Offboarding is the process of managing all aspects of an employee’s exit from your business, whether they are leaving voluntarily or involuntarily. An employee offboarding checklist, also known as a termination checklist, ensures you don’t miss steps, such as getting your office keys back and removing the former employee from databases. It also promotes your employment brand as you deal with each departing employee fairly and professionally.

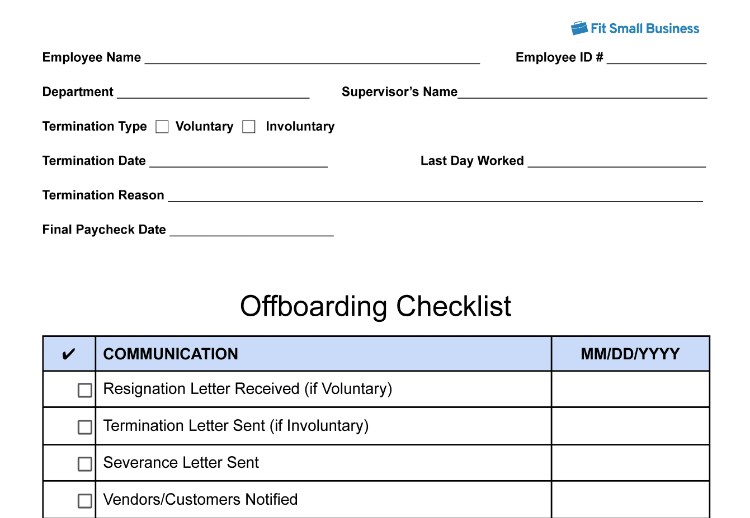

Download and customize our offboarding checklist template to ensure you have an efficient and successful offboarding process.

Thank you for downloading!

Quick Tip:

Gusto top features and services include automated payroll processing, tax filings, direct deposits, PTO management, insurance and benefits administration as well as a cash-out (on-demand pay) feature for hourly workers.

Explore the seven steps below to successfully offboard your employees:

Step 1: Determine & Document the Termination Reason & Date

The approach you use when offboarding an employee depends on the circumstances under which they are leaving the organization. The most common reasons are voluntary resignation or involuntary termination, each carrying different legal and practical requirements for offboarding (different timelines, for example: severance packages in some cases, but not others; final pay timelines, etc.).

Step 2: Identify Responsibility & Delegate Tasks

Depending on the complexity of your organization, you may need to delegate tasks to different individuals.

The common people/job roles to delegate tasks to during offboarding are:

- Payroll rep: To provide a final check and compute all deductions, any unused PTO balances, expense reimbursements, and other monetary accountabilities

- Manager: To communicate to existing staff about the employee’s departure and who will take over their responsibilities, as well as whether the position will be backfilled

- IT/Admin: To gather and inventory equipment, manage account access, and/or disable the employee’s building access

- Executive: To communicate to vendors/clients or approve companywide messages

- HR: To manage the process and update org charts, employee data systems, and files

- Specified employee(s): To be cross-trained or take over some/all job tasks and responsibilities from the former employee

In a smaller organization, one or two individuals may oversee all these tasks—or perhaps you’re the one who needs to ensure offboarding occurs. In a larger firm, oversight of the offboarding process is typically managed by the employee’s manager, an administrative assistant, or an HR representative.

Step 3: Customize & Use an Employee Offboarding Checklist

Once you’ve documented a termination and determined who on your team will handle different tasks, you are ready to customize and use your offboarding checklist.

Depending on the size and complexity of your business—such as what state your employee works in and whether you offer benefits—your offboarding checklist will vary. For some companies, it includes only a handful of tasks. Other firms may require a larger list of procedural steps.

At a minimum your employee offboarding checklist should include:

- Employee data: Include the employee’s name, ID number, and other relevant information such as their work location, department, and supervisor’s name.

- Termination info: Include the employee’s last day worked and termination reason (these often drive decisions such as when their final check is due, whether they’ll get severance pay, and if they’ll be eligible for unemployment).

- Communications: Determine who you’re going to notify, such as vendors or co-workers, and how.

- Company property: Identify company resources the employee will need to return (i.e., cell phone, laptop, vehicle, keys, badges, manuals, files, etc.).

- Information technology: Close software accounts or change passwords, such as the employee’s email, POS login ID, or VPN account.

- Contact information: Obtain their permanent mailing address, phone number, and email account in case you need to follow up with the employee after they depart (i.e., to provide W-2 forms at year-end).

- Benefits: Depending on the size of your company and/or whether you offer employee benefits, you may be required to offer COBRA (continuation of benefits).

- Leave balances: Based on state requirements (or your company policy), you may need to calculate and pay out accrued but unused PTO or sick leave.

- Legal notices: Remind the departing employee of key details they’ve agreed to, such as a nondisclosure agreement (NDA), or obtain their signature on those documents to protect your business.

- Exit interview: Note the time, date, and person who will conduct the exit interview.

- Deductions: If the employee has any outstanding monies, such as a loan balance or a charge for failing to return their cell phone, you’ll want to gather these amounts to deduct from their final paycheck.

- Expenses: You’ll need the employee to turn in outstanding expense reports so you can reimburse them on their final paycheck (or by the end of the pay cycle).

- Final check: Note the date their final check is due based on whether they quit (voluntary) or were fired (involuntary).

Step 4: Communicate to Relevant Parties

Employees who are fired are either terminated on the spot and asked to leave or given an employment end date. Meanwhile, if they quit, they often provide notice and end employment on a predetermined date. Whenever the end date can be determined in advance, make sure you document and communicate it to all relevant parties, including confirming it with the employee.

Proper communication ensures that there will be no surprises or misunderstandings that might devolve into a lawsuit. You’ll want to communicate about the employee’s departure to a broader audience in a way that maintains the employee’s dignity and confidentiality rights.

Here are the parties to communicate employee offboarding to:

- The employee: Document in writing the termination date, reason, and any expectations as soon as possible before their last day.

- Internal departments: Use email, Slack, or some other confidential HR workflow to notify departments like security, IT, or payroll about which employee is leaving and when.

- Company employees: Request that managers notify team members directly when a coworker is leaving or has left. Some companies wait until after the employee is off-site to discourage unnecessary chatter and not disrupt the flow of work.

- Clients and vendors: For practical business reasons, clients and vendors need to know if their go-to person is no longer there, and who they should contact instead.

Step 5: Conduct an Exit Interview

Conducting an exit interview should be one of the key steps of your offboarding process. However, it’s optional, depending on the situation. For example, if you have an employee that you’ve had to terminate for stealing, fighting, or violating company policy, there may be no point in retaining them on the job site to get their opinion on how to make the workplace better.

However, whenever possible, it’s in your business’s best interest to find out why employees quit. That allows you to assess and address issues proactively, such as those regarding workload, pay, benefits, personality issues, or management training.

Asking the right questions during an exit interview can help you gather information about why the employee is leaving, what the employee’s goals are, and how the employee plans to move forward. Start with the following:

- What were your reasons for leaving the company?

- What were the challenges you faced while working at this company?

- What are your thoughts on the company’s culture and how would you describe it?

- What do you think of the company’s management and what would be your advice to them?

- Do you have any suggestions on ways to improve the company?

There are a lot of insights you can glean from exit interviews, as employees leaving the organization are often more open to sharing specific concerns. Knowing why your employees are leaving can help you better manage existing employees and reduce employee turnover.

Step 6: Provide Final Paycheck

Using the details you’ve gathered in your offboarding checklist, you should be able to process the employee’s final paycheck. You’ll know how many hours they’ve worked (or will work through the end of their last day). You’ll know about any deductions that need to be taken such as any remaining benefits premiums to keep their insurance in place until the first of the month. You’ll also have received their expense reimbursement requests, calculated any PTO to pay out, and determined how much severance they’ll receive.

When to provide that paycheck depends on the state your employee works in and whether the employee quit or was fired. In some cases, you’re required to provide a paycheck upon termination.

That may be a problem if you fire your bartender at midnight on a Saturday. In that case, you can use free payroll software or a paycheck calculator to come up with the exact amount, pay them with a check (there are free options to print checks online) or cash, and then enter the final paycheck earnings and deductions data into your payroll software on the following business workday. If you do this, make sure you retain a receipt.

Related Articles:

Step 7: Retain Employee Documentation

Document retention requirements vary by state, but as a general rule, you need to maintain files of terminated employees for at least four years. Of course, if you are concerned about claims of unfair employment practices, discrimination, or any other issue, it’s best to retain documentation of your termination reasons (such as performance reviews, warnings, or behavioral issues) for as long as the risk of a lawsuit exists. That ensures you can defend your position.

Further, your unemployment insurance (UI) rates are dictated by your employee turnover experience, and whether employees were terminated for cause or other reasons. That’s why it’s important to receive an employee’s resignation in writing, and/or document clearly why the employee was let go from the position. You don’t want your unemployment insurance rates to ratchet up simply because you don’t have documentation proving that the employee quit. In fact, employers typically end up on the losing end if an employee disputes your undocumented termination reason.

Finally, if the employee has a retirement plan or 401(k), they have a right to view documents up to six years after the plan ends. That’s why using a payroll service, like Gusto, can help. Electronic documentation like tax forms and 401(k) balances are retained online in case the employee needs it at a later date. To learn more about its features, check our Gusto review.

Why a Structured Offboarding Process Is Important

Offboarding benefits both the employer and the employee. It protects your company and your managers by ensuring that expectations are clear, reducing the likelihood you’ll make a mistake (like failing to pay out an earned bonus) that might cause the employee to sue you.

Consider both audiences when you customize your offboarding process:

- Employer: Your process should include tasks to protect the business and its employees, including getting keys and requesting confidential documents be returned.

- Employee: Your process must respect the rights of your employee to be paid on time and be spared from discrimination, harassment, or slander.

Employee offboarding ensures all parties—the employee, their manager, their co-workers, your payroll rep, your IT team, and HR—are all on the same page when it comes to an employee’s last day on the job.

The more managers and departments you have, the more likely a task will fall through the cracks. You don’t want to make the mistake of leaving a disgruntled employee with access to your building or your client’s online accounts after you’ve fired them.

Best Practices for Your Offboarding Process

As mentioned above, we recommend having a structured offboarding process and using an offboarding checklist. However, there are some best practices you must keep in mind:

- Ensure proper process management: It’s best to appoint a designated person to manage each offboarding event (i.e., you, the person’s manager, or an HR rep).

- Take your time and do it right: In a crisis, like when firing an employee for misconduct, you may need to slow down and take time to process a termination request to ensure it goes smoothly.

- Be flexible: When an employee exits due to unique circumstances, such as during a military deployment or serious employee injury, you may need to adapt.

- Review the process regularly: Labor laws change; you’ll need to review your offboarding process and checklist periodically to ensure it’s up to date.

- Seek professional feedback: It’s not a bad idea to have an attorney review your offboarding process to make sure it’s not inadvertently violating employee rights or putting your business in a risky situation. For example, a noncompete agreement isn’t valid in all states, and each state has different requirements for when COBRA notices or final paychecks are required.

Offboarding Costs

The cost of offboarding is related primarily to payments or benefits you provide once an employee is terminated or quits. For example, if you are subject to COBRA (50 employees or more in most states), you may have to pay benefits administration fees of a few dollars per month. Other costs are incidental, such as the time it takes to retrieve and take inventory of company property or manager/HR time spent conducting an exit interview.

The most common costs of offboarding include:

- Labor costs: The time it takes you, your managers, and/or your HR staff to manage the offboarding checklist, update your company data, and manage communications.

- Payroll/Bookkeeping costs: If you use payroll software or a bookkeeper to manage HR data, there’s typically a cost to process a termination and issue a final paycheck.

- Hidden costs: The hidden expense of offboarding is what it costs to replace an employee who has quit or that you’ve fired. Those costs can run into the thousands.

In truth, offboarding properly is a way to avoid further unnecessary costs. For example, the time you spend conducting an exit interview can save you money down the road as you address systemic workforce issues that may be causing your organization to suffer turnover. It may be as simple as motivating your staff or recognizing their efforts.

Choosing an Offboarding Provider

Most offboarding software providers have automated the employee offboarding checklist by providing reminders and communication templates to save employers time. You don’t need a provider to do offboarding, but using one can ensure you don’t miss any steps in the process.

To ensure employee offboarding is handled professionally, consider using one of the options below:

Unless you’re a labor law expert or employ only next of kin, you might want to get the support of an outsourced HR expert. Online services like BambooHR provide dedicated and unbiased assistance to manage your entire offboarding process, including all compliance paperwork. Pricing is custom, depending on the scale of your business, with add-ons for certain features like payroll processing and time tracking. Learn more about it in our BambooHR review—or find more options in our guide to the best HR outsourcing services.

Businesses that want to take a hands-off approach to all things HR and payroll are best suited to work with a professional employer organization (PEO). A PEO is a co-employer that partners with your business to manage the people side of your operations. Such organizations ensure that employees are hired and classified correctly, paid legally, and provided with big-company employee benefits like health care.

PEOs start as low as $49 per employee per month, with add-on services (and fees) that can help you attract top talent to your business. They help with offboarding by maintaining data on the termination date, termination reason, last check date, and any information that you need to be signed, such as an NDA or severance agreement. Find some options in our roundup of the best PEOs for small businesses.

Human resource information system (HRIS) software can help you keep track of new hires and terminations, as well as provide legal and tax-compliant payroll and benefits offerings. Unlike a PEO, you maintain control of your business practices, including employee-related decisions like hiring and firing. An HRIS is best for small businesses that already have a good handle on workforce compliance and tax laws in their state.

HRIS software varies greatly in price, with some starting as low as $1.50 per month per employee. To get payroll services as well, expect to pay between $6 to $12 per month per employee with monthly service fees in the range of $40 to $120 per month. Most software contain an employee portal that can allow terminated employees to access data they need, such as pay stubs, tax forms, and benefits documentation. Read our best HRIS software buyer’s guide for some recommended providers.

Many payroll software and payroll service providers cover common HR transactional needs, such as hiring and terminating employees. Some of these, like Gusto—our top recommended payroll service provider—have a way to store employee documents, as well as ensure final paychecks are accurate and required services (COBRA) are provided to terminated employees. Like HRIS software, some even offer an employee self-service portal that former employees can use to obtain their own forms and documents.

Smaller companies may be OK managing employee offboarding manually. This can be done by using our offboarding checklist or keeping track of terminated employees in a spreadsheet.

Employee Offboarding Frequently Asked Questions (FAQs)

A good offboarding process is structured, respectful, and comprehensive. It ensures the departing employee transitions smoothly while protecting the company’s interests. Key elements include an exit interview, ensuring company property is returned, revoking access to sensitive systems, and settling final pay and benefits. The process should ideally include knowledge transfer to ensure the departing employee’s responsibilities are properly handed over.

An exit checklist—another term for an offboarding checklist—is a detailed list of tasks that must be completed when an employee leaves your company. The checklist serves as a guide for HR, managers, and the employee to ensure nothing is overlooked during the offboarding process.

Start by identifying key tasks like knowledge transfer, exit interviews, final pay, and the return of company property. Next, assign responsibilities to HR, IT, and the departing employee to ensure each task is completed.

In HR, the exit process—otherwise known as the offboarding process—refers to the procedures followed when an employee leaves an organization. This process typically includes notifying HR of the departure, along with other steps mentioned above. The HR team will handle the legal and compliance aspects of the departure, along with legal counsel should that be necessary.

Bottom Line

Employee offboarding is an important process for both the employee and the company. It can help the employee transition into their next role and ensure that all company information is transferred properly. For the company, offboarding can help protect sensitive information and reduce the risk of legal issues.

Using an offboarding checklist to keep your offboarding process on track is an HR best practice. It ensures that you and your team have thought of everything you need to do when an employee leaves your company.