Both Stripe and PayPal are excellent online payment processors. We like Stripe for international sales, B2B businesses, and larger companies. PayPal is great for small businesses, solopreneurs, and as an additional payment method to any website or online store.

They both made our list of the best online payment and credit card processors. Stripe took the top spot with an overall score of 4.33 out of 5, while PayPal received 3.82 out of 5. Both Stripe and PayPal can also accept in-person payments and offer POS terminals and card readers.

What we’re keeping an eye on: PayPal announced new features that will be rolling out throughout 2024. These features include improvements to its online checkout, a redesigned app, and AI-powered tools. We’ll continue to re-evaluate PayPal as these tools roll out as it will likely boost PayPal’s rating.

When to Use an Alternative: Helcim

High-volume businesses might find Helcim a better option with its zero monthly fees, interchange-plus pricing, automatic volume discounts, all-in-one hardware, and an option to accept ACH payments or pass-on credit card fees for bigger savings. Visit Helcim to learn more, or see how it compares below.

Stripe vs PayPal Quick Comparison

Get a Personalized Recommendation

If you’re looking for a more specific solution, both Stripe and PayPal frequently make our lists of the following:

Stripe vs PayPal: Fees

|  | |

|---|---|---|

3.38 out of 5 | 3.06 out of 5 | |

Monthly ecommerce subscription | Varies (third-party) | $0, $25/month for use of payment gateway |

Ecommerce transaction fees | 2.9% + 30 cents | 2.59% + 49 cents to 3.49% + 49 cents |

Virtual terminal transaction fees | 3.4% + 30 cents | 3.09% + 49 cents |

ACH transaction fees

| 0.8%, $5 cap | Echecks: 3.49% + 49 cents, $300 cap; ACH: Upgrade to Braintree |

Invoice fee | 2.9% + 30 cents plus 0.4%–0.5% per invoice, depending on plan | 3.49% + 49 cents plus $10–$30/month for recurring billing/payments |

Chargeback fees | $15 | Chargeback: $20 US (varies by country) Dispute: $15 US (varies by country) |

Special pricing for nonprofits | Custom, discounted | 2.89% + 49 cents |

High-volume discounts | Offers custom rates | None |

International transactions | +1.5% on transaction fee, +1% currency conversion (if needed) | +1.5% on transaction fee, +4% currency conversion (if needed) |

We gave Stripe and PayPal good scores for not having any contract or monthly fees. Stripe has a simpler pricing structure, charging 2.9% + 30 cents for all domestic card and wallet transactions, whereas PayPal has a more complex pricing schedule ranging from 2.29% + 9 cents to 3.49% + 49 cents.

Although Stripe and PayPal earned similar scores for this category, Stripe’s payment processing fees are overall less expensive and easier to understand. It has a more straightforward, less expensive schedule of fees, discounts for high-volume sales and nonprofits, and lower chargeback fees. If you primarily handle online sales, it’s the more economical choice.

PayPal’s fees can be complex and confusing, even if we only consider online payments. Aside from this, PayPal does not accept ACH, but does take echecks—charging you according to payment venue. The echeck fee is at a higher 3.49% + 49 cents with a $300 cap.

Unlike Stripe, PayPal charges $30 per month for virtual terminals and $10 per month for recurring payments. It does offer excellent rates for nonprofits and has the ability to hold and accept cryptocurrencies—and thus, deserves consideration. However, the main reason to choose PayPal as an online payment processor is if you want a recognizable, trusted alternative for your customers. It is the most used online payment service (82%) by customers.

We only evaluated the online payment processing capabilities of PayPal and Stripe for this review. However, if you would like to accept in-person payments, both Stripe and PayPal offer card readers and terminals that can process card payments.

PayPal’s hardware is available through PayPal Zettle, which is a free point-of-sale (POS) software with an integrated PayPal checkout. Stripe’s in-person payment processing capabilities are not out-of-the-box solutions, unlike PayPal’s. With Stripe, you will need to use Stripe’s API to configure the hardware with your POS system or with Stripe Terminal.

Card Readers | |

Stripe Reader M2

|  PayPal Zettle Card Reader 2

|

Smart Terminals | |

Stripe S700

|  PayPal Zettle Terminal

|

Stripe vs PayPal Calculator

Compare Stripe vs PayPal fees. Enter an estimate of your monthly sales data in the calculator below:

Stripe vs PayPal: Payment Types

|  | |

|---|---|---|

4.63 out of 5 | 3.88 out of 5 | |

Payment types | Credit card, debit card, digital wallets, ACH, gift cards | Credit card, debit card, digital wallets, echeck, digital gift cards, crypto, Venmo |

Ecommerce payment tools subscription | Varies (third party) | $0, $25/month for payment gateway |

Virtual terminal | Limited | With $30 monthly fee |

Invoiced payments fee | Included | Included |

Recurring payments and card on file fee | Included | With $10–$30 monthly fee |

ACH and eCheck | Included | eCheck only, no ACH |

International payments | 135+ currencies, 47+ countries | 25+ currencies, 45 countries |

Buy Now, Pay Later | Affirm, Afterpay, Klarna | PayPal Pay Later (Pay in 4, Pay Monthly) |

Tap to Pay on iPhone and Android | ✓ | ✓ |

Ecommerce integrations | 239 | 33 online stores, 18 marketplaces, 17 website design systems, shipping label tools, and many others not mentioned on the website |

Micropayment fee | 5% + 5 cents* | 4.99% + 9 cents or applicable standard transaction rate |

*Must contact Stripe to apply for a custom microtransaction rate.

Both Stripe and PayPal are focused primarily on online payment solutions, but their best features are directed to different user types. PayPal is the better choice for smaller businesses with occasional online sales, such as hobbyists or those that only need an online payment option for some of their customers. Stripe, on the other hand, is suitable for international payments processing, invoicing, and recurring payments.

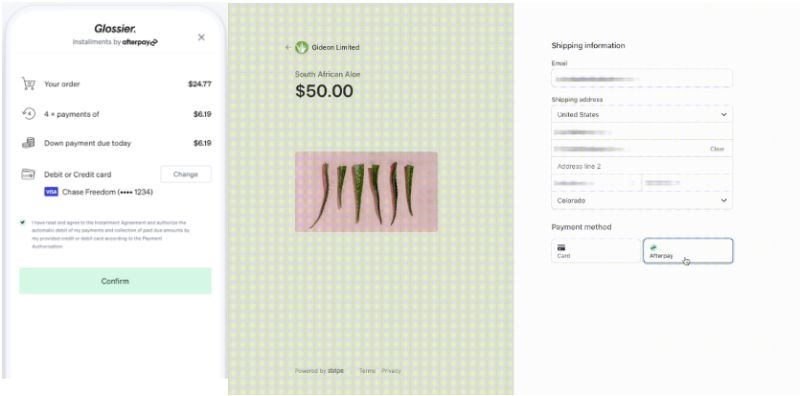

If your online business regularly handles large-volume transactions for local and international customers, such as B2B, Stripe is the better option. While it requires third-party integrations for ecommerce and multichannel tools, Stripe is more flexible and customizable. It supports more currencies and charges less for currency conversion compared to PayPal.

Stripe’s hosted payment page optimizes the checkout experience for international customers.

(Source: Stripe)

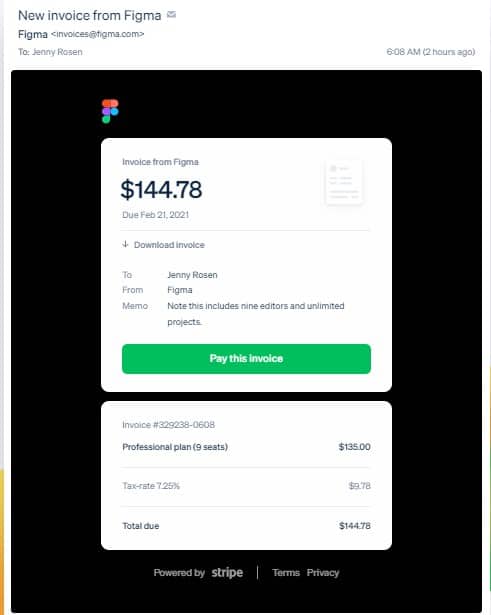

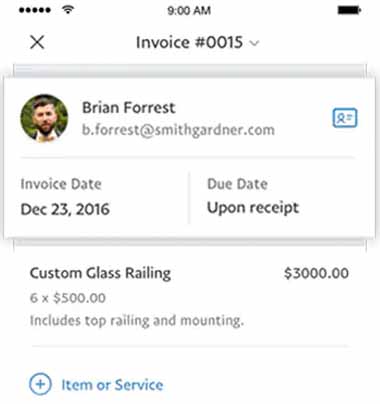

Stripe stands out with lower fees and versatile customization for invoicing and recurring payments. Its flat rate plus service fee is slightly more cost-effective than PayPal, which charges $10 for recurring billing and an extra $30 for billing tools, along with a gateway fee. Stripe accepts ACH debit and credit payments with fees ranging from $1 to $5 per transaction, while PayPal’s echeck fees for invoices are 3.49% plus 49 cents, capped at $300.

Stripe’s customization options extend to simple invoicing tools accessible from the dashboard or advanced features through the API, enabling automated collection and reconciliation. For subscription-based businesses, Stripe Billing offers diverse models, customizable with features like coupons and free trials, automatically generating invoices upon plan selection.

If you send out occasional local invoices and prefer echeck payments, PayPal is a user-friendly choice. Its tools, available through the PayPal for Business app, facilitate easy creation and scheduling of professional invoices for recurring transactions on mobile devices. The platform generates shareable links for invoices, simplifying communication with customers via email or messaging.

In micropayments, PayPal takes the lead, offering a dynamic fee structure and multiple methods for transaction acceptance. It supports peer-to-peer transactions and provides convenient access to funds. Conversely, Stripe’s website indicates limited availability of microtransaction payments for certain markets, advising users to contact support for details.

Stripe’s custom micropayment rate is typically quoted at 5% + 5 cents for transactions under $5, while PayPal offers a slightly lower rate of 4.99% + 9 cents. Stripe may provide better rates for businesses processing micropayments regularly. Additionally, Stripe allows batching multiple payments from a single person into one charge, a useful feature for minimizing transaction fees, particularly beneficial for those dealing with numerous micropayments from a small user base.

With Dynamic Micropayment pricing, merchants who have frequent transactions valued at $26.67 or lower get better rates. (Source: PayPal)

PayPal provides payment flexibility, with Venmo and cryptocurrency on its list. While Stripe has a feature that allows customers to purchase cryptocurrencies, it requires a separate application and API integration.

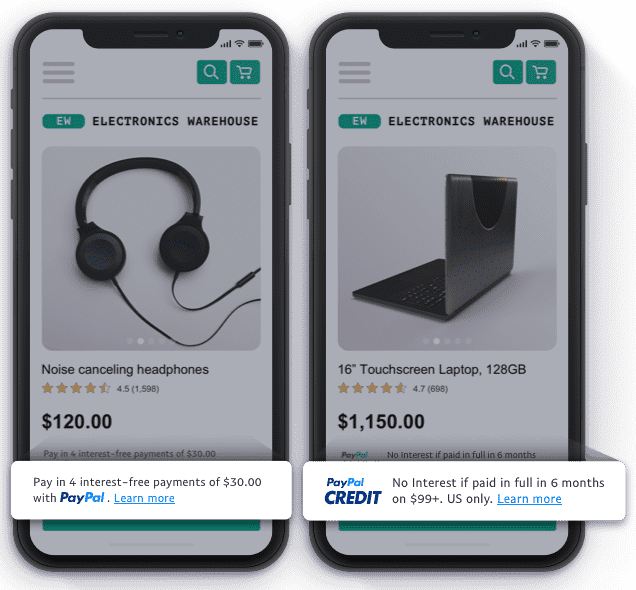

Both PayPal and Stripe also offer Buy Now, Pay Later options. PayPal has built-in Buy Now, Pay Later, PayPal Credit, and Pay Monthly options to encourage more customers to buy, while Stripe integrates with Affirm, Afterpay, and Klarna to offer its own Buy Now, Pay Later payment method.

Stripe vs PayPal Account: Features

|  | |

|---|---|---|

4.38 out of 5 | 3.81 out of 5 | |

Bank deposit speed | 2 business days, first deposit takes up to 14 days | Approximately 3 business days |

Instant deposit | 1% of payout volume | 1.5% of payout volume |

Chargeback protection | 0.4% per transaction | 0.4% per approved transaction |

Dispute fees | $15 | $15–$20 |

Dispute management tools | Included | Included |

Advanced risk monitoring | $0–7 cents per transaction | With an upgrade to PayPal Enterprise |

Payment security features | Payment data encryption Built-in machine-learning fraud detection Customized payment risk evaluation 3D secure authentication Secure data migration Online identity verification | Email confirmations PayPal Security Key TLS connection Key pinning Data protection Machine-learning fraud detection technology |

API | Yes | Yes |

Developer tools | CLI, Visual Studio Code, live event monitoring, advanced SDKs | API executor, multiple languages, interactive mode, or mock mode |

Developer support | Documentation, YouTube tutorials, newsletter, live chat with developers, 24/7 support | Documentation, updates, demos, developer community, FAQ, live support via ticket |

PCI compliance | Included | Included |

Customer service | 24/7 chat and phone support, email, resource library | Extended phone support, active seller community, help center, text messaging and social media customer support |

Stripe wins over PayPal when it comes to features. While they both offer good security tools and wide integrations, Stripe offers better customer support hours and more robust developer tools.

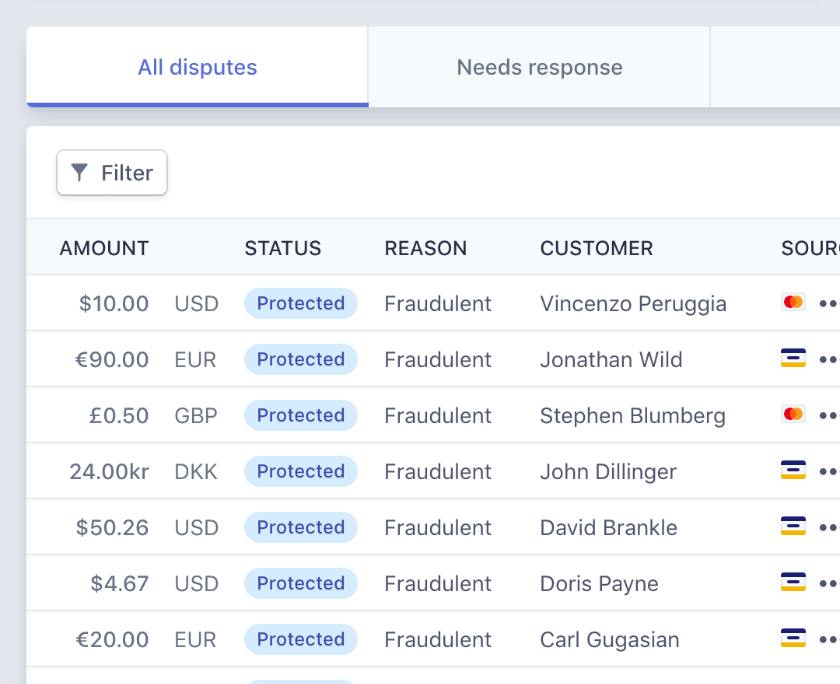

Both Stripe and PayPal offer significant security for online payments, but Stripe provides more customization, including identity verification. Both charge the same amount for chargeback protection. The dispute fees for both are non-refundable, but this fee is generally lower for Stripe.

Stripe is miles ahead when it comes to online payment security and has built a robust infrastructure for monitoring tools to protect your transactions. It provides advanced machine-learning fraud detection features and allows you to customize your acceptable payment risk level, so you won’t miss out on sales that regular fraud monitoring tools might rule as suspicious and block the transaction.

Real-time risk assessment is also central to Stripe’s chargeback protection features. Its Dynamic 3D Secure tool is built-in on every checkout page and screens medium-risk buyers to protect any business size from potential disputes.

Consider PayPal if your customers are primarily domestic and mostly PayPal account holders as well. This ensures that your transactions are covered by PayPal’s Seller Protection policy. Also, while Stripe provides more sophisticated payment security features, PayPal is still one of the most trusted security seals in the payments industry, making it an ideal choice if you’re trying to boost sales.

Stripe is the better option if you want a more customized payment solution for your business. B2B businesses that deal with large volumes of international transactions will require a more sophisticated fraud detection system to minimize risk and provide maximum seller protection—and Stripe provides this.

Stripe stands out for its extensive integrations among payment processors, boasting plug-and-play compatibility with popular POS and ecommerce software. With over 700 partner apps, Stripe’s app marketplace and developer tools make it easy to find and integrate applications like Salesforce, Harvest, Shopify, QuickBooks, and Eventzilla. The platform offers robust API and SDK support, accompanied by comprehensive documentation, video tutorials, live chat with developers, and a CLI for integration management.

While PayPal is integrated into numerous retail applications, Stripe leads in integrations due to its app marketplace and developer-focused approach. PayPal, however, provides broader customer support access and lists thousands of integrations for various functions. With PayPal, fewer third-party integrations are typically needed, and the platform offers plug-and-play options for easy addition of PayPal checkout to websites and online marketplaces. However, businesses may face challenges finding integrations on the PayPal page, which primarily focuses on PayPal apps and lacks third-party options.

PayPal excels in native apps for pay buttons, subscription processing, invoicing, and casual money acceptance. It also offers applications for digital advertising, customer messaging, gift cards, discounts, fundraising, and developer programs for marketplaces and enterprise-level businesses. Despite a comprehensive support system, live tech support with PayPal is available through ticket-only access.

Stripe offers 24/7 email, phone, and chat support. There is also a comprehensive knowledge base and detailed API documentation. On the other hand, PayPal only offers extended phone support hours compared to Stripe’s 24/7 support. It has an active seller community that provides almost every answer for using PayPal, along with access to customer service via text messaging and social media.

Stripe vs PayPal: Expert Score

We scored this category based on our own experience of ease of use and how affordable and transparent the pricing is. We also looked at the number and ease of integrations, as well as the input of real-world users as recorded in third-party user review sites like Capterra and G2.

Stripe earned an overall expert score of 4.69 out of 5. As a provider that consistently gets excellent marks in our reviews, it is no surprise that Stripe gets perfect scores in pricing, integration, and popularity. It requires zero monthly fees and provides advanced payment processing and security features you would often find for larger businesses.

Despite the technical skills needed to maximize its potential fully, Stripe gets above-average user reviews. It has hundreds of integrations beyond ecommerce tools such as accounting software, CRM platforms, and POS systems, making the system a highly scalable solution that we look for and recommend to small businesses.

However, Stripe lost some points for ease of use. Although it offers payment processing tools that don’t require coding knowledge, some customizations are still needed to get up and running. Its many tools and features can be an advantage, but it can be overwhelming for small and new merchants.

Meanwhile, we gave PayPal 4.38 out of 5 for expert score. PayPal had perfect scores for its popularity and integrations. It lost a few points for its complex pricing structure and some unfavorable user reviews that mention the possibility of having your funds withheld or frozen.

Although Stripe scored slightly higher in this category, PayPal is a solid option for small businesses looking for an online payment processor. Even if you choose to go with Stripe, PayPal is still an excellent option as an additional payment option.

Want to learn more?

- Read our full Stripe review and PayPal Business review for more details on pricing and features.

- Check out our list of Stripe alternatives and PayPal alternatives.

- Find out why both Stripe and PayPal are on our list of the best merchant services, best payment gateways, top-recommended B2B payment solutions, and leading international merchant accounts.

Methodology—How We Evaluated Stripe and PayPal

We test each online payment processor ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to various payment processing features, scalability, and ease of use.

The result is our list of the best online and credit card processors. However, we adjust the criteria for specific use cases, such as for different business types and merchant categories. This is why every online payment processor has multiple scores across our site, depending on the use case you are looking for. For this in-depth analysis, we looked closely at how Stripe and PayPal performed.

Click through the tabs below for our overall online payment processor evaluation criteria:

20% of Overall Score

We graded based on monthly fees, online rates, chargebacks, and whether or not you could get volume discounts.

30% of Overall Score

Online payments go beyond website checkouts. We looked for invoices, recurring billing, and virtual terminals. We also gave points for stored payments and Level 2 and 3 processing for B2B sales.

25% of Overall Score

This score considered sales tools like customer management features, BNPL, fraud prevention, and developer tools for customizations. We also considered deposit speed, giving the most points for same-day processing and customer service.

25% of Overall Score

Here, we scored based on our own experience of ease of use, plus research into account stability. The number and ease of integrations contributed to this score. Finally, we gave some weight to the input of real-world users as recorded in third-party user review sites like Capterra.

Frequently Asked Questions (FAQs)

Here are some of the most common questions we encounter about Stripe vs PayPal.

Stripe is known for its ability to provide a range of customization options for different types of payment methods. While it does support simple hosted payment links, Stripe stands out for its level of customization, including payment security and fraud detection features. This is made possible through higher-level coding, which Stripe makes available through APIs.

PayPal and Stripe are outstanding choices for online payment processing. However, PayPal is ideal for low-volume, seasonal, small businesses. It charges cheaper in-person transaction fees and supports peer-to-peer payments like Venmo. Stripe is the better option for merchants with regular monthly sales, especially for B2Bs.

Stripe is cheaper than PayPal for processing international payments and accepting online transactions, which makes it the best option for B2Bs.

Bottom Line

There is no clear winner in the debate of PayPal vs Stripe. Both are excellent options when choosing an online payment processor. While Stripe scored higher overall, PayPal still makes a good addition because it is a trusted service, expands your payment processing capabilities, and has no additional fees if it’s not used regularly. Even if you have your own payment processing service or choose to go with Stripe, PayPal is still good to include as an alternative.