Direct deposit is a secure and efficient way to pay employees by electronically transferring wages into their bank accounts. This eliminates the need for paper checks and ensures timely payments. If you’re wondering how to set up direct deposit for employees, this guide will walk you through the process, including the legal requirements, costs, and troubleshooting tips.

The steps to set up employee direct deposit are as follows:

- Check legal requirements

- Choose a direct deposit provider

- Determine direct deposit costs

- Set up the service

- Get authorization and bank information

- Identify the pay schedule

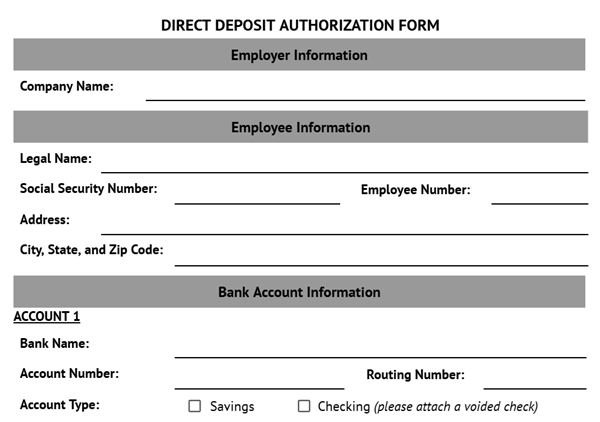

To process direct deposit for employees, you’ll need to get signed authorization from your workers. You can use our free direct deposit authorization form template to collect employee consent and banking details efficiently. To customize the form, download it in Word or Google Docs.

Step 1: Check legal requirements

Although direct deposit is the most common way to pay your employees, your workers still must choose to be paid via direct deposit. Many states have their own regulations about how you can pay your workers and whether or not you can mandate electronic payments for your team.

For more detailed information on your state’s mandates around direct deposits, check out our state payroll directory for easy access to all of our state payroll guides.

Step 2: Choose a direct deposit provider

The two popular ways to set up direct deposit for employees are through your bank and with your payroll software. Many payroll systems offer this function and can automatically process employee payments as direct deposits. There are also some HR services and software with payroll capabilities that can provide direct deposit services.

No matter which option you choose, your bank is the one that transfers the funds. If you don’t work with your bank directly, you will need to share your bank account information with the software or service provider to have direct deposits set up.

Step 3: Determine direct deposit costs

When looking for a provider, one of the questions you would likely ask is, “How much does direct deposit cost?” While most payroll software providers offer this as a free service or include it in their standard package, some have add-on fees for processing employee direct deposits.

The fees vary depending on the provider, but if you plan to work directly with a bank, you may need to pay a setup fee of up to $150. Some financial institutions also charge transaction fees, which typically run from $1 to $2 per individual transaction.

Further, in the unlikely event that your company bank account doesn’t have sufficient funds to pay employees and you already sent the direct deposit payment instruction, you will need to pay a returned item fee or a non-sufficient funds (NSF) fee. This can cost up to $50 per item, depending on the provider.

Step 4: Set up the service

Once you’ve decided on your direct deposit service, it should tell you the steps you need to take to set up your direct deposit. Remember that it can take a few days to a week to have everything in place. It’s important to set realistic expectations with your team so your employees don’t expect direct deposit with their next paycheck if it’s not yet possible.

Click the tabs below to learn the specifics of setting up direct deposits through your bank or with a payroll service provider:

Step 5: Get employee authorization and bank information

You will need signed consent to gather your workers’ bank account details. To collect their information more efficiently, use our direct deposit form template and distribute it to all employees.

Some of the information you’ll need from your employees to set up their direct deposits properly include:

- Bank routing number

- Bank account number

- Bank account type (checking or savings)

- Bank name

- Social security number

- Employee’s full name or legal name

- Employee address on the account (for verification to avoid mix-ups)

Step 6: Identify the pay schedule

When having your employee direct deposits set up, choose a regular pay period that works best for your company and workers. This is crucial to ensure that your payroll process runs smoothly. To help you make that decision, consider these factors:

- Payday frequency: Determine how often you need to do payroll. The most common pay periods are monthly, semimonthly (15th and 30th/31st), or biweekly. Biweekly employees usually get 26 paychecks a year at a slightly smaller amount, while semimonthly get 24 paychecks at a slightly higher amount.

- Processing lead time: Consider the lead time that your bank or payroll service needs to complete the direct deposits. Also, decide whether you need a longer lead time for holidays or weekends. Some businesses move paydays to an earlier date to get deposits out the business day prior to the holidays or weekends.

- Company’s financial schedule: Funds must be available to transfer into your business bank account before paychecks can be distributed, so be sure your schedule works with anticipated cash flow.

- Deadlines for employees to submit time cards: Give your workers enough time to submit timesheets. You should also allot some time for yourself to review the data and send the processed payroll for direct deposit.

- Employee expectations: Employees expect to receive their pay based on the payroll schedule. If there are changes due to holidays and other factors, clearly communicate when payroll funds will be available. This transparency builds trust and helps employees better plan their finances.

How do direct deposits work

Now that you know how to set up direct deposit as an employer, you must also understand how it works. Direct deposits are a widely used automated clearing house (ACH) payment method that securely transfers funds through an encrypted electronic network between the payer’s and payee’s banking institutions.

For payroll direct deposits, you or your finance manager sends the payment instructions to your bank on paydays. Then, your bank processes the transaction, also known as an electronic fund transfer (EFT) payment, transferring wages directly into your employees’ bank accounts.

Benefits of direct deposits

Direct deposits offer several benefits to you and your employees.

- Convenience: It eliminates the need for physical checks, trips to the bank, or waiting for paper checks to arrive in the mail.

- Streamlined pay processing: Funds are automatically deposited into the recipient’s account on the scheduled date, which helps save time and improve processes.

- Enhanced security: Direct deposits reduce the risk of lost or stolen checks, and the electronic transfer process is highly encrypted and protected. It is also less susceptible to fraud compared to paper checks, as there is no physical document that can be altered.

- Reliability: With direct deposits, you can rely on consistent and predictable payment schedules with timely payouts regardless of holidays or weekends.

- Cost savings: It reduces the costs associated with printing and mailing paper checks, as well as the expenses related to handling returned or lost checks.

- Enhanced record-keeping: Direct deposits often come with detailed electronic records that make it easier to track and reconcile transactions. This can simplify financial management for both individuals and businesses.

Direct deposit errors: How to prevent and fix issues

One of the prime benefits of direct deposit is that it is generally timely and error-free as long as you enter the correct payroll information. However, errors can occur. Here are some of the most common problems that people experience with direct deposit and how to handle them.

- Resolution:

- Check if you and the employee are looking at the same bank account details (the employee may be referring to their checking instead of a savings account).

- If the funds were sent to the wrong account, work with your bank or payroll provider to trace where the money has been deposited and notify the affected payee. Then, request a reversal within five business days.

- Consider issuing an emergency paper check payment to the employee while the reversal processes.

- Prevention:

- Require employees to include voided checks or copies of bank statements that show account details with their direct deposit authorization forms.

- Implement a dual verification process where two HR staff members confirm employee bank account information inputted into the system.

- For new hires or employees who changed their bank account details, verify the information by conducting small test deposits (up to $1) before processing their payroll.

- Resolution:

- Contact your bank or payroll provider immediately to track the direct deposit payment status and determine the cause of the delay.

- Request expedited processing if funds have yet to leave your account.

- Establish a clear communication plan for updating affected employees.

- Provide employees with transaction confirmation numbers, if available, and expected resolution times.

- Prevention:

- Run payroll three to four business days before paydays to ensure enough time for processing.

- Create a payroll schedule that accounts for holidays and weekends, and adjust pay processing timelines during these periods.

- Maintain adequate funds in your business bank account at all times to prevent direct deposit delays due to insufficient funds.

- Communicate potential delays (e.g., longer processing time because of holiday schedules) to employees well in advance.

- Resolution:

- Verify if the incorrect amount has been deposited and if there is an overpayment or underpayment.

- Process additional payments or corrections as soon as the error is discovered. You may need to run an off-cycle payroll if needed.

- Check state regulations regarding overpayments before deducting from future paychecks. You also have to ensure that the employee will receive minimum wage after the payroll correction.

- Prevention:

- Double-check payroll calculations, especially for employees with variable hours or commission payments.

- Implement a review process for overtime, bonuses, and deductions to ensure that the correct details are captured for pay processing.

- Run preliminary payroll reports for the HR or payroll manager’s approval before final processing.

- Use payroll software with built-in validation checks.

- Resolution:

- Verify the double payments and request a reversal immediately.

- Inform the affected employees about the error and reversal process. Note that NACHA rules require the full amount to be recovered in one transaction.

- Prevention:

- Double-check payment records before processing payroll for the pay period.

- Implement system checks or use payroll software that flags duplicate payment transactions.

- Use unique batch identification numbers for each payroll run for easy tracking.

- Maintain clear records of completed payments.

For all the direct deposit errors you encounter, it’s crucial to document the incident and the correction process. These files will serve as your supporting records if the HR or finance team conducts a payroll audit or spot-checks special or off-cycle pay runs for potential issues and discrepancies.

Direct deposit frequently asked questions (FAQs)

It depends on where your business is located. Some states, like Texas allow you to require direct deposits, while others have specific requirements, such as Alabama only allowing it for employers in the private sector.

No, as an employer, you can’t charge employees fees for processing direct deposit payments. Many states also have laws prohibiting employers from imposing such fees.

Yes. Your employees can get direct deposit payments without a bank account by using a prepaid debit card. They just need to provide you with the card’s account and routing numbers for pay processing.