The best accounting software for Mac is easy to use, has good customer support, and offers accounting features that are compatible for Mac users. In addition to essential general accounting features like project accounting, inventory management, and invoicing, some of the leading software have Mac-specific tools, such as Quick Notes and Lock Screen widgets.

Here are the best Mac accounting software that we recommend:

- QuickBooks Online: Best overall accounting software for Mac users

- Zoho Books: Best mobile accounting app for Mac users

- FreshBooks: Best for service-based businesses and freelancers

- Xero: Best Mac accounting software for businesses with many users

- Wave: Best free cloud-based Mac accounting software

- GnuCash: Best free open-source accounting software for Mac users

At Fit Small Business, our editorial policy is rooted in our company’s core mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audiences have. This ensures that the content is rooted in knowledge and accuracy.

We also employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

Best Accounting Software for Mac: Quick Comparison

QuickBooks Online: Best Overall Accounting Software for Mac Users, Including a Huge Support Network

Pros

- Access to a huge network of QuickBooks ProAdvisors; makes it easy to find help if needed

- Option to sign up for QuickBooks Live for more extensive bookkeeping support and guidance

- Able to track income and expenses by location and class

- iOS and Android mobile apps perform many accounting tasks on the go

Cons

- Requires either the Plus or Advanced version to use project accounting and inventory management

- A bit more expensive than most other similar software

- No Mac-specific features or widgets, like those in Zoho Books

New users can get either a 50% discount for three months or a 30-day free trial. The Plus or Advanced plan is required to track inventory or projects.

- Simple Start: $30 per month for one user

- Essentials: $60 per month for three users

- Plus: $90 per month for five users

- Advanced: $200 per month for 25 users

You can check out our QuickBooks Online plans comparison to find out which plan is right for you.

We selected QuickBooks Online as our overall best accounting software for Mac because of its extensive feature set and vast support network. It has all of the accounting features that most businesses need—including invoicing, banking, bill management, inventory, and reporting—and they work well on Mac and Windows devices.

While the platform has no Mac-specific features, all of its features perform well on Apple devices, plus it has an iOS mobile app that lets you track mileage, create and send invoices, track sales and expenses, and more.

Additionally, as our best small business accounting software, QuickBooks Online provides easy access to bookkeeping support through QuickBooks ProAdvisors, who are trained to provide assistance with installation, setup, troubleshooting, and general support for QuickBooks users. Since it’s popular in the US, you can easily find a QuickBooks ProAdvisor if needed.

Alternatively, you can sign up for the QuickBooks Live Bookkeeping add-on if you need professional help with categorizing transactions, reconciling accounts, and generating reports. You’ll be matched with your own dedicated bookkeeper who will provide you with personalized support, guidance, and expertise. Head out to our QuickBooks Live Bookkeeping review to learn more.

QuickBooks Online also has a vast community of users who provide support and guidance. An active online forum allows users to post questions and receive answers from other users, including QuickBooks ProAdvisors.

QuickBooks Online aces almost all the categories in our evaluation, but its most notable strengths lie in its accounting features, including banking, A/P and A/R management, reporting, inventory, and integrations. It also did well in customer support because of access to a huge network of QuickBooks ProAdvisors, but we docked a few points because you can’t directly initiate a phone call to an agent unless you subscribe to Advanced.

Additionally, the mobile app lost some points because it doesn’t allow you to enter and track bills and record billable time—things you can do with Zoho Books’ mobile app. QuickBooks earned a relatively high mark for pricing; however, we deducted a few points because of its slightly higher cost compared to most other similar software. It also did well in ease of use, but it takes time to set up a company.

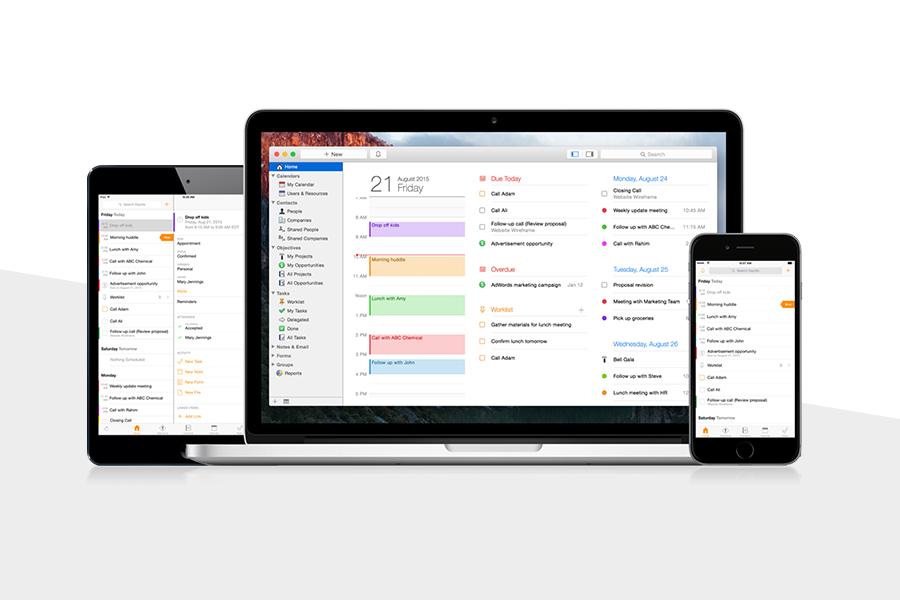

Zoho Books: Best Mobile Accounting App for Mac Users

Pros

- Powerful mobile app can perform almost any accounting task

- Built-in widgets are exclusively designed for Mac users, such as Zoho Notebook and Zoho Doc Scanner

- More affordable than most similar accounting software

- Integrates with several Zoho applications to automate business processes

- Free plan for businesses with $50,000 or less in annual revenue

Cons

- No unlimited invoices in the free plan

- No integrations with tax preparation software

- Requires a separate subscription to Gusto for payroll integration

- Can’t set up multiple companies in a single account

- Must upgrade to higher plans to access advanced features like project accounting and inventory management

Zoho Books offers six plans, each accommodating a specific number of users. All plans include basic features, like invoicing and bank reconciliation, but the higher subscription options include advanced functionality, like unlimited invoicing, enhanced inventory, and advanced analytics.

- Free: $0 for businesses that make $50,000 or less in revenue per year

- Standard: $20 per organization, per month, for up to three users

- Professional: $50 per organization, per month, for up to five user

- Premium: $70 per organization, per month, for up to 10 users

- Elite: $150 per organization, per month, for up to 10 users

- Ultimate: $275 per organization, per month, for up to 15 users

Zoho Books has a 14-day free trial, and additional seats are available for $3 monthly per user. You may also purchase the following add-ons:

- Advanced auto-scans: $10 for 50 scans per month in all plans

- Snail mails: $2 per credit in all plans

We included Zoho Books in our list of the best accounting software for Mac because of its fantastic mobile app, which leads our roundup of the best mobile accounting apps. It lets you perform all the basic accounting functions you need to manage your business, like sending invoices and accepting online payments. Unlike QuickBooks, the app can do more by allowing you to enter unpaid bills, record bill payments, and log time entries.

Another key feature that sets Zoho Books apart from the competition is that it has many integrated Mac-specific features, including Quick Notes, Live Text, Lock Screen widgets, and Weather Kit. These can help improve different aspects of your business, such as workforce identity and access management, document signing, and mobile invoicing. For example, a construction company can use the Weather Kit feature to check the weather conditions at a job site before sending workers out.

Zoho Books earned perfect marks for mobile app, inventory, general features, integrations, and pricing. We also found it commendable in other areas, like A/P and A/R management, banking, and reporting. On the flip side, it took a hit for pricing because only a certain number of users can access the software. For instance, in the Zoho Books Professional plan, which is the basis for this evaluation, only five users are included, and you have to pay $3 monthly for each additional member.

Zoho Books could have done better in customer support if it had an extensive network of certified advisors. Compared to QuickBooks Online, it can be more difficult to find professional bookkeepers who are proficient in Zoho Books. However, we appreciate that Zoho Books offers direct phone support to all paid users, unlike QuickBooks Online where you have to wait for customer support to call you.

FreshBooks: Best for Service-based Businesses & Freelancers

Pros

- Able to compare estimate vs actual budget costs

- Easily track billable time and add to invoices

- Intuitive and easy-to-use interface

- Automatic mileage tracking on iOS app

- Provides phone support and live chat

Cons

- Supports only a single user in the base price of all plans; $11 fee for each additional user monthly

- No inventory management or cost tracking features

- Not able to track cash balances without establishing automatic bank feeds

- Lacks Mac-specific widgets

FreshBooks has four plans, and if you buy now, then you get either 60% off for four months or a 30-day free trial:

- Lite: $19 per month for one user and five billable clients

- Plus: $33 per month for one user and 50 billable clients

- Premium: $60 per month for one user and unlimited billable clients

- Select: Custom-priced

All plans come with one user, and additional seats can be added to any plan for $11 per user, per month.

FreshBooks is focused on the needs of service-based businesses and freelancers due to its strong project accounting features. It includes a built-in time tracking tool that makes it easy to monitor the time spent on projects and bill clients accurately. After tracking work hours, you can create invoices from the time entries directly on the platform and then send them out to your clients.

Other software also have standard project accounting features, but FreshBooks stands out because of its ability to compare estimated costs against actual costs. QuickBooks also has this feature, but it’s only offered in the most expensive plan, QuickBooks Online Advanced.

Additionally, FreshBooks includes the ability to easily create professional-looking documents with your customized logo, set up recurring invoices, and automatically calculate late fees. This makes it our best invoicing software for freelancers and solopreneurs.

FreshBooks’ highest scores come from project accounting, A/R management, integrations, and ease of use. Unfortunately, it didn’t meet our expectations in other areas, like pricing, inventory, and customer support. We docked significant points for pricing because only one user is included in all plans, and you have to pay $11 monthly for each additional user. It also scored poorly in inventory, mainly because of its inability to track COGS and inventory items.

While FreshBooks offers direct phone support to users, we deducted points for customer service because it has no live chat feature and online user communities. Also, seeking bookkeeping support is difficult because of the limited network of independent bookkeepers who are knowledgeable about the FreshBooks program.

Xero: Best Mac Accounting Software for Businesses With Many Users

Pros

- Add more users without additional fees

- Strong inventory accounting features but at a more affordable price than most competitors

- Includes iOS mobile app for invoicing, receipt scanning, and expense tracking

- Access to a network of Xero Advisors

Cons

- Includes only 20 invoices and five bills in the lowest plan

- Limited mobile app; can’t record time worked or accept payments

- No telephone and live chat support

- Early: $15 per month up to 20 invoices and five bills

- Growing: $42 per month for unlimited invoices and bills

- Established: $78 per month for unlimited invoices and bills plus project accounting

All plans come with unlimited seats. You can try Xero for free for 30 days.

Xero has almost the same features as QuickBooks Online, including project accounting, inventory management, and an iOS mobile app. However, unlike QuickBooks, it comes with an unlimited number of users in all its plans, making it ideal for SMBs with more than the five users allowed by QuickBooks Online Plus. This means you can easily collaborate with team members, accountants, or stakeholders without any additional costs.

While the platform doesn’t have Mac-specific accounting tools, all its features and apps run smoothly on Apple devices. Mac users can access invoicing, bill payment, project management, expense tracking, and financial reporting.

Xero is exceptional in almost all accounting features, including inventory, project accounting, A/P and A/R management, and reporting. However, it needs some improvement in other aspects, such as pricing, ease of use, customer support, and mobile app. It lost points for pricing because some of the essential features, such as expense claim management and project tracking tools, are available only in the most expensive plan.

Meanwhile, we wish that Xero enhances its customer service by offering live support features, like phone support or live chat. Currently, the only ways to contact Xero are through a chatbot and email. Moreover, Xero’s mobile app is a bit limited, as you can’t use it to capture expense receipts, accept payments, record time worked, and view reports.

Wave: Best Free Cloud Accounting Software for Mac Users

Pros

- Decent accounting feature set in its free plan

- Easier to set up and use than most other similar software

- Free mobile app for creating and sending invoices

- Send unlimited invoices and quotes

- Uses optical character recognition (OCR) technology for receipt scanning

Cons

- Accommodates only a single user in the free plan

- Can’t connect bank accounts in the free version

- Not a good fit for large businesses; lacks advanced features like project accounting and inventory management

- Live support can only be accessed when you purchase an add-on or upgrade to the paid plan

Wave offers a free version (Starter) for accounting and invoicing and a paid plan (Pro) for unlimited users at $16 monthly or $170 annually. With Pro, you’ll get access to additional features, such as bank connections, receipt capture, and live chat and email support.

If needed, you can also purchase add-ons, including:

- Bookkeeping support (Wave Advisor): $149 per month (available in Starter and Pro)

- Assisted payroll (Wave Payroll): $40 per month for tax service states and $20 per month for self-service states plus $6 monthly per employee (available in Starter and Pro)

- Unlimited receipt scanning: $11 per month or $96 per year (Starter only; included in Pro)

If you want a free option for accounting and invoicing, then you might want to give Wave Starter a try. It lets you create and send an unlimited number of invoices to clients and offers an extensive list of accounting features, making it our top-recommended free accounting software.

It offers a range of features that are typically only available with paid accounting software, including invoicing, expense tracking, bill payment, and financial reporting. In addition, it has several premium features at an affordable cost, including payroll and payment processing.

Another benefit of Wave is that it has a simple user interface that is optimized for both PC and Mac users. The Mac interface is clean and organized, with all of the important features and functions easily accessible—making it a great option for users with no accounting background.

Wave stood out in pricing and ease of use which is expected from the free plan. However, as a trade-off, it didn’t quite measure up in terms of features. For instance, while it did a good job at A/R and tax management, it lacks inventory management and project accounting. It also scored poorly in customer service because it doesn’t offer live chat unless you purchase an add-on or upgrade to Pro. Additionally, there’s a mobile app available, but you can only use it for sending invoices and processing online payments.

GnuCash: Best Free Open-source Accounting Software for Mac Users

Pros

- Track both personal and business income and expenses

- Completely free open-source software, ideal for users with basic coding skills or those working with developers

- Decent accounting features, including the ability to print checks and track unpaid bills

Cons

- No inventory management features

- No mobile accounting app

- Traditional user interface; recommended for those who are comfortable with desktop software

GnuCash is completely available for free; however, you can make donations to its creators through its dedicated donation page. You can download the program for free on Mac OS X, Linux, and Microsoft Windows devices.

GnuCash is a free open-source desktop program that we recommend for Mac users who have basic coding skills or those who are working with developers. As an open-source software, you can access and modify the codes based on your specific requirements and integrate the program with other systems if needed. If you’re not planning on customizing the software, we highly recommend using Wave instead as we find it much simpler.

One key feature of GnuCash is that it can be used for both personal and business use. For instance, it allows you to set up separate files for your personal and each of your business entities. This allows you to better track your income and expenses associated with each entity and helps you better allocate your resources.

The program has a good set of accounting features, including A/P and A/R management, banking and cash management, and reporting. However, it’s not as extensive as other leading Mac accounting software like Zoho Books and QuickBooks Online. For instance, it has no iOS mobile app and doesn’t allow you to track inventory and COGS. If you have basic accounting needs and prefer locally installed software that you can use for free, then GnuCash should be enough.

GnuCash aced pricing and received a fairly high score for banking. On the downside, as a free software, we found many missing features, including project accounting and inventory. It has A/P and A/R management tools, but they are somewhat limited. For instance, we don’t recommend GnuCash for invoicing due to its limited invoice customization options.

Additionally, the program received low marks for ease of use and customer support. It has a steep learning curve as it requires coding skills to customize, and there’s no way to contact support in case you need help. You can only rely on self-help guides like blogs and setup guides.

How We Evaluated the Best Accounting Software for Mac

We evaluated the best Mac-based accounting software using our internal case study, with a focus on the following criteria:

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users.

5% of Overall Score

This section focuses more on first-time setup and software settings. The platform must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

5% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

5% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

5% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

10% of Overall Score

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform.

10% of Overall Score

This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

10% of Overall Score

Ease of use includes the layout of the dashboard and whether new transactions can be initiated from the dashboard rather than having to navigate to a particular module. Other factors considered are user reviews specific to ease of use and a subjective evaluation by our experts of both the UI and general ease of use.

5% of Overall Score

This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

5% of Overall Score

The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Some of the features we looked into include the ability to create and send invoices, accept online payments, enter and track bills, and view reports on the go.

7% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

You must choose software that’s easy to use and accessible and has good customer support. It should have essential accounting tools like income and expense tracking and invoicing, and if possible, look for a program with Mac-specific features, like iCloud document sharing.

The best Mac accounting software depends on your needs. If you work remotely and need a program that’s easy to use and has great features, like class and location tracking, then choose QuickBooks Online. If mobile accounting is a priority, choose Zoho Books.

Yes, especially if you only have simple accounting needs, like invoicing and income and expense tracking.

No, as most accounting software for Macs is designed to be user-friendly.

We reviewed Mac accounting software that ranges from $0 (free) to over $200 per month.

Bottom Line

The best accounting software for Mac is the one that’s easy to use and provides the features that you need at a price you can afford. If budget isn’t a concern and you need a comprehensive accounting software program, you can choose from premium accounting programs like QuickBooks Online, Zoho Books, Xero, and FreshBooks. If you’re a solopreneur or just starting a business, Wave or GnuCash can help you handle your invoice and income and expense tracking needs for free.