Learning how to do payroll in California can be more complex than for most states, as laws and other requirements can change frequently. What’s more, you’ll need to keep an eye out for local requirements that apply in specific cities and counties. Unlike states like Texas and Florida, employees are given a great deal of protection, so it’s vital for employers to understand everything, from minimum wage and overtime requirements to the ins and outs of paid leave.

Key Takeaways:

- California has 40 local minimum wage requirements, plus a higher than average state minimum wage of $16.00 per hour.

- California requires different overtime pay calculations than federal rules, including daily overtime rates.

- California mandates that employers provide paid sick leave and participate in the state’s paid family leave program.

Running Payroll in California: Step-by-Step Instructions

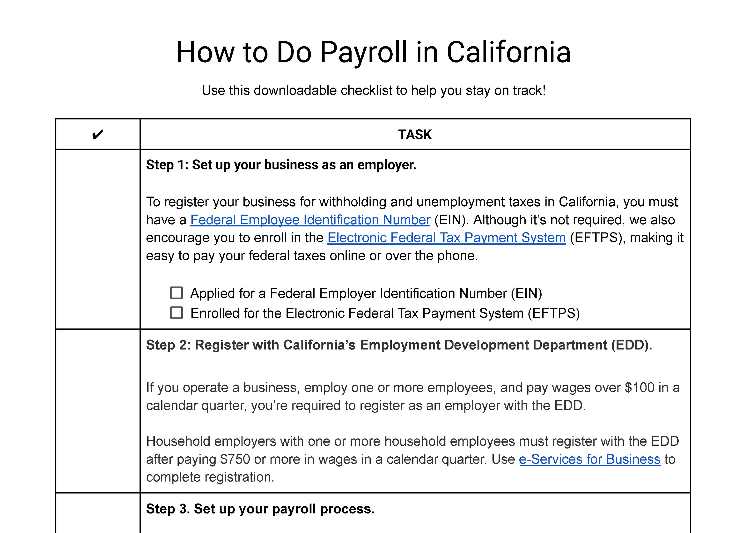

Step 1: Set your business up as an employer. At the federal level, make sure you have an employer ID number (EIN) and an account with the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with California’s Employment Development Department (EDD). If you operate a business, employ one or more employees, and pay wages over $100 in a calendar quarter, you’re required to register as an employer with the EDD. Household employers with one or more household employees must register with the EDD after paying $750 or more in wages in a calendar quarter. Use e-Services for Business to complete registration.

Step 3: Set up your payroll process. Under California law, employees must be paid at least twice during each calendar month, and paydays must be designated in advance. Notice of regular paydays must also be posted, including the day, time, and location/method of payment.

Step 4: Collect employee payroll forms. When onboarding new employees, request the necessary payroll forms, including those specific to California. This should include the Employee’s Withholding Allowance Certificate (DE 4).

Step 5: Collect, review, and approve time sheets. Be sure to collect time sheets with enough time to review and approve them before paychecks are due under state law.

Step 6: Calculate payroll and pay employees. California payday law states that wages earned between the first and 15th day of the calendar month must be paid on or before the 26th day of that month. Work performed between the 16th and last day of the month must be paid by the 10th day of the following month. Depending on your accounting preferences, use payroll software, a calculator, or even Excel to calculate payroll.

Step 7: File payroll taxes with the federal and state government. All state tax payments need to be made directly to the applicable agency based on whatever schedule is assigned to your business. Federal tax payments must be made via EFTPS. Generally, you have to deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned to your business by the IRS. The IRS can assign you to one of the following depositing schedules:

- Monthly Depositor: Requires that you deposit employment taxes on payments made during a month by the 15th day of the following month.

- Semiweekly Depositor: Requires that you deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Deposit taxes for payments made Saturday, Sunday, Monday, and/or Tuesday by the following Friday.

It’s important to note that schedules for depositing and reporting taxes are not the same. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

Step 8: Document and store your payroll records. Keep records for all of your employees, including those who have resigned or were terminated, for at least four years (eight years for exempt employees). Learn more in our resource on retaining payroll records.

Step 9: Complete year-end payroll tax reports. You will need to complete W-2s for all employees and 1099s for all independent contractors. Both employees and contractors must have received these documents by Jan. 31 of the following year.

Download our free checklist to help you stay on track while you’re working through these steps. Also, check out our overall guide on how to do payroll for more general information.

California Payroll Laws, Taxes & Regulations

Generally speaking, California’s payroll laws, taxes, and other regulations are more stringent than federal regulations. The state’s payroll requirements are also more complex than those common in other states like Texas and Florida.

California Payroll Taxes

In addition to FICA and unemployment taxes, California employers must pay for payroll taxes—two of which are withheld directly from employee paychecks. To comply with California’s tax reporting requirements, employers must register with the EDD, set up an account, and make quarterly payments.

In addition to the federal income tax, employees who work in California also pay two state taxes that must be deducted by employers:

- State Disability Insurance (SDI) Tax: SDI provides temporary benefit payments for non-work-related illness, injury, or pregnancy. It also includes Paid Family Leave (PFL) which extends benefits to individuals unable to work because of a seriously ill family member or to bond with a new child.

The SDI Rate and Wage Limit for 2024 are as follows:

State Disability Insurance (SDI) Withholding Rate | 1.1% |

Taxable Wage Limit (Per Year) | No cap |

- California Personal Income Tax (PIT): PIT is a tax on the income of California residents and on income of nonresidents that is earned within the state of California. California PIT is used to provide the state with public services such as schools, public parks, roads, and health and human services. Similar to other states, personal income tax is based on income and the amount withheld is according to the PIT withholding schedule. There is no taxable wage limit or maximum tax.

California requires employers to pay unemployment insurance tax. The UI program exists to provide temporary relief to people who are unemployed at no fault of their own. The EDD determines a percentage rate for each employer, which it needs to pay on the first $7,000 of wages to each employee annually.

The UI schedule and amount of taxable wages are determined annually, and employers are notified of their new rate each December.

New Employer Rate | 3.4% |

Highest UI Rate | 6.2% |

Certain government and nonprofit employers are given the option to elect a “reimbursable method” of financing UI. In this case, they then reimburse the UI Fund on a dollar-for-dollar basis for all benefits paid to their former employees.

California also requires employers to pay an Employment Training Tax (ETT). This is an employer-funded program that provides funds to train employees in targeted industries to make California businesses more competitive. Its purpose is to promote a healthy labor market and help businesses to invest in a skilled and productive workforce.

The ETT Rate and Wage Limit for 2024 are as follows:

ETT Rate | 0.1% |

Taxable Wage Limit | $7,000 |

Workers’ Compensation Insurance

California Labor Code Section 3700 mandates that all California employers must provide workers’ compensation benefits to their employees as long as the business has one or more employees. California Labor Code Section 3351 defines who is an employee, and therefore who can be covered under a workers’ compensation policy.

Executive officers and directors of corporations must be included in workers’ compensation coverage, unless the corporation is fully owned by the directors and officers. Business owners can obtain coverage from a private insurance company or from a state fund.

California Minimum Wage

California’s minimum wage is much higher than the federal minimum wage and comes with additional eligibility requirements.

2024 California State Minimum Wage Law

On Jan.1, 2024, California’s minimum wage increased to $16.00. It’s important to note that in the past, minimum wage amounts were determined based on the number of employees within an organization, but the new minimum wage rate applies to all employers.

Exempt employees in California must meet certain requirements in order to be exempt from overtime pay. With every minimum wage increase in California, the salary threshold for exempt workers also goes up. For 2024, this amount is $66,560.

Effective April 1, 2024, covered employers must also pay fast food workers a $20.00 minimum wage. Certain businesses, like bakeries, are exempt from this law, as well as restaurant brands operating in grocery stores.

Effective June 1, 2024, healthcare workers at covered healthcare facilities will also see a minimum wage increase. This law is expansive and we highly recommend you seek advice from an HR consultant or employment attorney.

2024 California Local Minimum Wage Law

In addition to California’s statewide minimum wage increase, many cities and counties have enacted their own minimum wage ordinances that exceed state requirements. If a local minimum wage rate is more generous to employees than the state minimum wage rate, employers must comply with the local law.

The following are the most accurate minimum wage rates per jurisdiction:

- Jurisdiction: Alameda

- Jurisdiction Minimum: $16.52

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Belmont

- Jurisdiction Minimum: $17.35

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Berkeley

- Jurisdiction Minimum: $18.07

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Burlingame

- Jurisdiction Minimum: $17.03

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Cupertino

- Jurisdiction Minimum: $17.75

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Daly City

- Jurisdiction Minimum: $16.62

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: East Palo Alto

- Jurisdiction Minimum: $17.00

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: El Cerrito

- Jurisdiction Minimum: $17.92

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Emeryville

- Jurisdiction Minimum: $18.67

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Foster City

- Jurisdiction Minimum: $17.00

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Fremont

- Jurisdiction Minimum: $16.80

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Half Moon Bay

- Jurisdiction Minimum: $17.01

- Wage Date of Most Recent Change: Jan.1, 2024

- Jurisdiction: Hayward

- Jurisdiction Minimum: $16.90 ($16.00 for small employers)

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Los Altos

- Jurisdiction Minimum: $17.75

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Los Angeles

- Jurisdiction Minimum: $16.78

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Los Angeles County (unincorporated)

- Jurisdiction Minimum: $16.90

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Malibu

- Jurisdiction Minimum: $16.90

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Menlo Park

- Jurisdiction Minimum: $16.70

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Milpitas

- Jurisdiction Minimum: $17.20

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Mountain View

- Jurisdiction Minimum: $18.75

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Novato

- Jurisdiction Minimum: $16.60 ($16.04 for small employers and $16.86 for employers with 100 or more employees)

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Oakland

- Jurisdiction Minimum: $16.50

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Palo Alto

- Jurisdiction Minimum: $17.80

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Pasadena

- Jurisdiction Minimum: $16.93

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Petaluma

- Jurisdiction Minimum: $17.45

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Redwood City

- Jurisdiction Minimum: $17.70

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Richmond

- Jurisdiction Minimum: $17.20

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: San Carlos

- Jurisdiction Minimum: $16.87

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: San Diego

- Jurisdiction Minimum: $16.85

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: San Francisco

- Jurisdiction Minimum: $18.07

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: San Jose

- Jurisdiction Minimum: $17.55

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: San Mateo

- Jurisdiction Minimum: $17.35

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: San Mateo County (unincorporated)

- Jurisdiction Minimum: $17.06

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Santa Clara

- Jurisdiction Minimum: $17.75

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Santa Monica

- Jurisdiction Minimum: $16.90

- Wage Date of Most Recent Change: July 1, 2023

- Jurisdiction: Santa Rosa

- Jurisdiction Minimum: $17.45

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Sonoma

- Jurisdiction Minimum: $17.60 ($16.56 for small employers)

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: South San Francisco

- Jurisdiction Minimum: $17.25

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: Sunnyvale

- Jurisdiction Minimum: $18.55

- Wage Date of Most Recent Change: Jan. 1, 2024

- Jurisdiction: West Hollywood

- Jurisdiction Minimum: $19.08

- Wage Date of Most Recent Change: July 1, 2023

Calculating Overtime Regulations

Nationwide, overtime is calculated as any hours worked over 40 in a standard workweek, is paid at 1.5 times the employee’s regular hourly rate, and typically affects workers who are nonexempt. California adds to this by requiring employers to pay employees time and half and even double time for hours worked beyond their normal workweek. For more details regarding overtime regulations in California, see the below table:

Time Worked | Overtime Rate |

|---|---|

Over eight hours in one day | 1.5x |

Over 40 non-consecutive hours in one workweek | 1.5x |

Seventh consecutive day in one workweek | 1.5x |

Over 12 hours in one day | 2x |

Over eight hours on the seventh consecutive workday in one workweek | 2x |

Some California employees are exempt from these requirements and do not receive overtime in accordance with state law.

These exemptions include:

- Outside salespersons

- Employees categorized as executive, administrative, or professional

- Certain unionized employees who are subject to a collective bargaining agreement

To avoid workplace audits, penalties, and fines, it’s important to calculate overtime accurately and classify employees correctly. Some job types, like live-in home healthcare workers, are exempt from overtime in California. That’s why we recommend using payroll software to manage these overtime rules and calculations for you.

Different Ways to Pay Employees in California

While there are many different ways to pay employees, California’s Labor Code specifies that an employer must pay wages by either:

- Cash

- Check payable on demand without discount or fee

- Direct deposit (with employee consent)

- Pay cards (the use of pay cards is allowed in California as long as your employees are made aware of all payment options, and it is their choice to be paid via pay card)

California Pay Stub Laws

California’s Labor Code requires that all employers must provide employees on each payday an itemized statement of earnings and deductions that includes:

- The legal name and address of the employer

- The legal name and Social Security number of the employee (last four digits, only)

- Total gross and net wages earned

- The inclusive dates of the period for which the employee is paid

- All applicable hourly rates in effect during the pay period

- Total hours worked by the employee, except for any employee whose compensation is solely based on a salary and who is exempt from payment of overtime

- All deductions, provided that all deductions made on written orders of the employee may be aggregated and shown as one item

Minimum Pay Frequency

California requires that most employers pay their employees at least twice a month on the days designated in advance as regular paydays. Employers must establish a regular payday and are required to post a notice that notifies all employees of that payday.

Wages earned between the first and 15th days of any calendar month must be paid no later than the 26th day of the month. Wages earned between the 16th and last day of the month must be paid by the 10th day of the following month. Other payroll periods—such as weekly, biweekly, or semimonthly when the earning period is something other than between the first and 15th and 16th and last day of the month—must be paid within seven calendar days of the end of the payroll period within which the wages were earned.

Employers may pay executive, administrative, or professional employees under the Fair Labor Standards Act once per month on or before the 26th day of the month.

Final Paycheck Laws in California

California Labor Code 202 dictates when employees need to receive their final paycheck based on the situation surrounding their termination/discharge.

The following mandates are in place for employees in the state of California:

Reason for Termination: | Final Paycheck Due: |

|---|---|

Employees who are fired, discharged, or terminated | At the time of termination unless an exception applies |

Employees who quit or resign | With 72 hours notice—at the time of quitting Less than 72 hours notice—within 72 hours after the time of quitting Payment must be made by mail to any such employee who so requests and designates a mailing address |

Employees who are suspended or resign due to a labor dispute (strike) | By the next regular payday |

Employees who are laid off | Within 72 hours after layoff; Payment must be made by mail to any such employee who so requests and designates a mailing address |

Severance Pay in California

As a California employer, you don’t have to provide your employees with severance pay if they are terminated or voluntarily leave. California law will only enforce that you pay severance payments to your employees if there is a signed written agreement in place between an organization and an employee.

Accrued Paid Time Off Payouts

Currently, there is no legal requirement for California employers to provide employees with any vacation time (whether that be paid or unpaid). However, if an employer does have an established policy in place, there are certain restrictions that they have to follow to be in compliance. Vacation pay is accrued as it is earned and cannot be forfeited for any reason.

Unless otherwise stated in a collective bargaining agreement, all earned and unused vacation must be paid to an employee at their regular rate of pay upon termination. The reason for termination does not impact this policy. Whether an employee quits voluntarily or is terminated, they are still entitled to pay out for all unused vacation.

California HR Laws That Affect Payroll

California has many HR laws in place that are focused on protecting employees. It’s important that you are aware of what they are and how they need to be followed. Make sure to pay special attention to required breaks and regulations around hiring minors.

California New Hire Reporting

New hire reporting is required in California to establish wage withholding for child support payments and to locate parents who fail to make on-time payments. The information is also sent to the National Directory of New Hires to assist in the location of debtors in other states.

Report of New Employee(s) (DE 34)

Using the DE 34 form, California employers must report all new employees and rehires to the New Employee Registry within 20 days of the first day they performed services for wages—their start-of-work date. A rehire is someone who formerly worked for the employer and was separated from that employer for at least 60 consecutive days before returning to employment.

Report of Independent Contractor(s) (DE 542)

Employers that are required to file a federal Form 1099-NEC, must also report that information to the EDD. Employers must submit a DE 542 to the EDD within 20 days of hiring an independent contractor if all of the following apply:

- You are required to file a Form 1099-NEC for the services performed by the independent contractor

- You pay the independent contractor $600 or more or enter into a contract for $600 or more

- The independent contractor is an individual or sole proprietorship

If you have independent contractors, visit the EDD’s Independent Contractor Reporting page for more details on the requirements.

Rest & Lunch Breaks in California

California’s requirements differ from federal rest and lunch break guidelines, which don’t require breaks at all. In California, employers must provide an employee a 10-minute paid rest break for every four hours worked. These breaks should be scheduled in the middle of the four-hour stretch. In contrast, off-duty meal breaks are unpaid.

Employers must provide one 30-minute meal break for every five hours an employee works. Unless the employee is relieved of all duty during the 30-minute meal period, the meal period shall be considered an on-duty meal and must be paid at the regular pay rate.

Employees who work more than 10 hours a day are entitled to a second meal break. Meal breaks can be waived by the employee if certain conditions are met.

To manage breaks in California, we highly recommend using time and attendance software that can be pre-programmed with the state’s rules. This can help employees log their rest and lunch breaks correctly, while streamlining payroll calculations and ensuring you have the necessary documentation for tax and audit purposes.

California Paid Time Off

Paid time off (PTO) isn’t required at the federal level, nor are California employers required to provide paid vacation or paid time off to employees. However, California law does restrict PTO in other ways:

- Accrued vacation time never expires. To protect an employee’s right to paid time off, California does not allow “use it or lose it” PTO policies. That said, employers can cap vacation benefits and place restrictions on notice requirements for employees who want to use vacation days.

- Earned vacation time is equivalent to wages. If an employee who has earned PTO is terminated, they must receive payment for that unused vacation time in their final paycheck. Payment must include a full day’s wages or the salary equivalent for each day of unused PTO.

- PTO cannot be retracted as punishment. Once an employee earns PTO, it is treated as wages and, therefore, cannot be taken away. However, employers can count partial-day absences against PTO, including for long lunches, half-day vacations, and personal errands.

Leave Requirements in California

Under the federal Family and Medical Leave Act, employers with 50 or more employees must provide eligible employees up to 12 weeks of unpaid leave each year for applicable reasons:

- Birth and care of an employee’s newborn child

- Placement of a child with the employee for adoption or foster care

- Care of an immediate family member with a serious health condition

- Medical leave when the employee is unable to work due to a serious health condition

In addition to those requirements, California’s paid family leave laws apply to employees who need to care for a seriously ill family member or bond with a new child, whether through birth, adoption, or foster care placement.

Employees are entitled to eight weeks of paid leave at a rate of 60% to 70% of their wages. Pregnant and new moms can also receive up to four weeks of disability insurance benefits before their due dates, and six or eight weeks of benefits after childbirth.

Paid Sick Leave

California is also one of the states that requires employers to provide paid sick leave to their employees. In California, employees:

- Accrue a minimum of one hour of paid sick leave for every 30 hours worked

- Accrue paid sick leave based on a 40-hour workweek if they are exempt from overtime requirements

- Can start using accrued paid sick leave on their 90th day of employment

- Determine how much paid sick leave they need to use, but use is subject to reasonable minimum increments (up to two hours) set by the employer

Reproductive Loss

A new California law requires employers with at least five employees to provide up to five days of unpaid, job-protected leave to employees who have suffered a reproductive loss. To be eligible, employees must have worked for the employer for at least 30 days. Employers may choose to pay employees on reproductive loss leave but are not required to do so.

Child Labor Laws

California defines a minor as any person under the age of 18. This applies to those who attend school, dropouts, and emancipated minors. Except in limited circumstances, minors employed in the state of California must have a permit to work.

Before hiring a minor, employers are responsible for possessing a valid copy of their Permit to Employ and Work. These permits are issued at a minor’s school. During summer months or when school is not in session, the permits are obtained from the superintendent for the district in which the minor resides. Permits issued during the school year expire five days after the beginning of the following school year and must be renewed annually.

The California Department of Industrial Relations published requirements on their website categorized by age and penalties for violating child labor laws. The regulations are as follows:

Ages 16 and 17 Must have completed 7th grade to work while school is in session | Ages 14 and 15 Must have completed 7th grade to work while school is in session | Ages 12 and 13 | |

|---|---|---|---|

School in Session |

|

|

|

School Not in Session |

|

|

|

Spread of Hours |

WEE students, with permission, until 12:30 a.m. on any day |

|

|

Payroll Forms

In addition to federal payroll forms, there are a few specific to California that you’ll need to make sure are filled out correctly and filed on time.

California State Payroll Forms

- Employee’s Withholding Allowance Certificate (DE 4): The DE 4 form is used by employees to calculate the amount of taxes that should be withheld by an employer to meet the state’s tax withholding obligation. Obtain this form from each employee during onboarding to ensure your HR team has all of the necessary data on file.

- Quarterly Contribution Return and Report of Wages and Continuation (DE 9): The CE 9 form helps employers reconcile reported wages and paid taxes for each quarter and makes it easy for the EDD to automatically refund overpayments.

- Quarterly Contribution Return and Report of Wages – Continuation (DE 9C): The DE 9C form lets employers report wages and withholdings for additional employees. If you are a household employer, you may be subject to additional filing requirements.

Where tax payments are due, employers must submit a DE 9 separately with a Payroll Tax Deposit (DE 88/DE 88ALL).

California State Payroll Tax Deposit Forms

The Payroll Tax Deposit (DE 88/DE 88ALL) form is used for reporting and paying Unemployment Insurance (UI), Employment Training Tax (ETT), State Disability Insurance (SDI) withholding, and California Personal Income Tax (PIT) withholding to the EDD. Use e-Services for Business to submit these online.

Employer contributions for UI and ETT are due quarterly based on the dates for the DE 9 and DE 9C, but employers may need to deposit employee wage withholdings for SDI and PIT more frequently. These due dates can be found in IRS Publication 15 (PDF), and a 15% penalty and interest are charged on late payments.

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees; summary form of W2

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Resources and Sources

- State of California EDD – Payroll Taxes: This webpage contains a list of payroll tax resources, including how to enroll in or log in to e-Services for Business, how to get started with state payroll taxes, and payroll tax FAQs.

- State of California EDD – Required Filings and Due Dates: Employers can use this page to stay on top of the necessary filings and due dates for California-specific payroll forms.

- State of California EDD – Payroll Taxes – Forms and Publications: This general repository contains links to employment publications and resources such as the California Employer’s Guide and Household Employer’s Guide.

Agency/Governing Body: | How If Affects Payroll: | Where to Find More Info: |

|---|---|---|

California Labor Code | Covers payment of wages, sick pay, and workers' comp | |

California Payday | Paydays, final wages | |

Department of Fair Employment and Housing | Ensures fair wages paid | |

California Unemployment Disability and Paid Family Leave | Requires you to track leave and pay eligible employees for leave taken | |

California Family Medical Leave | Requires you to track leave eligibility | |

California Payroll Taxes | Specifies taxes and rates | |

Wage Theft Protection Act | Requires you provide employees fair and transparent pay |

Doing Payroll in California Frequently Asked Questions (FAQs)

Visit the California Employment Development Department. Provide your information and expect to receive your account number immediately. You will need this account number to properly remit your payroll taxes.

California’s four main payroll taxes that you need to withhold are:

- State disability insurance

- Personal income tax

- Unemployment insurance

- Employment training tax

Overtime in California is calculated in compliance with federal rules at 1.5 times the employee’s regular rate of pay for every hour worked over 40 hours in a workweek. However, California requires 1.5 times the employee’s regular rate of pay for every hour worked over eight in a single workday, plus double time for work over 12 hours in a single workday.

Yes. When you have workers in any state, you must abide by those state’s laws, even if your company is based elsewhere. This means you may need to provide increased benefits for your California employees. Don’t forget that many cities and counties also have higher minimum wages, so you’ll also need to pay attention to the laws of the specific location where your employees work.

Bottom Line

There are so many factors to consider when doing payroll in California. Employers are required to pay special attention to laws and regulations for specific cities or counties due to the granular laws that affect employment there. California employees are given a great deal of protections, and therefore, it’s vital for employers to understand all the requirements.