Square and PayPal are popular tools for accepting payments and work well for most small businesses. Both can serve as merchant services providers and point-of-sale (POS) and ecommerce platforms. The primary difference lies in what they do best.

While both offer free POS systems, Square’s is more feature-rich and has add-on software to grow with your business. PayPal’s Zettle POS app is more rudimentary, but it has stronger online and international payment processing tools. PayPal checkout is also a popular payment option with online shoppers, making it a great addition to any website. In short:

In our evaluation of the leading merchant services, Square came out as the best overall with a score of 4.53 out of 5. PayPal also made the list as the best provider for occasional and online sales with a score of 3.86 out of 5.

When to Use an Alternative: Helcim

If you process over $20,000 monthly, you can get lower rates by using a traditional merchant account instead of Square or PayPal. We recommend Helcim with its zero monthly fees, interchange-plus pricing, automatic volume discounts, all-in-one hardware, and an option to opt for ACH payments or pass on credit card fees for bigger savings. Visit Helcim to learn more, or see how it compares below.

Square vs PayPal Quick Comparison

Looking for more options? See our roundup of the leading retail payment processors.

Get a Personalized Recommendation

Need help choosing between Square and PayPal? Our quiz takes less than a minute, and you’ll get a recommendation without being redirected to another page.

Square vs PayPal Pricing & Contract

FSB Rating | 4.31 out of 5 | 3.5 out of 5 |

Payment processing monthly fees | $0 | $0 for Standard account $30 for Pro account |

POS monthly fees | $0–$60 | $0 |

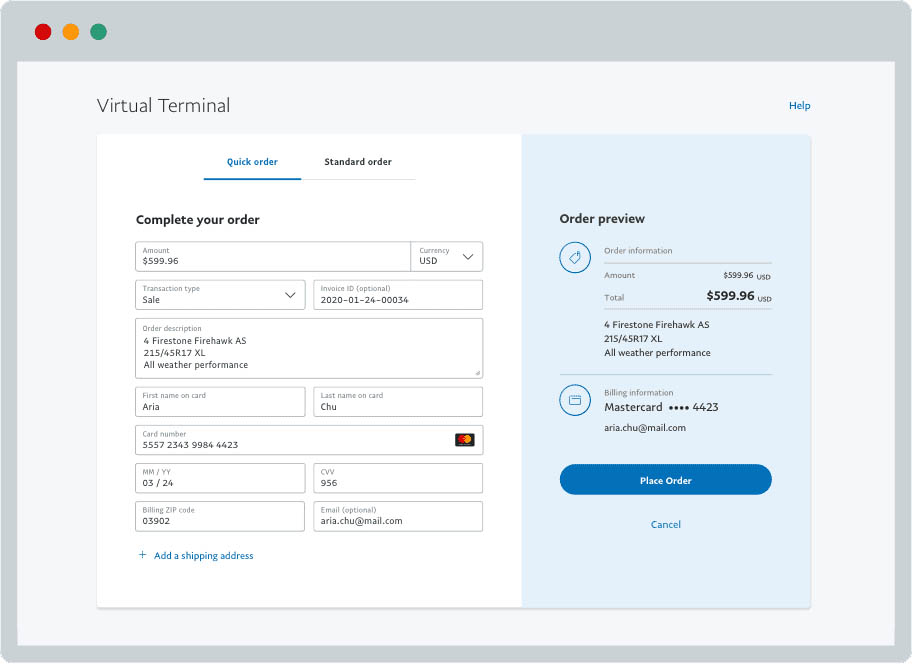

Virtual terminal | $0 | $30 per month |

In-person payment processing fees | 2.6% + 10 cents | 2.29% + 9 cents |

Keyed-in fees | 3.5% + 15 cents | 3.49% + 9 cents |

Online and invoice fees | 2.9% + 30 cents | 2.59% + 49 cents to 3.49% + 49 cents |

ACH fees/e-check fees | 1% (Min $1) | 3.49% + 49 cents capped at $300 (echeck) |

Chargeback fees | Waived up to $250/month | Chargeback: $20 US (varies by country) Dispute: $15 US (varies by country) |

First card reader | Free (magstripe only) | $29 (Contactless and chip) |

Subsequent readers | $10 (magstripe) $49 (contactless and chip) | $79 (Contactless and chip) |

Fees

When it comes to PayPal vs Square fees, Square leads with 4.31 out of 5 while PayPal received 3.5 out of 5. There are no monthly fees and no lengthy application process with Square. It has reasonable processing fees that start at 2.6% + 10 cents. PayPal also does not charge any monthly fees, but while its rates are generally better than Square’s, they can be quite confusing, especially for new merchants.

The biggest edge Square has over PayPal when it comes to pricing and contracts is the chargeback fee—Square waives up to $250 per month. On the other hand, PayPal chargeback fees range from $15 to $20.

Aside from this, the Square POS comes with a free magstripe card reader and virtual terminal so new businesses can start accepting payments in minutes and without any upfront cost. With PayPal, there is an added monthly fee for the use of a virtual terminal, and you will need to purchase your first card reader.

Note that this is a comparison of US prices; if you do business elsewhere, PayPal has different flat-added amounts for different countries. In addition, PayPal offers significant discounts for nonprofits, making it a better choice for many 501(c)3s.

POS Hardware

Square offers a wide range of full POS hardware solutions with optional accessories, such as cash registers, thermal printers, and barcode scanners. While not as robust as Square, Zettle also offers a range of hardware solutions for its users.

Square vs PayPal Estimated Fees

Compare Square vs PayPal fees. Enter an estimate of your monthly sales data in the calculator below:

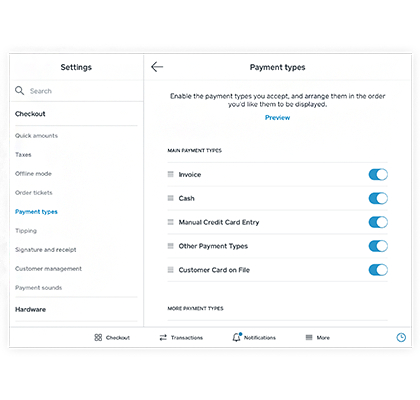

Square vs PayPal Payment Types

FSB Rating | 4.88 out of 5 | 4 out of 5 |

Full POS on mobile | ✓ | ✓ |

Offline mode | ✓ | ✕ |

Virtual terminal | ✓ | $30 |

ACH/e-checks | ACH only: 1%, min $1 | Echecks only: 3.49% + 49 cents capped at $300 |

Social selling | Products, subscriptions, appointments | Products, subscriptions |

Multichannel (eBay, Amazon) | ✕ | ✓ |

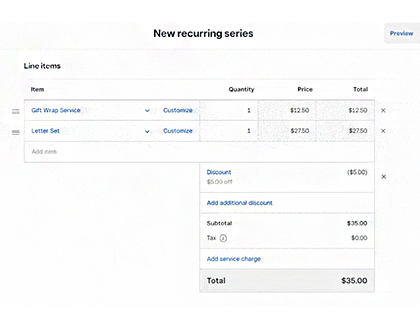

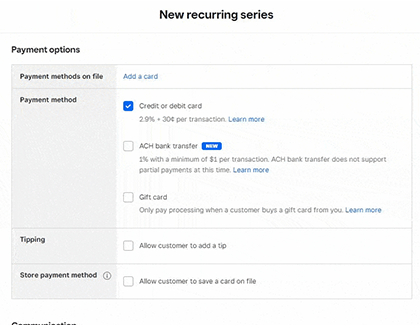

Subscriptions/Recurring | ✓ | ✓ |

QR codes for contactless payments | 2.9% + 10 cents per transaction | 1.90% + 10 cents–2.4% + 5 cents per transaction |

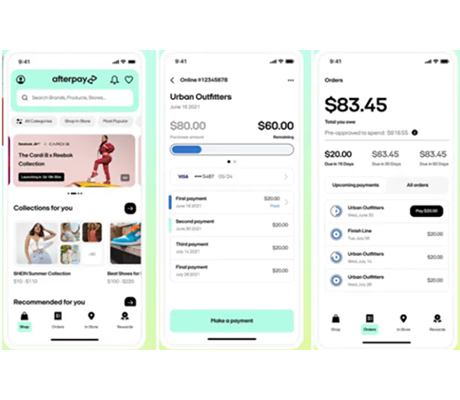

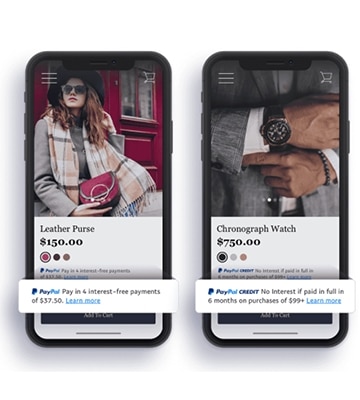

Buy Now Pay Later (BNPL) | 6% + 30 cents, 4 payments, 0% interest In person and online | 2.59% + 49 cents, 4 payments, 0% interest Online only |

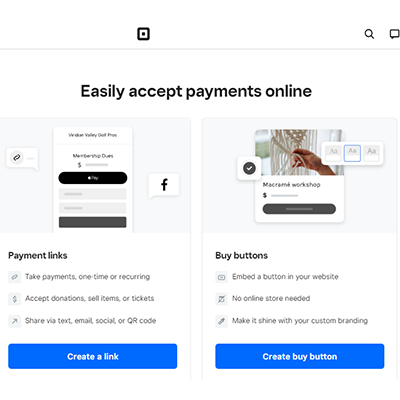

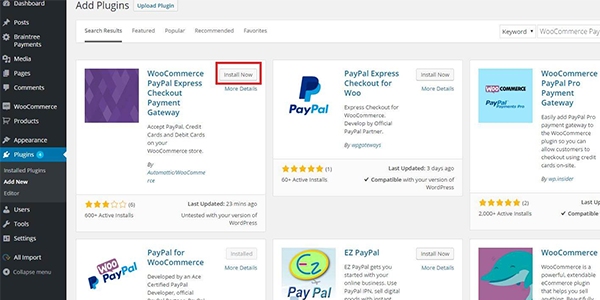

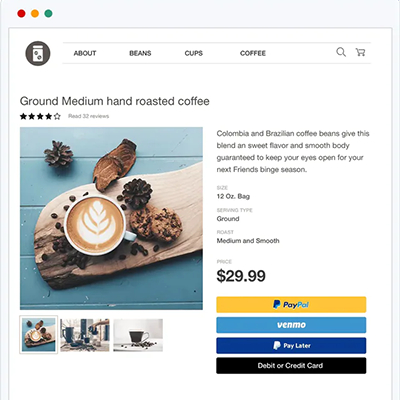

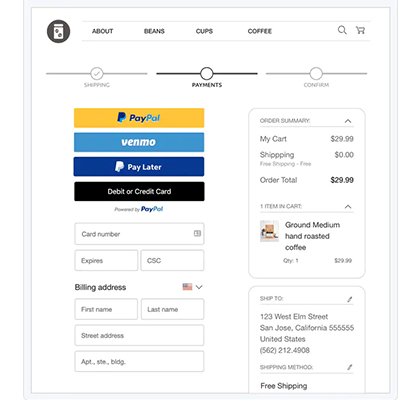

Square received nearly perfect scores across all payment types we considered, earning a high 4.88 out of 5 overall. PayPal also offers a wide range of payment options and also scored well with 4 out of 5. It lost points for the extra monthly virtual terminal fee whereas Square offers this for free. The best thing about PayPal is that most ecommerce platforms offer easy integration with just a few clicks and your PayPal business account details.

The Square payment app for mobile is compatible with Android and iOS devices and free to download and use. It also comes with a free magstripe reader that can be mailed immediately after you sign up for an account.

You can set up your inventory in the app and then select items from your library or manually enter the transaction amount. The Square POS app also now has a Tap to Pay on iPhone feature, so you don’t need another card reader for contactless payment if you have a compatible iPhone.

Like Square, PayPal has a mobile app that also works as its POS app. If you prefer PayPal to Square, you are still getting a great system. This is especially important if you want to offer Pay by PayPal, as Square can’t handle this. While you can put the same Zettle account on multiple systems, it does not distinguish locations like Square can.

However, keep in mind that PayPal’s app does not have offline capabilities. It still scored well on iOS, with a score of 3.0 from 730+ reviews, and on Android, with 3.3 from 42,000+ reviews. Real-world users also rate Square highly on iOS, with a score of 4.8 from 400,000+ reviews, and Android, with a score of 4.8 from 216,000+ reviews.

When it comes to PayPal Zettle vs Square POS devices, PayPal Zettle’s mobile card reader includes a PIN pad while Square does not. To get PIN pad capability with Square, you’d need to upgrade to its $299 card reader terminal. However, the PayPal Zettle reader doesn’t have a card swipe option while you get a complete three-in-one (swipe, dip, and tap) payment setup for $49 with Square.

Square’s POS system and credit card processing make it the better choice for mobile sales. Optimized so you can easily ring up sales on a smartphone or tablet, the POS system does everything on mobile that it does on desktop, including reports. The offline mode lets you continue to take payments and have them sync when the internet is back. Square took the top spots on our lists of the best mobile POS and leading mobile credit card processors (though PayPal also placed on these evaluations).

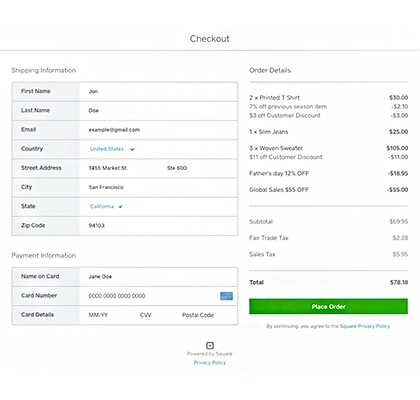

If you need hosted checkouts, choose Square, as PayPal charges extra for customizable hosted checkouts. Square also integrates with over 100 applications for online sales. Of special note are all the third-party delivery options. If you run a restaurant, this is a good way to expand your customer base. (Learn more about the best delivery services.)

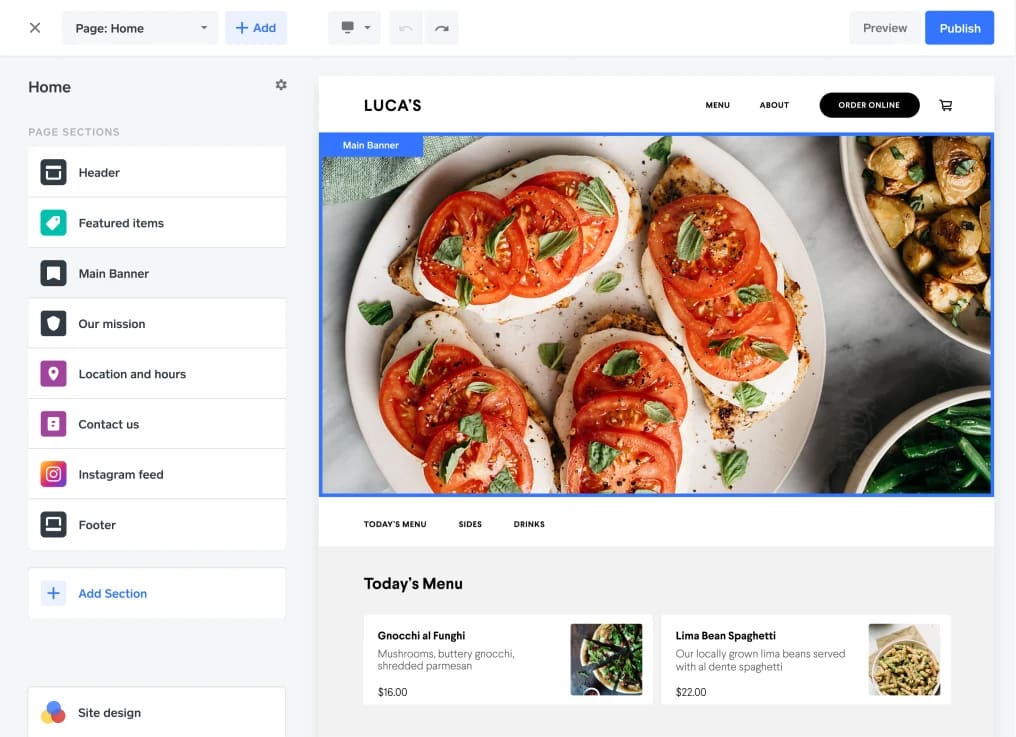

If you need to build a website, Square provides an easier option with its website builder that helps design an online store that integrates with your Square POS system. With PayPal, you will need to set up your website with a separate ecommerce platform, which may incur additional fees.

Want more customizability? Consider Stripe. Its API and SDK programming are excellent, making it the best for standalone online payments and specialty cases, like monetizing an app. Check out how Stripe compares to both Square and PayPal.

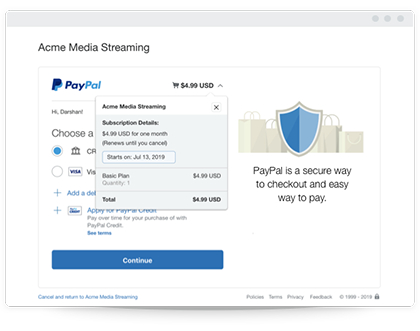

While Square ties tightly to its POS tools, PayPal can work as an independent payment gateway. This means you can have customers pay by PayPal just about anywhere, even third-party sales sites like eBay. Its ability to handle cross-border payments and make currency exchanges is also important when selling online.

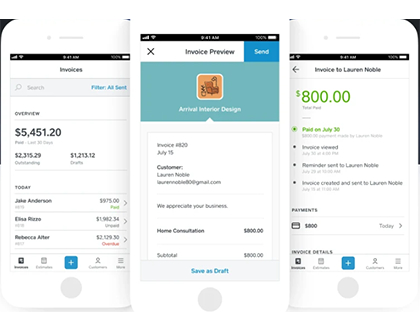

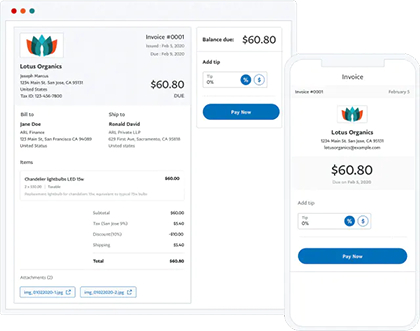

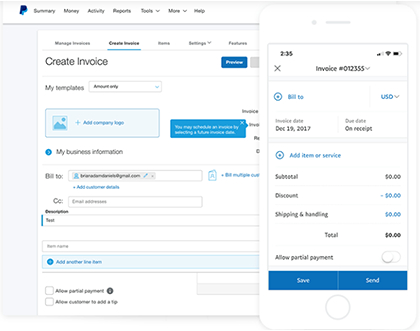

Square’s invoicing feature allows you to create, send, and track invoices online or via Square Payments’ iOS and Android apps. Additionally, you can use automatic payment reminders, advanced reporting, and recurring billing. Advanced invoicing features are also available for those wanting a more customized look, plus additional tools like multi-package estimates and milestone-based payment schedules.

Like Square, PayPal lets you generate attractive, branded invoices for full, partial, or recurring payments. It boasts a 76% paid rate within the first day of sending the invoice. Unlike Square, it accepts echecks rather than ACH transfers. Regardless of how your customer pays, it charges 3.49% + 49 cents including for echecks, which are also capped at $300 per transaction, while Square only charges 2.9% + 30 cents or 1% per invoice using the ACH payment method.

When it comes to PayPal vs Square invoicing, both systems allow you to create and send custom invoices, handle recurring payments, and send reminders. Square, however, is the cheaper choice.

Square is best when you want a completely free invoicing system that accepts ACH transfers. It lets you send multiple estimates, request a deposit, set partial payments by milestones, and more. When paying by ACH, it charges 1% of the invoice, a minimum of a dollar, making it cheaper than PayPal. Otherwise, it costs 2.9% + 10 cents per invoice or 1% per invoice using the ACH payment method.

Learn more in our ultimate Square Invoice guide.

Both Square and PayPal are secure and easy to use as payment processors. Taking price out, Square simply beats PayPal on features, especially protection and versatility, and fewer complaints about held funds when processing credit card payments with Square. Despite PayPal’s popularity and international scope, Square is the better payment processor for small businesses doing domestic sales. For selling internationally, PayPal is a better option.

When it comes to chargeback protection, Square stands out. In addition to working with you to manage disputes, it forgives the first $250 a month in chargeback fees. If you are an occasional seller, this is probably more than sufficient, and if not, it’s still a big help. It also has a risk management program for an additional charge if you are concerned about chargebacks and transaction issues. PayPal, on the other hand, provides seller dispute help and protection, and has a chargeback protection program for physical items at an additional 0.4% to 0.6% per transaction.

Aside from EMV, mobile wallets, and digital invoicing, Square lists nine additional methods of accepting payments, including payments unique to Square, such as Cash App integration, ecommerce APIs, and appointment prepayments. Similarly, PayPal also offers unique alternative payment methods. For example, you can include a cryptocurrency option on your PayPal checkout page. Personal PayPal account holders who buy and sell cryptocurrencies using their PayPal account can convert their cryptocurrency holdings into fiat currency during checkout to pay for goods and services.

Square vs PayPal Features

FSB Rating | 4.19 out of 5 | 3.38 out of 5 |

Immediate access of funds within the software | With Square Banking | As PayPal balance |

Integrations | 150+ | 1,000+ |

Business tools | Business loans, savings and checking accounts, product photography, business events | PayPal balance, working capital, business loans |

Deposit speed to your bank | 1–2 business days | Approximately 3 business days to a bank account |

Option for instant deposit | Same-day for 1.75% fee | Instant with 1.5% fee |

Live support | Extended hours, chat | Extended hours, message or phone |

Live hardware support | 24/7 phone | Extended hours, message or phone |

Online knowledgebase | Good | Good |

Loan sourcing | 1 option | 2 options |

Loanable amount | $300—$250,000 | $1,000—$125,000 (Working Capital), $5,000—$500,000 (Business Loan) |

Loan approval speed | Minutes | Minutes (Working Capital), Next business day (Business Loan) |

Loan funding speed | Next business day | Minutes (Working Capital), Next business day (Business Loan) |

Square’s score of 4.19 out of 5 beats PayPal’s 3.38 out of 5 with Square’s more well-rounded suite of business, banking, and money management features, as well as software tools and integrations—most of them free. Aside from offering working capital loans, it also provides traditional banking services at no extra cost.

These earned Square perfect scores for business management and software tools. A few points were docked for its slower deposit times and limited customer service hours.

Although lower than Square’s scores, PayPal still earned above-average scores for its management features. It is among the most popular and widely used payment platforms because of its excellent integration options and international payment processing. Customers and shoppers recognize it as a secure platform for sending and accepting payments online. However, it would have performed better if there were no extra fees for some of the features, such as its chargeback protection.

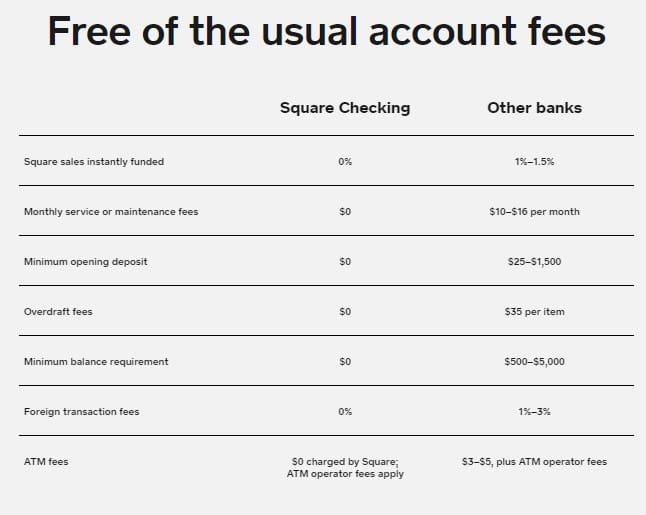

Square offers a single platform for Square merchants to manage their finances. Similar to traditional banking, you can sign up for a savings account and a checking account with Square. There’s no minimum opening deposit or balance requirement, and there’s also no charge for service and maintenance fees, as well as overdrafts.

You can set up an automatic saving feature with a Square Savings account, so Square will regularly deposit a percentage of your sales into your savings account, which will then regularly earn interest. On the other hand, a checking account gives you instant access to your funds as your sales proceeds will directly be deposited there. You can then use Square’s debit card to spend your money digitally or in person.

Both Square and PayPal offer business loans to merchants. PayPal’s working capital is available for PayPal business account holders who regularly accept payments through their PayPal accounts. It essentially lets you take an advance on anticipated credit card sales, which you then pay back with a percentage of those future sales.

Square’s working capital offer is similar to PayPal’s working capital loan, which gives you the ability to choose your loan size and will then provide you with a customized offer based on your card sales. There’s no interest fee, and you pay it automatically with a percentage of your daily card sales made through Square, so you never get charged a late fee. Square even offers proprietary, industry-grade hardware in affordable installments, and we find this accessibility a huge plus for small businesses and startups working on a budget.

Square offers money management with competitive interest rates and loans with affordable plans. (Source: Square)

Square’s customer service is also limited to extended business hours. Chat support is accessible in the Square POS app—a handy feature. Square’s phone customer support is available from 6 a.m. to 6 p.m. Pacific time, Monday through Friday. PayPal, on the other hand, offers extended business hours for live customer and technical support. Phone support is available 6 a.m. PT to 6 p.m. PT, Monday through Sunday.

Both Square and PayPal provide extensive knowledge bases, which include step-by-step guides, troubleshooting, how-tos, and developer documentation.

Despite complaints of frozen funds and canceled accounts, customers are overall satisfied with both PayPal and Square customer support. However, for Square, only active accounts are given access to phone support, and even then, you will require a customer code when calling. You will need to log in to your account to get a “Call Support” option, including your own customer code.

Square vs PayPal User Reviews

Capterra | 4.7 out of 5 (2.2K+) | 4.7 out of 5 (24.9K+) |

G2 | 4.6 out of 5 (140+) | 4.4 out of 5 (2.0K+) |

Users Like | Easy to use Reasonable transaction fees No monthly fee | Easy to use Safe and secure Widely available |

Users Don’t Like | Holds funds Connection issues with the card reader Limited integrations | High transaction fees Account holds High currency conversion fee |

Both Square and PayPal enjoy positive reviews for their ease of use and accessibility. However, Square tends to outshine in terms of transaction fees and the absence of a monthly fee, while PayPal users appreciate its safety and wide availability. The choice between the two will ultimately hinge on your specific preferences and business requirements.

Square vs PayPal Expert Score

We scored this category based on our own experience of ease of use and how affordable and transparent the pricing is. We also looked at the number and ease of integrations, as well as the input of real-world users as recorded in third-party user review sites like Capterra and G2.

Square earned a score of 4.38 out of 5. Even with zero upfront cost, new merchants can easily start their business with Square. For an all-in-one solution with a flexible POS software, extensive business management tools, industry-grade hardware, and versatile payment processing, Square is very competitive and always a top contender in many of our buyer’s guides. It is extremely popular among small businesses because the system is stable, reliable, and easy to use.

However, this does not mean that PayPal is a lesser choice. It tied with Square’s score of 4.38 out of 5. PayPal received perfect scores from our experts for its pricing, popularity, and integrations. It is a secure platform with simple payment methods and provides integration with almost any popular online platform. Unless you need some of the other added features, you don’t need to pay any fees to use PayPal Business to receive payments.

While Square lost a few points with its smaller number of integrations, minor points were deducted from PayPal in the ease of use sub-criteria because of the possibility of having your funds withheld or frozen and the complex pricing it offers. Aside from that, with PayPal’s wide and easy integrations, it is an excellent option for online payments. But if you are looking for a provider with seamless mobile and in-person payment processing capabilities, we find Square an outstanding choice.

Methodology—How We Evaluated Square and PayPal

We test each merchant service provider ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to various payment processing features, scalability, and ease of use.

The result is our list of the best merchant services providers. However, we adjust the criteria for specific use cases, such as for different business types and merchant categories. This is why every provider has multiple scores across our site, depending on the use case you are looking for. For this in-depth analysis, we looked closely at how PayPal and Square performed.

Click through the tabs below for our overall merchant account evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and echeck payments, and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same-day or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use―including account stability―popularity, and reputation among business owners and sites like the Better Business Bureau (BBB). Finally, we considered how well each system works with other popular small business software, such as accounting, POS, and ecommerce solutions.

Frequently Asked Questions (FAQs)

Here are the most common questions around Square vs PayPal.

Both Square and PayPal are excellent choices for payment processors and POS systems. However, Square is a better option for mobile payments and in-person transactions, while PayPal is better suited for ecommerce and online payments.

Square is an excellent option for startups or small businesses processing up to $10,000 a month. Aside from offering an all-in-one solution without any upfront costs, its payment processing rates are competitive for businesses processing low-volume transactions.

Although Square’s flat processing fees are competitive, they can get expensive for large-volume businesses. Nevertheless, Square offers custom pricing for businesses processing more than $250,000 annually, so it is worth checking with Square for custom pricing rates.

Square Online is automatically configured to work with its built-in payment processor, Square Payments. However, you also have the option of using a different processor, and PayPal is one of the options for processing payments. You will need a PayPal Business account and to at least be on a Square Online Plus plan ($29 monthly fee) to accept PayPal.

Bottom Line

When comparing Square vs PayPal, you are going to get a strong payment processor with a free, fully-featured POS system and online sales tools that include social selling no matter which one you choose. Both have complaints about held funds but strong customer satisfaction, nonetheless.

While most of PayPal’s rates are cheaper than Square’s, Square is overall the more robust solution. It has free specialty POS software for restaurants and salons and add-ons for all aspects of a business—from customer loyalty to payroll and banking services. It’s the most complete solution at an excellent price.