Learning how to do payroll in Iowa involves following some common steps like registering for state unemployment insurance taxes (called SUTA) and workers’ compensation insurance. You’ll need to withhold money from employee paychecks for state income taxes and pay close attention to the calculations—they’re tiered and range from 4.4% to 6.0%. But that’s changing—more on that later.

Key Takeaways:

- Iowa is moving to a flat income tax by 2026 of 3.90%

- When hiring minors, Iowa employers are no longer required to use work permits

- Every local jurisdiction in Iowa levies income tax, ranging from 1% to 20%

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

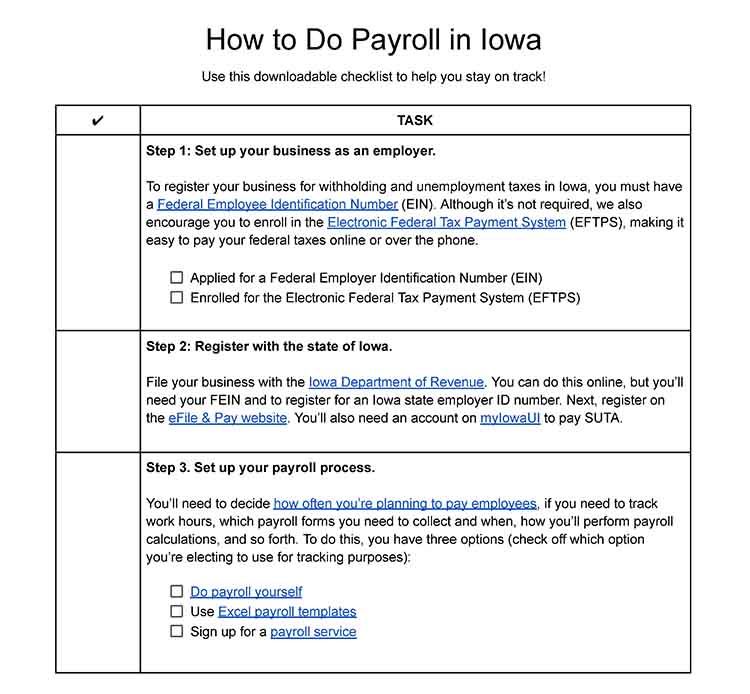

Step-by-Step Guide to Running Payroll in Iowa

Below are the basic steps to handling payroll in Iowa, with an emphasis on the state’s regulations.

Step 1: Set up your business as an employer. At the federal level, you need your federal employer identification number (FEIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the State of Iowa. File your business with the Iowa Department of Revenue. You can do this online, but you’ll need your FEIN and to register for an Iowa state employer ID number. Next, register on the eFile & Pay website. You’ll also need an account on myIowaUI to pay SUTA.

Step 3: Set up your payroll process. You can set any regular payday schedule as long as you pay at least monthly. You’ll also need to determine when you’ll collect payroll forms, how you’ll pay employees, and what and how often taxes will need to be filed.

Step 4: Collect employee payroll forms. It’s best to fill out payroll forms during employee onboarding. These include the W-4 form, I-9 form, and direct deposit information forms. For Iowa, employees need to fill out an Iowa W4. Employees who are Illinois residents and want to be exempt from Iowa taxes need to fill out Form IA 44-016.

Step 5: Collect, review, and approve time sheets. Plan so that you have the time sheets approved to pay employees within 12 days of the end of the pay period. You can create your own time sheets or use a time and attendance system to help collect the information.

Step 6: Calculate employee gross pay and taxes and pay employees. You’ll need to familiarize yourself with tax rates and other information that you’ll need to do payroll calculations. You can either use a program like Excel to calculate your payroll or find a reputable payroll software vs doing it by hand.

Step 7: File payroll taxes with the federal and Iowa state government. Follow the IRS instructions for federal taxes, including unemployment.

File Iowa taxes and unemployment insurance on the eFile & Pay site by 4 p.m. on the due date.

- Iowa Income Taxes: To file and pay withholdings, use Form 44-095b. File according to the schedule below. For complete details, check the website.

Amount of Withholdings Filed | Due By | |

|---|---|---|

Quarterly | <$6,000 |

|

Monthly | $6,000 - $120,000 |

|

Semimonthly (electronic) | >$120,000 |

|

- State Unemployment Taxes (SUTA): Pay SUTA each quarter via myIowaUI.

For Wages Paid During | Calendar Quarter Ends | Must Be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

Step 8. Document and store your payroll records. Iowa requires you to keep records on employees for at least three years. Information should include contact information, name, Social Security number, days and calendar weeks worked, and earnings for each period worked. Learn more about federal requirements in our article on retaining payroll records.

Step 9. Do year-end payroll tax reports. You’ll need to send out year-end federal forms W-2 (for employees) and 1099 (for contractors) by Jan. 31 of the year following the one for which you’re reporting. You’ll also submit your copies and a Verified Summary of Payments Report (VSP) by Feb. 15 with the Iowa Department of Revenue.

You can also download our checklist on how to do payroll in Iowa to make sure you don’t miss a single step.

New to payroll? Read our articles on how to do payroll in general and how to ensure your payroll is compliant with regulations.

Iowa Payroll Laws, Taxes, & Regulations

No matter what state you are in, you must follow federal law for income taxes, Social Security and Medicare, and federal unemployment insurance (FUTA). Social Security and Medicare are 6.2% and 1.45% of each employee’s check, respectively; you’ll withhold the amounts each pay period and pay a matching amount from your own bank account. FUTA is generally 6% of each employee’s check, up to a maximum of $7,000.

Iowa Taxes

Iowa payroll taxes run from 4.4% to 6.0% for tax year 2023. Iowa has a reciprocity agreement with Illinois, which means that if you’re paying an employee who lives in Illinois while your business is based in Iowa, you’ll need to calculate taxes based on their residence—and vice versa. The unemployment insurance taxes are 0% to 7%, with a taxable wage base of $36,100. In 2024, the wage base increases to $38,200.

Important Tax Update: For the tax year 2023, Iowa has reduced to four tax brackets ranging from 4.4% to 6.0%. In 2024 and 2025, the top tax rate will be eliminated, reducing the tax brackets to three and then two, respectively. In tax year 2026, Iowa will switch to a flat tax rate of 3.9%.

State Income Taxes

Iowa has a tier-based income tax system. You can find the tax tables online, or you can use the Iowa withholding formula for wages paid to determine how much you owe.

Income | 2023 Rates | 2024 Rates | 2025 Rates | 2026 Rates |

|---|---|---|---|---|

$0 to $6,000 | 4.40% | 4.40% | 4.40% | 3.90% |

$6,001 to $30,000 | 4.82% | 4.82% | 4.82% | 3.90% |

$30,001 to $ $75,000 | 5.70% | 5.70% | 4.82% | 3.90% |

Over $75,000 | 6.00% | 5.70% | 4.82% | 3.90% |

It’s also important to note that Iowa has local taxing jurisdictions. Every local jurisdiction in Iowa levies local tax, ranging from 1% to 20% of an employee’s taxable income. All but one of these jurisdictions are school districts.

Reciprocity Agreements

Iowa has a reciprocity agreement with the state of Illinois. Any wages or salary paid to an Illinois resident working in Iowa is taxable only to Illinois and not to Iowa. You’ll need to have such employees fill out Form IA 44-016, Employee’s Statement of Nonresidence in Iowa. You do not need to submit withholdings for these employees.

Unemployment Insurance

You need to register and pay unemployment insurance if you have even one employee. You must register with the Iowa Workforce Development site at myIowaUI.org within 30 days of hiring employees.

Iowa charges SUTA taxes on wages up to $36,100. The rates range from 0% to 7% with the new employer rate of 1% and the new construction employer rate of 7.5%. It’s divided into 21 ranks. Your rank is determined by your benefit ratio, which is your five-year average of payments charged divided by your five-year average annual taxable payroll.

If any of your former employees use unemployment benefits within 40 days after the close of the calendar quarter, the IWD sends a notice of benefits paid to those employees and amounts due from you, if there are any.

Did you Know? When you pay SUTA, you may qualify for up to a 5.4% discount on your federal unemployment insurance taxes.

Workers’ Compensation Insurance

All Iowa businesses that employ people must pay workers’ compensation with the following exceptions:

- Domestic and casual employees making less than $1,500 from their employer in the 12 consecutive months before the injury

- Agricultural employees in companies with a cash payroll of less than $2,500 in the calendar year before the injury

- People working for a relative

- Exchange labor in agriculture

- The president, vice president, secretary, or treasurer of a family farm corporation and their spouses, along with the parents, brothers, sisters, children, stepchildren, and their spouses

- Police officers and firefighters who are entitled to benefits under a firefighter pension fund

- Employees who are entitled to benefits under any rule of liability or method of compensation, for federal employees, established by the Congress of the United States

You need to pay workers’ compensation insurance for your corporation officers. However, you can fill out Form 14-0061 to exempt up to four officers (president, vice president, secretary, and treasurer). The officers must sign it in front of witnesses. Corporate officers of family farms are exempt without having to fill out the form.

You can purchase workers’ compensation insurance from a private insurance agency. If you wish to self-insure, you need to apply with the Iowa Division of Workers’ Compensation (DWC). A group of employers can form their own insurance association, combining resources to self-insure each member. Self-insurers appoint a representative who lives in Iowa and knows Iowa workers’ compensation laws. This person must be registered with the DWC. Look at Iowa Code 2016, Chapter 87.4 for details.

Minimum Wage Laws in Iowa

The minimum wage in Iowa is $7.25 per hour, which is aligned with the federal minimum wage. Employees who make more than $30 per month in tips may be paid as little as $4.35 per hour, as long as their tips bring them up to minimum wage (if not, you must make up the difference).

Employers grossing at least $300,000 a year in sales or business must comply with the minimum wage law. Construction companies and public agencies, hospitals, medical centers, and schools must also comply.

Overtime Regulations

Iowa follows federal law for overtime, which states that for hourly and nonexempt salary employees, you must pay 1.5 (time and a half) of the regular salary rate for hours worked over 40 in a workweek. To ensure you’re always paying your employees accurately, check out our article on calculating overtime.

Different Ways to Pay Employees

Iowa lets you require direct deposit of wages if:

- Employees were hired after July 1, 2005

- The cost of opening and keeping an account does not put the employee below minimum wage

- The employee is not charged for direct deposit

- There’s no union contract forbidding mandatory direct deposit

Otherwise, you may pay in cash or via paycheck. To mail a paycheck, you must have the employee’s written consent. You can also pay wages with a prepaid debit card, also known as a pay card, by employee agreement if the funds are available on or before payday and the employee is not charged a fee to use their earnings.

Pay Stub Laws

Employees must get a pay stub each payday with the hours worked, wages earned, and deductions made on each regular payday. You can mail, email, or keep a printed copy that the employee can pick up during normal business hours. To mail a pay stub, you need the employee’s written consent.

If you need to create your own pay stubs, use one of our free pay stub templates.

Minimum Pay Frequency

Iowa lets you set the frequency of payments, but they must be at least monthly and regularly spaced. You must pay employees within 12 days (excluding Sundays and legal holidays) of the end of the pay period.

If you have employees earning commissions, you can, by a written agreement, pay a credit toward wages earned on commission. These credits need to be paid at regular intervals of less than 12 months.

Paycheck Deduction Rules

Iowa allows deductions for taxes, garnishments, and (with employee agreement) employee benefits, like a 401(k), health insurance, and the like. You cannot deduct for cash shortages in the register, breakage or damages, lost or stolen property, or personal protective equipment. There are some exceptions to these rules. See Iowa Code Chapter 91A.5 for details.

Uniforms: You can require employees to buy uniforms, but cannot deduct the cost of the uniform from their pay if the uniform identifies the business through a logo or company colors. However, you can deduct for generic uniform items, like black slacks.

Final Paycheck Laws

Regardless of whether an employee is fired or quits, they need to be paid by the next regular payday.

If you provide paid vacation or sick leave as part of the employment contract, then whether you have to pay them for unused time is dependent on the wording of your contract. Be sure your contracts are clearly worded.

Iowa HR Laws That Affect Payroll

Iowa’s HR laws are simple, often defaulting to federal regulations.

New Hire Reporting

Report new hires within 20 days of hire or rehire. You’ll need to register on the Department of Human Services website and report there.

Lunch & Other Break Time Requirements

Like many states, Iowa does not mandate meal breaks. If you decide to allow breaks, you must pay employees for breaks shorter than 15 minutes, but not for meal breaks over 20 minutes if the employee is not working. Employees are allowed bathroom breaks.

Labor unions and special industries like airline travel may mandate certain breaks. Additionally, minors younger than 16 must have a 30-minute break if they work five or more hours in a day.

Paid Time Off & Sick Leave

Iowa does not mandate paid time off or paid sick days. You need to establish these policies through an employment agreement.

Iowa Family Leave Act

Iowa follows the federal Family and Medical Leave Act (FMLA), which allows up to 12 weeks of leave in a year or 26 weeks for military caregiver leave. Our article about federal labor laws goes into deeper detail about FMLA.

Time Off to Vote

You need to provide eligible employees time to vote if they do not have three consecutive hours in the period between the time of the opening and the closing of the polls. Employees need to request this time off in writing before the date of the election, however, and it must be paid if they’re going during work hours.

Hiring Minors

Iowa law states that no child may work without compensation, not even as migratory labor. It takes a court order to get a work permit for a child 10 or under, and they can only work in very limited occupations.

Work permits are no longer required to hire minors aged 14 up to 18. Those under 14 are limited to migratory work and certain street occupations like selling newspapers. For migratory work, their hours are limited to between 5 a.m. and 7:30 p.m. between Labor Day and June 1, and 5 a.m. to 9 p.m. the remainder of the year. For street work, the hours are between 4 a.m. and 7:30 p.m. when school is in session and 4 a.m. and 8:30 p.m. during the rest of the year. Children under 14 shall not work during school hours.

Children aged 14 and 15 can work between 7 a.m. and 7 p.m. Labor Day through June 1, and until 9 p.m. during the summer. They can only work during school hours as part of a work-study program or if they are legally out of school or enrolled in school part-time. At this age, they can work in such jobs as:

- Retail or comparative shopping

- Foodservice, gas stations, or as cashiers

- Office and clerical work

- Artwork, modeling, entertaining

- Cleanup work and grounds maintenance

- Errand duty

- Kitchen work

The list of prohibited occupations includes manufacturing, mining, construction, warehousing, and anything involving heavy machinery.

While the list of occupations opens up for children aged 16 and 17, they still cannot work in occupations involving:

- Explosives

- Driving

- Logging

- Mining

- Meat slaughtering or meatpacking

- Demolition

- Power-driven machines for woodworking, metalworking, baking (except small appliances), construction, dry cleaning

There are no restrictions on minors engaging in these activities:

- Volunteer work charity or public purpose

- Referees 12 or older working for a charitable organization, the government, or an organization recognized by the United States Olympic Committee

- The Iowa Summer Youth Corps Program

- Any recognized program of the Iowa National Service Corps for children over 14

For more information on federal child labor laws, check out our guide on hiring minors.

Payroll Forms

Most of Iowa’s payroll tax forms need to be filed electronically as stated in the instructions at the top of this article. However, there are some fillable PDFs online.

Iowa State W-4 Form

Iowa’s withholding exemption form is IA W-4: Employee Withholding Allowance Certificate. It should be filled out along with the federal W-4 form during an employee’s onboarding.

Other Iowa State Payroll and Tax Forms

- IA 44-016: Employee’s Statement of Nonresidence in Iowa

- Form 44-095: Iowa Withholding Quarterly Tax Return and instructions

- Form 14-0061: Rejection of workers’ compensation, which exempts certain corporate officers from workers’ comp

Find other payroll forms on the Iowa Department of Revenue Forms page. This page includes forms for individuals as well as businesses.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing nonemployee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

State Payroll Tax Resources

- Division of Labor/Child Labor: Summarizes and gives links to the state laws concerning hiring minors and instructions for children wanting work permits

- Iowa Department of Revenue: The go-to place for information on registering businesses and paying taxes of all types

- Unemployment Insurance Employer Handbook: For all the information you need about unemployment insurance

- Employee Wage Law FAQs: Directed toward employees but contains information and links to wage laws you should know

Iowa Payroll Frequently Asked Questions (FAQs)

When an employee leaves your company, you must pay them any wages they’ve earned up until their termination date. You are not required to pay them any severance, though if you have a PTO policy and you regularly pay out accrued but unused PTO when an employee leaves, you’ll need to account for that additional payment.

Yes—over 280. These taxes range from 1% to 20% of the employee’s taxable income. Missteps here can lead to incorrect deductions and unhappy employees.

You must keep these for at least three years. These records include hours worked, wages paid, taxes withheld, and dates of pay. Good records are not only required by law, but it’s also good business practice.

Bottom Line

Learning how to do payroll in Iowa is not unusually complex, although there are some rules and regulations to know. Iowa charges income taxes based on a tiered system—though that’s changing—and it has state unemployment insurance. Its workers’ compensation requirements can be fulfilled through a private insurance agency, by self-insuring, or by creating a co-op with other companies to self-insure. The time off and medical leave rules defer to federal law.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.