Learning how to do payroll in North Carolina (NC) is pretty straightforward. It simply follows general federal guidelines, requiring you to secure a Federal Employee Identification Number and a NC Withholding Identification Number, as well as register for unemployment tax. While that may be the case, there are some regulations to note—and by using our guide, you can handle your NC payroll efficiently and compliantly.

Key Takeaways

- North Carolina follows the federal minimum wage of $7.25 per hour

- Unlike many states, accrued and unused vacation time must be paid out to departing employees unless you have a written policy stating otherwise

- North Carolina has a state-specific W-4—the NC-4 tax form.

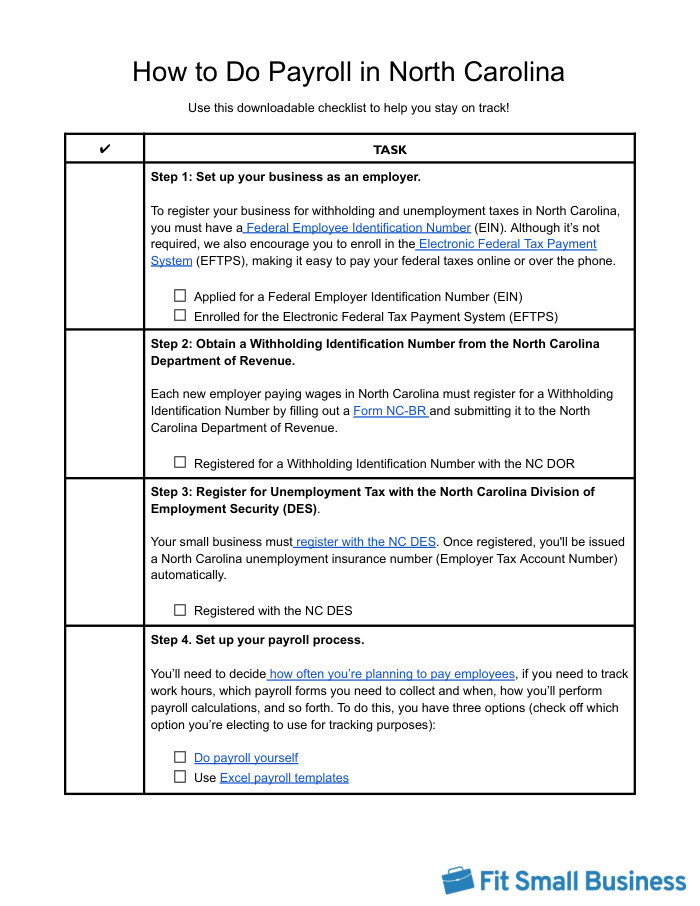

Running Payroll in North Carolina: Step-by-Step Instructions

To register your business for withholding and unemployment taxes in North Carolina, you must have a Federal Employee Identification Number (EIN). Although it’s not required, we also encourage you to enroll in the Electronic Federal Tax Payment System (EFTPS), making it easy to pay your federal taxes online or over the phone.

Each new employer paying wages in North Carolina must register for a Withholding Identification Number by filling out a Form NC-BR and submitting it to the North Carolina Department of Revenue.

Your small business must register with the NC DES. Once registered, you’ll be issued a North Carolina unemployment insurance number (Employer Tax Account Number) automatically.

Established businesses may already have a payroll process in place, but a new company will need to begin by considering how often employees will be paid, when they will be paid, and how hourly employees’ work time will be calculated. You can elect to do payroll yourself, set up an Excel payroll template (you can download our Excel payroll template for starters), or use a payroll service (check out our roundup of the best payroll services for some options).

To run payroll, you will need to collect specific information from each employee:

- W-4 tax form

- NC-4 tax form

- I-9 paperwork

- Direct deposit bank information

You must collect and approve time sheets before submitting payroll. You can use paper time sheets, but we recommend time tracking software that can save you time and ensure the accuracy of reported hours (our guide to the best time tracking software has some options you can start with).

You can also use a payroll software system or just calculate payroll on your own. You must pay your employees on a regular schedule (daily, weekly, biweekly, semimonthly, or monthly). Be sure to also comply with the minimum wage requirements.

Based on your withholding frequency, you must file Form NC-5 (monthly and quarterly withholding filers) or Form NC-5Q (semiweekly withholding filers). You can file your taxes online with the North Carolina Department of Revenue. The form you’ll use for federal tax filing depends on whether your business is a sole proprietorship or LLC (Schedule C) or corporation (Form 1120 or 1120-S).

North Carolina requires employers to keep payroll records for at least three years. These records must contain the employee’s name, address, job title, amount paid each payroll, and daily and weekly hours worked. It is important to retain records for all employees, including those who are no longer with your company. If you need help with which records to keep, see our article on retaining payroll records.

Every employer, regardless of which state your business is in, will need to fill out form W-2s for all employees and form 1099s for independent contractors. By law, you must provide all employees and contractors with their annual tax form no later than January 31 of the following year.

Download our free checklist to help you stay on track while you’re working through these steps:

For general instructions on the basics of doing payroll, check out our guide on how to do payroll.

North Carolina Payroll Taxes, Laws & Regulations

North Carolina follows the general federal payroll laws currently in place, making it a simple state for payroll taxes and regulations.

There are a few payroll compliance regulations, however, to consider:

- Employers are required to notify new hires orally or in writing about their wages and regular pay schedule.

- Employers are required by law to provide written notice at least 24 hours before any reduction in wages.

- Employers must abide by the minimum wage law and pay time and a half to nonexempt employees who work over 40 hours in a workweek.

North Carolina Payroll Taxes

Every North Carolina employer is responsible for paying payroll taxes, as well as Social Security, Medicare, and unemployment taxes for every employee. Social Security and Medicare taxes are paid under the Federal Insurance Contributions Act (FICA). The employer pays half of FICA, and the other half is paid from the employee’s wages, resulting in each party paying 6.2% for Social Security and 1.45% for Medicare.

Employers must also pay State Unemployment Taxes (SUTA) and Federal Unemployment Taxes (FUTA) based on a percentage of each employee’s salary. The North Carolina new employer SUTA rate is 1% with a taxable wage base of $31,400. After 12 months of paying into the system, you will receive a new SUTA rate each year. The rates range from 0.06% to 5.76%.

FUTA is taxed at 6% on the first $7,000 earned.

Keep in mind that the following services are exempt from withholding laws:

- Agricultural labor, except where subject to federal withholding

- Domestic service in a private home

- Services performed by military spouses that are federally exempt, under the Veteran’s Benefits and Transition Act of 2018

State Income Taxes

North Carolina has a flat income tax rate of 4.75%. This means that regardless of an employee’s taxable income or filing status, the rate is the same for all. North Carolina requires employers to withhold state income tax from employees’ wages and remit the amounts withheld to the Department of Revenue. Any employer that does business or has an employee in North Carolina, whether the employer is a state resident or not, must withhold state tax.

Local Taxes

There are no local or city taxes in North Carolina, making it one of the easier states in which to file payroll taxes.

Unemployment Insurance Taxes

If your small business has employees working in North Carolina, you’ll need to pay North Carolina unemployment insurance (UI) tax. The UI tax funds unemployment compensation programs for eligible employees.

Employers must file a Quarterly Tax and Wage Report (Form NCUI 101). Both tax and reported wages are due by the last day of the month following the end of each quarter.

North Carolina 2024 UI Tax Rates | |

|---|---|

Taxable Wage Base for 2024 | $31,400 |

Base Rate | 1.9% |

Employer’s Reserve Ratio Percentage (ERRP) | Employer’s Reserve Ratio multiplied by 0.68 |

UI Tax Rate for New Employers | 1% |

Minimum UI Tax Rate | 0.06% |

Maximum UI Tax Rate | 5.76% |

Workers’ Compensation Insurance

All businesses with three or more employees in North Carolina are required to carry workers’ compensation insurance coverage to assist with medical costs in case employees are injured on the job. Workers’ Compensation Insurance is administered through the North Carolina Industrial Commission.

Exceptions to the three-employee rule are as follows:

- Businesses whose work involves the use or presence of radiation must carry workers’ compensation on as few as only one employee.

- Agricultural employees are not required to carry workers’ compensation unless they employ 10 or more full-time, nonseasonal workers.

- Federal workers’ compensation is covered under the US Department of Labor.

Be sure to follow all guidelines for workers’ compensation insurance. Failure to provide it could result in penalties, a misdemeanor or felony charge, and even imprisonment.

Minimum Wage Laws in North Carolina

Employers must pay all nonexempt hourly employees a minimum wage of $7.25 (the current rate under both state and federal labor laws). For salaried exempt employees, employers must pay a guaranteed salary of $844 per workweek ($43,888 per year). Note that this amount is set to increase on January 1, 2025, to $1,128 per week ($58,656 annually).

However, for employers that have tipped hourly employees, such as restaurants, the minimum wage is set at $2.13 so long as the tips the employee receives bring their hourly wage up to the minimum of $7.25. This is known as a “tip credit.” However, if the worker’s tips do not bring their hourly rate up to the minimum wage, the business must offset the cost so that the employee is making at least $7.25 per hour.

North Carolina law also allows tip pooling—the combining of all tips received and then the distribution of the collected monies equally between employees. Employees must end up with at least 85% of the tips they earned before contributing to the pool. Only employees who customarily and regularly receive tips may participate in the pool, and the employer cannot keep any part of the pool.

North Carolina Overtime Regulations

There are no labor laws in North Carolina that limit the number of hours an employee 18 years or older can work. However, nonexempt employees are required to receive time and a half overtime pay if their working hours reach beyond 40 hours per workweek. Exempt employees are not subject to overtime pay.

Private employers are not permitted to give comp time to nonexempt salaried employees in place of time and a half. Simply being paid a salary does not exempt an employee from receiving overtime pay.

Different Ways to Pay Employees in North Carolina

There are currently no laws in North Carolina that designate a specific form of payroll payment. Therefore, employers may pay their employees using any legal method they choose, as long as payment is made in full on the designated payday.

Acceptable forms of payment include the following:

- Cash

- Check

- Money Order

- Direct Deposit

- Debit-Payroll Card

If an employer chooses to pay with a debit-payroll card, to be compliant, the employee must be able to withdraw all funds on payday; also, there should be no cost to the employee for use of the card.

North Carolina Pay Stub Laws

North Carolina requires employers to provide written or printed pay stubs. This also includes electronic pay stubs that can be printed by the employee.

Minimum Pay Frequency

North Carolina does not have a mandatory pay frequency law; therefore, employers have a few options when it comes to how often they are required to pay their employees:

- Monthly

- Semimonthly

- Every other week

- Weekly

- Daily

If you provide bonuses, commissions, or other forms of payment, you may pay these as infrequently as annually, provided that you’ve notified employees in advance.

Paycheck Deduction Rules

Some deductions from paychecks are required by law, including state and federal income taxes and FICA. Court-ordered garnishments, such as child support or debt, can also be automatically deducted from an employee’s paycheck based on the ordered amounts and frequency.

Additionally, North Carolina employers can deduct the following from employee paychecks with prior written consent:

- Health insurance premiums (medical, dental, vision, FSA, HSA)

- Retirement plan contributions

- Life and disability insurance premiums

- Job-related expenses, such as uniforms

- Tuition costs

- Donations for charity

- Purchases that require reimbursement by the employee

Final Paycheck Laws in North Carolina

North Carolina law states that an employee must receive their final paycheck on or before the next available payday following their termination, whether they quit or were terminated by the company. The final paycheck must include payment for all hours worked, commissions due, and any accrued but unused paid time off. Additionally, final paychecks can’t be held until the return of company equipment.

North Carolina Severance Pay Laws

North Carolina labor laws do not require employers to pay a severance upon employee termination. Should an employer choose to provide severance benefits, they must comply with any terms or conditions established by a severance policy or employment contract.

Accrued Paid Time Off

If there are no company policies in place, the employer is required to pay employees for accrued time off upon termination of employment (voluntary or involuntary). Any unused time off must be paid at the employee’s regular rate of pay.

Earned time off cannot be forfeited unless the employer has a written forfeiture clause in its company policies under N.C.G.S. 95-25.13(2). This means that if your company handbook or policy manual does not specifically state what happens with accrued paid time off, you are liable to pay it upon termination.

North Carolina HR Laws That Affect Payroll

Human resources laws in North Carolina align with federal guidelines. While there are no special requirements, you should be aware of federal rules.

North Carolina New Hire Reporting

Federal law requires employers to report all new hires and rehired employees in the state of North Carolina within 20 days of hire to the Division of Social Services (DSS) State Directory of New Hires. Employers must first register with the DSS and then log in to report any new hires.

Lunch & Other Break Time Requirements

State law only regulates rest breaks or meal breaks for youths under 16 years of age, as required by the Wage and Hour Act. Youths under 16 must be given a minimum 30-minute break after five consecutive hours of work.

Lunch or break time is not required for any employee age 17 or older, regardless of the number of consecutive hours they work.

Child Labor Laws

The Wage and Hour Act protects minors by restricting the types of jobs and the number of hours they are allowed to work. North Carolina law follows the federal employment guidelines for youths under the age of 18 employed in nonfarm jobs. Employment in certain occupations, such as hazardous or detrimental occupations, is not allowed for those under the age of 18. Additionally, federal law prohibits you from scheduling minors to work during school hours on school days.

Work Permit for Minors

Employees between the ages of 14 and 17 who work in North Carolina must obtain a Youth Employment Certificate.

Once the minor has registered, they will receive a Youth Employment Identification (YEID) number. To obtain the certificate, they must provide their YEID number to their employer.

The employer can then begin the process:

- You must verify the youth’s age, proposed job duties, and any restrictions.

- You then enter the appropriate business and employer information with the North Carolina Department of Labor. The YEID number must be entered during this process.

- Once submitted, an email will be sent to the youth for the next step in the process.

- After the youth and the parent/guardian sign the certificate, you will receive an email with the completed youth employment certificate attached.

- As a best practice, you should retain a copy of the certificate for three years after the youth turns 18 or separates from employment.

Payroll Forms

Beyond federally required forms, the payroll forms that must be submitted in the state of North Carolina are limited to those for unemployment tax. You will be required to file a quarterly wage report to the Division of Employment Security.

North Carolina State W-4 Form

North Carolina requires employers to obtain a federal W-4 form from all employees to determine the number of withholdings from their paychecks. Additionally, you should collect an NC-4 form from employees. The NC-4 makes sure you are withholding the correct amount of state income tax. Should an employee not provide you with an NC-4 form, you are required to set their withholding to “single,” zero exemptions.

Unemployment Tax Forms

North Carolina employers doing business as a sole proprietorship, partnership, or corporation must file a quarterly Unemployment Insurance Tax Payment, as well as the Employer’s Quarterly Tax and Wage Report (NCUI 101). You may also be required to pay unemployment insurance tax on any North Carolina business you acquire that is already subject to the tax.

Both taxes and reported wages are due by the last day of the month following the quarter and must be submitted even if the employer has no employees in that quarter.

Federal Payroll Forms

- W-4 Form: Helping employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reporting total wages and taxes for all employees

- Form 940: Reporting and calculating unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing nonemployee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

North Carolina Payroll Tax Resources and Sources

Department of Revenue (NCDOR):

- Monthly:

- Withholding Payment Voucher (NC-5P)

- Quarterly:

- Withholding Return (NC-5)

- Quarterly Income Tax Withholding Return (NC-5Q)

- Annually:

- Annual Withholding Reconciliation (NC-3)

- Wage and Tax Statement (NC-W2)

Division of Employment Security (NCDES):

- Quarterly:

- Unemployment Insurance Tax Payment

- Employer’s Quarterly Tax and Wage Report (NCUI 101)

Department of Health and Human Services

- Applicable for All New Employees:

- New Hire Report

Payroll in North Carolina Frequently Asked Questions (FAQs)

North Carolina does not require payments to employees more frequently than once per month. However, most employees expect to be paid at least twice monthly. Whatever schedule you choose, keep it consistent, and if you need to change it, give your employees plenty of notice.

North Carolina law requires employers to keep payroll records for at least three years. Maintaining accurate records helps ensure compliance, and it protects your business in the event of an audit or employee dispute. Keep the following information:

- Employee information

- Hours worked

- Wages paid

- Deductions and withholdings

- Pay periods

If you make a mistake on payroll, work to correct it immediately. Contact the relevant state agency if you’ve missed a payment or made an incorrect payment. If you’ve paid an employee incorrectly, speak with them immediately and explain how you’re going to fix the issue.

Bottom Line

As an employer in North Carolina who needs to pay employees, you’re in for more than just cutting checks. Navigating the waters of North Carolina payroll may seem straightforward, and it is simpler than in many states, but you still need to keep a close eye on payroll taxes, employee deductions, and unemployment. Specific labor laws can be tricky, so be sure to follow all requirements listed in this article to properly set up and submit your North Carolina payroll.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.