North Dakota is one of the simpler states in which to do payroll, as it is a pro-employer state. It does not have a lot of state-specific payroll laws and typically follows federal guidelines. North Dakota does have a state income tax; however, it’s one of the lowest rates in the country. Employers are also required to pay state unemployment insurance tax and workers’ compensation insurance, common among most states.

Key Takeaways:

- In 2024, North Dakota changed to a two-tiered tax rate system, still holding the place for lowest income tax rates in the country for states who collect income taxes

- North Dakota has income tax reciprocity with Minnesota and Montana

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Running Payroll in North Dakota—Step-by-Step Instructions

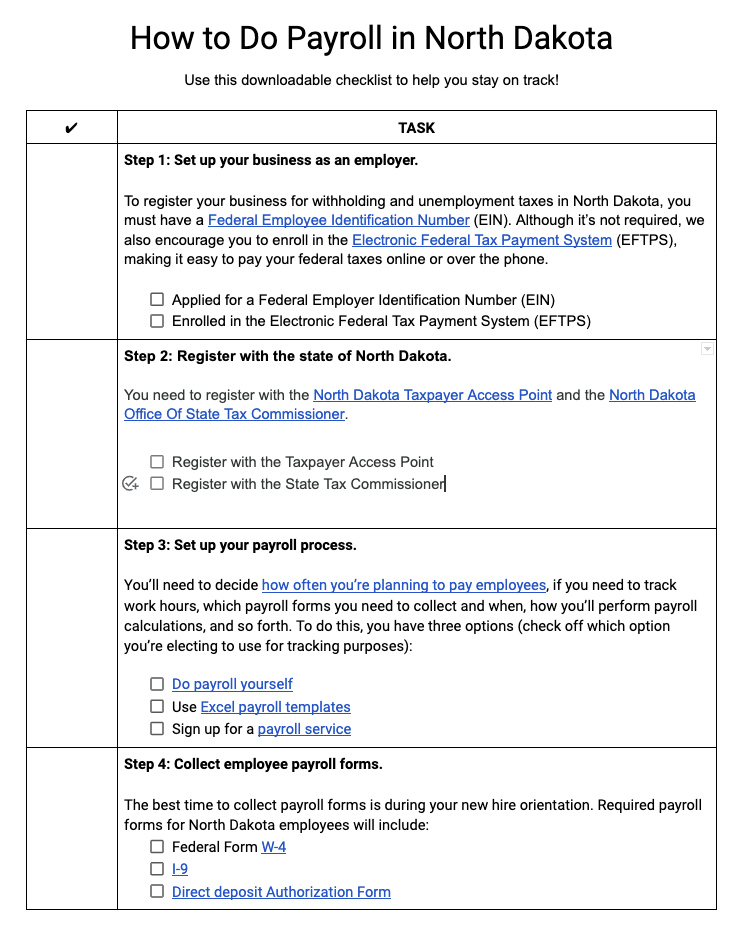

Step 1: Set up your business as an employer. To register with the federal government, you will need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the state of North Dakota. For withholding taxes in North Dakota, you will need to apply online with the North Dakota Taxpayer Access Point (NDTAP). You’ll also need to register with the North Dakota Office Of State Tax Commissioner.

Step 3. Set up your payroll process. You will need to set up payroll, implement a pay schedule, determine a method to pay employees, and figure out how you will process taxes and deductions, etc. You can choose to do payroll yourself, use an Excel payroll template, or choose a payroll service.

Step 4: Collect employee payroll forms. The best time to collect payroll forms is during onboarding. Payroll forms include W-4, I-9, and direct deposit information. North Dakota utilizes the federal W-4 form for its own state withholding.

Step 5: Collect, review, and approve time sheets. If you have hourly or nonexempt employees, you’ll need to track your employee time before calculating their pay. You have three options:

- Use a paper time sheet

- Use free or low-cost time and attendance software

- Use a payroll service that also has a time and attendance system

Step 6: Calculate employee gross payroll and pay employees plus taxes. You’ll need to make numerous payroll calculations, from total hours worked and gross pay to total income taxes and benefits deductions. Tax calculations tend to be the most complex for employers. You can choose to pay employees in a number of different ways (i.e., cash, check, direct deposit, pay cards). Federal taxes should be paid through EFTPS.

Step 7: File payroll taxes with the federal government. The IRS has forms and instructions on filing federal taxes. If needed, you can also order official tax forms from the IRS. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday by the following Friday

Please note that reporting schedules and depositing employment taxes are different.

Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 8: File payroll taxes with the state government. All North Dakota state taxes need to be paid to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the North Dakota Department of Revenue website. Almost all North Dakota employers must file withholding tax quarterly (dates listed below). These returns can be filed on the NDTAP website or via a paper application that can be mailed to the North Dakota Office of the State Tax Commissioner (P.O. Box 5624, Bismarck, ND 58506-5624).

All employers in North Dakota are required to file a Transmittal of Wage and Tax Statement at the end of each calendar year that includes federal W-2 copies that have the withholding amount of North Dakota’s state income tax.

North Dakota Quarterly Return Due Dates

Months | Due Date |

|---|---|

January–March | April 30 |

April–June | July 31 |

July–September | October 31 |

October–December | January 31 |

Some employers are eligible for annual filing only. These employers must meet the following requirements in the previous year.

- A withholding amount of $500 or less

- Paid the full amount of state income tax by the due date

- Required to do quarterly filings for all four quarters in the previous calendar year

Step 9. Document and store your payroll records. It is important to retain records for all employees for several years, including those who are no longer with your company. Federal law requires you maintain payroll records for three years and payroll tax records for four. For more information on which records to keep, please see our article on retaining payroll records.

Step 10. Do year-end payroll tax reports. The federal forms that are required are W-2s (for employees) and 1099s (for contractors). These forms should be provided to employees and contractors by Jan. 31 of the following year. State W-2s are required for North Dakota and these forms are also due by Jan. 31.

Download our free checklist to help you stay on track while you’re working through these steps:

North Dakota Payroll Laws, Taxes & Regulations

Federal law requires that you pay income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. Federal taxes are remitted based on a tiered progressive tax system where higher income employees pay more. Called FICA taxes, Social Security and Medicare are withheld from each employee’s paycheck at 6.2% and 1.45% respectively. You, as the employer, also pay a matching amount. The FUTA rate is 6% on the first $7,000 that is paid to each employee in that year.

North Dakota Taxes

North Dakota only has a few items that differ from federal regulations. It has state income taxes, with reciprocal agreements with Montana or Minnesota, as well as state unemployment insurance.

State Income Taxes

North Dakota is a progressive income state tax with five income tax brackets. Three tables (single, married filing jointly, and head of household) are listed below. To determine what you specifically need to withhold, use the North Dakota withholding table.

If you need assistance with income tax withholdings, the state provides a guide to help.

Income Tax Reciprocity

North Dakota has income tax reciprocity with Minnesota and Montana. This means if you have employees who live in either of those states but work for you in person in North Dakota, they’ll only be taxed in their home state. Make sure your eligible employees complete the form NDW-R.

State Unemployment Tax

North Dakota requires you to pay state unemployment taxes (SUTA). This provides funds to support employees who lose their jobs. The rate your company pays will be determined by your prior six quarters of coverage for non-construction employers and for the last 10 quarters of coverage for construction employers. Rates are recalculated each October and become effective the following January. If your company doesn’t have the requisite number of past quarters of coverage, you will be classified as a new employer.

The wage base for 2024 is $43,800. This amount is recalculated each year and set based on 70% of the statewide average wage. The state will also look at whether your company has a positive or negative unemployment insurance balance. If your account is negative (meaning you’ve had at least some unemployment claims recently), your rates will be higher.

If the reserve fund is positive: The unemployment tax rate is 1.09% for new employers not in the construction industry and 9.68% for new employers in the construction industry. Established employers will have a rate between 0.08% and 1.21%.

If the reserve fund is negative: The unemployment tax rate is 6.08% for new employers not in the construction industry and 9.68% for new employers in the construction industry. Established employers will have a rate between 6.08% and 9.68%.

Workers’ Compensation

Workers’ compensation insurance ensures you’re covered if any of your employees become hurt or ill as a result of work performed on the job. You are required to provide workers’ compensation if you have any employees in North Dakota or if you have a business location in North Dakota. It is solely provided by the North Dakota Workforce Safety & Insurance Office (WSI). As a result, you must report all wages to the WSI. Premiums are calculated using employment classes and the taxable payroll amount, which is capped at 70% of the state’s average annual wage.

The cost of workers’ compensation insurance is around $1.25 for each $100 payroll you processed. For example, a company that processes $500,000 of payroll can expect to pay around $6,250 in insurance. Even if you have no employees or a very low payroll, your company may be subject to a $250 minimum premium.

Minimum Wage & Tips

Almost all jobs will require you to pay at least minimum wage. If you need any assistance on the federal guidelines on exemptions, please use the following: Federal Exemptions for Minimum Wage.

North Dakota’s current minimum wage is $7.25 per hour for non-tipped employees. There’s also a $4.86 cash wage per hour for tipped employees, provided that their tips allow them to receive a minimum wage of $7.25 per hour. Up to 33% of a tipped worker’s wage can be used as a tip credit for employers. This is the same minimum wage requirement as the federal government.

Overtime

North Dakota adheres to the federal guidelines regarding overtime. You’ll need to pay one and a half times the regular hourly rate of pay for any hours over 40 that your employees work in a workweek. North Dakota allows hospital and residential care employers to adopt a 14-day overtime period. For more information, please see our guide on calculating overtime.

Different Ways to Pay Employees

In North Dakota, you are able to pay employees via standard payment options, including cash, paper check, direct deposit, and payroll card. If you decide to pay employees via pay card, you must make sure that all fees are covered without it affecting the employee’s pay.

Please see our guide on how to pay employees for more in-depth information.

Minimum Pay Frequency

North Dakota requires that you pay employees at least once a month on a regularly scheduled pay date. For a list of pay schedule options and a free payroll calendar, check out our guide on pay periods.

Pay Stub Laws

You must provide a written or digital statement of your employee’s earnings and withholdings in North Dakota every time an employee is paid.

Paycheck Deduction Rules

North Dakota does not have any laws mentioning what can or cannot be deducted from an employee’s paycheck. Common deductions may include:

- Taxes

- Garnishments

- Levies

- Benefits

- Reimbursements

Final Paycheck Laws

North Dakota requires you to pay employees their final pay by the next regularly scheduled payday. If an employee is not paid by this date, they can charge wages for each day the employer is in default for up to 30 days.

North Dakota HR Laws That Affect Payroll

North Dakota HR laws mostly follow federal guidelines, with the exception of required meal breaks and child labor laws for 14- and 15-year-olds.

North Dakota New Hire Reporting

North Dakota requires you to report new hires within 20 days of the first day of work. You can report using the North Dakota New Hire Reporting Form.

Breaks, Lunches & Time Off Requirements

North Dakota follows federal law for time off requirements with the exception of a required meal break for eligible employees.

- Breaks and Lunches: North Dakota requires you to provide a 30-minute meal break for shifts that are longer than five hours if there are at least two people on duty at the time. The break can be unpaid if the employee is free from any work responsibilities. Rest breaks are not required by law. Retail employees must be given at least 24 consecutive hours off from work in every seven-day period.

- Vacation and Sick Leave: North Dakota does not have any vacation or sick leave requirements. However, if you do provide leave benefits, you must abide by your company’s policy.

- Family Leave: North Dakota does not have a separate state law regarding family leave. In fact, there is a law in place that no localities in North Dakota can put in a leave law that supersedes federal or state laws. Since there is no state law, employers must abide by the federal law in the Family and Medical Leave Act (FMLA).

- This law is for companies that have 50 or more employees for 20 or more weeks in the current or previous year. Employees can take FMLA leave if they have worked at the company for at least a year, with 1,250 hours worked in the previous year, and if their physical work location has 50 or more employees in a 75-mile radius.

State Disability Insurance

North Dakota does not have a state disability program and does not require companies to obtain disability insurance. However, it is a prudent idea to have disability insurance for your employees and yourself.

Child Labor Laws

North Dakota follows federal guidelines regarding youth work for 16- and 17-year-olds. Federal law prohibits some job occupations for this age group, including roofing and using power-driven tools.

North Dakota does have additional work restrictions for 14- and 15-year-old employees. They include the following:

- Cannot work more than three hours on a school day

- Cannot work more than eight hours on a non-school day

- Cannot work more than 18 hours in a school week

- Cannot work more than 40 hours in a non-school week

- Cannot work between the hours of 9:01 p.m.- 6:59 a.m. from June 1 through Labor Day; after Labor Day, minors under the age of 16 cannot work between the hours of 7:01 p.m.- 6:59 a.m.

- Cannot work in a field that requires power machinery, construction, chemicals, door-to-door sales, or cooking.

In addition, minors ages 14 and 15 must submit an employment and age certificate to the North Dakota Department of Labor and Human Rights. Information from the teen, employer, and parent is needed for the form to be considered valid by the Department of Labor.

Payroll Forms

Listed below are some of the state and federal forms needed to produce accurate pay for employees as well as compliant payroll reporting and tax remittance for businesses.

North Dakota Payroll Forms

- Reciprocity Exemption Form: This is used for claiming North Dakota income tax exemption status for Montana and Minnesota residents who work in North Dakota.

Federal Payroll Forms

- W-4 Form: Helps employers calculate withholding tax for employees

- W-2 Form: Reports total yearly wages earned (one per employee)

- W-3 Form: Reports total yearly wages and taxes for all employees

- Form 940: Calculates and reports unemployment taxes due to the IRS

- Form 941: Files quarterly income and FICA tax withholding

- Form 944: Reports annual income and FICA tax withholding

- 1099 Forms: Provides contractors with pay information and amounts that assist them in tax calculation

North Dakota Payroll Tax Resources & Sources

- North Dakota Taxpayer Access Point: File tax returns, make payments, and access tax account information.

- ND UI Easy: File quarterly wage reports, make payments, and access unemployment insurance tax accounts.

- North Dakota Workforce Safety and Insurance: Apply for workers’ compensation coverage, submit payroll reports, make payments, and view frequently asked questions.

- North Dakota New Hire Reporting Center: Complete new hire reporting and view common questions relating to new hire compliance.

For more information on payroll laws, please see our payroll compliance guide.

Doing Payroll in North Dakota Frequently Asked Questions (FAQs)

No, there are no local payroll taxes in North Dakota. You’ll still need to withhold applicable state taxes and make sure you’re remitting them on the right schedule for your business. Also, make sure you’re withholding employee income tax at the correct rate, as North Dakota entered into a new tax system in 2024.

No. North Dakota relies on the federal withholding form W-4. Even though there isn’t a state-specific withholding form, you’ll still need to collect the federal version from each of your employees.

North Dakota does not require employers to offer severance to employees who are terminated. However, it can be a prudent business decision, depending on the circumstances.

Bottom Line

North Dakota payroll only has a few state-specific items to be aware of and otherwise follows federal guidelines. Be sure you’re properly calculating your employee’s state income tax and paying the right unemployment rate.

If you need help running your North Dakota payroll, consider using payroll software like QuickBooks Payroll. It files and pays your payroll taxes and covers any penalties you’re charged if its software or representatives make mistakes. You can pay employees by direct deposit or check, and same-day payment options are available. Sign up today for a free trial.