PayPal is one of the first and most trusted names in online payment solutions, offering PayPal Business for ecommerce and PayPal Zettle POS software for in-store sales. Small business owners love PayPal’s easy setup, convenient payment methods, and recognizable brand that’s proven to increase conversions. PayPal often makes our list of best merchant services and leading mobile payment solutions.

We generally recommend PayPal as a good payment processor for small businesses, but its range of payment services may not be ideal for all. Consider the following pros and cons of PayPal for small businesses before signing up.

Key Takeaways:

- PayPal Business is ideal for small merchants that accept payments online.

- PayPal Zettle allows merchants to offer PayPal payment methods to in-store customers.

- PayPal offers exclusive payment methods such as Pay Later, Pay with Rewards, and Venmo.

- Payment processing fees are competitive but confusing, with so many rates for different payment methods.

- Ease of use is one of PayPal’s major advantages, and it’s even easier to set up.

PayPal Business Overview

| PROS | CONS |

|---|---|

| Wide range of payment solutions | Reports of frozen accounts and funds |

| Over 26 currencies plus cryptocurrencies | Complex pricing structure |

| Strong invoicing features | Not compatible with high-risk merchants |

| Instant fund access via PayPal Balance | Popular target for phishing and scams |

| Merchant & customer financing options | Poor and hard-to-reach customer service |

Learn about PayPal’s detailed pricing and features for online payment processing with our PayPal Business review.

Pros of PayPal Business

Extensive Suite of Payment Solutions

For a long time, PayPal’s payment solutions were focused on online personal and business customers. However, the company has expanded its features to offer on-site and on-the-go payment services as well. This puts PayPal in a great position to work with small businesses that are native to the online world but are looking to expand into brick-and-mortar stores and vice versa.

Small online businesses can use PayPal Checkout to offer a variety of payment methods. It gives customers the freedom to pay however they want, whether with credit or debit cards and even funds from their bank. PayPal Checkout uses intuitive Smart Payment ButtonsTM, so it always presents the payment methods that are most relevant to each customer.

PayPal is recognized as one of the strongest pioneers of peer-to-peer and merchant online payment processing and has, since then, developed a wide range of exclusive PayPal checkout methods for its 435 million users. (Source: PayPal)

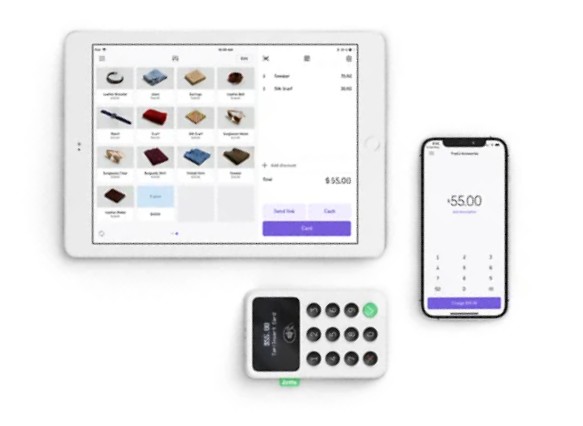

Brick-and-mortar shops can now manage their in-store transactions with PayPal’s mobile app and card reader. Businesses can accept chip or magstripe credit cards, debit cards, and even contactless payments with the same security feature they offer to online customers. PayPal also has Zettle as its point-of-sale (POS) software, and it includes POS equipment like lockable tablets, receipt printers, card reader docks, and even cash drawers.

PayPal’s expansion to in-person payment processing created opportunities for merchants with a storefront to offer the same convenient PayPal checkout options. It supports both card-present and contactless payment methods for customers who feel more secure making purchases through PayPal. (Source: PayPal)

Works With Multiple Currencies, Including Crypto

PayPal’s ability to make cross-border payments is among the reasons it has become one of the most popular online payment processing providers today. It supports 24 countries across the globe, allowing account holders to transact and convert their PayPal balance to any of these currencies for an additional 1.5% transaction fee.

Another unique service of PayPal is its cryptocurrency management features. It supports its own cryptocurrency wallet and provides conversion to fiat currency at no extra cost. This allows account holders to use their cryptocurrency balance to make payments through PayPal. As long as customers have a PayPal cryptocurrency wallet, merchants with or without a cryptocurrency account can offer checkout with crypto without any add-on transaction cost.

Strong Invoicing Features

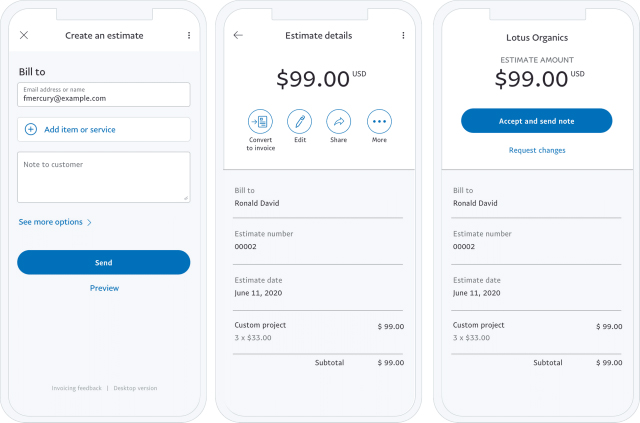

PayPal offers strong invoicing features for businesses that accept payments after billing their customers. There’s no extra monthly and setup cost, and PayPal is pre-loaded with small business tools for easy billing management—including accepting ACH and e-check payments.

PayPal invoicing includes tools for accepting one-time and recurring transactions. Subscription-based retailers get tools for creating and customizing invoice templates and setting up recurring billing subscription options that are automatically delivered and include payment reminders. For service-type businesses, PayPal lets you create customized quotes or estimates, make adjustments based on customer requests, and convert the same estimates into invoices once approved.

The PayPal for Business app allows you to create and send invoices from your mobile device. (Source: PayPal)

Instant Deposits to Your PayPal Account

For a small business, having quick access to funds helps continue its operations. What PayPal brings to the table is immediate access to your sales proceeds in the form of PayPal balance. And, because PayPal is a widely accepted payment method, you can use your balance to pay your vendors and contractors.

Also, if you sign up for a PayPal Debit Mastercard, you can immediately spend or withdraw your funds anywhere that accepts Mastercard and earn 1% cash back rewards for every eligible purchase. There’s no annual fee and no credit checks, and the card will be sent to you one or two days after your request.

Diverse Financing Options

PayPal offers loans to its business clients to ensure they always have access to cash needed to expand their operations. Aside from this, PayPal also gives its clients’ customers a credit line they can use to “buy now and pay later.” That option alone makes businesses more attractive and helps drive more sales.

There are two different types of loans available for business clients:

- PayPal Business Loan: Offers small business owners loans from $5,000 to $500,000 and is best suited for companies that are at least nine months in operation with at least $42,000 in annual revenue.

- PayPal Working Capital: Provides business loans from $1,000 to $125,000 and is best suited for customers with PayPal accounts that have been active for at least 90 days and have processed at least $15,000 in PayPal transactions within the last 12 months.

PayPal Business Loans are fixed-term debts and considered based on a full picture of your business. You can receive funds as fast as the next business day after you request them. PayPal requires you to make fixed payments on the loan and will deduct funds directly from your business bank account on a weekly basis.

Meanwhile, PayPal Working Capital is a loan you can apply for based on your PayPal account history, and it only takes minutes to complete the application, approval, and funding process. PayPal automatically debits fixed repayment amounts through a share of your PayPal sales.

Another advantage of PayPal is the way business owners can offer credit to their customers as long as they have an eligible PayPal payment solution integrated into their website. It also assists in making sure customers know this option is available for them early in their buying journey.

There are no extra steps to start offering PayPal Credit. It is automatically available as a payment option at checkout for your customers who have been approved for this payment service. (Source: PayPal)

Buy Now Pay Later is another PayPal customer financing payment option. By partnering with a long list of retail brands, merchants can provide customers with the option to pay for their purchases in four interest-free installments while merchants get the proceeds of their sale upfront. This payment method is compatible with popular ecommerce platforms, and setup at checkout is easy.

PayPal’s Q2 Quarterly Earnings report for 2021 noted a 39% increase in buyer’s cart sizes when using the buy now pay later checkout option. (Source: PayPal)

Cons of PayPal Business

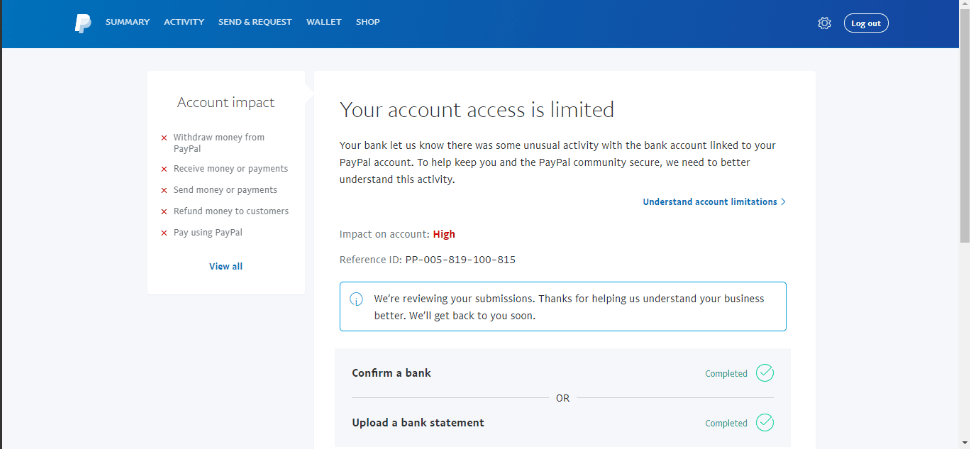

Potential for Frozen or Delayed Funds

Regardless of who’s at fault, any dispute raised by either the buyer or seller can result in PayPal limiting the merchant’s account. Accounts may be frozen, and refunds or returns may be delayed until the issue is resolved. To avoid this hassle, small businesses should maintain constant communication with their customers. This will ensure that customers feel more comfortable reaching out to the seller directly to solve misunderstandings instead of going straight to PayPal to file a complaint.

Verifying your account and being aware of account hacking strategies are just a couple of ways to prevent your PayPal account from being limited and your balance from being withheld. (Source: PayPal)

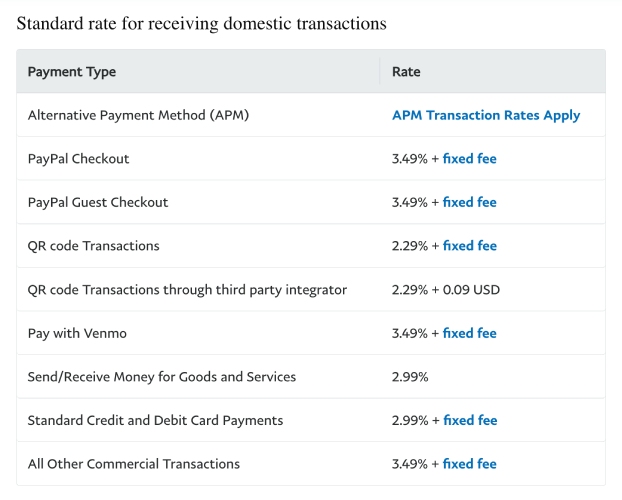

Complex Transaction Fees

PayPal’s transaction fees are widely varied, and rates differ per use case. For example, under PayPal’s commercial transaction category, rates range from 1.90% + 10 cents to 3.49% + 49 cents per transaction. Another category for online card payment services charges anywhere from 2.59% + 49 cents to 3.49% + 49 cents per transaction. There’s also a different set of rates when using PayPal Zettle and for accepting international payments.

Below is a list of PayPal’s current merchant fees:

PayPal US Merchant Fees

Incompatible With High-risk Businesses

As an aggregate payment processor, PayPal is incompatible with high-risk businesses of any kind. Likewise, PayPal Zettle does not support age verification tools, making it incompatible for businesses selling age-restricted products. It also has limited integration features, meaning you can’t really upgrade or expand Zettle’s features.

If you need an online payment processor that’s compatible with high-risk businesses, consider Payment Cloud. It supports medium- and high-risk merchant accounts, and unlike PayPal, it is highly praised for its customer support and has only a few complaints of frozen funds. For a POS system that’s compatible with high-risk businesses such as CBD retailers, consider KORONA POS.

Popular Target for Phishing & Other Scams

Of the many pros and cons of PayPal in our list, this is what concerns potential customers the most. PayPal consistently ranks among the most popular targets for phishing scams. According to a cybersecurity report by VadeSecure, PayPal hit its peak in 2019, recording a phishing increase of 111.9% year over year.

And while there’s been recent improvements, PayPal is still ranked seven on the most favorite websites to hack in 2023. The sensitive information inherent to a PayPal account makes it attractive to phishers.

PayPal has installed the most updated security measures in place; however, business account owners will need to know how to identify the latest and most common scam strategies. More information about this is available and always updated on the PayPal website.

Customer Service Needs Improvement

Small business owners will find that the majority of negative feedback about PayPal is connected to its quality of customer service. Complaints vary from lack of support for fraudulent transactions to slow response times when resolving disputes. While PayPal’s customer service is available via phone, email, and social media platforms, users still report unresolved issues that directly relate to poor customer service.

As of this writing, PayPal reviews sank even lower, receiving a score of 1.3 out of 5 from around 4,500 PayPal account holders rating their experience of PayPal’s customer service. Majority of complaints revolved around the poor service they received while asking for assistance over fund freezes and account holds.

PayPal Zettle Overview

| PROS | CONS |

|---|---|

| Mobile-friendly | No add-on features available |

| Multichannel sales tools | Lacks offline payment processing |

| Free POS | Limited inventory features |

Find out PayPal’s detailed pricing and features for in-person payment processing with our in-depth PayPal Zettle review.

Pros of PayPal Zettle

Mobile-friendly Payment Solutions

PayPal offers mobile-friendly payment solutions for small businesses looking to increase their conversion rates on mobile devices. Whether the business has its own store app or a mobile-first/mobile-optimized website, customers can log in to their secure PayPal account to make payments without having to leave the seller’s website. This added security puts customers’ minds at ease so that they can complete their purchases.

More and more customers are exploring online stores using their smartphones. While mobile sales have seen a huge leap in its share of all ecommerce sales, stores experienced almost 77% cart abandonment rate from a mobile device standpoint in the first quarter of 2024. Customers cite poor user experience (such as difficulty locating checkout buttons) as the top reason for leaving their carts. PayPal’s POS app is optimized for mobile so customers can shop effortlessly in any online store.

Link your PayPal Zettle card reader to any mobile device to start accepting payments anywhere with an internet connection. (Source: PayPal)

Includes Multichannel Sales Features

If you are an online business owner who wants to participate in occasional in-person sales, such as trade shows, fairs, and farmers’ markets, PayPal’s POS (PayPal Zettle) and competitive processing rates are a viable option. It provides you with inventory tracking, basic restaurant tools, and clock-in/out features to ensure that your sales run smoothly. The mobile app comes with a complete register that lets you ring up sales and manage your inventory.

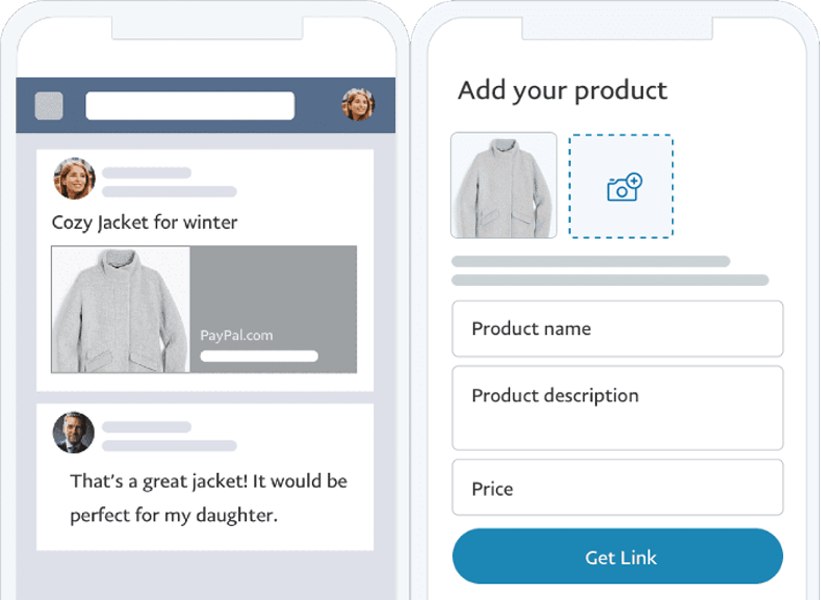

Want to sell on social media? PayPal’s commerce platform can host your listings, so you can sell online even without a website. PayPal provides you with tools to create listings that generate links you can share on Facebook and Instagram and via email, text, and chats. All you need to do is connect the PayPal Commerce Platform to your social media, and your customers can start making purchases securely.

Add your product details, including shipping and tax rates, from the “Sell on Social Dashboard” page, then click the create button to produce a payment link. (Source: PayPal)

Free POS

PayPal now offers Zettle as its POS software, along with mobile card readers to help users start accepting payments in-store and on the go. There’s no monthly subscription fee or setup cost to use this product, and PayPal offers competitive transaction fees against most flat-rate payment processor alternatives like Square.

Below is PayPal Zettle’s pricing:

Transaction Types | Rates |

|---|---|

Card-present transactions | 2.29% + 9 cents |

Keyed-in transactions | 3.49% + 9 cents |

QR code | 2.29% + 9 cents |

PayPal Zettle allows you to accept credit card, gift card, PayPal, and Venmo payments. And, while inventory management is basic, you can easily create variants, sell by specific units, upload and delete products in bulk, and set up low-stock alerts. It also lets you generate QR codes that your customers can scan and use to pay for their purchases.

Cons of PayPal Zettle

Lacks Compatible Business Integration

PayPal is an online payment processor first. Its point-of-sale (POS) service is meant to support business account holders who wish to process transactions through PayPal.

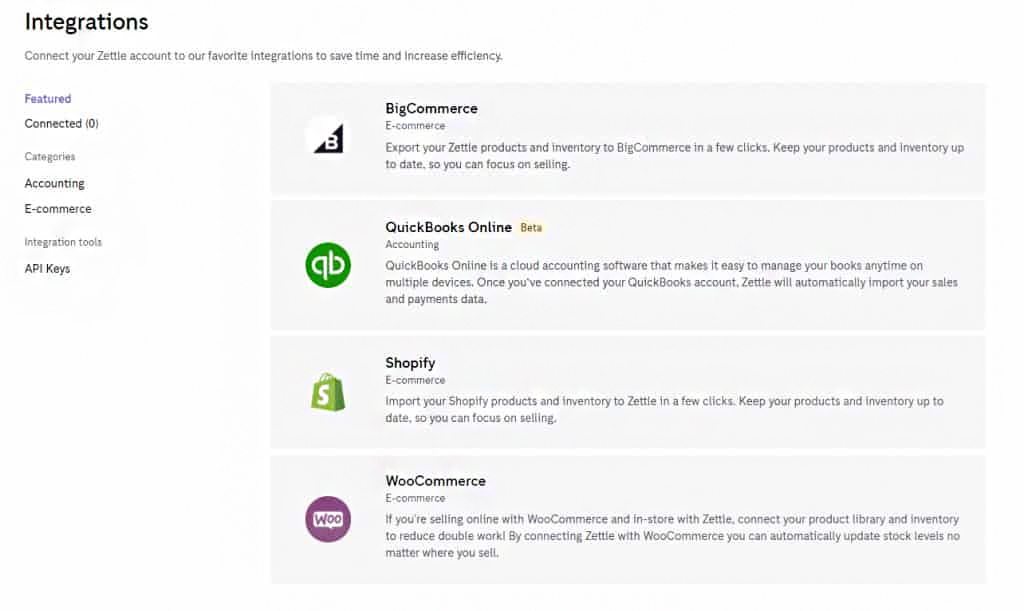

Unfortunately, one of the disadvantages of PayPal Zettle is that it does not come with any available add-on POS features, nor does it have a range of compatible POS integrations. This makes it difficult for merchants with fast-growing companies that require other back-office tools such as shipping and vendor and employee management.

PayPal Zettle only has four integrations and, unlike Square, does not support any add-on tools for streamlining your point-of-sale processes. (Source: PayPal)

No Offline Payment Processing

For a mobile POS, it’s crucial to be able to continue accepting payments even when the internet connection is interrupted. Unfortunately, while its mobile card reader is more feature-rich than most of its competitors, PayPal Zettle does not support offline payments. You will have to depend on your data or Wi-Fi when accepting on-the-go payments.

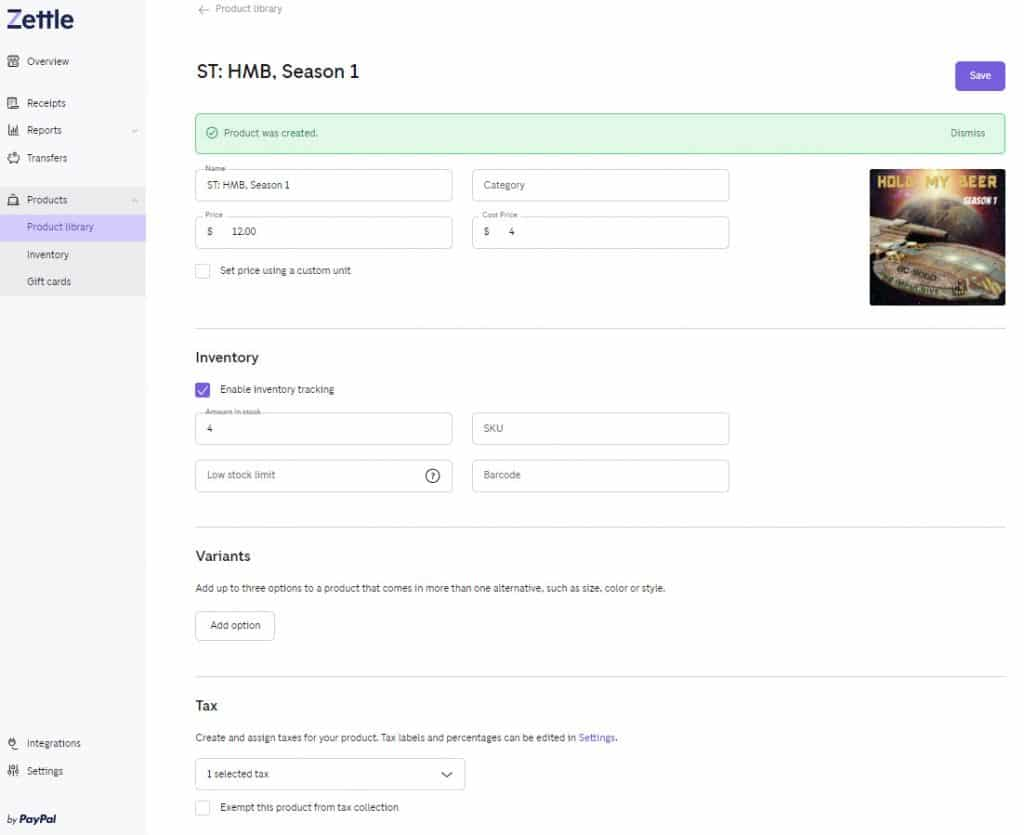

Limited Inventory Features

Inventory management tools in PayPal Zettle are limited and ideal only if you don’t have a large volume of products. You can perform bulk actions—such as uploading, updating, and deleting product listings, and even tracking your inventory level to set a low-stock alert. However, you can only add up to three variant options, and PayPal does not allow you to create kits, build menu items, or manage your vendor list.

PayPal Zettle does not have the features to support inventory kitting, menu building, and vendor management. (Source: PayPal)

Alternatives to PayPal for Small Business

There are many alternatives to PayPal, but did you know that PayPal offers some of the cheapest payment processing fees for small businesses?

However, not all small businesses are the same, so consider other payment processors if you find some of the disadvantages of PayPal a huge dealbreaker for you. Other providers also support most of PayPal’s payment services features:

- Square: Best PayPal alternative for mobile payments

- Stripe: Popular PayPal alternative for accepting online payments

- Shopify: Best non-PayPal option for online stores

- Helcim: Best alternative for cheaper fees and zero-cost processing

- Payoneer: Best PayPal alternative for freelancers

See our full list of recommended PayPal alternatives or visit our most recommended merchant services.

Pros and Cons of PayPal Frequently Asked Questions (FAQs)

Yes. Except for those classified as high-risk, most small businesses can use PayPal. We even recommend PayPal to occasional sellers and hobbyists because it offers a $0 monthly subscription and does not charge for inactivity. PayPal also now has a POS solution for merchants looking to accept payments in-person.

In general, PayPal business accounts are free. Merchants can use PayPal Business (online payment app) to accept payments online and PayPal Zettle (POS and in-person payment app) for free, so you only need to pay the transaction fees. However, some features, such as virtual terminals and recurring invoice management tools, are add-on services that include a separate monthly subscription.

PayPal’s popularity is in its ease of use and free payment app, but Paypal users also like the system because it is easy to set up, does not have an application process (you can start accepting payments in minutes), and lets you immediately access your funds through your PayPal Balance.

PayPal is also widely trusted by consumers, boosting online conversion on any website with a PayPal logo at checkout.

Yes, like any other payment services provider, PayPal carries some disadvantages. While affordable, PayPal’s transaction fees vary widely so merchants may find it complicated to keep track of their payment processing costs. As a payment aggregator, PayPal is also quick to freeze merchant accounts to reduce its own financial risk. PayPal is also widely known for its poor customer support, which makes resolving frozen funds and accounts difficult to manage.

Bottom Line

There are 431 million active PayPal accounts that have made at least one transaction by the end of 2023, which means there’s more potential business for small business owners who use the platform. Knowing the pros and cons of PayPal for small business gives merchants important decision-making information before signing up. And when managed effectively, the benefits of owning a PayPal account can quickly outweigh the disadvantages.