Learning how to do payroll in Pennsylvania is simple overall, as most of its regulations are in line with federal employment laws. However, the multiple taxes to factor in make the process a bit complex. With state income tax, earned income tax, and local and city taxes, you’ll need to know which taxes you and your employees are responsible for paying.

Key Takeaways:

- Pennsylvania has a flat income tax but some cities have their own income taxes

- Pennsylvania currently mirrors the federal minimum wage but that could change soon

- Pennsylvania requires workers aged 14 to 17 to have a valid work permit

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Running Payroll in Pennsylvania: Step-by-Step Instructions

Step 1: Set up your business as an employer. At the federal level, you need to apply for a Federal Tax ID and register for an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the Pennsylvania Department of Revenue. You can register for both Income Withholding and Unemployment Insurance tax accounts online using the myPATH system. In 2022, this online registration system replaced the old PA-100 Business Entity Registration Form. After registering, you should receive your account number instantly.

Step 3: Register for City Taxes. If you are paying an employee in either the City of Pittsburgh or the City of Philadelphia, you will be required to register for tax accounts with those cities individually.

- City of Pittsburgh: If you do not have a City ID and will be paying an employee in Pittsburgh, then you must register your business with the City of Pittsburgh.

- City of Philadelphia: If you do not have a City ID and will be paying an employee in Philadelphia, you must register your business with the City of Philadelphia. You can register with the City of Philadelphia.

Step 4: Register for local taxes. If one of your worksites is located in Pennsylvania, you are required to withhold and remit the local Earned Income Tax (EIT) and Local Services Tax (LST) on behalf of employees working in Pennsylvania. Worksites include factories, offices, branches, and warehouses. You can register by completing an Employer Registration Form and remitting it to your local tax collector.

Step 5: Set up your payroll process. You’ll need to decide how often you’re planning to pay employees, if you need to track work hours, which payroll forms you need to collect and when, how you’ll perform payroll calculations, and more. To do this, you can do payroll yourself, use payroll software, or use an Excel payroll template.

Step 6: Collect employee payroll forms. The best time to collect payroll forms is during your new hire orientation. Forms include the W-4, I-9, and direct deposit information. Pennsylvania does not have any additional forms.

Step 7: Collect, review, and approve time sheets. Make sure to do this a couple of days before payday, as Pennsylvania Wage Payment and Collection Law says employees must receive their wages no later than the specified payday. There are multiple ways you can track employee time—use one of our free time sheet templates to help if you don’t yet have an established system.

Step 8: Calculate payroll and pay employees. There are many ways to calculate payroll, and it’s up to you to decide which is best for your business. You can use payroll software, a calculator, or even Excel.

Step 9: File payroll taxes with the federal and state government. All state and local tax payments need to be made directly to the applicable agency based on whatever schedule is assigned to your business. Federal tax payments must be made via EFTPS. Generally, you have to deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned to your business by the IRS. The IRS can assign you to one of the following depositing schedules:

- Monthly Depositor: Requires you to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Semiweekly Depositor: Requires you to deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Deposit taxes for payments made Saturday, Sunday, Monday, and/or Tuesday by the following Friday.

It’s important to note that schedules for depositing and reporting taxes are not the same. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

Step 10: Complete year-end payroll reports. You will need to complete W-2s for all employees and 1099s for all independent contractors. Both employees and contractors must have received these documents by Jan. 31 of the following year.

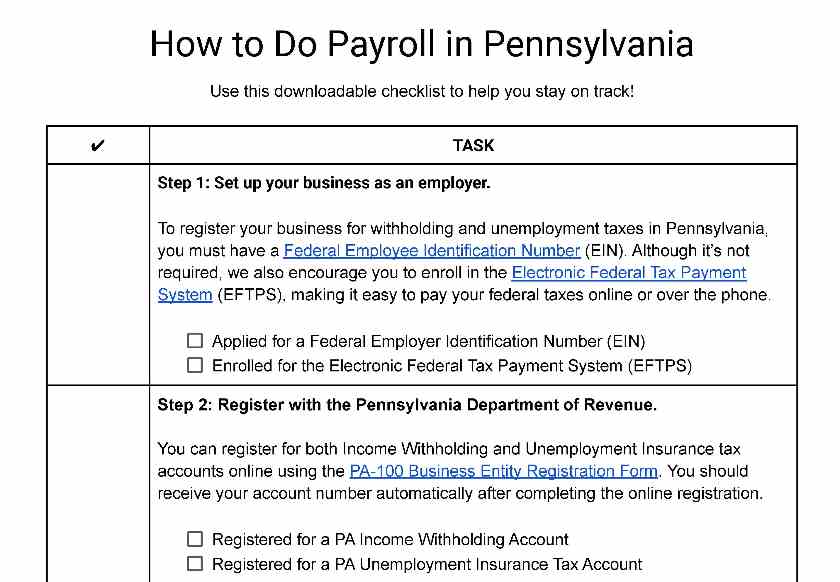

Download our free checklist to help you stay on track while you’re working through these steps:

For general instructions on the basics of doing payroll, check out our guide on how to do payroll.

Pennsylvania Payroll Law, Taxes & Regulations

Pennsylvania payroll laws are in line with most of the federal regulations. There are some overtime laws and specific taxes you’ll need to stay abreast of. Overall, it is important to remember that Pennsylvania has state tax, earned income tax, and local taxes, which can make things a bit more complicated.

Pennsylvania Payroll Taxes

As a Pennsylvania employer, you will be responsible for withholding and remitting taxes on behalf of your employees. Pennsylvania has both state and local taxes for its residents, so it’s important that you have a general understanding of what those are to ensure you’re in compliance.

State Income Tax

The state personal income tax withholding rate for all employees in Pennsylvania is a flat 3.07%. Employers are required to withhold state withholding from an employee’s income and remit it on their behalf, based on the following schedule:

- Quarterly: If total withholding is under $300 per quarter, the taxes are due the last day of April, July, October, and January.

- Monthly: If total withholding is $300 to $999 per quarter, the taxes are due the 15th day of the following month.

- Semimonthly: If total withholding is $1,000 to $4,999.99 per quarter, the taxes are due within three banking days of the close of the semimonthly period.

- Semiweekly: If total withholding is $5,000 or greater per quarter ($20,000 per year), the taxes are due on a Wednesday following the pay dates for employers whose paydays fall on a Wednesday, Thursday, or Friday; and on the Friday following the pay dates for employers whose paydays fall on Saturday, Sunday, Monday, or Tuesday.

Local Taxes

Employers with worksites located in Pennsylvania are also required to withhold local EIT and LST on behalf of their employees working in PA. The Department of Community and Economic Development assigns PSD (political subdivision) codes to each municipality to help employers and tax collectors remit the correct amount of local Earned Income Tax.

These PSD codes also help employers know which agency is responsible for their district. With over 50 Tax Collection Agencies responsible for local taxes within the state of Pennsylvania, it’s important to know which one to register with and remit taxes to so that you can avoid making any mistakes.

Employees are required to complete a Residency Certification Form upon hire, which you will be required to keep with their employee files. If you ever have any issues with this or need verification for a PA employee, you can visit the DCED website and search by address to determine the proper PSD codes.

Unemployment Insurance Tax

Pennsylvania has a state Unemployment Compensation (UC) fund that protects workers against job loss by providing temporary income to qualified individuals. Employer contributions, charged for the first $10,000 that each employee earns in a calendar year, are the primary funding.

Every calendar year, a contribution tax rate is computed and mailed to each employer for the following year. If you disagree with the information on the rate notice, you can file an appeal within 90 days of the date of the rate notice.

The first time you pay wages in Pennsylvania, you will be considered a “new employer” and assigned a contribution rate of:

New Employer | Rate |

|---|---|

Non-Construction Employers | 3.8220% |

Construction Employers | 10.5924% |

There are exceptions to the Pennsylvania UC Law that exclude certain employers from being liable. Those exceptions include:

- Sole Proprietorships/Partnerships: Owners of an individual entity or partnership are considered self-employed. Self-employed individuals are not technically employees, and their earnings are not considered wages.

- Family Employment: If an individual is employed by a son, daughter, or spouse, or a child under the age of 18 is employed by a parent. Additional covered family include stepchildren and their parents, foster children and their parents, and adopted children and their parents.

- Agricultural Employment: If there are fewer than 10 employees for over 20 calendar weeks or if there is less than $20,000 in cash wages paid.

- Domestic Employment: Individual homeowners, local college clubs, fraternities, or sororities paying less than $1,000 during any quarter of the calendar year.

- Elected vs Appointed Officials: Services of an elected official

It’s important to remember that you will also be responsible for federal unemployment taxes. The standard rate is 6% on the first $7,000 of each employee’s taxable wages. The maximum tax you’ll pay per employee is $420 ($7,000 x 6%).

Tip: When you pay state unemployment taxes, you may qualify for up to a 5.4% discount on your federal unemployment insurance taxes. This can significantly reduce what you pay to the IRS—from 6% to 0.6%.

Workers’ Compensation Insurance

Workers’ compensation insurance covers medical bills, rehabilitation costs, and lost wages for employees who get injured or experience a work-related illness. Coverage is mandatory for most employers under Pennsylvania law. You can obtain workers’ compensation insurance through a licensed insurance carrier or the State Workers’ Insurance Fund (SWIF).

Some employers are exempt from workers’ compensation coverage. Exemptions include railroad workers, longshore workers, federal employees, domestic servants, and certain agricultural workers; there are also exemptions for religious beliefs and executive status in certain corporations.

Pennsylvania Minimum Wage

The current minimum wage in Pennsylvania mirrors the federal minimum wage of $7.25 per hour. However, at the time of publication of this article, the Pennsylvania House has passed a minimum wage increase bill which would increase the minimum wage to $11.00 per hour on Jan. 1, 2024, $13.00 per hour on Jan. 1, 2025, and $15.00 per hour by Jan. 1, 2026. The minimum wage would then increase based on inflation annually beginning in 2027. This legislation would also increase the tipped minimum wage to 60% of the base minimum wage.

It’s important to note that this bill faces challenges in the Republican-majority Pennsylvania Senate, so it becoming law is not guaranteed. We’ll update this article accordingly as the legislation progresses.

Pennsylvania does have a Minimum Wage Law which essentially mirrors the federal minimum wage and overtime laws. If you do any of the following, you will violate the Pennsylvania Minimum Wage Act:

- Misclassifying employees as exempt from overtime when their job duties should qualify them from overtime pay.

- Deducting expenses in large enough amounts that the employee’s take-home pay falls below the minimum wage.

- Not making up the difference for tipped employees whose tips don’t raise their pay to the minimum wage.

Violating the Pennsylvania Minimum Wage Act may subject your business to serious fines, penalties, and other legal consequences.

Pennsylvania Overtime Regulations

There are three major differences between federal overtime laws and Pennsylvania’s regulations.

- Pennsylvania does not recognize the highly compensated employee exemption, which allows employers to avoid paying overtime to employees who earn more than $107,432 annually. You’re liable for paying eligible employees overtime regardless of how much they earn.

- Federal overtime laws do not require overtime for certain computer employees; however, Pennsylvania does not have an exemption for these employees. Pennsylvania requires that overtime must be paid.

Pennsylvania recently repealed a portion of the Pennsylvania Minimum Wage Act which provided for a higher salary exemption for employees to be exempt from overtime. With the repeal of that portion of the law, the salary threshold reverts back to 2020 levels, $684 per week or $35,568 annually.

It’s important to note here that, at the federal level, there is increasing pressure to update and increase the salary threshold for exemption. So even if Pennsylvania doesn’t act to update the salary threshold, the federal government might, and you’d have to follow the law that’s most beneficial to workers. As legislation progresses, both at the state and federal levels, we’ll update this article accordingly.

Different Ways to Pay Employees in Pennsylvania

While there are many different ways to pay employees, Pennsylvania’s Wage Payment and Collection Law specifies that an employer must pay wages by either:

- Cash

- Check

- Direct Deposit (with employee consent)

- Pay Cards (while originally not permitted, an amendment was passed in 2017 allowing the use of pay cards—as long as your employees are explicitly made aware of all payment options, and it is their choice to be paid via pay card)

Pennsylvania Pay Stub Laws

Pennsylvania requires every employer to provide each employee with a pay stub for each pay period. This pay stub must show hours worked, gross wages, net wages, and itemized deductions.

Tip: If you don’t use payroll software that automatically creates pay stubs for you, check out our free pay stub template article for additional guidance.

Minimum Pay Frequency

Pennsylvania employers are required to pay their employees at least semimonthly, meaning that they are paid two times per month. The first payment has to be between the first and 15th day of the month, and the second payment must be made between the 14th and the last day of the month. The waiting time between the end of a pay period and payday must not exceed 15 days.

If you need help understanding pay periods or deciding which pay period is best for your organization, check out our article on pay periods and download one of our free payroll calendars.

Final Paycheck Laws in Pennsylvania

When a business parts ways with an employee, it’s very important that their final paycheck is paid in a timely manner. Pennsylvania law requires that final paychecks be paid on the next scheduled payday, regardless of whether the employee quit or was terminated. The final paycheck should contain the employee’s regular wages from the most recent pay period, plus other types of compensation due to them (commissions, bonuses, and accrued sick/vacation pay).

Employers are legally allowed to withhold money from the employee’s last paycheck if the employee owes your organization. This could be the result of things like unpaid loans from the company, money for uniforms that were never paid, or even unauthorized expenses on a company card.

Tip: While it’s not required legally, it’s a good idea to be sure that any deductions from final paychecks are documented. Take note of the amount deducted and what it was for so that it’s easily available if needed.

Severance Pay in Pennsylvania

As a Pennsylvania employer, you don’t have to provide your employees with severance pay if they are terminated or voluntarily leave. Pennsylvania law will only enforce that you pay severance payments to your employees if there is a signed written agreement in place between an organization and employee.

Accrued Paid Time Off Payouts

There is no regulation in place requiring accrued vacation payouts. Both Pennsylvania and federal law leave it up to employers to decide.

Similar to Severance Pay, an employer is only required to pay accrued vacation upon separation if it is included in a previously signed employment contract or policy.

Pennsylvania HR Laws That Affect Payroll

Although Pennsylvania does have many HR laws in place, most of them align with federal HR laws. You’ll want to pay extra attention to required breaks and work permits for minors.

Pennsylvania New Hire Reporting

As a Pennsylvania employer, you will have to report all employees who reside or work in Pennsylvania to the Pennsylvania Department of Labor and Industry. All new employees need to be reported within 20 days of their hire date. The Pennsylvania CareerLink website gives employers a few ways to report, including:

- Manual Entry: Use a web form to enter new hires one at a time (best for 10 or fewer)

- File Uploads: Copy your data into a template to upload at once (best for 10 or more)

- Secure File-Transfer: Use a web portal to send a file to their server (best for large companies to automate reporting)

Breaks, Meals & Paid Leave

Pennsylvania’s break laws are all based on age. As a Pennsylvania employer, you are required to provide a 30-minute break period to employees aged 14–17 who work five or more consecutive hours. Employers are not required to provide breaks to employees 18 and over.

While not required, it is, of course, at the discretion of the employer if they would like to provide breaks to their employees. It’s important to know that if you do decide to provide breaks, there are regulations about pay. If the break provided is less than 20 minutes, an employee must still be paid for that time. However, if the break is more than 20 minutes and the employee is not working during the break, it does not have to be paid.

Child Labor Laws

The Pennsylvania Child Labor Law (CLL) was put in place to help protect children under the age of 18 and provide a safe and healthy work environment. The CLL requires workers under 18 to have a valid work permit, prohibits children from working in certain establishments and occupations, and also regulates the number of hours that they can work.

- Minors under the age of 18 are also required to obtain a work permit before they are able to seek employment.

- Minors under the age of 16 must also submit a written statement from their parent or legal guardian acknowledging and granting permission for the nature of the work and the hours of employment.

Work Permits for Minors

Employment Certificates, also known as Work Permits, are mandatory in Pennsylvania for minors under 18. The certificate has to be obtained by the minor and given to their employer to verify their ability to work before they are able to be hired. In Pennsylvania, minors can apply for a Work Permit of Employment Certificate through the public school in their district.

It is vital that if you intend to hire a minor, you follow these regulations and ensure that you obtain a copy of their work permit before hiring. Failure to do so can result in fines and penalties against your business.

Payroll Forms

The only state-specific payroll forms you’ll need to worry about as an employer in the state of Pennsylvania are for unemployment compensation. Otherwise, you’ll just use federal payroll forms.

Pennsylvania W-4 Form

Pennsylvania does not have a statewide withholding document like the federal W-4 form. Since Personal Income Tax is based on a flat tax rate of 3.07% in Pennsylvania, there is no need for separate state documentation.

Pennsylvania Unemployment Tax Forms

The Department of Labor and Industry requires employers to electronically file UC wage and tax information. The most frequently used include:

- Form UC-2 Employer’s Report for Unemployment Compensation: This form is used to report an employer’s quarterly gross and taxable wages and UC contributions due.

- Form UC-2A Employer’s Quarterly Report Of Wages Paid To Each Employee: This form is used to list employees’ Social Security numbers, names, gross wages earned, and credit weeks for a particular quarter.

- Form UC-2B Employer’s Report of Employment and Business Changes: This form is used to report any recent change in name, mailing address, or business location. It is also used to report that an employer no longer has employees or that a business has been sold or discontinued.

- Form UC-2X Pennsylvania UC Correction Report: This form is used to make changes to the gross and/or taxable wages previously reported.

Federal Payroll Forms

- Form W-4: To help employers calculate taxes to withhold from employee paychecks

- Form W-2: To report total annual wages earned (one per employee)

- Form W-3: To report total wages and taxes for all employees to the IRS (summary of W-2s)

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- Form 1099-MISC: To provide non-employee pay information that helps the IRS collect taxes on contract work

Resources & Sources

- Pennsylvania Department of Revenue: Find links to business resources, e-file your state taxes, and learn about how property tax and rent rebate programs can help you with your cash flow.

- Pennsylvania CareerLink: Find hiring resources for your business, learn about disability service partnerships, and report new hires.

- Pennsylvania Office of Unemployment Compensation: Register for a UC Tax Account Number and Appeal a UC Contribution Rate directly from Pennsylvania’s Office of Unemployment Compensation website. It also provides employers with state-specific information about audits, appeals, common paymasters, and more. There is an employer quick guide with contact information for each department that employers can use to call for guidance on everything from registrations to tax filings to labor law posters.

Also, check with your payroll software or service for resources and state-specific features.

Bottom Line

While processing Pennsylvania payroll is pretty simple overall, it’s important to remember all the taxes that come into play. Though many of its labor laws align with federal guidelines, there are quite a few that are unique to Pennsylvania. With state income tax, earned income tax, and local and city taxes, you will want to make sure that you are diligent with your payroll to avoid penalties.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: