QuickBooks Desktop Pro, the entry-level version of QuickBooks Desktop, is a locally installed accounting solution that lets you make payments and deposits, send and track invoices, and run payroll within a single platform. It includes key accounting features, such as bank reconciliation, accounts payable (A/P), accounts receivable (A/R), inventory, and sales tax management.

Prices start at $549.99 per year for one user.

If for any reason you’re unsatisfied with QuickBooks Desktop Pro, you can request a full refund within 60 days of buying the product.

QuickBooks Desktop Pro is being discontinued and will no longer be available for new users after September 30, 2024 and on October 1, 2024 the annual price for existing subscribers will increase to $999 for one user. It has already been removed from Intuit’s website, so you need to contact QuickBooks Desktop’s sales team at (844) 848-0426 prior to July 31, 2024 if you want to subscribe.

Pros

- Manage inventory and calculate the cost of goods sold (COGS) using the average cost

- Export prior-year data via an Accountant Copy while continuing to work on current-year data

- Access a large network of independent QuickBooks ProAdvisors

- Track employee time and bill to customers

- Compare budgeted costs to actual costs

Cons

- QuickBooks Pro is no longer found on Intuit’s website, so you must speak with the QuickBooks sales team

- Cannot track inventory assemblies like QuickBooks Premier

- Cannot manage fixed assets

- No industry-specific editions like Premier and Enterprise

- Limited to three users

- Desktop software requires installation

- Managing multiple companies: A single subscription lets you manage the books of an unlimited number of companies, making QuickBooks Desktop our overall best multicompany accounting software.

- Businesses that prefer desktop software: QuickBooks Desktop doesn’t require an internet connection to run, making it ideal for business owners who have problems with internet connectivity and speed. This makes it our leading farm accounting software.

- Companies with in-house bookkeepers: QuickBooks Desktop works best if you have an in-house accountant working on a single computer, where you can physically work closely with them to check books right from their computer rather than sharing them online.

- Businesses with minimal inventory: If you only need basic tracking of stock on hand and inventory costs without dealing with inventory in multiple locations, then QuickBooks Desktop Pro should be enough.

- Companies with remote bookkeepers: You can’t share your files with your accountant remotely with QuickBooks Desktop. A suitable alternative is QuickBooks Online, which lets your bookkeeper access your files from anywhere. Learn more about this cloud-based program in our QuickBooks Online review.

- Mobile accounting: If you want the ability to send invoices, pay bills, and track cash flow anytime and anywhere using your smartphone, consider Zoho Books. Read our detailed Zoho Books review to see if it’s a good fit, or find other alternatives in our list of the best mobile accounting apps.

- Businesses that need multiple users: Xero has features similar to QuickBooks Desktop Pro for a lower price and with unlimited users. Head over to our Xero review to see if it’s a great alternative to QuickBooks Pro.

- Businesses with multiple locations: Pro can’t track activity by location. QuickBooks Online’s ability to track income and expenses by location makes it our top-recommended real estate accounting software.

Are you looking for something else? Read our guide to the best small business accounting software.

QuickBooks Desktop Pro Deciding Factors

Supported Business Types | Small and medium-sized businesses (SMBs) with up to three accounting users |

Pricing |

|

Money-back Guarantee | 60 days from the purchase date |

Ease of Sharing Files with Accountant | Must make an Accountant’s Copy to send to your accountant; not as convenient as file sharing in QuickBooks Online (send an email invite) |

Standout Features |

|

Scalability | Not scalable, as it’s limited to three users |

Overall Ease of Use | Above average; not as easy to use as cloud-based accounting software |

Customer Support | Phone support (callback only), live chat, chatbot, and self-help guides |

QuickBooks Desktop Pro Alternatives

| ||

|---|---|---|

Best for: Businesses working with remote accountants | Best for: Companies that need to send invoices and pay bills from mobile devices | Best for: Businesses looking for a low-cost inventory management solution |

Starts at: $35 per month | Starts at: $0 for companies with less than $50,000 in revenue | Starts at: $20 per month |

QuickBooks Desktop Pro New Features for 2023

- Cash Flow Hub: This new feature, which is available in all QuickBooks Desktop products, allows you to manage your cash flow in one place. You can view your account balances easily, add new accounts, monitor cash performance over a certain period, track overdue bills and payments, and create cash flow reports.

- Automatic mileage tracking: QuickBooks Pro 2023 tracks your mileage automatically, so you don’t have to record your odometer readings manually. You just need to input your place of origin and destination so that QuickBooks can calculate the mileage for you automatically. You can use this feature from your desktop or mobile app (only for iOS devices).

- Payment links: QuickBooks Pro 2023 lets you create custom payment links to simplify payment collection from customers. Simply create a customized link within QuickBooks, and the system will send an email to your vendor containing the payment details and pay button.

QuickBooks Desktop Pro 2023 is offered as an annual subscription, and prices start at $549.99 per year for one user. While it may be affordable for a single user, prices increase with every additional user, which explains its low score. Below is QuickBooks Pro’s pricing breakdown per user:

- $549.99 per year for one user

- $$749.99 per year for two users

- $949.99 per year for three users

If you need more than three users, you’ll need to upgrade to Premier or Enterprise. Read our QuickBooks Desktop versions comparison for insightful details on pricing and features.

QuickBooks Desktop Pro vs Competitors

Using our internal case study, we compared QuickBooks Desktop Pro against its top competitors, QuickBooks Online and Xero. Using a structured scoring rubric, we evaluated the three programs across 12 accounting metrics and rated them anywhere from zero (very poor) to five (excellent) for each category.

The chart below sums up the results of our case study.

QuickBooks Desktop Pro vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

QuickBooks Desktop Pro $549.99 per year for one user

-

QuickBooks Online Starting at $30 per month, $60 as tested

-

Xero Starting at $12 per month; $65 as tested

Based on the chart above, QuickBooks Desktop Pro excels in most areas of accounting, including banking, A/P and A/R, project accounting, and inventory, which we discuss in greater detail below.

However, we found notable differences in two categories:

- Pricing: QuickBooks Pro lost to QuickBooks Online and Xero because annual subscription prices increase as you add more seats. At around $550 per year ($45.83 per month), it’s very affordable for a single user given its powerful features. QuickBooks Online Plus is $99 per month and includes five users. All Xero plans include unlimited users at no additional charge.

- Mobile app: We believe you shouldn’t have to wait until you’re back at your computer to check your books. Unfortunately, QuickBooks Pro doesn’t let you do this, as it has a very limited mobile app—you can only use it to capture expense receipts and track mileage. Meanwhile, QuickBooks Online and Xero’s mobile apps have more features, such as the ability to create and send invoices and accept online payments. More information about QuickBooks Desktop Pro’s app is found in our mobile app section below.

QuickBooks Desktop Pro Features

QuickBooks Pro could have earned a perfect score if it could track income and expenses by location, which is a standout feature of its cloud-based counterpart, QuickBooks Online. However, Pro still has great general accounting features, comparable to QuickBooks Online and the other QuickBooks Desktop products.

After you download and activate your QuickBooks Desktop Pro account, you can set up a new company by entering your company name, telephone number, email address, and entity type. You can also customize the chart of accounts or start with a default chart of accounts or import your existing chart of accounts.

Pro also offers the other general features we look for, including the ability to import beginning and ending balances, create user-defined classes, and close year-end books. One of the best things about it is that a single license allows you to do bookkeeping for an unlimited number of companies—something you can’t do with QuickBooks Online. You can add a new company from the File menu in your QuickBooks Desktop homepage.

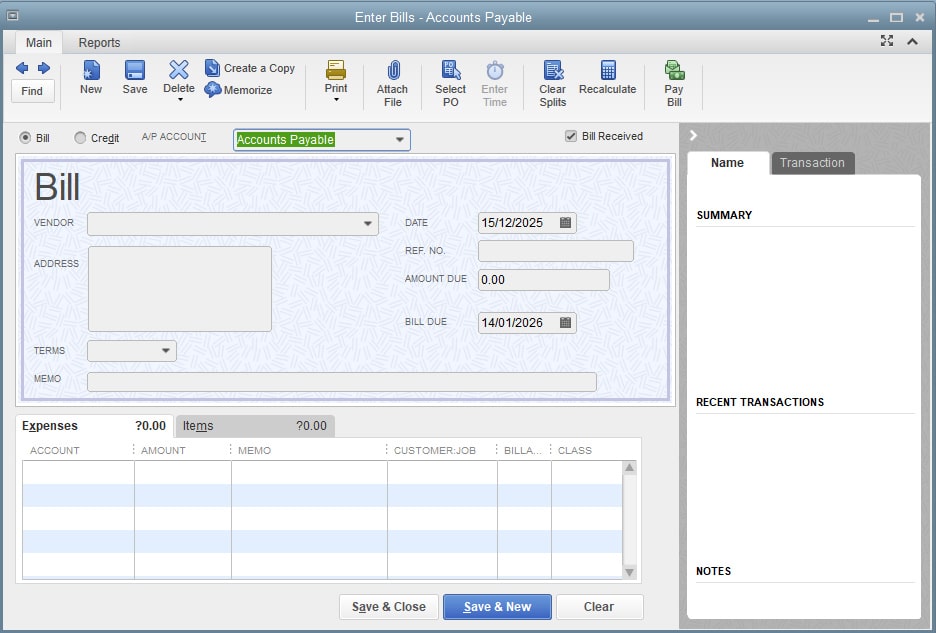

QuickBooks Desktop Pro doesn’t fall short in terms of A/P features, but we found the A/P module difficult to use. While you can enter bills and vendor credits easily straight from the A/P register, the process can be difficult to follow for nonaccountant users.

However, despite this minor issue, Pro offers almost all the A/P features we look for in accounting software. It allows you to enter bills as you receive them and then pay them later. You can record a new bill from the Enter Bills window from the Vendors menu.

Enter Bills window in QuickBooks Desktop Pro

QuickBooks will include the unpaid bills in your expenses if you choose to print an accrual-basis income statement—but not if you print a cash-basis income statement. You can track outstanding bills until they’re paid and set up recurring expenses, which is useful when you have regular monthly bills to pay, such as subscription fees.

Bill tracker in QuickBooks Desktop Pro

QuickBooks Pro also allows you to record purchase orders, create bills from purchase orders, and short-pay an invoice. You can also set up reminders so that you’ll know when your bills are due.

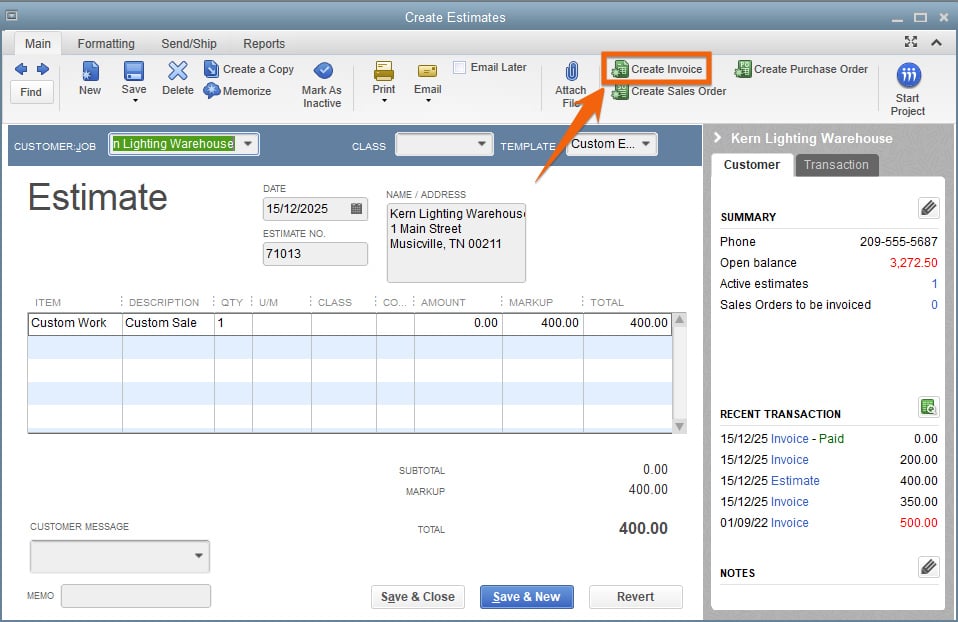

Based on our subjective evaluation, QuickBooks Pro’s A/R module wasn’t as easy to use as we expected—hence the slight blow to its score. However, the program offers a solid A/R management solution.

There are three ways you can create an invoice in QuickBooks Desktop Pro: from scratch, a sales order, or an estimate. When creating an invoice from an estimate, you can either convert the entire estimate to an invoice or choose a selected item or percentage to invoice, which is called progress invoicing.

Create an invoice from an estimate in QuickBooks Pro

To help you stay on top of your A/R, Pro has an income tracker that monitors overdue and almost overdue invoices and sends email reminders of due payments to your customers.

Income tracker in QuickBooks Desktop Pro

You can set up invoices to send on a recurring basis, issue a credit memo to a customer, and accept short payments from customers. You can also track unpaid invoices and print an Aged Accounts Receivable Report to identify potential collection problems.

Using QuickBooks Payments, you can include a link with every invoice so that your customers can pay online using their credit cards. For customers who pay at the time of purchase or service, you can print or email a sales receipt instead of an invoice. Read our QuickBooks Payments review to learn more about the platform.

Another useful feature is the ability to track employee time, assign it to customers and jobs, and then mark it as billable to add it to a customer invoice. Time tracking can be integrated with payroll through QuickBooks Time, which you can read about in our QuickBooks Time review.

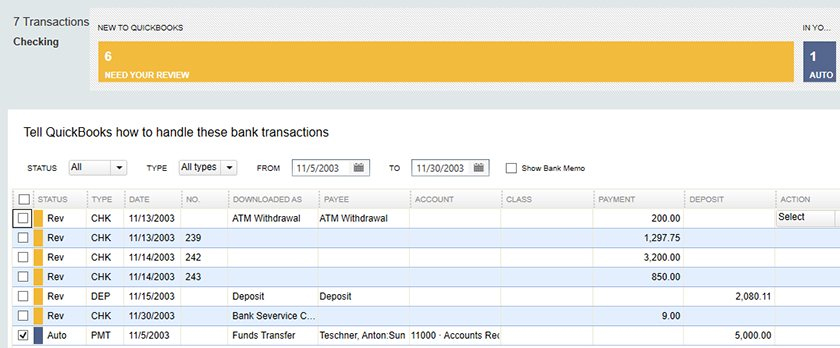

The platform earned a perfect score in this criterion because of its comprehensive bank reconciliation feature that’s comparable to QuickBooks Online. You can set up a bank feed for your checking and credit card accounts to transfer transactions automatically. After the transfer, you can review the information and make changes prior to adding it to your account register.

Classifying bank transactions in QuickBooks Desktop Pro

One thing we like about QuickBooks Desktop is that you can combine multiple cash and checks into a single deposit, which is a very useful feature if you accept multiple checks daily.

QuickBooks Pro has all the ideal project accounting features, including the ability to create an estimate, attach items (like inventory and sales taxes when creating an estimate), and allocate costs and estimates to a project. QuickBooks Desktop is better at project accounting than QuickBooks Online because of its ability to compare actual costs to estimates, which is an important feature for contracting companies.

You can create a project, or “job” as QuickBooks calls it, for a customer to track your income and expenses by job. You can monitor the progress of the tasks involved in a project and even compare your actual to planned costs and progress so that you can easily identify issues that might affect your schedule and budget. This provides project managers meaningful insights into what and how much work has been done and whether the project can be completed on time.

You can access the New Job screen from the Customer Center window under the Customers menu. The New Job screen menu includes four sections to complete: Address Info, Payment Settings, Additional Info, and Job Info.

Typically, the address info and payment settings are automatically filled in, but you can make changes on the fly if needed. You will most likely need to provide important details in the Job Info section, such as job description, job type, job status, and projected end date.

New job form in QuickBooks Pro

After creating the job, you can look at its progress by running job reports, such as Job Profitability Summary, Profit and Loss by Job, and Unbilled Costs by Job.

If you’re selling taxable products and services, you can use QuickBooks Desktop to track sales tax collections and remittances for each state and tax authority. Sales taxes can be added to receipts, estimates, and invoices.

You can run a tax liability report for a certain time period and track tax payment due dates to avoid late filing and penalties. In addition, you can monitor what you owe from the Sales Tax Payable register and the Pay Sales Tax window.

Tracking tax liabilities in QuickBooks Desktop Pro

QuickBooks Desktop Pro’s inventory accounting isn’t as enhanced as QuickBooks Premier’s, but it does a great job of monitoring the COGS and calculating ending inventory. You can track the availability of inventory and the average and the total number of items, create purchase orders (POs) for vendors, and set up alerts when you’re running out of inventory.

QuickBooks Pro lets you set up inventory items so that you can track what you have on hand and how much you’ve spent and earned with it. When you sell a product, the program records both purchase (COGS) and sales revenue in a single entry. This helps you easily track and analyze your gross profit and gross margin and whether you are making enough money on a certain item to replenish your inventory. Also, QuickBooks will adjust your inventory in your balance sheet automatically, eliminating the need for manual data entry.

There are three types of items you can add in QuickBooks Desktop: noninventory items, inventory items, and services. Noninventory items are those you purchase but don’t track, such as office supplies, while inventory items are those you purchase, track, and resell. Service items are services you purchase or offer, such as consulting hours and labor fees.

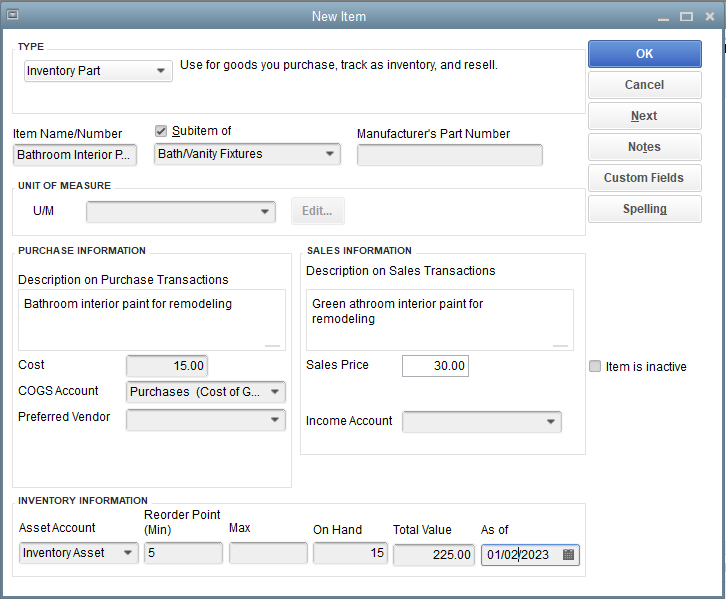

When recording an inventory item in QuickBooks Pro, select Inventory Part and then complete the New Item form that shows up. To set up new inventory, complete important details, such as item name, purchase cost and description, and sales cost and description.

One of the best parts about inventory in QuickBooks Pro is that you can set reorder points. QuickBooks will alert you to replenish your inventory when the item’s count hits the reorder point you specified.

Adding a new inventory item in QuickBooks Pro

QuickBooks Desktop Premier is more advanced as it handles inventory assembly items to build and track finished goods. This is essential when building products with separate parts or materials to track. You can learn more about the version through our in-depth QuickBooks Desktop Premier review.

We attempted to generate 16 types of reports in QuickBooks Desktop Pro, and the only missing report is profit and loss (P&L) statements by location. QuickBooks Desktop lets you run an array of reports, including P&L statements, cash flow statements, and balance sheets. There are more than 100 reports available, and you can find the list of present reports from the Reports Center:

Report Center in QuickBooks Desktop Pro

If you need to track P&L separately between two locations, you need QuickBooks Online. QuickBooks Pro or any version of QuickBooks Desktop doesn’t offer location tracking.

The QuickBooks Desktop Pro mobile app is very limited as it’s intended mostly for receipt capture. Snap a picture of an expense receipt or a vendor invoice from your smartphone, and QuickBooks Pro will create a digital transaction automatically from the uploaded receipt or invoice. Additionally, the iOS app lets you track business mileage.

If mobile accounting is important to you, you should consider QuickBooks Online or even the more powerful Zoho Books mobile app. It has almost all the mobile accounting features you wish to have, such as the ability to send invoices, enter bills and payments, record billable time, and assign projects to customers. You may check out our Zoho Books review to learn more about its mobile app.

QuickBooks Desktop Pro can be cumbersome to use if it’s not set up properly, which explains its average score. We highly recommend hiring a QuickBooks ProAdvisor to set up your company and items, such as inventory. Spending the time and money to get your company set up correctly will make entering everyday activities a breeze.

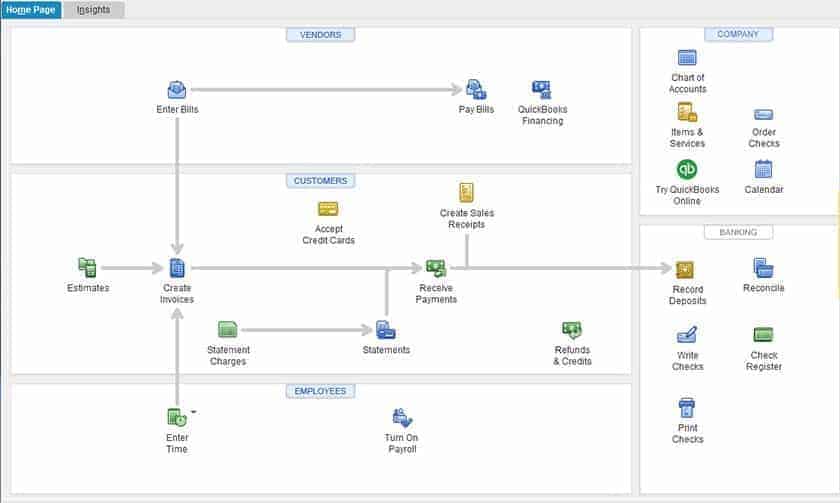

With a little practice, you may find Pro easy to navigate. From the homepage, you’ll see the workflow navigation chart, which is grouped into Vendors, Customers, Employees, Company, and Banking.

QuickBooks Desktop Pro’s homepage

If you need help, you can talk to an agent through live chat or get self-help information with a chatbot. QuickBooks Desktop also has a vast help center with plenty of how-to guides, learning videos, and tutorials. While it offers phone support, you have to send a message first and then wait for a rep to call you. Some of the accounting software we reviewed, such as Zoho Books and FreshBooks, have better customer service, with the option to initiate a call.

Most of the positive QuickBooks Desktop Pro reviews are attributed to the program’s strong set of features and ample integration—some users said that inventory items can be categorized and tracked easily and that it integrates with many programs, such as BigCommerce and Magento. However, some reviewers said it’s difficult to set up and has below-average customer service.

Here’s how QuickBooks Desktop Pro is rated by popular review websites:

- G2: 4.3 out of 5 based on around 1,670 reviews

- Software Advice: 4.5 out of 5 based on over 1,700 reviews

Frequently Asked Questions (FAQs)

If you have no more than three accounting users, need basic inventory tracking, and don’t need remote access to your books, then QuickBooks Pro is right for you.

No, it isn’t. QuickBooks Pro and other QuickBooks Desktop products are no longer offered as a one-time purchase. Instead, subscriptions are purchased on an annual basis.

If you need access for up to five users and require an industry-specific edition like Retail and Manufacturing and Wholesale, then choose Premier. If you need up to 40 users and desire advanced inventory, like multilocation tracking, then you should upgrade to Enterprise.

No, it’s not. Some of the older versions are being phased out (recently the 2020 version), but it only means you need to upgrade to the newer version of QuickBooks Pro.

Yes, as QuickBooks Desktop syncs with QuickBooks Online Payments, which allows you to process payments online through credit card or automated clearing house (ACH) bank transfer. Learn more about the solution in our QuickBooks Payments review.

Bottom Line

QuickBooks Desktop Pro is a powerful desktop accounting solution, particularly for companies with in-house bookkeepers. It may not offer the accessibility and convenience of cloud-based software, but it has many strong features that are worth considering. If you only need a few users and have no intensive inventory to manage, then it’s a great accounting solution for your business.