Stripe is a popular payment processor with numerous tools for selling products, services, and subscriptions online and integrating with hundreds of sales, ecommerce, and business software. Chargebee is a powerful software for managing subscription services and works with payment processors—including Stripe.

Stripe is more versatile and more technical, while Chargebee does one thing—subscriptions—with easy-to-use tools that don’t require a lot of coding. However, Chargebee lacks payment processing; for that, you need to integrate it with a payment processor like Stripe.

Chargebee vs Stripe Quick Comparison

|  | |

|---|---|---|

Monthly Processing Fee | $0-$599+ | $0 |

Payment Processing | Third-party | ✓ |

Recurring Payments | ✓ | ✓ |

One-time Payments | N/A | ✓ |

✓ | ✓ | |

Chargeback Tools | Varies by payment processor | ✓ |

Fraud Prevention Tools | ✓ | ✓ |

International Payments | Works with 150+ merchant countries | Works with 45+ merchant countries |

Payout | Varies by payment processor | 2-7 business days |

Real-world User | 4.4 out of 5 | 4.45 out of 5 |

Accepts PayPal | Yes | No |

Selling on-premise? Consider Square

If you primarily run a brick-and-mortar business with an online component that includes subscriptions, we recommend Square. It often ranks high on our lists for payment processing, POS systems, and more. It has competitive pricing and offers a free POS and other paid features that let it grow with your business. Visit Square to create a free account.

When to Use Chargebee vs Stripe

Asking, “Which is better, Chargebee or Stripe?” may be the wrong question. In fact, you can use Stripe to process the payments you collect from customers using the Chargebee software. Both are excellent, but Chargebee is a software with a greater depth of functionality for managing subscriptions, while Stripe is a payment processor with broader features and capabilities when it comes to processing payments.

Click through the tabs below to learn more about the use case for each.

Best for Pricing: Stripe

|  | |

|---|---|---|

Monthly Processing Fee | $0 | |

Online Processing Fee | Varies by payment processor | 2.9% + 30 cents + $10/mo for custom domain (optional) |

Invoicing Fee | Varies by payment processor | +0.4%-0.5% per invoice or |

Recurring Billing/ Subscription Fee | Varies by payment processor | +0.5%-0.8% per billing |

Varies by payment processor | 0.8% ($5 cap) | |

Keyed-in Transactions | Varies by payment processor | |

In-person/POS Fee | Varies by payment processor | 2.7% + 5 cents $0/mo. |

Chargeback Fee | Varies by payment processor | $15 |

Failed Transactions Fees | Varies by payment processor | $4-$15, depending on the type of transaction |

Free Trial | N/A | N/A |

Discounts | Varies by payment processor | Volume and nonprofits |

Card Reader Prices | Varies by payment processor | $59-$349 |

We chose Stripe as the most affordable because Chargebee has a monthly fee of up to $599, yet you still have to pay a third party for payment processing. Stripe, meanwhile, offers its subscription tools for free and charges only for payment processing.

Stripe also has its own POS-type system, Stripe Terminal, while Chargebee requires a third-party add-on. Finally, Stripe is among the cheapest credit card processors and even has special pricing for nonprofits and high-volume merchants.

When to Use Chargebee

New businesses can take advantage of Chargebee’s Starter Plan, which gives you access to most of its tools for your first $250,000 in total (not monthly) billing. There are no monthly fees at this time, but once you exceed the $250,000 limit, you will be charged 0.75% of your total transactions every month.

Best for Recurring Payments: Chargebee

|  | |

|---|---|---|

Recurring Payments and Card on File Fee | Varies by payment processor | +0.5%-0.8% per billing |

Credit Card Management | ✓ | ✓ |

No-code Custom Checkout | ✓ | Limited |

Payment Gateways | Multiple | Stripe payment gateway |

Dunning Management | ✓ | ✓ |

Handles One-time and Recurring Checkouts | Included in all plans | One-time billing costs higher |

Our score (out of 5) | 3.76 | 4.04 |

Chargebee takes the lead for recurring payments because it offers more subscription payment options. To start, it will manage subscriptions with offline payments. Second, if you use multiple payment processors, Chargebee’s smart routing tool will use the payment processor that gives you the best deal.

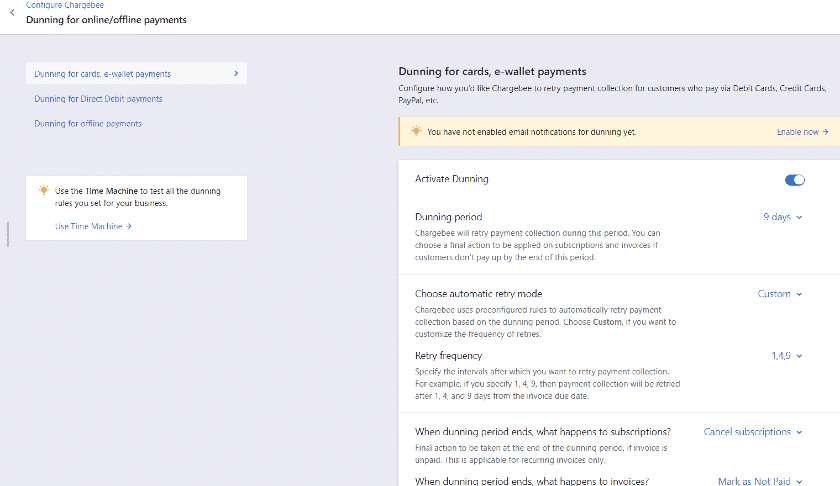

Chargebee’s dunning management also applies to offline payments and is highly configurable. You can even send up to 12 emails to customers to remind or entice them to renew.

Chargebee’s dunning controls work with offline and online payments. (Source: Chargebee Support)

When to Use Stripe

If you don’t take cash or checks for subscriptions and are happy using Stripe, then there’s not a lot extra that Chargebee offers for recurring billing. Like Chargebee, Stripe works with credit card companies to ensure account information stays current. It also says its dunning tools result in a 38% recovery of failed recurring billing.

Best for Managing Subscriptions: Chargebee

|  | |

|---|---|---|

Automations | ✓ | ✓ |

Free Trial Management | ✓ | ✓ |

Upgrades, Downgrades | ✓ | ✓ |

Self-service Subscription Management | ✓ | ✓ |

Start Subscription with Next Billing Cycle | ✓ | ✓ |

Manage Add-ons | ✓ | N/A |

Customer Portal | Free | Custom API + $10/mo if using custom domain |

Pause and Reactivate Subscriptions | ✓ | Limited |

Gift Subscriptions | ✓ | With coupons |

Chargebee is made for subscription management—and it shows. While both it and Stripe check off the most important tools for subscriptions, it’s the depth of control that gives Chargebee its lead. It offers dozens more subscription models than Stripe and allows customers to manage their subscriptions or connect with a sales rep for a customized subscription plan.

You can manage coupons, gift subscriptions, add-ons, and more. Changes made mid-subscription period that result in different pricing can be prorated if needed, and changes are reflected in the invoices.

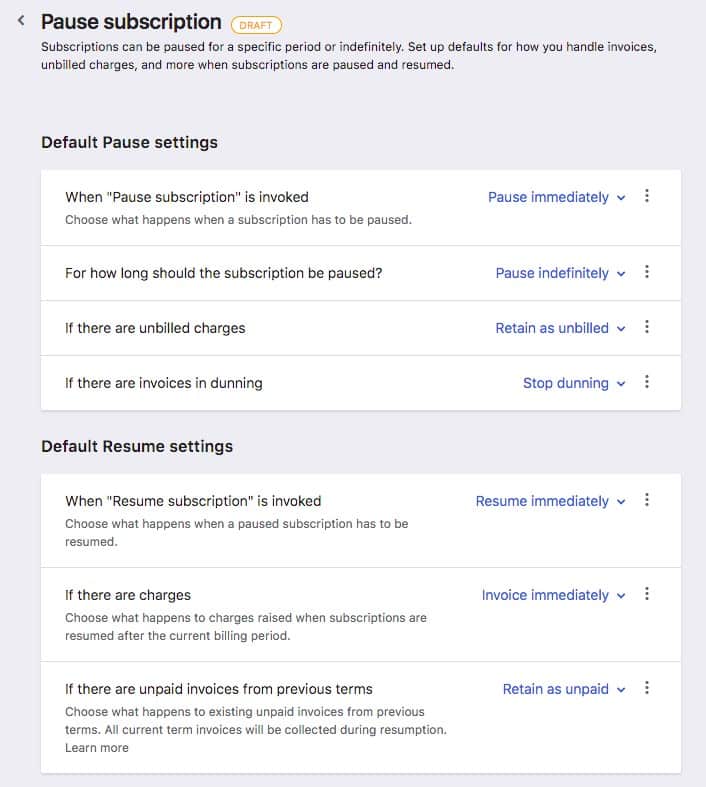

Another tool that sets Chargebee ahead is the ability to pause and restart subscriptions.

(Source: Chargebee Support)

When to Use Stripe

If you have straightforward subscriptions and are satisfied handling payments through Stripe, then its strong subscription toolset should be good enough for you. Stripe offers multiple subscription types, from standard monthly billing to plans-plus-overage. Like Chargebee, you can manage trials, upgrades, or downgrades. It can pause subscriptions after a trial if payments are not made. Overall, it is feature-rich but not as extensive as Chargebee.

Looking for additional functionality? See our list of the top-ranking invoicing software and best recurring billing software.

Best for Billing & Invoicing: Stripe

|  | |

|---|---|---|

Invoiced Payments Fees | Varies by processor | +0.4%-0.5% |

Types of Billing | 65+ models | 15+ |

Customizable Invoices | ✓ | ✓ |

Virtual Terminal | Free | Custom API |

Quote-to-Cash Automation | ✓ | ✓ |

Plan and Product Catalog | ✓ | ✓ |

B2B | ✓ | ✓ |

Request Deposits/Down Payments | ✓ | ✓ |

Partial Payments | ✓ | N/A |

Manage Offline Payments | ✓ | N/A |

Refunds via Credit | ✓ | N/A |

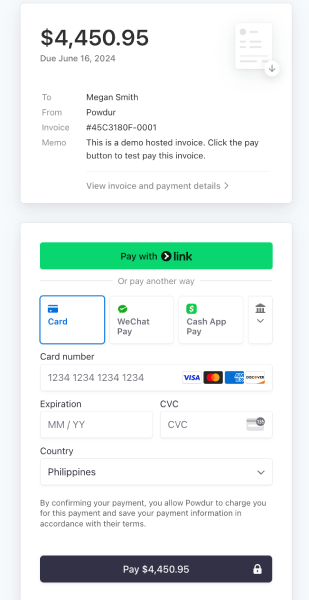

Stripe is our choice for billing and invoicing features primarily for its pricing structure that’s ideal for small businesses. While Stripe does charge an additional 0.4% to 0.5% per invoice and 0.5% to 0.8% for each billing sent, all its features are accessible.

This is in stark contrast to Chargebee, which requires merchants to pay $599 per month to use advanced invoicing tools, generate quotes, access basic reports, and even get live support. With Stripe, any additional functionalities that merchants look for can often be set up with advanced customization.

Stripe’s highly customizable invoice and billing forms are available without a monthly fee. (Source: Stripe)

When to Use Chargebee

Use Chargebee if your business heavily relies on invoicing and billing to generate sales. If you process large volumes of invoiced and billed transactions, accessing Chargebee’s complete features even with a steep monthly fee is a more reasonable choice.

This is because Chargebee allows you to choose your own payment processor, which enables you to select a provider that offers interchange plus pricing instead of paying for Stripe’s flat-rate transaction fees.

Learn more about merchant transaction fees:

- Our guide to credit card transaction fees

- Choose from the cheapest credit card payment processors

Best for Ecommerce Checkout: Stripe

|  | |

|---|---|---|

Invoiced Payments | ✓ | ✓ |

Custom Domain | Varies by payment processor | $10/month |

Payment Types | Varies by payment processor | Credit card, debit card, digital wallets, ACH credit, gift cards |

Multichannel (eBay, Amazon) | N/A | With third-party integrations |

Buy Buttons/Cancel Buttons | N/A | ✓ |

Social Selling | N/A | Stripe Payment Link, Stripe Connect |

Ecommerce Integrations | <10 | 230+ |

Buy Now, Pay Later | Varies by payment provider | Klarna, Afterpay, Clearpay, credit card installments |

One-click Checkout | Varies by payment provider | ✓ |

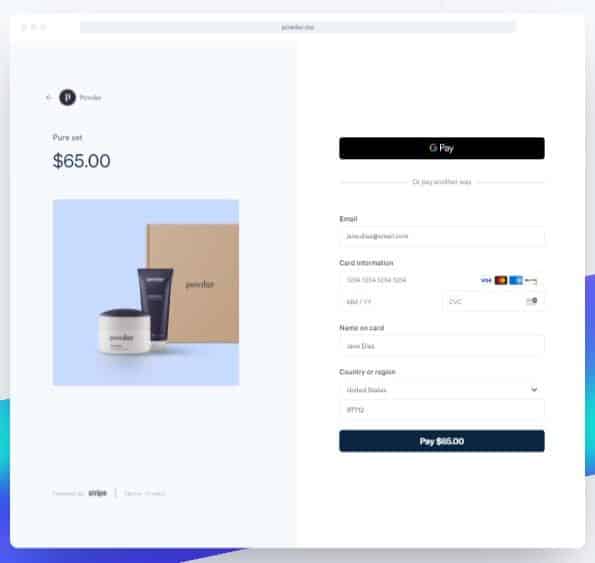

Stripe takes the lead for ecommerce checkouts because it’s more versatile than Chargebee. While Chargebee has a checkout tool for subscriptions that offers a lot of options, Stripe offers more in terms of buy buttons, social selling, and ecommerce. It has over 230 integrations for ecommerce; compare this to Chargebee’s eight, only two of which are online shopping carts.

Stripe’s versatility for multichannel sales makes it the best choice for ecommerce checkout. (Source: Stripe)

When to Use Chargebee

If all you need is a checkout for subscriptions on your website, then Chargebee can do the job. One advantage it has over Stripe is that it allows multiple payment processors. For example, you can offer payment by Stripe and PayPal, Amazon Pay, or others.

However, depending on the ecommerce platform you use, you can likely add multiple payment options to your checkout just through your platform’s settings.

Best for International Subscriptions: Chargebee

|  | |

|---|---|---|

Cross-border Fee | Varies by payment provider | 1.5% |

Currency Conversion Fee | Varies by payment provider | 1% |

# Currencies | 100+ | 135+ |

# Languages | 7 | 34 |

# Merchant Countries | 150 | 47 |

Multiple Currencies | ✓ | Beta |

Chargebee is slightly superior to Stripe for international payments because it can work with non-US payment processors and has plans that allow multiple currencies. It works with over 20 payment gateways around the world (including Stripe), with a reach of 150 countries.

Naturally, what cross-border or other fees you pay and what restrictions you face will depend on the payment provider you use. (You can, of course, use multiple providers to expand your reach.) You can set multiple currencies by creating plan variations within the subscription base.

The drop-down menu shows only 58 nations, but it supports more; contact support if you are based in a different country. (Source: Chargebee)

When to Use Stripe

Stripe lets you work in more languages than Chargebee, which is good for where your customers may not speak English, French, German, Italian, Portuguese, Spanish, or Ukrainian. Of course, Stripe is the better choice for international sales that are not subscription-based. In fact, Stripe tops our list of the best international merchant accounts.

Best for Chargeback Prevention & Fraud Monitoring: Tied

|  | |

|---|---|---|

Fraud Protection | Unit charges, address verification; more depending on payment processor | Advanced machine-learning fraud protection, ID verification |

Transaction Security | PCI DSS Level 1, SOC-1, SOC-2, ISO compliant | PCI DSS Level 1, AES-256 encryption, SSAE18 SOC 1 and 2 reports, PSDS2 and SCA compliant |

Chargeback Fees | Varies by payment processor | $15 |

Dispute Management | Requires paid plan | ✓ |

Chargeback Protection | Varies by payment processor | ✓ |

This was a tough one to judge because while both services offer excellent transaction security and basic fraud prevention, many of Chargebee’s tools for fraud prevention and chargeback protection will depend on the payment processor you use. As a result, you could find something even better than what Stripe offers—although Stripe is top-of-the-line.

Use Stripe if dispute management automation is important to you. Stripe provides this function at no additional cost while you can only get this feature from Chargebee if you subscribe to its $599 monthly paid plan.

Additionally, Stripe Radar offers complete chargeback protection—it handles everything and takes care of any fees if a chargeback is upheld. This costs an extra 5 cents per screened transaction but is waived for accounts that are being charged 2.9% + 30 cents per transaction. If you need more control and customizations, the Radar for Fraud Teams is an additional 7 cents per transaction or 2 cents per transaction with the standard 2.9% + 30 cents pricing.

Best for Ease of Use: Stripe

|  | |

|---|---|---|

Frozen Accounts | Varies by payment processor | Low |

Application and Approval Requirements | Varies by payment processor | None |

Payment Platform Setup | Varies by payment processor | Needs some coding skill |

Plug-and-Play Integration | ✓ | ✓ |

Customer Service | 24/7 email (all plans) 24/7 chat support (paid plans) 24/5 phone support (Rise & Scale plans) 24/7 phone (Enterprise Plan) | 4.4 out of 5 |

PCI Compliance | ✓ | ✓ |

Video Tutorial | Few | Many |

Premium Support | Enterprise Plan | Included in all plans |

Real-world User | 4.4 out of 5 | 4.45 out of 5 |

Overall, Stripe is the easiest to use. Even though you need some coding skills to get the most out of the platform, the majority of the basic functions—including invoicing and checkout—have a plug-and-play option. It offers quick and stable accounts, whereas with Chargebee, that depends on the payment processor you select.

We like Stripe’s YouTube channel, with its plethora of help videos for users and developers, which are done with real people. Chargebee only has a handful of videos—and many are computer-read. It does offer premium support, whereas Stripe gives the same support to all its customers. However, real-world users were satisfied overall with Stripe’s regular customer service.

Stripe feedback from real-life users on third-party review sites:

How Hard Is Chargebee to Use?

While Stripe is easier overall, Chargebee is nonetheless simple. Real-world users, for the most part, praised the user interface, although some said the coding was outdated. It does provide setup help, as well. The sandbox is a great tool for experimenting with billing before going live, and the interface is clean and straightforward. It also has in-app help buttons that explain individual tools.

Chargebee feedback from real-life users on third-party review sites:

Frequently Asked Questions (FAQs)

These are some questions we commonly encounter about Stripe vs Chargebee.

Absolutely not. Chargebee is a Stripe partner, and you can easily integrate its service if Stripe’s subscription tools are not enough for your business. You can even add Stripe as one of your payment processors if you want to use more than one on Chargebee.

Adding Stripe to Chargebee is pretty straightforward. You go to settings and configure Stripe as a payment gateway. Of course, you need to have a Stripe account first. Chargebee recommends you configure first on your test site, then go live. You can find complete details in Chargebee’s knowledge center.

Chargebee works with over 20 payment gateways around the world. Which ones you can use depends on the country you operate out of. They include:

- Credit/Debit cards: Visa, Master Card, Discover, JCB

- Bank-based payments: iDEAL, Bancontact, Giropay

- Direct debit: ACH, SEPA, PAD, BACS, BECS

- Offline payments: Cash, check

- Digital wallets: Apple Pay, Amazon Pay, PayPal, Braintree, Google Pay

A quick search of Stripe’s partners showed 36 partners for subscriptions, including Recharge, Zoho Subscriptions, Recurly, and Paid Memberships of WordPress. Recurring billing revealed 10 partners. Some, like Paywhirl, were also listed under subscriptions, but it also included Chargify, Instapayments, and MyFundBox. You may also find recurring subscription tools in some of the POS and ecommerce solutions.

Bottom Line

When considering Chargebee vs Stripe, there is only one question to consider: Do you need heavy-duty subscription service management? If so, and Stripe is not enough for you, then Chargebee is the best choice. However, it’s never an either-or decision. You can integrate Chargebee and Stripe and get the best of both worlds.

1Stripe on G2

2Stripe on Capterra

3Chargebee on G2

4Chargebee on Capterra