Missouri payroll is fairly straightforward as most laws mirror federal regulations. However, you need to pay close attention to taxes since Missouri has a progressive tax and a few cities levy their own taxes.

Key Takeaways:

- Missouri’s minimum wage is currently $12.00 per hour and set to change each year based on cost of living

- Missouri requires tipped workers to make at least 50% of the present minimum wage before tips

- Workers in Kansas City and St. Louis are subject to an additional 1% income tax

Running Payroll in Missouri—Step-by-Step Instructions

Listed below is a guideline with specific information related to the state of Missouri. If you need more general information, then please visit our guide on how to do payroll.

Step 1: Set up your business as an employer. At the federal level, you need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the state of Missouri. At the state level, you need to register with the Missouri Department of Revenue. To do so, you need to complete the Missouri Tax Application. You can fill out the application online at the Missouri Department of Revenue’s website or mail the Missouri tax registration form to Missouri Department of Revenue, P.O. Box 357, Jefferson City, MO 65105-0357.

Step 3. Set up your payroll process. You’ll need to set up payroll and decide a pay schedule, how you’ll pay employees, and how to process taxes and deductions. You can complete payroll yourself, use an Excel payroll template, or select a payroll service. Each option comes with benefits and drawbacks.

Step 4: Collect employee payroll forms. The best time to collect payroll forms is during the new hire process—these include the W-4, I-9, and direct deposit information. Missouri also requires you to submit Form MO W-4.

Step 5: Collect, review, and approve time sheets. If you have hourly or nonexempt employees for whom you need to pay an hourly rate, you’ll need to determine how you’re going to track their work hours. Some options include using:

- Paper time sheets

- Free or low-cost time and attendance software

- Payroll services that include a time and attendance system

Step 6: Calculate employee gross pay and taxes and pay employees. You can decide to pay employees in different ways (e.g., cash, check, direct deposit, pay cards). Federal taxes should be paid through the EFTPS.

Step 7: File payroll taxes with the federal and state governments. The IRS has forms and instructions on filing federal taxes, including unemployment. You may order official tax forms from the IRS.

For Missouri state taxes, you must report withholding tax on either a weekly (quarter-monthly), monthly, quarterly, or annual basis. The filing frequency depends on your withholding amount for existing employers. For new employers, it depends on your estimated withholding. Listed below is a way to determine your filing frequency.

- Weekly (also called quarter-monthly): If you withhold $9,000 or more in at least two months during the previous year, you must file weekly.

- Weekly periods are:

- Days 1 to 7 of the calendar month

- Days 8 to 15 of the calendar month

- Days 16 to 22 of the calendar month

- Day 23 to the last day of the calendar month

- The payment deadlines are no later than three banking days after the seventh, 15th, 22nd, and the last day of the month.

- Weekly periods are:

- Monthly: You should file monthly if you were required to withhold $500 or more for at least two months within the past 12 months. The payment deadlines are due on the same days as the quarterly reports and on the 15th (or the next business day) for all other months.

- Quarterly: You should file quarterly if you withheld at least $100 during at least one quarter of the last four quarters and are not required to file monthly per the statement above. The payment deadlines are the last day of the month in a quarter or on the next business day if the last day of the month falls on a banking holiday or weekend.

- Annually: You should file annually if you withheld less than $100 during the previous four quarters. The payment date is due Jan. 31 of the following year.

Regardless of how often you file, you must complete only one MO-941 form per filing period.

Tip: The Missouri Department of Revenue will assign you a filing period when you become a newly registered employer. If the period that they assign you does not align with the rules listed above, you should contact the department immediately to avoid being penalized in the future.

Step 8: Document and store your payroll records. Missouri requires you to maintain payroll records for three years. These records must contain the employee’s name, address, job description, amount paid on each payroll, pay rate, and daily/weekly hours worked.

It is important to retain records for all employees for several years, including those who are no longer with your company. If you need help with which records to keep, please read our article on retaining payroll records.

Step 9: Do year-end payroll tax reports. The federal forms that are mandated are W-2s (for employees) and 1099s (for contractors). These forms should be provided to employees and contractors by Jan. 31 of the following year. State W-2s are also required for Missouri and must also be provided by Jan. 31.

If you have 250 or more employees, you must file electronically. If you have fewer than 250 employees, you may mail your information to the State of Missouri Taxation Department. For more information on filing, please visit the Missouri Department of Revenue’s website.

Download our free checklist to help you stay on track while you’re working through these steps:

Learn more about doing payroll yourself in our guide on how to do payroll. It even has a free checklist you can download to make sure you don’t miss any steps.

Missouri Payroll Laws, Taxes & Regulations

Federal law requires that you pay income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. Social Security and Medicare (FICA) are withheld from each employee’s paycheck at 6.2% and 1.45%, respectively. As an employer, you also have to pay a matching amount. The FUTA rate is a 6% employer tax that you pay on the first $7,000 paid to each employee in that year.

Missouri Taxes

Missouri has a few items that differ from federal regulations. It has a progressive state income tax that has more brackets than the federal income tax schedule. It also has local income taxes in its two metropolitan cities (St. Louis and Kansas City) and requirements relating to unemployment insurance, workers’ compensation, minimum pay frequency, and final pay stub laws.

State Income Taxes

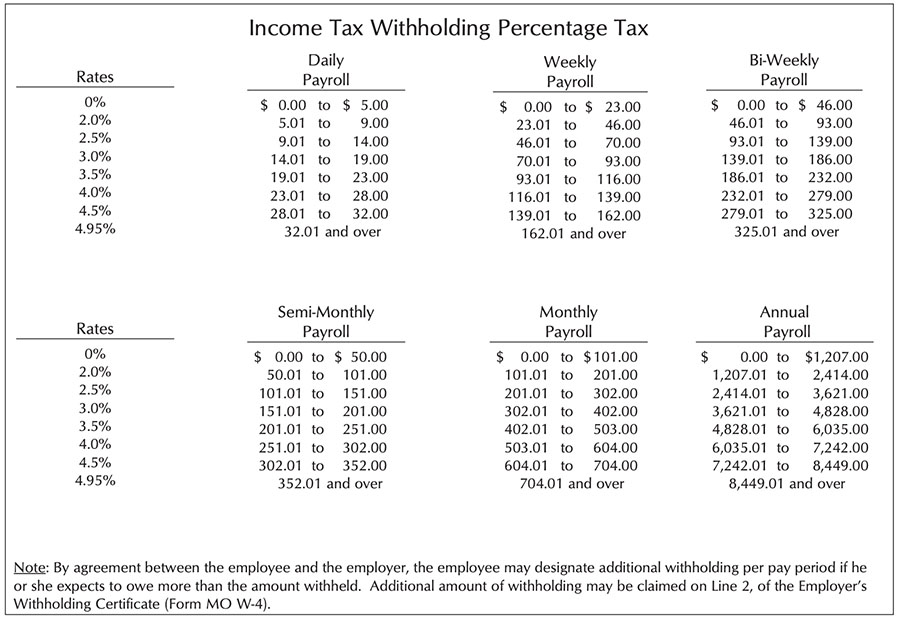

Missouri has a progressive income tax structure. A table listing the brackets and the amounts you’ll need to withhold based on your employees’ income is shown below.

Local Income Taxes

The two largest cities in Missouri (Kansas City and St. Louis) collect local income taxes at a flat rate of 1%, and all their residents have to pay the tax. In addition, non-residents must also pay the tax if they are doing work on providing services in the respective cities, so you’ll need to withhold if you have an office in either area.

State Unemployment Tax

Missouri has two calculations for unemployment rates: one for new companies and one for existing companies.

New companies are defined by being in their first, second, and third years of business. In 2023, the rate for nonprofit 501(c)(3) companies is 1.00% and 2.511% for all others. The current wage base is $10,500.

After your third year of business, the unemployment tax rate is dependent on three factors: taxes paid, unemployment benefits paid, and annual taxable payroll amount. In 2023, the existing employer rate is typically anywhere from 0% and 6%. This does not include these exceptions:

- Maximum Rate Surcharge: An employer can be charged an additional rate if they have been at the maximum experience rate for back-to-back years. This can occur if you have high employee turnover and your employees are applying for unemployment.

- Contribution Rate Adjustment: An increase or decrease in the tax rate can occur due to the changes in the average cash balance in Missouri’s unemployment trust fund.

- Voluntary Payments: Employers can submit a voluntary payment in order to reduce the UI tax rate for the year.

If you participate in the Shared Work Program, which provides an alternative to layoffs, then your rate could be as high as 9%. For more information on unemployment taxes, please visit the Missouri Department of Labor’s website.

Workers’ Compensation

You are mandated by law to provide workers’ compensation for employees in Missouri if you have five or more employees. The one exception is the construction industry, where you are required to provide workers’ comp insurance even if you only have one employee. If you are not required and choose not to voluntarily provide it, you can be sued by an employee who is injured on the job.

The cost of workers’ compensation insurance is around $1.11 for each $100 payroll you processed. For example, a company that processes $500,000 of payroll can expect to pay around $5,550 in insurance.

Minimum Wage & Tips

The majority of jobs will require you to pay at least minimum wage. If you think you may be exempt, please check out our guide on Federal Exemptions for Minimum Wage to confirm.

Missouri has two sets of requirements regarding minimum wage: one for companies that gross over $500,000 in a year and another for retail and service-based businesses that gross less than $500,000 in a year. For the larger revenue-generating companies, you must pay at least the state’s minimum wage rate of $12.00 per hour. For the smaller revenue-generating companies, you can pay the federal minimum wage of $7.25 per hour.

If you have tipped employees and your business earns over $500,000 annually in revenue, you are required to pay them at least half of the minimum wage amount you’re subject to. That means they should earn at least $6.00 per hour, plus any additional amounts needed to bring their hourly rate up to the current minimum wage amount if they don’t earn enough tips.

Breaking News: Starting on Jan. 1, 2024, the Missouri minimum wage may increase or decrease depending on cost of living changes in the Consumer Price Index.

Overtime

Missouri follows federal law in regard to overtime. You’ll need to pay 1.5 times the regular hourly rate for any hours your employees work over 40 in a workweek. For more information and help making the calculations, check out our guide to calculating overtime.

Different Ways to Pay Employees

In Missouri, you can remit payments to employees by common payment options. These options include via check, cash, pay cards, and direct deposit. However, the employee must be able to receive their funds without facing a mandatory processing fee.

Pay Stub Laws

You must provide a statement of your employee’s earnings and deductions for the pay period at least once per month. While Missouri only requires you to show total deductions for the pay period, it is a good idea to include common information such as the employee’s name, address, rate of pay, total hours worked, and itemized benefit costs, such as 401(k), medical, and vision.

To make your own pay statements, download one of our free pay stub templates. They’re already formatted, so you can print and use them immediately.

Minimum Pay Frequency

Missouri law requires that you pay employees at least twice a month, with a few exceptions. For instance, executive, administrative, professional, and commission-earning employees can be paid monthly—these positions are typically salaried workers in an office setting. When in doubt, it is best to pay twice monthly or every other week as opposed to monthly.

To help ensure you pay your employees on a regular schedule, download one of our free pay period calendars to keep track of pay dates.

Paycheck Deduction Rules

Missouri does not have any specific laws stating what may or may not be deducted from an employee’s paycheck. Common deductions include:

- Taxes

- Garnishments

- Levies

- Benefits

- Reimbursements

Final Paycheck Laws

Missouri does not have state laws regarding final paychecks for employees who voluntarily leave; however, you must pay an employee who is involuntarily terminated immediately at the time they are let go. If they do not receive their final pay and they reach out to you via certified mail, you have seven days to respond and pay said employee without having to pay penalties.

If you need to print a check for a terminated employee quickly to maintain compliance, then use one of our recommended ways to print payroll checks online for free.

Missouri HR Laws That Affect Payroll

Missouri HR laws mostly follow federal guidelines, with the exception of more detailed child labor law requirements.

Missouri New Hire Reporting

Missouri requires you to report new hires (employees, not contractors) within 20 days of the hire date. You can report online, or you can mail your information to the Missouri Department of Revenue. If your business is in multiple states, you can choose one state in which to report all of your new hires to make it easier.

For more information, please visit the Missouri Department of Social Services’ website.

Breaks, Lunches & Time-off Requirements

Missouri generally follows federal law regarding time-off requirements with rare exceptions. Details are listed below.

- Breaks and Lunches: Missouri does not mandate employers to provide breaks to employees, with the exception of 15- and 16-year-olds who work in the entertainment industry. These youth employees must receive a 15-minute rest break for every two hours of continuous work and must receive a meal break if they work over five and a half hours in a day.

- Vacation and Sick Leave: Missouri does not have any vacation or paid sick leave requirements.

- Family Leave: Missouri does not have a separate state law regarding family leave. Employers are mandated by federal law in the Family and Medical Leave Act (FMLA). The law is for employers that have more than 50 employees for 20 or more weeks in the current or previous year. Employees can take FMLA leave if they have worked at the company for at least a year, with 1,250 hours worked in the previous year, and if their physical work location has 50 or more employees in a 75-mile radius. To learn more about the Family and Medical Leave Act, visit the Department of Labor’s guide to FMLA.

- Jury Duty Leave: Employers in Missouri are prohibited from terminating, disciplining, threatening, or taking adverse employment action against employees who receive or respond to a jury summons. Missouri employers cannot require employees to use vacation or sick leave for time spent responding to a jury summons, time spent in the jury selection process, or time spent sitting on a jury. If a company has five or fewer employees, the company can request a change to the employee’s jury summons if another employee has already received a summons within the same time period.

- Voting Leave: Employees must be provided at least three consecutive hours of time off work to vote, provided that the employee provided notice to the employer at least the day before election day. The employer may specify the time period when an employee is permitted to miss work to vote, provided that the time period given is when the polls are open.

State Disability Insurance

Missouri does not have a state disability program and does not require companies to obtain disability insurance. However, it is advisable to have both for your employees and yourself. For more information on insurance in Missouri, please visit the Missouri Department of Insurance’s website.

Child Labor Laws

In Missouri, you are required to record and maintain hours worked, employee names, birth dates, and addresses for all youth employees under the age of 16 for two years. Children under age 14 are not permitted to work in Missouri. Missouri also limits the work hours of individuals 15 and 16 years of age. The restrictions are:

Scenarios | Daily Restrictions | Weekly Restrictions | Time Restrictions |

|---|---|---|---|

Between Labor Day and June 1 | Cannot work more than three hours on a school day, including Fridays. Cannot work more than eight hours on Saturdays, Sundays, and days when school is not in session. | Cannot work more than six days and 40 hours Cannot work more than 40 hours | Cannot work before 7 a.m. or after 7 p.m. |

Between June 2 and Labor Day | Cannot work more than three hours on a school day, including Fridays. Cannot work more than eight hours on Saturdays, Sundays, and days when school is not in session. | Cannot work more than six days Cannot work more than 40 hours | Cannot work before 7 a.m. or after 9 p.m. |

In addition, there is a list of jobs that 14- and 15-year-olds cannot do, which includes cook, baker, driver, and power equipment handler. For more information on federal child labor laws, check out our guide on hiring minors.

Payroll Forms

Listed below are some federal and state forms needed to produce accurate payroll for employees and for compliant payroll reporting and on-time tax remittance for businesses.

Missouri Payroll Forms

- Missouri MO W-4: To assist employers in calculating tax withholding for employees

- Missouri MO 941: Missouri return of state income tax withheld from employee paychecks

- Form 2643: Application to register in Missouri for all types of business taxes, including withholding taxes

- St. Louis Form E-234: This is used to report and pay earnings for the St. Louis local income tax

- Kansas City Form RD-108: This is used to report and pay earnings for the Kansas City local income tax

- Missouri Quarterly Tax Report: This is used for filing unemployment taxes.

Federal Payroll Forms

- W-4 Form: Assists employers calculate withholding tax for employees

- W-2 Form: Reports total yearly wages earned (one per employee)

- W-3 Form: Reports total yearly wages and taxes for all employees

- Form 940: Calculates and reports unemployment taxes due to the IRS

- Form 941: Files quarterly income and FICA tax withholding

- Form 944: Reports annual income and FICA tax withholding

- 1099 Forms: Provides contractors with pay information and amounts that assist them in tax calculation

Missouri Payroll Tax Resources & Sources

- Missouri Department of Revenue: Access and submit forms, view the latest regulations, and view information on all types of business taxes.

- Missouri New Hire Reporting Center: Complete reporting for new hires and view frequently asked questions

- Missouri Department of Labor: Find information relating to unemployment taxes.

For more information on payroll laws, visit our payroll compliance guide.

Bottom Line

Missouri payroll differs from other states by its tiered income tax structure, final pay requirements for involuntarily terminated employees, frequency on when employees should be paid, and when employers must remit withholding taxes. Be sure to stay aware of deadlines and requirements by federal, state, and local governments.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: