Payroll automation uses advanced technology—particularly through software—to streamline and simplify the complex process of managing employee pay. It can reduce errors and save time and resources for your small business by calculating wages, taxes, benefits, and deductions automatically.

Key Takeaways

- Saves time and money by streamlining the payroll process

- Payroll automation software keeps businesses compliant

- Reduces the chance of human error

Types of Payroll Automation Software

Payroll automation software helps small businesses by handling complex functions automatically and allowing you to manage other daily tasks. We’ve broken it down into the different types of payroll automation software below. Plus, check out our guides to find providers that might work best for your small business.

Cloud-based Payroll Software

Online (or cloud-based) payroll automation software will allow you to automate tax calculations, set up direct deposit, and usually offer employee self-service portals. This type of payroll software usually starts at around $5 per employee monthly, with a $40 base fee.

When choosing the best payroll software for your small business, it is important to look for features like unlimited and automatic pay runs, PTO tracking, automated tax filings, year-end reporting, and the ability to pay W2 employees as well as contractors.

Cloud-based payroll software, like Gusto, makes it easy to automate payroll. (Source: Gusto)

Gusto provides robust payroll services, and can help streamline your payroll processing. Learn more about it in our Gusto Review—or check out our best payroll software for small businesses guide for our other top picks for payroll automation.

Human Resources (HR) Software

Most payroll processing services can be found within human resources (HR) software. However, with HR software, you get much more than just basic payroll processing—it includes hiring, onboarding, benefits, performance management, and more. This type of software typically charges a base fee (around $40 per month) and a per-employee fee (around $6 per employee monthly).

HR software is perfect for smaller companies that do not have a dedicated human resources department, or only have one individual who handles all HR functions. The software can streamline most basic HR processes, from onboarding new employees to tracking hours worked and paying employees on time.

Rippling combines payroll and HR functions by syncing hours worked, benefits, and taxes into one system. (Source: Rippling)

The best HR software for small businesses are all-in-one systems, which include payroll automation and help in handling daily HR functions. Our top pick, Rippling, provides end-to-end HR services to help make managing your employees, as well as their pay, much easier. Learn more about it in our Rippling Review.

Time and Attendance Tracking Software

When you use time and attendance tracking software, you eliminate the need for manual timesheets. This allows for accurate calculation of employee hours worked and streamlines the payroll process. Many popular time and attendance tracking software are free for basic use; however, adding payroll may come with a monthly fee.

Time and attendance tracking software is designed to track the hours worked of your employees and move that information into a payroll system for processing of employee time. Using software to track time eliminates the potential for errors, making your payroll more accurate. This software will allow you to track hourly employees, salaried employees, part-time and full-time hours, paid time off, sick time, and more.

Homebase allows your employees to easily track their time, and your HR rep to run payroll with a click of a button. (Source: Homebase)

For the best time and attendance software that can track actual hours worked, overtime, absences, and leave balances, while also keeping you in compliance with labor laws, check out our guide. Our top pick, Homebase, offers easy scheduling and time tracking to make managing your pay runs quick and efficient. Besides that, it offers a free plan for business with one location with a max of 20 employees. Learn more in our Homebase review.

PEO Software

A professional employer organization (PEO) is a service that handles all payroll, benefits, and employee management for you. They act as the employer of record, and in turn, are able to offer large company benefits and cost-savings to small businesses. Because this software is all-inclusive, it is a bit pricey (around $60 per employee per month) and may include features your business does not need.

With a PEO, you are added to their software and have access to automatically calculate and run payroll, pay workers, run reports, and export payroll costs to your company ledger.

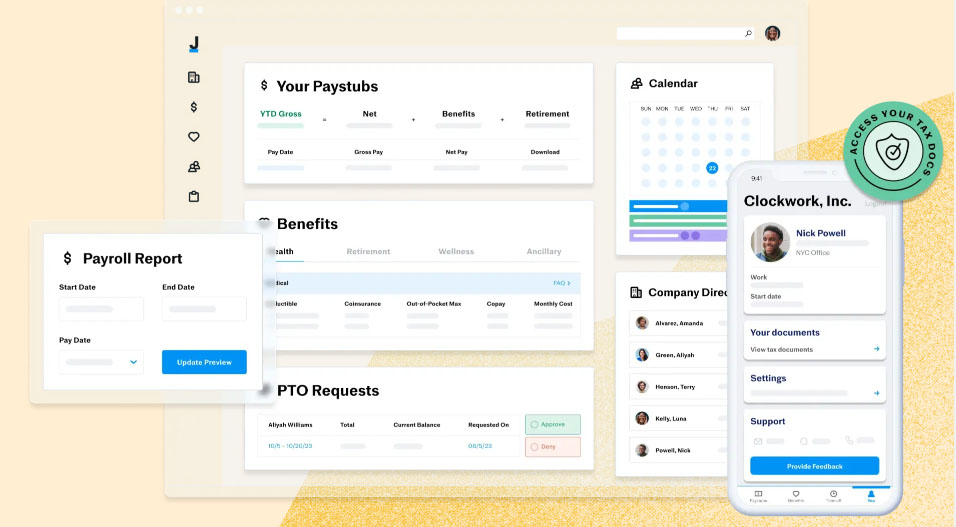

Justworks PEO allows you to process payroll, update benefits, and manage PTO through their online dashboard and easily via mobile devices. (Source: Justworks)

If you are thinking about hiring a PEO, try Justworks. Besides affordability, it offers robust payroll services that would take the stress of managing it off your plate. Learn more about it in our Justworks review—or check out our best PEO companies guide for an in-depth look at the top PEO companies.

Benefits of Payroll Automation

- Saves time

- Reduces costs

- Minimizes risk

- Improves employee satisfaction

- Includes detailed reports and analytics

- Streamlines administrative tasks

- Increases accuracy

- Offers compliance

Payroll automation offers numerous benefits to small businesses, ranging from time and cost savings to increased accuracy and compliance. By automating your payroll, you significantly reduce the time spent on manual data entry and calculations, thus allowing your HR team to focus on more strategic initiatives. Additionally, an automated payroll system can minimize the risk of human errors, ensuring that employees are accurately compensated and taxes are correctly withheld.

Another benefit of payroll automation is the ability to improve employee satisfaction by providing timely and error-free payments. Employees no longer need to worry about discrepancies in their paychecks or delays in receiving their pay, which can ultimately lead to improved morale and productivity. Detailed reporting and analytics will allow you to gain valuable insight into labor costs and make informed decisions about resource allocation and budget planning.

Implementing Payroll Automation

The first step in properly implementing payroll automation is to find the right software that can integrate with your existing HR and finance systems. Once you’ve settled on the right software, you will need to migrate your payroll data, train your employees, and test the software prior to going live.

- Data Migration: Integrate all payroll information into the new payroll software. This includes all employee data, tax information, and salary and payroll information.

- Training: Payroll automation should include advanced training in the software’s use, including educating employees on how to input their time sheets accurately.

- Testing: We recommend testing the software before completely abandoning your current payroll method. This includes ensuring that employees are paid correctly, taxes are calculated accurately, and benefits are allocated.

Pro Tip: Some payroll providers offer migration and training support for new clients, which can assist you with payroll automation implementation. Check out our Best Payroll Services providers for more information.

Payroll Automation Compliance

When you handle all payroll processes yourself, you must ensure you remain compliant in all areas—wages, tax laws, overtime regulations, and more. Using payroll automation software means built-in compliance. These features allow you to reduce the risk of non-compliance penalties.

Tax Laws

Payroll automation software has the capability to adapt to new tax laws, helping you stay compliant while streamlining administrative processes. This means the software can navigate complex tax codes without you having to manually update the system.

It calculates and pays taxes for you, making sure the correct rates are applied no matter where the employee is located. Additionally, it can generate detailed reports that help you demonstrate compliance with specific tax regulations.

Labor Regulations

With constantly changing labor regulations, using payroll automation software keeps you compliant with legal requirements on employee wages and benefits. This is especially helpful if you pay employees in multiple states, as it ensures you are paying the required minimum and overtime wages and that your benefits comply with state and federal laws.

Not sure if you’re compliant? Learn more about payroll compliance and how it can help you navigate state and federal labor laws.

Bottom Line

Automating anything makes life easier, but when you automate payroll it makes paying your employees easy while remaining compliant. It reduces the time spent calculating employee hours, time off, and taxes. By streamlining the payroll process and reducing manual errors, you save time and money and ensure employees are paid accurately.