If you’re comparing Stripe vs PayPal vs Square, you’re likely looking for the best online payment processor for your business. These three providers accept various payment types, come with checkout customization tools, and have digital wallets and other one-click payment options to improve the customer experience. Plus, all three offer baseline solutions with no contracts or monthly fees.

However, there are a few key differences that make Stripe, Square, and PayPal best for specific use cases:

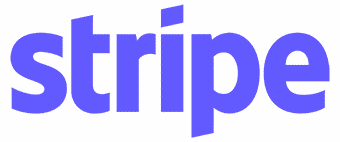

- Stripe: Best for online-only businesses, including tech-savvy startups, B2B businesses, and international companies

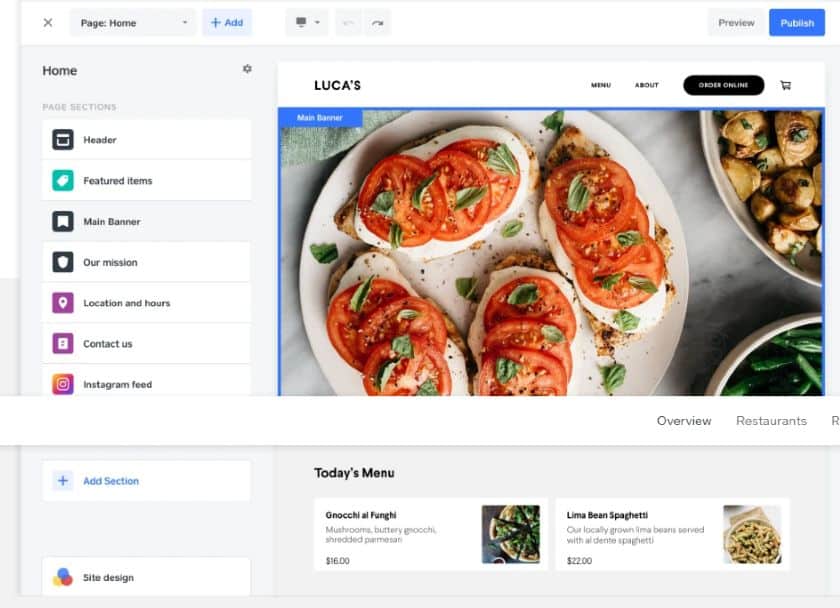

- Square: Best simple, low-maintenance online payment solution for individuals and small businesses

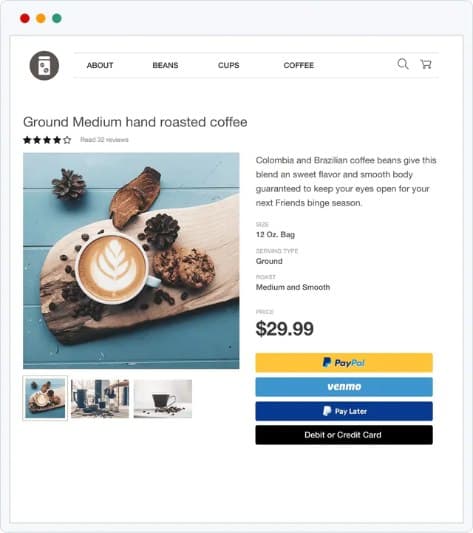

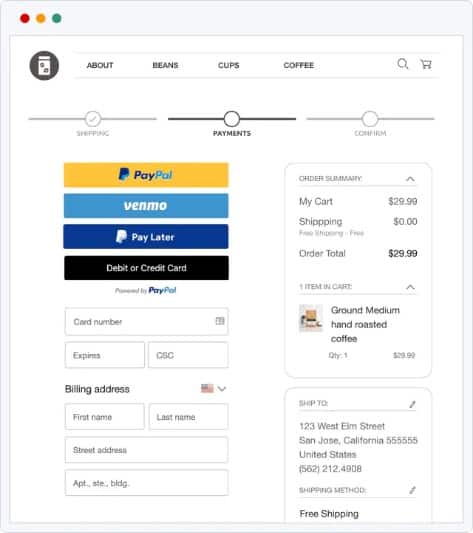

- PayPal: Best customer-friendly checkout option to add to an existing website

In our review of the best online payment and credit card processors, Stripe came out as the best overall with a score of 4.33 out of 5. Square and PayPal also made the list, with scores of 4.18 and 3.82, respectively. Although all three providers have in-person payment processing capabilities discussed in this review, the scores do not consider this payment type.

Looking for the cheapest rates? Consider Helcim

Helcim, which scored a 4.19 in our online payment processor review, offers lower rates than Stripe, Square, and PayPal. Visit Helcim to learn more, or see how it compares below.

Stripe vs Square vs PayPal Quick Look

Stripe vs Square vs PayPal Pricing

| ||||

|---|---|---|---|---|

Pricing Score | 3.38 out of 5 | 3.88 out of 5 | 3.06 out of 5 | 4.5 out of 5 |

Get Started | ||||

Monthly Processing Fee | $0 | $0 | $0-$30 | $0 |

Online processing fee | 2.9% + 30 cents | 2.9% + 30 cents | 1.99% + 49 cents to 3.49% + 49 cents per transaction | Interchange plus 0.15% + 15 cents to 0.5% + 25 cents |

Invoicing Fee | 3.3%-3.4% + 30 cents $0/mo. | 2.9%-3.3% + 30 cents $0-$20/mo. | 3.49% + 49 cents $0/mo. | Interchange plus 0.15% + 15 cents to 0.5% + 25 cents |

Recurring Billing/ Subscription Fee | 3.4%-3.7% + 30 cents $0/mo. | 2.9% + 30 cents $0/mo. | 3.49% + 49 cents $10-$30/mo. | $0/mo. |

Card-on-File Processing Fee | 3.4%-3.7% + 30 cents | 3.5% + 15 cents, or 2.9% + 30 cents (for ecommerce) | 3.49% + 49 cents | Interchange plus 0.15% + 15 cents to 0.5% + 25 cents |

ACH/e-check Processing | $1/payment (ACH debit) 0.8% capped at $5 (ACH credit) | 1%, min. $1 (ACH) | 3.49% + 49 cents capped at $300 (eCheck) | 0.5% + 25 cents ($6 cap) |

Virtual Terminal Fee | 3.4% + 30 cents | 3.5% + 15 cents (keyed-in) $0/mo. | 3.09% + 49 cents $30/mo. | $0/mo. |

In-person and POS Fee | 2.7% + 5 cents, or 2.9% + 30 cents (for touchless), third-party for POS | 2.6% + 10 cents $0-$60/mo. | 2.29% + 9 cents $0/mo. | Interchange plus 0.15% + 6 cents to 0.4% + 8 cents |

POS software | Third-party | $0-$60/mo | $0/mo. | $0/mo. |

Chargeback Fee | $15 | Waived up to $250/mo. | $15-$20 | $0 or $15 |

When it comes to Stripe vs PayPal vs Square fees, Square scored the highest with 3.88 out of 5 while both Stripe and PayPal received 3.38 out of 5. Although all these payment processors have processing fees within the same range, Square’s advantage is its waived chargeback fee of up to $250. On the other hand, Stripe’s chargeback fee is $15, and PayPal charges $15 and $20, depending on the checkout option.

If affordability is your only consideration, Square wins slightly over Stripe and PayPal.

Square vs Stripe vs PayPal Payment Types

| |||

|---|---|---|---|

Payment Types | 4.63 out of 5 | 3.13 out of 5 | 3.88 out of 5 |

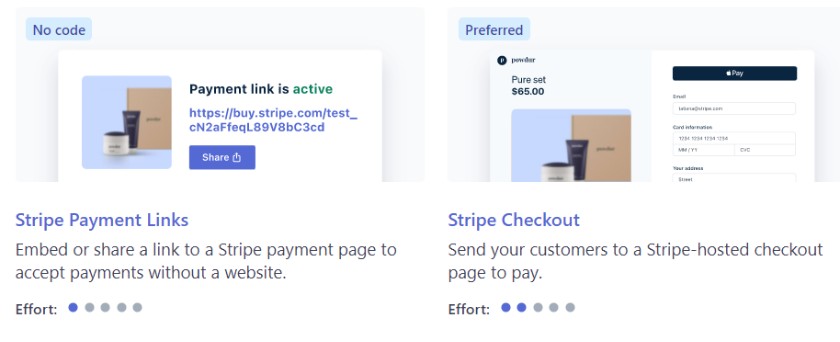

Invoicing | 3.3%-3.4% + 30 cents $0/mo. | 2.9%-3.3% + 30 cents $0-$20/mo. | 3.49% + 49 cents $0/mo. |

Recurring Payments | $0–$10 | ✓ | $10-$30 per month |

International Payments Processing | 1.5% fee, 1% spread for currency conversion 135 currencies | 2.9% + 30 cents 8 currencies | 1.5% fee, 4% spread for currency conversion 24 currencies |

Virtual Terminal | ✓ | ✓ | $30 per month |

ACH/eCheck | ✓ | ACH only | eCheck only |

Micropayments | 5% + 5 cents (Contact Stripe) | N/A | 4.99% + 9 cents |

Hosted Checkout | ✓ | ✓ | $0-$25 |

Cryptocurrency | Exchange only | ✕ | ✓ |

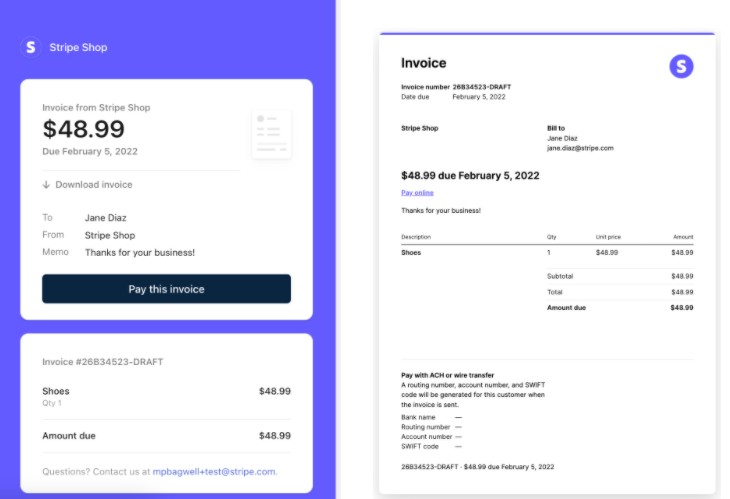

QR Code/ Buy Now, Pay Later/ Tap-to-Pay on Mobile | ✓ | ✓ | ✓ |

When it comes to the available payment types offered, Stripe is the clear winner. It offers all the payment types we considered, even if it has add-on rates for some services, such as for invoicing and recurring payments.

Square would have done better in this category if it offered wider international payment processing—it only accepts international card processing in eight countries. Both Stripe and PayPal are more internationally recognized payment processors, but PayPal’s international fees are more costly with its 4% currency conversion spread. For other international payment processing options, read our guide to leading international merchant accounts.

PayPal lost points in this category mainly for the additional monthly fees it charges for certain services, such as for recurring payments and virtual terminals. If you would like both these options, you will pay as much as $40 to $60 per month—for small businesses, this can be hefty.

Stripe vs Square vs PayPal Features

| |||

|---|---|---|---|

Features Score | 4.38 out of 5 | 4 out of 5 | 3.81 out of 5 |

Customer Service |

|

|

|

Deposit Time |

|

|

|

Fraud Prevention | Stripe Radar: machine learning and advanced real-time fraud protection | Square Risk Manager: machine learning, customizable | PayPal Fraud Protection: machine learning, custom filters |

Mobile App | ✓ | ✓ | ✓ |

Buy Now, Pay Later | Affirm, Afterpay, Klarna | Afterpay | PayPal Pay Later (Pay in 4, Pay Monthly) |

Partner Integrations | 700+ | 300+ | 60+ |

Stripe again has the edge when it comes to features. Its 24/7 customer service, more robust fraud prevention, and flexible developer tools earned it a higher score of 4.38 out of 5. Stripe also offers a slightly lower fee for instant payouts and wider integrations.

For businesses that are not after the flexibility and customizability that Stripe offers, Square and PayPal have numerous app integrations to increase functionality. Keep in mind that many of these third-party integrations require separate signups and fees.

Although all three providers are secure platforms that use machine learning for fraud protection, Stripe’s Radar uses billions of signals and data points from the Stripe network, which supports better machine learning outcomes.

Stripe vs Square vs PayPal User Reviews

| |||

|---|---|---|---|

Capterra | 4.6 out of 5 (3,000+) | 4.7 out of 5 (2,000+) | 4.7 out of 5 (25,000+) |

G2 | 4.3 out of 5 (300+) | 4.6 out of 5 (100+) | 4.4 out of 5 (2,000+) |

Software Advice | 4.6 out of 5 (3,000+) | 4.7 out of 5 (2,000+) | 4.7 out of 5 (24,000+) |

All three online payment processors are well-reviewed with thousands of reviews and rated high across the different sites we looked at. This shows the popularity and reliability of these three providers. Stripe, Square, and PayPal are all excellent choices when it comes to online payment processing—you only need to choose the one that best fits your needs.

Get a Personalized Recommendation

Need help choosing between Stripe, Square, and PayPal? Our quiz takes less than a minute, and you’ll get a recommendation without being redirected to another page.

Methodology: How We Evaluated Stripe vs Square vs PayPal

To evaluate Stripe versus PayPal versus Square, we looked at overall fees, payout times, and reliability. We also considered ease of use, variety of features offered, number and types of platform integrations, and each payment processor’s customer service reputation.

Click through the tabs below for our overall online payment processor evaluation criteria:

20% of Overall Score

We considered contracts; monthly, chargeback, and cancellation fees; transaction pricing; and availability of volume discounts. While all three offer pay-as-you-go billing, Square scored highest here with a lack of chargeback fees. PayPal requires a monthly fee for Pro accounts, which caused it to fall behind.

30% of Overall Score

We looked at how many types of transactions each processor can handle. Stripe pulled ahead with its international and multicurrency capabilities, ACH and eCheck, and B2B payment options. All three offer invoicing, ecommerce, and card-on-file payments.

25% of Overall Score

Overall, all three scored fairly evenly for deposit speed and mobile app. Square has better customer management tools, while Stripe offers the best fraud prevention and developer tools.

25% of Overall Score

Here we looked at overall pricing transparency and value; ease of use, including account stability and the user interface; popularity, including reputation and user reviews; and integrations, including ecommerce platforms, website builders, and CRM software. All three received closely similar scores, with Square losing minor points for integration, Stripe for ease of use, and PayPal for pricing.

Bottom Line

In comparing Square vs PayPal vs Stripe, it’s important to consider which features are most important for your business. Square and Stripe offer the best value with free business management tools and custom volume discounts. PayPal has an edge with its user-friendly reputation with customers and speedy checkout.

All three are compatible with the most popular small business software. Additionally, all three are plagued with account stability issues because they are aggregators and not traditional merchant accounts.

PayPal is the best option if you want a simple way to accept money securely online by the world’s most recognized brand in this category. If you need an easy way to accept online payments or a solution that handles online and in-person payments, Square is your best choice.

Finally, if you want a customizable online payment solution that can scale with your business, Stripe is the best option for you.