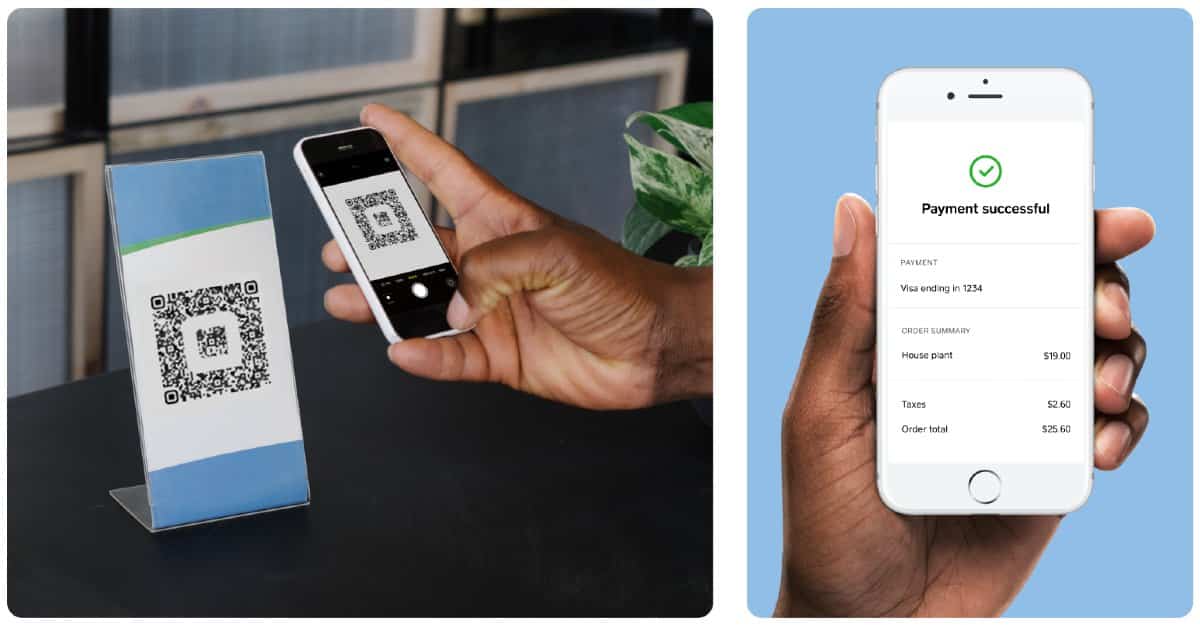

A QR code payment is a contactless payment method made via scannable graphics. It requires a very simple set up, but the potential payoff is great.

What Is a QR Code Payment? Small Business Guide

This article is part of a larger series on Payments.

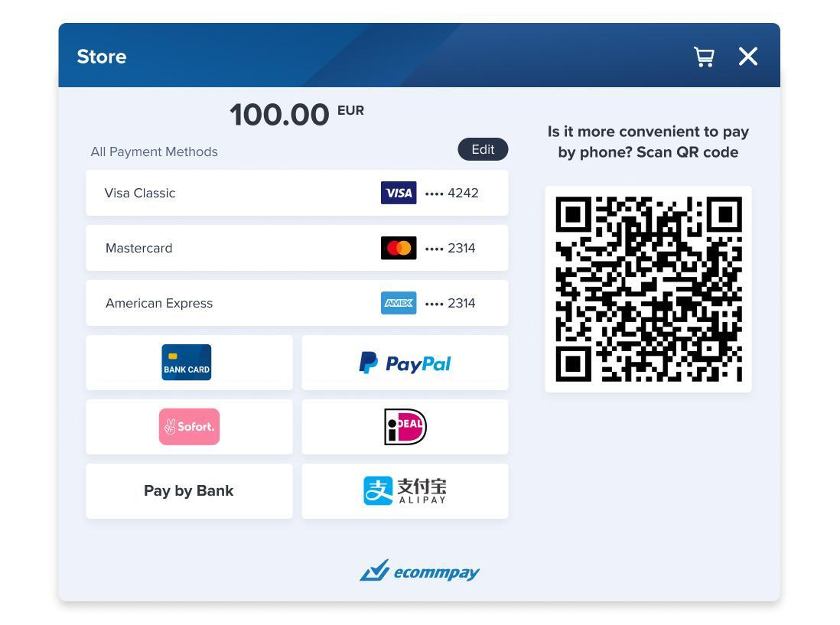

QR stands for quick response and refers to the black-and-white square graphic label that looks like a bunch of large pixels. Each graphic contains unique information that lets you visit a website, place an order, and make a payment by scanning the image with an app on your mobile device.

How Do QR Code Payments Work?

QR code payments work much like many other contactless payment methods.

- Step 1: The customer scans the QR code with their mobile device.

- Step 2: The code then leads the customer to an online terminal.

- Step 3: Customers follow the prompts to perform an online checkout. The customer enters and approves the payment information.

- Step 4: The merchant then receives an alert that the payment went through.

Given that these steps are purely contactless, QR code payments can be used both in-store and online.

Many existing payment platforms and technologies are compatible with QR codes to some degree. And, if you already use QR codes for things like your menu or marketing and promotions, setup is even easier.

QR Code Payments vs Other Contactless Payment Methods

Requirements | QR Codes | Mobile Wallets | EMV Chip Cards | Tap-to-Pay |

|---|---|---|---|---|

Merchant contactless card reader | No | No | Yes | Yes |

Customer smartphone | Android and iOS | Android and iOS | Not required | Android and iOS |

Customizable checkout | Yes | No | N/A | N/A |

Customer ease of use | Log-in, scan, pay | Log-in, pay | One-tap | One-tap |

Online payment option | Yes | Yes | No | No |

For merchants, setting up a QR code payment method takes a few extra steps because you need to generate a code, create a checkout page, and display your QR code. However, it will cost you less because you won’t need a contactless card reader, so you can add a QR code payment option to as many terminals as you want for free.

For customers, using a QR code to make payments takes significantly longer than holding their smartphone or even wearables near a contactless card reader. Then again, the cost of adding additional hardware is the major limitation to merchants.

To summarize, merchants should consider using QR code payments if:

- They want a zero setup cost regardless of the number of checkouts

- They want a custom checkout/ payment link to add marketing and customer engagement functions

- They want a single quick payment method for online and in-person transactions

How to Set Up QR Code Payments

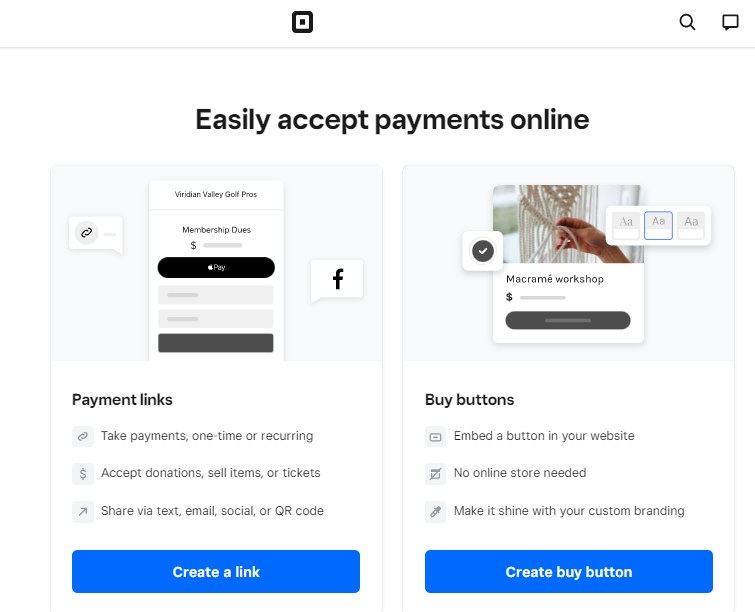

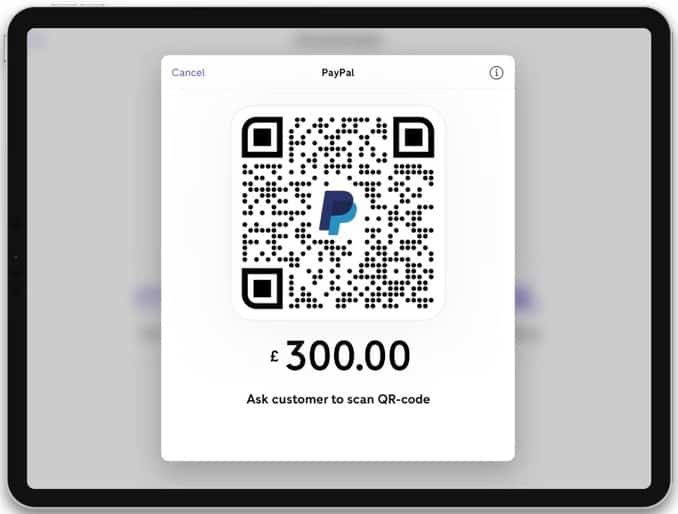

Even if you’re not currently using tools that can handle QR codes, it’s easy enough to get set up. Using PayPal or Square is a quick and affordable way to start taking online and in-person payments via QR code. Or, you can ask your merchant service or point-of-sale (POS) system provider to see if it has that capability.

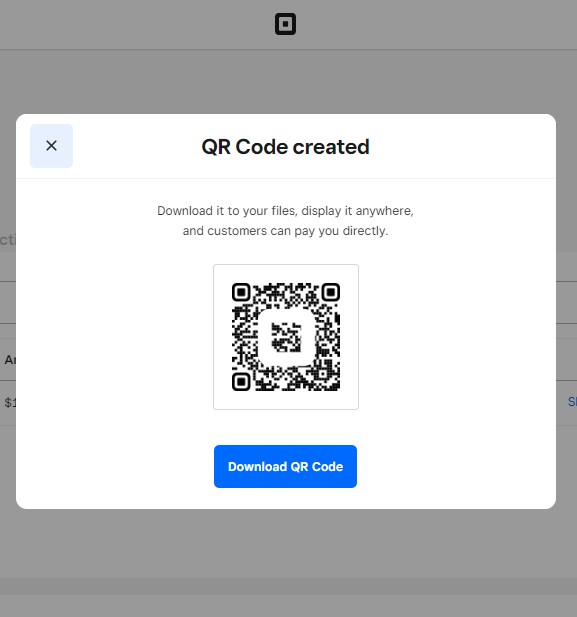

Once you have an app, you can print and set up a QR code for customers to scan, or you can have them scan it off your screen. You don’t need any special hardware—in fact, one advantage of QR codes is that they can work without a POS system or card reader.

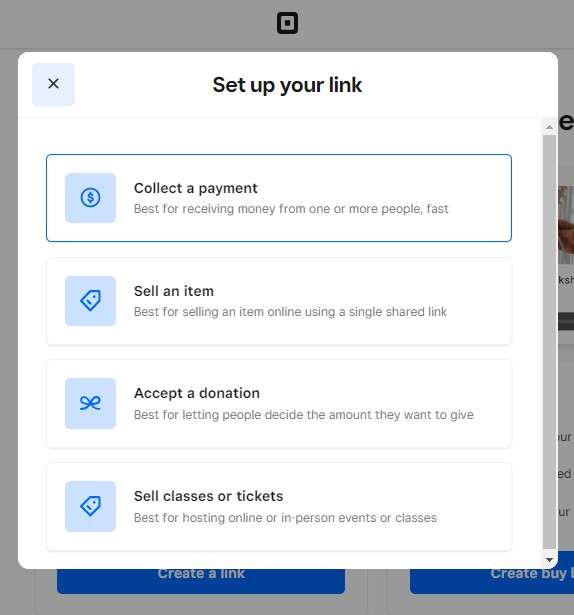

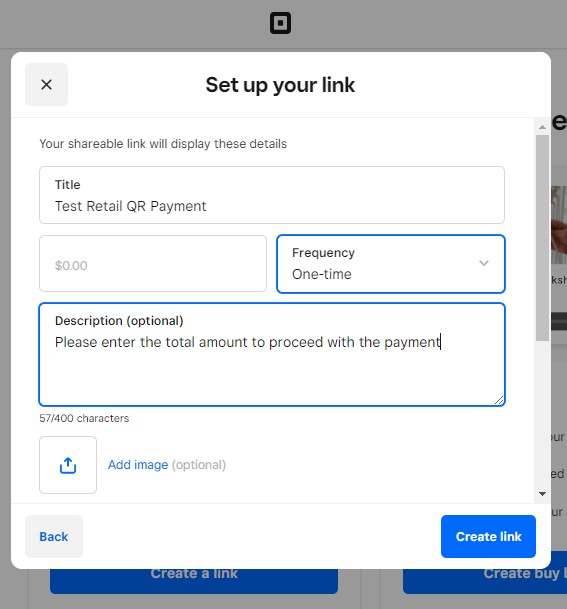

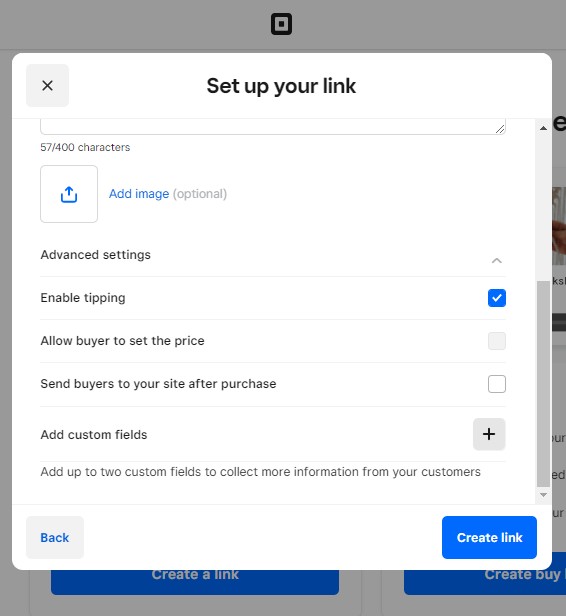

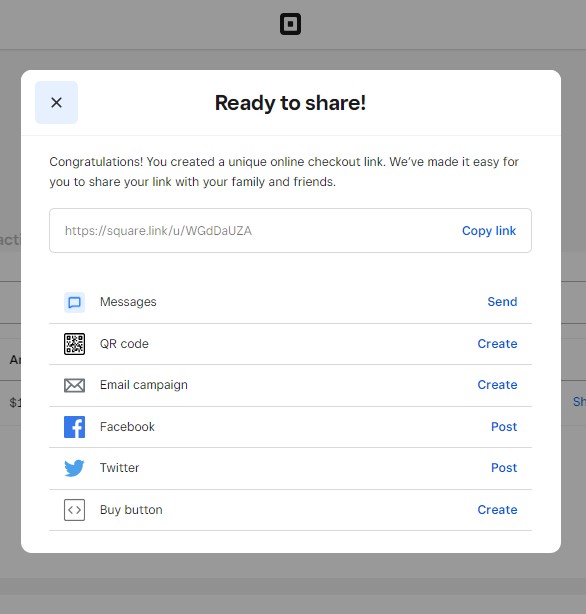

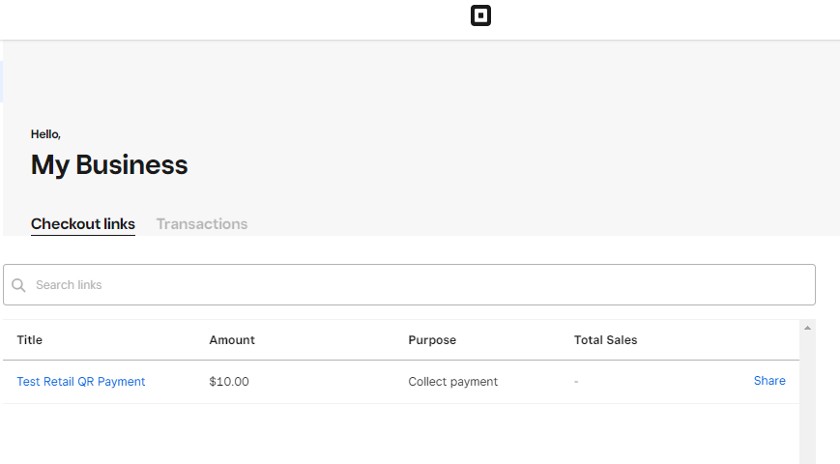

Here is an example of how to generate a QR code for payments with Square:

Top QR Payment Apps

Do QR Code Payments Make Sense for Small Business in 2023?

Nowadays, convenience is the new customer service—and there is no better symbol of convenience than the smartphone. Approximately 89 million US smartphone users used their mobile devices to scan a QR code in 2022—a 26% increase from 2020.

Like other contactless payment methods, QR code payments offer both ease of use for customers and ease of setup for merchants with the help of smartphones.

In a survey by Square, of the 77% of retailers that offered contactless payment options, 25% offered the option to pay via QR code.

According to the latest Future Markets Insights study, global QR code payment transactions are expected to reach $11.67 billion by the end of 2023.

Benefits of QR Code Payments

- No hardware needed: The QR code takes the customer to a website for payments, so you don’t need a card swiper or POS hardware. This can be an advantage for those just starting out or with mobile or off-site salespeople.

- Lower fees: Typically, QR code payments come with lower fees than card-not-present (CNP) transactions. Sometimes, fees are even lower than card-present. PayPal, for example, currently charges only 1.9% + 10 cents to 2.4% + 5 cents per QR code transaction.

- Faster payments: You can process payments from several customers at once since they scan the code and put in their payments themselves.

- Improved customer experience: In addition to paying faster, customers can easily pay with their preferred method simply by scanning the app with their phone. This seamless digital experience lets you concentrate on the customer.

- Greater security: QR codes are tokenized and encrypted, making payment details less vulnerable to theft or hacking. Plus, the processing takes place by the credit card company directly for a more stable transaction.

- Multiple uses: QR codes are also a handy way to share coupons and promotions. Customers can scan the code and be directed to a landing page or downloadable coupon to use for their next purchase. You can also use QR codes to promote your customer loyalty program and offer a way for customers to enroll.

QR Code Payments Frequently Asked Questions (FAQs)

Yes, QR code transactions use encryption and tokenization security so your customer’s payment information is not in any way compromised in the course of completing a transaction.

QR code transactions are considered as card-not-present payments (which are usually more costly than accepting card-present payments), so expect fees similar to your online payment rates. However, PayPal charges 1.9% + 10 cents to 2.4% + 5 cents per QR code transaction, which is one of the cheapest to date.

Yes, all you need to do is display your QR code on your website so customers can scan using their smartphones and be taken automatically to your checkout page.

You need a payment processor that supports QR code payments. It will provide you with tools to generate QR codes similar to how you can generate payment buttons.

Bottom Line

QR code payments may not be the fastest contactless payment method out there, but it is one of the most flexible and as customizable as a payment button—with the convenience provided by your customer’s mobile device. Having QR payment codes can help you keep up with the times, improve your customer experience, and make things easier for you and your employees, too.

To implement QR code payments in your business, see our top picks for merchant services. Many of these solutions, including Square, PayPal, and Payment Depot, offer QR code payments.