There are some nuances to remember when learning how to do payroll in Wisconsin. It has a progressive income tax system, which means the math for calculating payroll taxes won’t be as straightforward as it is with a flat-tax system. In addition, it has special laws governing family and sick leave that employers must comply with and child labor regulations. Otherwise, Wisconsin payroll generally aligns with federal regulations.

Key Takeaways

- Minimum Wage Rate: $7.25/hr

- Overtime Rate: Time and a half ($10.88/hr)

- Income Tax Rate: Graduated-rate income tax of 3.54%–7.65%

- PTO Regulations: Varies for family, medical, and voting leaves (to know more, skip to the section on Wisconsin leave rules)

Step-by-Step Guide to Running Payroll in Wisconsin

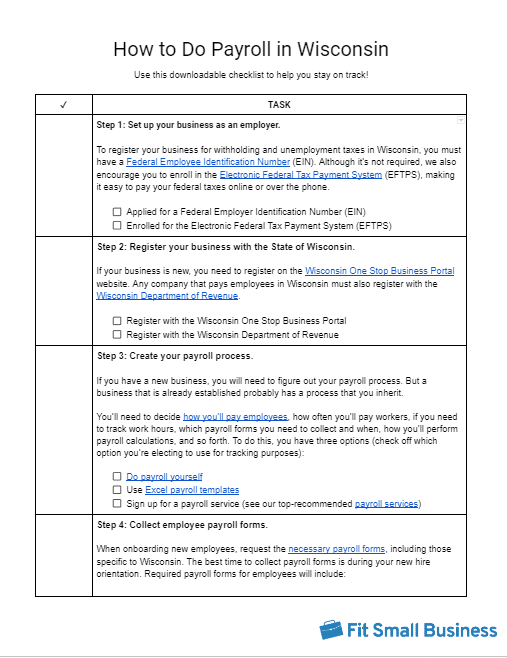

Here is a basic guide on how to do payroll in Wisconsin.

Step 1: Set up your business as an employer. New companies may need to access the federal Electronic Federal Tax Payment System (EFTPS) to create a new Federal Employer Identification Number (FEIN). Your FEIN is required to pay federal taxes.

Step 2: Register your business with the State of Wisconsin. If your business is new, you need to register on the Wisconsin One Stop Business Portal website. Any company that pays employees in Wisconsin must also register with the Wisconsin Department of Revenue.

Step 3: Create your payroll process. If you have a new business, you will need to figure out your payroll process. But a business that is already established probably has a process that you inherit. It’s important to decide how often, when, and how you will pay your employees. You can opt to process payroll by hand (not recommended), set up an Excel payroll template, or sign up for a payroll service (check out our top payroll services guide for options) to help you handle your Wisconsin payroll.

Step 4: Have employees fill out relevant forms. Your business must have every employee complete payroll forms during their onboarding process. Every employee must complete I-9 verification. New employees must also have a completed W-4 form on file, as well as a Wisconsin Withholding Exemption Certification (WT-4).

Step 5: Review and approve time sheets. Running payroll accurately requires you to begin the process before the day your payroll is due by collecting time sheets. There are many ways to track employee time—some of which are free. Reviewing the time sheets from your nonexempt employees gives you time to speak with anyone who might have made mistakes. To know more about the different employee classifications, check out our exempt vs nonexempt employee guide.

Step 6: Calculate employee gross pay and taxes. You can manually do the pay computations, such as sum of hours worked (you can also use our free timecard calculator), total employee pay, deductions, and tax withholdings, but we don’t recommend it. Payroll and tax computations can be complicated, and errors can lead to costly fines and penalties. Learn more about how to calculate payroll if you need help.

Plus, the state of Wisconsin payroll tax rules don’t follow a flat-rate system. To know more, check out our Wisconsin income tax table.

Step 7: Pay employee wages, benefits, and taxes. The best way to pay your employees is through direct deposit. Other options are paper checks and by paying cash (not recommended). Wisconsin does not have a state minimum wage, so the federal minimum wage of $7.25 per hour applies. You can pay your federal and Wisconsin state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 8: Save your payroll records. Keeping your company business records is good practice. Wisconsin requires businesses to keep a record of all hours worked and wages paid to each employee, including their name, address, and date of birth, for at least three years. This mirrors the Fair Labor Standards Act (FLSA) recordkeeping requirements. You’ll also need to maintain payroll tax records for four years, maximum. Learn more about the retention period of pay- and HR-related documents in our payroll records guide.

Step 9: File payroll taxes with the federal and state governments. All Wisconsin state taxes need to be paid to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the Wisconsin Department of Revenue website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month.

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday, by the following Friday.

Please note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 10: Complete year-end payroll reports. Doing payroll in Wisconsin requires more than just paying employees on a regular schedule. Every year, you will need to complete payroll reports, including all W-2 and 1099 tax reports (if you need help completing these documents, check out our guides to filling out W-2 and 1099 forms). You must provide these forms to employees no later than Jan. 31 of the following year. You’ll also need to send copies to the IRS along with a summary form that totals the data.

For more general information on handling payroll, check our guide on how to do payroll.

Download our free checklist to help you stay on track while you’re working through these steps.

Wisconsin Payroll Laws, Taxes & Regulations

Wisconsin state payroll laws generally follow federal guidelines, but there are still items that you need to pay close attention to so you can be sure your payroll is accurate. To help you maintain compliance with payroll regulations, review Wisconsin’s relevant regulations below.

With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Both the employer and the employee will pay these taxes, each paying 7.65% for the combined Social Security and Medicare taxes.

Wisconsin Taxes

As with most states, Wisconsin requires that you withhold certain taxes from employee paychecks, as well as make tax payments from your business. Wisconsin does not levy local taxes on employees.

Income Taxes

Wisconsin has a fairly complex progressive income tax. Individual income tax rates for 2023 vary from 3.54% to 7.65%, depending on marital status and income. The more an employee makes, the more you’ll need to withhold; this includes charging different rates on various ranges for each salary/wage amount.

The Wisconsin Department of Revenue provides the following withholding tables for reference:

Employer Unemployment Taxes

All businesses in Wisconsin must pay State Unemployment Tax Act (SUTA) taxes.

Wisconsin’s wage base for 2023 is $14,000. The wage rate has not changed since 2022. Unemployment rates range from 0.0% to 12.0%.

New employers in Wisconsin are also given an initial SUTA tax assessment, depending on the size of payroll and the industry their business belongs to.

New Employer Rate (for Construction Businesses) | New Employer Rate (Other Industries) | |

|---|---|---|

Payroll less than $500,000 | 2.90% | 3.05% |

Payroll greater than $500,000 | 3.10% | 3.25% |

Did You Know? Businesses that pay SUTA in full and on time can claim a tax credit of up to 5.4% on their Federal Unemployment Tax Act (FUTA) taxes. To learn more about FUTA requirements, check out our guide on FUTA and Form 940.

Workers’ Compensation

Wisconsin requires every employer with three or more employees to carry workers’ compensation insurance unless your business qualifies for self-insured status. Workers’ compensation insurance provides benefits to employees who suffer on-the-job injuries and covers the cost of medical treatment and lost wages. For every $100 of annual payroll you pay out, you’ll be charged an average of $1.58.

Wisconsin Minimum Wage

In learning how to do payroll in Wisconsin, it’s important that you stay on top of the minimum salary rates to pay workers. Wisconsin follows the federal minimum wage of $7.25 per hour. For tipped employees, companies must pay at least $2.13 per hour, provided that their tips get them to the hourly minimum wage. If not, the company must make up the difference.

Calculating Overtime

Payroll in Wisconsin requires you to follow the Fair Labor Standards Act requirements for overtime. Under the FLSA, all employers must pay employees 1.5 times their regular hourly wage for hours worked over 40 in a workweek. If you fail to pay overtime when it’s due, you’ll underpay taxes and face late fees and penalties.

Paying Employees

You’re required to pay employees at least once per month. Each payment must be made within 31 days after the end of a pay period. You are free to pay employees more frequently but must choose a pay schedule and stick with it. If you need help keeping track of your payroll periods, use one of our free pay period calendars.

Wisconsin also requires employers to pay workers by one of the following methods:

- Cash

- Paper check

- Direct deposit

You may pay employees by payroll card, but only if the employee agrees in writing.

Pay Stub Laws

All Wisconsin employers are required to give employees a pay stub with every paycheck. There is no requirement that it be paper or electronic. However, the paystub must include the following information:

- Base rate of pay

- The number of hours worked

- Itemized deductions

- Total net pay to the employee

If you do not use a payroll service, download one of our free pay stub templates to help you create your own.

Wisconsin Paycheck Deductions

Wisconsin explicitly forbids you from deducting money from employee paychecks for damaged or stolen property, cash shortages, or poor work. You may make deductions for the following reasons:

- An employee provides written authorization to deduct wages for each occurrence

- The business and a union representative determine an employee was negligent and liable for damaged or stolen property

- Other lawful reasons

Terminated Employees’ Final Paychecks

You have to pay an employee’s final paycheck on the next regular payday when the employee quits, resigns, or is discharged or terminated. When a company closes or is sold or merged, an employee must be paid within 24 hours of the separation.

If you need to pay an employee right away and aren’t currently using a service, use one of our recommended ways to print a free payroll check

.

Wisconsin HR Laws That Affect Payroll

Wisconsin mostly follows federal guidelines for HR laws. But make sure you pay close attention to ensure that your company is not violating any employment laws.

Wisconsin New Hire Reporting

Every employer in Wisconsin must report new hires and any rehired employees to the Wisconsin New Hire Reporting Center within 20 days of their hire date. This information is used to enforce child support orders and must include the employee’s name, address, and Social Security number.

Meals & Breaks

Wisconsin law mandates that every employer give employees under 18 at least one 30-minute break if they are scheduled to work more than six consecutive hours. There are no requirements to give breaks to any employee 18 years of age or older. Breaks of fewer than 20 minutes must be paid, but breaks or meal periods over 30 minutes generally do not need to be paid.

The state of Wisconsin also has a “One Day of Rest in Seven” law. This law applies to employers operating factories or mercantile businesses. These employers must give employees at least one 24-hour period of rest every calendar week.

Wisconsin Child Labor Laws

Wisconsin does not restrict the working hours or days of children aged 16 and 17. However, minors aged 14 and 15 can only work up to three hours on school days and 18 hours in a school week. On non-school days and when school is not in session, they can work up to eight hours per day and 40 hours per week.

Check out our guide to hiring minors for more insight.

Time Off & Leave Requirements

Click through the tabs below to learn more about Wisconsin’s time off and leave requirements.

Payroll Forms

Wisconsin has a state W-4, the Employee’s Wisconsin Withholding Exemption Certificate. Wisconsin has no other state payroll forms.

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees; summary form of W2

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

For a more detailed discussion of federal forms, check out our guide on the federal payroll forms you may need.

Wisconsin Payroll Tax Resources

- Wisconsin State Tax Commission provides many forms, information on the latest laws and regulations, and other employer-specific information.

- Wisconsin One Stop Business Portal has many great resources for new and existing businesses to help them navigate licensing, taxes, and employer requirements.

- Wisconsin Department of Workforce Development offers support and resources to help businesses ensure compliance with unemployment and workers’ compensation, plus other labor laws.

Bottom Line

Wisconsin has a complex progressive income tax system. You’ll also need to stay abreast of family and sick leave laws. Otherwise, doing payroll in the state is fairly straightforward.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.