The best restaurant payroll software helps process employee salaries accurately and on time while offering tools to manage payroll taxes, monitor attendance, and track tips. It must also be easy to use, have good client support, and handle the complexities of paying restaurant staff efficiently. Pricing is also important, especially for small establishments, so a reasonably priced plan with unlimited payroll runs is ideal.

Here are the eight best restaurant payroll services for small businesses:

- Gusto: Best overall

- Square Payroll: Best for bars and cafes using Square POS

- QuickBooks Payroll: Best for mom-and-pop shops hiring contractors

- Homebase Payroll: Best for hourly workers

- Paychex: Best for restaurants needing expert payroll support

- SurePayroll: Best affordable payroll for DIY taxes

- OnPay: Best for client support and delegating payroll tasks

- ADP Run: Best for scaling with fast-growing restaurant businesses

Best Restaurant Payroll Software Compared

Our Score (out of 5) | Starter Monthly Pricing | Special Contractor-only Payroll | Multistate Payroll | Health Benefits Available in 50 States | |

|---|---|---|---|---|---|

| 4.64 | $49 per month + $6 per person per month | Included in higher tiers | ✓ | |

| 4.60 | $6 per employee + $35 base fee | $6 per contractor monthly | ✓ | ✓ |

| 3.96 | $6 per employee + $50 base fee | $15 monthly for 20 contractors; plus $2 per additional worker | ✓ | ✓ |

3.85 | ✕ | ✓ | ✕ | ||

| 3.84 | $5 per employee + $39 base fee | ✕ | ✓ | ✓ |

| 3.81 | ✕ | ✓ | ✓ | |

| 3.81 | $6 per employee + $40 base fee | ✕ | ✓ | ✓ |

| 3.76 | ✕ | ✓ | ✓ | |

If you need more information before choosing a provider, check out our easy guide to understanding restaurant payroll. We walk you through everything you’ll need for restaurant payroll, from tips and tipped minimum wage to labor laws.

Monthly Fee Calculator: Compare Costs

Use our online calculator to compute the estimated monthly fees of our top-recommended restaurant payroll services.

Gusto: Best Overall Payroll Software for Restaurants

Pros

- Unlimited and automated pay runs with electronic tax payments, filings, and year-end reports

- Two-, four-, and next-day direct deposits

- Reasonably priced plans with a contractor-only payroll option

- New hire reporting for contractors and state payroll tax registration assistance if you’re setting up a new business in another state

Cons

- Limited premade reports

- Extra fees for state payroll tax registration services

- Next-day direct deposits, time tracking, hiring, and HR advisory services only included in higher tiers

Overview

Who should use it:

Gusto has all of the essential features you need to pay restaurant staff, calculate and file payroll taxes (federal, state, and local), track attendance, manage benefits, and onboard employees, making it our top pick overall.

It can generate and file W-2 and 1099 forms automatically. Its full-service payroll covers all 50 US states and includes tip reporting, direct deposits, and flexible payroll capabilities, such as multistate payroll processing and multiple pay options, rates, and schedules.

The platform also allows you to enter cash tips that staff receive during work hours to ensure they’re taxed properly. This can be a huge time-saver and avoids manually doing these calculations.

Why we like it:

In our evaluation, Gusto earned an overall score of 4.64 out of 5. It received perfect marks in nearly all criteria, including pricing, given its transparent fees, multiple plan options, unlimited pay runs, and a reasonably priced starter plan.

However, Gusto’s pricing isn’t as affordable as Square Payroll, SurePayroll, and Homebase Payroll. It also has limited health insurance coverage, and while its interface is intuitive, it isn’t all customizable.

Users on third-party review sites like Gusto because of how easy it is to integrate payroll into the workflow for any size business. They also raved about the autosync and tax payment features as going above and beyond other products.

- G2: 4.5 out of 5; 2,000-plus reviews

- Capterra: 4.6 out of 5; 3,900-plus reviews

- Simple: $49 per month + $6 per person per month

- Includes full-service payroll, tax filings, payroll tax filings, single state pay processing, two- and four-day direct deposits, employee benefits, new hire reporting, offer letter templates, onboarding, and basic support

- Plus: $80 per month + $12 per employee monthly

- Simple + next-day direct deposits, time and paid time off (PTO) tracking, applicant tracking, basic job postings, project tracking, and full support with extended support hours

- Premium: $180 per month + $22 per employee monthly

- Plus + performance reviews, surveys, full-service payroll migration, access to HR experts, direct line to priority phone and email support, and a dedicated account manager

- Contractor-only plan: $35 per month + $6 per contractor monthly

New clients get discounted pricing of only $6 per contractor monthly (no base fee) for the first six months.

- Full-service payroll, four-day direct deposits, and state new hire reporting

Add-ons

- State payroll tax registration: Pricing varies per state

- Global contractor payments: Pricing shown before payment

- Gusto Global EoR services: $699 per employee per month

- Next-day direct deposit: $15 per month + $3 per employee monthly*

- Time tracking: $6 per employee monthly*

- Priority support: $30 per month + $3 per employee monthly**

- HR resources: $50 per month + $5 per employee monthly**

- Performance: $3 per employee monthly*

- Priority support and HR resources: $8 per employee monthly**

- Health insurance broker integration: $6 per eligible employee monthly

*This is available for the Simple plan holders; free for Plus and Premium tiers

**For the Simple plan only; different add-on package for Plus and free for Premium

- Efficient time tracking and workforce management tools: Aside from monitoring your employees’ and contractors’ time through its system or via the Gusto Wallet, Gusto offers project tracking and workforce costing tools. You can create custom PTO policies and send/approve time-off requests online.

- Multiple pay options: With Gusto, employees are paid through manual checks, pay cards, or direct deposits. The standard direct deposit timelines are two and four days, but subscribing to Gusto’s higher tiers gets you a next-day option.

- Comprehensive employee benefits options: With Gusto, you are granted access to both standard and nonstandard benefits choices, such as retirement, medical, dental, and college savings plans. The only drawback is the limited coverage of its health insurance options (available in only 38 states, plus Washington, D.C.).

- Solid HR solutions and services: Gusto helps you avoid expensive compliance mistakes through its team of HR and tax experts that you can contact for help whenever you need them—provided you get its Premium option. Hiring is also easy with Gusto’s job postings, applicant tracking, and onboarding solutions.

Gusto allows you to input hours worked, bonus and tip amounts, and other earnings while running payroll. (Source: Gusto)

Gusto may have next-day direct deposits, but this is available only in its higher tiers. For fast processing timelines that don’t require plan upgrades, we recommend QuickBooks Payroll, as its starter Simple plan comes with next-day direct deposits (same-day for premium plans). Square Payroll also offers instant payouts through its Square Payments solution.

If offering benefits is important to you and your business is located in one of the states where Gusto’s health insurance isn’t available, consider any of the providers in this guide—except Homebase Payroll, which doesn’t have benefits plans.

Square Payroll: Best for Bars and Cafes Using Square POS

Pros

- Reasonably priced full-service payroll with unlimited pay runs

- Integration with Square POS and comes with free time tracking

- Preparation and filing of year-end reports

- Ability to import credit card tips from POS and do tip pooling and splitting

Cons

- Four-day processing period for direct deposits

- Square Payments account required for Instant payments

- No option to create new reports from scratch

Overview

Who should use it:

If you’re already using Square POS for your restaurant, adding Square Payroll is simple. It has a low-cost full-payroll service, which includes unlimited pay runs, automatic payroll tax calculations, tax filings and payments, and multiple pay options, such as direct deposit, check, and through Square’s mobile payment service, Cash App.

In addition, you get a better value if you use Square POS in your restaurant since this software directly integrates with it. Plus, you get access to Square’s timecard integration for free—allowing you to track employee attendance seamlessly and easily.

Why we like it:

Score-wise, we gave Square Payroll an overall rating of 4.60 out of 5. The software’s standout features, based on our evaluation criteria, are its affordable flat-rate pricing and robust payroll functionalities that include tip management and reporting.

You can import credit card tips from the Square POS and let its “pool and split tips” functionality divide the amount among employees based on the number of hours worked in a pay period.

However, Square’s payroll and customer support are only available through phone and email on weekdays, from 6 a.m. to 6 p.m. Pacific time. In addition, if you’re not yet a Square client, then speaking to a customer representative may be difficult because of the occasional long wait times.

Users also like Square. Although reviews were much lower than typical, Square Payroll scored above a 4 out of 5 across the board. Users like the integration with its POS product, how simple it is to convert time cards into payroll, and automated tax processing.

- G2: 4.2 out of 5; 30 reviews

- Capterra: 4.7 out of 5; 600-plus reviews

- Full-service payroll: $35 + $6 per employee monthly

- Includes unlimited pay runs, payroll tax filings, year-end tax reports, and access to employee benefits

- Contractor-only payroll: $6 per contractor monthly

- Square POS integration: Square Payroll seamlessly integrates with Square POS, making it easy for you to track and import employee time cards, including tips and commissions data, for pay processing. Read our Square POS review for more.

- Online tax filing and reporting: Square Payroll files quarterly and annual taxes automatically and prepares and files W-2s or 1099s. This is unlike Paychex and ADP, which charge fees for some of their payroll tax services. QuickBooks Payroll may not have add-on fees to file taxes for you, but you have to get its highest tier if you want automated local tax filings.

- Instant payments: While its standard direct deposit processing timeline is four days, if you accept payments via Square and have a Square balance, then you can activate its “Instant Payments” feature. This allows you to pay employees instantly via its Cash App, provided you have sufficient funds in your Square account.

Learn more about what is Square in our guide.

You can import timecards, change payment methods, and manually input work hours and additional payments directly into Square Payroll. (Source: Square Payroll)

If you aren’t a Square user but still want fast payments, try QuickBooks Payroll. It offers next-day direct deposits and even a same-day option, provided you get its higher tiers. Gusto, Paychex, and ADP are also good alternatives if you’re looking for full-service payroll with a wide suite of HR solutions to manage the entire employee lifecycle.

QuickBooks Payroll: Best for Mom-and-Pop Shops Hiring Contractors

Pros

- Reasonably priced plans with unlimited and automated pay runs

- Seamless integration with QuickBooks Accounting

- Same- and next-day direct deposits

- Low-cost contractor payments plan

Cons

- Limited integration options (of non-Intuit products); QuickBooks Accounting account required to unlock full integrations

- Local tax filings available only in higher tiers

- 24/7 product support and HR advisory services included only in the Elite plan

Overview

Who should use it:

QuickBooks has released a Contractor Payments package that’s optimal for businesses with only contract workers. For $15 per month, you can process payments for up to 20 workers (plus $2 for each additional contractor), e-file 1099 forms, and pay contractors via next-day direct deposits.

Plus, its contractor payments package is cheaper than plans from Square Payroll and Gusto, making QuickBooks Payroll a great option for small contractor-only businesses.

Why we like it:

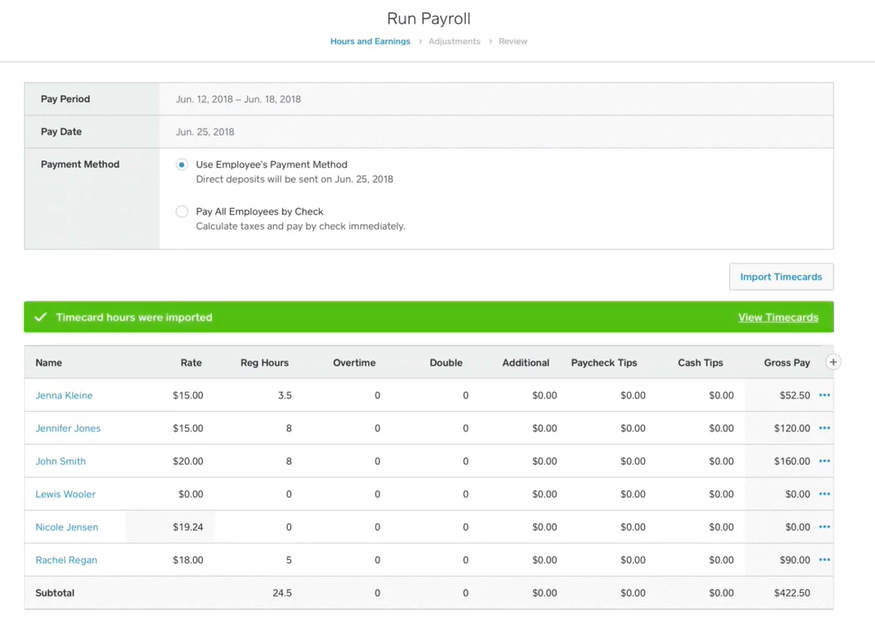

Based on our criteria, QuickBooks Payroll received an overall score of 3.96 out of 5. Its fast unlimited pay runs, automated payroll tax calculations, year-end filings, and customizable reports also earned QuickBooks Payroll high marks for payment features and reporting tools.

It also has one of the fastest direct deposit timelines—processing within 24 hours. This is unlike similar payroll software providers that typically offer two- to four-day processing.

In addition, it has restaurant-specific functionalities that allow you to track time and manage tips. The platform allows you to enter cash and credit card tips into its system, enabling it to withhold the applicable taxes. For cash tips, it will calculate the taxes but not include the tip in the employees’ actual pay since they already received the money as cash.

User ratings are average on third-party review sites; however, users like that it has an easy setup and good customer service. One user even said they like how QuickBooks Payroll allows their small business to have the look and feel of a big corporation.

- G2: 3.8 out of 5; 60-plus reviews

- Capterra: 4.4 out of 5; 850-plus reviews

- Core: $50 per month + $6 per employee monthly:

- Includes full-service payroll, next-day direct deposit, federal and state tax filings and payments, and access to 401(k) plans and benefits

- Premium: $85 per month + $9 per employee monthly:

- Core plus same-day direct deposit; federal, state, and local tax payments and filings; workers’ compensation administration; and HR support center

- Elite: $130 per month + $11 per employee monthly:

- Premium plus multiple state tax filing, project tracking, personal HR adviser, tax penalty protection up to $25,000 per year, and expert setup

- Contractor payments package: $15 monthly for 20 workers; plus $2 for each additional contractor

- Includes next-day direct deposits, 1099 e-filings, and a contractor self-setup tool

- Fast direct deposits: Apart from next-day direct deposits, you can pay employees through same-day direct deposit at no extra cost, provided you subscribe to QuickBooks Payroll’s higher tiers. Most of the providers on this list have a standard two-day processing time—although Square Payroll offers instant payments if you activate its “Instant Payments” feature and have funds in your Square account.

- Tax penalty protection: QuickBooks will cover the penalty and interest for any payroll tax error for up to $25,000 a year—regardless of who made the mistake. You must purchase its Elite plan to have your errors covered. Experts will also represent you before the IRS and concerned agencies and will assist you in resolving the problem. No other providers on our list will offer to cover tax mistakes you make under any circumstance.

- Seamless integration with QuickBooks Accounting: For businesses already using QuickBooks Online for their accounting needs, the direct integration between platforms makes QuickBooks Payroll a great option. With the click of a button, all payroll information can be directly synced to your accounting system, making payroll and tax costs so much easier to track.

Learn more in our QuickBooks Online review.

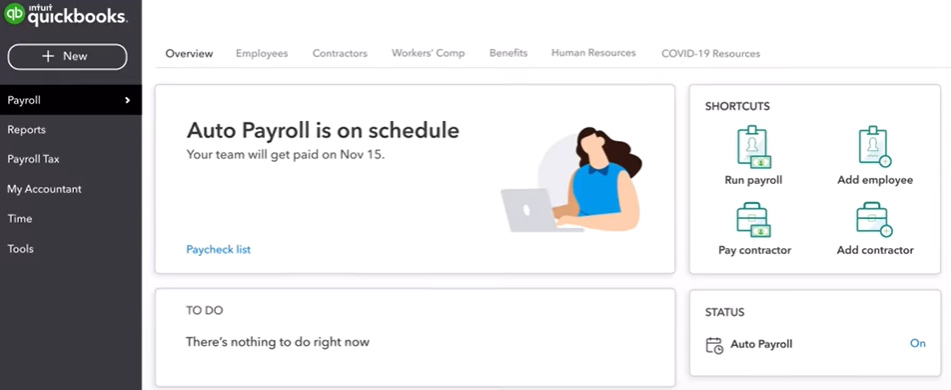

Aside from a “to-do” list, QuickBooks Payroll’s dashboard contains helpful links for processing staff payments and adding new employees to its system. (Source: QuickBooks Payroll)

Unlike the other payroll software for restaurants we reviewed, you have to upgrade to either the Premium or Elite plan if you want QuickBooks Payroll to handle your local tax filings. Plus, if you already have an accounting system and don’t plan to switch to QuickBooks, you’ll find more reasonably priced options for paying employees with SurePayroll, Square Payroll, and Homebase Payroll.

Homebase Payroll: Best for Hourly Workers

Pros

- Flat pricing with reasonable monthly fees

- Feature-rich platform that includes time tracking, scheduling, job postings, and applicant tracking tools

- Unlimited pay runs with automated payroll tax payments and filings

Cons

- No health insurance options

- PTO tracking, onboarding, and access to HR advisers not included; you have to upgrade to its core platform’s paid plans

- Add-on fees to include payroll module in its main scheduling/time tracking platform (although it has a free plan)

Overview

Who should use it:

Homebase is designed specifically for hourly teams, as it comes with essential scheduling and time tracking tools to help you manage your hourly workforce more efficiently. It offers job postings, applicant tracking, PTO management, new hire onboarding, and time clock apps.

The platform has added a payroll module to its suite of time tracking and scheduling solutions. Similar to Square Payroll, Homebase Payroll offers flat pricing for its easy-to-use pay processing solution, which includes automated payroll tax payment and filing services.

Why we like it:

Homebase Payroll earned an overall score of 3.85 out of 5 in our evaluation. Its reasonably priced plan with flat pricing and robust HR tools contributed to its high scores (4 and up) in several criteria. However, the lack of online third-party Homebase Payroll reviews resulted in it getting a zero rating in our popularity criterion.

Homebase’s main platform does rank well among users on third-party review sites. They like the scheduling and time tracking capabilities, as well as labor cost reporting. Others like the ability to cash out money early for the next check.

- G2: 4.2 out of 5; 100-plus reviews

- Capterra: 4.6 out of 5; 1,000-plus reviews

- Robust payroll plan: Homebase Payroll is the only payroll system for small businesses that we reviewed that’s affordably priced and comes with several HR features. You get hiring, onboarding, time tracking, and scheduling tools in addition to full-service payroll and automatic tax filing services.

- Early access to wages: Similar to Gusto and Square Payroll, Homebase Payroll offers an employee perk that grants your staff early access to wages. Your workers can transfer a portion of their salary to their bank account before payday to help pay for emergency expenses.

- Time tracking integration: Because Homebase is a time tracking and scheduling app first, it seamlessly integrates with its payroll solution. This means you can schedule employees, track their time, and push it directly to payroll for processing.

With Homebase Payroll, you can run payroll in three easy steps. (Source: Homebase)

While Homebase Payroll is generally easy to use, it isn’t as simple to set up as most of the payroll software in this guide. It also only offers its two-day direct deposits to qualified companies.

If you don’t qualify, your direct deposit processing timeline will be four days. We recommend QuickBooks Payroll for fast payments that aren’t restricted to certain companies. If you prefer check payments, both ADP Run and Paychex can help you prepare employee paychecks.

Paychex: Best for Restaurants Needing Expert Payroll Support

Pros

- User-friendly and intuitive interface

- Multiple pay options, such as direct deposits, paper checks, pay cards, and pay-on-demand

- Customizable plans; 24/7 customer support included in all tiers

- Automatic calculations of tip pooling and sharing amounts

Cons

- Not all pricing details are transparent

- Extra fees for automatic W-2 and 1099 tax forms

- Access to a dedicated payroll specialist available only in higher tiers

- Add-on fees for time tracking

Overview

Who should use it:

With Paychex Flex Select and Paychex Flex Pro, business owners get access to dedicated support representatives that can help with anything they may need throughout the payroll process. This is a huge plus for business owners that want a do-it-yourself (DIY) approach to payroll but need the support of experts to feel confident.

You also get multiple pay options that enable you to process direct deposits, paper checks, and pay cards. Moreover, what sets it apart from other payroll providers is its pay-on-demand feature, providing your employees the option to access their earned pay―up to $500―before payday.

Why we like it:

Paychex earned an overall rating of 3.84 out of 5 in our evaluation. It received high scores for payroll and HR features, primarily because it offers a suite of solutions for processing employee pay, managing payroll taxes, reporting tips, tracking attendance, onboarding new hires, and conducting background checks. Its platform even has employee performance and learning management tools.

Paychex averaged a 4.2 out of 5 across multiple third-party review sites. Users liked its analytics features with automated reporting capabilities. They also stated that its personalized customer service makes the product easy to use.

- G2: 4.2 out of 5; 1,500-plus reviews

- Capterra: 4.2 out of 5; 1,500-plus reviews

- Paychex Flex Select: $39 per month + $5 per employee

Pricing is listed as starting at $39 per month plus $5 per employee. However, you must contact Paychex for a custom quote.

:

- Includes online payroll and tax filing services, direct deposits, new hire reporting, and financial wellness

- Paychex Flex Pro: Custom-priced:

- Everything in Select plan, plus full-service payroll and tax filing services, check logo and signing services, garnishment payments, general ledger services, and access to a dedicated payroll specialist

- Paychex Flex Enterprise: Custom-priced:

- Everything in Pro plan, plus onboarding, background checks, state unemployment insurance (SUI) services, performance management, document management, job costing and labor distribution, and an employee handbook builder

- Add-ons

Add-ons are an additional cost. You must first purchase one of the Paychex Flex plans listed.

:

- HR Analytics

- Time and Attendance

- Learning Management System

- Retirement Plans and Readiness Dashboard Tools

- Workers’ Compensation Coverage

- Business Insurance

- Benefits Administration

- Group Health Benefits

- FSA, HSA, and HRA

- COBRA

- Premium Only Plan

- Paychex Integrations

- Flexible plan options: Paychex offers flexible HR and payroll packages that target businesses of all sizes. Its Paychex Solo plan is ideal for solopreneurs and the self-employed. Paychex also has a professional employer organization (PEO) service to help you manage essential day-to-day HR processes.

- Dedicated payroll support: Paychex is the only restaurant payroll software provider we reviewed that assigns a dedicated payroll specialist to its clients. This is great if your in-house HR staff isn’t knowledgeable in handling pay processing and payroll tax filings.

- Paychex Voice Assist: Offers a hands-off experience in processing, reviewing, updating, and submitting payroll. This voice-activated tool, which works on any Google Assistant-compatible device, comes with built-in verification and artificial intelligence (AI) solutions for user authentication. You can start a new pay period, make adjustments, or continue a pay run that’s already in progress—without having to manually log into your Paychex Flex account.

- Paychex Flex Perks: A digital employee benefits marketplace that includes early access to earned wages, financial wellness solutions, and voluntary lifestyle benefits for employees. This is a brand new (as of August 2024) solution offered to help employees manage their personal well-being.

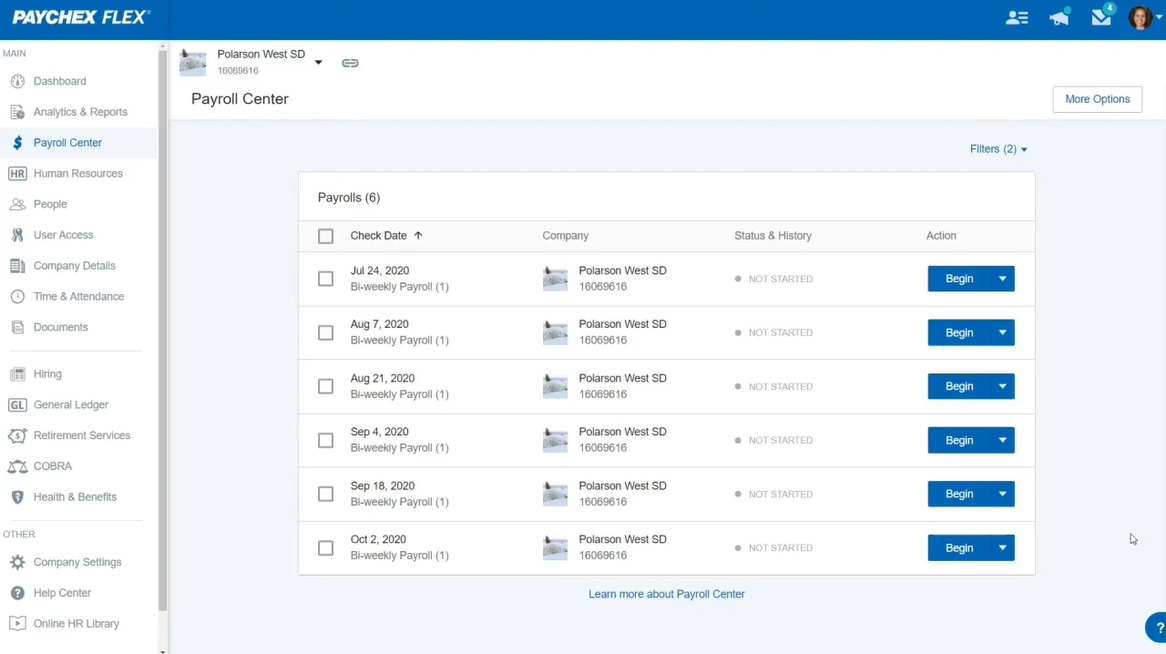

Paychex Flex’s “Payroll Center” contains a list of pay runs you can start, resume, and complete. (Source: Paychex)

Paychex’s HR payroll platform may be too feature-rich for those only needing pay processing tools. If you don’t require learning management solutions and an employee handbook builder, try SurePayroll. Restaurants with small teams can benefit from its Full Service plan with tax filing support.

And, in case you only have up to 10 employees and prefer to file tax forms yourself (or have an in-house HR staff who can handle this), SurePayroll has a low-cost “No Tax Filing” option.

SurePayroll: Best for Affordable Payroll for DIY Tax Filings

Pros

- Unlimited and automatic pay runs

- Affordable full-service payroll and DIY tax filing plans

- Minimum wage notifications and tip sign-off reports

Cons

- Add-on fees for Ohio and Pennsylvania local tax filings

- Extra fees for accounting and time tracking integrations

- No integration with POS systems

Overview

Who should use it:

SurePayroll, a subsidiary of Paychex, is designed specifically for small businesses and is more affordable than other restaurant payroll solutions on our list. It has a low-cost “No Tax Filing” plan that allows you to run unlimited payrolls for a monthly fee of $20 plus $4 per employee. This is a great option for small businesses that are able to handle their own tax filings. Meanwhile, its full-service plan, which includes unlimited pay runs and payroll tax filings, costs $39 plus $7 per employee monthly.

Why we like it:

In our evaluation, SurePayroll earned an overall score of 3.81 out of 5. The software earned high scores (4 and up) for pricing, HR tools, and reporting capabilities. It would have ranked higher on our list if it had pay-on-demand and built-in time tracking functionalities. Its low popularity scores—primarily because of having less than 1,000 user reviews in G2 and Capterra—also pulled its overall rating down.

Aside from unlimited pay runs, SurePayroll can help you manage restaurant-specific taxes and payments. It has Federal Insurance Contribution Act (FICA) tip credit reports for tracking and calculating how much you claim on annual business taxes. It even offers tip sign-off reports, which can serve as written proof that your workers’ tips have been declared and received.

From a user standpoint, SurePayroll ranked well on third-party review sites. Users like the competitive pricing and how easy it is to set up and use. Plus, they report accurate federal and state tax filings and how easy payroll is to run and check for errors.

- G2: 4.4 out of 5; 500-plus reviews

- Capterra: 4.2 out of 5; 200-plus reviews

- Full-Service plan: $29 + $7 per employee monthly

- Includes unlimited pay runs, payroll tax filings, year-end tax reporting, two-day direct deposits, online pay stubs, and new hire reporting

- No Tax Filing plan

The No Tax Filing plan is ideal for paying contractors and 1099 workers.

: $20 + $4 per employee monthly

- Includes unlimited pay runs, four-day direct deposits, online pay stubs, and new hire reporting

Additional Plans & Solutions

- Household Payroll Plan: $39 per month (includes one employee) + $10 each additional employee

- SureHR: pricing starts at $25 per month plus $5 per employee; includes live on-demand HR services from certified professionals

- 401K: pricing varies

- Workers’ Compensation: pricing varies

- Health Insurance: pricing varies

Add-ons

- Local tax filing services: $9.99 per month

- Multiple state tax filings: $9.99 per month

- Stratustime integrated time clock: $5 per month + $3 per employee per month

- Integrate your time clock: $9.99 per month

- Accounting software integration: $4.99 per month

- Unlimited and automatic payroll runs: With SurePayroll, you can process employee payments as many times as you need—unlike ADP, which charges fees for every pay run. You can even set it to process payroll automatically. This is a helpful option for those who don’t expect any changes to their pay runs. It even handles payroll tax payments, quarterly filings, and year-end tax reporting for you—provided you subscribe to its Full-Service plan.

- Multiple employee payment options: SurePayroll pays your hourly and salaried employees via direct deposits. If you prefer paychecks, it has check printing capabilities, although you print the checks yourself.

- Customer support: You can contact SurePayroll’s support team easily through chat, phone, or fax. The provider’s customer service runs six days a week, Mondays through Saturdays, with extended weekday evening and weekend hours. Apart from ADP Run and Paychex—which provide 24/7 support across all of its plans—none of the software we reviewed offers live phone support on weekends.

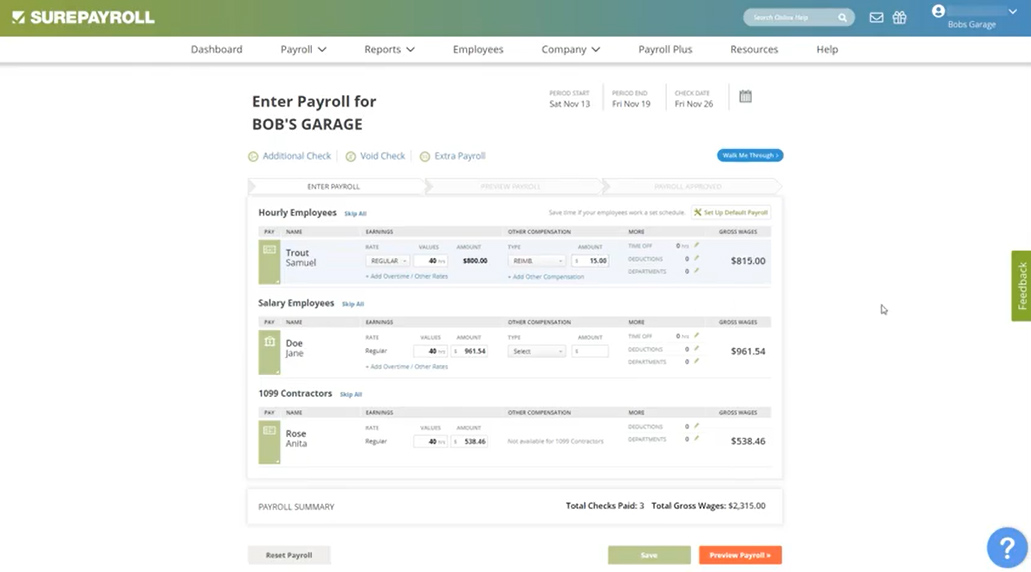

A snapshot of SurePayroll’s pay processing tool where you can input hours worked and additional earnings (Source: SurePayroll)

SurePayroll doesn’t integrate with POS systems. If you’re a Square POS user, consider Square Payroll; but if you’re a non-Square user, the other payroll software in this guide can connect with POS solutions (except OnPay).

Square Payroll, Gusto, ADP Run, OnPay, and Paychex are good options if you’re looking for multiple payment options—from direct deposits to manual checks. For stress-free paycheck processing, we recommend ADP Run, as it offers check signing, stuffing, and delivery services.

OnPay: Best for Client Support & Delegating Payroll Tasks

Pros

- Flat pricing with reasonably priced monthly fees

- Unlimited pay runs with payroll tax filing services

- Preparation of Form 8846 and assistance in calculating tips

- Six levels of system permissions for delegating payroll tasks

Cons

- Eligibility for two- or four-day direct deposits based on OnPay’s risk assessment

- Limited third-party software integrations; no integration with POS systems

- Extra fees for W-2/1099 form printing and mailing services (online forms are free)

Overview

Who should use it:

For those with in-house HR staff familiar with running payroll, OnPay allows you to delegate pay processing tasks and control payroll access through its six-level system permissions. None of the restaurant payroll services in this guide have system permissions that are as robust as OnPay’s. New clients even get setup and data migration support, including customization assistance for third-party software integrations.

What’s also great about this software is its restaurant-specific services that include automatic tip calculations and Form 8846 filings. If you’re a new restaurateur, it can even help you set up minimum wage tip calculations. However, don’t expect to integrate your POS with this software—its partner systems only include QuickBooks, Xero, QuickBooks Time, Deputy, When I Work, Mineral, and PosterElite as of this writing.

Why we like it:

In our evaluation, OnPay earned an overall rating of 3.81 out of 5, with high scores (4 and up) in most of our criteria. It didn’t rank higher on our list because of its limited number of user reviews in G2 and Capterra (fewer than 1,000) and the lack of POS integrations.

Similar to Homebase Payroll and Square Payroll, OnPay offers flat pricing for its payroll and basic HR solutions—another reasonably priced payroll plan in this guide. It provides health benefits with coverage that extends to all US states.

Although the number of reviews was low, OnPay received the highest marks for third-party reviews than any other provider on our list. Users love how feature-laden and easy-to-use the platform is, both on desktop and mobile devices. They also liked the live chat feature when they have questions, with instant responses.

- G2: 4.8 out of 5; 300-plus reviews

- Capterra: 4.8 out of 5; 400-plus reviews

- $40 + $6 per employee monthly

- Includes payroll processing, multiple payment options, payroll tax management, onboarding and new hire reporting, PTO management, employee benefits, self-service portal, reporting tools, and third-party integrations

- Unlimited payroll runs: Like the other restaurant payroll software we reviewed, OnPay lets you run payroll for both employees and contractors as many times as you need and want without having to pay extra. You can also generate year-end W-2s and 1099s without paying a per-employee rate (Paychex and ADP Run charge extra for this).

- Multiple employee payment options: With OnPay, employees can get their wages through direct deposits, debit cards, and paychecks. While it offers both two- and four-day direct deposit options, you have to undergo OnPay’s risk assessment to determine the processing timeline that will apply to you.

- Essential HR tools: Streamline onboarding processes with OnPay’s in-app offer letters, online I-9 and W-4 forms, e-signature tool, and automated onboarding workflows. It handles state new hire reporting, plus you can create custom checklists to ensure that incoming employees complete all the new hire requirements. If you need HR guides and legal templates, OnPay has an online HR resource library that you can access.

- Employee benefits: Unlike Gusto’s limited health insurance coverage (only 38 states + Washington, D.C., as of this writing), OnPay’s health plans are available in all US states. Your employees are also granted access to dental, vision, disability, and retirement plans. Further, OnPay can easily generate employee census data reports that you can use when requesting insurance quotes from carriers and benefits providers.

OnPay’s payroll solution (Source: OnPay)

If you want to provide employees early access to earned wages, OnPay lacks the pay-on-demand feature that Square Payroll, Paychex, and ADP Run offer. Similar to Homebase Payroll, two-day direct deposits are only for qualified businesses. We recommend QuickBooks Payroll if you want fast direct deposits—its standard processing timeline is a next-day option.

ADP Run: Best for Scaling With Fast-growing Restaurant Businesses

Pros

- Flexible plans

- Feature-rich with strong HR tools; tax payment and filing services included

- 24/7 customer support

- FICA tip reports provided

Cons

- Nontransparent pricing for full-service payroll

- Extra fees for year-end tax reporting

- Add-on fees for time tracking, health insurance, and workers’ compensation

Overview

Who should use it:

ADP Run is ADP’s web-based payroll solution that’s ideal for growing businesses. With many different plan options available, ADP can cater its platform and offerings to best fit the current needs of your business as it grows and evolves. It has all of the essential features you need to process employee wages, manage payroll taxes, onboard new staff, and complete federal and state new hire reporting.

For restaurateurs, the software also has a time and attendance management module that includes basic tip reporting tools. You can use ADP Run to process credit card tips, enter cash tip amounts, and withhold the applicable taxes. Plus, it can provide FICA tip reports.

Why we like it:

In our evaluation, ADP Run scored 3.76 out of 5. Its feature-rich platform and analytics are just some of the factors that earned this software high ratings (4 and up) for HR, payroll, and reporting tools. While there are not a ton of restaurant-specific features available for use, unlike Gusto and Square, ADP Run offers strong reporting features and timekeeping, which—while not specific to the industry—are equally important for all restaurants to function properly.

Users on third-party review sites like ADP Run for its straightforward interface and easy handling of payroll. They also say their customer service is always polite and helpful. Plus, since it assumes 100% liability for any wrongdoing, users feel at ease that their payroll is compliant and accurate.

- G2: 4.5 out of 5; 1,400-plus reviews

- Capterra: 4.5 out of 5; 750-plus reviews

- Essential: Custom-priced

- Includes full-service payroll, tax filings and year-end tax reports, new hire reporting, and onboarding tools

- Enhanced: $81.66 weekly to pay 25 employees, plus $1.89 per additional worker

Pricing is based on a quote we received.

- Essential plus check signing and stuffing services, SUI management, ZipRecruiter job postings, and background checks

- Complete: Custom-priced

- Enhanced plus access to HR forms, an employee handbook wizard, and a dedicated HR support team

- HR Pro: Custom-priced

- Complete plus online training programs, employee handbook creation assistance, and HR advisory services

- Efficient payroll and tax filing services: In addition to its solid payroll tools, ADP Run offers automated payroll tax payments and filings. It also has built-in compliance tools that notify you of payroll errors.

- Multiple employee payment options: With ADP Run, you can pay your employees via direct deposit and paychecks and through the Wisely Direct Debit Card. It also offers secure paychecks with check signing and stuffing services. ADP will even deliver the sealed envelopes containing employee paychecks to your office so you can distribute these to your staff.

- Employee benefits: While its retirement, health insurance, and workers’ compensation plans are paid add-ons, ADP Run’s starter Essential plan comes with employee discounts. Its partnership with brand-name products and local retailers allows it to provide special pricing and discounted rates, which you can offer as a perk to your workers. None of the providers in this guide have this type of benefit.

- Flexible plan options: In addition to ADP Run’s multiple tiers with full-service payroll and access to essential HR tools, ADP has a wide range of products that can cater to growing businesses. It offers a PEO option, ADP TotalSource, for companies that need to outsource their payroll and HR administration completely.

Read our ADP TotalSource review to learn more.

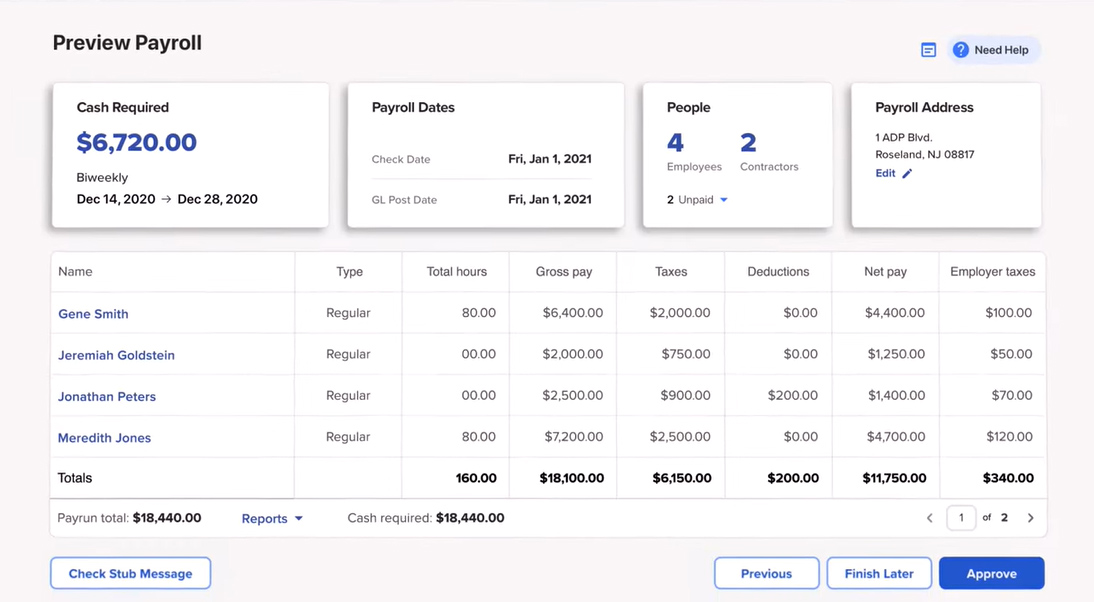

With ADP Run, you can choose to immediately approve payroll or finalize the pay run before the pay period’s payroll deadline. (Source: ADP)

Before you decide on getting ADP Run, note that based on a quote we received, it is the most expensive payroll solution on our list. If you have a limited budget, consider either OnPay, SurePayroll, Square Payroll, or Homebase Payroll, as all these offer reasonably priced plans and unlimited pay runs.

While ADP handles year-end reporting—W-2s and 1099s—it charges extra for this. If you want full-service payroll without paying add-on tax filing fees, we recommend the other restaurant payroll software in this guide, except for Paychex, which also charges extra for year-end filings.

Are you looking for more payroll options? Check out our guide to the best online payroll services for small businesses to help you find the right pay processing solution for you.

How We Evaluated the Best Payroll Software for Restaurants

We compared 14 reputable payroll providers that, apart from processing employee payroll, offer attendance management and restaurant-specific solutions, such as time tracking and tip reporting. We rated each on a five-star scale designed to assess restaurant payroll services, narrowing our list to the top eight.

You can click through the tabs in the box below to see our full evaluation criteria.

20% of Overall Score

We looked at the monthly implementation costs, processing costs, setup, and year-end fees. Payroll providers that offer a plan that’s priced at less than $50 for one employee are rated more favorably since they’re budget-friendly. We also considered whether each provider has transparent pricing, multiple plan options, and unlimited pay runs.

15% of Overall Score

Time tracking features, tipped minimum wage features, tip reporting features, and POS integration options are incredibly important for restaurant owners and can play a huge role in finding the payroll provider that is right for them.

15% of Overall Score

Automatic payroll runs, payroll tax filing, 1099 form preparation, manual check capabilities, and two-day direct deposits are just some of the features that we consider essential payroll services. Providers also get a point if they offer attendance monitoring and restaurant-specific solutions, such as tracking employee time-ins and outs plus managing tips.

15% of Overall Score

In this criterion, we use our expert opinion to assess whether the software’s ease of use and the width and depth of its payroll and HR tools are ideal for small business owners.

15% of Overall Score

Aside from having a user-friendly and intuitive platform, payroll software that integrates with common POS and third-party systems are awarded extra points. Given that restaurants operate on weekends, we also prioritized providers that offer live phone support and a dedicated representative.

10% of Overall Score

Having access to a professional who can provide expert advice on compliance issues is one of the top criteria, including new hire state reporting and online onboarding. Following closely behind these is the capability to provide employee benefits plans and a self-service portal that allows your staff to view payslips and access tax forms online.

5% of Overall Score

We considered user reviews, including those of our competitors, based on a 5-star scale; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.

5% of Overall Score

We find that restaurants benefit more from having customizable reporting tools, as it enables them to easily create their own reports. Hence, providers that offer the said functionality get extra points. Additionally, those that have a selection of basic payroll reports are prioritized.

How to Choose the Best Restaurant Payroll Software

All payroll software may not be right for your restaurant business. When thinking about payroll options, consider the following:

- Budget: If you are a large chain restaurant, budget may not be an issue. However, if you run a small cafe or restaurant, keeping costs down will be essential. Consider a payroll software that is not only affordable but offers a wide range of options.

- Scalability: As your restaurant business grows, so should your payroll software. ADP offers the best scalability on our list; however, others may provide you with the tools you need as your company and employee base grow.

- Legal Compliance: Software that handles tax processes for you is ideal. This ensures that the proper taxes are taken out of each paycheck, including tip tax, and are reported to the correct government.

- Support: Especially for small restaurants, having a dedicated representative may be key. Make sure that the provider you use offers at least fast email communication. Phone and live chat support is ideal.

- Integration: Most restaurants use POS systems for customer payments. Payroll software that integrates, or includes it (like Square), can help streamline your processes.

- Time Management: Software that helps you manage employee schedules and time off, as well as payroll, will allow you to bring recorded time into your payroll for accurate processing.

Frequently Asked Questions (FAQs)

Most restaurants use a payroll system that combines with point-of-sale (POS) payment processing systems. A POS can help with order processing, payments, and inventory control. Because of this, a POS that also offers a payroll option, like Square, is ideal for restaurants.

According to recent statistics, payroll and labor costs for restaurants should not exceed 25%-30% of their total revenue. This means that for every $10 generated, no more than $3 should be spent on payroll, benefits, and required taxes. For this reason, depending on the size of your restaurant, it is important to keep payroll costs low.

The best payroll software for small business depends on the size of your business, what payroll features you are looking for, and your budget. For restaurants with hourly workers, we recommend Homebase. It has payroll software and scheduling capabilities to help your restaurant run smoothly. For growing restaurants, we recommend Paychex. It has increased features as you move up in its plans and can help with learning and performance management.

Bottom Line

When looking for software that processes employee salaries and taxes, it’s important to consider whether it has industry-specific payroll features that fit your business’s requirements. For restaurants, you need a solution that offers payroll and tax processing, time tracking, HR support, and tip reporting functionalities to help restaurateurs maintain compliance. Platforms should also be affordable if you’re running small restaurants.

For these reasons, we chose Gusto as the best restaurant payroll software. It provides the greatest balance among features and offers a variety of tools that address the needs of restaurants. It also has an intuitive platform and a full-service payroll option that’s budget-friendly. Sign up for a payroll plan today.