Amid the planned 10% tariff in custom charges from China to the USA, importing from China remains to be lucrative.

How to Import from China to the US in 6 Steps 2025

This article is part of a larger series on Retail Management.

This guide gives all the information you need to get started importing from China—finding products, choosing and negotiating with suppliers, purchasing, and figuring out the best way to ship your items. I also discuss common shipping terms you need to know, plus an overview of import costs from China—duties, taxes, and other fees.

Key Takeaways:

- Importing products from China can be very affordable, allowing for bigger profit margins.

- Do diligent research and follow US and Chinese regulations to avoid penalties and delays.

- Always examine product quality when receiving your shipments.

- Maintain relationships with your suppliers; this allows more leeway when negotiating on price, shipping, payment terms, and more.

China is commonly called “the factory of the world” due to its enormous manufacturing infrastructure, skilled population, and wealth of industry experience. Importing products from China to sell to local businesses or in your store can boost your store’s profitability by increasing your margins and making customized products more accessible.

Here’s everything you need to know about importing goods from China in six steps.

To get started:

You might like to have as you grow:

- A customs broker

- A third-party logistics company (3PL)

- A freight forwarder

Step 1: Select Products to Import

While sourcing Chinese goods for your retail business provides a wider product range at significantly lower costs, it is imperative to select your product offerings wisely. If you’re developing a new concept or aren’t sure what to sell, read our guide to the best products to import from China.

From a profitability standpoint, choose products that have:

- Consistent and sufficient demand

- Profit margins of at least 30%-50%

- Reliability (creating a low possibility for warranty cases)

- Low maintenance requirements in transit, warehousing, and/or storage (i.e., no need for climate control or special handling needs)

- No laws prohibiting them for sale in your state or country

When importing from China, consider product restrictions, permits and licensing, and import taxes.

Product Restrictions

Ensure that all the goods you plan to import comply with the regulations before partnering with suppliers and making your first purchase. The U.S. Customs and Border Protection (CBP) has laws and regulations that prohibit or restrict certain product categories to safeguard consumer health.

Ensure that all the goods you plan to import comply with the regulations before partnering with suppliers and making your first purchase.

Some examples of import regulations include:

- Commercial equipment: Products such as air conditioners, water heaters, and furnaces must have energy efficiency labels.

- Fruits, vegetables, and nuts: Many varieties must meet size, quantity, and maturity requirements. An inspection certificate must be issued by the U.S. Food and Drug Administration (FDA).

- Meat, poultry, and egg products: All varieties must include government-issued inspection certificates from the origin country, and are reinspected by the U.S. Department of Agriculture (USDA) upon entry.

- Seeds: Shipments containing seeds are detained pending the drawing and testing of samples upon entry.

- Wood packing materials: Pallets, crates, boxes, and dunnage must be heat-treated or fumigated and marked to certify treatment.

- Toys: Children’s articles must comply with safety regulations under the Federal Hazardous Substances Act and be inspected to define hazardous sharp edges and points.

For a full list of commodity regulations and restrictions, refer to the CBP’s Importing Guide. Try searching the document for keywords related to your selected product(s). If you have questions, contact your local port of entry.

Permits & Licensing

The US is one of the most import-friendly countries in the world, and in most cases, individuals and businesses do not need a license to import.

Certain commodities require a special permit or license issued by one of the government agencies that work with the CBP, like arms and ammunition, agricultural and livestock commodities, tobacco and alcohol, and medical equipment and supplements. For a full list of license and permit requirements, refer to the CBP’s Importing Guide.

If you have questions or need help with permits and licensing, the CBP recommends hiring a customs broker. The basic role of customs brokers is to assist importers in meeting Federal requirements—but I’ll cover their services in-depth down below. Use the CBP’s free tool to find a customs broker near your local port of entry.

Import Taxes

Nearly every product imported from China is subject to import taxes (often called tariffs or duty) that are charged in addition to federal and local sales and use taxes, so import costs from China should be factored in when you source products.

I talk more about import taxes in the sections below.

Step 2: Find Chinese Wholesale Suppliers

Once you know which products you’re sourcing, you’ll need to find a trade partner. The majority of Chinese suppliers you’ll encounter are either factories or trading companies.

Trading Companies | Factories | |

|---|---|---|

Best For | Sourcing a variety of products | Sourcing custom products |

Pros | Greater quality control and wide product selection Lower minimum order quantities (MOQs) | Lower prices More control over design, materials, and production |

Cons | Higher prices Less control over design, materials, and production | Smaller assortment of products Higher MOQs |

Business Model | Trading companies are suppliers that stock a variety of products. They do not mainly produce goods, but source products (from one or more factories). | Factories primarily manufacture goods from raw materials. |

Minimum Order Quantity (MOQ) | Lower MOQ requirements; many don’t even have an MOQ | High MOQ requirements; usually start at 250 to 500, depending on product |

Customer and Sales Support | Robust | Average to poor |

The process of importing items from your Chinese supplier will be more or less the same when working with trading companies or factories.

Work directly with factories if you need custom products made and have a local Chinese middleman to act as a translator and intermediary since factories usually work with intermediaries—and it may be hard to do business because of the language barrier.

Otherwise, trading companies will be your best option.

Create a Shortlist of Potential Chinese Suppliers

To find potential Chinese suppliers to work with, look at supplier directories, wholesale marketplaces, trade shows, import records, and fellow supplier networks.

Refer to our guide on how to source wholesale suppliers or click through the sections below to read more about each option. Then, create a shortlist based on your initial findings.

Supplier directories are a database of thousands of factories, trading companies, and other vendors. Simply search through the established filters to see a range of possible trade partners and reach out to them through the directory’s messaging service or listed vendors’ contact info

Wholesale marketplaces, on the other hand, serve as B2B ecommerce sites that mainly specialize in import and export trade. They can be used to buy merchandise from suppliers in bulk.

Here are some of the top supplier directories and marketplaces for importing goods from China.

- Alibaba and AliExpress are the most notable supplier and product directories for importers and dropshippers alike because they offer amenities to simplify the process for beginners. Read our guide to using Alibaba and AliExpress to learn more about how each platform works.

- Global Sources is a large trade show exhibition based in Hong Kong and has expanded to strictly a B2B wholesale directory. It is the go-to resource for electronics and fashion apparel, but its sellers usually have higher MOQs than other directories. It also employs a much more involved vetting process for its suppliers—definitely geared toward the more advanced buyer.

- DHgate serves as a wholesale marketplace more than a supplier directory, making it a good choice for beginners and casual importers. The platform is known for hosting competitively priced merchandise with considerably low MOQs, but buyers frequently report disappointing quality. One major advantage of DHgate is its payment handling system, which secures funds until the buyer confirms receipt of the goods.

The best way to get connected with high-quality trade partners is to visit trade shows. Chinese trade shows are mostly free to attend and generally seasonal—usually early May and November). If you can’t attend in person, many virtual options are available.

These exhibitions draw large, international crowds where English is commonly spoken, but translators can be hired for about $15 per day.

Some of the biggest trade shows to source Chinese products and suppliers are the following:

- Canton Fair: Also called the China Import and Export Fair, it is the largest trade show in the country and is considered to be the most important trade exhibition in the world. The Canton Fair is held in Guangzhou, China, twice a year and occurs in three phases—electronics; consumer goods, gifts, and home decor; and textiles, garments, shoes, and office supplies. For more information (plus a directory of exhibitors and products), check the Canton Fair website.

- Global Sources Trade Show: Taking place twice a year in Hong Kong, the Global Sources Trade Show is strategically scheduled to occur just before the Canton Fair, so that attendees can easily visit both exhibitions on the same trip to China. It provides a host of educational services during the event, including a conference on how to run a successful importing business. Visit the Global Sources Trade Show page to learn more.

- East China Fair: The East China Import and Export Commodity Fair (ECF) takes place in Shanghai every March. ECF vendors primarily specialize in fashion accessories, consumer goods, art, decor, and housewares, and the fair is divided into four categorized exhibition areas. While it is a smaller event, the majority of ECF attendees come in from foreign countries. This leads to a low language barrier and focuses on import/export infrastructure. For more info, visit the East China Fair website.

Unlike China’s popular trade shows, the Yiwu Wholesale Marketplace is open every day of the year (except for national holidays). The city of Yiwu is actually known as China Commodity City (or CCC) and serves as a hotspot for consumer goods trade. Aside from the primary trade center, multiple marketplaces around the city specialize in various merchandise.

Most vendors are trading companies that work closely with factories in neighboring provinces. You can work with them to arrange transport and future reorders, or you can choose to hire a local agent (who also aids in negotiation and purchase agreements).

Products sold in Yiwu are generally very inexpensive and have the reputation of being low in quality. Many products don’t display any branding, and the majority of those that do are counterfeit. This is why it is a popular sourcing destination for retailers seeking cart-stuffers and filler items for their stores. These products can be useful for cross-selling or offering “free gift” promotions.

Most suppliers in Yiwu primarily do business with Indian, African, and Middle Eastern buyers. The import laws in these countries vary dramatically from that of the US, so do not expect Yiwu suppliers to comply with safety, trademark, and labeling regulations automatically.

Be sure to know which regulations and restrictions apply to your product categories before purchasing. To avoid risk at customs, avoid sourcing these goods in Yiwu:

- Cosmetics

- Electronics

- Toys & Children’s Products

- Medical Devices

To get more information and see a variety of the products sold in Yiwu, visit the Official Website of the Yiwu Market.

You can also check which supplier your competition is working with by checking public import records.

When imported shipments enter the US, the government retains a copy of the bill of lading—which includes the importer’s name, the supplier’s name, and shipment details—and makes it available for public access. This information is limited to shipments that have arrived via boat, but that still accounts for roughly 10 million records per year.

Obtaining these import records is perfectly legal but it’s not that easy. To get it from the customs bureau, you have to request the information, pay a fee, and wait multiple weeks for processing.

As an alternative, you can use these third-party tools to eliminate the waiting period and simplify the process.

- Port Examiner is a free tool that allows you to search through archived import records instantly. It is functional on a small scale but lacks the features needed to aggregate raw data and export it as a CSV or Excel file.

- ImportGenius is a global trade database that allows users to download aggregate import data in spreadsheet format. You can sign up for a one-month free trial, and continue as a paid user—its starter plan costs $149/month.

- Panjiva is a more robust but expensive tool. Its platform includes advanced search functions to find relevant import data by HS number, item category, location, and more. It also expands many import records into full company profiles and provides contact information. Membership costs aren’t disclosed, but a one-month trial is available for $400.

If you already work with a reliable Chinese vendor but seek a different product they don’t supply, try using them as a resource. It’s standard for suppliers to have tight networks and happily refer clients (they often make a 5%-10% finder’s fee).

As you curate a shortlist of Chinese trade partners, look for suppliers that:

- Have long-term experience with the product or category

- Have a well-established and professional operation

- Agree to a price that gives you a sufficient profit margin

- Provide after-sales support and/or warranty services

- Have all applicable certificates needed in your country

- Already export to your country and can provide references

- Give you reasonable payment terms

You can also try searching SupplierBlacklist.com to see if other importers have filed any reports about a particular supplier.

Once you have a shortlist of your suppliers, it’s time to begin working with them. To begin working with a potential supplier, reach out to them to ask about their product catalogs and MOQs, request samples if you can meet their MOQs, and once you receive the samples and are satisfied with the quality, negotiate pricing and payment terms.

Initiate Contact

If using an online resource, begin a dialogue with many prospective suppliers at a time, then refine your search as you go. Try sending an initial email or message that introduces yourself and requests any basic info that wasn’t covered in the product listing.

You can reference our template below.

Hi, (supplier name).

My name is _____, and I’m a buyer for _____, a store in (your country) that sells (product offering). We are interested in carrying many of the products that you have to offer.

Specifically, I would like to get pricing and availability for the following items:

- (Item name, include listing photo)

- (Item name, include listing photo)

- (Item name, include listing photo)

If you could send more information, as well as your product catalogs, and MOQ requirements, I would greatly appreciate it.

Thank you,

If you receive a response that seems promising, proceed to establish key info, such as

- Product sample options

- Lead times

- Payment terms

- Packaging

- Material specifications

- Quality standards

- Shipping terms

Once they reply, try to move correspondence to WeChat if possible. WeChat is a Chinese instant messaging, social media, and mobile payment app and is often called China’s “app for everything”. Many suppliers prefer WeChat correspondence and respond faster on WeChat than email.

Request Samples or Place a Trial Order

If the supplier’s prices and terms are sufficient, you can “test” their goods by requesting a sample. However, note that samples you receive are likely hand-chosen and may not be representative of the supplier’s stock as a whole.

To get a more accurate picture of the vendor’s regular output, try placing a trial order. By ordering a small but sufficient trial order, you can test the true quality of the supplier’s product.

Negotiate Pricing & Terms

Once you’re satisfied with your new supplier, you can attempt to negotiate before making a full purchase. Of course, high-volume businesses have more bargaining power, but even small operations may be able to negotiate price, freight terms, deposit terms, and packaging details.

Step 3: Purchase Products

With the legwork of sourcing out of the way, you’re ready to place an order with your Chinese supplier(s). When placing your first order with a new supplier, it’s typically best to start with a low initial quantity before you know how a new item will perform.

Transaction details are laid out within purchase orders and invoices. In addition to a purchase order, it’s important to agree with the supplier on a product specification document to ensure you’re getting what you pay for.

These documents should clearly define all transaction details without leaving any room for misinterpretation. This includes basics (like item specifications, unit quantities, pricing, and packaging) but should also cover shipping terms (also called Incoterms) and payment terms.

Shipping Terms (Incoterms)

Incoterms (International Commerce Terms) are 11 standardized freight terms that must be agreed to in writing between the supplier and buyer, or no air or ocean carrier will accept the shipment. They are grouped into two categories reflecting modes of transport—seven for any transport method and four for sea or land or inland waterway transport.

When importing from China to the USA, these Incoterms are commonly used:

- EXW (Ex Works): You take full responsibility and liability upon factory pickup of your order—from arranging, paying, to following up if there are any problems. Remember to add a clause to your purchase agreement that the supplier must help load the truck.

- FCA (Free To Carrier): You take responsibility and liability once the shipment is handed over to the carrier, typically near the port.

- FOB (Free On Board):You take responsibility and liability once the shipment crosses the ship’s rail. You will have to pay for the local charges between delivery to the carrier and loading on the vessel.

Although the International Chamber of Commerce (ICC) recommends using Incoterms® 2020 beginning January 1, 2020, vendors and buyers can agree to use any version of Incoterms after 2020, they just need to clearly specify the chosen version of Incoterms being used (such as Incoterms® 2010, Incoterms® 2020, or any earlier version).

Payment Terms & Methods

Chinese suppliers typically require a 30% deposit prior to shipping, with the remaining 70% is paid once the goods are received. This helps to mitigate the risk of theft on both sides. You don’t need to worry about currency conversion, as US dollars (USD) is the primary global currency, and the majority of Chinese suppliers accept it.

You can send payments through the following methods:

- Telegraphic transfer (TT) payments are a standard electronic transfer of funds between banks, incur a smaller fee than other options, and are accepted by all Chinese suppliers. TT payments lack protection against theft but are still most recommended by import professionals.

- Letter of Credit (LC or LOC) is a fund transfer that includes insurance. You pay your bank, which then issues an assurance to the supplier. After your bank confirms that your order has arrived at the correct destination, the vendor is paid. The added security is helpful but might not be worth it because of the sizable fees. It’s very unlikely that a vetted supplier will take your money and run—the bigger risks that importers face are problems with item quality and shipping delays. An LC provides no protection against either of these possibilities, so it’s commonly used for very large transactions only.

- Alibaba Trade Assurance. Similar to how bank LOCs work, Alibaba offers this option where you submit the payment to a designated Alibaba account (with the Singapore City Bank), then it’s released to the supplier once shipping is confirmed. Unlike LC payments, Alibaba Trade Assurance will refund your money if the shipment is delayed beyond a specified date or if the quality of the goods is not compliant with the agreed product specifications. This method requires both parties to have an Alibaba account, but it is free to use. The only fee that incurs is the cost of processing your initial payment to the Alibaba account.

- PayPal. This option is secure and straightforward—but not commonly used by importers. PayPal charges very high transaction fees, and many suppliers don’t have PayPal accounts to accept the payment. When it is used, PayPal is usually reserved for small, introductory purchases—such as samples and trial orders.

Product Specifications

When purchasing products for import, it helps to include clearly defined product specifications that your supplier signs and agrees to. This document isn’t legally binding, but it greatly decreases your chances of winding up with a batch of low-quality, misrepresented products.

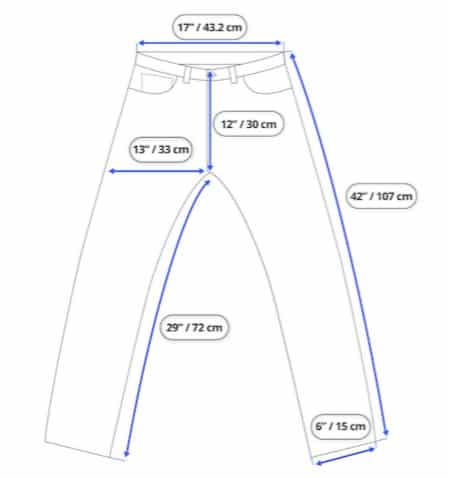

Along with your purchase order and invoice, submit a checklist or spreadsheet stating the product’s specs—such as weight, dimensions, color, material type, fabric thickness, component manufacturer, and labeling requirements. It also helps to create visual references when applicable (the more clear and straightforward you can be, the better). Here’s an example.

Product Specification Checklist

- Item: Women’s chino pants, size medium

- Fabric: Organic cotton, 200 gsm

- Fabric Color: Pantone 443

- Design: As specified in product_listing_image.png attachment

- Dimensions: As specified in product_measurements.png attachment

- Care label: As specified in label_design.png attachment

- Zipper: YKK

- California Prop 65 Compliant: Yes

- CPSIA (US) Compliant: Yes

Dimensions Attachment

Images, illustrations, and visual representations of product specs help to avoid any miscommunicated expectations.

(Source: Medium)

Label Attachment

Components that have their own designs should be specified, as well—like this care tag from a freelance designer on Fiverr.

Step 4: Arrange Cargo Transport

Depending on the shipping terms of your order, you may need to facilitate inland transport, including export customs clearance and loading. But more often than not, orders placed with new suppliers will be on FOB (as explained above)—in which case these steps will be handled by the supplier. It is recommended to use a freight forwarder, such as Flexport, to handle import shipping.

When it comes to transport rates, sea freight is quoted by volume, whereas air shipments are quoted by weight. Using an air courier is the most expensive method, while booking air freight costs about half as much and choosing sea freight costs about 10% as much.

Here’s a breakdown of your options for cargo shipping methods:

Air Courier | Air Freight | Sea Freight | |

|---|---|---|---|

Weight Guidelines | ≤150 lbs (68 kg) | 200–500 lbs (90–225 kg) | 500+ lbs (225 kg) |

Average Cost | $10+/kg | $5–$7/kg | < $1/kg |

Average Delivery (port-to-port) | N/A** | 1–5 days | 12–16 days (west coast) 30–42 days (east coast) |

Average Delivery (door-to-door)* | 2–5 days | 4–11 days | 22–50 days |

*Includes customs and inland transportation **Express air courier freight service is door-to-door | |||

Air courier shipping is typically a door-to-door service, meaning your goods are shipped straight to their final destination. DHL, FedEx, and UPS are commonly-used air courier services. If your goods are valued at $800 or more, these carriers will provide customs brokerage services to get your shipment cleared for entry—although it usually incurs an additional surcharge.

Air and sea freight methods are booked from the port of origin to an airport or seaport near you. From there, you’ll need to arrange shipping to your final destination. This can be done by your freight forwarder or scheduled yourself using a freight broker. We recommend Redhawk Logistics as the best freight broker for small businesses; you can read our top picks for best freight brokers for small businesses for more information.

Step 5: Clear Your Shipment Through Customs

Customs clearance is a critical part of importing from China. If you don’t provide the correct documentation and follow the right procedures, you risk having your goods detained and/or examined—both of which result in delays and hefty fees. In the worst-case scenario, your merchandise is seized by CBP and destroyed or sold at auction.

To obtain clearance from the CBP, you must take the necessary entry, examination, valuation, classification, and clearance measures. The customs process, costs, and requirements vary depending on the value of your shipment, as shown below.

Shipment Value | |||

|---|---|---|---|

<$800 | $800–$2,500 | >$2,500 | |

Import tax applicable | ✕ | ✓ | ✓ |

Formal entry process | ✕ | ✕ | ✓ |

Customs bonds required | ✕ | ✕ | ✓ |

Customer broker advised | ✕ | ✕ | ✓ |

CBP examinations* | ✓ | ✓ | ✓ |

*Subject to potential holds and examinations

Here’s a breakdown of each of these factors.

Duties—also called tariffs—are paid at the time of import by the importer of record—which can be you, the exporter, or another party you designate (like a customs broker).

- Imported cargo valued at $800 or more (as according to the order’s commercial invoice) is subject to duties and other taxes.

- Shipments below the United States’ de minimis value of $800 are duty-free.

Import duties are to be paid to the port of entry, prior to release of your cargo. Accepted forms of payment include US currency, personal checks, government checks, money orders, and travelers’ checks. Some ports also accept Visa and Mastercard.

To calculate your import taxes, identify your products’ Harmonized Tariff System (or HTS)

Duty rates are organized in the Harmonized Tariff System (or HTS), which classifies imports by category and assigns a taxation percentage. The U.S. International Trade Commission hosts an interactive database that can help you find the HS (Harmonized System) code and estimate the duty rate for any product you’re considering.

classification. Once you find their corresponding HS codes

An HTS/HS code indicates whether or not the U.S. has a trade relationship with any country for specific product imports. The U.S. International Trade Commission (USITC) classified tariff rates into three categories:

- General (Normal Trade Relations or Most Favored Nation)

- Special (Free Trade Agreement)

- No Trade Relationship

, you will know the tariff rate associated with that product. The code will then be listed on the commercial invoice.

China falls under the “General” category, meaning the countries do not have a trade agreement in place. As such, no special treatment is given to imports of goods from China to the US.

Refer to the government’s Harmonized Tariff Schedule to estimate duties for your shipment. For the most accurate information on what tariffs to expect, contact your local port of entry or hire a customs broker (which is an option we’ll explore below).

As your merchandise reaches the United States, it will need to be filed for either informal or formal entry.

Informal Entry

Shipments valued at less than $2500 don’t require formal entry—they are processed through informal entry, which can be done on the spot. The shipping company can clear them through customs on your behalf—although it often incurs a charge. Alternatively, you can process the entry at the port yourself or authorize another party to do so for you. For more info on these options, contact your carrier company, or refer to the CBP’s website.

Some products are restricted from informal entry regardless of value. These include goods subject to quota, anti-dumping, countervailing, or high-risk regulations—including many foods products. See the CBP’s guide to importing to check on your product’s eligibility.

Formal Entry

Cargo with a value of $2,500 or more must be filed as a formal entry. It’s advisable to hire a customs broker for filing formal entries because it requires a hefty amount of documentation as well as a Surety bond (which we’ll explain below).

- You can expect roughly $200–$300 in customs fees for formal entries and $100–200 in brokerage fees.

- If you used air or sea freight to transport your shipment, you’ll be notified five days from the cargo’s expected arrival.

- If you shipped via air courier (such as DHL), it’s standard for the carrier to take care of customs clearance for you, then bill you for the service (along with any incurred fees).

Once notified, it’s your responsibility to file an entry with the port director at the port of entry (or to hire a broker to do so on your behalf).

You’ll need to have the following documents prepared:

- A receipt or a bill of lading that states the importer of record (i.e., you or your hired broker) and the items to be imported.

- An official invoice that lists

- US port of entry

- Contact information of Purchaser, Vendor, and Shipper

- Detailed description of merchandise (including country of manufacture)

- Piece count of each product (quantities and measures)

- Cost per item and currency

- All charges relating to the shipment including packaging, shipping charges

- Date of purchase

- The invoice must be in English or accompanied by an accurate English translation

- An arrival notice, issued by the shipping carrier and authorized by a U.S. Customs Agent.

If your goods are restricted or regulated by a PGA (Partner Government Agency, such as the FDA), they may require additional forms or documents. Check the CBP’s Guide for Commercial Importers to ensure that you have everything you need for your goods to enter.

To speed up the customs process and ensure things go smoothly, work with your supplier on the following tips:

- Be sure that all information on the provided invoice is legible, clear, organized, and well-translated.

- Submit a packing list along with other documentation.

- Mark or number the outside of each package in your shipment with corresponding designations on your invoice or packing list. This will help customs officials identify particular items in your shipment.

- Assure compliance with government regulations in your country before export.

If your shipment is a formal entry, you’ll also need a customs bond.

A customs bond is a legal contract between you (the principal), a surety company, and CBP. Its purpose is to guarantee that the importer complies with customs regulations and that CBP is paid for applicable import duties, taxes, fines, and penalties.

If the principal doesn’t pay up, the CBP will collect from the surety company that issued the bond. From there, the surety company can use legal means to collect what is owed to them. When a bond is required, Customs will not release the goods until the bond is posted and regulatory requirements are met.

To obtain a customs bond, you must go through a surety licensed by the U.S. Department of the Treasury—which includes many customs brokers. To get more information and a full list of sureties, visit the CBP’s webpage on customs bonds.

Using a customs broker is not legally required during import shipments. It is, however, strongly recommended by both CBP and industry pros when importing formal entries.

- Customs brokers assist importers in meeting Federal requirements for entry. These import/export professionals are licensed by the CBP but are not government employees—they usually work for freight forwarders, independent businesses, shipping lines, or dedicated customs brokerage firms.

- Customs brokers work as liaisons between you and relevant agencies, preparing and submitting necessary documents, properly classifying goods, and providing personalized consulting. Plus, many customs brokers sell bonds and are also agents for sureties.

Overall, customs brokers are extremely savvy in import and export laws and are actively regulated by the government agencies they work with. This makes them a vital resource to have while navigating your first formal entry.

The cost of customs brokerage varies depending on the agent and shipment, but expect to spend somewhere around $100–$200 for their services. Alternatively, many brokers are available for consulting on an hourly basis.

Use the CBP’s free tool to find a customs broker near your local port of entry. You can also contact the CBP Broker Management Branch by emailing brokermanagement@cbp.dhs.gov.

In an effort to improve the security of the supply chain, CBP can select certain shipments to examine during customs. This results in delays, and the responsible party is charged an examination fee.

Highly confidential algorithms are used to evaluate the degree of risk for each shipment entering the United States. If your cargo is flagged as potentially risky for any reason, it may be selected for a customs exam.

While it’s impossible to know what exactly goes into the CBP’s algorithms, it’s accepted that these factors increase your chances of being selected for an exam:

- Lack of shipment history

- Infrequency of shipments

- Questionable chain of custody

- High-risk products or materials

- Problematic packaging or labeling

- High-risk country of origin

- Incomplete paperwork

- Consolidation with other shipments that have high-risk attributes

Ultimately, even if your shipment is totally benign and you follow every precaution, your cargo may still be included in the 1%–3% that are randomly chosen for examination.

Multiple types of exams may be done:

- An x-ray is the least invasive and takes two to three days and costs around $300.

- A “Tail Gate Exam” will break the seal of your container or packaging to inspect its contents visually; this takes 5–6 days and generally incurs a $350 charge.

- The most intrusive exam requires your shipment to be transported to a Customs Examination Station, where it is thoroughly inspected and sometimes laboratory-tested. This process takes anywhere from a week to 30 days or longer and incurs thousands of dollars in fees (including drayage charges).

The best way you can avoid being selected for customs holds and examinations is to ensure your paperwork is complete, provide accurate valuations of your goods, and work with well-vetted suppliers.

Retrieving Your Imported Goods

Once your goods have been cleared through customs and all parties have been paid, the cargo needs to either be retrieved or transported to its final destination.

- If you shipped LCL (Less than Container Load), your goods would arrive in a container with a variety of other shipments. Typically, after customs clearance, this container will be transported to a separate location for destuffing. In these cases, you (or your freight forwarder) will be provided with a secondary location near the original port.

- If you shipped FCL (Full Container Load), the port of entry would be the location to use.

You’ll also be provided with a Cargo Control Number that serves as a unique identifier for your shipment. These details can then be used to pick up or ship the imported goods.

Hiring a freight forwarder is the most common way to handle transport to your final warehouse, office, or retail space. Depending on the distance, this can require delivery by train, air, truck, or a combination of modes. Expect to pay $100 or more for this inland shipping. Alternatively, you can use a broker such as NTG to book inland freight.

If you choose to retrieve your goods rather personally than have them delivered, you can bring your vehicle to the port or warehouse. Be sure to carry a small amount of cash ($25–$75) to pay potential parking, loading, and/or dock fees.

Step 6: Process Imported Goods for Sale

When your imported goods reach the end of their journey at your warehouse, store, or office, the final step is to process them for sale like you would any other merchandise. This usually involves:

- Pricing products profitably

- Creating product listings with product descriptions and photos that sell

- Managing inventory

- Fulfilling orders in-house or through a third-party service like ShipBob

Selling imported goods requires a few slight differences in your operation. Be sure to consider these final and ongoing tasks when importing goods from China:

Check Product Quality

Product quality is a common pain point importers struggle with when buying from new suppliers, and it’s always best to detect discrepancies early on.

When you first receive an imported shipment, thoroughly evaluate the goods you received against your agreed-upon specification checklist.

If the product you received is not what you expected, start by identifying who is at fault. Did you accidentally overlook a crucial detail in your specifications or design illustrations? Or did the vendor simply deliver a misrepresented product?

If the supplier is at fault, there are a few courses of action you can take.

- If you opted for Alibaba’s Trade Assurance option or used PayPal for the transaction, there’s a high chance of getting your money back through those companies.

- Try contacting the supplier to request some form of resolution—be it a replacement order or a complete (or partial) refund.

- If the loss is great enough, you may consider litigation. You would need to carry out any legal action in China because the country’s courts do not enforce judgments from those in foreign countries. Needless to say, this process is resource-intensive—and it comes without any sort of assurance that you’ll come out on top.

- When all else fails, you can discourage others from using crooked suppliers through social media, industry forums, and sites like SupplierBlacklist.com.

The best way to approach quality issues is to avoid them in the first place by thoroughly vetting your new suppliers and placing trial orders.

Negotiate Wisely

If you were satisfied with the supplier(s) you initially worked with, continue negotiations with them as you place future orders.

Remember that price isn’t the only factor subject to negotiation—you can improve transport costs, Incoterms, MOQs, sample sizes, packaging, payment terms, and more by forging a relationship with your supplier.

Here’s an example of a negotiation strategy over the course of a budding trade partnership.

Order Requirement | Negotiation Example | |

|---|---|---|

1st order | Minimum Order Quantity | 750 units from 1,000 |

2nd order | Incoterms | FOB from EXW |

3rd order | Unit price | $2.71 from $2.84 |

4th order | Deposit terms | 20% from 30% |

Analyze Costs & Refine Order Quantities

As you sell and reorder imported goods, monitor your processes and costs closely. Be sure to keep track of your procurement, freight, insurance, handling, duty, and inland transportation costs—as well as the charges involved in hiring a customs broker and/or freight forwarder.

These expenses can be rolled into the core item cost to accurately measure profit margins, which is a metric commonly called landed costs.

As you analyze the performance of your products and operation as a whole, identify ways to improve profitability and promote growth. To learn more, read our guide to retail analytics.

Forecast & Reorder

If your imported goods are a hit, it only makes sense to reorder as stock depletes. But when your suppliers are on the other side of the world, replenishing inventory can take months.

For this reason, it’s vital to properly forecast demand, calculate stock, and consider lead times when selling imported goods from China. Consider having a buffer of safety stock on hand.

Additionally, keep a calendar of Chinese holidays in consideration when forecasting your upcoming orders. Celebrations throughout the year will affect lead times, but Chinese New Year is the biggest obstacle to work around—it halts business dealings for the majority of a month every year.

In addition to smart forecasting, some retailers find it beneficial to use two different suppliers for each item that they sell. This way, if one manufacturer can’t provide a product due to material or labor shortages, there’s a backup source to ensure your stock never runs dry.

Pros & Cons of Importing from China

China is one of the largest suppliers of imported goods in the US, with imports totaling $427.2 billion in 2023, according to the U.S. Bureau of Economic Analysis. China has historically been one of the US’ biggest trading partners, with more businesses sourcing their products from the “factory of the world.”

| PROS | CONS |

|---|---|

| Significantly lower manufacturing costs | Challenging logistics (shipping costs and delivery times) |

| Access to a wide range and customizable products | Product quality risks |

| Product demand (quantities) can easily be met | Communication problems / language barrier challenges |

Why Are Chinese Products Less Expensive?

- Integrated domestic supply chain: Manufacturers have easy access to a wide variety of affordable raw materials from local suppliers.

- Government promotion: China promotes exports through the establishment of special economic zones, tax and financial benefits, subsidized utilities, duty drawback, export insurances, and exchange rate management.

- Efficient logistics: China has built numerous ports, roads, and railroads in a rapid effort toward industrialization. This system connects major cities to small towns used as industrial manufacturing zones, allowing for cheaper transport costs.

- Technology and automation: Availability of the latest technologies allows Chinese factories to manufacture products with both high efficiency and scalability.

- Labor: China hosts a vast population of educated, trained, or otherwise skilled workers, contributing to a wide talent pool. Additionally, the cost of labor is significantly cheaper than that of other countries.

What to Expect When Working With Chinese Businesses

Business culture in China is unique and potentially surprising to Westerners. Here are some tips for working with Chinese businesses—both remotely and face-to-face.

- Mind the language barrier. Many Chinese professionals can read English better than they can understand it in spoken conversation. Use printed communication when possible—use short sentences and avoid complex words.

- Don’t assume anything. Chinese culture tends to be non-confrontational, so business dealings are often less straightforward. Ask direct questions, reiterate, clarify, and confirm everything to avoid misunderstandings. Cover every transaction detail for purchase orders, and operate under the assumption that anything you don’t spell out clearly will be done differently than you expect.

- Be wary of contracts. Contracts and signed agreements hold a different meaning in China. Your purchase agreements are still an important part of the transaction, but beware that they are not final and are subject to change at any time without notice or penalty.

- Form a relationship. Friendly relationships and social networks are vitally important to Chinese culture; they form the foundation of business dealings. Some vendors may be inflexible and difficult until you’ve established a relationship or met in person. Others will value your business significantly more once you’ve stopped by for a visit—resulting in better negotiations down the line. If you are limited to remote relationships, be sure to stay communicative, cordial, and friendly.

Frequently Asked Questions (FAQs)

Click through the tabs below to learn more about the most frequently asked questions about importing from China.

Costs vary depending on the type and quantity of an imported product. There are fees involved in each step of importing from China to the USA. You need to pay import tax, other duties–such as Section 301 tariffs, and anti-dumping and countervailing duties—, and fees like merchandise processing and harbor maintenance fees.

Importing goods from China to the US typically takes up to six weeks. There are instances when it can take longer, especially during peak seasons like Christmas and holidays.

Yes, you can definitely import goods from China without a middleman. There are risks such as language barriers and not being able to perform due diligence or background checks, but as long as you know the associated risk and take proper precautions, you can purchase goods from China directly.

If your goods are not picked up within 15 days of arrival, they’re sent to a General Order Warehouse, where storage charges are assessed on a daily basis. In order to retrieve your merchandise from the G.O. Warehouse, those fees will need to be paid. After six months of storage, unretrieved goods may be discarded or sold at auction.

Certain commodities require a special permit or license issued by one of the government agencies that works with the U.S. Customs and Border Protection (CBP), like arms and ammunition, agricultural and livestock commodities, tobacco and alcohol, and medical equipment and supplements.

Bottom Line

Importing goods from China is a great way to increase profitability while drawing from a wide and diverse pool of products. Despite the cost of tariffs, transport, and customs, the low prices you’ll get on Chinese imports make the procurement process more than worthwhile.