Probate leads are valuable to investors because they expand your portfolio and are typically priced at a reduced rate, allowing investors and real estate flippers to make larger margins. There are numerous ways to get probate leads—from public records and auctions to paid sources. To succeed in this process, you must know how to find probate real estate leads, how they are beneficial, and how to buy them.

What Is a Probate Lead?

Before finding and buying probate leads, it’s important to understand what they are. Probate leads refer to real estate properties that become available for sale as part of the legal process following an individual’s passing. When a person dies, their assets, including real estate, go through a legal procedure to settle debts and distribute assets to beneficiaries.

In many cases, these properties may not have designated heirs, or the heirs might choose not to retain or maintain them. Consequently, the courts or executors often aim to sell these properties quickly and at prices well below market value. It’s important to note that probate properties are typically sold “as-is,” with potential defects undisclosed by the executors. This means buyers interested in probate properties must be prepared to assume the associated risks and navigate the complex probate procedures.

6 Ways to Find Probate Real Estate Leads

Now that you understand what a probate lead is, you must be able to find probate leads to purchase. It can be challenging to find probate real estate leads if you don’t know where to look. The challenges associated with probate properties make the probate market unsaturated, with an ever-growing inventory untapped by new real estate investors. If you’re up for the challenge and willing to deal with the probate process, then you can obtain many opportunities to find probate property listing leads.

Here are a few ways on how to find probate properties:

1. Probate Properties Through Public Records

While it requires more time and effort, one effective way to find probate leads is to get the probate list from the courthouse. All probate cases are filed with the county courthouse, which makes these records publicly available. If your local area does not have an online resource for the probate properties list, you may need to visit the courthouse to access the physical files.

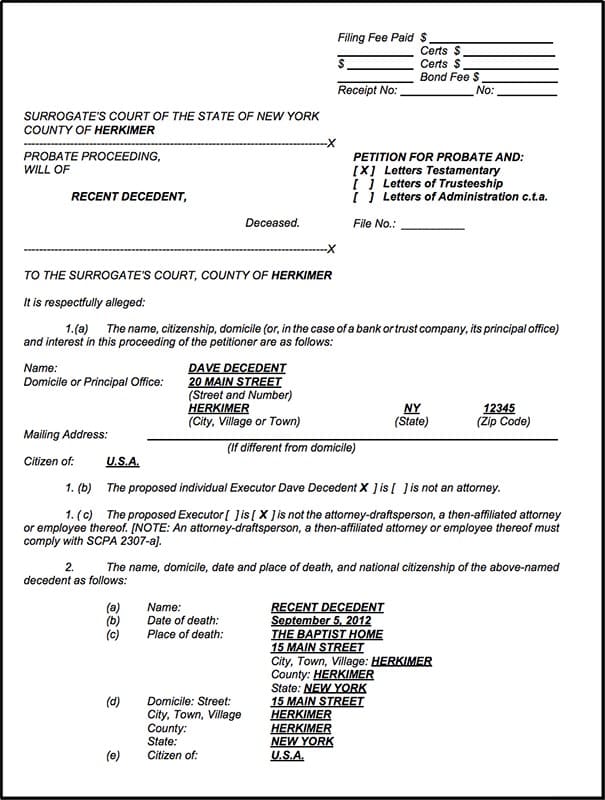

Probate Petition Example (Source: Teahan & Constantino LLP)

Once you can access the active probate files, read through the assets to see if any real estate is listed. If you find an opportunity within the files, contact the executor or administrator of the case to inquire about the real estate. Another public way to get a probate list is through the newspaper. Because estate executors are motivated to sell the available assets, they’ll sometimes list the property for sale in the local newspapers and through social media.

2. Purchase Probate Leads From Providers

Real estate investors can also buy probate leads. This option is more costly, with monthly subscription fees and limited access depending on your preferred state and county. However, these online lead providers digitize and simplify access to information about probate leads for real estate professionals. Leads are typically segregated by state and county since probate cases are filed in the county where the person lives.

Here are a few of the top providers to purchase probate leads:

Providers |  |  |  | |

|---|---|---|---|---|

Best For | An overall probate lead seller that provides exclusive leads | Its “Done-For-You” probate leads management and marketing system | Its customizable approach that lets you choose the tools and systems that best fit your business | Finding motivated seller leads |

Key Features |

|

|

|

|

Monthly Starting Price | $120 | Contact for pricing | $99 | $180 |

Learn More |

3. Obtain Referral Probate Leads

Acquiring referral leads is one of the best real estate lead generation sources. They can be lower in cost since they’re provided by friends, families, and colleagues. Ask your social circles or inquire with your close family and friends for any probate real estate leads. By telling your sphere of influence (SOI) that you are interested in probate opportunities, they’ll know to refer such information to you.

Referral leads from friends and family is a cost-effective gem for real estate.

Through referral relationships with probate and estate attorneys, you can tap into probate attorney leads. This would provide you with access to probate leads before they become public, as these attorneys work alongside the executors and beneficiaries to settle an estate. Their expertise includes recording the assets of an estate, helping to pay the liabilities owed, and distributing the estate’s assets. Therefore, they would know if real estate is associated with an estate and the current plans for it.

To get more real estate referrals for your business, check out our article on the 9 Ways to Get Referrals & Grow Your Business.

4. Market Yourself as a Probate Investor

If purchasing probate property is the majority of your business model, then investors should market themselves as probate investors to generate leads in their area. Investors can create marketing materials that drive business from surviving spouses, probate attorneys, real estate agents, etc.

Investors can begin with a simple website that legitimizes your business and landing pages with specific language and calls to action to drive visitors to submit leads. Other marketing materials that can be dispersed within a neighborhood are flyers and postcards discussing your specialty and familiarity with probate properties. You may even want to offer incentives to your leads if a deal closes.

Custom landing pages and lead capture forms (Source: Placester)

To assist with developing your website and landing page designs, enlist the help of Placester. It offers customizable websites that can be launched instantly with tools to help generate and capture incoming leads. Websites can be created by yourself, or their website designers can create one for you. They offer a client relationship manager (CRM) for leads generated through the site, which helps keep track of lead contact information.

5. Partner With a Certified Probate Real Estate Specialist

Much like partnering with probate attorneys who work with executors, partnering with a certified probate real estate specialist (CPRES) is a great way to obtain probate real estate leads. The CPRES will work with the families involved, helping them navigate the probate process. They are trained to understand the nuances of the probate court system, assisting families in understanding the legal steps and upcoming deadlines.

A CPRES also supports families in marketing and selling the real estate involved in the probate process, so they can therefore help find buyers for the properties. Partnering with a CPRES can be a beneficial way to get probate listings that have motivated sellers. There are a few ways to find a CPRES. You can search LinkedIn for someone with CPRES in their title, or US Probate Services has a directory of probate vendors like attorneys and real estate agents listed on their site.

6. Purchase Probate Property at Auctions

Once a property is ready for sale in probate, it will typically be auctioned off for a quick sale or by order of a judge if the beneficiaries involved cannot agree to sale terms. Find auctions through your county website, newspapers, or even some real estate agents who may have insight.

Probate properties often go to auction for fast sales or judicial orders.

Real estate investors should beware that property in an auction may have multiple bids that bring property prices up to market value. Additionally, at auction, a prospective buyer must put a cash deposit payment on the spot, which can be up to 10%. This is generally paid through a cashier’s check during the auction.

An investor could take out a personal loan or obtain a home equity line of credit for cash if they need to finance the deposit, but understand that a deposit can be lost, and you’ll be stuck with paying the line of credit.

How to Buy Probate Properties

Finding out how to get probate leads is the initial challenge to the probate process, but after obtaining the leads, you must go through the purchasing process. The length of a probate sale process can extend from six to 12 months due to court involvement. Traditional real estate transactions usually take up to two months to complete, with the motivation of both buyer and seller.

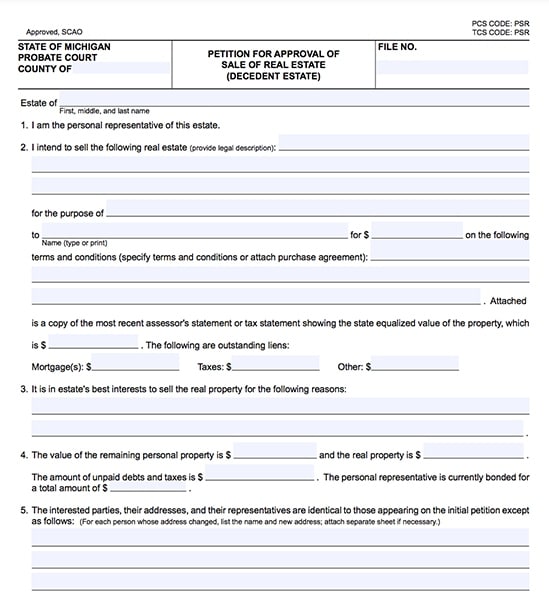

Petition for Approval of Sale of Real Estate example

(Source: State of Michigan)

Each state does have its own probate process, which can vary widely. Many states have adopted the Uniform Probate Code, streamlining the probate process and assisting with minimizing costs. Additionally, each state has defined probate thresholds.

For example, in California, you can avoid probate entirely if the estate value is $184,500 or less. However, in Michigan, the estate value must be 15,000 or less, but no real estate can be included. So if a real estate investor is looking to purchase a potential probate property in an estate valued less than $184,500 in California, they may not have to go through the probate process at all.

If you do purchase property in probate, the standard process is as follows:

- Make an offer: Once you’ve found a property you want, start by making a written offer. Be ready with a 10% deposit, typically non-refundable. The estate representative or listing agent will respond, and if they accept, they’ll file a Petition for Sale Approval.

- Attend the court hearing: After accepting your offer, a court hearing will be scheduled to finalize the sale. During this hearing, other buyers might try to outbid you. If that happens, the judge will raise the property’s price, and to secure the purchase, you need to outbid the others, if there are any.

- Submit paperwork and secure financing: If you become the top bidder at the court hearing, you’ll complete the paperwork to finalize the purchase. Probate properties are often distressed and may not qualify for traditional financing like a mortgage. Typically, probate purchase agreements don’t include a loan contingency, so if you can’t secure a loan in time, you may lose your deposit. Alternatively, the seller might prefer an all-cash offer.

- Finalize the purchase: After that, the probate judge or estate representative will give you a sales contract for your signature. Once it’s signed, no more bids are considered, and the court will continue with the probate process, which can take up to 12 months to finish.

Pros & Cons of Buying Probate Leads

Purchasing probate real estate at a significant discount is attractive to real estate investors, but it comes with risks. Before determining whether you would like to use probate leads as a strategy to acquire real estate, consider all the pros and cons of this real estate investing strategy. Although there are many benefits to this niche market, there are downsides every investor should be aware of.

| PROS | CONS |

|---|---|

| The biggest advantage of purchasing probate properties is that you’ll save some money since the sale price must be 90% of the appraised value, saving buyers at least 10%. | The probate process can be long and extremely complicated. Some probate cases can take up to three years to resolve. |

| The probate process may eliminate other investors unfamiliar with the process; therefore, there may be less competition. | Risk of losing deposit if you fail to complete the purchase process. |

| Housing inventory differs from what is available through the Multiple Listing Service (MLS) or other real estate marketplaces. | Since you have to purchase the property “as-is,” you may uncover hidden issues with the property. |

| Owners of probate properties are often highly motivated sellers eager to sell their properties quickly. | Upgrade and repair costs you’ll potentially have to do on the probate property may eat up your profits. |

Every probate sale is unique, so real estate investors must continuously weigh the pros and cons of a probate sale to determine if they will use this investment strategy. Investors should determine if the discounted property outweighs the unknown timeline for finalizing a purchase.

If an investor does have time to spare, the potential risk of unknown expenses for the property may reduce your return on investment (ROI). This niche has been proven successful for many investors as long as it fits in their overall business plan and model.

Frequently Asked Questions (FAQs)

In real estate, leads are potential customers interested in buying or selling a property. Leads can come from various sources, such as online portals, referrals, open houses, and marketing campaigns, and they help real estate professionals connect with individuals looking to buy or sell properties.

Whether or not paid leads are worth it depends on various factors, such as the quality of the leads and your ability to convert them into actual clients. Paid leads can benefit real estate professionals who don’t have the time or resources to generate leads themselves. However, it’s important to research and choose a reputable lead generation service that provides quality leads.

Additionally, you should have a solid strategy for following up with and converting leads into clients to maximize your investment. Ultimately, it’s up to each real estate professional to weigh the costs and benefits of paid leads and decide if they are worth it and suitable for their business.

You can acquire estate leads through public records and auctions or purchase them from probate leads providers like CatalyzeAI, All the Leads, and US Probate Leads. Referrals and connections with probate and estate attorneys can also help you acquire leads. Another way is to team up with a Certified Probate Real Estate Specialist (CPRES) who can assist you in finding leads.

Bottom Line

Learning how to find probate properties can help you invest in real estate at a highly discounted rate if you’re willing to go through the process. Because the process can be difficult, there is a high barrier to entering this market, which weeds out newer and inexperienced investors. However, once you learn the process, it can be a lucrative real estate investing niche.