No matter the size of your nonprofit organization, the ability to accept credit card donations can radically increase the amount of money you can raise. It also allows you to easily set up recurring donations or online giving. Some traditional merchant account providers and credit card processors offer discounted rates for nonprofits, whereas other solutions are designed specifically to help nonprofits collect donations and include tools to make fundraising easier.

After hours of research, my picks for the best nonprofit credit card processing are as follows:

- Helcim: Best overall

- iATS: Best for on-site and online donations

- PayPal: Best variety of payment types

- Givebutter: Best for online fundraising and marketing

- Stripe: Best for customizing online donation platforms

- Square: Best free POS and chargeback protection

- Donorbox: Best for payment processing flexibility

- PaymentCloud: Best high-risk merchant account

Best Nonprofit Credit Card Processors Compared

Our Score (Out of 5) | Monthly Fee | Discounted Processing Rates | Option for Donor-covered Fees* | Funding Speed | |

|---|---|---|---|---|---|

4.27 | $0 | Card network discount | ✕ | 1-2 business days | |

| 4.21 | Not disclosed | 2.49% to 3.2% | ✓ | 1-2 business days |

| 4.18 | $0-$30 | From 1.99% + 49 cents | ✕ | Instant/ same-day/ up to 2 business days |

| 4.17 | $0-$29+ | Standard Givebutter rates only | ✓ | 2-3 business days |

| 4.11 | $0 | Card network discount | ✕ | Same-day to up to 2 business days |

4.04 | $0-$89 | Standard Square rates only | ✕ | Same-day to up to 2 business days | |

| 4.04 | From $0 | 2.2% + 30 cents 1.99% + 49 cents | ✓ | 1-3 business days |

| 4.03 | Custom | Custom | ✓ | 2-3 business days |

*Donor-covered fees: It’s not uncommon for nonprofits to provide their donors the option to cover a portion of the nonprofit’s costs for maintaining its platform. Also called a convenience fee, donation forms often include a check box where a donor can confirm their intention to pay for the use of the platform (platform fee). Learn more about convenience fees. | |||||

Helcim: Best Overall Nonprofit Credit Card Processor

Pros

- Customer portal tools for donation

- In-person donation through mobile

- Built-in CRM, invoicing, and recurring billing tools

- Free credit card processing program

Cons

- No dedicated fundraising tools

- Limited third-party integrations

- Discount only through card network fees, not Helcim’s markup

- Charges higher for Amex transactions

Overview

Who should use it:

Growing nonprofits accepting online and in-person payments

Why I like Helcim:

Helcim is one of the most cost-effective payment processors in the industry, with very low per-transaction costs and zero monthly fees. Unlike iATS, Helcim is not a dedicated nonprofit platform, but it does come with a full suite of online and in-person payment tools, plus customer relationship management (CRM) features that can easily be adapted to nonprofit functions.

I like how Helcim designed its software to optimize merchant processing fees. So, while it does not offer discounted processing fees, Helcim does offer Visa and Mastercard special interchange rates for nonprofits, which lowers your overall processing fee. It also supports free credit card processing for organizations accepting ACH payments.

However, note that Helcim offers a traditional, dedicated merchant account. While this is more secure, organizations must undergo a strict application process to get approved for one.

- Monthly fees: $0

- Nonprofit discount: Card network discounted interchange rates

- Card-present fee: Interchange plus 0.15% + 6 cents to 0.4% + 8 cents

- Card-not-present fee: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents

- Amex surcharge fee: + 0.5% + 25 cents per transaction

- ACH fee: 0.5% + 25 cents

- Additional fee for international payments: Card network rates

- Deposit speed: 1-2 business days

- Contract: Month to month

- Chargeback fee: $15 (refundable)

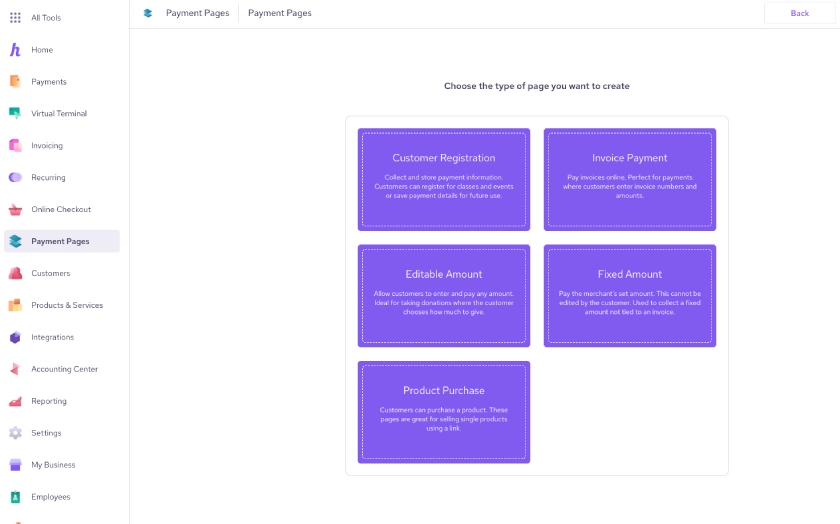

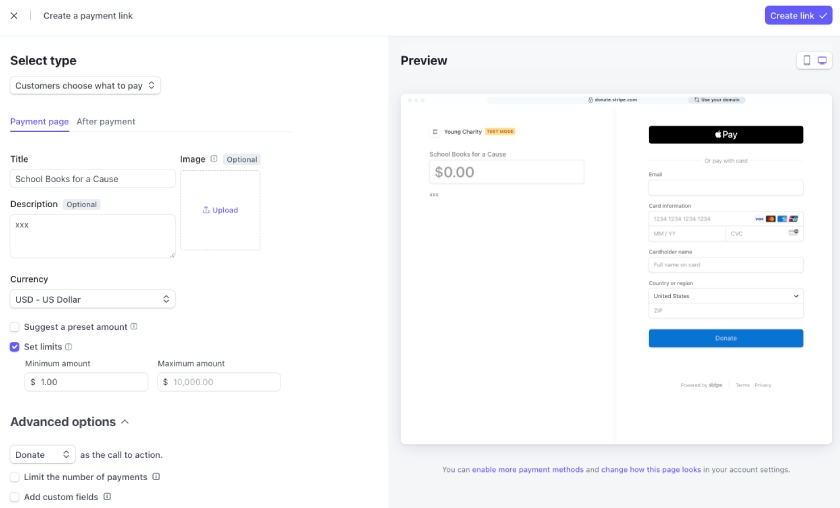

Create online payment pages to accept online donations. (Source: Helcim)

Payment Types

- Card-present

- Online/remote

- Recurring

- Invoicing

- Virtual terminal

- ACH/e-check

- International payments

Fundraising Tools

- Donate button

- QR code

- Sharable payment link

- Hosted donation page

- Memberships

- International payments processing: Helcim does not take any cross-border fees (except for what card networks are charging) or collect any currency conversion fees when you accept donations from overseas—unlike most providers on our list.

- Over-the-phone payments: Use Helcim’s virtual terminal to collect donations over the phone. It can be accessed from any browser and even allows you to set up recurring payments.

- Customer portal: Helcim provides a free customer portal where your donors can manage their memberships and subscriptions. The portal also includes a card vault feature that securely stores credit card information.

- Online donations: Helcim’s payment gateway is easy to set up with its payment page wizard for customization. You can also design “Donate” buttons and QR codes to embed in your emails and social media campaigns.

- Free credit card processing: Helcim offers an automated zero-cost processing program for merchants accepting ACH payments. For donations, it is normal for donors to cover the transaction fees (also called donor-paid fees).

- Security: Helcim is a fully Payment Card Industry (PCI)-compliant merchant account services provider with industry-standard protocols for protecting donors’ sensitive data. It also comes with built-in transaction monitoring features that track visitor behavior and block or approve payments according to your acceptable risk.

Did You Know? Visa and Mastercard offer special discounted interchange rates for eligible nonprofits and are assigned a special merchant category code (8398). The card networks apply lower rates for these types of merchant accounts.

For example:

- Visa US standard interchange fee from 1.15% + 10 cents to 2.5% + 10 cents

- Visa discounted fees for charities from 0.65% + 15 cents to 1.35% + 5 cents

- MC US standard interchange fee from 1.15% + 10 cents to 2.6% + 10 cents

- MC discounted fees for charities from 1.45% + 15 cents to 2% + 10 cents

To know if your organization qualifies for the discounted fees, refer to your merchant processor’s billing statement.

iATS: Best for Dedicated Donation Platform

Pros

- Integration with charity/donation-specific software and organizations

- No chargeback or early termination fees

- International donations capable

- Merchant account provided

Cons

- Undisclosed fees

- No invoicing function

- Limited reporting features

Overview

Who should use it:

Small, established nonprofits

Why I like iATS:

iATS Payments is an all-in-one payment solution built specifically for nonprofits. It works with over 15,000 nonprofits and partners with over 100 different CRM, event management, and charitable services.

It can handle international credit card transactions (like PayPal) and ACH payment processing. However, iATS is unique because it works with charities of all sizes and offers secure online forms, making accepting donations safe and easy. This immediately gives iATS an advantage over traditional payment processors like Helcim and PayPal.

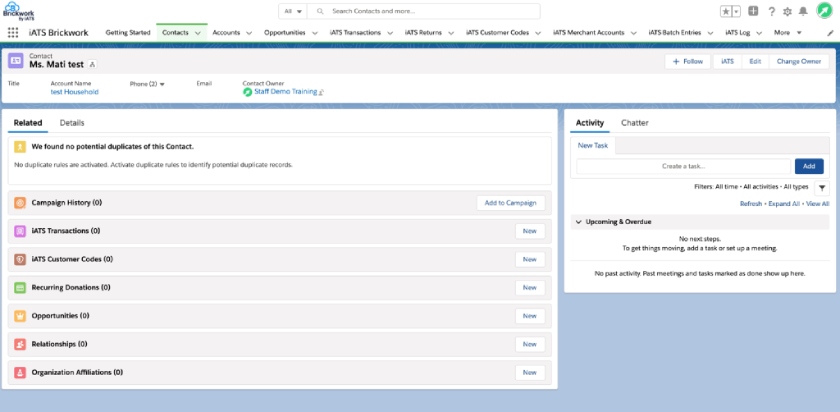

It has a mobile app for accepting donations and a Salesforce payment processing app, Brickwork, which makes it easy to take donations, simplify donor updates, and keep donor information and transactions on the same platform.

Unfortunately, iATS does not have an invoicing function, which cost it points in our rankings. However, nonprofits do like iATS for its reliable and easy-to-use platform and praise it for excellent customer support.

- Monthly fee: Not disclosed

- Per transaction: Not disclosed (third-party sources say from 2.49% to 3.2% for cards, 26 cents per ACH transaction)

- Additional fee for international payments: Card network fees

- Deposit speed: 1-2 business days for Visa, Mastercard, and American Express, every Thursday for Discover transactions, and every Wednesday for ACH transactions.

- Contract: 1 year, with 6 months automatic renewal

Integrate iATS directly with your Salesforce account to seamlessly manage all your donor information. (Source: iATS)

Payment Types

- Card-present

- Online

- Recurring billing

- ACH/e-check

Fundraising Tools

- Hosted donation page

- Online forms

- Event registration

- Text-to-donate

- Auction bids

- Online forms: iATS specializes in creating online forms that you can customize for different types of donations, such as tithing, event signups, and auction bids.

- Mobile payment: iATS includes a mobile payment app. It’s simpler than PayPal Zettle or Square, so it is good for donations, but not if you also sell items for your charity.

- Third-party integrations: iATS integrates with hundreds of technology partners and can manage payments from your CRM, auction software, and online fundraising platform.

- Works with Salesforce: Worth mentioning is Salesforce’s exclusive integration with Brickwork iATS for more nonprofit and management tools, such as online and offline virtual terminals, donor databases, and scheduling recurring donations. This gives iATS an advantage over most nonprofit processors, including Stripe.

- Deposit speed: iATS lists variable deposit times based on payment type, from one to two business days for Visa, Mastercard, and American Express transactions to every Thursday for Discover transactions. Meanwhile, ACH transactions are deposited every Wednesday.

- Security: iATs is level 1 PCI-compliant, so its security measures meet industry standards for protecting sensitive donor information. It also employs fraud prevention features, such as two-factor authentication, to minimize the risk of unauthorized transactions.

PayPal: Best Payment Variety for Small Nonprofits

Pros

- Discounted rates for nonprofits

- Venmo, PayPal, ACH, and other payment types easily accepted

- In-person and online payment processing

- International payments accepted

Cons

- Limited customer database tools

- Discounts for confirmed IRS 501(c)(3) nonprofits only

- Monthly fee collection for use of virtual terminal

- Upgrade to Braintree to accept ACH payments

Overview

Who should use it:

Small nonprofits looking for no-fuss collection tools like PayPal and Venmo

Why I like PayPal:

With no minimums and a name trusted by consumers and donors everywhere, PayPal is a good match for nonprofits of any size looking to accept donations easily. It can accept international currencies, ideal for international organizations or nonprofits looking to fundraise overseas. What makes it unique, however, is that, in addition to accepting PayPal payments, nonprofits can accept PayPal Credit, Pay in 4, and Venmo, which PayPal also owns.

I like how PayPal offers discounted rates for both recognized charities and simple donations. But unlike Helcim, PayPal offers only an aggregate merchant account that is susceptible to frozen funds. PayPal’s sister service Braintree, however, offers a traditional merchant account and is best suited if you need greater online customizability and want to accept donations through ACH payments.

- Monthly fees:

- PayPal account: $0-$30

- Virtual Terminal: $30

- Payment Gateway: $0-$25

- Transaction fees for confirmed nonprofit accounts*:

- 1.99% + 49 cents for online transactions

- Zettle: 2.29% + 49 cents to 3.49% + 49 cents

- Instant transfer: 1% fee

- Additional fee for international payments: 1.5%

- Deposit speed: Instant (via PayPal Balance), Instant deposit (with fee), Standard deposit two-business days

- Contract: Month to month

*Discounts for 501(c)(3) are only for nonprofit organizations confirmed by PayPal. Otherwise, donations to PayPal Business accounts incur a 2.89% + 49 cents transaction fee.

**Update: PayPal no longer charges extra monthly fees for recurring donations (subscriptions), but it may charge a higher transaction rate.

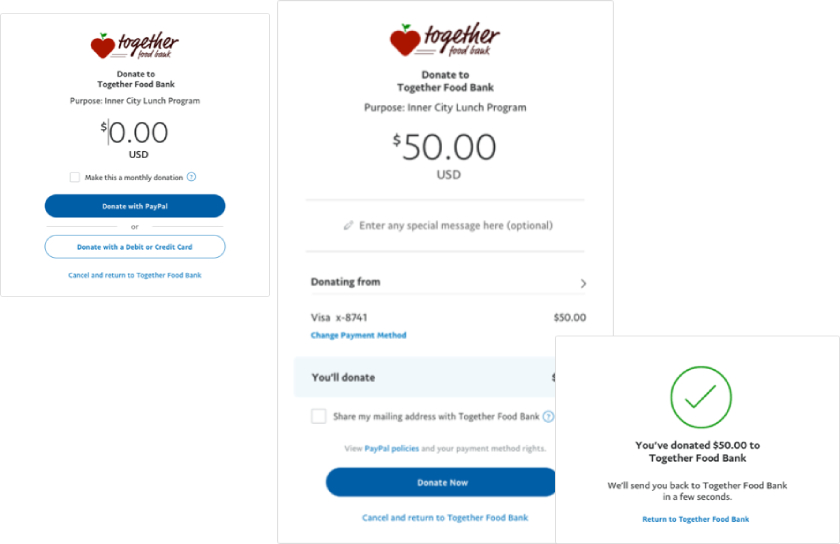

Build a complete donation payment platform with PayPal. (Source: PayPal)

Payment Types

- Card-present

- Online donations

- Recurring donations

- Invoiced payments

- Virtual terminal

- ACH/e-check (via Braintree)

- International payments

Fundraising Tools

- Donate button

- QR code

- Sharable payment link

- Hosted donation page

- Online donations: PayPal lets you create customized donate buttons to add to your website or send via email, as well as shareable URLs for your social media account and other online platforms.

- In-person donations: Create a QR code you can display during events that your guests can scan to take them directly to a mobile-friendly checkout to make payments. You can also add a donate button to your mobile payment app.

- Recurring payments: You can safely store your donors’ credit card information to process automatic recurring payments or send invoices via email with a link to your payment page.

- PayPalMe: Set up a donation link for social channels (higher transaction fees apply).

- PayPal Giving Fund: Register to receive donations through PayPal, eBay, and other partner platforms. This program is unique to PayPal.

- Security: In addition to level 1 PCI compliance, PayPal offers seller and buyer protection tools to protect users from unauthorized transactions. PayPal is also equipped with machine-learning tools you can customize with a variety of filters based on your acceptable risk.

When to choose Braintree:

Braintree is run by PayPal but offers more customizability, including transaction reporting for its online tools. We find that PayPal offers more discounts for nonprofits, and users give it a much higher ease-of-use score. Braintree fared better for features and customizations. Both are excellent for a nonprofit and popular with 501(c)(3)s of all sizes.

However, it’s also more complex, and according to users, you need someone tech-savvy to get the most from it. It accepts ACH and e-checks (PayPal cannot), is better for handling Bitcoin payments, and has cheaper international payment processing. It is also the processor to choose from if you are developing a marketplace.

Read our full Braintree review to learn more.

Givebutter: Best for Online Fundraising and Marketing

Pros

- Free online donation and marketing tools

- Donor-advised funds (DAFs) integration

- Automated deposits for verified nonprofits

- 24/7 support via live chat and email (phone support only during business hours)

Cons

- Limited in-person donation option

- Automation feature available only in paid plans

- Email marketing tool only available as an add-on

- Platform fees imposed if donor-covered fee option (“tipping”) feature is disabled

Overview

Who should use it:

Nonprofits looking for an all-in-one free plan for managing online donations and quick integration with DAF accounts.

Why I like Givebutter:

Givebutter offers a feature-rich online donation platform for a small fraction of the cost and better contract terms than similar offerings like Charity Engine (which used to appear on this list). Since its launch in 2016, Givebutter has managed over $300 million in donations to date for organizations like GetUsPPE during the COVID-19 pandemic and Help Peru.

Like iATS, Givebutter lets you run events, set up regular donations, have a website, manage direct mail campaigns, and run peer-to-peer fundraisers. It can even process funds from credit cards, e-checks, and direct transfers/ACH. It does have a mobile app to accept in-person donations; however, you’ll need to purchase a Stripe Reader M2 to accept swipe, EMV chip, and contactless transactions.

Note that, while most processors offer lower transaction fees for card-present payments, that is not the case for Givebutter. It charges the same fee whether you accept donations online or from your mobile app. If you don’t want to spend money for a mobile card reader, you can always use tap-to-pay or digital wallet transactions.

- Monthly fee: $0-$29+/month

- Per transaction: 2.9% + 30 cents per transaction

- Platform fee: If tipping or donor-covered fee feature is disabled

- 1% for donation forms

- 3% for fundraising pages

- 5% for events and auctions

- Email marketing: $1.95/letter for paid plan, $2.95/letter for free plan

- Additional fee for international payments: None

- Deposit speed: 2-3 business days

- Contract: Pay as you go

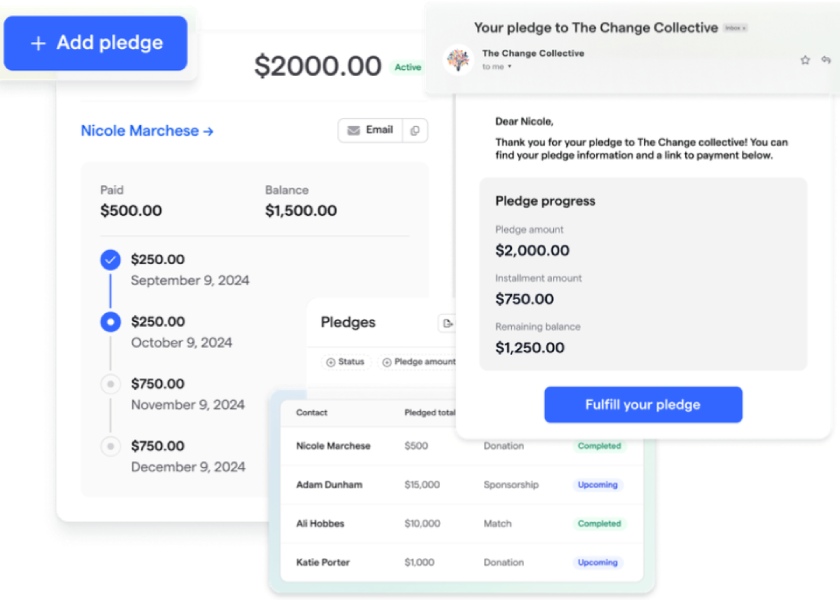

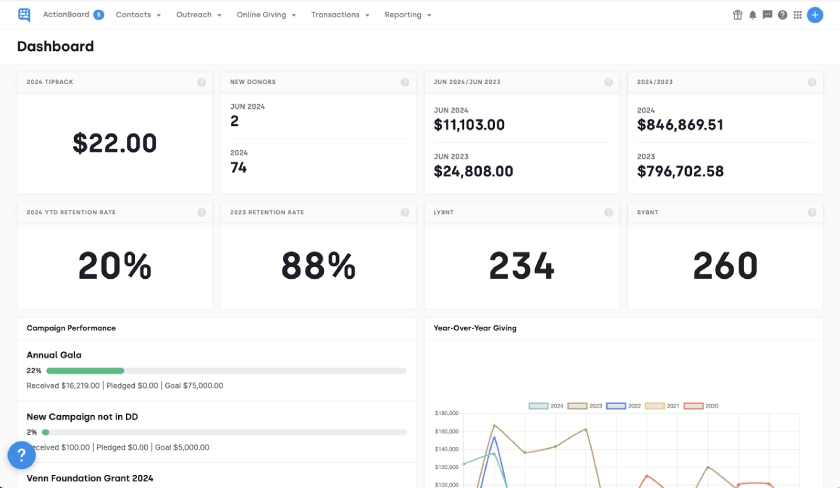

Start and manage donation pledges with Givebutter. (Source: Givebutter)

Payment Types

- Card-present via mobile app

- Online

- Recurring billing

- ACH/e-check

Fundraising Tools

- Hosted donation page

- Online forms & widgets

- Event registration

- Text-to-donate

- Auction bids

- Mobile payment processing: Givebutter offers a full-featured mobile app to accept in-person payments. You can opt for tap-to-pay and digital wallet transactions like Google Pay and Apple Pay or purchase a Stripe M2 mobile card reader to accept swipe, chip, and contactless payments.

- Online donation tools: Givebutter excels in online credit card processing for nonprofit organizations. Its online fundraising tools include website widgets, a shopping cart builder, and online donation forms. The system also supports pledges, event management, and auction tools.

- CRM and marketing: You can run a direct mail fundraising program (for a fee) and market your campaigns from a single platform.

- DAF donations: Givebutter integrates with DAF with a prebuilt DAF pay button for easy and fast access to DAF funds.

- Donation management: With Givebutter, you can track pledges and generate comprehensive reports.

- Workflow automation: Workflows is Givebutter’s task automation feature that allows you to set repetitive tasks such as donor communications, data entry, and reporting functions. Givebutter offers templates and start-from-scratch automation options.

- Security: Givebutter is powered by Stripe, using the latter’s advanced transaction monitoring and validation features.

Stripe: Best for Customizing Online Donation Platforms

Pros

- Versatile: 450+ integrations, 135+ currencies

- Ability to handle recurring donations, invoicing

- 24/7 support

- Highly customizable online donation forms

Cons

- Complex pricing; need to call for the nonprofit discount

- Discount only for 501(c)3 and donations

- No nonprofit-specific tools

- Some coding skills required to customize

Overview

Who should use it:

Online nonprofits needing advanced customizations

Why I like Stripe:

Stripe is a popular PayPal competitor for payment processing because it, too, offers good rates and works on a per-transaction schedule rather than requiring a lengthy contract. It also gives 501(c)(3) nonprofits a discount on processing fees. Many online business software use Stripe to power their payment processing, including nonprofit fundraising platforms like Givebutter.

See our Stripe vs PayPal comparison.

While it does not have special tools for nonprofits, Stripe’s comprehensive feature set includes an advanced fraud protection system and advanced customization tools. However, this means you need coding skills if you want donation forms with adaptive language and local payment methods or if you want to develop custom payment buttons.

That said, it’s hard to ignore Stripe’s potential for tailored online donation functionalities that can provide your donors with a streamlined experience on your platform.

Stripe offers nonprofit credit card processing discounts, though it does not disclose them publicly. The following are Stripe’s merchant rates to be used as a comparison for its discounted nonprofit rates:

- Monthly fee: $0

- Online: 2.9% + 30 cents

- In-person via Terminal: Starts at 2.7% + 5 cents

- Digital wallet: 2.9% + 30 cents

- ACH direct debit: 0.8% capped at $5

- Recurring payments: 0.5%-0.8% per transaction

- Invoicing: 0.4%-0.5%

- Additional fee for international payments: 1.5%

- Contract: Month to month

Stripe lets you customize donor pages and optimize both for websites and mobile. (Source: Stripe)

Payment Types

- Card-present

- Online donations

- Recurring donations

- Invoicing

- Virtual terminal payments

- ACH/e-check payments

Fundraising Tools

- Custom donation page & donate button

- Custom donation portal

- Shareable payment links

- Fundraising platform integration

- Customizable checkout page: Use Stripe’s dashboard to customize your checkout settings with client-only integrations for accepting donations.

- Customizable donation pages: Set up your donation pages by adding donation amounts as products that your donors can choose from. They will be redirected to your thank-you page.

- Nonprofit integrations: Integrate with POS and ecommerce systems or build your own. Stripe has the greatest flexibility with over 450 integrations. For example, Stripe integrates with CharityWeb, Kindful, Donorbox, and others.

- Customizable fund transfer: Get a two-day transfer to your bank or on a schedule you set. Stripe, however, does not have same-day or next-day funds availability. For that, consider PayPal or Square.

- Global payments: Stripe supports 135-plus currencies and has 24/7 support. Most on our list offer multiple currencies, but only Braintree comes close in the number available.

- Business support: Stripe also offers financial and business tools that include financing, banking, accounting, and more. Only Square offers as many additional tools.

- Security: Stripe is fully PCI-compliant and offers tools to implement two-factor authentication, IP monitoring, and more. It also offers machine-learning tools to adjust transaction monitoring according to your acceptable risk.

Square: Best for Nonprofits That Need a Free POS

Pros

- Free POS software and ecommerce tools

- CRM tools included for donor database management

- Waived chargeback fee

- Simple transparent pricing

Cons

- Integration required for some fundraising tools

- No discounts for nonprofits

- Live support during business hours only

- Account stability issues

Overview

Who should use it:

New nonprofits that need free POS software and those who want the best protection from chargebacks

Why I like Square:

Square offers a completely free merchant account that includes POS and ecommerce software, is incredibly easy to use, and has a fast sign-up process. You even get a magstripe reader for free. Though Square doesn’t offer discounts for nonprofits, its pricing is competitive and transparent, making it a good option for organizations that collect in-person donations. Square also offers CRM functions for communicating with your donors and functions for monitoring campaigns and setting up recurring donations.

Related: Our review of Stripe vs Square vs PayPal

Square also simplifies the chargeback process. Not only does it have built-in tools to manage and respond to chargeback claims, Square even waives chargeback fees for up to $250/month. That said, using Square means you won’t be able to integrate with other payment processors or POS solutions.

- Monthly fee: $0-$89 (with POS)

- In-person transaction fee: 2.6% + 10 cents

- Online transaction fee: 2.9% + 30 cents

- Keyed-in/virtual terminal, card in file: 3.5% + 15 cents

- Invoices and online payments: 3.3% + 30 cents

- Additional fee for international payments: Card network fees

- Same-day transfers: 1%

- Deposit speed: Next-day funding and same-day options for a fee (1.75%)

- Contract: Month to month

DonorDock uses Square to manage their donations. (Source: DonorDock)

Payment Types

- Card-present

- Online

- Recurring donations

- Invoicing

- Virtual terminal

- ACH/e-check

Fundraising Tools

- Hosted donation page

- Donate buttons and payment links

- Memberships

- Ticket and merchandise sales

- Online donation options: With Square, you can create donate buttons, set recurring payments, and customize invoiced donations.

- Mobile payments: Square is known for its mobile payments capabilities with its free mobile app and card reader, so you can turn your phone into a payment processor.

- Built-in payment tools: It offers a free virtual terminal, native POS, and ecommerce systems to give you various ways to accept donations.

- Reporting features: You gain access to analytics and real-time reports to monitor your different donation payments from one platform.

- CRM tools: The system includes a customer engagement feature, which allows you to maintain a customer database, send emails, and monitor campaigns.

- Business tools: Square offers banking features, including an account that lets you get quick access to your funds, payroll and employee benefits, and more.

- Security: Square is PCI-compliant and comes with customizable monitoring tools you can use to determine how to handle flagged transactions, as well as chargeback management features to fight fraudulent chargeback claims.

Want to learn more about Square?

- Read about Square and all of its solutions

- Check out our Square POS review for Square’s in-person sales tools

- See why Square offers our favorite card readers for small businesses

Donorbox: Best for Flexible Payment Processing

Pros

- Ability to work with Stripe and PayPal

- Free plan available

- Donor-covered platform fee option

Cons

- Platform fee on top of monthly account fee

- Nonprofit discounts only for registered 501(c)(3) nonprofits

- Add-on monthly fee for customization tools and to accept in-person payments

Overview

Who should use it:

Small nonprofits looking for flexibility in payment processing options

Why I like Donorbox:

Donorbox started in 2014 as a WordPress fundraising plug-in using PayPal and Stripe to accept payments. Today, it is a fully operational donation platform with a feature-rich free plan that rivals Givebutter and with better crowdfunding management tools than GoFundMe (previously on our list). Popular charitable organizations such as Habitat for Humanity and various animal shelters around the country use Donorbox to raise funds for their causes.

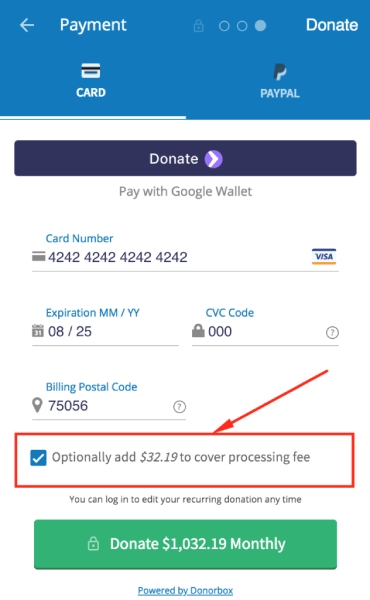

Having its pricing plans available also gave Donorbox an advantage. Although Donorbox imposes add-on fees on advanced nonprofit tools, the basic features in the free plan are enough to start accepting payments. I like how organizations can choose between Stripe and PayPal/Venmo. This means you have an option between basic and advanced donor page features, particularly if you accept international donations. Donors can send payments via Google Pay, Apple Pay, and even bank transfers. Donorbox also has settings to allow donors to cover platform fees.

- Monthly fee: $0/$139, custom plan also available

- Nonprofit discount rate: For Registered 501(c)(3) nonprofits

- Stripe: 2.2% + 30 cents

- PayPal/Venmo: 1.99% + 49 cents

- Standard rates:

- Stripe: 2.9% + 30 cents

- PayPal/Venmo: Contact PayPal

- ACH payments: 0.8% ($5 maximum)

- Platform fee: 1.75%

- International payments: Card network rates

- Chargeback fee: Depends on payment processor

- Contract: Month-to-month

- Funding speed: 1-3 business days

Accept standard credit card and PayPal payments methods on a Donorbox online donation form. (Source: Donorbox)

Payment Types

- Card-present

- Online

- Recurring donations

- ACH

- Cryptocurrency and stock donations

Fundraising Tools

- Donation forms

- Text-to-give (text-to-pay)

- Payment links/Donation buttons

- Crowdfunding

- Event ticketing

- Recurring donation/memberships

- Peer-to-peer (Venmo)

- In-person/kiosk: Donorbox’s Live kiosk allows nonprofits to accept cashless donations via card or digital wallet by downloading the Donorbox Live app on a tablet.

- Event ticketing: Donorbox provides nonprofits with its very own ticketing software for nonprofits that sell tickets for fundraising events.

- Online platform: Donorbox provides nonprofits with tools to create online donation platforms and a customer portal so donors can sign up on the nonprofit’s site and send a one-time donation or sign up for membership with a recurring donation.

- Peer-to-peer donation: With Venmo, nonprofits using Donorbox can accept peer-to-peer payments easily.

- Crowdfunding pages: Nonprofits can create crowdfunding pages hosted by Donorobox at no extra cost.

- Security: Donorbox comes with tokenization tools, two-factor authentication, and session tokens via Proper Access Control for securing third-party integrations. It is also equipped with advanced algorithms that monitor visitor profiles such as IP addresses, user behavior, and device information.

PaymentCloud: Best for High-risk Merchant Account

Pros

- Dedicated merchant account

- Excellent client onboarding support

- Payment gateway agnostic

Cons

- Add on fees for payment gateway and virtual terminal

- Requires merchant account application

- Lacks fee transparency on its website

Overview

Who should use it:

Nonprofits that prefer a flexible dedicated high-risk merchant account for processing recurring and over-the-phone donations

Why I like PaymentCloud:

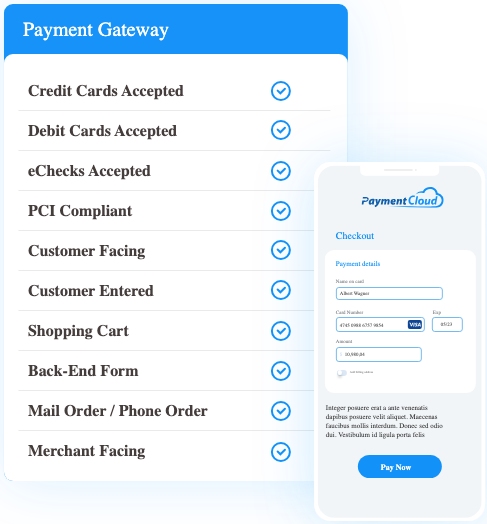

Nonprofits, particularly new ones, often encounter challenges opening a merchant account because some activities, such as accepting donations over the phone (MOTO) and setting up subscription-based online donations, are considered risky. This is where PaymentCloud comes in. A traditional merchant account provider, PaymentCloud also works with low-risk organizations, but it truly shines in mid- and high-risk industries.

PaymentCloud stands out both for its expertise in the industry and flexibility. I especially like how it can adapt its pricing structure depending on the organization’s needs.

PaymentCloud is also payment gateway agnostic, which means you can choose from a variety of partner gateways or keep what you already have in place. If your nonprofit requires a unique payment platform, PaymentCloud can even customize one for you. You can find this level of customization with Stripe, but it doesn’t offer a dedicated merchant account or the same level of support in getting set up.

PaymentCloud does charge monthly account and gateway fees, unlike Stripe and Square, which are free and quick to set up. That said, PaymentCloud is well known for its onboarding support, and many clients rave about how efficient and seamless it is to set up an account.

PaymentCloud offers fully custom pricing. The figures below are estimates provided by PaymentCloud for mid- to high-risk businesses or organizations and will vary based on your preferred pricing structure and business profile.

- Monthly account fee: $10-$45

- Card-present fee: 2%-$4.3%

- Card-not-present fee: 2%-$4.3%

- ACH payments: Not disclosed

- Virtual terminal fee: $15-$45/month

- Payment gateway fee: $15/month

- Chargeback fee: $25

- Application/Setup fee: $0

- Cancellation fee: Waived early termination fee

PaymentCloud offers flexible payment gateway options both for online and in-person platforms. (Source: PaymentCloud)

Payment Types

- Card-present

- Online

- Recurring donations

- Mail Order/Telephone Order (MOTO

- ACH

- Cryptocurrency

Fundraising Tools

- Donation forms

- Payment links/Donation buttons

- Event ticketing

- Recurring donation/memberships

- In-person: PaymentCloud works with a number of mobile card reader providers that can allow you to accept donations in person. This includes popular devices such as SwipeSimple and Clover.

- Event ticketing: PaymentCloud’s online platform integration can be customized to sell and manage tickets for fundraising events and auctions.

- Online platform: PaymentCloud’s ability to integrate with most payment gateways allows you to choose based on the level of customization you need in developing online donation forms, such as the ability to adapt the interface based on your donor’s location.

- Recurring donation: Create donation subscriptions through PaymentCloud’s subscription manager, which allows you to create custom plans and embed payment methods.

- Over-the-phone donations: Use PaymentCloud’s virtual terminal to process over-the-phone donations. You can set it up to accept a one-time donation or sign up your donor for recurring payments. The system can also be set to send digital receipts immediately for every transaction.

- Security: PaymentCloud is PCI level 1-compliant, so your donor information and payment records are safe. PaymentCloud’s dedicated merchant account also minimizes the risk of account holds and frozen funds.

How to Choose Your Nonprofit Credit Card Processor

Still not sure how to choose the best nonprofit credit card processing solution for your business? Follow these simple steps:

Step 1: Determine How You Want to Accept Donations

Create a list of merchant account providers and payment processors that can match your requirements (online, in-person, or both). To help you get started, consider these questions:

- Does your nonprofit only accept donations online?

- Are you looking to expand your online campaign by attending events that require tools to accept donations in person?

Step 2: Match Your Payment Processing Methods

Narrow down your list by identifying the payment processing tools you need and matching these with what each provider has to offer. For example, if you want to accept payments in person, do you prefer a mobile device so you can move around during events? Or, when considering the best way to collect donations online, decide if you want to sign up donors for a recurring collection, just a one-time payment, or both.

Payment Processing Methods to Look for in Nonprofit Payment Solutions

- Card-present/mobile

- Card-not-present/online

- Recurring payments

- Invoicing

- Virtual terminal

- ACH/e-check

Most payment processors offer additional features such as a website builder, rewards program, accounting tools to track NGO payments, and more. However, be sure to watch out for extra fees that sometimes accompany these functions. Start a tally and compare, then remove those with the highest add-on cost from your list.

Step 3: Choose Your Preferred Donation Tools

Now that you have a solid list of payment processor options, it’s time to take a closer look and find out which ones support the donation tools you need.

For example, not all payment processors that allow you to accept donations online have the ability to set up registration for events or manage auction bids. In the same way, not all in-person payment processors can manage inventory to sell tickets or other merchandise.

Tools to Look for in Nonprofit Credit Card Processors

- Donate button

- QR codes

- Shareable payment link

- Hosted donation page

- Membership/sign-up forms

- Event management

- Ticket and merchandise sales

Evaluate Additional Account Features

You’ll also want top-notch security and maybe even business management features from your merchant account. Think about what other software you’re using and what you want from your payment processor. Ideally, these features are built-in and will not require any additional integration (and fees). Compare the security features of your shortlisted nonprofit credit card payment processing options and the additional account features they provide.

- Fraud detection and chargeback management: Nonnegotiable. The credit card processor should have level 1 PCI compliance to take care of data security as donors and integrated third-party software access your platform. Learn about PCI compliance.

- Marketing: Marketing tools are necessary for nonprofit organizations. Make sure that your payment processor has a variety of marketing tools in place to launch different kinds of campaigns.

- Reporting: At the minimum, a nonprofit payment processor should have built-in basic reporting tools that track processed transactions and marketing campaigns.

- Easy-to-use platform: Look for a payment processor with a platform that’s easy to navigate and set up tools that don’t require complex coding skills.

Note that advanced features such as analytics, multiple access, and accounting integrations may require extra fees. Decide whether that additional cost is worth the role that these functionalities play in your nonprofit.

Step 5: Identify Your Nonprofit’s Size

Once you have all the features you need in place, it’s time to consider the cost of accepting donations. To do this, you need to identify the size of donations your nonprofit processes in a month or year.

Your goal should be to accept the most donations with the lowest nonprofit credit card processing fees. If you process less than $10,000 in donations per month, look at payment processors that charge flat rate fees (example: 1.9% + 49 cents). Otherwise, consider payment processors with interchange plus pricing like Helcim and Dharma, which offer big discounts to large volume transactions.

Before disregarding payment processors that charge a monthly subscription straight away, consider what comes with these paid plans. It may have interchange-plus rates and/or free payment and donation tools that may actually save you money depending on your processing volume.

Methodology: How I Evaluated Nonprofit Credit Card Processors

For charities and nonprofits, credit card processors should do more than handle your payments. They should provide discounted rates, simple tools for fundraising, and the ability to reach out to donors. I examined 20 solutions for credit card processing for nonprofits to determine the eight best.

I worked extensively to include all significant factors that can affect the best choice for nonprofit credit card processors. To consistently provide the best answer, this guide is regularly updated to reflect changes in payment services industry standards.

With an overall score of 4.27 out of 5, Helcim ranked as the nonprofit best credit card processing solution. It offers good rates with no contracts or monthly fees—in fact, it’s also our top recommendation as the cheapest credit card processor for most nonprofit organizations and for-profit businesses.

Click through the tabs below for a full list of our scoring criteria:

25% of Overall Score

You may not have full-time fundraising needs, so we favored processors that did not have contracts or charge monthly fees. I also looked for discounted rates, the ability to process donor-covered fees with convenience fees, low chargeback fees, and no cancellation penalties.

30% of Overall Score

You need to be able to accept multiple payment types and from many places. Thus, I gave points for in-person payments (including tap payments like Apple Pay), ecommerce transactions, ACH and e-checks, and stored payment information for recurring donations.

30% of Overall Score

The best credit card processors for nonprofits don’t stop at managing payments. They also offer fundraising tools, a customer database, and marketing functions. I favored those that offered quick disbursements and 24/7 live customer service. Lastly, I evaluated each provider’s payment security features, which include PCI compliance and chargeback management.

15% of Overall Score

In addition to our own evaluation of the features and platform, I considered the opinions of real-world experts: nonprofits that use these platforms. I examined ratings and comments on independent user review sites.

Frequently Asked Questions (FAQs)

These are some of the questions I encounter most often about nonprofit credit card processing.

Nonprofits accept credit card donations the same ways as traditional businesses accept payments via credit cards. They will need a merchant account that can process credit card transactions and a payment gateway to capture and encrypt credit card information while data is transmitted to the relevant banks and card networks.

The best payment system for nonprofits depends on your organization type. If your nonprofit is steadily growing in donations, Helcim is the best option with its automated volume discount and all-around payment processing tools at zero monthly fees.

If you are running a new or small nonprofit, the best payment system would be one that provides an all-in-one solution like Square or Donorbox to quickly get you started. For established nonprofits, platforms with advanced tools like iATS and Charity Engine and highly customizable payment processors like Stripe are the better option.

Yes, nonprofits are required to pay credit card processing fees if it is to accept cashless donations. However, nonprofits that fall under the category of “charities” enjoy much lower transaction rates. There are also options for donors to cover the fees for using the platform.

Yes, like every payment processor, Square charges fees for nonprofits that use the platform to collect donations. Note that Square offers free POS and payment processing, but it does not provide discounted rates for nonprofits.

Bottom Line

If you are a nonprofit, you should be getting a discount on your payment processing. There are many fantastic merchant services and credit card processors, both direct and third-party, that work with nonprofits. Third-party processors offer not only reduced rates but also additional tools to make fundraising easier.

Overall, Helcim offers the best credit card processing for nonprofits with its free merchant account, interchange-plus rates for low-volume transactions, and automatic volume discounts for nonprofits processing $50,000 per month and above.