Learning how to do payroll in Delaware is fairly straightforward because most of its laws follow federal guidelines. Take note that there is a progressive income tax, no reciprocity with neighboring states, and an increasing minimum wage. Also, make sure you pay close attention to leave laws so you’re compliant with Delaware’s changing requirements.

Key Takeaways:

- The current Delaware minimum wage is $13.25 per hour, set to increase to $15.00 on Jan. 1, 2025

- Delaware has enacted a paid leave law which begins providing benefits Jan. 1, 2026

- Wilmington levies local income tax—a flat rate of 1.25%

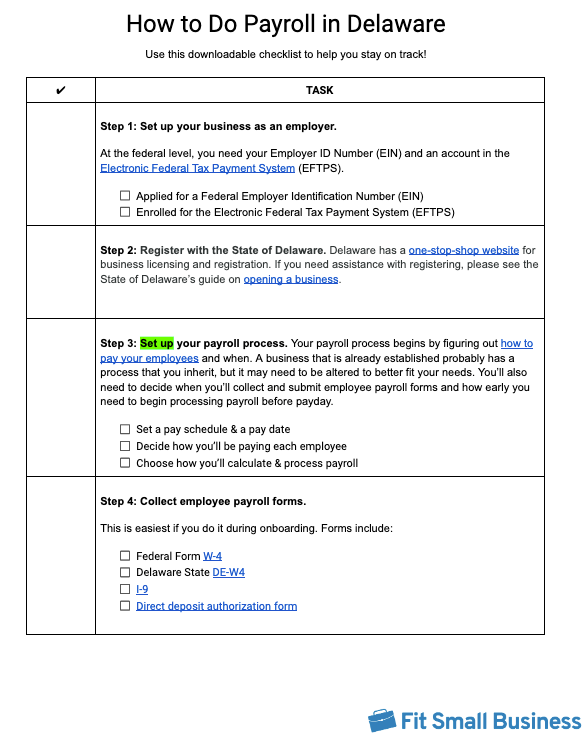

Running Payroll in Delaware—Step-by-Step Instructions

At the federal level, you need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Delaware has a one-stop-shop website for business licensing and registration. The website allows you to register a new business or location, open or close business licenses, report hiring, register a tax withholding account, view your accounts, and more. If you need assistance registering your business, please see the State of Delaware’s guide on opening a business.

You will need to set up payroll, set a pay schedule, decide on how to pay employees, and how you will process taxes and deductions.

The best time to collect payroll forms is during the new hire process. Payroll forms to collect include the W-4 form, I-9 form, and direct deposit information. Delaware requires you to submit form DE-W4 as well.

If you employ hourly or nonexempt employees (learn the definitions of exempt vs nonexempt employees in our guide), you’ll need to track their work time. You have three options that you can use:

- A paper time sheet (Use one of our free time sheet templates);

- Free or low-cost time and attendance software, such as those in our guide to the best time and attendance software; or

- A payroll service that has a time and attendance system—check our best payroll services guide for some options.

You can process payroll yourself, use an Excel payroll template to help with calculations, or select a payroll service. Each option comes with benefits and drawbacks. Normally, you have the option to pay employees in a number of ways, including by cash, check, direct deposit, or pay cards. Federal taxes should be paid through the EFTPS.

Federal law requires you to keep payroll records for all employees for at least three years or payroll tax records for four years, including those who are no longer with your company. If you need help with which records to keep, please see our article on retaining payroll records.

Delaware requires employers that have more than three workers to maintain records relating to hours and wages for at least three years. In addition, upon hiring, you must let each employee know in writing about their pay rate, pay date, and the location of payment.

The IRS has forms and instructions on filing federal taxes, including unemployment. You can also order official tax forms from the IRS. For state taxes in Delaware, you remit your taxes on the following schedules: Eighth-monthly (eight times in a month), monthly, or quarterly.

Your withholding schedule is based on your average withholding amount over the previous year’s lookback period. For 2024, this period is from July 1, 2022, to June 30, 2023. New employers should remit quarterly until their lookback period has been established.

Classification | Withholding Amount |

|---|---|

Eighth-Monthly | If your company pays more than $25,410 over a 12-month lookback period |

Monthly | If your company pays more than $4,570 but no more than $25,410 over a 12-month lookback period |

Quarterly | If your company pays less than $4,570 over a 12-month lookback period |

The federal forms required include the W-2 forms (for employees) and 1099 forms (for contractors). These forms should be given to employees and contractors by Jan. 31 of the following year. State W-2s are also required for Delaware and these forms are due by Jan. 31 as well, including the Form WTH-REC.

Download our how to do payroll in Delaware checklist to make sure you don’t miss a single step.

Delaware Payroll Taxes, Laws & Regulations

Delaware has a few payroll rules that differ from federal regulations. It has a progressive state income tax. One city, Wilmington, has a local tax which is a flat tax. The state also has requirements relating to unemployment insurance, workers’ compensation, minimum pay frequency, and final paycheck laws.

Federal law requires you to pay income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. Called FICA taxes, Social Security and Medicare are withheld from each employee’s paycheck: Social Security at 6.2% and Medicare at 1.45%. In addition, you must pay a matching employer’s amount out of your bank account. FUTA is an employer-only tax that is 6% on the first $7,000 paid to each employee in that year.

Delaware Taxes

Like most states, Delaware has certain taxes that companies must pay or withhold, including local income taxes for residents of Wilmington.

State Income Taxes

Delaware has a progressive income tax that taxes an employee’s income at a higher rate as their income goes up, which is similar to the federal income tax guidelines but with a couple of differences. At $60,000, Delaware has a much smaller income cap than the federal cap of $518,401; it has the same brackets for each filing status.

Delaware Taxable Income | Tax Rate |

|---|---|

$0–$2,000 | 0% |

$2,000–$5,000 | 2.2% |

$5,000–$10,000 | 3.9% + $66 |

$10,000–$20,000 | 4.8% + $261 |

$20,000–$25,000 | 5.2% + $741 |

$25,000–$60,000 | 5.55% + $1,001 |

$60,000+ | 6.6% + $2,943.50 |

Source: Delaware Division of Revenue

Local Income Taxes

The most populous city in Delaware, Wilmington, has a local income tax. It is a flat rate of 1.25% for both residents and non-residents. It is the only location in Delaware that has a local income tax, though any municipality in Delaware with over 50,000 residents can implement a local income tax.

State Unemployment Tax

Delaware’s state unemployment tax (SUTA) rate is 1.2% for new employers. For established employers, the rate is based on your taxable payroll, how many of your former employees applied for unemployment benefits and the state unemployment fund balance. In 2024, the rate can be anywhere between 0.3% and 5.4%. The percentages for both new and experienced employers are on the first $10,500 of taxable income per employee.

Note: When you pay SUTA in full and on time, you may qualify for a reduction on your FUTA taxes. This can decrease your FUTA tax from 6% to 0.6%.

Workers’ Compensation

You are required to provide workers’ compensation in Delaware unless you work in agriculture. Delaware is also a no-fault state, so workers’ compensation claims can be covered regardless of the cause of the workplace injury.

The cost of workers’ compensation insurance is around $1.29 for each $100 payroll you processed. For example, a company that processes $500,000 of payroll can expect to pay around $6,450 in insurance.

Minimum Wage and Tips

Most jobs will require you to pay at least minimum wage. Delaware’s current minimum wage is $13.25 per hour, set to rise to $15.00 per hour in 2025 on the below schedule.

Year | Minimum Wage |

|---|---|

2024 | $13.25 |

2025 | $15.00 |

For tipped employees, employers may pay a cash wage of $2.23 per hour, provided that their tips ensure that the employee’s take-home pay is at least the minimum wage, which at the time of this writing is $13.25 per hour.

There are some exceptions to the minimum wage rule. This includes employees who work in domestic service, agriculture, and the federal government, as well as actual executives and administrators.

Overtime

Delaware does not have any separate laws regarding overtime and follows federal guidelines. You’ll need to pay 1.5 times the regular hourly rate for any hours your employees work over 40 in a workweek.

Different Ways to Pay Employees

In Delaware, you are able to give employees a few payment options. These options include check, cash, pay cards, or direct deposit. You are required to provide employees the option of being paid by check or by cash. You can pay via direct deposit if the employee provides written consent.

How Often You Must Pay Employees

To comply with Delaware rules, you must pay employees at least monthly and no more than seven days from the close of each pay period. Federal law requires you to maintain consistency with whichever period you choose. You should also communicate your pay frequency to employees upon hire and notify them whenever changes arise.

Pay Stub Laws

You must provide a statement of your employee’s earnings, withholdings, and hours worked in Delaware. This statement can be written or electronic, as long as the employee is able to save it for their own records. If the record is provided online, the employee must be able to receive a written statement upon request.

If you’d like to produce your own pay statements, then you can download one of our free pay stub templates. They’re already formatted, so you can print and give these to your employees today.

Paycheck Deduction Rules

Delaware does not allow you to deduct the following and similar items from an employee’s check:

- Shortage of cash

- Lost or damaged possessions of the company

- Equipment, supplies, or uniforms

- Bad checks

However, you are able to deduct these common items from an employee’s check:

- Taxes

- Garnishments and levies

- Benefits

- Reimbursements

Final Paycheck Laws

Delaware requires you to pay all final wages by the next scheduled payday regardless of whether the employee voluntarily left their position or was fired. We recommend paying as soon as possible to ensure you don’t face any litigation.

If you find yourself needing to print a final check for a former employee, you can use one of our suggested free ways to print payroll checks online.

Delaware HR Laws That Affect Payroll

Delaware does not have many state-specific HR laws that you have to be aware of. You don’t have to provide employees with any leave, with the exception of family leave. It also does not require employers to purchase disability insurance. However, it requires breaks and has stricter rules than the federal government concerning employment of minors.

Delaware New Hire Reporting

Delaware requires that you report new hires within 20 days of the hire date. This includes rehires and return-to-work employees. You can report new hires online on the Delaware New Hire reporting website or by mail to the Delaware State Directory of New Hires, P.O. Box 90370, Atlanta, GA 30364. If you decide to report electronically, you must submit the reports at least semimonthly.

Breaks, Lunches & Time-Off Requirements

Delaware only requires daily breaks and family leave.

- Breaks and Lunches: Delaware’s law requires that you give a 30-minute break to employees who work at least seven and a half hours consecutively. This break must be given after the first two hours and before the last two hours of an employee shift. For example, an employee working from 9 a.m. – 5 p.m., must have a break between 11 a.m. and 3 p.m.

- Vacation, Sick, and Holiday Leave: Delaware does not have any requirements on vacation, sick, or holiday leave for private employers but if you do provide unpaid or paid leave, you must abide by the policy you set. Public employees are entitled to state holidays.

- Family Leave: Employers are mandated to follow federal law in the Family and Medical Leave Act (FMLA). The law, which allows for 12 weeks of unpaid time off, is for employers that have more than 50 employees for 20 or more weeks in the current or previous year. Employees can take FMLA leave if they have worked at the company for at least a year, with 1,250 hours worked in the previous year, and if their physical work location has 50 or more employees in a 75-mile radius. To learn more about the Family and Medical Leave Act, visit the Department of Labor’s guide to FMLA.

Reminder: Delaware Paid Leave is coming January 1, 2026. This law provides up to 12 weeks of paid leave and benefits to covered employees for reasons, e.g., caregiving, parental duties, medical, etc. It will provide up to 12 weeks of leave and benefits to covered employees for parental, family caregiving and medical reasons, similar to FMLA. Employers and employees will fund the program; you can start withholding contributions from employee paychecks from Jan. 1, 2025, and benefits will become available Jan. 1, 2026.

Employers with fewer than 10 employees will not have to comply with this new law. Also, if you currently offer paid leave to your employees, you can apply to opt out of the Delaware paid leave program by Dec 1, 2024. Employers with 10 to 24 employees need only comply with the parental leave portion of the law. Employers with 25 or more employees will need to comply with the entire law.

- Jury Duty: You are required to provide employees with time off if they’re summoned to jury duty. If they’re hourly workers, you don’t have to pay them; however, you must keep their jobs open and aren’t allowed to threaten or coerce them into not participating. Consequences for violating this can be a lawsuit for lost wages and a fine of up to $500.

- Voting Leave: You’re not required to provide employees with time off to vote. They can use their vacation or other PTO if available.

- Bereavement Leave: You’re not required to provide bereavement leave unless you have a policy that outright states you will provide it. And in that case, you’d need to follow it accordingly.

State Disability Insurance

There is no state disability program in Delaware, and the state does not mandate companies to purchase disability insurance. However, it is a good idea to have, both for yourself and your employees.

Child Labor Laws

In Delaware, you are required to have and keep a work permit for all employed minors under 18. Depending on the youth’s age, Delaware also restricts work hours. The restrictions are the following:

Minors who are 14- and 15 years old:

- From Labor Day to June 1, minors can work between the hours of 7 a.m. and 7 p.m.

- During the summer (from June 1 to Labor Day), minors can work between the hours of 7 a.m. and 9 p.m.

- Cannot work more than four hours on school days and more than eight hours on non-school days

- Cannot work more than 18 hours in a week when school is in session for the full week and cannot work more than 40 hours when school is out of session

- Cannot work more than six days in a week

- Are required to have a 30-minute break if they work more than five hours straight

- Cannot work in a profession that is not described in the Delaware’s Child Labor Law Booklet; some of these professions include grocery store shelver, tutor, and office clerk

Minors who are 16- and 17 years old:

- Cannot work more than 12 combined hours of school and work in a day

- Must have eight straight hours in a day that is not at work or school

- Cannot work in a profession that is described as a prohibited job in the Child Labor Law Booklet; some of these jobs include using power tools, mining, and forest fire fighting

- Required to have a 30-minute break if they work more than five hours straight

Check out our guide to hiring minors for insight on federal child labor laws. Keep in mind, though, Delaware’s laws are more restrictive and you must follow the regulations that provide children with the most protection.

Payroll Forms

Listed below are some of the federal and state forms needed to produce accurate pay for employees and compliant payroll reporting and tax remittance for businesses.

Delaware Payroll Forms

- Delaware W-4 Form: To help employers on calculating tax withholding for employees

Federal Payroll Forms

- W-4 Form: Help employers calculate withholding tax for employees

- W-2 Form: Reports total yearly wages earned (one per employee)

- W-3 Form: Reports total yearly wages and taxes for all employees

- Form 940: Reports and calculates unemployment taxes due to the IRS

- Form 941: Report and files quarterly income and FICA tax withholding

- Form 944: Report and files annual income and FICA tax withholding

- 1099 Forms: Provides contractors with pay information and amounts that assist them in tax calculation

Delaware Payroll Tax Resources & Sources

- Delaware One Stop Shop: One consolidated location to find everything you need regarding starting a business, registration, and licensing in the state of Delaware.

- Delaware Department of Revenue: File and pay withholding and corporate taxes.

- Delaware Department of Labor: Find information pertaining to Delaware’s workers’ compensation law as well as a FAQ section allowing employers to connect with qualified potential employees.

- Delaware New Hire Reporting: Complete new hire reporting, access forms, and view FAQs.

To learn more about payroll laws, please see our payroll compliance guide.

Delaware Payroll Frequently Asked Questions (FAQs)

No. However, many states, including Delaware, provide tax credits for taxes paid in other states. So if you have an employee who lives in Maryland but works for your company in Delaware, they may be able to get a credit on their Maryland income taxes for the Delaware withholdings.

If you currently offer paid leave to your employees, you can apply to opt out of the Delaware paid leave program which will begin taking contributions in 2025. Your program must meet certain requirements and you must act fast: you only have until Dec. 1, 2024, to apply.

Yes, upon the request of an employee. You can restrict when and where employees can view their files but you cannot prohibit the employee from taking notes about what’s in their file.

Employees in Delaware must be paid within seven days of the end of the pay period. So even if you pay your employees monthly, you must pay them by the seventh day of the following month.

Bottom Line

Delaware differs from other states by the way it structures state income taxes, its higher minimum wage, workers’ compensation requirements, and its youth employment rules. Be sure to follow deadlines by federal and state governments.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.