date by year-end, then you may submit the form (at the very latest) by Feb. 10 of the following year.

Need help completing this form? Check out our guide to Form 943, which contains step-by-step instructions on how to fill it out.

Other Forms for Payroll

Employer and employee payroll forms are the most pressing payroll documents for many companies. However, there are others (some specifically payroll and some not) of which employers should be aware.

For instance, HR and payroll go hand in hand, meaning you can’t or shouldn’t process payroll without filing some key HR forms. Also, completing the proper payroll forms for contractors can save your company time and money.

1. Employer Contractor Forms

There’s a significant difference between employees and contractors in the sense that contractors have much more autonomy because employers cannot legally control how they perform their work. There’s also a difference in how you should report the money you pay them. W-2, W-3, and W-4 Forms are not applicable to contractors—the Form W-9 and Form 1099 are more appropriate.

Here’s a list of forms you need when paying contractors:

- Form W-9: The W-9 is the W-4 for contractors. You should distribute a copy to each contractor you hire before they begin working. It will collect information like the employee’s name and Social Security number). You’ll use it to report to the IRS how much you paid out during the year (on Form 1099). Here’s our comprehensive W-9 vs 1099 guide if you want to learn more about their differences and how to fill them out.

- Form 1099-NEC: Similar to a W-2 (except it’s only for contractors that were paid at least $600 and don’t list any taxes paid), this form should report the total income paid to contractors. You should submit one to each contractor and send a copy to the IRS.

- Form 1099-MISC: Use this form to report miscellaneous income, such as tips, rents, awards and prizes, payment to an attorney, and medical or healthcare payments.

- Form 1096: It is a summary of all 1099 forms you distribute. It should reflect the grand total paid to all contractors and tie directly to each 1099 you’re distributing.

2. Health Coverage Forms

These forms are used to report information about health insurance coverage offered by employers and insurance providers to the IRS. The information is used by the IRS to determine whether individuals and families are eligible for the premium tax credit, which helps people afford health insurance, and enforce the Affordable Care Act (ACA).

Here are the forms you should use to report about your employees’ health coverage:

- Form 1095-B: It is used to report information about health insurance coverage offered by insurance providers to individuals and families. It includes the name of the insurance provider, the type of health insurance coverage, and the cost of the coverage, among other things. This form will be completed by the health insurance carrier.

- Form 1094-B: This is the transmittal form used to send Form 1095-B to the IRS. It indicates the name and address of the insurance provider, the number of Forms 1095-B that are being submitted, and the total cost of the health insurance coverage. This form will be completed by the health insurance carrier.

- Form 1095-C: It reports information about health insurance coverage offered by employers to employees. It includes information like the name of the employer, the type of health insurance coverage, and the cost of the coverage. This form will be completed by the employer.

- Form 1094-C: This is the transmittal form used to send Form 1095-C to the IRS. It includes information such as the name and address of the employer, the number of Forms 1095-C that are being submitted, and the total cost of the health insurance coverage. This form will be completed by the employer.

Did You Know? A company is only required to file IRS Form 1095-B if it meets two conditions—it offers health coverage to its employees, and it is self-insured. Self-insurance is when companies pay their employees’ medical bills directly, rather than through an insurance carrier. Businesses that don’t meet both conditions do not need to file Form 1095-B. However, their employees may still receive a Form 1095-B from their insurer, not their employer.

3. Non-tax Payroll Forms

There are numerous non-tax-related payroll forms you can use to help manage your internal processes better. Since these are not regulated, you can create them on your own or download a free online payroll template.

Here are three of the most common non-tax payroll forms you should consider using:

- Direct deposit authorization: Issued to employees wanting to receive their paychecks electronically vs by paper check. The form is needed if you’re setting up employee direct deposits. It shows you have permission to pay them via direct deposit and usually includes space for a routing and account number.

- Time sheet: A document employees can use to record the hours they work each period; you can use it to verify work time before issuing paychecks.

- Pay stub: A document you can issue with each paycheck that shows a breakdown of total earnings and deductions. Some states require you to issue them (and dictate what information to include), and others don’t.

In addition to payroll forms, many employers require HR forms for new employees, including Form I-9 (used to verify work eligibility), Employer Identification Number (EIN) Form (used to request a state-issued number for reporting and paying taxes), and so on. These aren’t payroll forms per se (although often confused as such) but are required before processing any paychecks.

Why Payroll Forms Are Important

Payroll forms help employers record, summarize, and report paycheck and payroll tax information. It’s best to integrate them into your company processes so they’re completed at the right time. You can face penalties for not submitting the proper documents to the appropriate agencies by their deadlines.

Most employer payroll tax reports are filed quarterly, while others are submitted annually. For your in-house forms, you can set your deadlines according to how you need to use the information (e.g., you can have employees submit timesheets weekly or biweekly, depending on your pay cycle).

Many forms are tax-related, subject to IRS regulations, and only reflect employee information (not contractors’); other forms are more flexible, and you can produce them in-house (direct deposit, time sheets, and so on). Forms like 1099s help organize payments made to contractors, although they’re usually considered vendor payments rather than payroll.

How to Avoid Payroll Mistakes

Payroll mistakes can be costly for businesses, both in terms of financial penalties and damage to employee morale. The penalties can vary depending on the severity of the mistake and whether it was intentional or not.

One of the first steps to learning how to do payroll successfully is to gather (and in some cases, create) the payroll forms that apply to your business. Below are more tips on how to avoid these mistakes:

- Use payroll software. A payroll software can help you automate many of the tasks involved in payroll processing, such as calculating wages, withholding taxes, and issuing paychecks. This can help reduce the risk of human error.

- Create a detailed payroll process manual. This manual should document all of the steps involved in payroll processing, from entering employee timesheets to issuing paychecks. This will help ensure that everyone involved in payroll processing is following the same procedures.

- Train your employees on payroll procedures. All employees who are involved in payroll processing should be trained on the correct procedures. This includes managers, payroll clerks, and anyone else who may be responsible for entering time sheets, handling payroll taxes, or issuing paychecks.

- Review payroll reports regularly. Payroll reports can help you identify any potential errors in payroll processing. These reports should be reviewed regularly by a supervisor or manager.

- Have a system for correcting errors. If an error is found in payroll processing, it should be corrected as soon as possible. This will help minimize the impact of the error on employees and the business.

Consider using payroll software to streamline the process. Not sure what kind of software to use? Read our payroll software guide for our top recommendations.

Bottom Line

Payroll forms are a necessity for your business. As a small business owner, it is best to start downloading the IRS forms applicable to your business. There are other less-urgent forms you can customize for internal use, but you can integrate those into your processes later.