To do payroll in Maine, it’s important to know its state payroll laws, especially for seasonal businesses. The state charges income tax from 5.8% to 7.15%, and its unemployment insurance tax runs from 0.22% to 5.69% (adjusted rate). In addition to rules for seasonal jobs, there are specific guidelines for employing minors.

Key Takeaways:

- Maine’s minimum wage is $14.65 per hour.

- Maine has detailed rules on seasonal employment.

- Maine is set to expand its paid family leave program.

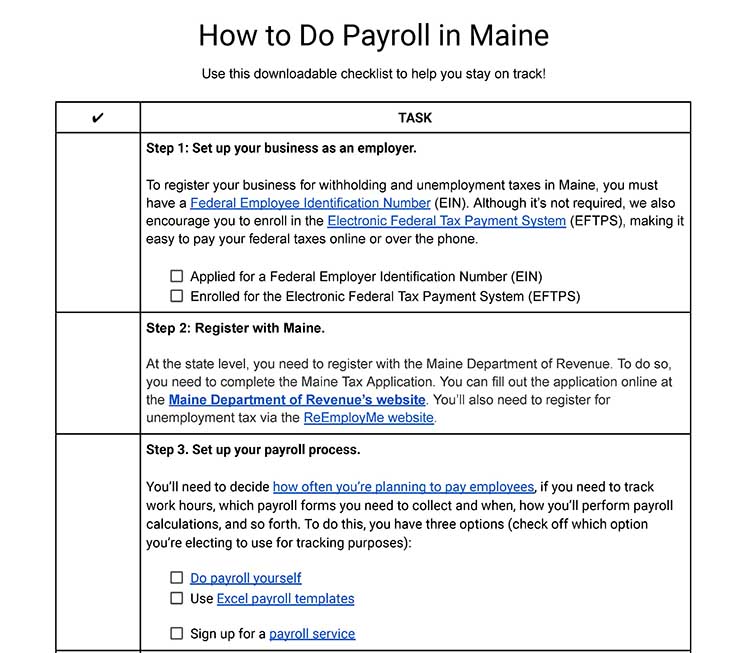

Step-by-Step Guide to Running Payroll in Maine

Step 1: Set up your business as an employer. At the federal level, you need your Employer ID number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with Maine. Register your business with Maine Revenue Services and get a state EIN. You’ll also file taxes there. You can file unemployment contributions on the ReEmployME system.

Step 3: Set up your payroll process. You must create a set schedule of paydays that are at least twice a month and be intentional when selecting the pay period that each pay date will cover. Also, allot enough time to gather the proper approvals and complete the payroll process by your target date. You must also decide when and how you’ll collect payroll forms, how you’ll pay employees, and more.

Step 4: Collect employee payroll forms. These payroll forms are best filled out during employee onboarding. These include the W-4 form, I-9 form, and direct deposit authorization. For Maine, employees must fill out a W-4ME. There’s also a Withholding Allowance Variance Certificate if they want to claim more personal allowances than are allowed on the W-4ME.

Step 5: Collect, review, and approve time sheets. Keep in mind that you must pay employees within eight days of the end of the pay period, and if the regular payday is a nonwork day, then you should arrange payment for the day before. This means you must establish a solid system for collecting approved time sheets for hourly and other nonexempt employees to ensure you’re never delayed when running payroll.

Step 6: Calculate employee gross pay and taxes and pay employees. There are numerous payroll calculations you must make to ensure employees, benefits providers, tax agencies, and others are paid appropriately. You can use payroll software, a calculator, or even Excel to calculate payroll.

Step 7: File payroll taxes with the federal and state governments. Follow the IRS instructions for federal taxes, including unemployment.

Maine Income Taxes: Maine offers several ways to file and pay income tax withholdings. Small businesses will find the I-File most convenient. Larger businesses and payroll processors can use the Maine Employers Electronic Tax Reporting System. Payments are made with Maine EZ Pay or by electronic funds transfer. You must pay electronically if your annual payments exceed $10,000 a year.

If you paid more than $18,000 in taxes in the preceding 12 months ending June 30, then you must pay semiweekly. Semiweekly payments follow this schedule:

- For wages paid Wednesday, Thursday, or Friday, remit withholding payment on or before the following Wednesday.

- For wages paid Saturday, Sunday, Monday, or Tuesday, remit withholding payment on or before the following Friday.

Otherwise, you must pay quarterly according to the schedule listed for SUTA below.

State Unemployment Insurance Taxes (SUTA): Pay SUTA via your ReEmployME account according to the schedule below.

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

If the due date for a report or tax payment falls Saturday or Sunday, reports and payments are considered on time if they are received on or before the following business day.

Step 8. Document and store your payroll records. Maine requires you to keep payroll records on employees for at least three years. Information should include contact information, hours worked, and wages earned. Learn more in our article on retaining payroll records.

Step 9. Do year-end payroll tax reports. Send the federal Forms W-2 (for employees) and 1099 (for contractors). You must also submit the W-3ME annual reconciliation of income tax withheld.

Download our free checklist to help you stay on track while you’re working through these steps:

Maine Payroll Laws, Taxes & Regulations

No matter what state you are in, you must follow federal law for income taxes, Social Security, Medicare, and federal unemployment insurance (FUTA). You must withhold 6.2% of each employee’s paycheck for Social Security and 1.45% for Medicare; in addition, you’ll pay a matching amount from your own business bank account. Learn more in our articles on FICA, unemployment insurance, and workers’ comp.

Maine Taxes

If you withhold federal income taxes for an employee, you must also withhold state taxes. This includes withholdings for agricultural employees and resident and nonresident employees. Maine charges state income taxes on a tiered system.

State Income Taxes

Maine’s state income taxes run from 5.8% to 7.15%. The personal exemption amount is $4,700 for each withholding allowance. There are two ways to calculate your withholdings: by a percentage calculation or by referring to the withholding tables. Withholdings must be paid quarterly or semiweekly, depending on how much you pay in taxes. See Step 7 in the instructions above for the schedule.

Unemployment Insurance

You are liable for SUTA when you pay more than $1,500 in gross wages in a calendar quarter or for work performed in any part of the day in 20 weeks in a calendar year. Maine charges SUTA for up to the first $12,000 earned by each employee. There are 20 tiers that depend on your user experience rate, and the percentages include SUTA, contributions to the Competitive Skills Scholarship Program (CSSP), and contributions to the Unemployment Program Administration Fund (UPAF).

Seasonal employment: Seasonal employees can only claim unemployment benefits if they lose their job during the season in which they work. Therefore, it’s in your best interest to designate seasonal jobs and employees. You can find the list of seasonal jobs and the dates for the seasons in the Maine UI Employer Guide.

Each year, Maine’s Department of Labor sends you a Form ME TAX-13, Notice of Contribution Rate. This is based on contributions paid vs liability for the past three years. If you are a new employer or your contribution ratio is zero, then you will pay 2.11%. Other adjusted rates run 0.22% to 5.69%. In addition, you pay 0.07% for CSSP and 0.15% for UPAF.

Exemptions include the following:

- Those exempted under federal law

- Aliens admitted to the US for agricultural work

- Spouses or children working in the family business

- Students in a training program

- Students in seasonal camps

- Real estate brokers and salespersons on commission only

- Newspaper carriers under 18

- Some workers in nonprofit or religious organizations

Find a full list in Maine’s Title 26. Agricultural businesses are liable if they pay more than $20,000 in gross wages during a calendar year or employ at least 10 individuals in agricultural labor in each of 20 different weeks in a calendar year. For nonprofits, you must have employed four or more people on the same day for 20 weeks in a calendar year. Domestic employers are liable when they pay $1,000 or more in gross wages in a calendar quarter.

Did You Know?When you pay SUTA, you may qualify for up to a 5.4% discount on your FUTA taxes. Remember, FUTA is generally 6% of each employee’s income up to the first $7,000.

Workers’ Compensation Insurance

Maine requires all employers to purchase insurance for workers’ compensation or self-insure with the following exceptions:

- Employers that have employees engaged in agriculture or aquaculture as seasonal or casual laborers, provided the employer maintains at least $25,000 in employers’ liability insurance, with at least $5,000 in medical payments coverage

- Employers of six or fewer agricultural or aquacultural laborers, provided the employer maintains employers’ liability insurance of at least $100,000 multiplied by the number of full-time equivalent employees and has at least $5,000 in medical payments coverage

- Employers of domestic servants in private homes

- Sole proprietors with no employees

Certain corporate officers of LLCs, nonprofits, or family businesses may waive the benefits of workers’ comp.

You can purchase workers’ compensation insurance from commercial insurance companies. You can apply to self-insure if you can afford to take on all the workers’ compensation losses; normally, only large corporations qualify for this option. There are also provisions to group with other businesses in a self-insurance co-op.

For more information on how you can insure your company or find providers that can sell you workers’ comp directly, check out the Maine employer’s guide to workers’ comp.

Minimum Wage Laws in Maine

Maine has a minimum wage of $14.65 per hour. Tipped employees earning over $100 a month in tips can be paid as little as $6.90 if their tips take them up to minimum wage in a pay period. Effective Jan. 1, 2025, the tipped employee minimum wage increases to $7.33 per hour.

Portland, Maine, has a minimum wage of $15.00 per hour ($7.50 per hour for tipped employees). Excluded from this are agricultural workers, taxi drivers, seasonal camp workers, fishermen, home assembly workers, and immediate family working in a family business.

Exceptions to Maine’s minimum wage laws closely follow those listed in the Fair Labor Standards Act and include farmworkers, seasonal workers, full-time and vocational students in certain situations (like work-study), and employees with disabilities in certain situations.

Maine Overtime Regulations

You must pay overtime for any time over 40 hours in a workweek at 1.5 times the employee’s regular wage. You cannot force an employee to work overtime, and you cannot “pay” for overtime with comp time.

You cannot force an employee to work more than 80 hours of overtime in a two-week period. Overtime regulation exceptions apply to the following:

- Salaried employees in executive or administrative positions as defined by the Fair Labor Standards Act and who earn at least $684 per week

- Work done in response to a governor-declared state emergency

- Essential services for the public

- Salaried employees in an executive position whose regular compensation exceeds 3,000 times the state’s minimum hourly wage

- Seasonal employees

- Medical interns or residents

- Employees who are doing overtime as part of a shutdown for annual maintenance

Different Ways to Pay Employees

In Maine, you can pay with cash, checks, direct deposit, pay card, or other electronic transfer as long as the employee can withdraw the entire amount without additional cost to the employee or choose an alternative that involves no additional cost. For more in-depth information on how to compensate your employees, check out our guide on the different ways to pay your employees.

Pay Stub Laws

You must issue pay stubs each payday with the date and pay period, hours worked, itemized deductions, and wages earned. Failure to issue pay stubs could result in fines, penalties, and even a lawsuit if you’re not careful.

If you’re not using a payroll service to help, you must create your own pay stubs. Use one of our free pay stub templates to get started and save you time in the long run.

Minimum Pay Frequency

You must pay employees at least every 16 days, which means a semiweekly, biweekly, or weekly payment system. You must pay employees within eight days of the end of a pay period. This can be hard to track if you don’t have a system in place. Download one of our free pay period calendars to stay on top of your pay schedule and dates.

Paycheck Deduction Rules

Maine lets you deduct for taxes, court-ordered garnishments, insurance premiums, retirement funds, loans, or advances you give the employee to pay for merchandise purchased from the employer, or rent for a company-owned building. You cannot deduct for cash shortages, damages, customer walkouts, or credit card errors.

Final Paycheck Laws

Employees who quit, were fired, or were laid off must be paid in full by the next payday. All employers with more than 10 employees must pay all accrued and unused vacation time to departing employees no later than the company’s next regular payday.

Maine HR Laws That Affect Payroll

Maine’s HR laws are a little stricter than those of other states. For example, you must report hires within seven days of hiring vs the usual 20, and lunch breaks are mandatory.

Maine New Hire Reporting

Maine requires that you report new hires within seven days of hire. This is a shorter time than most states. You must report any employee receiving a W-2 or independent contractor when you expect they will receive at least $2,500 in wages in a year.

Lunch & Other Break Time Requirements

You must provide at least a 30-minute unpaid or paid rest break for every six hours worked unless the employee waives that right, preferably in writing. Shorter breaks are not required by law, but they must be paid and not deducted from time worked. You do not need to supply breaks if you have fewer than three employees on duty at any one time or if the employee has frequent smaller paid breaks during the workday.

Nursing mothers need unpaid breaks or must be allowed to use paid break times or mealtimes to express milk. Employers must provide a clean location (not a bathroom) where milk can be expressed.

Paid Time Off & Sick Leave

As of 2021, Maine employers are required to provide workers with one hour of paid leave for every 40 hours worked, up to an annual cap of 40 total hours. Company policies may provide more.

Employees can use this leave for whatever reason they wish, but unless it’s for an emergency, illness, or sudden necessity, you can require that they give you advanced notice. That notice can be as far ahead as four weeks. Employees working in seasonal jobs only are exempt from earned paid leave. Download the list of seasonal industries and their dates of business from the Department of Labor website

Maine Family Leave Act

Under the federal Family and Medical Leave Act, employers with 50 or more employees must provide eligible employees up to 12 weeks of unpaid leave each year for specified family and medical reasons.

Starting on May 1, 2026, Maine’s Paid Family and Medical Leave law takes effect. Payroll contributions begin on Jan. 1, 2025, a 1% payroll tax. Under this law, employees can receive up to 12 weeks of paid leave for covered reasons, like caring for an ill family member or for health-related issues for the employee.

It’s important to note that employers can opt out of this law, provided that they have an existing paid leave plan that does not cost employees more than the state program. Be aware that many private paid leave plans won’t comply with this law as they won’t provide the same benefits and protections.

Hiring Minors

Minors under 16 need work permits, and the superintendent of schools needs to certify their academic standing. As an employer, you must keep accurate payroll records with the time the minor starts and stops work each day, as well as the total hours worked.

There is no minimum age or work permit required for agricultural work. Children under 14 can only work in agricultural work (except jobs that come into contact with heavy machinery), school lunch programs, or family businesses.

Maine allows minors 14 and up to work in any job that is not hazardous and does not jeopardize their health. Find a full list on the Maine Department of Labor website. Some examples of prohibited jobs include manufacturing, mining, working with explosives or hazardous materials, working with heavy machinery, and emergency response. The younger the employee, the more jobs are prohibited. For example, occupations on amusement rides are prohibited for minors under 16.

Minors 14 and 15 cannot work more than six days in a row and must work between the hours of 7 a.m. and 7 p.m. during the school year (not during school hours) or 7 a.m. and 9 p.m. during summer vacation. During the school year, they cannot work more than three hours a day during school days (including Fridays), with no more than 18 in a week. When school is not in session, that extends to eight hours a day and 40 hours a week (if school is out for the entire week).

Minors 16 and 17 cannot work more than six days in a row. They cannot work before 7 a.m. on school days or before 5 a.m. on nonschool days. On nights before school, the latest they can work is 10:15; when there’s no school the next day, they can work until midnight.

When school is in session, minors 16 and 17 cannot work more than six hours on a school day, 10 hours on a nonschool day, or more than 24 hours for the week. When school is not in session, they cannot work more than 10 hours a day and 50 hours a week. They can also work 50 hours when a school week has less than three days in it.

Payroll Forms

Most of Maine’s payroll tax forms must be filed electronically, although some can be mailed in. You can find the forms online, although some do not need to be used when filing online.

Maine State W-4 Form

Maine’s withholding exemption form is a W-4ME. Maine also has an additional form, the Personal Withholding Allowance Variance Certificate, that employees can fill out if they want to claim additional allowances.

Other Maine State Payroll and Tax Forms

- Form 900ME: Payment Voucher for Maine Income Tax Withheld (Semiweekly), which is not needed if the payment is made electronically

- Form 941ME: Employer’s Return of Maine Income Tax Withholding (Quarterly)

- W-3ME: Annual Reconciliation form, which is filed electronically at the end of the year along with any payments needed

- ME UC-1 ME: Department of Labor Filing for Unemployment Contributions

- ME UC-1-PV: Quarterly Return Payment Voucher for Maine Unemployment Contributions

Federal Payroll Forms

- W-4 Form: Helps employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reports total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculates unemployment taxes due to the IRS

- Form 941: Is for filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reports annual income and FICA taxes withheld from paychecks

- 1099 Forms: Provides nonemployee pay information that helps the IRS collect taxes on contract work

Maine Payroll Tax Resources/Sources

- Maine Department of Labor Laws Site: Access all the labor laws, FAQs, posters, and more

- Regulation of Employment: Poster outlining the most important laws concerning paychecks and leave

- Title 26, Labor and Industry: The rules for employment, labor, work hours, and more

- Maine Department of Labor Employment of Minors Site: All the child labor laws and restrictions for the state

- Department of Health and Human Services Employer Page: All the information you need for reporting new hires and filing garnishments for child support

- Employer’s Guide to Maine Unemployment Laws: Contains information about determining and paying SUTA, how to file SUTA and report new hires, and how to appeal employee requests for benefits

- Employer’s Guide to Workers’ Compensation Insurance: Who’s liable, how to insure or self-insure, and how worker’s comp works

Frequently Asked Questions About Maine Payroll

In Maine, you have to pay tipped workers at least $7.50 per hour. If an employee’s tips don’t increase their hourly rate to at least the state minimum wage of $14.65 per hour, you must make up the difference.

Yes and no. In 2023, Maine established a state-funded paid family and medical leave program that will become available to all Maine employees on May 1, 2026. Payroll tax contributions to this program begin on Jan. 1, 2025, so you’ll be expected to adjust your payroll withholdings depending on how many Maine-based employees you have:

- Employers with fewer than 15 employees will contribute 0.5% of wages, all of which may be deducted from the employee’s paycheck.

- Employers with more than 15 employees will contribute 1% of wages, half of which may be deducted from the employee’s paycheck.

Quarterly wage reporting and payments are due on April 30, 2025, and Maine’s DOL will open an online portal for submitting this information in early January 2025.

Speak with a Maine payroll tax representative immediately. You may be subject to late fees and penalties so you’ll want to set up a payment plan and address the issue as quickly as possible.

Bottom Line

Doing payroll in Maine is fairly straightforward. You must pay state income tax withholdings as well as unemployment insurance and workers’ compensation insurance. The state’s unemployment insurance covers not only SUTA but also a scholarship fund and an administrative fee. Some of Maine’s rules are stricter than those of other states, such as those for reporting new hires and defining seasonal employees, but by following this guide, you can ensure compliance with Maine’s payroll laws.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.