A recurring payment—also referred to as a subscription payment, recurring billing, or automatic payment—is an electronically processed payment that repeats according to a preset schedule. Businesses often set these up to collect fees for memberships, subscriptions, lessons, and services.

The easiest way to accept recurring payments is with an all-in-one payment processor or merchant account that handles the payments but also has software to manage the billing process and security features to protect your customers’ information.

The best payment processors for recurring payments are:

- Helcim: Best overall recurring payment platform

- Square: Best (and free) POS software with recurring payments

- Wave: Best (and free) recurring invoicing for individuals

- Stax: Cheapest, wholesale fees for growing businesses

- Stripe: Best for accepting international payments

- PayPal: Best invoice and subscription solution for online businesses

How to Implement Recurring Payments

Before signing up for a payment processor, have a clear idea of what your business needs. Creating an effective recurring payment strategy requires the right pricing and policies in place. Below are guidelines on how to accept recurring payments.

Establish Your Pricing Model

Your pricing model will depend on your business. Recurring payments are used by businesses that offer subscriptions for services or products but the pricing model varies based on:

- The terms for installment payments (frequency and number of installments)

- Whether you offer free trials, and if so, how does it affect the monthly cost

- The terms and how customers qualify for discounts, if any

For example, your internet service provider may require you to make payments at the beginning of the service cycle. They can offer lower monthly fees if you pay for services a year in advance. They can also offer a seven-day free trial and/or a limited-time promo that gives you 50% off for the first three months.

Also Read: What Is a Subscription Business Model?

Set Clear Repayment Policies

Create a clear outline of your repayment policy beginning with the payment terms and payment/collection method. While this is based largely on your pricing model, other particulars include interest, late payment fees, and partial payment options.

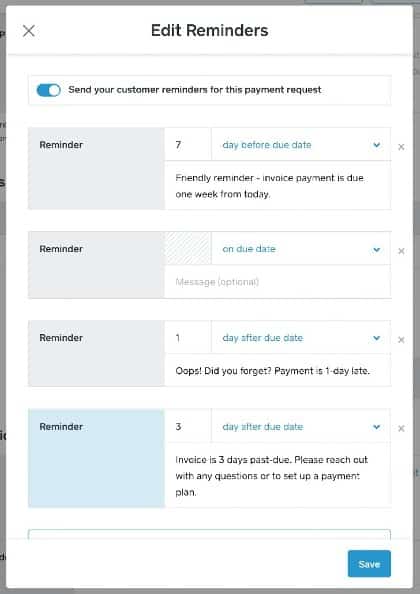

Also, consider the customer-facing aspect of your payment policies—what reminders will they receive? Will the payments be automatically charged or invoiced, or will customers receive a bill? Is the plan on auto-renew or will it need to be renewed?

This is also where you identify procedures for managing outstanding payments and failed collections.

Ensure Pricing & Terms Transparency

Decide where and how to display your pricing and payment terms. Being transparent with your pricing and payment terms on your website often contributes to customers choosing to give you their business over a competitor. Having your policies clearly displayed and accessible right before checkout also protects your business from customer complaints and eventual chargebacks.

When applicable, also consider adding this information to your templates for contracts, customer invoices, and payment reminders.

Offer Flexible Payment Methods

Whether you send out invoices or call customers to collect payments over the phone, you need to consider how you want your business to get paid. As a general rule, offering a variety of payment options allows merchants to sell to a wider customer base.

While most customers prefer to pay with credit cards, there is a growing number of consumers looking for other convenient modes of payment such as digital wallets and banking apps.

Read More: The Latest Payment Trends to Know

Check for Compliance

As you will likely accept credit cards for recurring payments, it’s important that you are aware of and follow guidelines for credit card payments. This includes the way you process transactions, secure customer data, and store credit card information. The recurring payments process also requires customers to sign an authorization form.

Most businesses that offer memberships, subscriptions, and recurring invoicing also set up options for automatic payments. This requires saving customer credit card information, which requires an authorization form. Learn more about credit card authorization forms.

The Payment Card Industry (PCI) Security Standards Council ensures the protection of customer and credit card information by requiring merchants to conduct annual internal and external evaluations. Merchants who fail to comply are subject to fees and legal action.

In 2023, the Federal Trade Commission submitted a proposal to add a “click to cancel” provision to the existing 1973 Negative Options Rule protecting consumers against deceptive practices related to recurring payment programs.

If approved, “click to cancel” will provide consumers with a simple means to cancel or opt out of subscriptions and memberships. Learn more about click to cancel.

Provide Outstanding Customer Service

Providing excellent after-sales customer support can be crucial to keeping a healthy state of recurring payments. If possible, offer 24/7 customer service and set up phone, email, and live chat support methods. Otherwise, ensure to respond to customer complaints within 24 hours.

Make sure to keep an organized record of customer accounts so it’s easy to address any misunderstanding. Follow up on any unresolved customer concerns with an email to confirm that you are actively working on the issue.

Choose the Right Payment Processor

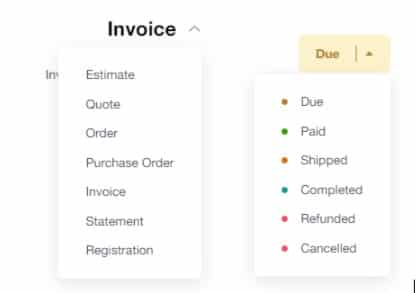

Invest in a payment processor that offers recurring payment tools matching your business needs. This includes the ability to create estimates that can be converted to an invoice, customize invoices for different business types, automate sending out reminders and receipts, and accept a wide range of payment methods. Some payment processors can also help you with PCI compliance, particularly for storing credit cards and encrypting data.

The right payment processor will also help you sign up for a merchant account that best suits your type of business. Learn more about merchant accounts.

Best Recurring Payment Processors

To help you get started, I evaluated the top payment processing providers in the industry for their recurring payment features. I also included a step-by-step guide on how to set up recurring payments with each processor below.

Helcim: Best Overall Solution for Accepting Recurring Payments

Pros

- Volume-based interchange-plus pricing

- Built-in invoicing and recurring billing tools

- Customizable customer portal

Cons

- Limited back-office integration

- Not ideal for occasional sellers

- Reports of poor customer support

Why I Like Helcim

Helcim is a traditional merchant account service provider. There are no monthly fees and the interchange plus rates come with automated volume discounts. What’s more, Helcim does not charge extra for using any of its payment services including billing management. And if you sign up for its ACH feature, you can use Helcim’s fee-saving service for online zero credit card processing.

- Monthly fees: $0

- Recurring billing/invoice fee: $0

- Card-not-present fee and card-on-file: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents

- American Express transactions: Interchange plus 0.10% + 10 cents

- ACH fee: 0.5% + 25 cents

- Chargeback fee: $15 refundable

- Payments accepted: Credit and debit cards, ACH, Apple Pay, and Google Pay

- Multiple invoice types: Estimates, recurring invoices, card-on-file recurring billing, progress-based invoices, and multipackage invoices

- Automated features: Automatic charging based on customers’ stored payment information, payment reminders, and auto card updates.

Helcim Zero-Cost Processing: Helcim now offers a free credit card processing service called the Fee Saver. The system can automatically determine which zero-cost program can be used based on location and card brand. It has also recently launched a new smart standalone point-of-sale (POS) terminal that can be used for tableside, curbside, and other mobile payments.

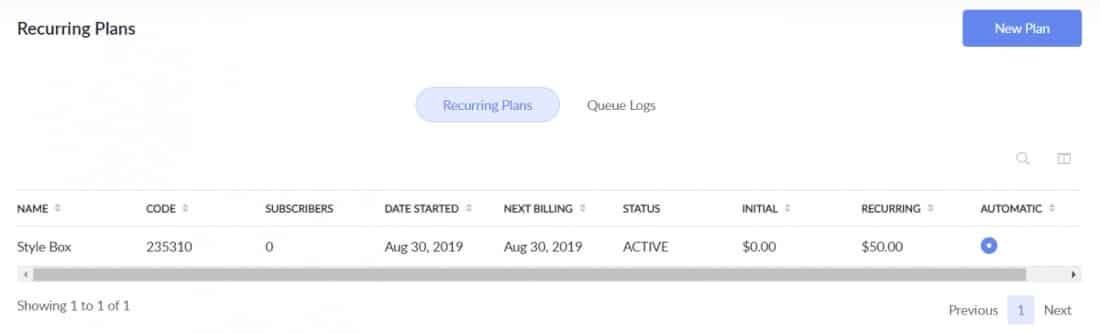

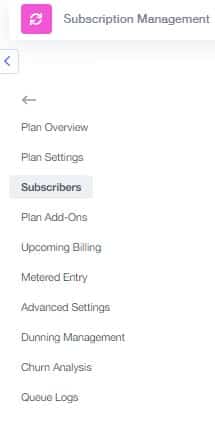

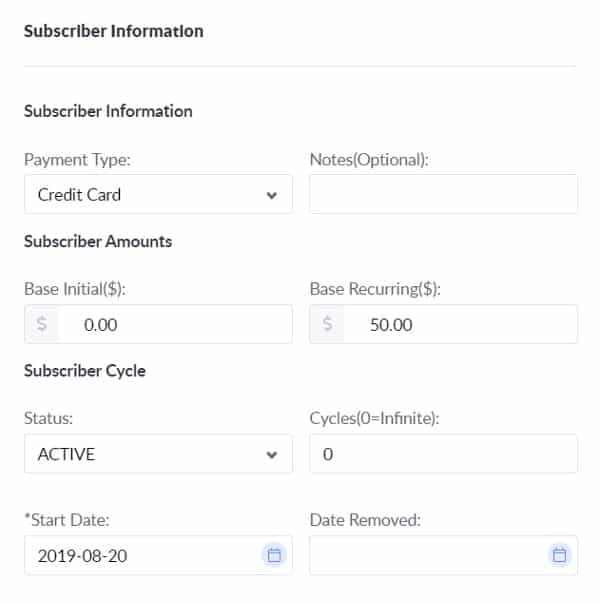

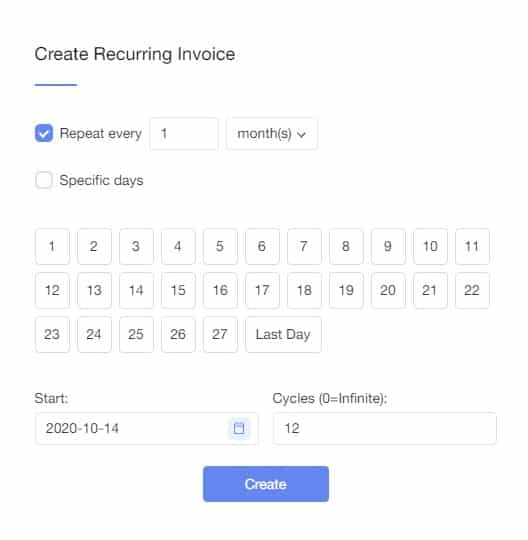

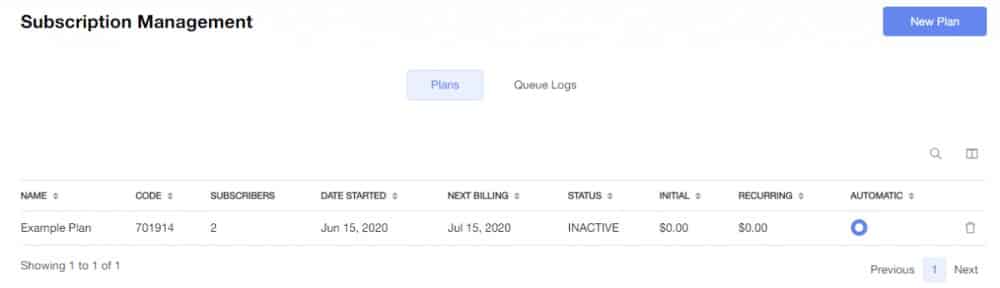

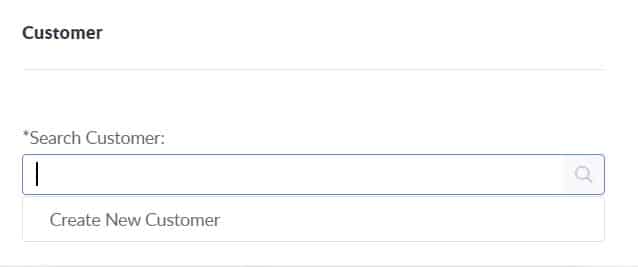

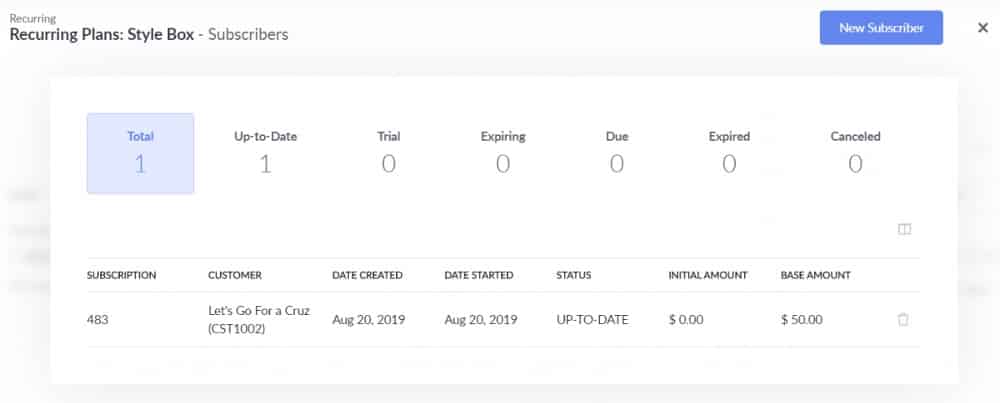

Helcim provides its users with detailed guidance on how to use the platform, including subscription management. It starts with creating a subscription plan, followed by adding a subscriber to a plan either manually or through an invoice.

Creating a Subscription Plan

Since our last update: Helcim’s subscription manager is now available for all Helcim merchants at no extra cost. This feature makes offering subscriptions easier with a setup wizard for creating plans, recurring payments, and adding and managing subscribers with a few clicks.

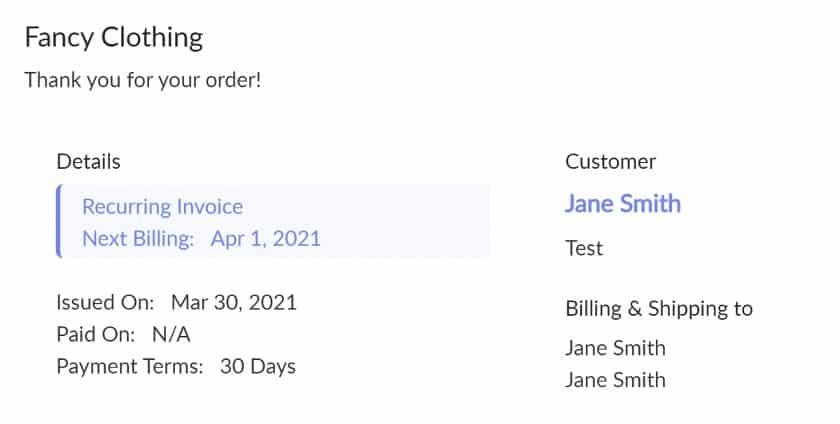

Creating a Recurring Invoice

Manually Adding a Subscriber

Square: Best for Small Businesses Needing Free POS

Pros

- Free iOS and Android app

- Automated payment reminders

- See when an invoice has been viewed

Cons

- High card-on-file processing fees

- ACH only for single payment invoice

- Custom rates available

Why I Like Square

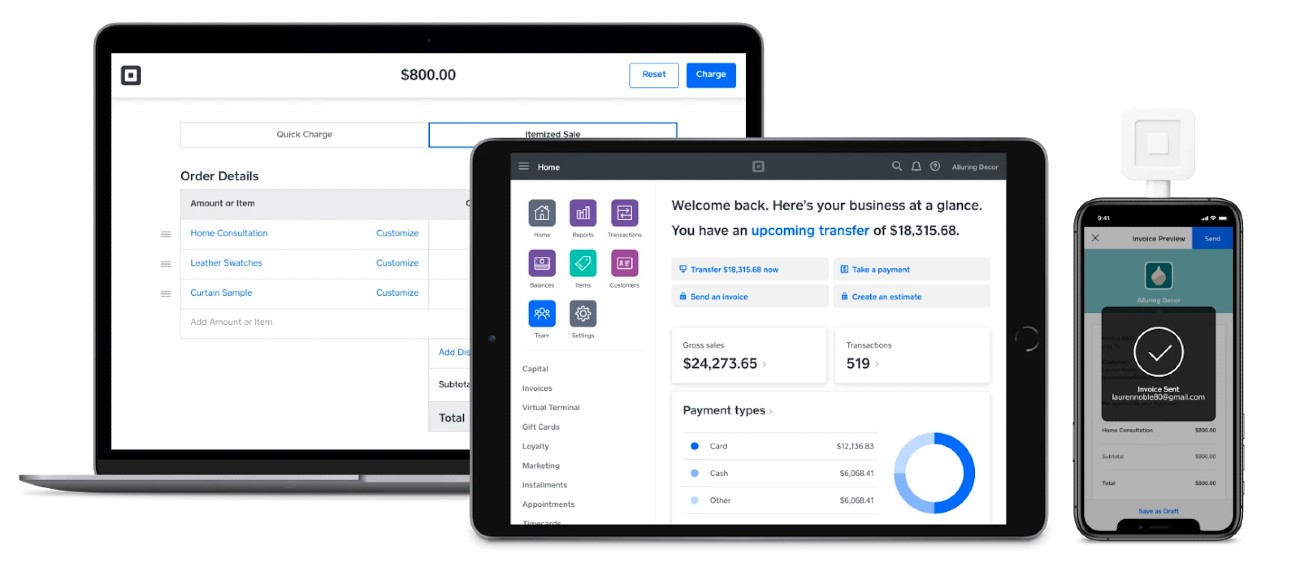

Square’s invoicing feature is impressive. It comes with a card vault and a complete billing management feature that includes creating custom reusable templates, estimates that are auto-converted to contract when accepted, milestone-based payment schedules, and more. The best part is that Square is easy to set up and use. It does not require a merchant application process like Helcim so you can start selling in minutes.

- Monthly fees: $0

- Invoice monthly fee: $0-$20

- Recurring billing and card-on-file processing fee: 3.5% + 15 cents per transaction

- Invoice fee: 3.3% + 30 cents per transaction

- ACH processing fee: 1% per transaction, minimum $1

- Chargeback fee: $0

- Payments accepted: Credit and debit cards, Apple Pay, Google Pay, and Square Pay

- Multiple invoice types: Estimates, recurring invoices, card-on-file recurring billing, progress-based invoices, and multipackage invoices

- Automated features: Reminders for upcoming and overdue payments

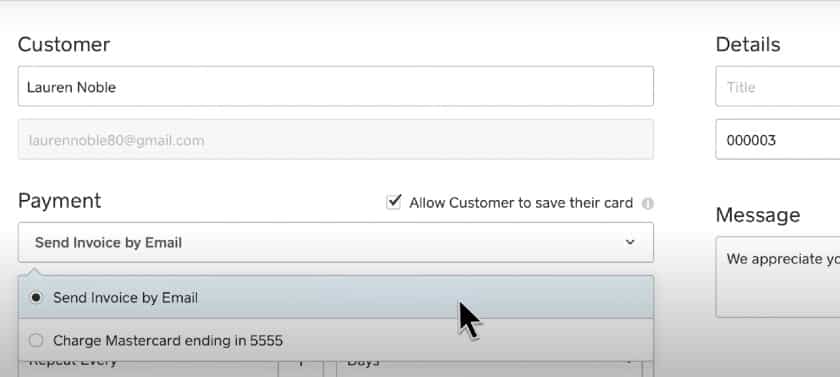

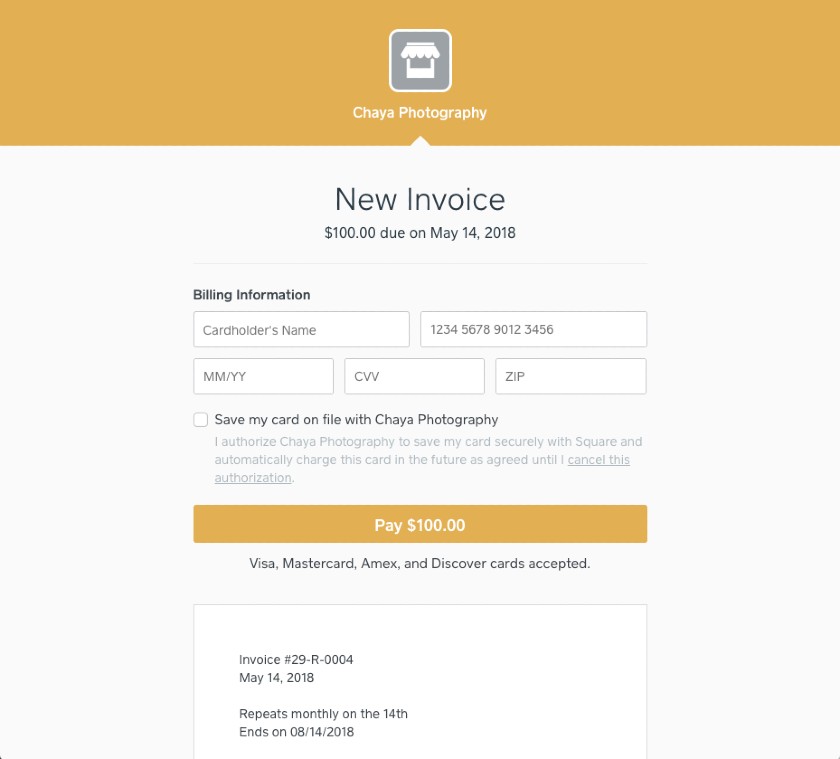

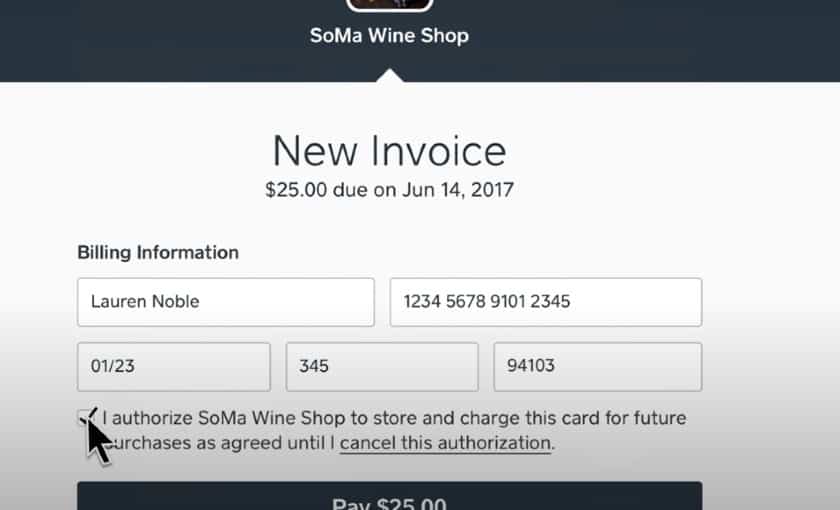

Square’s PCI-compliant payment system allows your customers to store their credit card information as a card-on-file in Square’s secure payments vault. Customers can enter this information via a link from your emailed invoice, or you can enter this on their behalf using your Square POS system or the virtual terminal in your online dashboard.

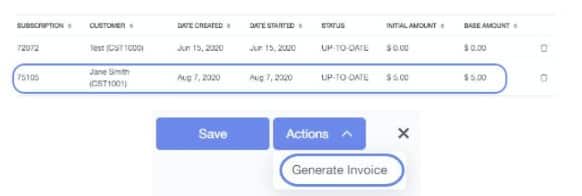

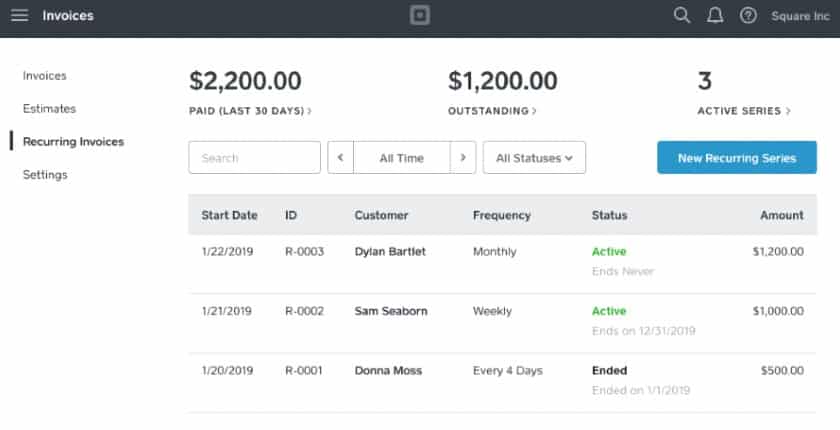

Recurring payments are triggered by Square’s invoicing function. When invoices are run—either individually or in a batch—any card-on-file customer payments are automatically charged. Customers are then notified of the payment via email with a “paid” invoice receipt.

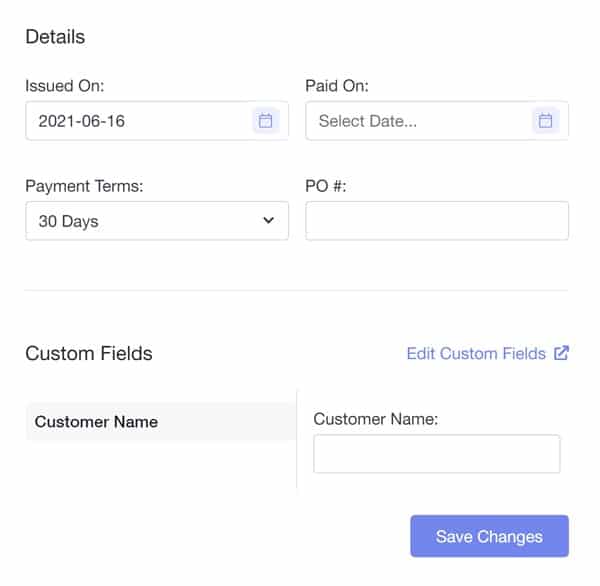

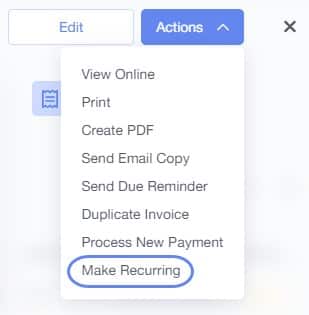

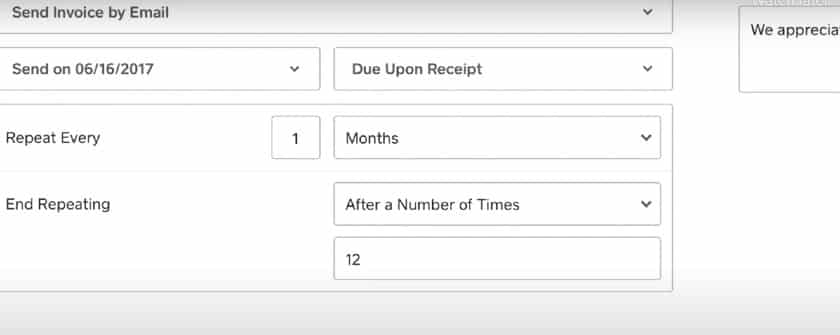

Scroll through the images below for more details:

The entire process is quick and requires minimal setup or ongoing management. Being invoice-based, Square’s recurring payments make it easy to process regular payments plus add-on charges as needed. Added fees can be entered as a separate invoice or combined with regular recurring charges—whatever fits the billing need.

Visit our step-by-step guide to sending Square invoices for more information.

Wave: Best Free Recurring Invoicing for Individuals

Pros

- No monthly fee; free invoicing and accounting software

- Low-cost ACH processing

- No additional fees for card-on-file or recurring payment transactions

Cons

- Slower, two-day payout time

- No phone support

- Higher fees for American Express transactions

Why I Like Wave

Wave is popular among freelancers and service professionals for its easy-to-use invoicing feature and native accounting software. You can create custom invoices, set up recurring billing for repeat customers with a few clicks, and switch between manual and automatic billing. The best part is, all of the payments are integrated into the bookkeeping feature so you don’t need to manually record your transactions.

- Monthly fee: $0

- Credit card processing fee: 2.9% + 60 cents

- American Express processing fee: 3.4% + 60 cents

- ACH/Bank payment fee: 1% ($1 minimum)

- Chargeback fee: $15

- Automated features: Payment receipts, past-due reminders, send out recurring invoices, charge clients based on a set schedule, and invoices sync with accounting

- Mobile app: Invoicing and receipt scanning app for iOS and Android

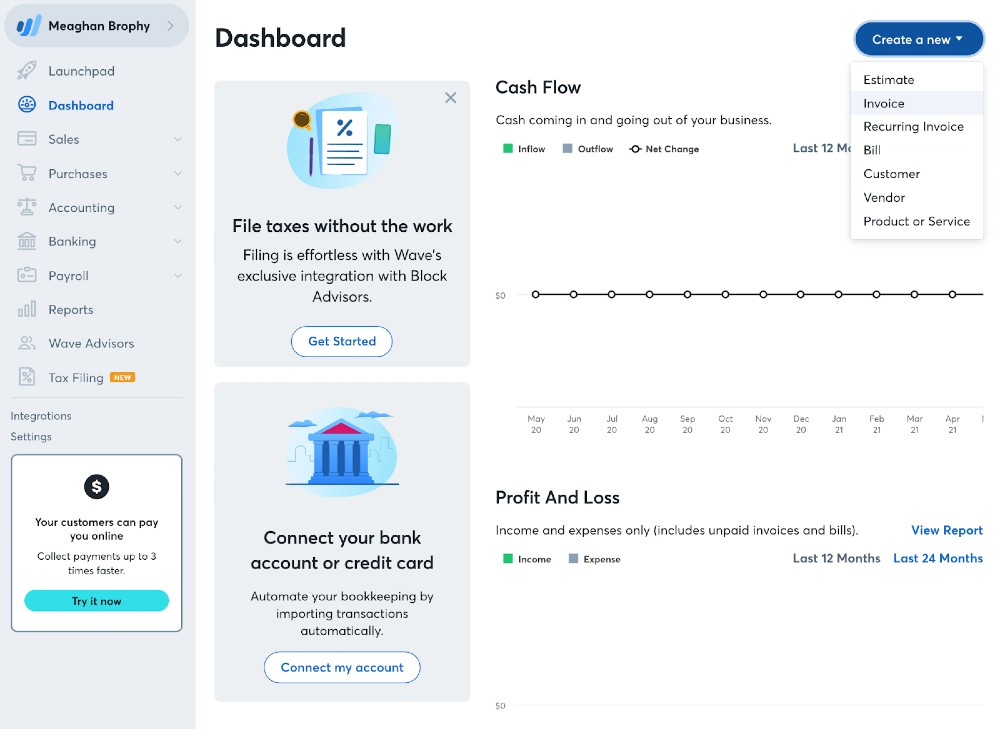

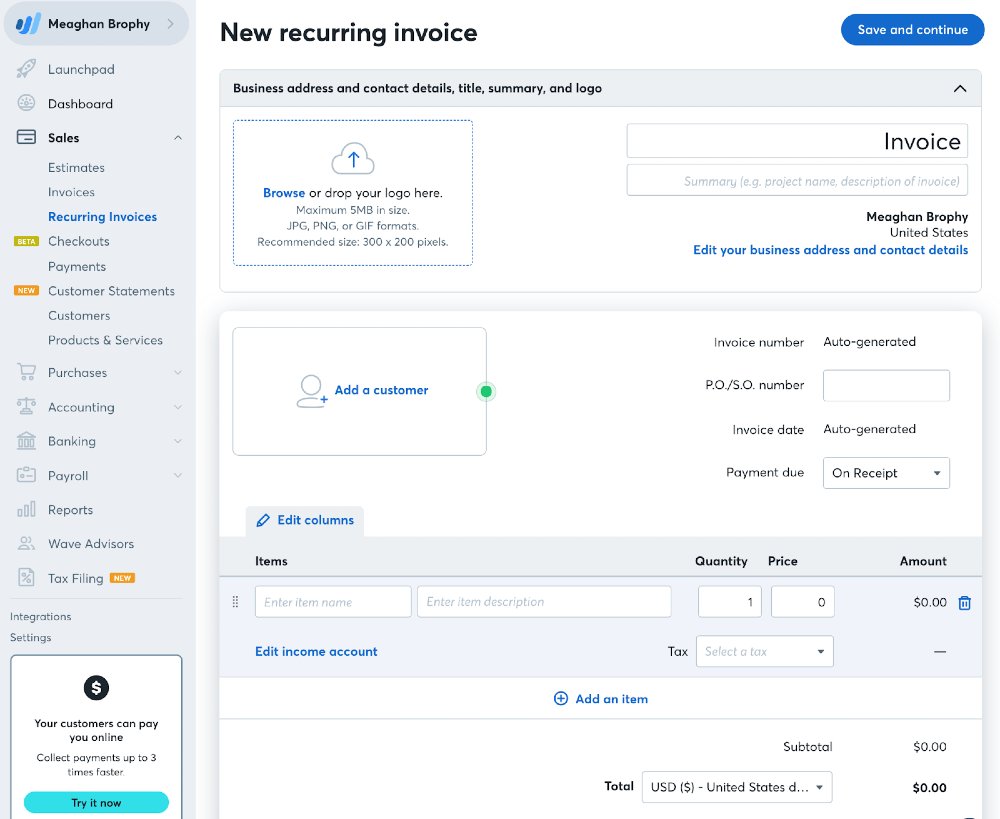

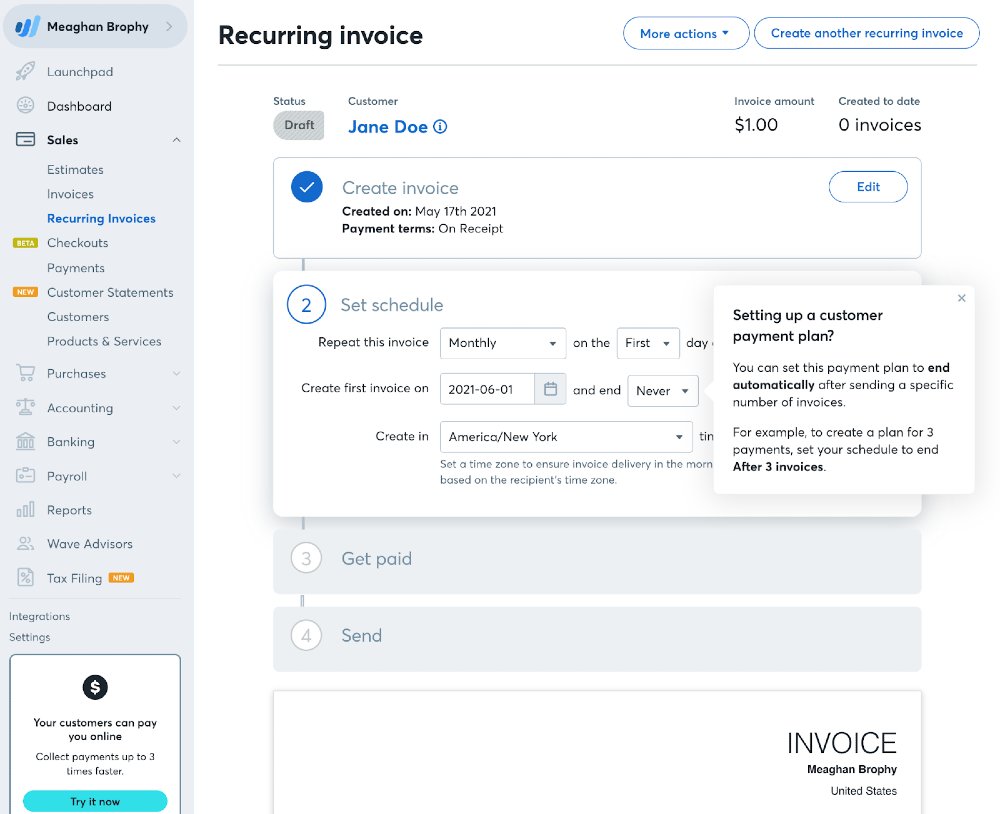

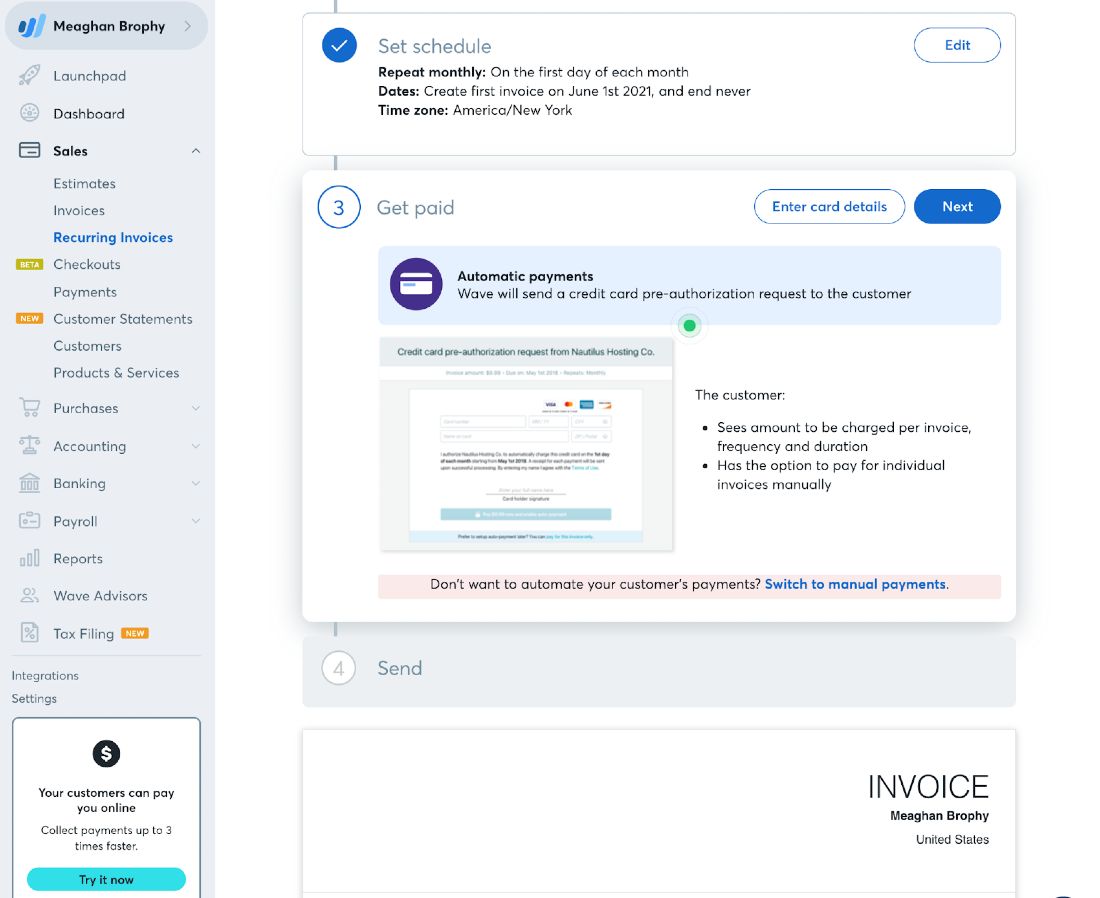

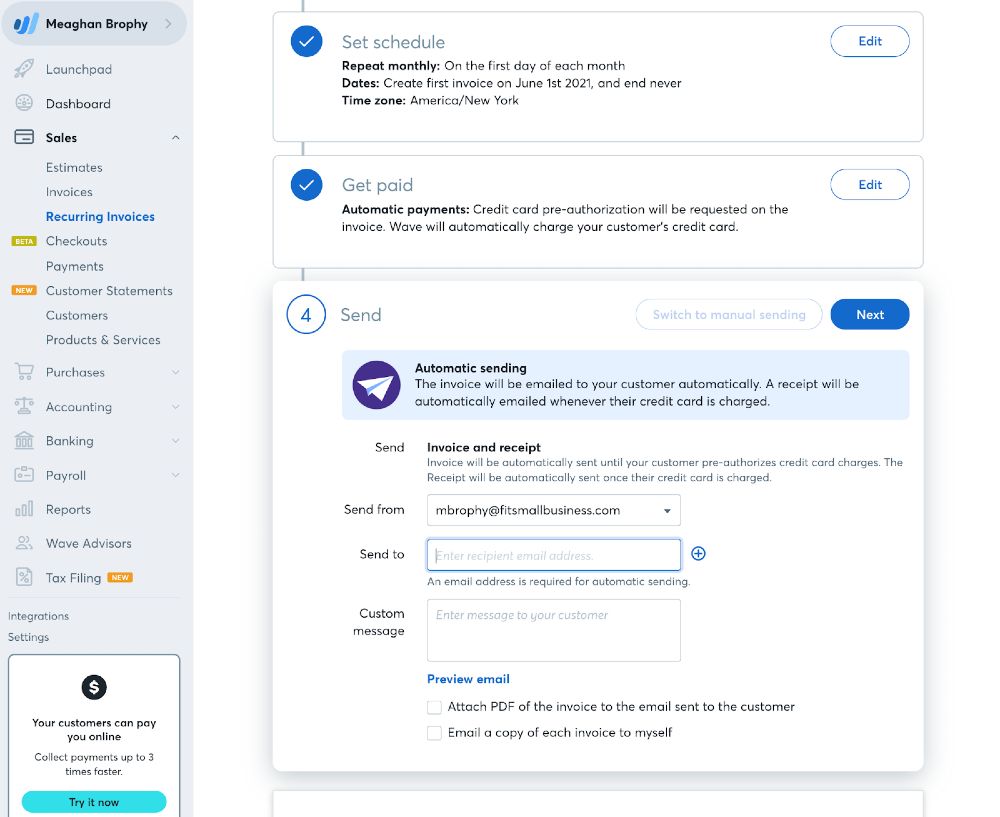

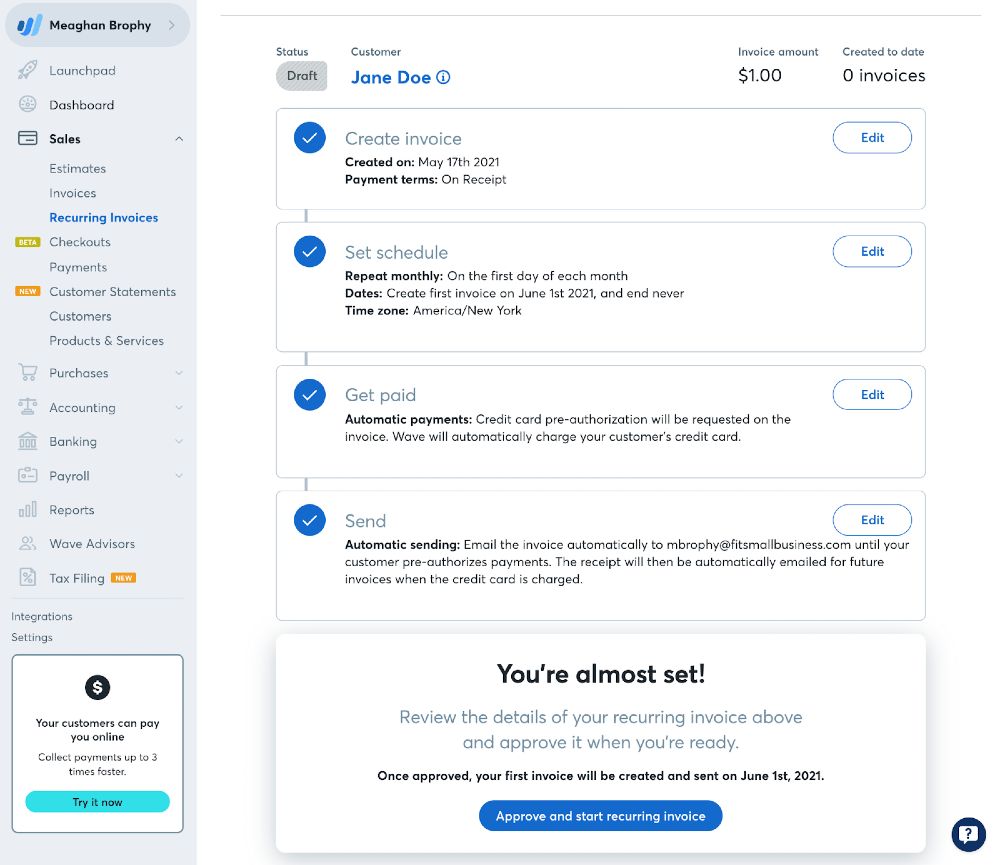

The first step for accepting payments with Wave is to create a free Wave account. Once you’re signed up, you can choose to create individual invoices or set up a recurring invoice, including options to save your customers’ payment information. There are also options to build payment plans.

From the dashboard, you can see at-a-glance invoices that are past due, outstanding, unsent, or upcoming and when your next payout is. Like Square and PayPal, Wave can also be used to create and send estimates that can then be converted into invoices.

Stax: Cheapest, Wholesale Fees for Growing Businesses

Pros

- Option to pay invoices via email and SMS text

- Automatic update of customers’ expired and changed card numbers

- Wholesale payment processing rates

Cons

- High monthly fees

- Not a good fit for small or occasional sales

- No same-day funding option

Why I Like Stax

Stax is a popular merchant account service provider for large-volume businesses. Like Helcim, it provides businesses with a stable merchant account and a complete range of payment processing tools, including billing management. With Stax, you can create custom invoices and set payment schedules based on your pricing model. It lets you accept both card and bank payment methods, with a secure card vault for storing payment information.

- Monthly fee: $99-$199

- Card-present processing: Interchange plus 8 cents

- Card-not-present processing: Interchange plus 18 cents

- Chargeback fee: Not disclosed

- Payments accepted: Credit and debit cards, ACH, and e-check

- Automated features: Automatically charge customer payment information stored on file according to preset schedules, send payment reminders, update expired card information, and sync with QuickBooks accounting

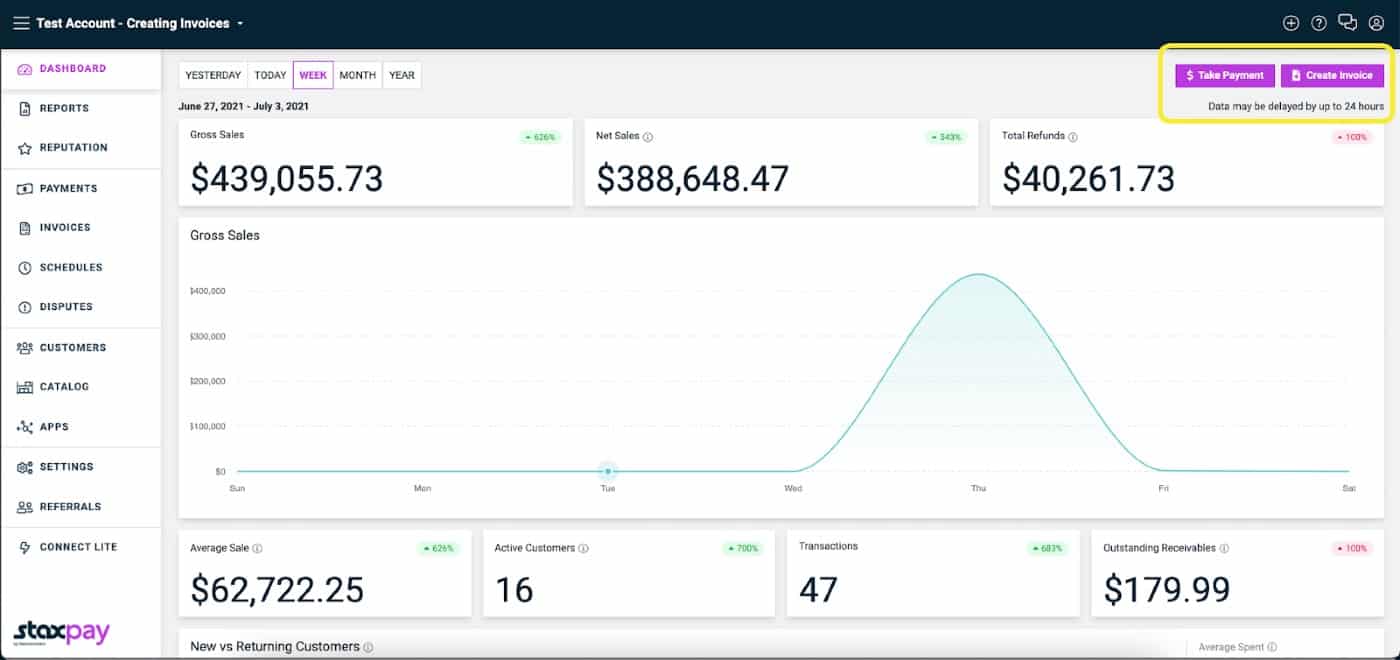

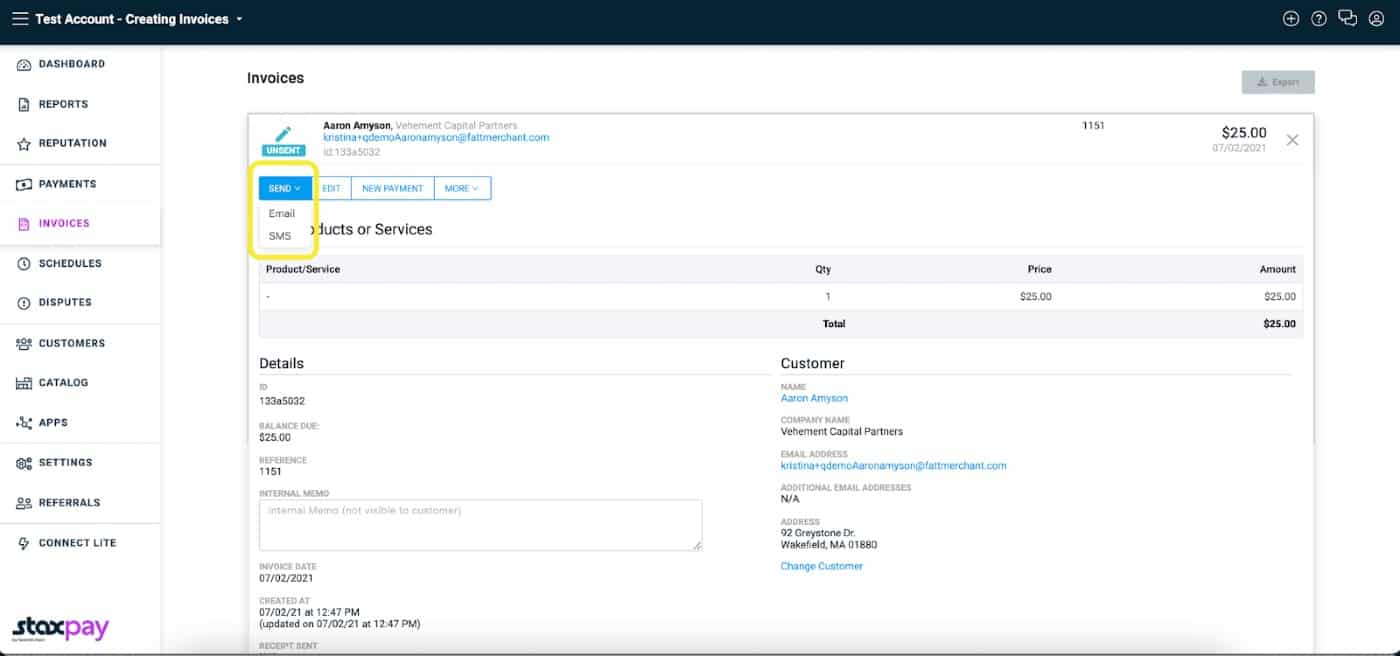

Stax Pay is Stax’s payment processing service for small businesses. When setting up an invoice or recurring payment, you can opt to create a single invoice or a recurring transaction. If you want to set up a recurring payment or invoice, simply navigate to the invoice tab in the Stax Pay dashboard. From there, you can create a new invoice, enter the price you want to charge, and specify the invoicing or automatic payment frequency schedule for clients with their card on file.

You have the option of sending recurring invoices that customers will need to click to pay or storing payment information on file and automating payments according to the set schedule.

Stax Bill is a cloud-based platform designed to simplify subscription billing management by automating your manual accounting and financial processes. Larger B2B SaaS using subscription-based business models can benefit from Stax Bill’s scalability to customize and automate everything from product management to revenue recognition accounting methods.

This gives merchants more time to focus on running their growing business instead of managing accounts receivables. Monthly fees start at $199/monthly.

Stax Bill Features include the following:

- Subscription offering

- Accounting and revenue management

- Catalog management

- API integrations

- Invoicing and recurring payments

- Self-service checkout site (online payments + sign up)

- Customer facing portal

- Message customization

- Advanced analytics + custom reporting dashboards

- Security + compliance

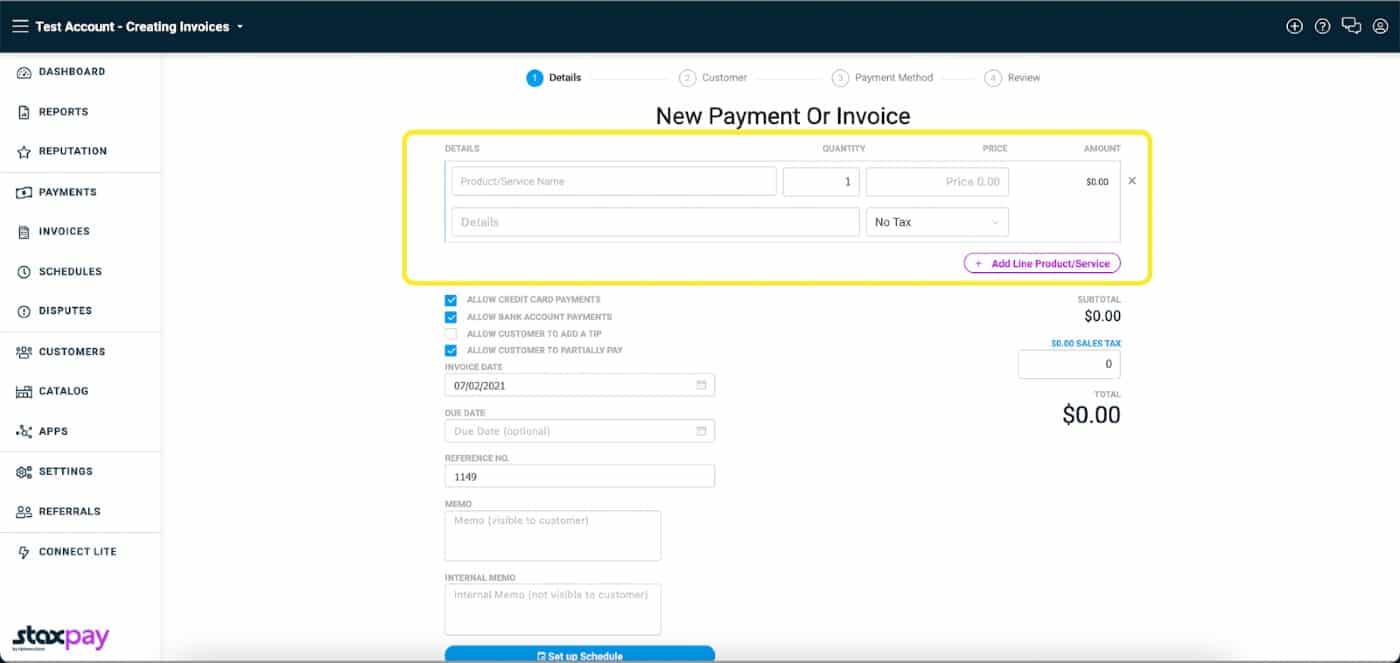

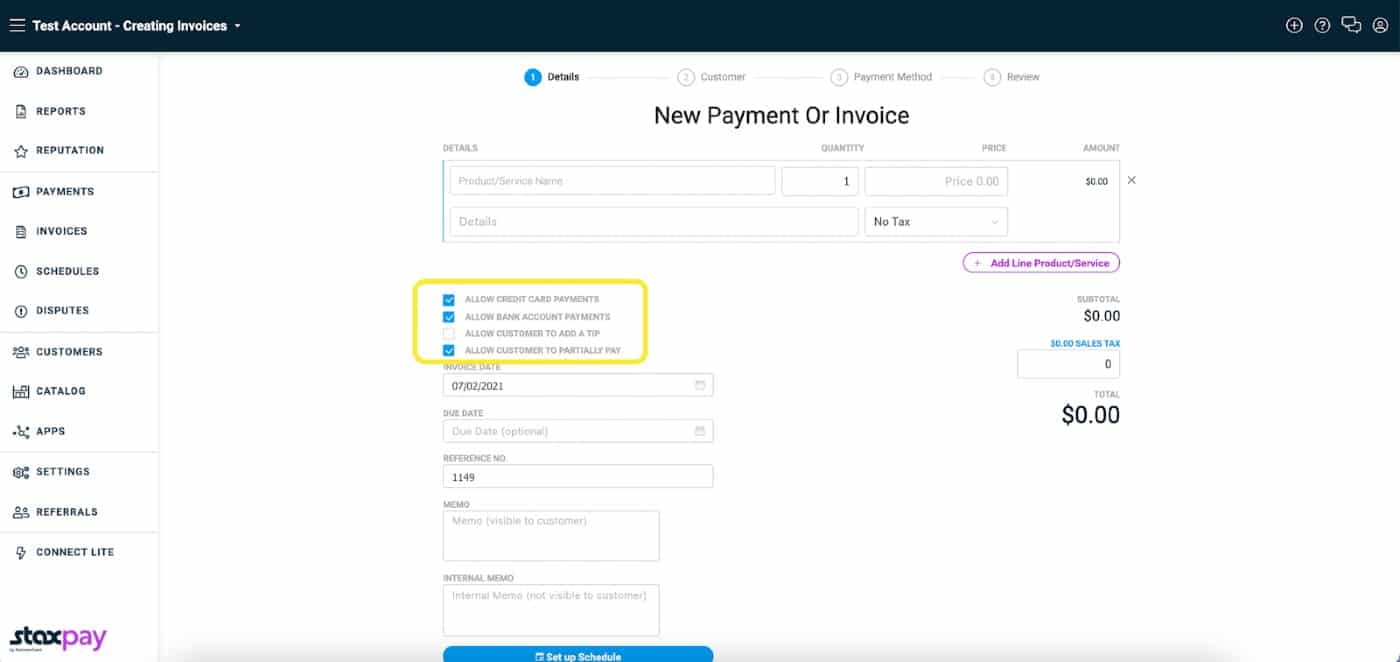

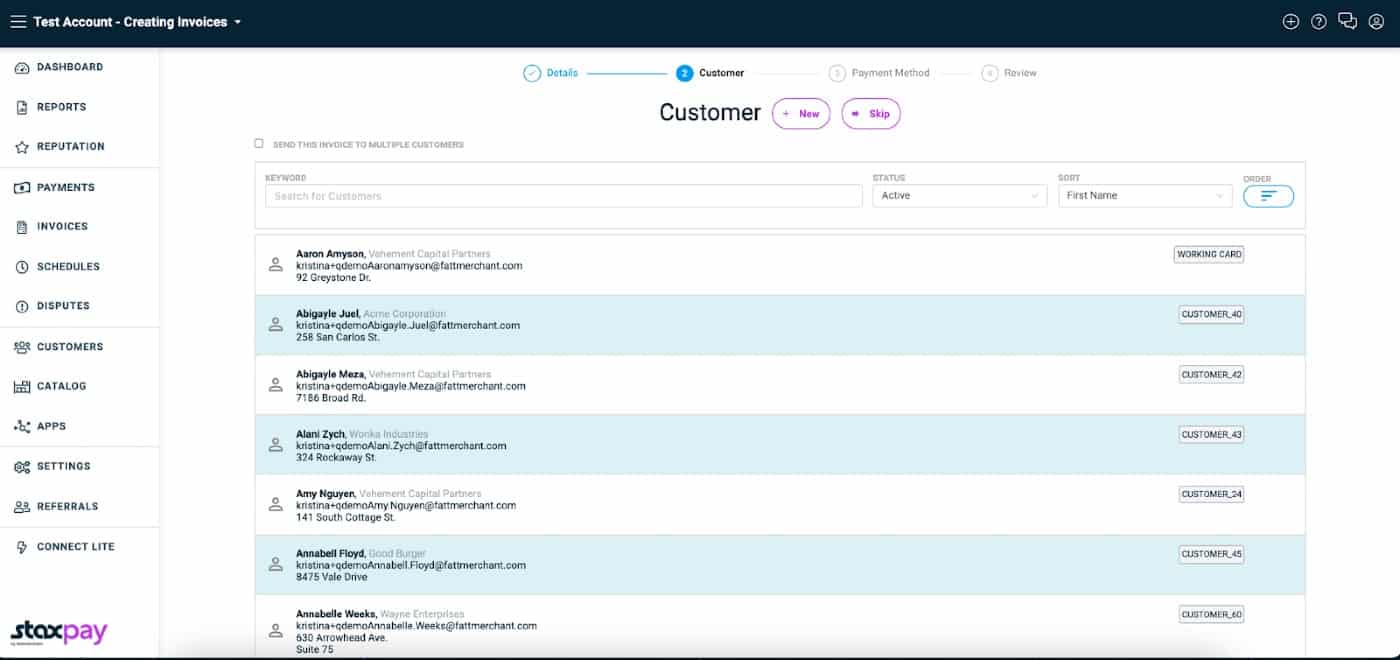

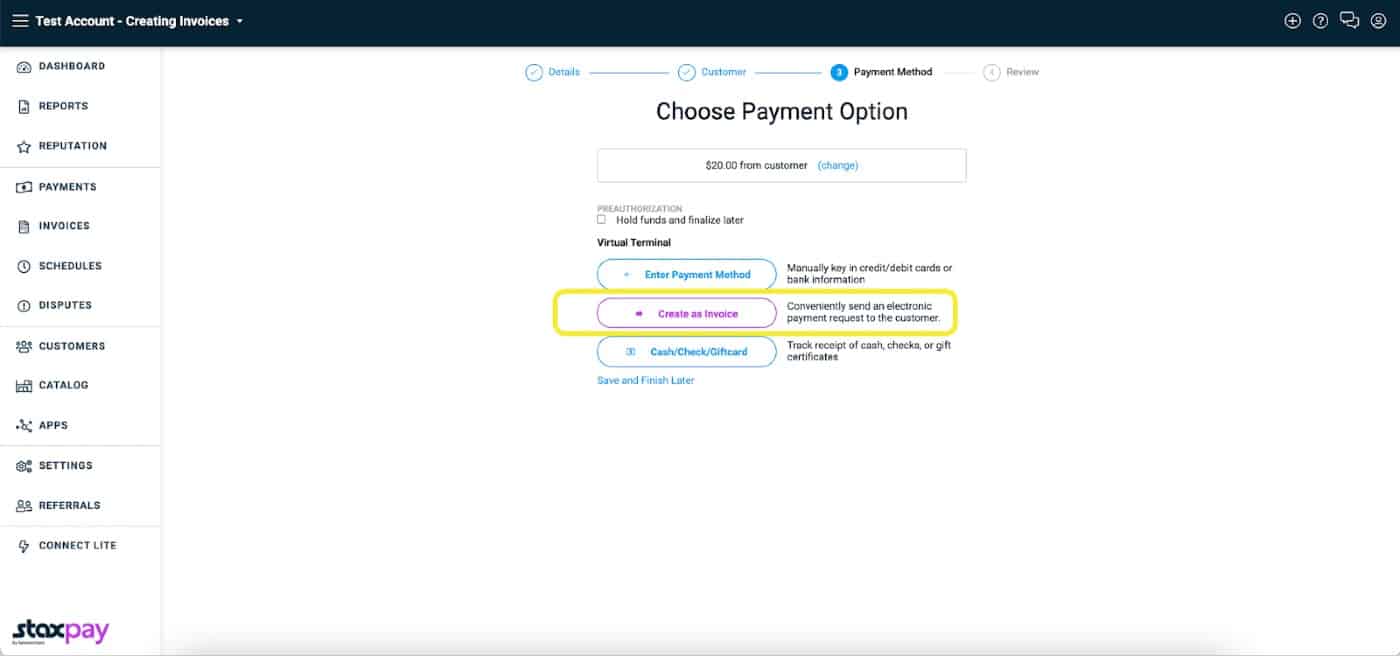

Setting Up an Invoice Through Stax Pay

Stax Pay is Stax’s payment processing service for small businesses. When setting up an invoice or recurring payment, you can opt to create a single invoice or a recurring transaction. If you want to set up a recurring payment or invoice, simply navigate to the invoice tab in the Stax Pay dashboard. From there, you can create a new invoice, enter the price you want to charge, and specify the invoicing or automatic payment frequency schedule for clients with their cards on file.

You have the option of sending recurring invoices that customers will need to click to pay or storing payment information on file and automating payments according to the set schedule.

Sign Up for Stax Bill

Stax Bill is a cloud-based platform designed to simplify subscription billing management by automating your manual accounting and financial processes. Larger B2B SaaS using subscription-based business models can benefit from Stax Bill’s scalability to customize and automate everything from product management to revenue recognition accounting methods.

This gives merchants more time to focus on running their growing business instead of managing accounts receivables. Monthly fees start at $199 per month.

Stax Bill Features include the following:

- Subscription offering

- Accounting and revenue management

- Catalog management

- API integrations

- Invoicing and recurring payments

- Self-service checkout site (online payments + sign up)

- Customer facing portal

- Message customization

- Advanced analytics + custom reporting dashboards

- Security + compliance

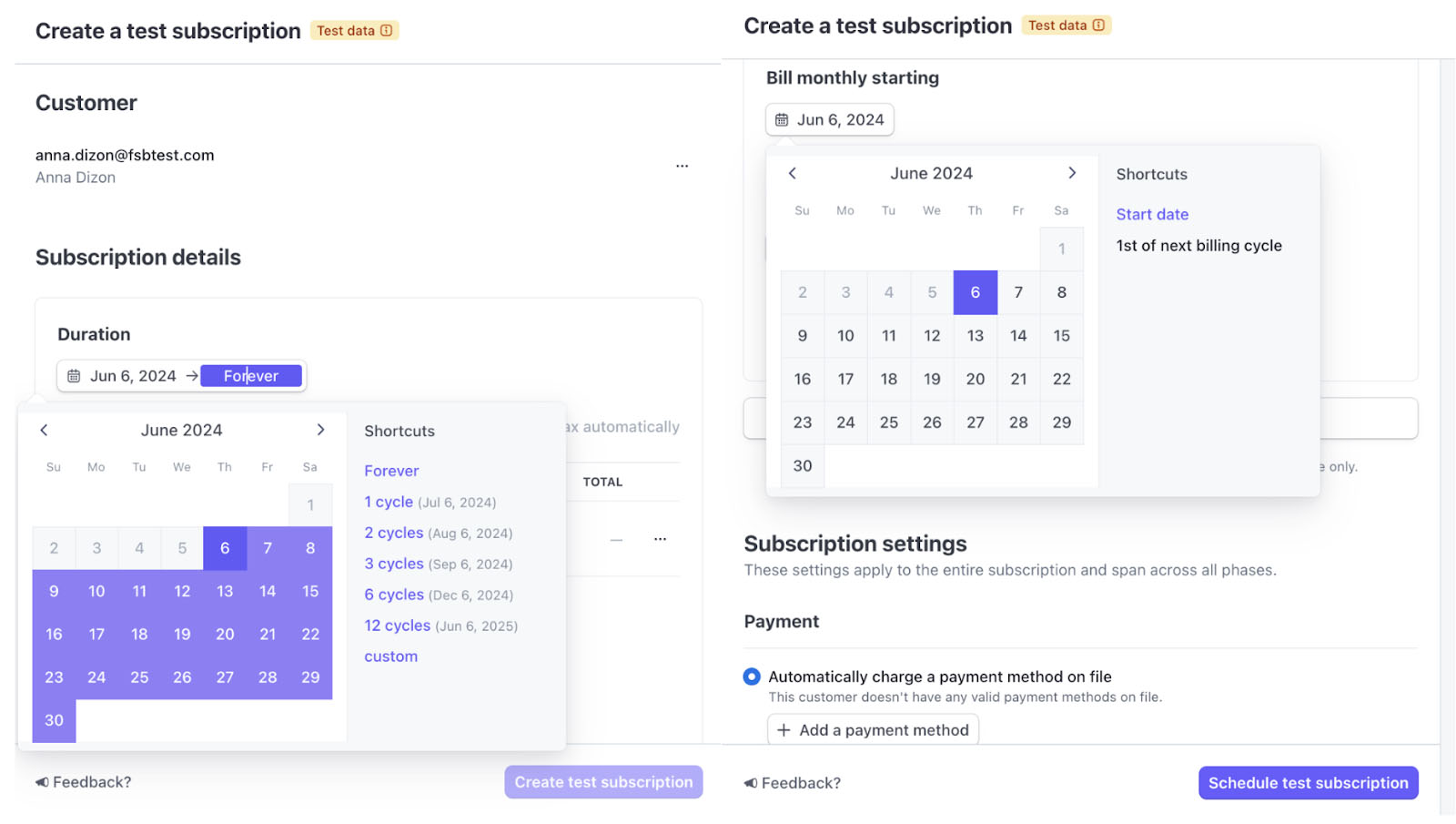

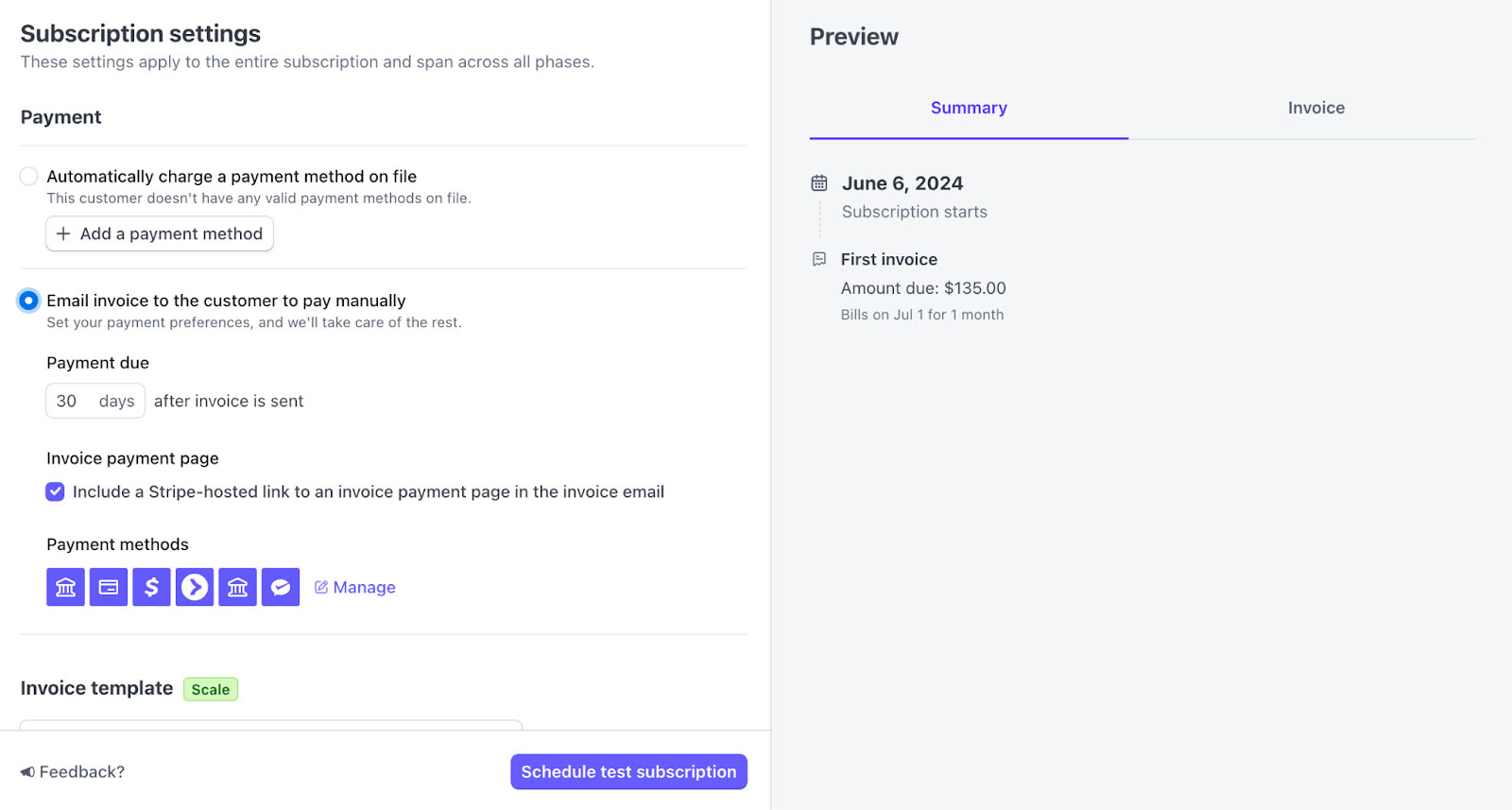

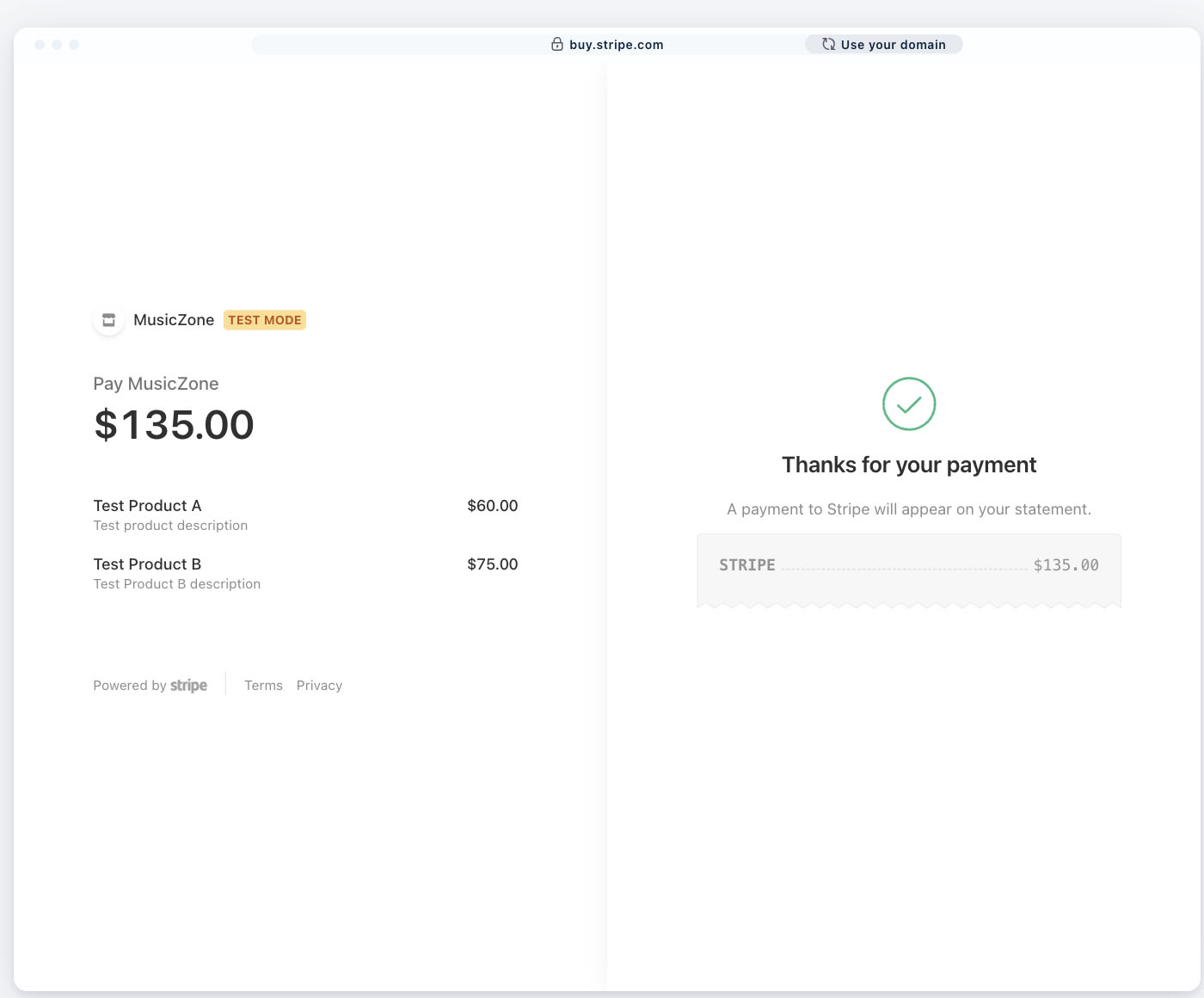

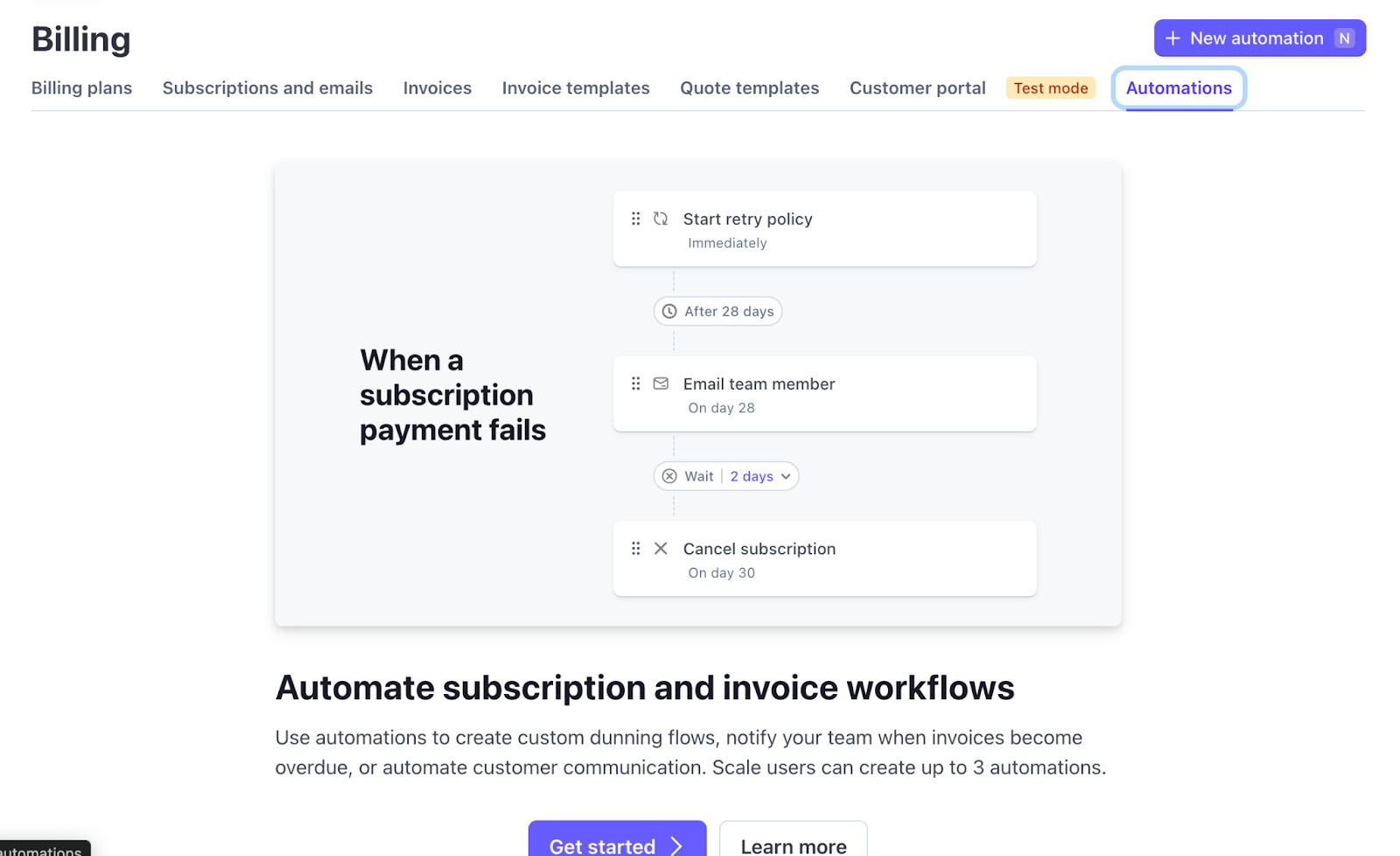

Stripe: Best Recurring Processor for Accepting International Payments

Pros

- ACH payments and local currency options

- Sophisticated billing logic

- International, ACH payment, and local currency options

Cons

- Longer setup; technical skill required to maintain

- Coding required for in-app payment features

- Limited CRM and virtual terminal features

Why I Like Stripe

Stripe leads the payment processing space when it comes to online payment customizations. Every merchant account gets access to Stripe’s developer tools to create custom payment gateways and subscription portals. This is particularly useful when accepting international payments where you can configure your online page to adjust the language and currency based on your customer’s location. Stripe supports 135 currencies and local payment methods in 47 countries.

- Monthly fee: $0

- Card-not-present processing fee: 2.9% + 30 cents per transaction

- Keyed-in processing fee: 3.4% + 30 cents per transaction (for first-time recurring payments and card-on-file)

- ACH debit payments: 0.8% capped at $5

- Recurring payments service fee: +0.5%-0.8% per transaction

- Invoicing: +0.4%-0.5% per transaction

- Chargeback fee: $15

- Payments accepted: Credit and debit cards, e-wallet, ACH, e-check, and over 135 currencies

- Flexible billing logic: Charge per seat, metered pricing based on use, multiple membership options, pricing tiers, flat rate, and flat rate plus overage charges

- Automated features: Payment and past-due reminders, card updater for new numbers and expiry dates, retry failed payments, membership renewals, and prorated billing

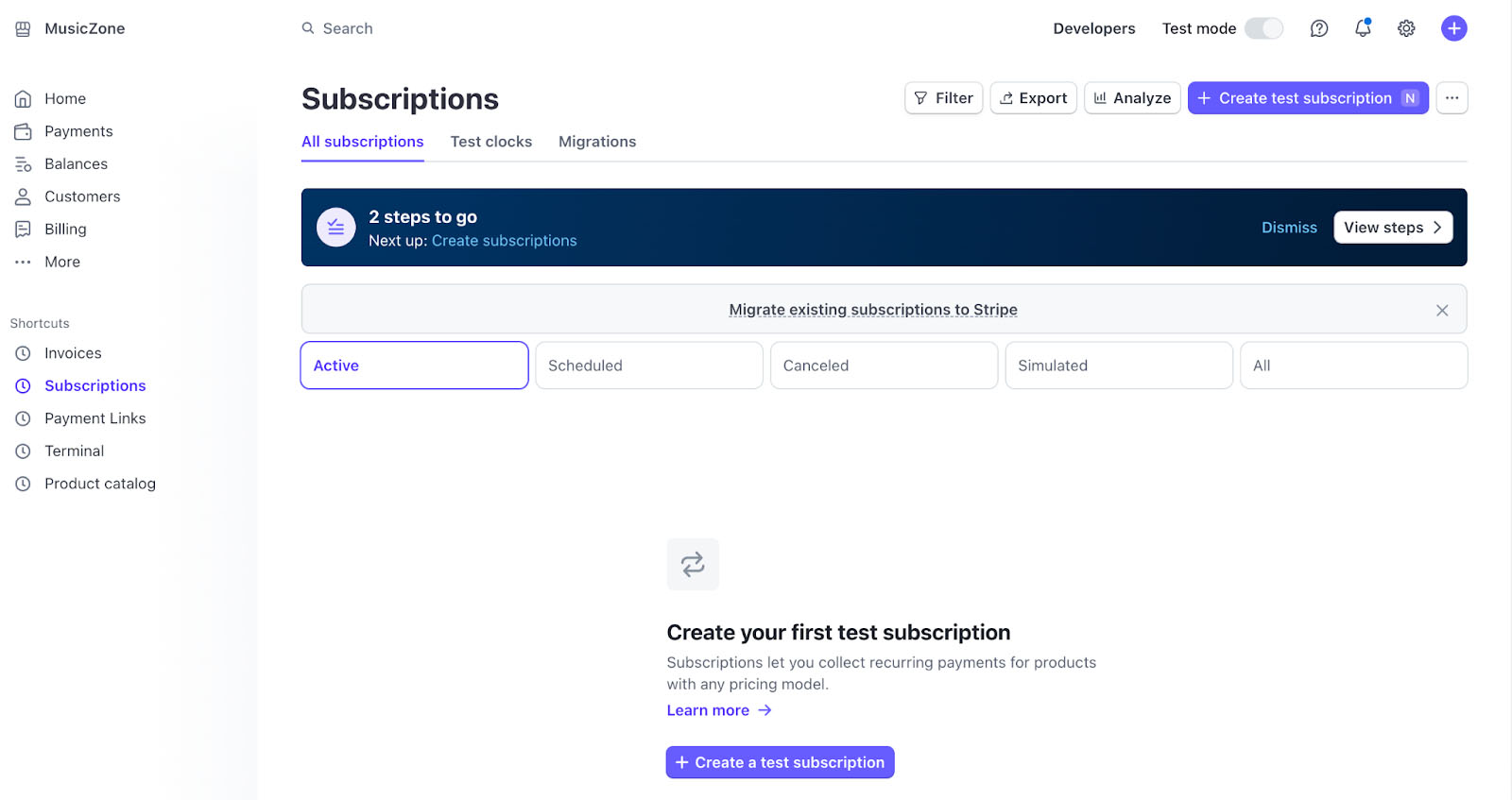

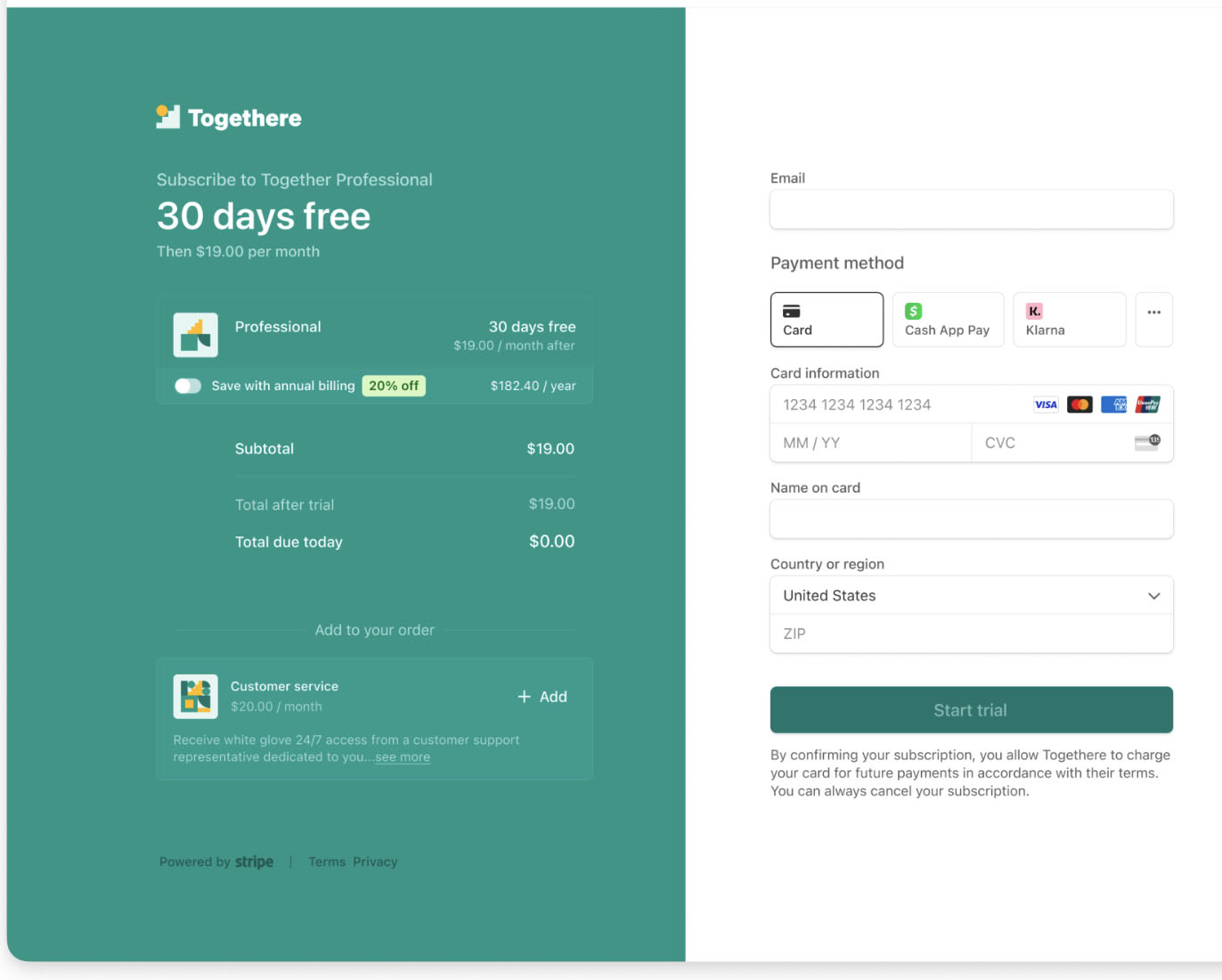

Stripe recurring payments can work with most ecommerce platforms and blog sites. In fact, many online subscription box marketplaces like Cratejoy seamlessly integrate with Stripe as their primary payment solution.

Using Stripe, you can quickly attach subscription payments to most ecommerce platforms using its automated integrations. Or, you can create pop-up membership or subscription forms that you can easily embed in your blog or website pages, and even in emails and online apps.

PayPal: Best for Online Businesses

Pros

- Accept PayPal payments

- Accept partial payments

- Convenient mobile app

Cons

- Monthly fee for subscriptions

- ACH and card-on-file payments only available through Braintree

- Not the best for multichannel businesses

Why I Like PayPal

PayPal is the pioneer in online and digital payment platforms. Like Square, PayPal is easy to set up so you can start accepting payments in minutes. And because it’s app-based, you can create invoices and manage your subscription billing from your mobile device. The interface is easy to use and the subscription management feature lets you track and update your outstanding receivables with simple reporting functions.

- Monthly fees: $0

- Virtual terminal (Payflow) fee to process invoice and recurring payments: $10-$40 per month ($10 plus optional $30 for recurring payment tool)

- Invoicing/Recurring payment processing: 3.49% plus 49 cents per transaction

- ACH processing: 0.75% capped at $5 (with Braintree; read our Braintree review)

- Chargeback fee: $20

- Payments accepted: PayPal payments, PayPal Credit, Venmo, credit and debit cards, e-wallet payments

- Automated features: Sends reminders and payment notifications and automatically retries failed transactions

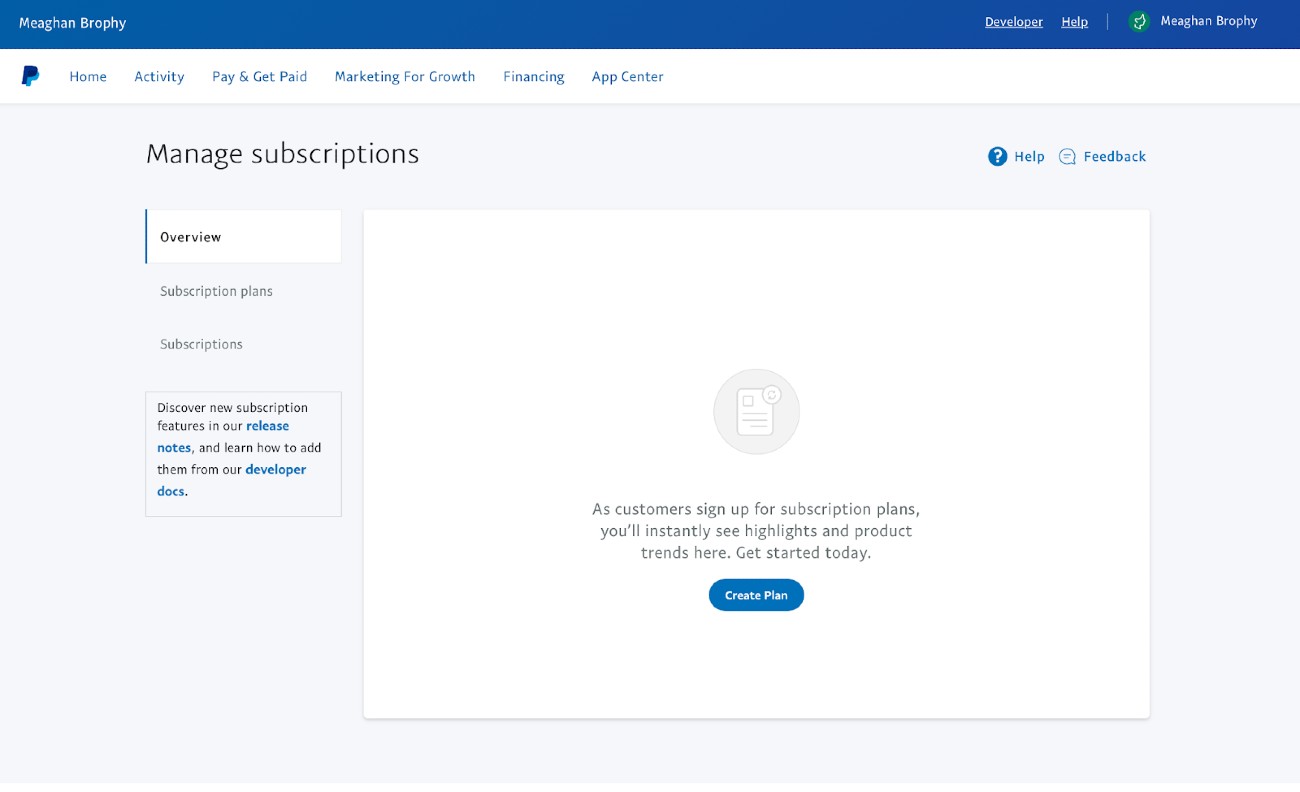

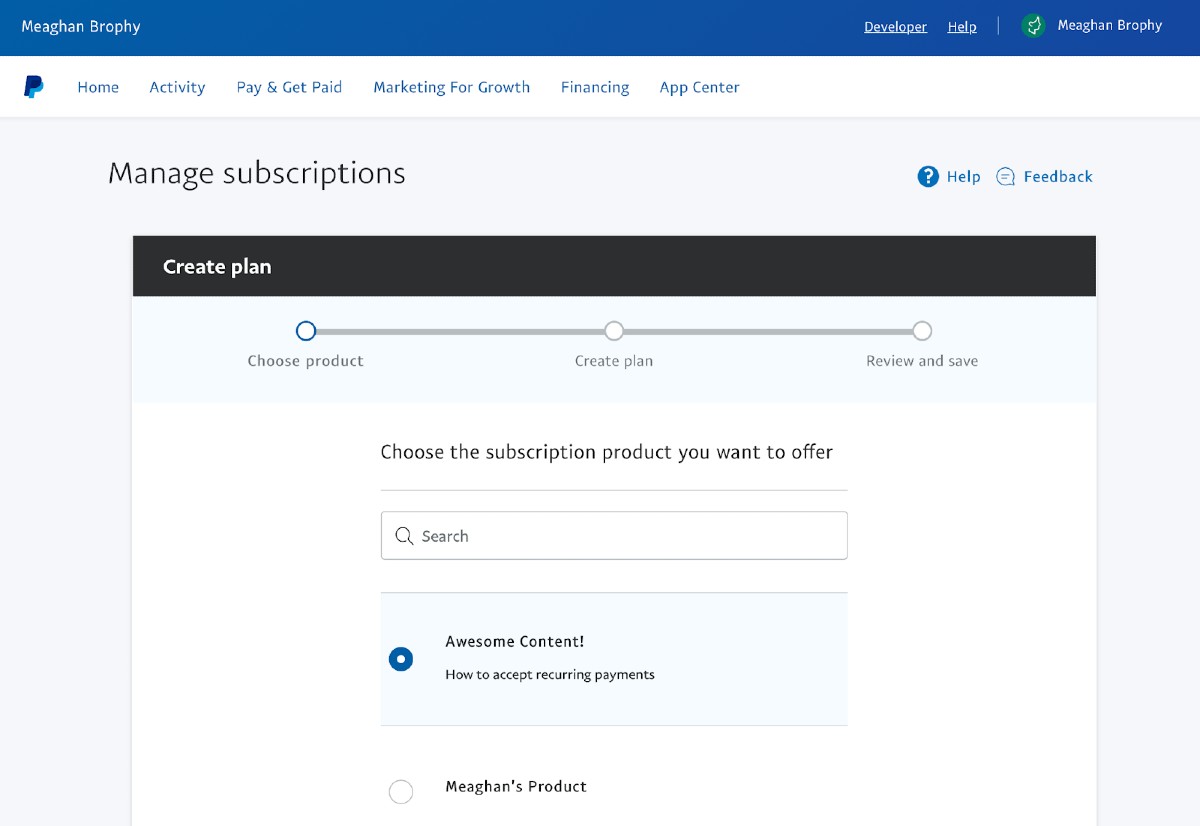

PayPal can accept automatic recurring payments in two ways: invoices and subscriptions. In both setups, the first step to accepting recurring payments is to open a free PayPal business account. PayPal also provides lower fees for nonprofits, which can be helpful for nonprofits setting up a subscription donation program.

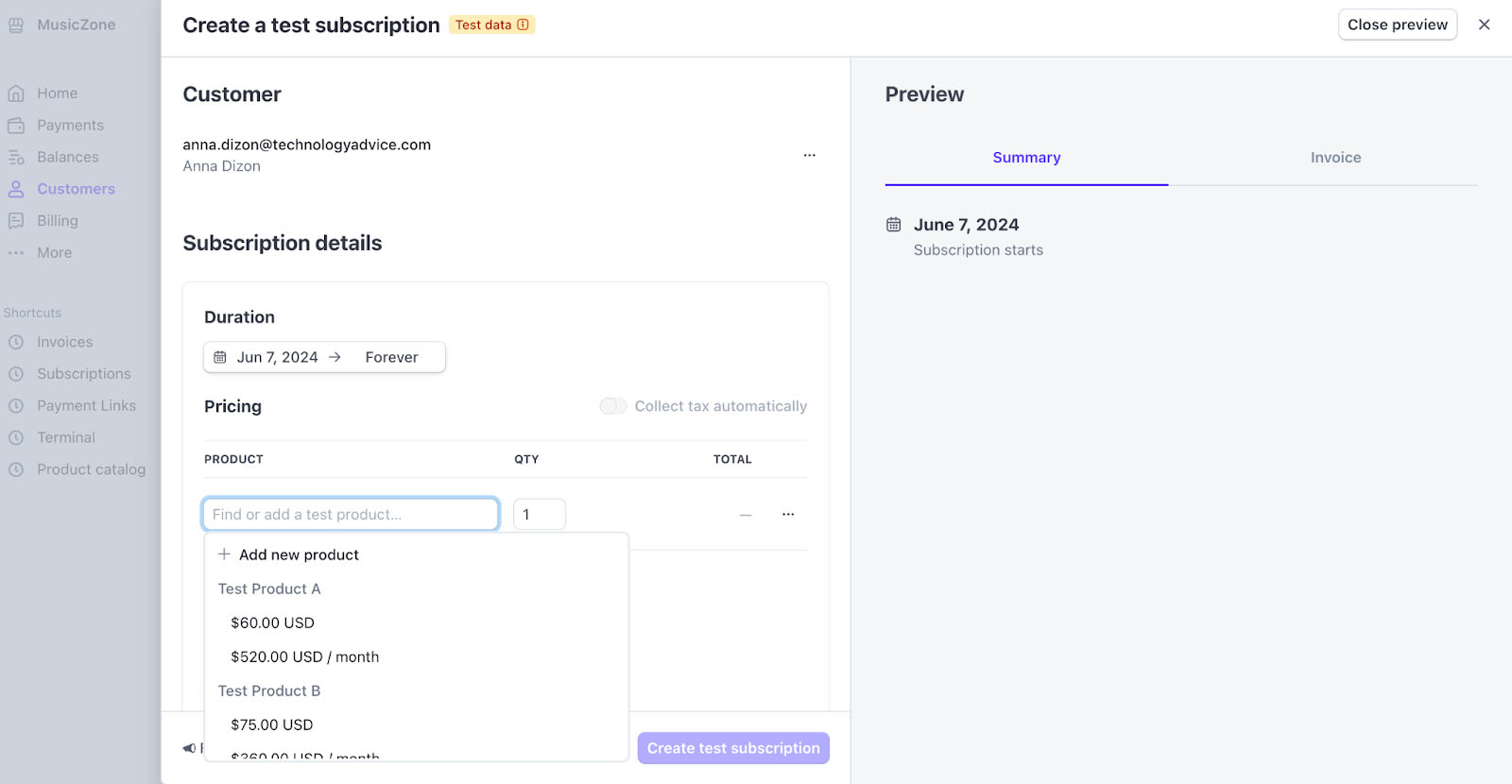

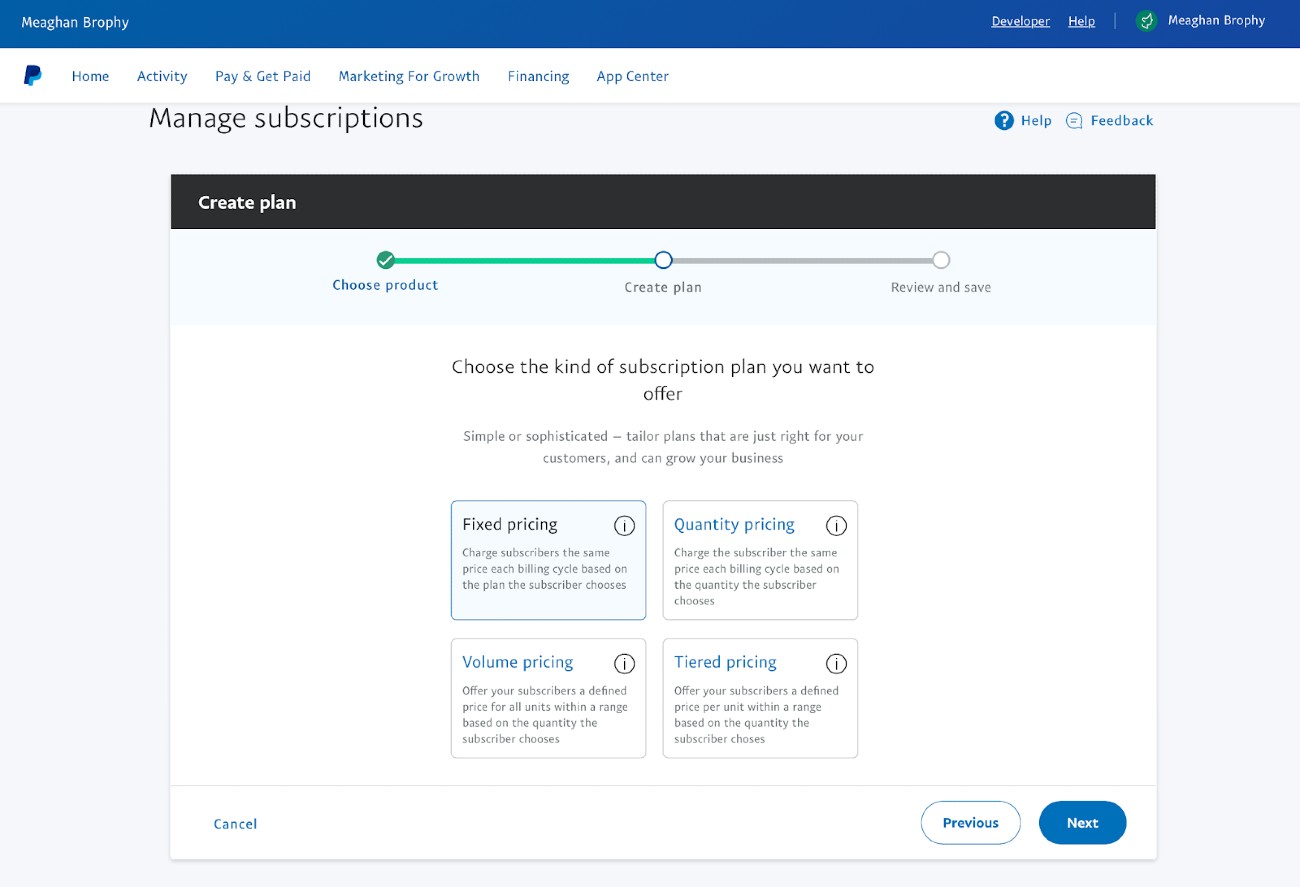

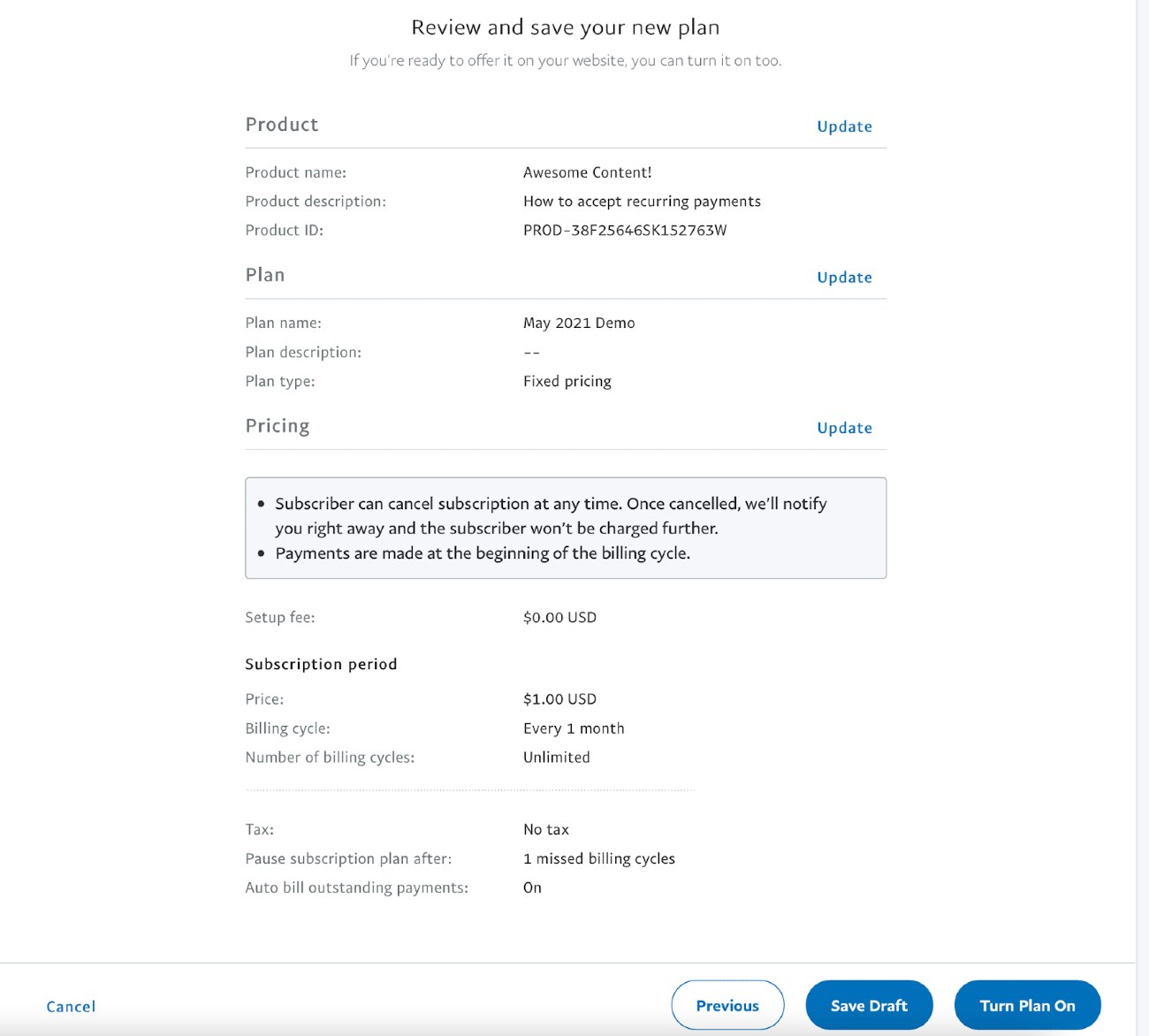

When creating a subscription, you’ll need to enter the type of product or service and choose how you want the subscription billing cycle to work—subscribers can pay the same rate each cycle or a variable rate based on the quantity of a product.

You’ll then create a subscription plan description and set pricing and tax settings. You can also choose to add a setup fee. Then, choose how to bill customers, pick payment frequency, and set free trials. After you’re done setting up the product and pricing information, you can add “Subscribe” buttons to product pages, blog posts, and marketing emails.

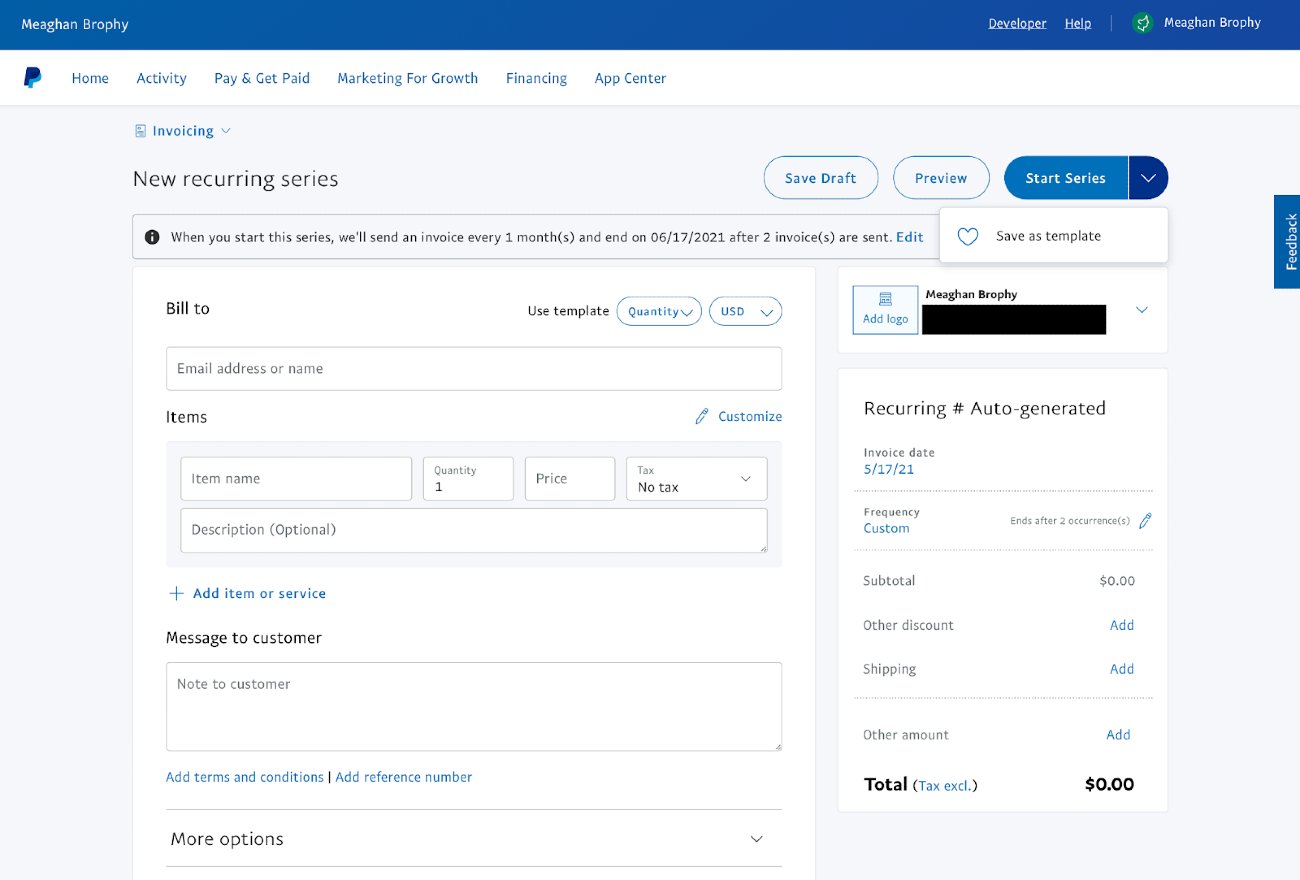

Scroll through the images below for more details:

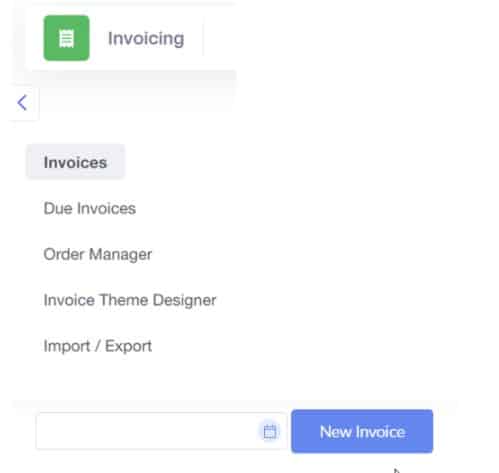

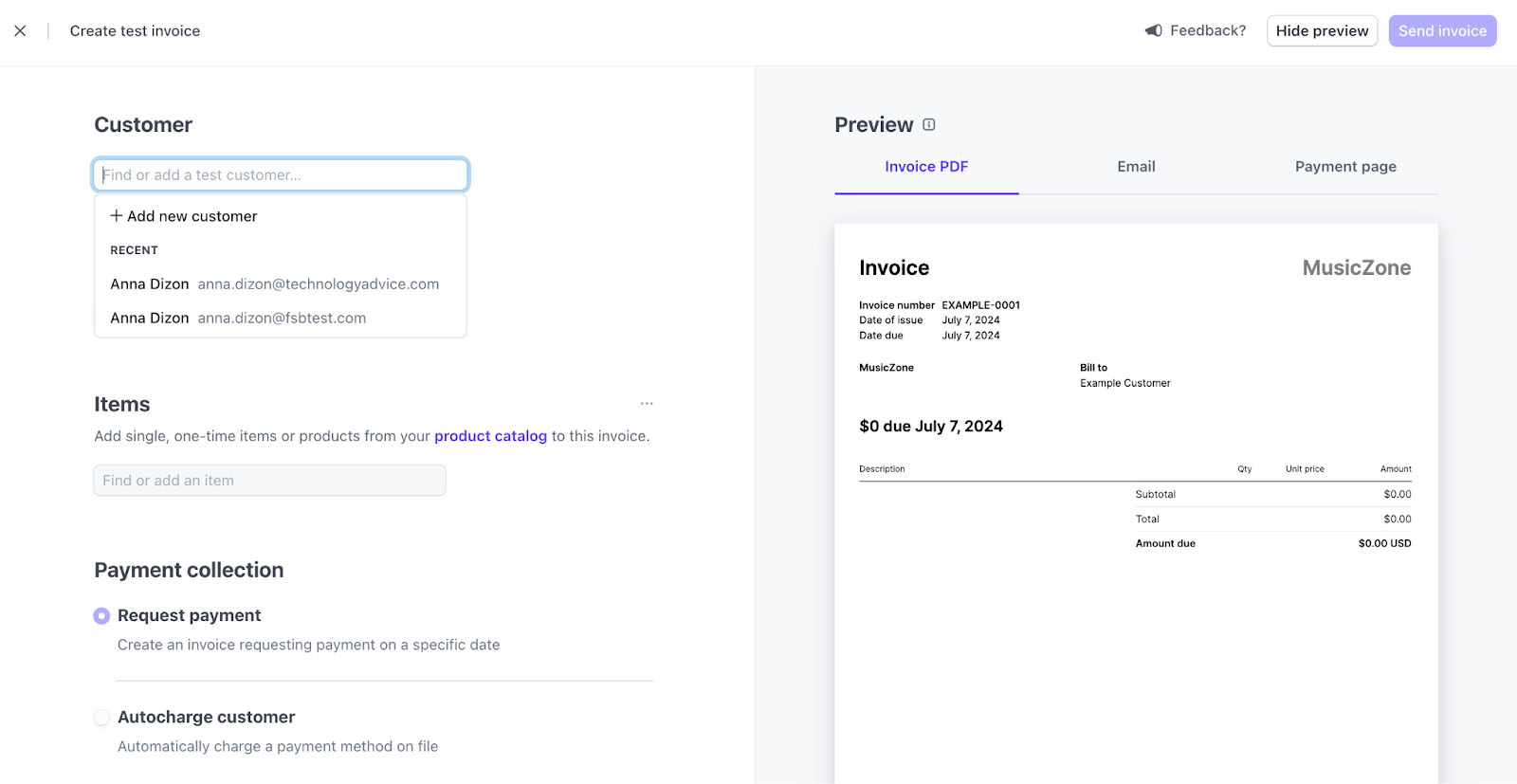

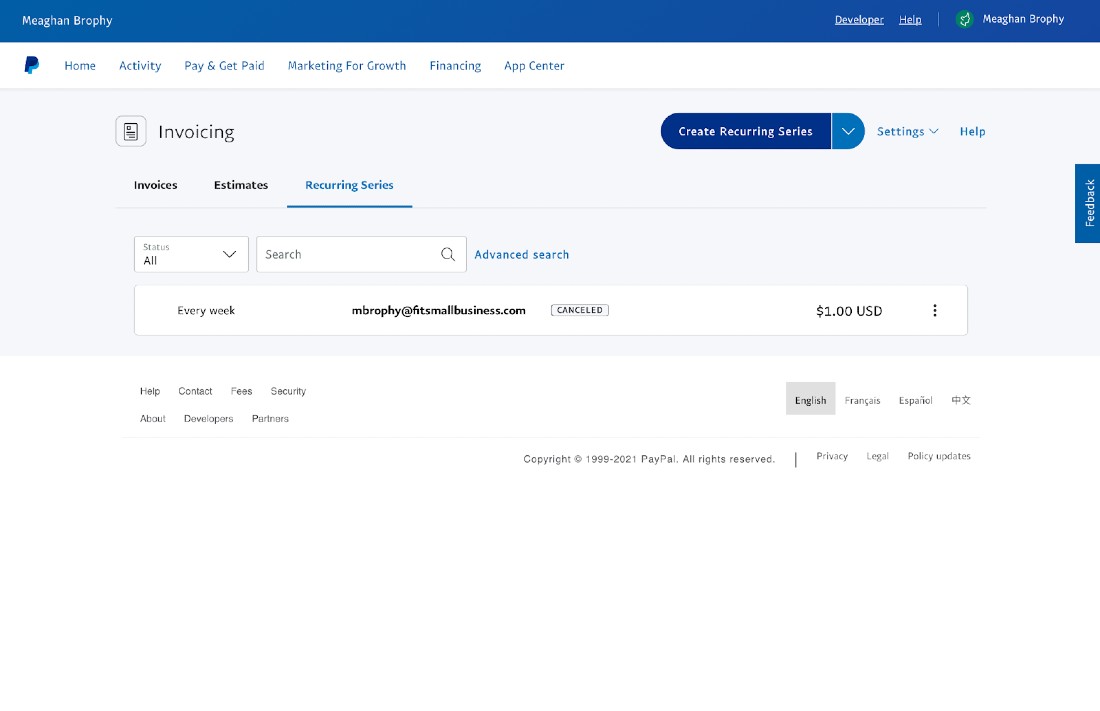

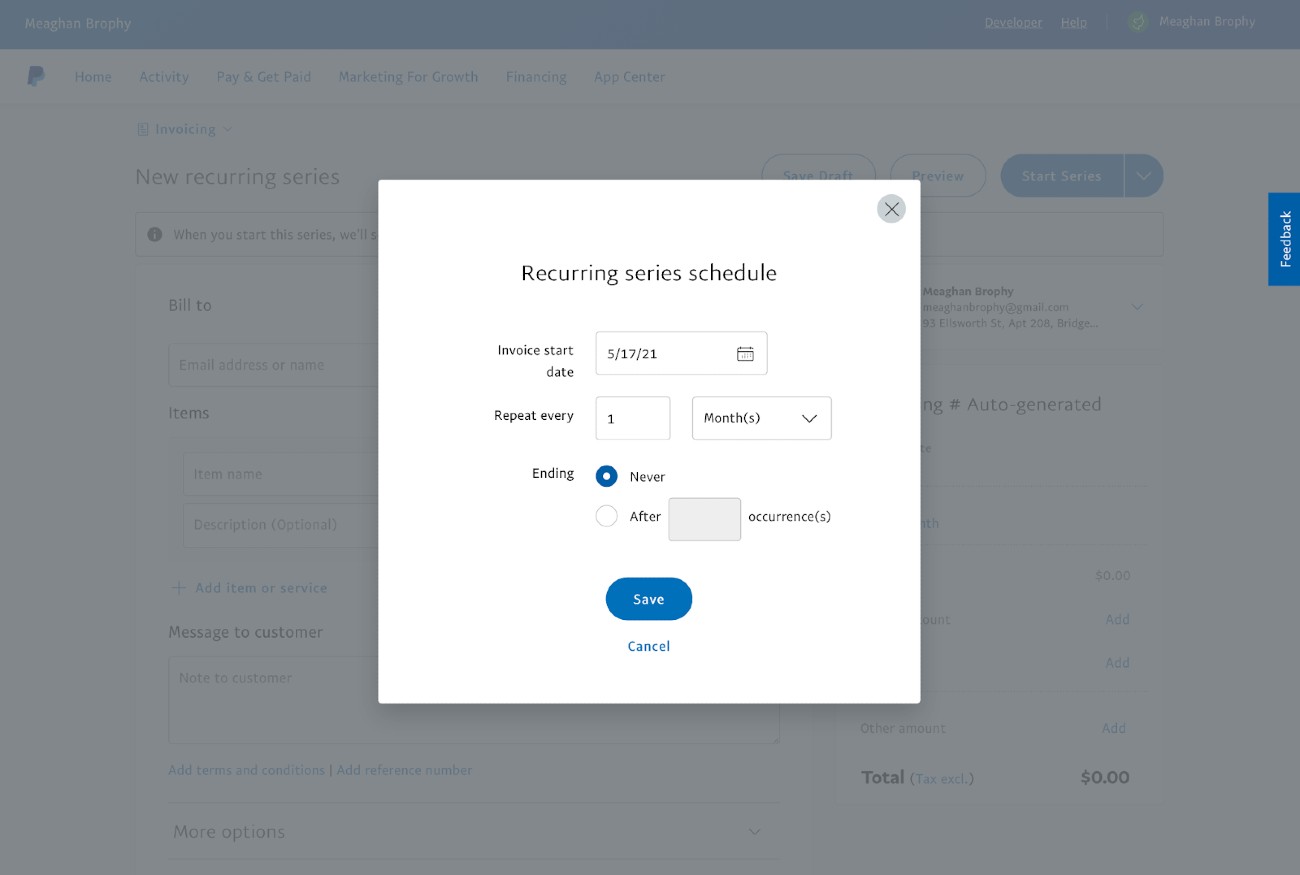

You can create, send, and manage recurring invoices with a PayPal Business account. From the user dashboard, create a new invoice and select a recurring option under the “Frequency” dropdown. You can create and save contacts, products, and services. Plus, you can add your business logo and information for a more professional look.

After adding recipients and products, choose tether to allow partial payments and tips. Add any relevant notes (like shipping or return information) and attach files, such as work orders or estimates.

Creating a Subscription in PayPal

When creating a subscription, you’ll need to enter the type of product or service and choose how you want the subscription billing cycle to work—subscribers can pay the same rate each cycle or a variable rate based on the quantity of a product.

You’ll then create a subscription plan description and set pricing and tax settings. You can also choose to add a setup fee. Then, choose how to bill customers, pick payment frequency, and set free trials. After you’re done setting up the product and pricing information, you can add “Subscribe” buttons to product pages, blog posts, and marketing emails.

Scroll through the images below for more details:

Setting up PayPal Recurring Invoices

You can create, send, and manage recurring invoices with a PayPal Business account. From the user dashboard, create a new invoice and select a recurring option under the “Frequency” dropdown. You can create and save contacts, products, and services. Plus, you can add your business logo and information for a more professional look.

After adding recipients and products, choose tether to allow partial payments and tips. Add any relevant notes (like shipping or return information) and attach files, such as work orders or estimates.

Most online customers regard PayPal as one of the most trusted ways to process online credit card payments. Read our guide on how to accept credit card payments online.

How I Evaluated Recurring Payment Processors

The best recurring payment processor for you will depend on the size of your business, the type of products or services you sell, and whether they require invoicing, subscriptions, memberships, or something in between.

For this guide, I tested each platform and documented the process while also evaluating the system for ease of use. Points were awarded for available payment types, recurring payment tools, and account features like customer support and payout times.

I also compared each provider’s pricing structure (monthly fees, transaction rates, and incidental fees), taking into consideration term and pricing transparency and overall value for money. Real-life user reviews and my personal experience interacting with each provider’s customer support teams are also given major points.

Helcim claimed the lead as the best choice for recurring payments, earning perfect scores for recurring payment features.

How Do Recurring Payments Work?

No matter which processor or invoicing solution you choose to manage recurring payments, the basic steps are the same: customers enroll in a subscription or recurring billing invoice, and you bill them at designated intervals. Ideally, you will save the customer’s payment information on file, so the charges are automated.

How Much Does It Cost to Accept Recurring Payments?

Recurring payment processing fees are typically a small percentage of the transaction total. Each payment provider sets its credit card processing fees; some tack on monthly account fees.

For example, Square charges 3.5% plus 15 cents per recurring payment, so a $100 charge costs $3.65 in fees. With Square, that’s all you’ll pay because Square has no other account fees. In contrast, Stax charges monthly fees for recurring payments—but both providers have lower per-transaction fees for accepting credit card payments.

You’ll also want to consider other payment processing services or perks that these providers offer. Value-added benefits, such as Square’s free business management suite, might be the deciding factor. Read our guide on credit card processing fees.

Costs of Accepting Recurring Payments With Our Recommended Processors

Application | Monthly Account Fees | Monthly Recurring Payments Service Fee | Recurring Payments Transaction Fee | ACH Transaction Fee | |

|---|---|---|---|---|---|

Virtual Terminal | $0 | $0 | Interchange plus 0.15% + 15 cents to 0.50% + 25 cents | 0.5% + 25 cents | |

Square Invoice | $0 | $0–$20 | 3.5% + 15 cents | 1% (minimum $1) | |

Wave platform | $0 | $0 | 2.9% + 60 cents (+ 0.5% for AmEx) | 1% ($1 minimum) | |

| Stax Pay/ Stax Bill | $99–$199 | $0 | Interchange + 18 cents | Not disclosed |

| Invoicing and Recurring Billing | $0 | $0 | 0.8%, $5 cap | |

Payflow | $0 | $10–$40 | 3.49% + 49 cents | 0.75% capped at $5 (Braintree) |

Who Should Use Recurring Payments?

Invoice-based recurring payments are ideal for the following:

- Service providers: Lawn care, house cleaning, personal training, and childcare can process automatic repeat payments via single or batch invoices.

- Monthly tuition or lesson fees: Fitness clubs, music lesson providers, dance studios, and tutoring businesses can run invoices and automated payments on a monthly basis.

- Subscription services or club sales: Wine-of-the-month clubs and store loyalty programs can use recurring payments to automate monthly club sales or fees.

Online recurring payment solutions are ideal for the following:

- Subscription box businesses: Subscription box sellers use online websites and marketplaces to sell subscriptions, then automatically run recurring charges for subscribers before shipping scheduled boxes.

- e-Learning academies: e-Learning businesses make online course content and instruction accessible on an ongoing basis via an online checkout with scheduled recurring payments.

- Membership blogs with restricted content: Informational bloggers can manage access to members-only content using recurring membership payments.

- Online services: Recurring payments are what make all types of online services possible, including software as a service (SaaS), online advertising, gaming products, virtual service providers, and mobile apps.

If you’re selling anything online that auto-renews or requires periodic automatic payments, you’ll need a payment processor that can handle recurring transactions. The easier you make it for customers to pay you, the better.

Benefits of Recurring Payments

There are several benefits to setting up recurring payments for your business:

- Saves time: Instead of manually setting up invoices or calling customers for payment, automatic billing can save hours of your or your employees’ time every billing cycle.

- Offers predictable revenue: Membership and subscription models offer businesses a more stable revenue stream than ad hoc billing, as it’s easier to predict revenue when you know how much customers will pay in advance.

- Improves collection: Automated recurring billing creates an efficient collection process that results in fewer late and missed customer payments. At the same time, it does not require additional manpower to manage collections, which in turn translates to lower operation costs.

- Better allocation of human resources: By automating recurring payments, the cost spent on hiring and paying employees can be reallocated to areas of operation for increasing sales (i.e., customer-facing).

- Increases customer loyalty: Customers look for the convenience of a set-it-and-forget-it payment option, particularly for necessities or services they use consistently and would not want interruption.

Frequently Asked Questions (FAQs)

These are some questions I often encounter about accepting recurring payments.

Recurring payments are automatically repeated transactions, so this payment method is most useful for memberships and subscriptions. Customers authorize the merchant to save their credit card information for future use. Examples of recurring transactions include online learning subscriptions like Coursera and even memberships to charitable organizations like UNICEF.

You can take recurring payments by using a payment processing service that comes with a secure card storage facility and billing management tools. These payment processors will also be able to integrate seamlessly with your online subscription platforms.

ACH payment is one payment method for accepting recurring payments. You can also receive recurring payments via your customer’s credit card.

Yes, look for the recurring payment feature on the Zelle platform to enroll for the payment service.

First, you will need to sign up for your payment processor’s ACH payment processing service. Once this is done, you can add ACH as a payment method option on your billing sign up portal. Customers who choose this option will be prompted to provide their banking information and sign an authorization form.

Bottom Line

Based on our evaluation, I recommend Helcim as the best overall recurring payment processor for most small businesses. Affordability and flexibility are the key reasons Helcim tops our list for the best recurring invoice payment provider.

There are very few traditional merchant account service providers in the industry, and Helcim’s free account includes card-on-file payments, invoicing software with automation tools, a sleek customer portal, and a mobile app to accept payments online or in person.