Omnichannel payments allow customers to complete their purchase (or even request a refund) on any one of a merchant’s selling platforms—in-store, online, mobile, or over the phone—regardless of where they started their buying journey. Omnichannel payments are a key component of omnichannel sales.

The omnichannel sales strategy, including omnichannel payments, focuses on improving the customer experience by letting shoppers interact with a business where and how they want. This includes creating a seamless omnichannel checkout.

Key takeaways:

- Omnichannel payments provide customers convenience with a seamless checkout experience.

- Latest research shows that more and more customers are engaging in omnichannel shopping, with omnichannel retail predicted to grow significantly this year.

- Integration technology is what makes omnichannel payments possible, and merchants can expand their omnichannel platforms as new integration tools become more accessible.

How Omnichannel Payments Work

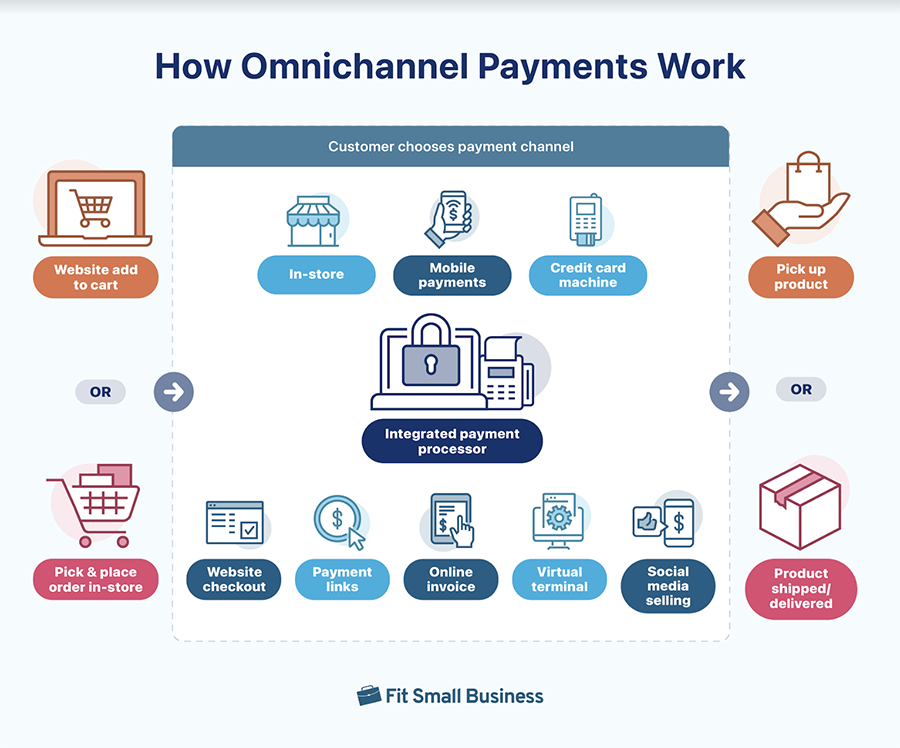

Omnichannel payments are possible via integrations between a merchant’s multiple sales channels and payment processor. That way, a customer may discover a product on social media, add it to their cart, come back to that product later directly via the merchant’s website, and then ultimately visit the storefront to make the purchase (also known as click-and-collect).

The omnichannel sales strategy would also give the customers the choice to have the product they paid for in-person to be shipped, and even file a refund on the merchant’s website should they decide to return the product.

Related reading: Omnichannel vs Multichannel Retailing

Omnichannel Payment Channels/Platforms

Generally, every payment channel, whether in-person or online, can become an omnichannel payment platform as long as you have a payment processor that supports each of your different sales channels. Below are the different card-present and card-not-present ways a merchant can accept payments to form an omnichannel payment solution.

Card-present

Customers nowadays often research products they intend to purchase online. They could discover a product through social media and visit the merchant’s ecommerce website, then add items to their cart, or even receive an invoice over messaging apps. However, instead of proceeding to complete their purchase remotely, some customers prefer to visit the merchant’s physical store to make a payment and pick up their items.

With an omnichannel payment feature, the following in-person payment methods can be used to accept purchases made online:

- Simple credit card machines: Traditional credit card machines that are connected to a point-of-sale (POS) software can accept credit and debit card payments at the checkout counter

- POS terminals: POS terminals at the checkout counter with built-in credit card readers

- Mobile in-person payments: Credit card readers paired with a smart mobile device that uses a payment processor’s mobile POS app, and smart POS terminals that come with built-in POS software, card reader, and receipt printers

Card-not-Present

Some customers who are already inside the merchant’s physical store may have begun their buyer journey visiting the merchant’s online store or prefer to make their payments remotely.

For example, merchants can send customers a digital invoice via email, or a payment link in a messaging app. A merchant may also upsell a customer at the checkout counter with a subscription service or a unique product that may only be available on the merchant’s website.

Business-to-business (B2B) clients can also be physically present at a merchant’s warehouse ordering new products but would wait for an invoice, which they would pay over the phone.

In an omnichannel system, these remote payment methods can access records and process payments of customer orders that were made in person:

- Online invoices: Digital invoices generated from the merchant’s payment processing dashboard come with embedded payment links in a “Pay Now” button

- Independent payment links: These payment links lead to a merchant’s checkout page where orders are already encoded and can be sent to a customer via instant messaging apps, email, and even text messages

- Virtual terminals: Merchant-facing checkout platforms that are used for customers who prefer to make payments via sharing their credit card data to the merchant over the phone

- Website checkouts: The merchant’s ecommerce website is equipped with a checkout page where customers can make payments

- Social media checkouts: A merchant’s social media posts come with an embedded “buy now” link

You need to identify the right payment channels for your business to optimize your sales. The key is to know your customers. Remember that an omnichannel approach is consumer-centric so your business model should adapt to your customer’s shopping habits. When you know how and where your customer wants to pay, then you identify the payment platforms that you need to invest in.

Benefits of Omnichannel Payments

Creating an omnichannel payment strategy is all about improving customer experience. That said, merchants also benefit from the automation that comes with an omnichannel setup.

Faster Payments

With integrated sales and payment channels, customers can choose how and where they want to pay. It also means merchants end up getting paid faster, which is particularly important for businesses with significant accounts receivable.

Increased Sales

Being able to provide various payment methods creates convenience for customers and encourages more sales. Efficient omnichannel payment solutions will remember a customer’s profile and their outstanding orders on every merchant platform, helping minimize cart abandonment.

Did you know? More than 6 out of 10 consumers participate in omnichannel shopping.

Enhanced Customer Loyalty

Providing customers with a personalized buying experience through convenient ways to pay creates a lasting impression that will keep a merchant top of mind. An omnichannel payment approach also allows merchants to have consistent branding across all their payment processing channels, building customer trust.

Less Time Spent on Administrative Tasks

With omnichannel payments, sales and inventory records are updated in real-time across all channels, optimizing the collection and reconciliation of accounts receivables. It also allows for business reports and insights to be accessible from a single platform.

Centralized Customer Data

An omnichannel payment system connects customer profiles across all its payment platforms. This allows merchants to follow customer shopping and spending habits, understand how they interact with multiple sales channels, and find out their preferred ways to pay.

With the availability of real-time information from an omnichannel payment system, merchants receive timely business insights needed to improve operations.

Features of Omnichannel Payments

The key to an optimized omnichannel payments strategy is for merchants to sign up for a merchant account with a payment processor that provides payment methods that match their business needs, and the ability to integrate with other key tools like your POS system, accounting software, and website.

That said, there are many POS software providers that come with built-in payment processing features that offer ready-made tools for all of a merchant’s selling platforms, often including social media and ecommerce. Most independent payment processors are also equipped with POS integration tools that allow merchants to collect payments in person, online, and over the phone.

Choosing from a long list of options can be a challenge, however, a truly omnichannel payment processing solution should have the following features:

Easy Integration

The goal of integrations is to provide simplicity. So omnichannel payment service providers should only require you a single integration for your payment processing needs. You should not be asked to deal with a third-party software to complete your omnichannel payment setup or to get support.

Enhanced Payment Security

Sharing payment information across multiple channels can carry a significant fraud risk. The right omnichannel payment service should be able to meet the Payment Card Industry Data Security Standard (PCI DSS) requirement for proper customer data and sensitive information data handling. This includes layers of encryption and authentication as well as established security policies.

Efficient Data Management

A centralized source of customer and payment information eliminates discrepancies in business reporting. Sales and inventory data across all channels are synced and updated in real time, accessible from a single platform. You only need to log in once to be able to access reports or update pricing. Customer profiles are shared so they can qualify for discounts and promotions regardless of which platform they use for checkout.

Cost-efficient

An omnichannel payment strategy promotes operational efficiency, reducing the cost of managing business systems to a single platform. Be wary of omnichannel payment processors that will charge you multiple monthly fees to give you access to all your payment platforms as this likely means they need a third-party integration to support your requirements.

Improved Customer Service

A truly omnichannel payment processing solution improves customer service. The omnichannel system should allow customers to engage with customer service representatives from their preferred platforms. Employees providing customer support should be able to access customer and transaction information initiated on every platform to quickly fix issues and address concerns.

Flexibility & Room to Grow

Merchants should only need a single integration to have the ability to add their preferred payment channel. Omnichannel payment should also mean better scalability, allowing merchants to upgrade their payment channels and keep up with new technology or replace their payment channels to adapt to customers changing shopping behaviors.

Related reading:

- Learn the role of payment gateways for small businesses

- How to accept credit cards as a small business

- Our guide to accepting credit card payments online

- Our list of omnichannel statistics for retailers

Frequently Asked Questions (FAQs)

Click through the sections below for the most common questions we get about omnichannel payments.

Yes. Generally, any small, local business looking to expand their sales and customer base in-person and online should consider omnichannel payments. Most payment processors and even POS software providers support this type of integration.

If you’re already working with a payment processor that supports omnichannel payments, your concern should likely be an upgrade of your monthly account fee (around $20–$50/month depending on your payment processor). Businesses on a budget should watch out for any additional monthly cost that payment processors may impose if your setup requires third party integrations.

Omnichannel shopping is a consumer behavior where customers engage multiple platforms of the same merchant to complete their buying journey. For example, customers may add products to their cart on the merchant’s website but elect to pay in-store and pick up their purchase in person.

Bottom Line

These days, consumers look for convenience and personalization when choosing a place to shop. So it comes as no surprise that customers become loyal to businesses that allow them to seamlessly switch platforms to complete their shopping.

However, an omnichannel payments strategy requires efficient and secure data sharing to create a truly connected customer experience. Merchants should, therefore, carefully evaluate the cost-effectiveness of setting up an omnichannel payments processing before making an investment.