Braintree is a PayPal-owned payment processor that specializes in online payments and offers complementary PayPal tools for in-person transactions. Notable features include top-notch security with level 1 PCI compliance, international payment processing, and developer tools, including a commitment-free sandbox.

It is a popular solution for ecommerce businesses. In particular, we recommend getting a merchant account through Braintree if your online business needs to process international payments.

Braintree didn’t make our list of the best online payment processors; it received an overall score of 3.57 out of 5 in our evaluation. While its developer tools and international payments are excellent, Braintree doesn’t offer the best customer support, and its platform isn’t very easy to use.

Pros & Cons

Pros

- International payments

- Reduced rates for nonprofits

- No monthly fees

- Comes with dedicated merchant account

Cons

- No native invoicing tool

- Complex interface can be difficult to use

- Less-than-favorable user reviews

- Transaction fees are not returned for refunded transactions

Braintree Overview

Braintree is one of the most popular online payment platforms, after PayPal, Stripe, and Amazon Pay. Its security, ease of use, wide array of payment types, and international capabilities make it an enticing option for any online merchant.

Using Braintree as your payment gateway allows you to accept PayPal, Venmo, and digital wallet payments, with the added perk of having a dedicated merchant account and free recurring billing. In addition, merchants using Braintree can access PayPal payment features at no extra cost—you only need to pay for PayPal’s processing fees.

See how Braintree compares to PayPal in our Braintree vs PayPal review.

However, Braintree is not the best option for brick-and-mortar stores and food-based businesses. Other retail credit card processors and restaurant payment processors offer more flexible industry-specific solutions.

Deciding Factors

Supported Business Types | Flexible Online businesses, nonprofits, international merchants, subscription |

|---|---|

Standout Features: |

|

Monthly Software Fees | $0 |

Setup and Installation Fees | $0 |

Contract Length | None |

Payment Processing Options | Integrates with PayPal, ecommerce platforms, and mobile payment processors |

Payment Processing Fees | Very competitive

|

Customer Support |

|

Looking for something different? See our recommendations for the best merchant services for small businesses to find a solution that’s right for you.

When to Use Braintree

- For international payment processing: Braintree is available to merchants in 45 countries and supports 130+ currencies. It has a low 1% additional processing fee for international transactions and does not charge any currency conversion fees. Although merchant accounts are on a single-currency setup by default, multi-currency setups are available upon request and approval.

- For nonprofit credit card processing: Braintree offers low processing rates for nonprofits and it is included in our list of the best nonprofit credit card processors together with PayPal.

- For recurring payments: Braintree offers a highly flexible recurring billing feature that allows you to create custom pricing plans and set up discounts, add-ons, promotions, and free trials for your customers. Unlike PayPal, Braintree offers this without any extra monthly fees or add-on transaction fees.

- For a merchant account with PayPal integration. Braintree accounts come with dedicated merchant accounts unlike other payment service providers, including PayPal, that only include an aggregated merchant account.

Dedicated Merchant Account vs Aggregated Merchant Account

Businesses need a merchant account to start accepting payments. A dedicated merchant account is an individual account that is unique to the business. On the other hand, an aggregated merchant account is a shared account for multiple businesses under a single account held by a payment facilitator.

A dedicated merchant account is a safer and more stable solution for businesses but usually involves a more stringent application and underwriting process. It is often much easier to open aggregated merchant accounts, although they are prone to account freezes and fund holds.

When to Use an Alternative

- High-risk merchants: Braintree does not support merchants in the high-risk category. Consider one of our recommended high-risk merchant account providers instead.

- Retail shops: Braintree does not have a native in-person payment processing solution. Any of the options on our list of retail credit card processors would be a more suitable option.

- Restaurants: Braintree does not offer any restaurant-specific features. Choose from one of our top restaurant payment processors instead.

- Businesses that send a lot of invoices: Braintree does not have any native invoicing tool. Sending invoices is possible through third-party integrations, which may often involve additional fees.

- Businesses looking for the lowest fees: Although Braintree offers competitive processing fees, there are other more affordable options. Check out our list of the cheapest credit card processors.

Braintree Alternatives

Best for | Dedicated merchant account | Online businesses | Growing businesses | Most small businesses |

Monthly fee | $0 | $0 | $99–$199 | Starts at $0 |

Card-present transaction fee | 2.29% + 9 cents | 2.7% + 5 cents | Interchange + 8 cents | 2.6% + 10 cents |

Keyed transaction fee | 2.59% + 49 cents | 3.4% + 30 cents | Interchange + 18 cents | 3.5% + 15 cents |

Ecommerce transaction fee | 2.59% + 49 cents | 2.9% + 30 cents | Interchange + 18 cents | 2.9% + 30 cents |

Looking for the lowest rates? The payment processing rates you will pay can vary based on your business’ size, type, and average order value. To find the most affordable option and compare multiple processing rates, read our guide on the cheapest credit card processing.

Braintree Fee Calculator

Pricing & Contract

Braintree offers very competitive transaction rates and does not require any monthly fees. It also comes with a merchant account and full PayPal integration at no extra cost. It was docked points for not offering automatic volume discounts, its non-refundable transaction fees for returned and refunded transactions, and its chargeback fee.

Visa / Master / Discover Rates | |

|---|---|

Cards and Digital Wallets | 2.59% + 49 cents |

Nonprofit 501(c)(3) | 1.99% + 49 cents |

International Payments | Plus 1% |

ACH Direct Debit | 0.75% capped at $5 |

Venmo | 3.49% + 49 cents |

PayPal and PayPal Credit | PayPal rates |

Chargeback Fee | $15 |

- Custom flat rates and interchange-plus pricing available for established businesses based on business model and processing volume for cards, digital wallets, and Venmo transactions.

- Discounted ACH debit rates are available for enterprise businesses.

- For merchants that have their own American Express account, Braintree can pass through American Express transactions at a cost of $0.15 per transaction with no additional Braintree fees. Merchants may be subject to additional fees assessed by American Express under their direct card acceptance agreement with American Express.

- Transaction fees for refunded transactions are not refunded by Braintree except for accounts that signed up before Aug. 1 2018.

Other possible fees include:

- Account updater: Contact Braintree sales

- PayPal payment fees: $0

- Fraud security 3DSecure: Contact Braintree sales

- Integrated third-party fees: Varies

- Overdue account fee: 1.5% per month or the maximum amount permitted by law

Using other merchant accounts? If you already have a merchant account, you can still use Braintree as a payment gateway. However, it comes with a monthly fee of $49 per month and 10 cents per transaction, and $10 for each additional merchant account.

Braintree does not have its own card readers. Its primary focus is on ecommerce, particularly for businesses that would like to accept payments on their websites or mobile apps. Merchants processing payments in person can use Braintree through PayPal Zettle card readers.

You will need to purchase a PayPal Zettle reader and enable PayPal Here under the Processing Options of your Braintree account settings.

Learn more in our PayPal Zettle review.

You can sign up for a merchant account through Braintree or integrate your existing one. When you want to apply, you’ll need your official ID, proof of address, bank statements, processing statements, and IRS SS4 letter. Overall, users report a fairly quick and easy application and approval process.

Braintree offers different products for various business models for accepting credit cards, debit cards, digital wallets, ACH, and Venmo payments on a website or mobile application.

- Braintree Direct provides a merchant account and payment gateway for an end-to-end payment solution.

- Braintree Marketplace is for businesses that need scalable payout management tools.

- Braintree Extend offers security for exchanging payment data.

- Braintree Auth takes authorized transactions from ecommerce platforms and merchant service providers on behalf of its merchant account holders.

A Braintree Direct account comes with:

- Merchant account

- Payment gateway

- Basic and advanced fraud protection tools

- Card details encryption (Braintree Vault)

- Phone and email support

- International payment processing

- Reporting

- Recurring billing

- Third-party integrations

- Data migration and integration support

Braintree lists general and product-specific agreements, which include stipulations for payment services as well as a separate agreement for those signing up for a merchant account. Note that Braintree works with both Wells Fargo and Chase, which provide different terms of service. Product-specific agreements are for those accepting PayPal and other payment technology services.

For the general payment service agreement, there are several stipulations you might want to note:

- Braintree may terminate its gateway service after sending a written notice if your merchant account is inactive for 12 months or more.

- Overdue payments of fees will incur a 1.5% interest per month or the maximum amount permitted by law on all overdue amounts.

- Braintree may impose a reserve requirement from a portion of your payouts for businesses that it deems operating at high risk.

- If your chargeback rate reaches 90 basis points and 100 chargebacks in a month, Braintree will impose a Chargeback Maintenance Fee, which starts at $2,000 for merchants with a sales volume of $0–$500,000 per month.

Payment Types

Braintree received decent marks for this category for its strong online payment processing capabilities. It makes accepting online and digital wallet payments easy, but lost a few points for its lack of invoicing capability and ecommerce website builder. Businesses that need invoicing or ecommerce payment processing will need to rely heavily on integrations. Unfortunately, except for PayPal integrations, other third-party services will require separate signing up and fees.

Braintree’s partnerships with local banks in other countries support global payments processing so you can get the best transaction rates possible. You can accept payments in more than 130 currencies with an option to settle one transaction in multiple currencies. All international payments you receive are automatically converted into US dollars and deposited to your bank account with a 1% fee for every transaction.

Braintree supports merchants in many countries located in the following regions: the United States, Canada, Europe, Asia, and Australia. See the complete list of countries supported by Braintree.

Braintree users provide their customers with the ability to pay securely through a direct connection to their local bank account. This functionality can be used for one-time and recurring payment arrangements and supports four methods of verifying a bank account before collecting any payments to minimize the risk of being fined for failed transactions. Clearing payments received is by batch processing and takes around five business days to deposit your funds into your account.

Note that there are fees associated with processing ACH payments and fines for rejected, returned, or disputed transactions. Also, not all Braintree merchant account holders can accept ACH payments unless they meet the following conditions:

- Your business is located in the US

- Your transactions are local and accept payments in US dollars

- You signed up for a merchant account with Braintree

- Your Braintree account is not enrolled in a chargeback program

- You are using Braintree’s custom payment gateway integration

Although Braintree does not have a native mobile app and reader, it works with PayPal Zettle. It still gets a perfect score for this sub-criteria because all PayPal integrations come with no additional cost except for PayPal’s processing fees. Aside from credit and debit cards, you can accept payments from mobile wallets such as Venmo, Apple Pay, Google Pay, and Samsung Pay.

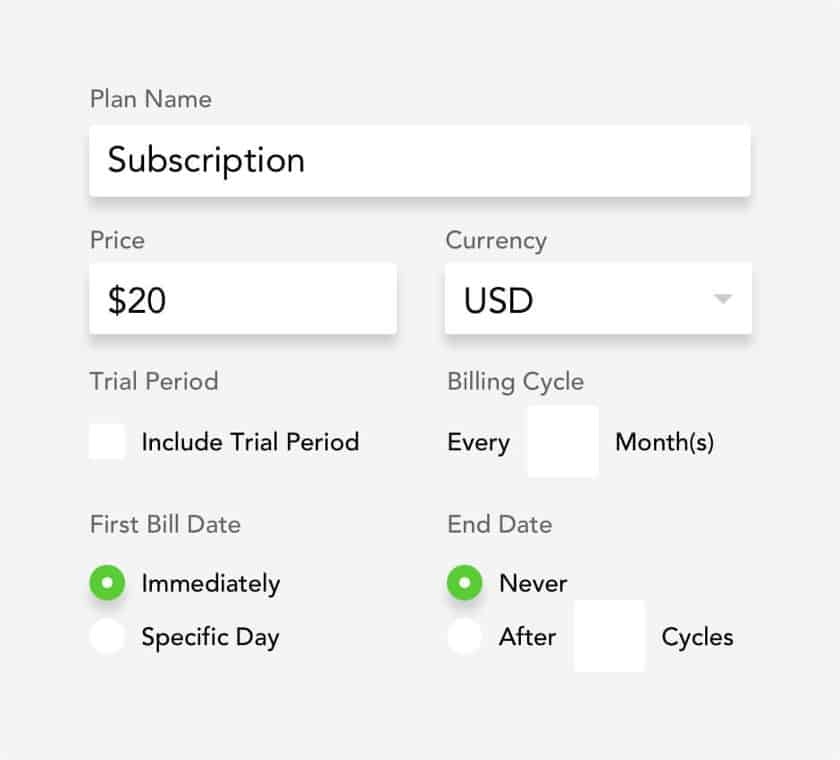

Braintree’s recurring billing feature allows you to create custom pricing plans and set up discounts, add-ons, promotions, and free trials for your customers. You can even set up rewards for long-term subscriptions.

Once your customers sign up, Braintree can securely store billing information and card or banking details for those wanting to enroll for automatic payments. It can also take care of computing prorated fees whenever your customers decide to upgrade or downgrade their subscriptions.

Braintree’s recurring billing tools are easy to use, and creating subscription plans can be customized for your business type. (Source: Braintree)

Braintree’s integration with PayPal means that businesses can easily incorporate PayPal payments into their checkout process. This allows customers to make purchases with their PayPal account, offering a quick and convenient way to pay. It also opens doors to several additional payment options that come with PayPal, such as Buy Now, Pay Later and crypto payments.

The ability to offer BNPL options can significantly boost conversion rates and customer satisfaction, especially with BNPL expected to grow at a compound annual growth rate (CAGR) of 25.5% from 2023 to 2026.

Cryptocurrencies have also gained popularity as an alternative form of payment and are expected to grow at a CAGR of almost 17% from 2022 to 2029. With PayPal, Braintree merchants also gain the capacity to facilitate crypto payments. This means customers can potentially make purchases using cryptocurrencies like Bitcoin and Ethereum. Offering such an option caters to tech-savvy customers and puts the merchant ahead when it comes to innovative payment solutions.

Sales & Account Management Features

Braintree earned top scores for its fraud protection, PayPal integration, and developer’s sandbox. It would have scored higher if it had better customer management features, faster deposit speed, and 24/7 customer support.

Braintree offers a seamless checkout process through its payment gateway feature. You can choose between a simple drop-in user interface (UI) for an easy checkout page solution or a custom UI for a more tailor-made user checkout experience. Both hosted payment options include secure data encryption and ensure that your payment processes remain PCI compliant.

Note that you can sign up for a Braintree payment gateway and integrate it with different merchant account service providers.

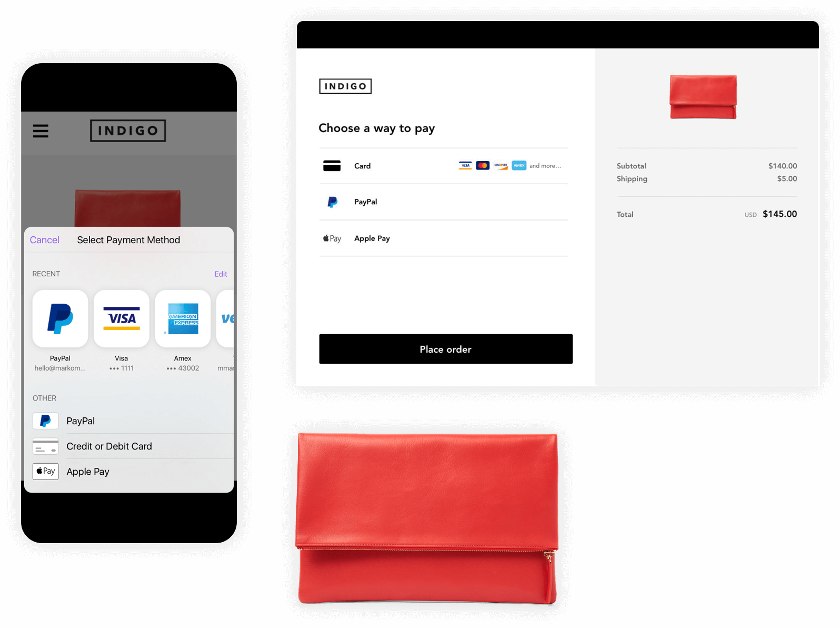

As an international payment processor, Braintree supports 23 languages with its drop-in UI and even more with additional integration. (Source: Braintree)

Braintree, like Venmo, is owned by PayPal and is therefore considered more of a major feature than just an ordinary integration. Offering PayPal payments can also help reduce cart abandonment rates at checkout because consumers are 54% more willing to buy when a business accepts PayPal.

Seamless integration with PayPal allows you to start accepting PayPal and in-person payments through PayPal’s infrastructure at no additional cost. You only need to pay for PayPal’s processing fees. You are also able to enjoy other business and financial services offered by PayPal, such as business debit and credit cards and business loans.

Having a PayPal integration means Braintree merchants have access to omnichannel tools. You can provide your customers with the option to buy in-store with payment methods saved to an online profile or buy online with payment methods used in-store. You can even support in-store pick-ups, returns, and exchanges.

However, despite the recent Braintree updates, its user guide still walks you through a PayPal Here integration, which may seem strange as PayPal has been actively redirecting its users to PayPal Zettle for in-person transactions. Make sure to ask for clarification on this with Braintree’s account managers before signing up for an account.

Braintree’s in-store payment processing is supported by PayPal’s in-person tools, which allow you to accept not only card payments but also digital wallets and PayPal-exclusive payment options as well. (Source: Braintree)

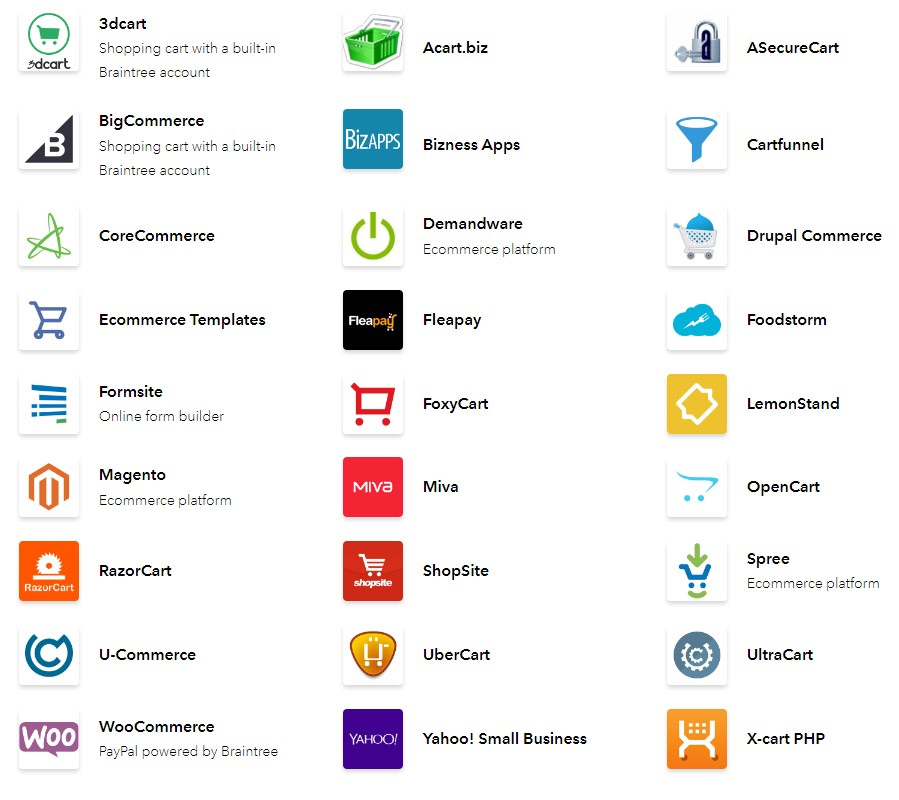

Braintree has no shortage of other integrations either. You can connect it to popular ecommerce platforms like Shift4Shop (formerly 3dcart), BigCommerce, and WooCommerce. Other integrations include options for recurring billing, shopping carts, accounting, analytics, online forms, event ticketing, and enterprise-specific tools.

Braintree offers integration with popular ecommerce platforms. (Source: Braintree)

For customers who want to sign up for automatic payments, Braintree offers a secure card and bank information vault feature. Braintree also provides an account updater service. Every saved payment method in the vault is encrypted by Braintree’s payment gateway and tokenized for PCI compliance.

The Braintree Vault also comes with an account updater, but you will have to request the service as there is a separate fee for it. An update is requested when the card:

- Is expired

- Is expiring within the current month

- Is enrolled in a recurring billing payment that’s due within two weeks

- Has been declined authorization for under specific decline codes

- Has been declined in the last 30 days

- Has not had any successful transactions in the last 30 days

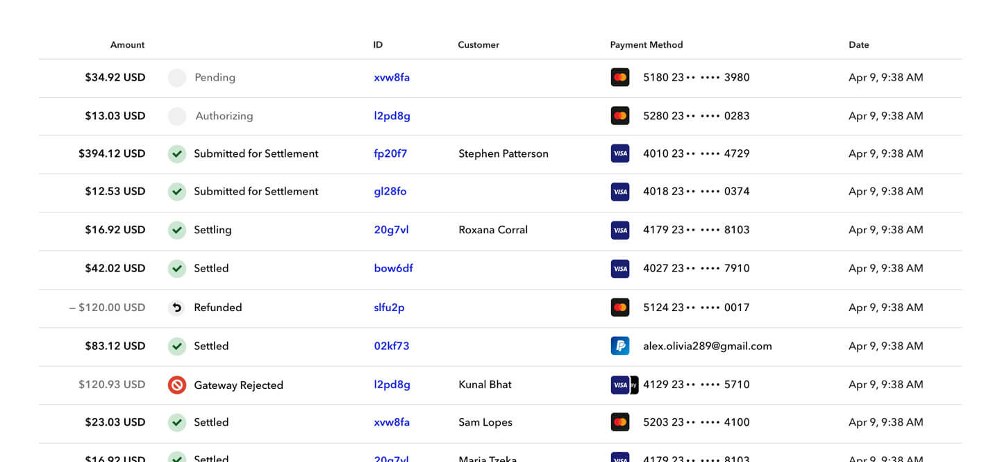

Take advantage of Braintree’s advanced transaction search options, or use the open API to build your own custom reports. The Control Panel also gives you reports on transactions, declines, and settlement batches. If you need real-time notifications for certain events taking place in your gateway, Braintree can be set up with Webhooks that can store a record of these events for you.

One thing to note about Braintree’s detailed transaction reports is that the availability of information depends on your merchant account’s pricing model. If you have signed up for interchange plus pricing, data for each of your transactions become available five days after the proceeds are deposited in your account. If you have a flat rate or blended pricing model, data for each transaction is added to the report three calendar days after proceeds are sent to your bank account.

Braintree’s transaction reports will include all credit and debit card transactions, Venmo, and digital wallet payments. PayPal transactions are not included. (Source: Braintree)

Braintree offers basic and premium fraud protection tools. Basic fraud protection includes address verification, card verification, and risk threshold settings. These ensure that all fraudulent transactions identified through the verification tools are blocked from being processed.

On the other hand, premium fraud protection offers two types of security: Fraud Protection and Fraud Protection Advanced. Fraud Protection comes with a fixed set of security rules such as geolocation and device information, while Fraud Protection Advanced (available for an additional fee) includes the ability to customize security rules, review transactions, and send notifications.

Braintree customer support is available over the phone, or you can submit a support ticket via an online form. You can also troubleshoot with its extensive support library or refer to its developer documentation. Most users report difficulty getting in touch with Braintree’s support team.

Trying out and testing Braintree is easy and convenient with its sandbox. It lets you get a better feel of its user interface before applying for a merchant account. Signing up for a sandbox account is quick and easy—you only need to fill out the form and verify your email. Braintree also has support articles, resources, and tools to help developers with easy integration.

Braintree’s developer sandbox allows anyone to try out its platform without signing up for a merchant account. (Source: Braintree)

Braintree offers a unique feature that allows businesses to operate as digital marketplaces—Braintree Marketplace. As a Braintree Marketplace Service Provider (MSP), merchants can manage and distribute funds to their sub-merchants. The payments are split between the MSP and sub-merchants and each party receives only the amount due to them.

Aside from seamless payment processing, the Marketplace also allows MSPs to create a tailored payment experience for their users. They can define the user interface, branding, and even the currency options to match their unique marketplace style. It also offers easy onboarding and comprehensive reporting. Braintree Marketplace is well-suited for ecommerce marketplaces, service providers, digital content platforms, or crowdfunding platforms.

Braintree Expert Score

We gave Braintree perfect scores for its transparent pricing, affordability, and popular integrations. It could’ve also gotten a perfect score for its ease of use if it offered its own native hardware options. The major factor that pulled down its score is its performance in user reviews. Many unfavorable Braintree reviews mention poor customer support and transactions being flagged as fraud.

Braintree’s biggest draw is that it comes with a merchant account and various integrations. Its ability to accept the most popular payment methods and international transactions makes it a good choice for merchants aiming to deliver next-generation commerce experiences.

What Users Say in Braintree Reviews

Braintree’s overall reviews are mixed, with most complaints about poor customer service. Well-liked features include the open API, integrations, ease of use, and global payment capability.

- Capterra: Over 60 users give Braintree a 3.9 out of 5 rating. Those who like it say it’s easy to use, though there are many complaints about customer service.

- G2: Braintree is rated 3.4 out of 5 based on 80+ reviews. While merchants like that they can do business across international borders, they have negative comments about fraud prevention, unresponsive customer support, and the inability to access funds.

- FinancesOnline: Around 20 reviewers rated Braintree an average of 4.5 out of 5 and gave a 95% user satisfaction rating. Some report difficulty from start to finish, even saying they had trouble closing their account entirely. Others like the pricing and how many payment types Braintree can work with.

While reading through reviews, here are the trends we noted:

| Users Like | Users Don’t Like |

|---|---|

| Open API and integration options | Poor quality customer support |

| Payment options, including PayPal and Venmo | Lack of customization |

| Setup and ease of use | Frozen funds and accounts |

How We Evaluated Braintree

We test each online payment processor ourselves to ensure an extensive Braintree review. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best online payment processors. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every online payment processor has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall online payment processor evaluation criteria:

20% of Overall Score

We awarded points to online payment processors that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

Braintree received perfect scores for not having any contracts and monthly fees. However, points were deducted for its chargeback fee and the lack of automatic volume discounts.

30% of Overall Score

The best online payment processors can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Despite Braintree’s strong showing in online, international, ACH, and e-check payments processing, it lacks native capabilities for invoicing, in-person transactions, and mobile payments.

25% of Overall Score

We gave Braintree perfect scores for its fraud prevention and developer tools. Its glaring weaknesses in this category are its slow deposit times and lack of a native Buy Now Pay Later feature.

25% of Overall Score

User feedback in several review sites is the biggest factor that deducted points from Braintree in this category. We gave it perfect scores for its affordability and wide range of integrations.

Braintree Frequently Asked Questions (FAQs)

Click through the sections below to learn more about the most common questions we get about Braintree.

No. Braintree and PayPal are both payment processors, but they are two different services. Braintree is owned by PayPal and offers full PayPal integration.

You only need a PayPal account to accept payments via PayPal.

Braintree does not charge a monthly fee. You only pay for what you use, and there is no minimum number of transactions.

Bottom Line

Overall, Braintree is easy enough to set up and use for mobile and online payments. If you’re a PayPal Business user looking for a merchant account, Braintree may be the most natural next step to scaling your operations. However, while features and functionality have improved along with better pricing, it’s still not the best long-term solution. Limited features and functionality, lack of customer support, and commonly frozen accounts and funds mean other payment processors may be better suited for the long run.