An OTB plan helps you have the right product quantities at the right time to maximize sales and minimize over-buying.

Open-to-Buy (OTB) Planning Guide for Independent Retailers

This article is part of a larger series on Retail Management.

Key Takeaways:

- Open to Buy (OTB) is a formula retailers use to determine how much to spend on inventory.

- OTB prevents over-buying and helps manage cash flow.

- Use OTB in conjunction with other metrics like demand and sales forecasts and inventory turnover for a complete picture.

What Is Open to Buy?

Open-to-buy (OTB) is an inventory planning strategy and formula retailers use to create buying budgets for specific periods of time.

It takes into account expected beginning-of-month and end-of-month inventory, planned sales, and planned markdowns. Basically, an open-to-buy budget tells retailers how much they can spend on inventory at a future date, whether it be the holiday season or the month of May.

With open-to-buy planning, retailers can forecast and spend proportionately to sales, meet demands for popular products, and prepare for seasonal surges. Open-to-buy planning reduces excessive spending and minimizes waste by helping retailers keep track of on-hand inventory compared to what is needed.

When to Use Open-to-Buy Planning

Open-to-buy planning can benefit any retailer wanting to buy with precision and reduce stockouts and deadstock.

Specifically, OTB can be helpful:

- For handling seasonality: Use historical data to stock enough inventory for peak seasons while also avoiding over-purchasing for slower seasons.

- If you have many SKUs: While any retailer can use an OTB plan, it’s most common for apparel stores and fashion boutiques that handle a large number of stock-keeping units (SKUs) and categories.

- To keep up with rapid growth: If you have specific growth targets, an OTB plan can help you purchase enough inventory to meet those goals.

- For testing new product lines: An OTB budget tells you how much you have to spend on new inventory, so you can test new products without guilt about detracting from other sales.

- Before a large buying event: If you’re attending a tradeshow, brand launch, or other buying event, running an OTB calculation ahead of time can give you a realistic budget to prevent overspending.

- If your suppliers have long lead times: An OTB plan can tell you your current cash flow and whether or not you can supplement your inventory while waiting for shipments with long lead times.

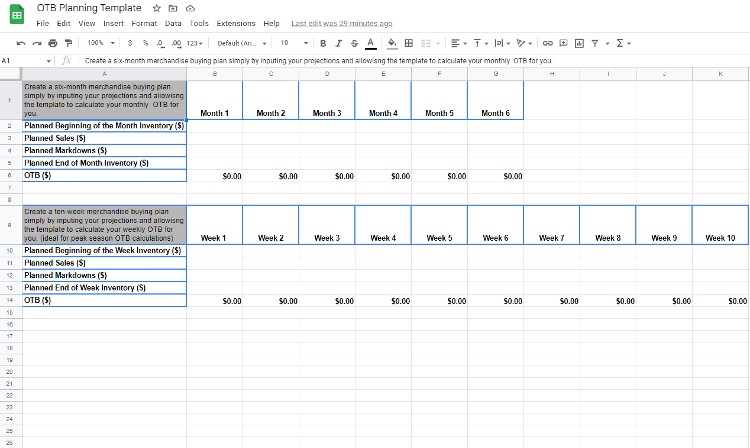

Free Open-to-Buy Template

Use our free open-to-buy template below to make six-month or 10-week purchasing plans that will keep your business on track.

Open-to-Buy Formula & Calculator

Like any effective budgeting tool, the OTB formula helps companies make reasonable predictions based on past performance while considering circumstances that might alter those expectations in the future. The formula creates a framework for best practices and helps you detect month-over-month changes in sales volume. Use the calculator below for your OTB budget:

You can also calculate it by hand using this formula:

Open to Buy = planned sales + planned markdowns + planned end-of-month inventory – beginning-of-month inventory

- Planned sales: The dollar amount of sales projected within a time period

- Planned markdowns: The total amount of discounts planned during the sales period in dollars

- Planned end-of-month inventory: The dollar value of the inventory that is projected to remain at the end of the month*

- Beginning-of-month inventory: The dollar value of the available inventory for sale at the beginning of the month

*Note that planned end-of-month inventory carries over to the next month as the new beginning-of-month inventory.

Although the formula is generally expressed in months, you can use it to calculate open-to-buy purchases for a longer period, as in our example below.

Say, you want to create an open-to-buy plan for the holiday season (November to January) at your clothing store. You anticipate heading into the season with $7,000 of inventory.

Last year you made $78,000 in sales during this time. This year, however, your customer base has grown and your business is making slightly more, so you anticipate making closer to $90,000.

Additionally, you plan to mark down summer items valued at $3,000 by 20% ($600), and you anticipate having about $5,000 of inventory in stock once the holiday period is complete. With all this, your OTB calculation would be:

Open to Buy = planned sales + planned markdowns + planned end-of-month inventory – beginning-of-month inventory

Open to Buy = $90,000 + $600 + $5,000 – $7,000

Open to Buy = $88,600

Based on your predictions, you should spend $88,600 on inventory for the holiday season to ensure you have enough items in stock but are not overspending and ending up with waste or sacrificing your bottom line.

You can make your open-to-buy plan as granular or as macro as makes sense for your needs. Simply apply the same formula to a single product to make predictions on a per-product basis.

Open-to-Buy Planning & Inventory Turnover Rate

Open-to-buy budgets measure multiple factors, but one of the most important things they gauge is your inventory turnover ratio. Identifying this number helps the architects of OTB plans understand the level of demand for each item in their inventory and how much of their OTB budget to allocate for each product sold.

Because products sell at different rates, most companies set individual turnover rates for each product category or individual item, which allows for a more accurate calculation of how much product you need for each SKU.

How to Create an Open-to-Buy Plan

Ready to create an OTB plan for your store? To create an accurate OTB plan, you’ll need to start with creating a sales plan. You’ll also need to check in on your inventory control process and fill in any gaps. Finally, you’ll want to think through any planned markdowns. Then, you can use all of this data to create your strategic inventory buying plan.

Step 1: Create a Sales Plan

While larger businesses and corporations make longer-term open-to-buy plans (quarterly, semi-annually, etc.), those running smaller operations with tighter budgets should use shorter-term plans.

For businesses that see large seasonal spikes, create open-to-buy plans for each week. This will ensure you stay on top of seasonal flows and also help your buyers understand which products need to be ordered at higher volumes more frequently during busy periods.

Below is a sample open-to-buy plan for how a small video game retailer might handle the holidays:

November | December | |

|---|---|---|

Planned Beginning of Month Inventory | $40,000 | $30,000 |

Planned Sales | $20,000 | $15,000 |

Planned Markdowns | $500 | $300 |

End of Month Inventory | $30,000 | $20,000 |

Planned Open To Buy Budget | $10,500 | $5,300 |

A longer-term open-to-buy plan for a family-owned art supply store might look like this:

January | February | March | April | May | June | |

|---|---|---|---|---|---|---|

Planned Beginning of Month Inventory | $35,000 | $25,000 | $20,000 | $18,000 | $28,000 | $22,000 |

Planned Sales | $30,000 | $35,000 | $19,000 | $27,000 | $40,000 | $25,000 |

Planned Markdowns | $800 | $400 | $250 | $450 | $100 | $500 |

End of Month Inventory | $25,000 | $20,000 | $18,000 | $28,000 | $22,000 | $30,000 |

Planned Open to Buy Budget | $20,800 | $30,400 | $17,250 | $37,450 | $34,100 | $33,500 |

No matter what kind of open-to-buy plan your business uses, it’s crucial for purchasers to review all forecasted amounts to make sure they are practical. While it’s important to look at current data and purchasing habits, it’s also beneficial to look at past sales figures to make estimates.

Step 2: Have a Solid Inventory Control Process

Once you have your sales plan, make sure your inventory management system is up to snuff. Have solid processes in place from ordering and receiving through post-sale to make sure every item is tracked accurately.

Two things to spot for are:

- Inventory shrink: Are you losing out on sales or revenue because of shrink? This could contribute to overbuying if left unchecked.

- Inventory turnover: As we mentioned earlier, knowing how fast you sell-through, or “turn” your inventory, will help you get a better understanding of how often you need to repurchase stock.

Step 3: Implement Planned Markdowns & Sales

Stick to your sales plan by implementing markdowns, promos, and end-of-season sales to help sell through merchandise and open up cash flow for your OTB plan.

If you’re struggling to move products, consider:

- Promotion ideas to attract customers

- Retail marketing strategies to drive sales

- Retail marketing calendar template for planning ahead

Step 4: Buy Strategically

One of the biggest challenges in modern retailing (at least in terms of inventory planning) is buying well enough in advance to combat supply chain and shipping disruptions, while also being nimble enough to capitalize on the lightning-fast trend cycle. Use our OTB plan to get the best of both worlds by purchasing seasonal staples six to nine months in advance while also monitoring trends week-to-week.

Step 5: Track Results, Monitor Trends & Adjust Accordingly

Unfortunately, OTB plans aren’t a set-it-and-forget-it strategy. As we mentioned earlier, spending on your niche, you may need to evaluate on a weekly basis to maximize growth and prevent overbuying.

Regularly examine your inventory and buying at a category, seasonal, and price-point level to identify opportunities for improvement.

Pros & Cons of Open-to-Buy Planning

Open-to-buy planning is an inventory management process used widely across the retail industry for a reason—it’s an effective way to make predictions about the future of your store and how you should allocate funds. The OTB predictive strategy, however, does have its drawbacks and you should be aware of them before you apply OTB planning to your business. Let’s take a look at its pros and cons:

Open to Buy Pros

- Flexible, reactive planning structure: Most businesses have weekly or monthly open-to-buy plans. This allows you to make adjustments as conditions change and update your budgeting plan without being locked into an annual or quarterly plan.

- Keep the right amount of stock on hand: When done well, open-to-buy planning allows you to anticipate how much stock you should have on hand based on your anticipated sales. This means you will be able to avoid stockouts, excess stock, or aging inventory and keep your customers happy.

- Detect patterns and trends: Because open-to-buy planning looks at specific periods of time and uses past sales data to make predictions, you can detect seasonal trends and patterns that will help you make even better decisions for your business.

- Avoid overspending: Open-to-buy planning splits up your spending into time periods, telling you what money is appropriate to spend and when. This means that you can avoid overspending—only buying in accordance with your budget. In turn, this ensures that you have adequate funds for future purchases.

- Smart cash flow allocation: With open-to-buy planning, you can see just how much money you can reasonably spend on inventory alone. This helps you remain cash flow positive, ensuring that your budget will have room for other things, like marketing or overhead costs.

Open to Buy Cons

- Need to supplement with other data: While your open-to-buy will set you on the right track, it will not give you the full picture of your business or inventory. To make truly data-driven budgets, you also need to consider other metrics, like your sales forecast, inventory turnover rate, and margins and markups.

- Not good for store staples: For products that are permanent staples in your store, open-to-buy planning is likely not the best way to make buying budgets. Open-to-buy planning says that you should buy $X of the item at a certain time, however, there are instances when it is better to wait until there is a shipping or volume discount to buy in greater bulk—but your open-to-buy plan won’t help you determine this.

- Best suited for companies with lots of SKUs: For companies with a few SKUs, open-to-buy planning might be more work than it is worth. If you don’t have many products, you can often make buying predictions simply by viewing past inventory and sales data.

- Little wiggle room: While your open-to-buy plan will give you a hard and fast number to use to make budgeting decisions, it does not leave room for error. In general, you will want to shave a few dollars off of your open-to-buy prediction in case an unexpected situation arises.

Frequently Asked Questions (FAQs)

The formula is:

Open to Buy = planned sales + planned markdowns + planned end of month inventory – beginning of month inventory

Often the default timeframe for an OTB plan is six months—this allows enough time to account for seasonal purchases and long supplier lead times. If you’re working directly with manufacturers, they often require a six-month lead time.

And, having a six-month budget plan means you only need to do this exercise twice per year. It allows you to divide budgets into Spring/Summer and Fall/Winter collections.

However, depending on your industry, sales volume, supplier lead times, and personal preferences, you can run an OTB plan as often as weekly.

No. There is a lot of guesstimating involved because you have to predict your sales and performance. Of course, the more accurate your planning the better. But, you can always adjust your plan as you go.

A 5% deviation is generally considered excellent in OTB planning.

If you’re operating on a rolling six-month OTB plan, next month’s budget will have been planned 5 months ago. Of course, you have to start somewhere.

At the time of publication, it’s October. Ideally, our October plan would have been set back in June. If we start now, we can plan for all of the following year, with a January-June and July-December plan.

Ideally, your point-of-sale system. Having a central place where your product and sales data are stored makes the OTB process infinitely easier.

Bottom Line

Considering the changing retail landscape, it’s more important than ever to create accurate forecasts and tight budgets to stay afloat. With historic numbers of retailers closing every day, keeping your store stocked with the items your customers need the most will go a long way as global supply chains become less reliable. In the end, open-to-buy planning is an essential tool in your arsenal.