Recurly is a powerful subscription management software that works with multiple payment processors. Stripe, meanwhile, is a powerful payment processor that works with subscriptions. Stripe integrates with hundreds of third-party apps—including Recurly.

Both offer strong tools for invoicing, billing, and preventing the loss of subscribers because of expired cards and other involuntary reasons.

Stripe does more with one-time product sales and social selling, while Recurly concentrates on building and keeping your subscriber base. However, it requires a third-party merchant account (such as Stripe).

Recurly vs Stripe at a Glance

|  | |

|---|---|---|

Product Type | Subscription management software | Payment processor with payment management software |

Monthly Fee | $249+ (with free trial) | $0 |

Payment Processing | Third-party provider | Via Stripe Connect |

Recurring Payments | ✓ | ✓ |

One-time Payments | ✓ | ✓ |

Dunning Tools | ✓ | ✓ |

Chargeback Tools | Varies by payment processor | ✓ |

Fraud Prevention Tools | ✓ | ✓ |

Accepts PayPal | ✓ | No |

International Payments | Works with 60+ merchant countries | Works with 45+ merchant countries |

Payout | 2-3 business days | 2-7 business days |

4.25 | 4.45 |

As an alternative, consider Square for in-person plus subscription sales: Recurly lacks an in-person POS, and Stripe Terminal is very basic. Thus, we recommend Square if you run a brick-and-mortar business with subscriptions.

One of our top picks for payment processing, POS systems, and more, it’s priced great, has a free and complete POS system, handles subscriptions, and offers banking and other features that let it grow with your business. Visit Square to create a free account.

When to Use Recurly vs Stripe

The question of Recurly vs Stripe is not a truly fair one, as you can have Recurly and Stripe.

Recurly is a Stripe Partner, which means they work well together. Recurly offers more depth to subscription management, while Stripe is an excellent and versatile payment processor. If you like Recurly but want Stripe as a merchant account, simply add Stripe as a payment processor—it doesn’t even have to be the only payment processor you use with Recurly.

Best for Pricing: Stripe

|  | |

|---|---|---|

Monthly Processing Fee | Starting at $249/month | $0 |

Free Trial | ✓ | ✕ |

Online Processing Fee | Varies by payment processor | 2.9% + 30 cents + $10/mo for custom domain (optional) |

Keyed-in Processing Fee | Varies by payment processor | |

Invoicing Fee | Varies by payment processor | +0.4%-0.5% per invoice or |

Recurring Billing/ Subscription Fee | Varies by payment processor | +0.5%-0.8% per billing |

Varies by payment processor + requires a higher plan | 0.8% ($5 cap) | |

In-person/POS Fee | Varies by payment processor | 2.7% + 5 cents $0/month |

Chargeback Fee | Varies by payment processor | $15 |

Failed Transactions Fees | Varies by payment processor | $4-$15, depending on the type of transaction |

Discounts | Varies by payment processor | For volume and nonprofits |

Card Reader Prices | Varies by payment processor | $59-$349 |

Stripe is the least expensive for small businesses simply because, with Recurly, you pay a monthly fee for the software and still need to pay for a payment processor. Merchants that frequently accept ACH payments also need to pay for a higher Recurly plan. It’s possible you may find a less expensive payment processor than Stripe, but it does rank among the cheapest payment processors in addition to offering discounts for nonprofits and high-volume sellers.

When to Use Recurly

Recurly’s pricing structure works best for fast-growing and midsized subscription businesses primarily because merchants can pick their own merchant account services provider to use with the software.

Merchants can thus choose a provider that offers interchange-plus pricing, which means more savings in transaction fees than Stripe’s flat-rate pricing. Even better, merchants with a preferred merchant account service provider can seamlessly switch to Recurly.

Learn more about credit card transaction fees.

Best for Recurring Payments: Recurly

|  | |

|---|---|---|

Recurring Payments and Card on File Fee | Varies by payment processor | +0.5%-0.8% per billing |

Credit Card Management | ✓ | ✓ |

No-code Custom Checkout | ✓ | Limited |

Payment Gateways | Multiple | Stripe payment gateway |

Dunning Management | ✓ | ✓ |

Our Score (Out of 5) | 3.81 | 3.80 |

Recurly offers a multitude of ways to set up billing: prepaid, usage-based, fixed, volume-based, tiered, stairstep, usage-based, and hybrids thereof. By integrating multiple providers, you also give your customers greater choice in how they pay. These things make it superior to Stripe for recurring billing.

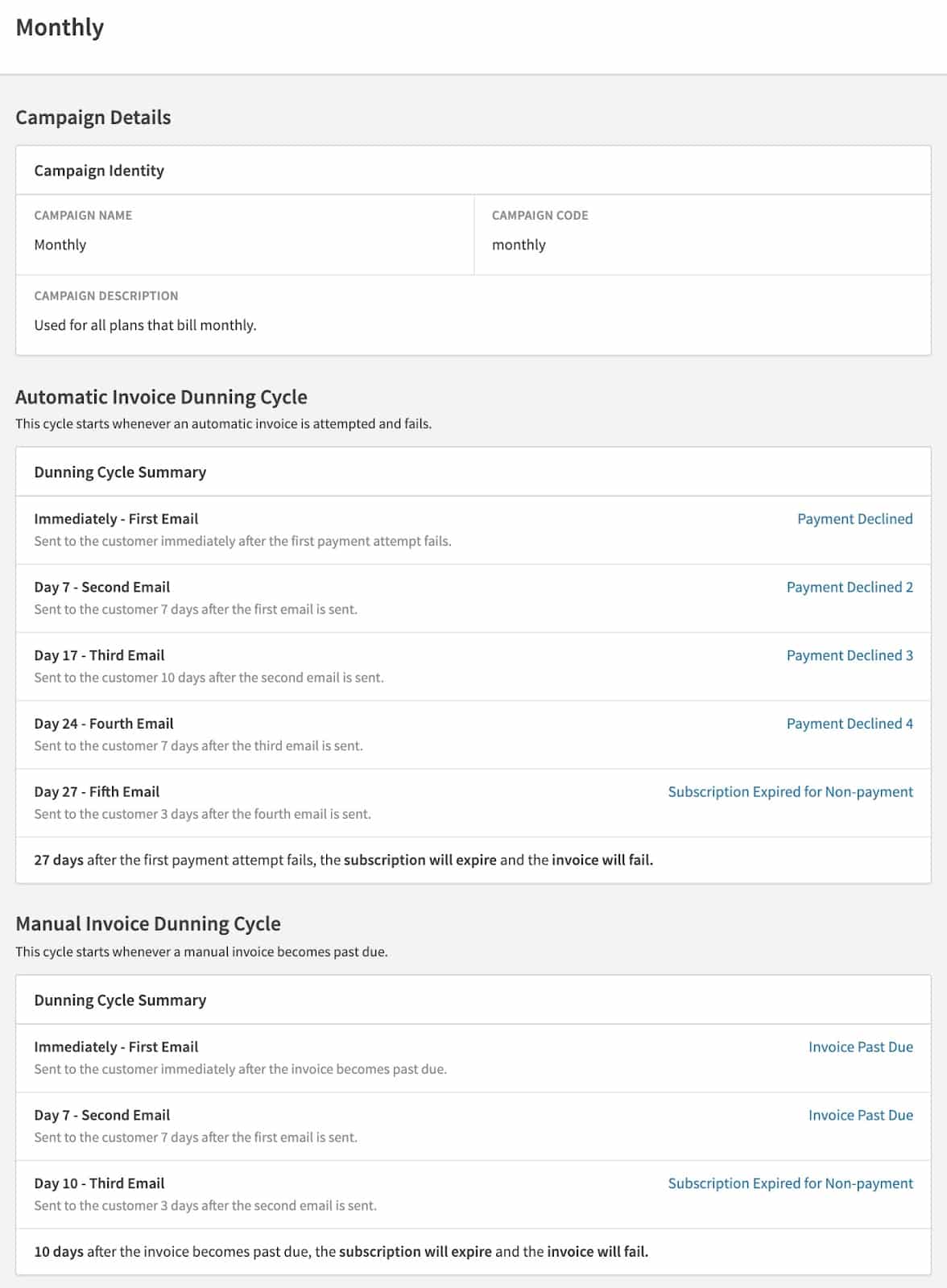

However, we were more impressed with Recurly’s dunning management tools. Like Stripe, it has an account updater so that when a credit card expires or is changed (like after a theft), Recurly gets the updated information with no interruption to the subscription. Even better, it proactively manages expired cards ahead of renewals to prevent declines. Plus, its intelligent retry analyzes reasons for declines and adapts to the transaction.

Finally, Recurly supports payment orchestration tools, where subscribers can pay you with more than one payment method so that you have an automatic fallback if one fails. Recurly says its customers report reducing involuntary churn to 1%.

Recurly has an extensive set of tools for dunning management. (Source: Recurly)

When to Use Stripe

While Recurly does more, Stripe is sufficient for businesses that only do small subscription sales. Stripe also uses 3D Secure authentication and smart retries to reduce involuntary churn. Its professed record is less than Recurly’s—38% recovery on average, with an additional 11% if using smart retries. It, too, has prebuilt email reminders you can send for overdue payments.

Best for Managing Subscriptions: Recurly

|  | |

|---|---|---|

Automations | ✓ | ✓ |

Trial Management | ✓ | ✓ |

Upgrades, Downgrades | ✓ | ✓ |

Self-service Subscription Management | Cancel and update credit card only | ✓ |

Start Subscription with Next Billing Cycle | ✓ | ✓ |

Manage Add-ons | ✓ | N/A |

Pause and Reactivate Subscriptions | ✓ | Limited |

Gift Subscriptions | ✓ | With coupons |

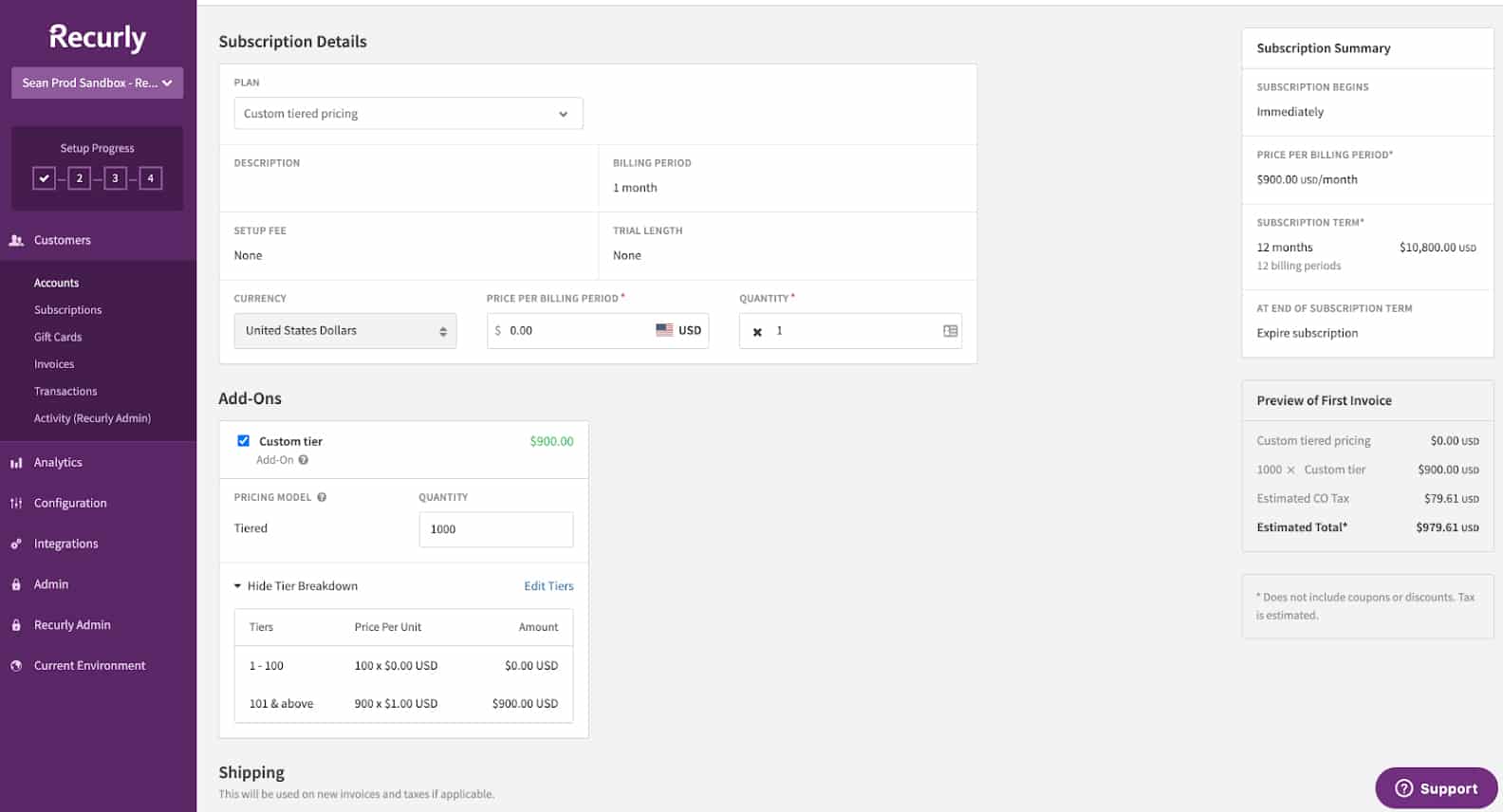

Recurly is the more powerful software for subscriptions; plus, it’s easier to use. With only a few clicks, you can set up a variety of subscription plans, trials, gift subscriptions, and more. You can set prices and start dates or individualize them for customers through the admin channel.

This provider stands out as it lets you manage add-ons as part of the subscription—for example, a free skillet with a meal box subscription—while Stripe makes these separate purchases. Recurly also lets you pause subscriptions to reactivate at a later date, which may help with customer retention.

In 2023, Recurly has added many features for subscriptions, including:

- More billing models to its Usage Based Billing Add-Ons module

- An Entitlements module, which lets you create a catalog of features that customers can access based on their subscription level

- Ramp Pricing, which lets you set a discount for new subscribers that ramps up over time to the full subscription cost

In addition to subscriptions, you can create one-time purchases as add-ons.

(Source: Recurly)

When to Use Stripe

If you are collecting subscriptions through third-party software, Stripe may be a better option. Its billing API makes it easy to integrate with websites, mobile apps, and customer relationship management (CRM) systems, plus it integrates with hundreds of software applications. It also has trial management, custom start dates, and flexible billing schedules. You can also create coupons for discounts or gift subscriptions.

Best for Billing & Invoicing: Stripe

|  | |

|---|---|---|

Invoiced Payments Fees | Varies by processor | Standard rate + 0.4%-0.5% |

Types of Billing | 5 | 15+ |

Customizable Invoices | ✓ | ✓ |

Quote-to-Cash Automation | With third-party app | ✓ |

Plan and Product Catalog | ✓ | ✓ |

B2B | ✓ | ✓ |

Single Payment Billing | ✓ | ✓ |

Request Deposits/Down Payments | Manually added | ✓ |

Partial Payments | Manually added | ✓ |

Refunds via Credit | ✓ | N/A |

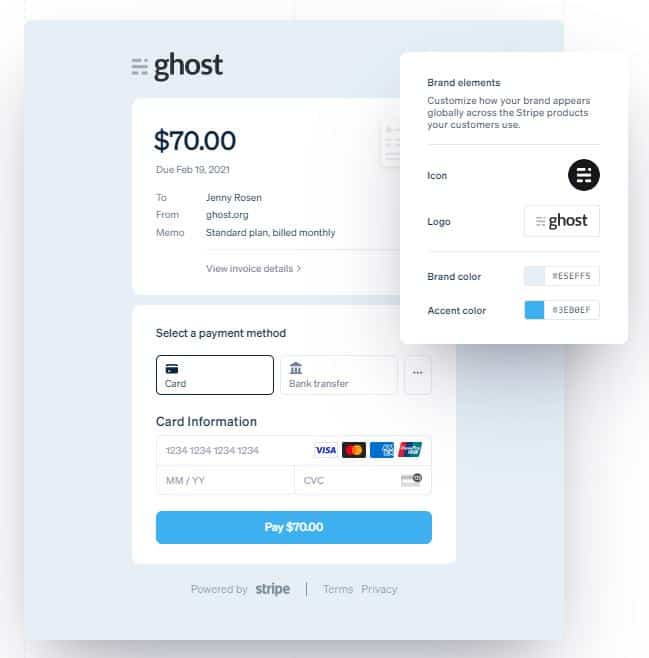

Stripe takes the lead for invoices. Like Recurly, it offers customizable invoices for one-time or recurring billing, where recurring billing can follow scenarios from per-seat pricing to metered billing. It allows payment by credit card or ACH. (With Recurly, it depends on the merchant account you choose.)

Invoices can be paid in installments, and you can create quote-to-cash automations. You can apply tax rates to the entire invoice or individually by line item, allow coupons, and more. For these reasons, it’s also an ideal B2B payment solution.

Stripe lets you make custom invoices.

(Source: Stripe)

When to Use Recurly

Recurly may not have some of the tools Stripe offers, but we were impressed with its flexibility with invoicing for recurring billing or subscriptions. You can give customers more choices for payment, including PayPal.

Recurly invoices are customizable and work for one-time purchases and recurring bills. It also has automated workflows to honor subscriber preferences for billing. We also like the refunds-via-credit feature, as it encourages return customers.

Best for Ecommerce Checkout: Stripe

|  | |

|---|---|---|

Invoiced Payments Fee | Varies by payment provider | +0.4%-0.5% |

Payment Types | Credit cards, debit cards, digital wallets, ACH credit, gift cards, PayPal, Amazon Pay, SEBA, etc. | Credit card, debit card, digital wallets, ACH credit, gift cards |

Multichannel (eBay) | No | With third-party integrations |

Buy Buttons/Cancel Buttons | No | Stripe Payments |

Social Selling | No | Stripe Payment Link, Stripe Connect |

Ecommerce Integrations | <5 | 230+ |

Buy Now, Pay Later | Varies by payment provider | Klarna, Afterpay, Clearpay, credit card installments |

PCI Compliance | ✓ | ✓ |

One-click Checkout | Amazon Pay, PayPal | Link with Stripe |

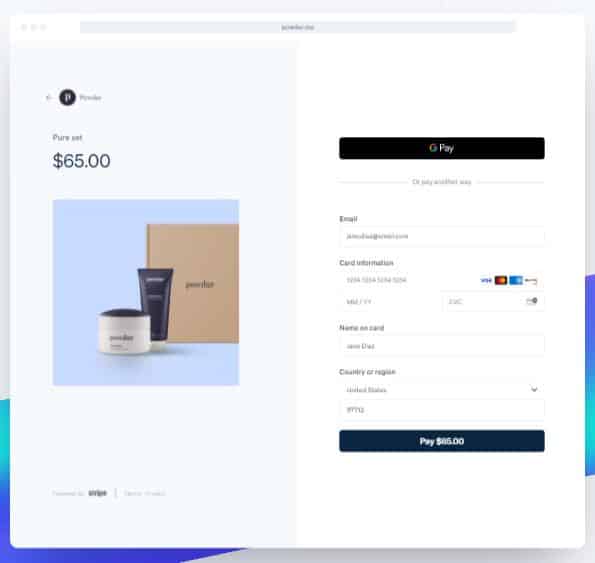

Stripe blows Recurly away in this category, with nearly 240 ecommerce integrations for everything from online stores to CRM tools like Salesforce. It integrates with multichannel sellers like eBay and lets you create links and buttons for posting on social networks.

Stripe has several options for buy now, pay later (BNPL) payments. This is not as important for subscriptions but does give it an edge for large one-time payments. Overall, Stripe is simply more versatile than Recurly.

Stripe makes it easy to create checkouts for websites or buttons for social sales.

(Source: Stripe)

When to Use Recurly

Recurly is no slouch for ecommerce. You can create custom checkout, hosted payment pages, and more. While it does not have social selling or buy buttons on its own, you may find those tools with your payment provider.

One advantage it has over Stripe is that Recurly does not require heavy coding to fine-tune its checkout features. So, if your business accepts large volumes of online subscription payments, you may want to use Recurly over Stripe not only to choose cheaper rates but also for easier customization.

Best for International Subscriptions: Recurly

|  | |

|---|---|---|

Cross-border Fee | Varies by payment processor | 1.5% |

Currency Conversion Fee | Varies by payment processor | 1% |

# Currencies | 140 | 135+ |

# Languages | 30+ | 34 |

# Merchant Countries | 195+ | 47 |

Multiple Currency Settlement | ✓ | Via API |

Recurly accepts payments in 195 countries (with the right merchant account), has hosted payment pages available in 14 different languages (30-plus languages overall), and automatically defaults to the customer’s local currency. It also has advanced VAT management, including the ability to automatically refund VAT for qualifying customers. Additionally, it offers integrations with tax management programs to help you stay on top of international tax mandates.

With a wide variety of payment providers, you can reach more countries.

(Source: Recurly)

When to Use Stripe

Stripe is nonetheless an excellent choice for international sales, ranking as the best overall international merchant account. It works in 34 languages and over 135 currencies. Smaller businesses that often accept small, one-time international payments may find Stripe a more cost-effective solution.

Best for Chargeback Prevention & Fraud Monitoring: Stripe

|  | |

|---|---|---|

Fraud Protection | Simple velocity checks; third-party options available | Advanced machine-learning fraud protection, ID verification |

Transaction Security | PCI DSS Level 1, TLS v1.2 + transmission encryption | PCI DSS Level 1, AES-256 encryption, SSAE18 SOC 1 and 2 reports, PSDS2 and SCA compliant |

Chargeback Fees | Varies by payment processor | $15 |

Chargeback Protection | Varies by payment processor | ✓ |

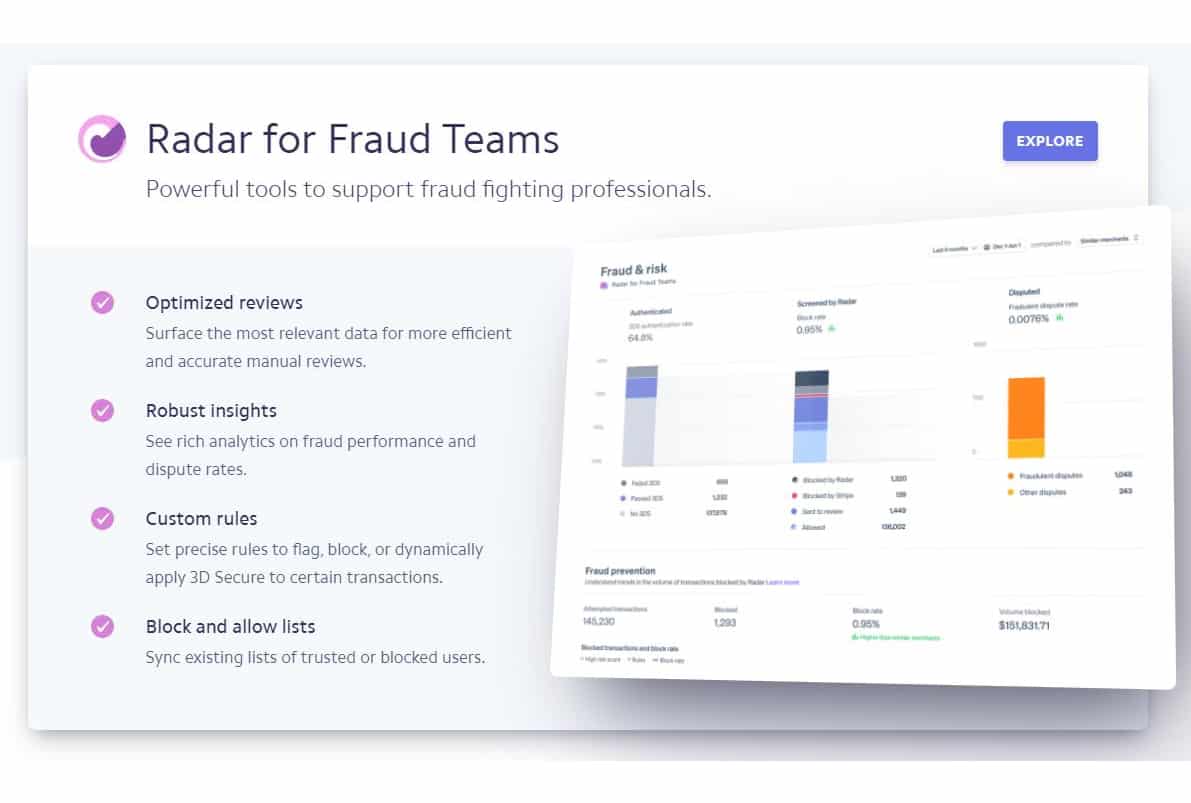

Like Recurly, Stripe uses Dynamic 3D Secure, and it screens medium as well as high-risk buyers. In addition, it has Stripe Radar, which uses machine learning and Stripe’s extensive database of information to spot and block fraud. You can even set custom rules and block lists.

For a fee, Stripe can also provide online identification and verification tools such as ID document verification, ID number lookup, and facial recognition.

Further, it provides chargeback protection by reimbursing you the disputed amount and waiving the dispute fees. Radar is available free on all purchases charged the standard 2.9% + 30 cents, and you can purchase it for other transactions for an additional 5 cents per transaction.

Stripe Radar offers advanced fraud protection tools.

(Source: Stripe)

When to Use Recurly

In 2023, Recurly added multiple authenticator apps to its two-factor authentication feature, including Okta Verify, Authenticator, and Twilio Authy. Recurly also uses Dynamic 3D Secure and does a simple fraud velocity check before passing a transaction to your payment gateway. Therefore, your fraud protection depends on the payment provider processing the payment.

However, higher-tier paid plans get the benefit of Kount’s fraud protection. Kount is a leading fraud protection program that is our #1 choice for chargeback protection services.

Best for Reporting & Analytics: Recurly

|  | |

|---|---|---|

Standard Reports | 20+—finances, sales, campaigns, etc | 2—Financial data only |

Custom Report Creation | ✓ | Filters |

Analysis Tools | ✓ | None |

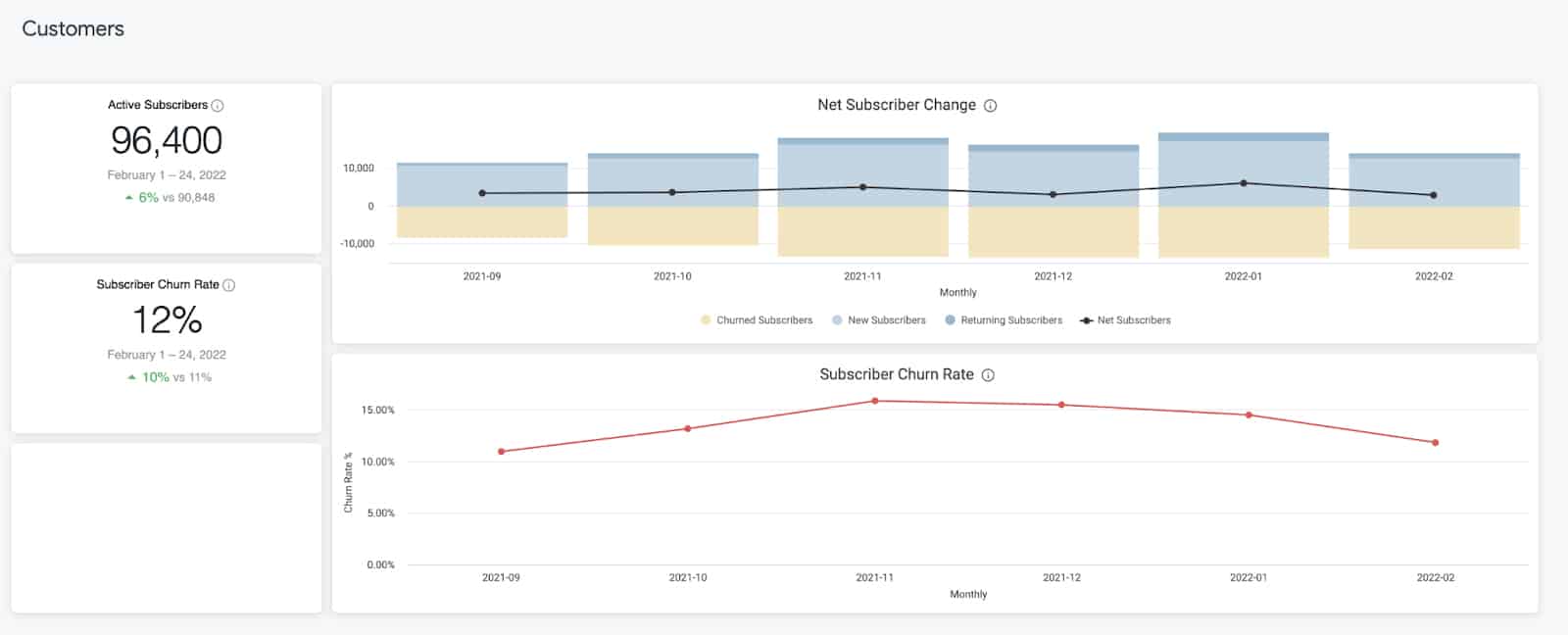

Recurly offers various reports for analyzing your sales, subscriber growth, trial performance, and standard revenue reports. As such, it’s best for reports and analysis, especially if you want to apply the data to key performance indicators and strategies. In 2023, Recurly added a custom report feature with formulaic fields within Report Builder for dashboard-specific reports.

Reports contain both graphics and data.

(Source: Recurly)

When to Use Stripe

Small businesses’ primary consideration for choosing Stripe over Recurly in most situations is the pricing. Low-volume businesses can get Stripe’s reporting and analytics tools without paying hundreds of dollars every month.

Stripe offers a balance report and a payout reconciliation report, which it says can answer most of your questions. Stripe Radar has reports for declined transactions and chargebacks. Otherwise, you can download the data and create your own reports or integrate it with third-party reporting apps.

Best for Ease of Use: Tied

|  | |

|---|---|---|

Frozen Accounts | Varies by payment provider | Low |

Application and Approval Requirements | Varies by payment provider | None |

Payment Platform Setup | ✓ | Needs some coding skills |

Plug-and-Play Integration | ✓ | ✓ |

Customer Service | 24/7 chat and phone support | 24/7 chat and phone support |

Video Tutorial | Several | Many |

Premium Support | Costs extra + only available in professional and higher plans | Costs extra |

4.25 | 4.45 |

The differences between Stripe and Recurly are minimal for ease of use. Recurly has an excellent user experience, needing only minutes to set up even complex subscriptions. Stripe needs coding for some modifications, but it also has plug-and-play tools that are easy for the layman to use. In addition, it has an impressive library of how-to videos done by live human beings.

Recurly makes it simple with setup widgets, but on the payment provider side, you may have varying results for ease of use and account stability. It’s been adding human-narrated how-to videos; previous ones were computer-generated. Real-world users highly rate both, although Stripe had the higher score.

Recurly feedback from real-life users on third-party review sites:

Stripe feedback from real-life users on third-party review sites:

Frequently Asked Questions (FAQs)

These are some of the most common questions people ask about Stripe vs Recurly.

Adding Stripe is as easy as adding any other payment gateway. Simply go to the Recurly Payment Gateway Configuration page on your software and log into your Stripe account, or set up a new Stripe account.

Recurly works with over 20 gateways, including Adyen, Braintree, Chase Paymentech Orbital, TSYS, Worldpay, Stripe, Authorize.net, Payeezy, PayPal, and more.

In addition to the payment processors, it integrates with over 30 applications, from Amity to Zendesk. Some notables are Chargeback (for chargeback and fraud protection), Kount (for installment payments), Mailchimp (for marketing), Salesforce (for customer relationship management), and QuickBooks (for accounting).

Stripe integrates with over 35 applications for subscriptions, including Recharge, Zoho Subscriptions, Chargebee, and Paid Memberships of WordPress. It also lists 10 recurring billing partners, including Chargify, InstaPayments, and MyFundBox. You may also find recurring subscription tools in some of the many POS and ecommerce solutions it partners with.

Bottom Line

Recurly is certainly the heavyweight in the question of which is best for subscription management, but Stripe does have some good low-cost subscription tools and works for many other kinds of sales, too. Regardless, it’s not necessary to choose one or the other. You can get Recurly as your subscription software and add Stripe as a payment processor.

User review references:

1 Recurly on G2

2 Recurly on Capterra

3 Stripe on G2

4 Stripe on Capterra