Stripe is a developer-friendly payment processor best for online businesses wanting to add a customizable checkout to their websites or sales applications. Square is an out-of-the-box point-of-sale (POS) and payment processing platform better suited for small businesses needing an all-in-one solution.

In short:

- Square: Best for individuals, brick-and-mortar businesses, and basic online sales.

- Stripe: Best for tech-savvy startups and growing ecommerce businesses, B2B, and international sales.

- Stripe requires some technical knowledge and customization while Square is more user-friendly, easier to set up, and offers a free POS system and website.

Both Square and Stripe made our list of the best merchant service providers. Square was our choice for best overall, with a score of 4.53 out of 5, while Stripe came out as the best online payment processor, with a score of 3.89 out of 5.

Square vs Stripe Quick Comparison

Get a Personalized Recommendation

Need help choosing between Stripe and Square? Our quiz takes less than a minute, and you’ll get a recommendation without being redirected to another page.

Stripe vs Square Pricing

| ||

|---|---|---|

Our Score (Out of 5) | 3.94 | 4.31 |

Monthly POS Subscription | $0-$10 | $0-$60 |

Monthly Ecommerce Subscription | Varies (third-party) | $0-$72 with add-on programs |

Mobile Card Reader Pricing | $59 | $0-$49 |

Terminal and Register Pricing | $249 | $149-$799 (all-inclusive) |

Card-present Transaction Fees | 2.7% + 5 cents, 2.9% + 30 cents for touchless | 2.5% + 10 cents to 2.6% + 10 cents |

Card-not-Present Transaction Fees (Keyed-in) | 3.4% + 30 cents | 3.5% + 15 cents |

Ecommerce Transaction Fees | 2.9% + 30 cents | 2.9% + 30 cents |

ACH Transaction Fee | 0.8%, $5 cap | 1% processing fee, minimum $1 |

Invoice Fee | 2.9% + 30 cents plus 0.4% or 0.5% per invoice, depending on plan | 2.9% + 30 cents or 3.5% + 15 cents if processed using Card on File |

Recurring Billing | 2.9% + 30 cents plus 0.5% or 0.8% per invoice, depending on plan | 3.5% + 15 cents |

Chargeback Fee | $15 | $0 (waived up to $250 per month) |

Looking at the processing fees alone, Stripe holds its own against Square—though they both scored well for not having monthly or cancellation fees. Although overall, for affordability, Square beats Stripe. Square offers a free, fully functional POS system and online store, with charges for upgrades and additions. On the other hand, as a payment processor, you only get the full potential of Stripe when it is integrated with third-party applications.

You will need to sign up with a third-party platform if you want an online store to use with Stripe. Unless you use a free ecommerce platform, you will incur additional fees for the platform subscription.

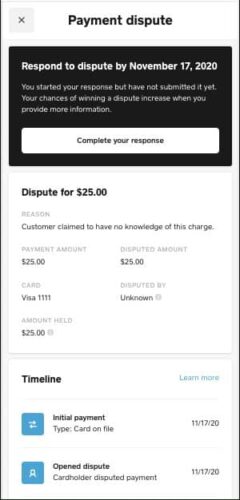

Another advantage that Square has over Stripe is that it waives chargeback fees of up to $250 per month while Stripe charges $15 for every chargeback. With Square, you might still be charged by your bank for any chargebacks, but unlike Stripe, Square does not charge any other fees.

Stripe may beat Square for ACH transactions and invoice payments, depending on the dollar amount. This makes Stripe better for B2B sales, and it makes our list of the best B2B payment solutions.

Learn more about Stripe’s pricing and fees and Square’s pricing and fees.

Square vs Stripe Estimated Fees

Compare Stripe vs Square fees. Enter an estimate of your monthly sales data in the calculator below:

Stripe vs Square Payment Types

| ||

|---|---|---|

Our Score | 3.75 out of 5 | 4.88 out of 5 |

In-person | Requires integration | ✓ |

Invoicing | With additional fee | ✓ |

ACH Payments | ✓ | ✓ |

Virtual Terminal | Limited | ✓ |

Mobile Payment | Requires integration | ✓ |

Buy Now, Pay Later (BNPL) | Affirm, Afterpay, Apple Pay Later, Klarna, Zip US | Afterpay |

International Payments | 135+ currencies, 47 countries Additional 1% fee | US, Canada, Australia, Japan, the United Kingdom, Republic of Ireland, France, and Spain only |

*Stripe advises against using the virtual terminal on the Stripe Dashboard. PCI compliance is the responsibility of the merchant when using the virtual terminal.

When comparing Stripe and Square, it’s essential to consider their strengths in different payment environments.

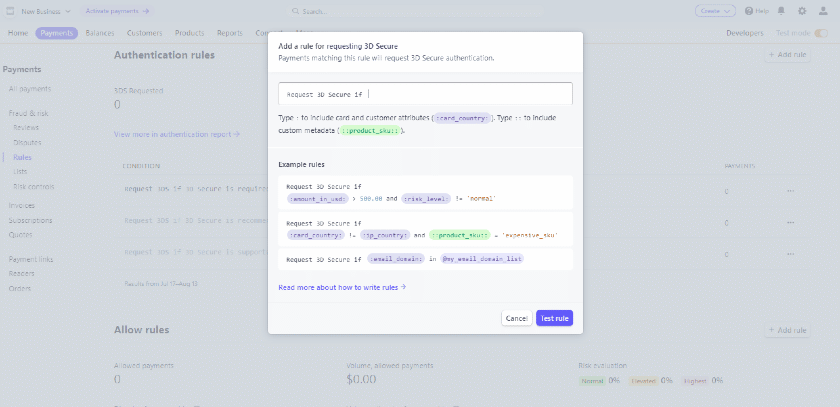

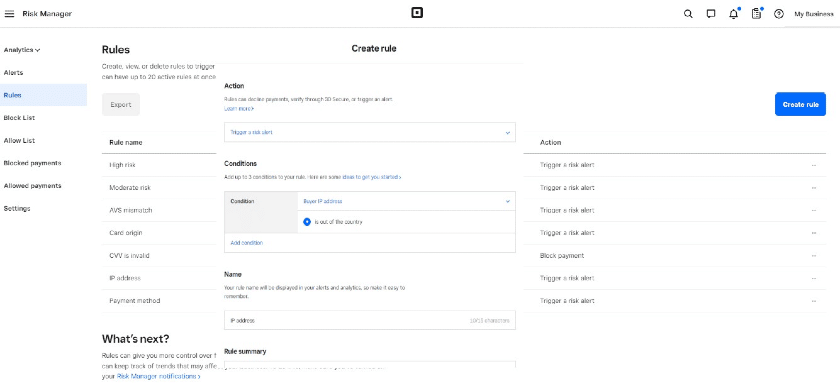

Stripe stands out as the top choice for online payment processing. Its advanced technology, including optimized hosted payments and customizable authorization processes, makes it particularly adept at handling online payments, even at high volumes. Its focus on flexibility and security, with features like fraud detection tools and customizable risk management, makes it a preferred option for businesses primarily operating in the digital space.

However, for businesses with a significant portion of in-person sales, Square shines with its seamless brick-and-mortar solutions. Square’s comprehensive POS ecosystem and easy integration options allow businesses to start accepting in-person payments quickly and efficiently.

With key integrations and a user-friendly interface, Square is an excellent choice for those needing a basic ecommerce setup or looking for a one-stop solution for both online and in-person sales.

It’s worth noting that while Stripe offers growing options for in-person payments, including card readers and POS integrations, it requires additional setup and integration compared to Square’s out-of-the-box functionality. Additionally, Square’s ecosystem locks users into its payment processor, which may be a drawback for those seeking more flexibility in their payment solutions.

Ultimately, the choice between Stripe and Square depends on the specific needs and priorities of your business. Stripe excels in online payment processing, while Square provides a seamless experience for in-person transactions, making each platform ideal for different contexts and business models.

Stripe can easily handle heavier online transaction volumes with powerful functionalities to secure payment processing, including a fine-tuned range of fraud detection tools and customizable risk management features. (Source: Stripe)

Stripe vs Square In-person Hardware Solutions

Stripe vs Square Features

| ||

|---|---|---|

Our Score (Out of 5) | 3.25 | 4.19 |

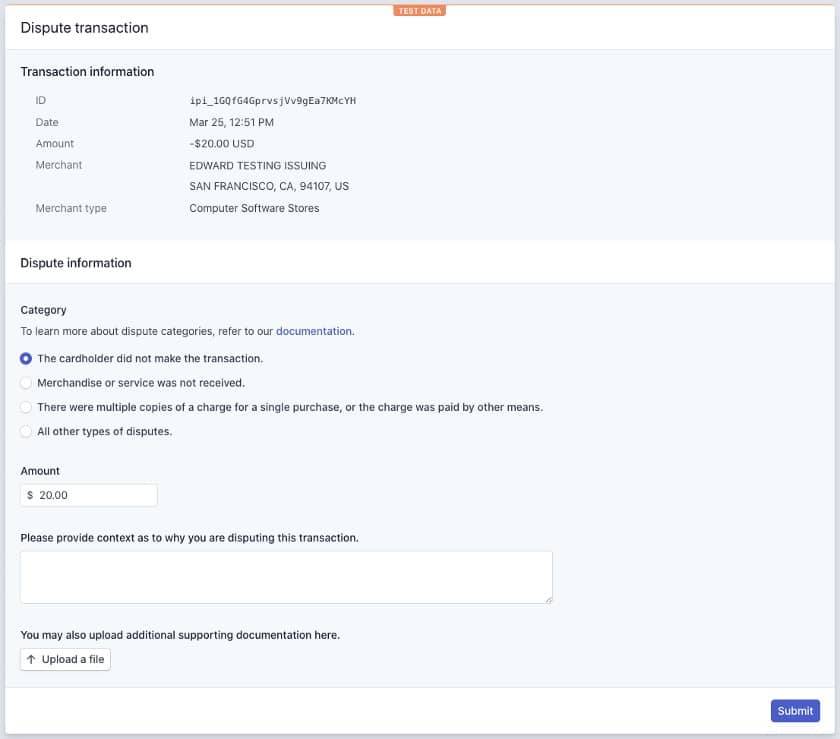

Chargeback/Dispute Fees | $15 (non-refundable) | $0 (waived up to $250) |

Chargeback Protection | Optional, additional fee of 0.4% per transaction | Included |

Advanced Risk Monitoring | 0-7 cents per transaction | 0-6 cents per transaction |

Dispute Management | ✓ | ✓ |

PCI Compliance | ✓ | ✓ |

Payment Security | Level 1 PCI compliance Payment data encryption Built-in machine-learning fraud detection Customized payment risk evaluation 3D secure authentication Secure data migration Online identity verification | Level 1 PCI compliance Payment data encryption Proprietary tokenization Systematic security updates |

Offline Payments | ✓ | ✓ |

API | ✓ | ✓ |

Developer Tools | CLI, Visual Studio Code, live event monitoring, advanced SDKs | Sandbox, API explorer, live event monitoring, backend SDKs, secure payment SDKs |

Developer Support | Documentation, YouTube tutorials, newsletter, live chat with developers, 24/7 support | Documentation, forums, Slack, contact support via online form |

Deposit Speed |

|

|

Customer Support |

|

|

Both Stripe and Square offer a range of features and integrations tailored to different business needs.

Security

Stripe prioritizes customization in its security features, offering tools beyond standard security measures like PCI compliance and dispute management. With options for customizable risk scoring and secure data migration, Stripe provides advanced protection for online transactions. Additionally, it supports global businesses with online identity verification from over 33 countries and centralized fleet management for registered card readers.

On the other hand, Square provides standard security tools suitable for small businesses, with options for advanced risk monitoring at an additional cost. While it offers chargeback protection and dispute management, the protection is capped at $250 per month, making it more suitable for smaller transaction volumes.

Integrations

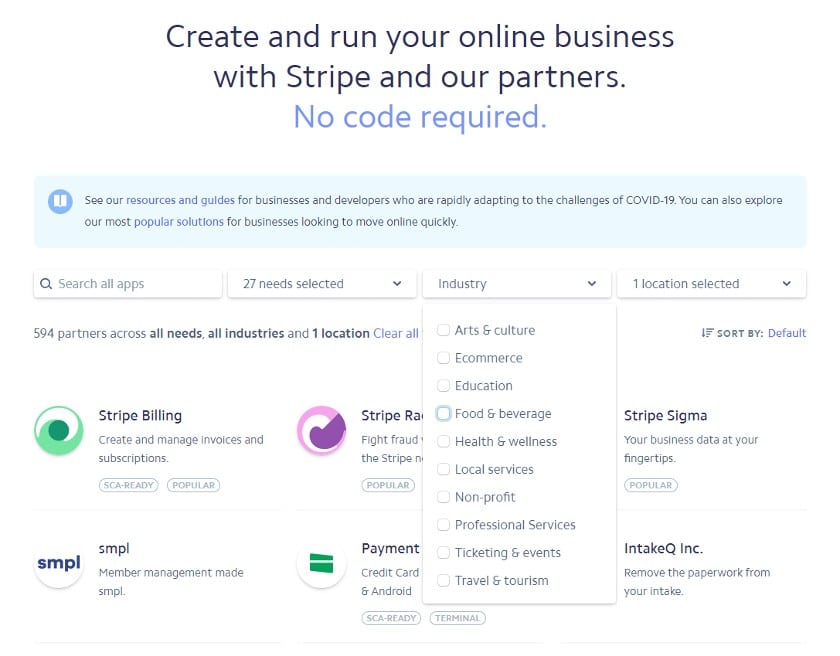

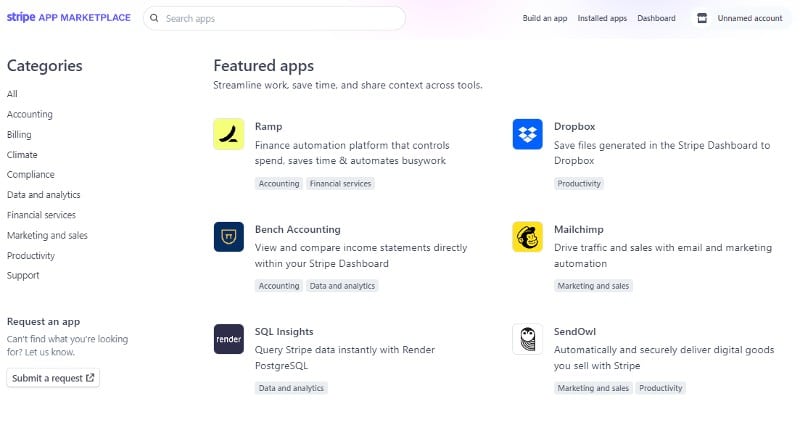

Stripe’s strength lies in its developer-friendly approach, offering extensive documentation, support, and tools for creating custom integrations. With over 700 partner apps, Stripe leads in payment processing software for integrations, including popular apps like Salesforce, Shopify, and QuickBooks. Its API support, CLI, and Visual Studio Code extension make it easy to build, test, and manage integrations.

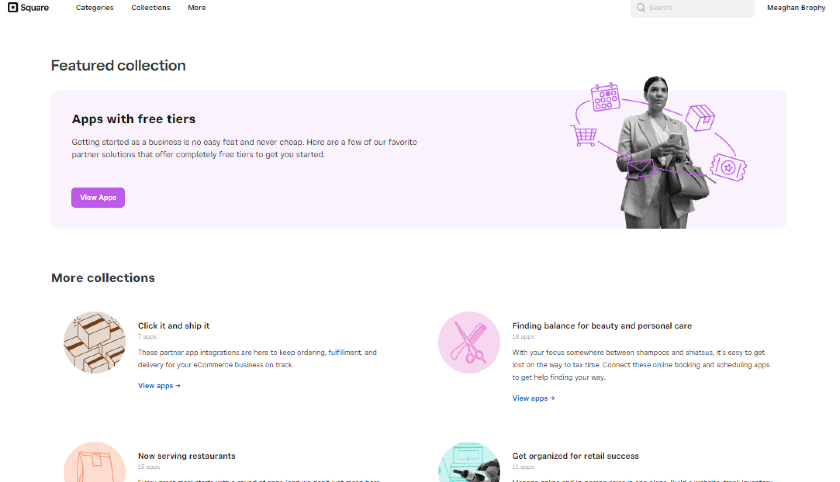

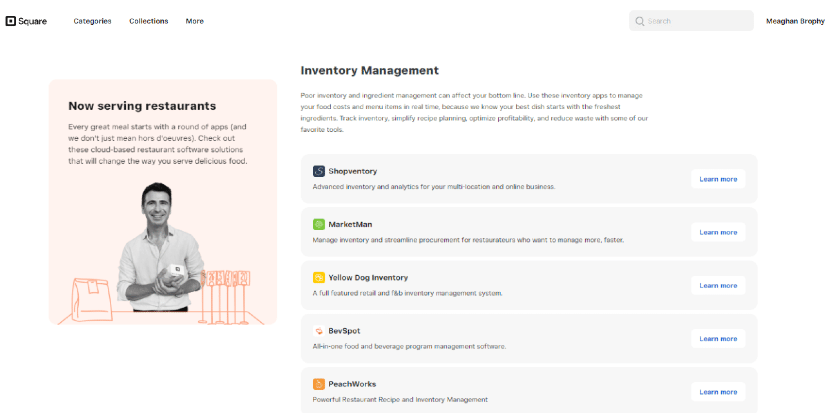

Square, while offering fewer integrations compared to Stripe, focuses on easy-to-use, industry-specific integrations. With 150 apps in its Marketplace and collections of recommended apps, Square provides convenient options for businesses seeking industry-specific integrations. It also offers robust API support with a sandbox for testing and a forum for developer support.

To sum it up, Stripe excels in customization and developer support, making it ideal for tech-savvy businesses with complex integration needs. On the other hand, Square offers simplicity and industry-specific integrations, making it a strong choice for small businesses and those seeking easy-to-use solutions.

Stripe vs Square Expert Score

We scored this category based on our own experience of ease of use and how affordable and transparent the pricing is. We also looked at the number and ease of integrations, as well as the input of real-world users as recorded in third-party user review sites like Capterra and G2.

Stripe earns a high score of 4.69 out of 5, primarily due to its extensive integrations, popularity, reasonable pricing, and robust security infrastructure. While it may require higher technical skills, especially for customization, its plug-and-play integrations and checkout templates simplify payment processing.

Stripe’s well-documented products and 24/7 support further enhance its appeal for businesses dealing with online sales, international payments, and large-ticket transactions.

On the other hand, Square, with the same score of 4.69 out of 5, stands out for its ease of setup and all-in-one business solution. Its user-friendly interface allows businesses to start accepting payments quickly without requiring technical skills. It offers a comprehensive platform, including payment processing, inventory, and operations management tools.

Although it has fewer integrations compared to Stripe, its built-in website builder facilitates online selling with easy drag-and-drop design tools. These make Square suitable for businesses looking for simplicity and convenience and aiming to quickly establish an online presence.

Stripe vs Square User Reviews

| ||

|---|---|---|

Capterra | ||

G2 | ||

Software Advice |

Both Stripe and Square scored high across different user review sites we looked at. Stripe garners praise for its extensive integrations, advanced security features, and reliability in handling online payments. Users appreciate the flexibility for customization but note a learning curve for setup, particularly for those lacking technical expertise. Despite this, Stripe’s robust support and documentation are commended.

On the other hand, Square is lauded for its simplicity and ease of use, making it a popular choice among small businesses. The built-in ecosystem, including payment processing and inventory management, receives positive feedback for streamlining operations.

However, some users highlight limitations in features and integrations compared to Stripe, especially for larger businesses with complex needs. Additionally, Square’s customer support availability receives mixed reviews, with some users expressing dissatisfaction with response times.

Methodology: How We Evaluated Stripe vs Square

We test each merchant service provider ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to various payment processing features, scalability, and ease of use.

The result is our list of the best merchant services providers. However, we adjust the criteria for specific use cases, such as for different business types and merchant categories. This is why every provider has multiple scores across our site, depending on the use case you are looking for. For this in-depth analysis, we looked closely at how Stripe and Square performed.

Click through the tabs below for our overall merchant account evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments, and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same-day or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use―including account stability―popularity, and reputation among business owners and sites like the Better Business Bureau (BBB). Finally, we considered how well each system works with other popular small business software, such as accounting, POS, and ecommerce solutions.

Frequently Asked Questions (FAQs)

Click through the sections below to read answers to common questions about Stripe vs Square.

Square is an all-in-one solution for small businesses that need a payment processor, POS, inventory, and operations management tools. It is easy to use and requires very little technical or coding skills. On the other hand, Stripe offers a lot of flexibility and customizability. It has over 700 integrations, exceptional data security, and global payment capabilities.

Stripe’s biggest strengths are its flexibility and customization. It has a robust API, supports payments in over 135 currencies, over 700 integrations, and high-level security infrastructure.

Square is best at providing an all-in-one solution—a range of payment processing options, a POS system, and various integrated tools.

Bottom Line

When debating between Square vs Stripe for your business, it comes down to one question: Are you a tech-savvy startup or a business owner looking for a user-friendly solution? For tech-savvy startups wanting lots of flexibility, Stripe is best for you. Meanwhile, Square offers a plug-and-play solution for accepting payments anywhere, along with a suite of free business management tools that is a better fit for most small businesses.