As you learn how to do payroll in New Mexico, you’ll find that labor laws for hours, time off, and overtime closely align with federal regulations—so you won’t have to deal with as many headaches as employers in some states do. Employers are required to pay state income tax withholdings monthly and state unemployment insurance (SUTA) every quarter. New Mexico also requires you to find a private insurer for workers’ compensation, which is common in most states.

Key Takeaways:

- 2023 New Mexico minimum wage: $12 per hour

- Paydays must be no more than 16 days apart

- State income tax rates: From 1.7% to 5.9%. All income is taxed, and rates depend on filing status and annual income.

- New Mexico charges SUTA

- Employers must provide workers with one hour of paid sick leave for every 30 hours worked

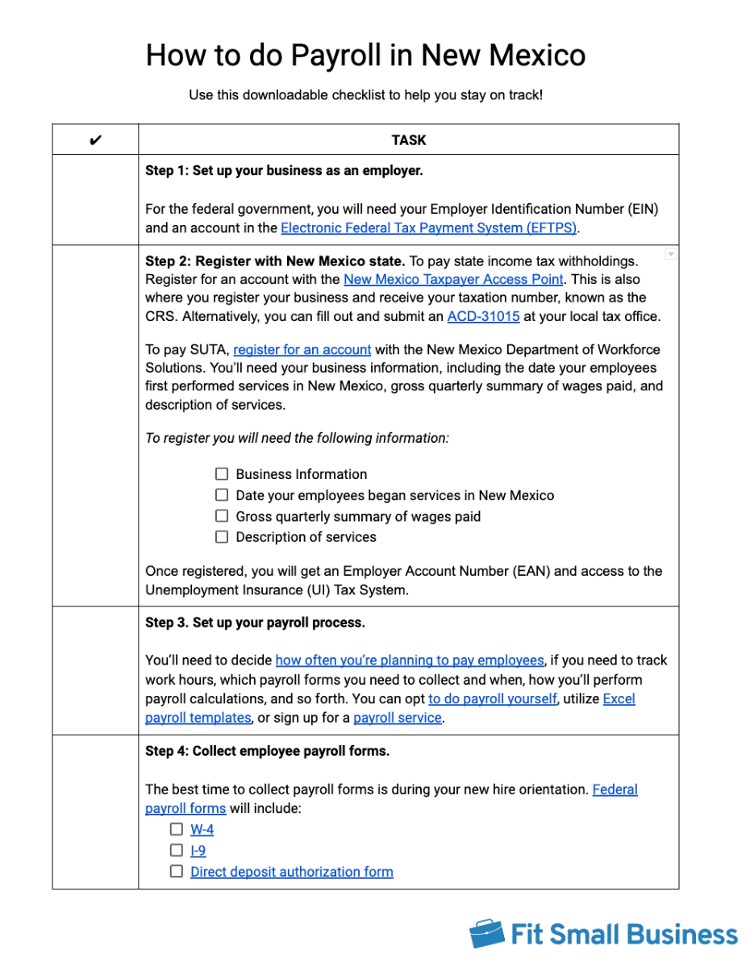

Running Payroll in New Mexico: Step-by-Step Instructions

Step 1: Set up your business as an employer. To comply with federal law, you need your employer ID number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with New Mexico state agencies. To pay state income tax withholdings. Register for an account with the New Mexico Taxpayer Access Point. This is also where you register your business and receive your taxation number, known as the CRS.

To pay SUTA, register for an account with the New Mexico Department of Workforce Solutions. You’ll need your business information, including the date your employees first performed services in New Mexico, gross quarterly summary of wages paid, and description of services. Once registered, you will get an Employer Account Number (EAN) and access to the Unemployment Insurance (UI) Tax System.

Step 3: Set up your payroll process. Create a set schedule of paydays that are at least twice a month (except for executives and supervisors, who can be monthly). Creating a payroll schedule will require you to have a payroll process already in place. If you don’t, learn how to set up payroll yourself in our helpful guide.

Step 4: Collect employee payroll forms. Payroll forms are best filled out during employee onboarding. These include the W-4 form, I-9 form, and a direct deposit authorization form. New Mexico does not have a state W-4.

Step 5: Collect, review, and approve time sheets. Be sure to accurately account for overtime. Time sheet templates or time clocks can help employees efficiently track their hours.

Step 6: Calculate payroll and pay employees. You can use payroll software, a calculator, or even an Excel template to calculate payroll.

Step 7: File payroll taxes with the federal and New Mexico state government. Follow the IRS instructions for federal taxes, including unemployment. You’ll report using the Wage Withholding Tax Return Form WWT-1. You can file New Mexico taxes and unemployment insurance online, as well, using the Taxpayer Access Point e-filing portal. You’ll just need your state tax ID number and PIN.

- New Mexico Income Taxes: New Mexico withholdings are paid on the 25th of the month following the end of a reporting period, unless the 25th is Saturday, Sunday, or legal holiday. Then it is due the next business day.

- SUTA: You must file online and pay via automated clearing house (ACH) debit.

For Wages Paid During | Calendar Quarter Ends | SUTA Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sep. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

If the due date for a report or tax payment falls Saturday or Sunday, reports and payments are considered on time if they are received on or before the following business day.

Step 8. Document and store your payroll records. New Mexico requires you to keep records on employees for at least one year. Information should include contact and payroll information about the employer and employee. See the pay stub requirements below and learn more in our article on retaining payroll records.

Step 9. Do year-end payroll tax reports. Send the federal Forms W-2 (for employees) and 1099 (for contractors). You also need to submit the state copy of the W-2 to New Mexico. You can file the Form RPD-41072, Annual Summary of Withholding Tax—but it is not required unless you underpaid or overpaid monthly withholdings.

Download our free checklist to help you stay on track while you’re working through these steps:

Learn more about doing payroll yourself in our guide on how to do payroll. It also has a free checklist you can download to make sure you don’t miss any steps.

New Mexico Payroll Laws, Taxes & Regulations

No matter what state you are in, you must maintain compliance with payroll regulations and follow federal law on withholding money from employee paychecks for income taxes, Social Security (6.2% from each employee paycheck and a matching 6.2% from your bank account), Medicare (1.45% from each employee paycheck and a matching 1.45% from your bank account), and federal unemployment insurance (6% of each employee’s first $7,000 earned).

Learn more in our article on federal and state payroll tax rates.

New Mexico Taxes

New Mexico has state income taxes, but no particular local income taxes. It charges unemployment insurance taxes. Companies hiring more than three employees also need to get workers’ compensation insurance unless they have over 100 employees and are large enough to self-insure.

State Income Taxes

If you withhold federal income taxes for an employee, then you must also withhold state income taxes. This includes agricultural workers under some conditions. However, Native Americans who are members of a New Mexico federally recognized Indian nation, tribe, or pueblo and who live on the lands where they are enrolled are exempt.

New Mexico charges income tax rates from 1.7% to 5.9%. All income is taxed, and rates depend on filing status and annual income. You can find New Mexico’s current rates and other information on filing by checking out the 2023 New Mexico Withholding Tax document the state released.

Unemployment Insurance

New Mexico charges SUTA; if you have employees, then you must pay it. In general, you need to pay if you paid an individual $450 or more in any calendar quarter in the current or preceding calendar year, or if you employed one or more persons—including part-time workers—in each of 20 different calendar weeks of the current or previous calendar year. There are different rules for farm, domestic, and nonprofit organizations.

The SUTA is based on a taxable wage base of $30,100. SUTA rates run from 0.33% to 5.4% for experienced employers. Rates are calculated and assigned based on your benefit ratio, reserve factor, and experience history factor. If that number exceeds 5.4%, you will add an excess claims rate, which is a pre-adjusted contribution rate minus 5.4%, then multiplied by 10%. The excess claims rate cannot be higher than 1%.

New employers are charged at their industry average or 1%, whichever is greater. You can find the industry rates and a full explanation of how experienced rates are calculated on the New Mexico Department of Workforce Solutions Website.

Did you Know?:

When you pay SUTA, you may qualify for up to a 5.4% discount on your federal unemployment insurance taxes (FUTA).

Workers’ Compensation Insurance

If you are a New Mexico business and have three or more employees anywhere in the US with at least one working in the state, then you need New Mexico workers’ compensation insurance. If you do work requiring licenses by the Construction Industries Licensing Act, you must have workers’ compensation coverage, even if you have fewer than three employees.

There are three types of coverage: conventional (for most businesses), assigned risk pool (for those in high-risk industries), and self-insurance (for larger, qualifying companies). You get workers’ comp insurance from a qualified insurance broker.

Minimum Wage Laws in New Mexico

Like many states, New Mexico is raising the minimum wage, although it has not posted rate increases past 2023. Be aware there is currently a bill working through the New Mexico legislature that would increase the minimum wage to $15.50 per hour starting in 2025.

In 2023, the hourly minimum wage rose to $12, or $3 for tipped employees. The rates for minors in training or student work-study have not been published.

Some counties and cities have different rates. Where there is conflict, such as for tipped employees, defer to the highest rate. Cities do not list different rates for students or work-study.

City/County | Hourly Minimum Wage (Most Employers) | Cash Wage for Tip Earners |

|---|---|---|

Albuquerque | $12 | $7.20 |

Las Cruces | $12 | $4.78 |

Santa Fe | $12.95 | The city’s Living Wage Ordinance does not set a minimum wage for tipped workers |

Santa Fe County | $12.95 | $3.69 |

There are some exemptions:

- Minors under 18

- Individuals employed in a bona fide executive, administrative or professional capacity and forepersons, superintendents, and supervisors

- An individual engaged in the activities of an educational, charitable, religious, or nonprofit organization where there’s no employer-employee relationship such as for volunteers

- Salespersons or employees compensated upon piecework, flat rate schedules, or commission basis

- Registered apprentices and learners otherwise provided by law

- Seasonal employees of an educational, charitable, or religious youth camp or retreat who are furnished room and board in connection with such employment

- Any agricultural worker who is a family member, is paid on a piece-rate basis, or whose employer did not, during any calendar quarter during the preceding calendar year, use more than 500 person-days of agricultural labor

Learn more on the New Mexico Department of Workforce Solutions Minimum Wage Website, but also check with city websites as the state does not always update changes.

New Mexico Overtime Regulations

New Mexico requires overtime pay of no less than 1.5 times the regular applicable minimum wage rate. Overtime counts as any hours over 40 in a week.

In addition, hotels, restaurants, or cafes shall not make employees work more than 10 hours in a 24-hour period or 70 hours in a seven-day period. The law specifically states male employees, but you should apply this rule for all workers. You must keep time records for employees.

Firemen, law enforcement officers, or farm or ranch hands whose duties require them to work longer hours, or employees primarily in a standby position, may not be required to work more than 16 hours in any 24-hour period except in emergencies.

Different Ways to Pay Employees

New Mexico lets you pay employees by cash, check, or direct deposit if agreed upon by the employer and employee. Payroll vouchers also work if they can be converted to cash at full value.

Check out our guide on how to pay your employees for more information.

Pay Stub Laws

New Mexico requires you to provide a written or printed statement detailing the employee’s pay information. Statements must include employee and employer, gross pay, number of hours worked, total wages and benefits, and an itemized listing of deductions. These records must be kept by the employer for a year.

If you need to create pay stubs, you can download one of our free pay stub templates.

Minimum Pay Frequency

Employees in New Mexico must designate paydays of no more than 16 days apart, usually for the 16th and end of the month. There are exceptions for executives, professionals, supervisors, outside salespersons, and others as defined in the federal Fair Labor Standards Act. These exceptions may be paid once per month.

If you need help keeping track of pay dates to ensure you maintain compliance, then download our free pay period calendar for help.

Paycheck Deduction Rules

New Mexico employers may make deductions for cash shortages, damage or loss of employer property, uniforms, required tools, or other items necessary for employment. They may also create deductions that are permitted by law or that employees have consented to in writing such as for benefits or retirement.

Final Paycheck Laws

When you fire or lay off an employee, you must pay all wages within five days of discharge if the wages are fixed. If they are based on a task, piece, or commission basis, you must pay within 10 days.

If you find yourself needing to process a check quickly, check out our guide on printing payroll checks for free to see your options.

Accrued Time Off

You are not required to provide paid or unpaid vacation benefits to employees. New Mexico also does not require you to provide holiday leave or premium pay on holidays unless the time worked qualifies as overtime. However, if you do so, you should provide an agreement in writing and adhere to it.

New Mexico HR Laws That Affect Payroll

New Mexico labor laws are relatively basic and not much different from federal law. When the two differ, be sure to meet the needs of both.

New Mexico New Hire Reporting

Employers must report new hires or rehires within 20 days, per federal law. Do this at the New Mexico New Hire Directory. You will need your EIN and contact information and the employee’s information, including Social Security number and date of hire. You can report electronically, by mail to the New Mexico New Hire Directory at P.O. Box 2999, Mercerville, NJ 08690, or by fax at (888) 878-1614. If you submit reports electronically, do so in two monthly transmissions not more than 16 days apart. There is no need to report if there are no new hires since the last report.

Paid Sick Leave & Caregiver Leave

New Mexico’s Healthy Workplaces Act took effect July 1, 2022. The law lets employees earn sick leave at a rate of one hour of paid sick leave for every 30 hours worked, up to a maximum of 64 hours.

Employers can have a policy more generous, but this is the minimum. This leave may be used for the employee’s own illness as well as acting as a caregiver to a family member who is ill.

Make sure you’re also following all federal regulations, including the Family and Medical Leave Act.

Voting Leave

New Mexico law allows employees two hours of paid leave to vote if their workday begins two hours before voting begins and ends less than three hours before the polls close. Employers can set up the time for leave to vote.

Lunch & Other Break Time Requirements

You are not required to give lunch or other breaks. However, if you do give breaks of less than 30 minutes, you cannot deduct pay for them. You don’t need to pay for lunch or long breaks if the employee is free to do whatever they like during the break.

Hiring Minors

Children 14 and 15 need a work permit to work in New Mexico. During the school year, they cannot work between 7 p.m. and 7 a.m. Outside the school year, the hours are reduced to between 9 p.m. and 7 a.m. They also cannot work during school hours or more than three hours per day or 18 hours per week.

They cannot work around heavy machinery, explosives, electrical hazards, door-to-door sales, or other similarly dangerous jobs as listed in New Mexico Statutes Chapter 50, Article 6. There are exceptions for children in film or TV productions.

New Mexico Payroll Forms

New Mexico prefers that you pay and file forms online. The state website has several dead links, but you can get these forms at your district office. Your payroll software may also have them in a fillable PDF.

New Mexico State W-4 Form

New Mexico does not have a state withholding form. You should use the withholding information on the employee’s federal W-4 with the withholding tables for New Mexico to determine how much to withhold for each paycheck.

Other Payroll and Tax Forms

- ES802 (A, B, C, and O): These forms let you opt to become liable for payments instead of contributing to unemployment insurance and to submit surety bonds or certificates.

- Form ACD-31015, Business Tax Registration Form: This form is for changing your business address or canceling your CRS number.

- WWT-PV Wage Withholding Tax Payment Voucher: To pay withholdings if you are not paying online, use this form.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

New Mexico Payroll Tax Resources/Sources

- New Mexico Tax Website: Get the forms and information and pay online here.

- New Mexico Department of Workforce Solutions: Where you can learn about unemployment, UI taxes, child labor laws, and more.

- New Mexico Employer Guidebook (Workers’ Comp): This downloadable PDF has all the information you need about workers’ compensation.

- FYI Form 104: New Mexico tax laws and tables.

- Wage Withholding Tax Return: All the information you need on withholdings.

Bottom Line

New Mexico has fewer labor regulations than many states, but it does charge state income taxes and SUTA and requires you to purchase workers’ compensation insurance. It pays to know the regulations and ensure you adhere to them. You can do this on your own, but a good payroll software that tracks New Mexico payroll regulations can make the process easier, plus keep up with changes on tax and SUTA rates.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: