Learning how to do payroll in New Hampshire is a breeze because the state doesn’t have income tax and local taxes. It also doesn’t require a state income deduction form, which is one less thing for you and your employees to worry about.

Key Takeaways:

- New Hampshire does not have personal income tax, so there are no employee forms and no state tax deductions for your employees who live in New Hampshire

- New Hampshire follows the federal minimum wage but requires tipped workers to be paid at least 45% of the current minimum wage before tips

Step-by-Step Guide to Running Payroll in New Hampshire

New Hampshire makes payroll easy for businesses by generally following federal guidelines. There are several steps you need to follow to set your business up for success, starting from setting yourself up as an employer by getting tax ID numbers to making calculations and paying employees.

Here are the basic steps you should follow to run payroll in New Hampshire.

Step 1: Set up your business as an employer. New companies may need to access the federal Electronic Federal Tax Payment System (EFTPS) to create a new Federal Employer Identification Number (FEIN). Your FEIN is required to pay federal taxes.

Step 2: Register your business with the State of New Hampshire. If your business is new, you need to register on the New Hampshire Secretary of State’s website. Any company that pays employees in New Hampshire must also register with the New Hampshire Department of Revenue Administration.

Step 3: Set up your payroll process. Determining how and when you pay employees is crucial to creating a standard payroll process. If your business is established, you may have inherited a process, but you may want to change it to better fit your needs. You can opt to process payroll by hand, use Excel payroll templates, or sign up for a payroll service to help you handle your New Hampshire payroll.

Step 4: Collect employee payroll forms. Every company that hires employees in New Hampshire must collect certain forms during the onboarding process. Each employee must complete I-9 verification. New employees must also have a completed W-4 form on file.

Step 5: Collect, review, and approve time sheets. The best practice is to collect time sheets several days before your payroll is due. Reviewing the time sheets from your nonexempt employees, hourly and some salaried, gives you time to speak with anyone who might have made mistakes. There are many ways to track employee time—some of which are free, such as free time sheets and free time tracking systems like Homebase (read our Homebase review to know more about its features).

Step 6: Calculate employee gross pay and taxes. There are numerous payroll calculations you’ll need to perform when doing your New Hampshire payroll. You’ll need to total employee work hours (our free time card calculator can help), gross pay, deductions and taxes withheld, benefits due, and final net pay.

Step 7: Pay employee wages and benefits. Most companies today pay all employees through direct deposit. But cash and paper checks are also options. New Hampshire does not have a state minimum wage, so the federal minimum wage of $7.25 per hour applies. However, under New Hampshire law, tipped employees who regularly receive more than $30 per month in tips must be paid at least $3.26 per hour—with the expectation that their tips make up for the minimum wage difference.

Step 8: Document and store your payroll records. Keeping your company business records is good practice and New Hampshire law requires that employers keep some records. Businesses must keep the following for at least three years for each employee:

- Payroll details showing time worked, breaks, PTO, and amount paid

- Signed copy of each written notice to an employee regarding their pay rate, pay frequency, date of payment, and method of payment

New Hampshire also requires that if a time sheet was appropriately altered, it must be signed by the employee—and, any software used to record time must not allow the employer to modify a time record without the employee’s knowledge.

Step 9: File payroll taxes with the federal and state government. All New Hampshire state taxes need to be paid to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the New Hampshire Department of Revenue website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month.

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday, by the following Friday.

Please note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 10: Complete year-end payroll reports. Every year, you will need to complete payroll reports, including all W-2 Forms and 1099 Forms. You must provide these forms to employees no later than Jan. 31 of the following year.

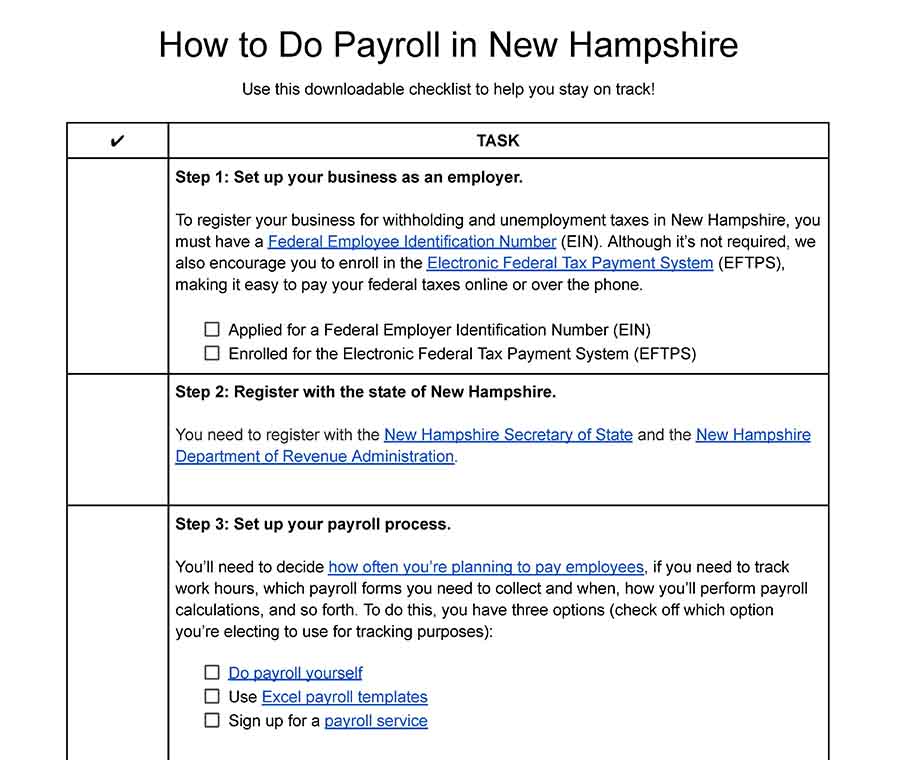

Worried you might miss a step? Here’s a checklist to help you stay on track.

Learn more about doing payroll yourself in our guide on how to do payroll. It has a free checklist you can download to make sure you don’t miss any steps.

New Hampshire Payroll Laws, Taxes & Regulations

Knowing how to calculate New Hampshire payroll taxes and ensure compliance with all federal and state employment laws is crucial to making sure your payroll is accurate every time. To help you maintain compliance with payroll regulations, learn more about doing payroll in New Hampshire below.

With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Both the employer and the employee will pay these taxes, each paying 7.65% for the combined Social Security and Medicare taxes.

New Hampshire Taxes

Like most states, New Hampshire has certain taxes that companies must pay. New Hampshire does not levy local taxes or a state income tax on employees.

Employer Unemployment Taxes

All businesses in New Hampshire must pay State Unemployment Tax Act (SUTA) taxes. The current wage base is $14,000 and rates range from 0.1% to 7.5%. All new employers in New Hampshire will pay a SUTA rate of 1.7%.

Did you know? Businesses that pay SUTA in full and on time can claim a tax credit of up to 5.4% on their Federal Unemployment Tax Act (FUTA) taxes. FUTA is generally 6% of the first $7,000 of each employee’s paycheck.

Workers’ Compensation

New Hampshire requires every employer with one or more employees to carry workers’ compensation insurance. Workers’ compensation insurance provides benefits to employees who suffer on-the-job injuries and covers the cost of medical treatment and lost wages. This protects you from potential lawsuits and other monetary damages.

For more information on workers’ compensation, check out our workers’ comp guide and the New Hampshire’s workers’ comp site.

New Hampshire Minimum Wage

New Hampshire does not have a state minimum wage, so the federal minimum wage of $7.25 is the default. For tipped employees who regularly receive over $30 per month in tips, businesses must pay them at least $3.26 per hour, provided that their tips get them to the hourly minimum wage. If not, the company must make up the difference.

Calculating Overtime

New Hampshire overtime rules follow the Fair Labor Standards Act requirements. Under the FLSA, all employers must pay employees 1.5 times their regular hourly wage for hours worked over 40 in a workweek.

Paying Employees

New Hampshire law mandates that employers pay employees at least every other week. The law breaks this down to provide for the following pay schedule options:

- Employees who are paid weekly must be paid within eight days of the end of the pay period.

- Employees who are paid every other week must be paid within 15 days after the end of the pay period.

Employers can request a different pay schedule from the New Hampshire Department of Labor, which will review requests on a case-by-case basis. If a company wants to pay employees less frequently, it must provide the following information to the state:

- Method of payment

- Proposed frequency of payments

- Designated payday

- Employee classification

- Salary range of all employees

- FEIN

New Hampshire also requires employers to pay workers by one of the following methods:

If you need help keeping track of your payroll periods, use one of our free pay period calendars.

Pay Stub Laws

New Hampshire requires every business to give its employees access to pay stubs, including an itemized accounting of wage deductions at least once per month. Pay stub information generally includes:

- Employee name and ID

- Pay period

- Pay date

- Gross wages, including regular and overtime pay

- Tips, commissions, or other earnings

- Deductions

- Net pay

If you do not use a payroll service, download one of our free pay stub templates to help you get started.

New Hampshire Paycheck Deductions

New Hampshire has an extensive law discussing wage deductions. A company cannot deduct any of the following from an employee’s pay:

- Cash shortages

- Broken, damaged, or stolen company property

- Returned checks

- Required uniforms or tools

The law goes further to say that a company cannot deduct any amount from an employee’s pay, unless:

- Permitted by law

- The employee has consented in writing, and the consent covers one of the following items:

- Union dues

- Healthcare and retirement contributions

- Charitable contribution

- Payments to a bank account held by someone other than the employee

- Vehicle use

- Child care

- Parking fees

- Loan repayment to employer

- Accidental wage overpayment

- Educational payments

- Gym or fitness center memberships

- Additional reasons agreed upon by the employer and employee

Please note that, according to the Department of Labor, a company cannot make deductions to an employee’s pay if those deductions would cause the employee to earn less than the federal minimum wage ($7.25 per hour) for that pay period.

Employees’ Final Paychecks

New Hampshire law sets requirements on employers to pay employees’ final pay based on how the employment relationship ended. The following chart breaks down the state requirements on when you need to pay an employee’s final wages after separation from employment with your company.

Manner of Employment Relationship Ending | Fired, discharged, or terminated | Quit or resigned with at least one pay period’s notice | Quit or resigned without notice | Laid off, suspended, or resigned due to labor dispute |

When Final Wages Must be Paid | 72 hours after final workday | 72 hours after final workday | Next regular pay day | Next regular pay day |

If you need to pay an employee right away and aren’t currently using a service, use one of our recommended ways to print a free payroll check.

New Hampshire HR Laws That Affect Payroll

New Hampshire does not have many state-specific HR laws. Even though there are few, you still need to ensure that you are following the federal guidelines, which New Hampshire law mostly follows.

New Hire Reporting

Every employer in New Hampshire must report new hires and any rehired employees within 20 days to New Hampshire Employment Security. This report is used to enforce child support orders and must include the employee’s name, address, and Social Security number.

Meals & Breaks

You must give employees a 30-minute break if they are scheduled to work more than five consecutive hours. This break does not have to be paid unless the employee cannot completely escape work during this time.

Child Labor Laws

Children as young as 12 years old can work, provided that they have a Youth Employment Certificate. Children between 12 and 15 cannot work more than three hours on a school day and not more than 23 hours in a school week. They cannot work more than eight hours per non-school day and not more than 48 hours during non-school weeks.

Children aged 16 and 17 do not need a Youth Employment Certificate to work, but they do need signed parental permission. These children are not restricted to hours per day but rather limited by the workweek hours and school days, as follows:

When School Is in Session Three Days or Less | When School Is in Session Four Days | When School Is in Session Five Days | School Vacations and Summer Break |

|---|---|---|---|

48 hours maximum per week | 40.5 hours maximum per week | 30 hours maximum per week | 48 hours maximum per week |

Under no circumstances can a child aged 16 or 17 work more than six consecutive days.

Check out our guide to hiring minors for more insight.

Time Off & Leave Requirements

New Hampshire Family Leave

Under the New Hampshire Paid Family and Medical Leave plan, workers can receive up to 60% of their average weekly wage for up to six weeks per year for covered leave. This is a fully voluntary plan that employers can enroll their entire company in—or, if an employer has chosen to not participate, individual workers can enroll.

If an employer or individual does not enroll in this program, New Hampshire follows the Family and Medical Leave Act (FMLA), which requires that all eligible employers provide up to 12 weeks of unpaid leave for employees who fall under a covered disability. This can include pregnancy and caring for an ill family member. The FMLA does not require that companies pay employees for this time off work, but it does require that employers keep the employee’s job, or a substantially similar one, available to them when they return. New Hampshire does not provide for any additional family leave under state law.

New Hampshire does, however, require employers with at least six employees to provide pregnancy disability leave. An employee who cannot work because of pregnancy, childbirth, or a related condition, may take unpaid leave for as long as the person is disabled. The employer must keep the employee’s position or similar position available for them upon their return.

Paid Time Off

New Hampshire has no laws requiring employers to provide employees with paid time off (PTO). Companies in New Hampshire are free to create PTO policies and may include whether they pay out accrued and unused PTO when an employee leaves. New Hampshire does not require that companies do, so it’s a good practice to have this clearly defined in your company policy. The important thing is to follow the guidelines in your policy, or you can be held liable.

If you offer PTO and need help to calculate employees’ PTO accrual, use our free PTO calculator.

Click below to see New Hampshire requirements for other types of leave.

Payroll Forms

New Hampshire does not have any state payroll forms because the state has no income tax.

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees; summary form of W2

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

For a more detailed discussion of federal forms, check out our guide on the federal payroll forms you may need.

State Payroll Tax Resources

- New Hampshire Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- New Hampshire Department of State Online Business Services has many great resources for new and existing businesses to help them navigate licensing, taxes, and employer requirements.

- New Hampshire Department of Labor offers support and resources to help businesses ensure compliance with unemployment and workers’ compensation plus other labor laws.

Frequently Asked Questions (FAQs)

How do I handle income tax for an employee who lives in Massachusetts but works on-site in New Hampshire?

If your employee works in New Hampshire but lives across the border in Massachusetts, you’ll need to withhold Massachusetts income tax. Your employee won’t get any credit, either, since New Hampshire doesn’t have income tax.

Does New Hampshire have paid family leave?

Yes, but it’s not mandatory. New Hampshire allows employers and individuals to enroll in the voluntary paid family leave program, which provides employees with up to 60% of their average weekly pay for up to six weeks per year.

How often do I have to pay employees in New Hampshire?

You must pay your workers at least once per month. The payment must also be made within eight calendar days of the end of the pay period.

Bottom Line

With no state income tax and no state payroll forms, New Hampshire is one of the easiest states to run payroll. For the most part, its HR laws follow federal regulations, making your job simple and straightforward. Still, New Hampshire payroll and tax calculations are complex. Follow our checklist to increase your efficiency and reduce the chance of mistakes.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.