Doing payroll in New York can be more tedious and costly than in other states. The state’s minimum wage rate is growing, and different areas of the state have varying minimum wages so make sure to pay attention to that section below. In addition to paying regular federal payroll taxes, unemployment insurance, and possibly, the Metropolitan Commuter Transportation Mobility Tax, you have to withhold federal, state, and local income taxes from employee paychecks.

Key Takeaways:

- Minimum wage: $15.00 per hour statewide, $16.00 in NYC metro

- To be exempt from overtime, employees must meet the duties test and make at least $58,458.40 annually, $62,400 annually in New York City, Nassau, Suffolk, and Westchester Counties

- Overtime: Follows the federal guidelines of 1.5 times the regular rate of pay

- PTO: Not required, but employers may need to provide up to 40 hours of sick leave each year

- Effective January 1, 2025, employers must provide pregnant employees with up to 20 hours of paid time off to attend prenatal medical appointments

Step-by-Step Guide to Doing Payroll in New York

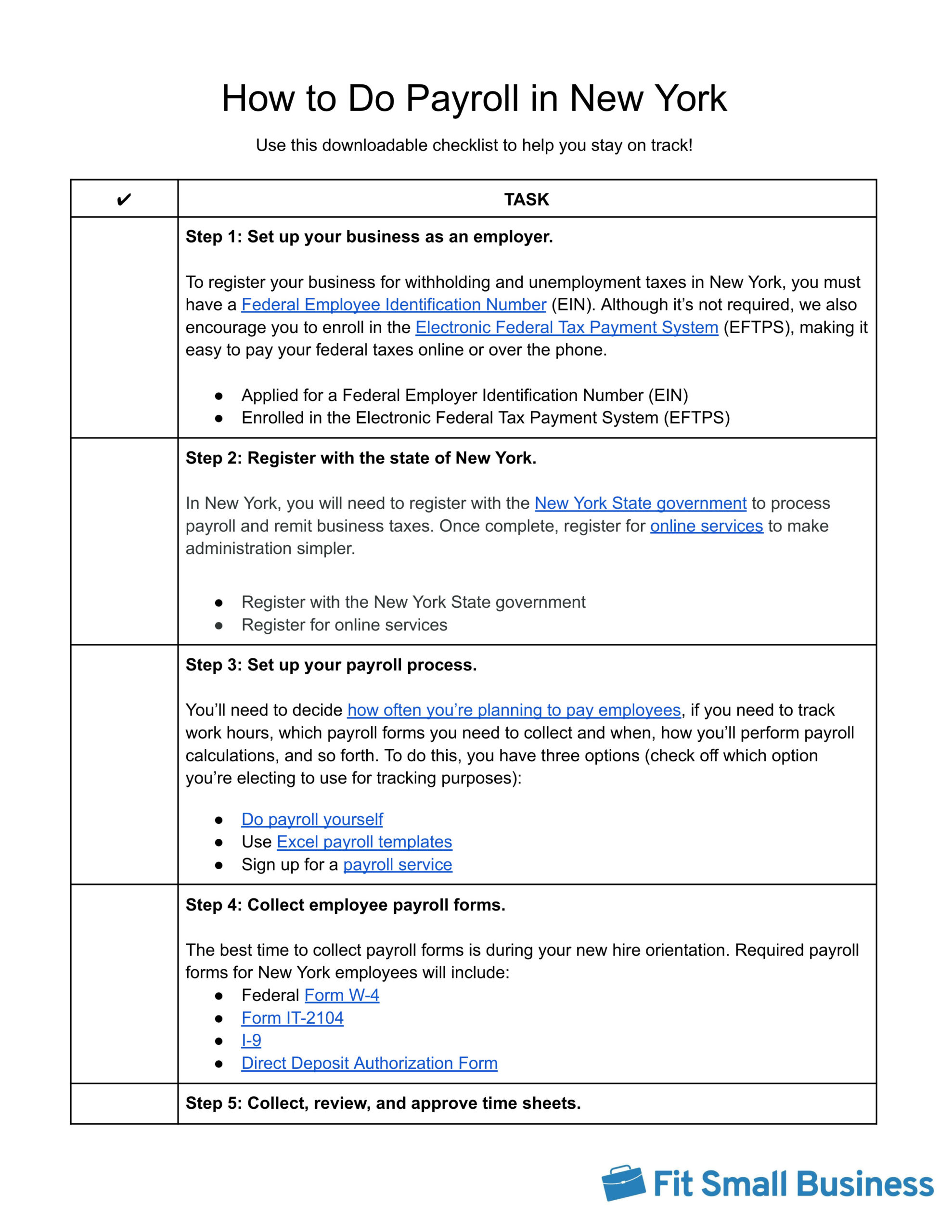

Below are the basic steps and specific instructions on how to do payroll in New York. If your total payroll tax withheld in the previous year was over $100,000, the state will enroll you in the PrompTax program and give you a six-digit code for filing electronically. If you use a payroll service, you will need this number.

At the federal level, you need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

If you are starting a new business or household employer, you need to register for unemployment insurance (UI), wage reporting, and withholding tax through NY Business Express (NYBE). To register an agricultural business, nonprofit organization, or Indian tribe, go to the New York Department of Labor’s website.

Your New York State Identification Number is for state income tax withholding; use your Federal EIN followed by a location code (if applicable to your business). Your UI employer registration number will be assigned to you separately.

Create an online services account to file electronically.

Established businesses may already have a payroll process in place, but a new company will need to begin with considerations such as how often employees will be paid, when they will be paid, and how hourly employees’ work time will be calculated. You can elect to do payroll yourself, set up an Excel payroll template, or use a payroll service.

This is easiest to do during onboarding. New employee forms to collect include W-4, I-9 Verification, and direct deposit information. Employees also need to fill out Form IT-2104, the NY State Withholding Allowances Certificate.

Whether using paper time sheets or time and attendance software, tracking employee hours is essential for ensuring accurate payroll. This step is repeated when doing payroll each period. Given the complexities of NYC tax law, inaccuracies could cost you, so review time sheets carefully. Make sure to discuss any issues with employees right away and consider having employees sign their time sheets.

Use a standard process to calculate payroll. A payroll software will reduce errors. Don’t forget to calculate withholdings for non-residents unless you have a bona fide business location in their state.

Federal tax payments must be made via EFTPS. You’ll need to deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned (either monthly or every other week) to your business by the IRS.

- Monthly depositors are required to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Every other week depositors are required to deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Taxes on payments made Saturday, Sunday, Monday, and/or Tuesday are due by the following Friday.

It’s important to note that the schedules for depositing and reporting taxes are different. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

In New York, you’re required to remit every other week, monthly, or quarterly, depending on the amount you’re withholding. Your payment due dates vary depending on the filer type, but many companies choose to streamline their processes by filing with each payroll run. The NYS-1 and your withholding payments are usually filed after each payroll. If your withholdings are less than $700 for a calendar quarter, then you can remit payment with the NYS-45 instead.

New York tax filings must be filed electronically.

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

You may file on the next business day if any of these dates fall on a Saturday or Sunday.

For New York Income Tax Withholdings:

Use the withholding allowance from the employee’s Form IT-210 to determine how much you should withhold in income taxes from each employee’s paycheck each period. If the employee did not file one, use zero as the number of allowances. You can find withholding amounts in the following tax tables:

- NYS-50-T-NYS, New York State Withholding Tax Tables and Methods

- NYS-50-T-NYC, New York City Withholding Tax Tables and Methods

- NYS-50-T-Y, Yonkers Withholding Tax Tables and Methods

- Unemployment taxes: When you register your business and apply for an EIN, the state will send you your UI tax rate for you for the year. If you don’t receive it, you may be able to look it up on your Business Express account or Department of Labor (DOL) account. You can also call the employer hotline at 888-899-8810 between 8 a.m. and 5 p.m. Monday through Friday. State unemployment taxes (SUTA) are recorded on the NYS-45 and paid quarterly.

- Metropolitan Commuter Transportation Mobility Tax (MCTMT): These are due each calendar quarter. The MCTMT is your payroll expense for all covered employees for each calendar quarter multiplied by the applicable MCTMT rate from the table below. File them using Form MTA-305 online through the online services account or by mail. These must be paid on time.

It’s important to keep records for all employees, even those terminated, for several years. Learn more about recordkeeping requirements in our article on retaining payroll records.

In New York, you must keep all records of employment taxes for at least six years. If you withhold state and city taxes, you need to keep all records of these tax filing reports and information returns available for review by the New York Tax Department.

These are the federal Forms W-2 (for employees) and 1099 (for contractors.) Employees and contractors must have these by January 31 of the following year. New York does not require you to file W-2s or 1099s with them.

Download our free checklist to help you stay on track while you’re working through these steps:

For greater detail on general payroll procedures, consult our article on how to do payroll.

New York Payroll Taxes, Laws & Regulations

Unlike some states, New York doesn’t have a regular payment schedule for tax withholdings, like semimonthly or quarterly. Form NYS-1 must be filed and the total tax withheld paid after each payroll that caused the total accumulated withholding tax to equal or exceed $700. If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45.

- If you have more than one payroll within a week (Sunday through Saturday), you are not required to file until after the last payroll in the week.

- If the calendar quarter ends between payrolls paid within a week, any accumulated tax required to be withheld of at least $700 must be remitted with Form NYS-1 after the last payroll in the quarter.

Filer Type | Due Date |

|---|---|

5-Day Filer: Filers who withhold less than $15,000 during the calendar year preceding the previous calendar year | Within five business days following the payroll that caused the total accumulated tax withheld to equal or exceed $700 |

3-Day Filer: Filers who withhold $15,000 or more for the calendar year preceding the previous calendar year | Within three business days following the payroll that caused the total accumulated tax withheld to equal or exceed $700 |

The state will inform you of changes, and new businesses have five days to file after being notified by the NY Tax Department.

New York Taxes

New York has state and some local taxes, state unemployment taxes (SUTA), and the MCTMT. You are also responsible for workers’ compensation and state disability insurance.

At the federal level, you need to pay FICA taxes (Social Security and Medicare) and withhold a matching amount from your employees’ paychecks. Both you and your employees will pay 6.2% of their paycheck to the Social Security fund and 1.45% to the Medicare fund.

Form NYS-50, Employer’s Guide to Unemployment Insurance, Wage Reporting, and Withholding Tax, has all the details you need for doing taxes in New York, including NYC and Yonkers. Most employers are required to file it electronically on the site; if you opt to mail in a paper copy, you could be charged penalties.

New York State Unemployment Insurance Taxes

New York charges SUTA in the amount of 2.025% to 9.825% on the first $12,500 of an employee’s wages. It also charges a reemployment tax of 0.075% on the first $12,300 of an employee’s wages. The new employer rate is 4.025%.

You must pay tax for all employees except the following:

- Members of an LLC, LLIC, or LLTC

- Students in regular attendance in the educational institution that employs them if their employment is incidental to their course of study

- Student’s spouse employed by student’s educational institution if advised at time of hire that the employee is under a program of financial assistance to the student

- Students enrolled in nonprofit or public educational institutions in certain work-study programs

- Students enrolled full-time in an educational institution who are employed at certain camps

- Sole proprietor, their spouse, or child under the age of 21

- Persons whose employment is subject to the Federal Railroad Unemployment Insurance Act

- Freelance shorthand reporters under certain conditions

- Licensed real estate brokers or sales associates under certain conditions

- Licensed insurance agents or brokers under certain conditions

- Some employees of nonprofit and religious organizations

- Clergy and religious

Please note that although unusual for some businesses, if you hire delivery drivers, traveling salespersons under certain conditions, musicians and other performers, professional models, and fellow, resident, and intern physicians, you must purchase unemployment insurance for them.

Most construction workers are also included under the New York State Construction Industry Fair Pay Act. Agricultural employers and farm crew leaders under certain conditions must provide unemployment insurance coverage for their employees. H-2A foreign guest workers are exempt.

In addition to New York state unemployment taxes, you’re also responsible for paying federal unemployment taxes. The standard rate is 6% on the first $7,000 of each employee’s taxable wages. The maximum tax you’ll pay per employee is $420 ($7,000 x 6%).

Did You know?

When you pay SUTA, you may qualify for up to a 5.4% discount on your federal unemployment insurance taxes (FUTA). This can lower your FUTA tax rate from 6% to 0.6%.

State and Local Income Taxes

New York uses the same rules for income tax withholdings as for SUTA when it comes to qualifying employment, determining liable employers, and calculating gross wages. You even file according to the same schedule using the same form, the NYS-45.

If you are an out-of-state employer withholding taxes for an in-state employee, you are subject to all the withholding requirements. In general, NY follows the same rules as the federal government for classifying taxable income. You’ll use the information on Form IT-2104 along with the New York tax tables that are updated each year to determine withholdings.

Non-resident employees sometimes pay taxes. If you have employees who do not live in New York State but earned money from work done in New York State, you still need to withhold New York state and local taxes unless you have a bona fide office in their state. These employees use Form IT-2104.1 to determine withholdings. To learn more about residency vs non-residency tax requirements, visit the New York State government website.

NYC and Yonkers Taxes

New York City and Yonkers also tax employees living in their areas. If in doubt as to whether an employee resides in a specific jurisdiction, you can look up an employee’s address to see if they are considered as residing in NYC or Yonkers.

Workers’ Compensation Insurance

Businesses in New York are required to have workers’ compensation coverage for all of their employees, including part-time employees and family employees. New York employers can come from private insurance carriers, the New York State Insurance Fund, or self-insurance (though self-insurance is very rare). Businesses may be exempt under very narrow circumstances. New York employers are not allowed to deduct the cost of their workers’ comp policy from their employees’ pay.

Estimated employer rates in New York are about 7 cents per $100 of payroll for low-risk businesses and $29.93 per $100 of payroll for high-risk businesses. This cost is based on several factors, including:

- Payroll

- Location

- Industry

- Risk factors

- Number of employees

Many payroll providers, like Gusto, offer a pay-as-you-go program that will work with your existing policy and automatically deduct your premiums each payroll. This is a great way to be sure that the premiums are deducted and remitted without having one more thing to worry about as a small business owner.

State Disability Insurance

If you employ one or more employees at least 30 days in a calendar year, you must provide temporary disability insurance. You can do this through private policy or the state insurance fund.

Did You know?

Unlike some payroll expenses (i.e., FUTA), New York allows employers to share the cost of disability insurance with employees. If you’d prefer your business not shoulder the cost alone, you can deduct half a percent of an employee’s wage up to a maximum of $60 per week. Just process payroll deductions from their paychecks each period, so you’ll have the money when it’s time to pay the bill.

Metropolitan Commuter Transportation Mobility Tax (MCTMT)

If you have payroll expenses within the Metropolitan Commuter Transportation District (MCTD), you are liable for the MCTMT for a calendar quarter if:

- You are required to withhold New York State income tax.

- Your payroll expense for all covered employees is more than $312,500 for that calendar quarter.

Find more information in MCTMT publications and tax bulletins.

To see if the MCTMT tax applies to your business, confirm whether you’re located in one of the following areas (within the MCTD):

- New York City: Manhattan, Bronx, Kings (Brooklyn), Queens, Richmond (Staten Island)

- Rockland County

- Nassau County

- Suffolk County

- Orange County

- Putnam County

- Dutchess County

- Westchester County

If you are located in one of the areas above, check the table below to find out your MCTMT tax rate.

MCTMT Tax Rates

Payroll expense | MCTMT Rate |

|---|---|

Up to $375,000 | 0.11% |

Over $375,000 but not over $437,500 | 0.23% |

Over $437,500 | 0.34% |

Minimum Wage Rules in New York

The state of New York now has a statewide minimum wage of $15 per hour, with $12.50 per hour for tipped service workers and $10.00 per hour for tipped food workers. Current rates depend on which city your business operates from. Here’s a chart to help you, but note that these rates are subject to increase annually:

Location | Minimum Wage | Tip Credit |

|---|---|---|

All New York City Employers | $16.00 | $2.65 for service workers $5.35 for food service workers |

Long Island and Westchester | $16.00 | $2.65 for service workers $5.35 for food service workers |

Rest of New York State | $15.00 | $2.50 for service workers $5.00 for food service workers |

If you’re unsure of the wage you need to pay, use the New York Department of Labor’s wage calculator.

The minimum wage does not apply to the following:

- Executives and administrators

- Certain professionals

- Outside salespersons

- Taxicab drivers

- Part-time babysitters

- Ministers and members of religious orders

- Volunteers, learners, apprentices, and students working in nonprofit institutions

- Students obtaining vocational experience

Please Note: When you hire a new employee and set their pay rate, you’ll need to provide them with a written pay notice that details the amount (hourly, salary, commission, etc.) along with the schedule on which they’ll be paid, their designated payday or pay date, the address and phone number of your business location, and any deductions you may take for tips, meals, or lodging.

New York Overtime Regulations

New York follows the federal rules for exemptions concerning overtime, payable at 1.5 times regular wages for all hours worked over 40 in a workweek. For everyone else, it sets these rules:

Employee Type | Overtime Rate |

|---|---|

Covered Employees | 1.5 times their regular, "straight-time" hourly rate of pay for all hours over 40 in a payroll week |

Residential Employees ("Live-in" Workers) | 1.5 times their regular, "straight-time" hourly rate of pay for all hours over 44 in a payroll week |

Farm Employees | 1.5 times their regular, "straight-time" hourly rate of pay for all hours over 60 in a payroll week |

New York has higher overtime exemption thresholds than the federal government. Besides the other requirements to be exempt from overtime pay, employees working in New York State must make at least $1,124.20 per week in 2024 to be exempt. That will rise in 2025 to $1,161.65 per week and again in 2026 to $1,199.10 per week.

New York City has higher requirements. $1200.00 per week in 2024, $1237.50 per week in 2025, and $1275.00 per week in 2026.

Different Ways to Pay Employees

You can pay employees in a variety of ways, including direct deposit, paper check, cash, and payroll card. Per New York law, you cannot base an employment decision on whether they consent to be paid via direct deposit or payroll card—some employees don’t have bank accounts, and any policy that targets them would be discriminatory in nature.

Pay Stub Laws

When you run payroll for your employees, you’ll need to prepare a pay statement, i.e., a pay stub, so they have a record of their earnings. Federal law doesn’t require it, but New York State does. It should include basic information, such as:

- Your company name

- The employee’s name

- Pay rate

- Pay period covered

- Hours worked

- Overtime pay

If you’d like a template to make creating your own pay statements easier, download one of our free pay stub templates; they’re already formatted, and you can print and use them today.

Minimum Pay Frequency

If you employ manual laborers, New York requires you to pay them at least weekly. If you’d like to process their payroll less often, you’ll have to apply for permission first. For all other employees, you can pay weekly, every other week, or twice monthly. New York law does not allow you to pay employees just once per month. Federal law doesn’t dictate how often you pay your workers; it only states that you must pay consistently.

If you need help selecting a pay period and scheduling pay dates, download one of our free payroll calendars to help.

Paycheck Deduction Rules

Although some states are lenient on payroll deductions as long as they don’t drop an employee’s pay below the minimum wage amount, New York has some strict rules. You are not allowed to deduct money from an employee’s paycheck for any of the following:

- Cash shortages

- Inventory shortages

- Loss of or damage to property

- Uniforms that you require

- Tools and other equipment required for the job

You can only deduct money from employee paychecks if it’s legal, both federal and state-wise, and the employee authorizes you to do so.

Please Note: You must get the authorization in writing or you could be penalized. Some common deductions employees request are insurance premiums, healthcare contributions, donations to charity, repayment of salary advances, and repayment of prior overpayments. Yes, this means you need to have written authorization from employees to deduct their health insurance premiums.

To learn about allowable payroll deductions and how to calculate them, read our article on post- and pre-tax deductions.

Final Paycheck Laws

If you ever find yourself terminating an employee in New York, you should move swiftly when sending them their last paycheck. Legally, you have until the nearest payday after the termination went into effect to distribute without facing legal issues. And, if you were managing benefits for them, you’re required to notify them within five days of their termination date of the exact date their benefits will be terminated.

If the employee quits, you should still strive to pay them by their next regular pay day. However, New York doesn’t have any specific laws governing this.

There are also special rules for paying out sales commissions when an employee is terminated. The sales commissions must be paid within five business days of the employee being fired, or within five business days of the commissions coming due.

Accrued Paid Time Off

Neither federal nor New York State law has stringent rules on how you should handle paid time off (PTO). When an employee leaves your company, you can opt to pay it out or take it back. However, if your employee has accrued sick leave, that must be paid out.

The caveat to this rule is that you need to have your process outlined in a policy that the employee receives at the time of hire. If you don’t lay down the ground rules regarding how you will handle paying accrued time off, you will be obligated to pay it out should they have a balance when they leave the company.

New York HR Laws That Affect Payroll

New York has many HR laws in place that are focused on protecting employees. It’s important that you are aware of what they are and how they need to be followed.

New York New Hire Reporting

When you make a new hire, and preferably before you process their first paycheck, you’ll need to report them to the state. New York requires you to submit the new hire report within 20 days of their hire date, which you can do online. If you prefer to file via mail, use Form IT-2104. If you don’t timely file a new hire report or you file a report without all the required information, you’re subject to a penalty of $20 per employee and per incomplete report.

Lunch & Other Break Time Requirements

Employees with shifts of more than six hours that start before 11 a.m. and continue to 2 p.m. must take an uninterrupted lunch break of at least 30 minutes between that time frame. This does not have to be a paid break unless the employee is unable to step away from their job duties. There is no other break requirement, but if you provide breaks of up to 20 minutes, you must pay it as work time. You’ll need to ensure their work and break time are properly documented using a time sheet or time clock.

Vacation & Leave

New York has no set laws for vacation or holiday PTO. Employers can set these rules however they wish. Just remember that if you state that you allow a certain number of PTO hours for the year, you are legally obligated to honor it.

Sick Leave

As an employer, you are required to provide sick leave per the New York Paid Sick Leave Law as follows:

Number of Employees | Sick Leave Required |

|---|---|

0-4 | If net income is $1 million or less in a calendar year, up to 40 hours of unpaid sick leave. If net income is over $1 million in a calendar year, up to 40 hours of paid sick leave. |

5-99 | Up to 40 hours of paid sick leave per year |

100+ | Up to 40 hours of paid sick leave per year |

New York City has its own Paid Safe and Sick Leave Law, but it mirrors the state law. It’s important that you track each employee’s leave—especially sick leave—so that you can prove compliance in the event of an audit. It will also make it more convenient for you to manage the employee’s accrued sick time so that you can better anticipate the timing of potential future expenses.

Paid Family Leave

New York’s Paid Family Leave provides workers with paid time off to:

- Bond with a newborn, adopted child, or fostered child

- Care for a family member (including siblings) with a serious health condition

- Assist loved ones when a spouse, domestic partner, child, or parent is deployed abroad on active military service

This law provides the following benefits:

- Job protections

- Health insurance continuation

- Protection from discrimination and retaliation

Employers in New York with at least one employee must follow the state’s Paid Family Leave requirements. Employers must provide employees with up to 12 weeks of paid leave that can be taken all at once or in increments of full days. Employees are eligible for up to 67% of their regular rate of pay, not to exceed 67% of the current New York State Average Weekly Wage which, for 2024, is $1,718.15. The maximum weekly benefit is $1,151.16.

This program is funded by employee payroll deductions. Employees contributed 0.373% of their gross wages per pay period, up to a maximum annual contribution of $333.25, which is $66.18 less than 2023’s deduction rate.

Child labor

There are child labor laws governing how you can employ minors in New York. Overall, a minor is considered anyone under the age of 18, but the rules vary for different age ranges.

Some state-specific child labor laws you should know when doing business in New York are:

- Children 14 to 17 need working papers to hold a job in New York.

- Children 14 and 15 cannot be employed during school hours.

- Minors cannot do factory work.

- Minors aged 16 and 17 may work full time if not attending school.

The law makes some exceptions for:

- Babysitters

- Bridge caddies

- Farm laborers

- Newspaper carriers

- Performers

- Models

Freelance Isn’t Free Act

Starting May 20, 2024, a new law went into effect protecting an estimated two million freelance workers in New York State. The new law mandates a written contract specifying key information and payment by the due date or within 30 days after service completion if no due date is set when the services a freelancer provides exceed $800 within 120 days. Employers must keep the contract for at least six years and provide it to the commissioner upon request. Failure to do so will result in a presumption that the freelancer’s version of contract terms is accurate.

Payroll Forms

New York has its own form for calculating state income tax withholdings, as well as for reporting other taxes. However, it uses the same form for filing income tax withholdings and SUTA.

New York Form IT-2104

New York uses a Form IT-2104, Employee’s Withholding Allowance Certificate. Like the IRS Form W-4, it sets withholdings for income taxes depending on your employee’s choices. Use this for calculating withholdings for NY state taxes, which differ from federal withholdings. Every employee should fill this out.

There are different versions of the form for exemption requests for Native Americans, military members, those in the START-UP NY program, and other situations. Make sure your HR department is familiar with these to offer them to qualified employees.

Other New York Withholding Forms

- Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return: You must fill this out completely each quarter.

- Form NYS-45-ATT, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return-Attachment: You must fill this out completely each quarter.

- Form MTA-305, Employer’s Quarterly Metropolitan Commuter Transportation Mobility Tax Return: This is only required if you’re filing MCTM taxes.

- NYS-100, New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting: There are different forms for agricultural workers, government entities, Indian tribes, and nonprofits.

- Form NYS-209, Instructions for Electronic Media Reporting of Employees Hired or Rehired

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: To report total annual wages earned (one per employee)

- W-3 Form: To report total wages and taxes for all employees

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- 1099-NEC: To provide non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

New York State Payroll Tax Resources & Sources

- Employer’s Guide to Unemployment Insurance, Wage Reporting, and Withholding Tax: This booklet contains just about everything you need to know about your rights, responsibilities, and filing requirements for payroll, withholdings, and unemployment insurance.

- New York Business Express website (NYBE): This is where you register as a new employer. Also, get information on licensing, regulations, incentives, and other business needs.

- Department of Taxation and Finance: The website has multiple menus for finding information on any aspect of taxes, including demo videos, articles, and forms. The search bar works pretty well for finding topics quickly.

For general information on payroll laws, check out our guide on payroll compliance.

New York Payroll Frequently Asked Questions (FAQs)

New York State payroll tax includes several components. Employers are responsible for withholding these taxes from employees’ wages and from business accounts. Employers also need to contribute to the state unemployment insurance fund and, if applicable, the MCTMT.

Yes, employers must withhold additional local taxes for employees who work in or are residents of New York City or Yonkers. Not only are there higher minimum wages and additional requirements, but the income tax rates can be different from the rest of the state.

The MCTMT is a tax imposed on certain employers and self-employed individuals conducting business within the Metropolitan Commuter Transportation District which includes New York City and several surrounding counties.

Bottom Line

There’s a lot to consider when doing payroll in New York because of the complexity of the taxes. Not only does it have state income taxes and SUTA, but it also has some local income taxes. Even non-resident employees must pay taxes, which means you need to calculate withholdings differently based on where employees live and where your business is located. New York also has comprehensive paid leave that you’ll need to follow.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.