The best PEO companies offer comprehensive HR and payroll services, providing expert support in managing regulatory compliance, payroll tax regulations, and labor laws. PEO providers also offer access to a wide range of benefits at competitive rates that you can’t normally get as a small or midsize company.

In this guide, I reviewed seven popular options and identified the best PEO companies for small business owners.

- Justworks: Best overall

- TriNet PEO: Best for benefits support and options

- Paychex PEO: Best customizable PEO plans

- ADP TotalSource: Best for growing businesses

- Rippling PEO: Best for HR technology

- Insperity: Best for training services

- XcelHR: Best for risk management

The Fit Small Business editorial process follows strict standards to ensure that our best answers are founded on the basis of accuracy, clarity, authority, objectivity, and accessibility.

My software and product recommendations are based on more than six years of experience writing about and evaluating HR systems and services for small to mid-sized businesses (SMBs). I also have 10 years of expertise in handling different facets of human resources, including managing HRIS, time tracking, and payroll systems. These allowed me to provide insights to help business owners determine which platform or HR service best fits their needs.

To evaluate the best PEO services for small businesses, I compared seven top-rated PEO companies across 50 data points, prioritizing service features, ease of use, and value for money. See my full methodology below.

Best PEO companies compared

All the professional employer organization (PEO) companies I reviewed offer hire-to-retire services, pay processing, payroll tax administration, year-end tax reporting, employee benefits plans, and compliance assistance. Below are the providers’ pricing details and other key features.

Expert Score (out of 5) | Starter Monthly Pricing | 24/7 Phone Support | |||

|---|---|---|---|---|---|

4.27 | $59 per employee | ✓ | ✕ | ✓ | |

3.95 | Call for a quote | ✓ | ✓ | ✕ | |

3.80 | Call for a quote | ✓ | ✓ | ✓ | |

| 3.69 | Call for a quote | ✓ | ✓ | ✓ |

3.68 | Call for a quote | ✕ | ✕ | ✕ | |

3.63 | Call for a quote | ✓ | ✓ | ✕ | |

3.20 | Call for a quote | IRS-certified only | ✓ | ✕ | |

Justworks: Best PEO for small business owners

Pros

- Transparent pricing.

- Excellent customer support.

- Offers time tracking tools, global contractor payments, and employer of record (EOR) services for hiring and paying international workers.

- Has IRS, certified PEO (CPEO), and ESAC certifications.

Cons

- Limited reports and integrations

- Mobile app is limited (lack of basic employee self-service features)

- Users say the PTO tools are not robust

- Has preset payout schedules for hourly and non-exempt salaried employees (set every other Friday)

Overview

Who should use it:

Justworks is an excellent choice for small businesses with limited HR experience. It offers payroll processing, tax filing services, and employee benefits with enterprise-level options from top carriers and insurers. It also provides access to HR professionals who can help you navigate the complexities of HR and payroll compliances.

Why I like it:

I consider Justworks as the best PEO for small business owners because of its affordability and reliable PEO services. Scoring 4.27 out of 5 in my evaluation, it received high marks of 4 and up in many criteria due to its transparent pricing, strong compliance tools, good customer support, and payroll and benefits administration features that simplify HR tasks.

While it has an intuitive interface, it lost points because it doesn’t file Equal Employment Opportunity Commission (EEOC) reports or handle Occupational Safety and Health Administration (OSHA) claims. It only provides tools that support compliance and reporting for these requirements. Plus, unlike the others on my list, it has limited learning management features, and its time tracking module costs extra ($8 per employee monthly).

PEO plans

- Basic: $59 per employee monthly

- Plus: $109 per employee monthly

Payroll plan: $50 base fee per month plus $8 per employee monthly

- This is a standalone payroll option for businesses that only need pay processing tools. PEO services not included.

Add-ons for Basic, Plus, and Payroll plans

- Time tracking: $8 per employee monthly

- International contractor payments: $39 per paid worker monthly

Add-on for Basic and Plus plans

- EOR: $599 per employee monthly

Add-on for Payroll plan

- Health insurance: $8 per benefits-eligible employee monthly

- Compliance monitoring: Justworks helps you navigate complex labor laws across multiple states effortlessly, reducing the risk of costly penalties. In addition to having HR professionals who keep you up-to-date on ever-changing regulations, several state policies, guides, and labor law posters have been preloaded into its platform to keep you compliant.

- Benefits overview report: Instead of keeping a separate document that contains the different types of benefits you offer, you can generate this directly from Justworks. This saves you time from checking what new employee perks are available, and you can share the report with your prospective hires so they know what to expect if they join your company.

- Extensive customer support: With Justworks, you get HR consulting services and dedicated support. If you need assistance, its customer service representatives are available 24/7 through email, chat, phone, SMS, and Slack. The other PEO providers on my list don’t have this many ways to contact support.

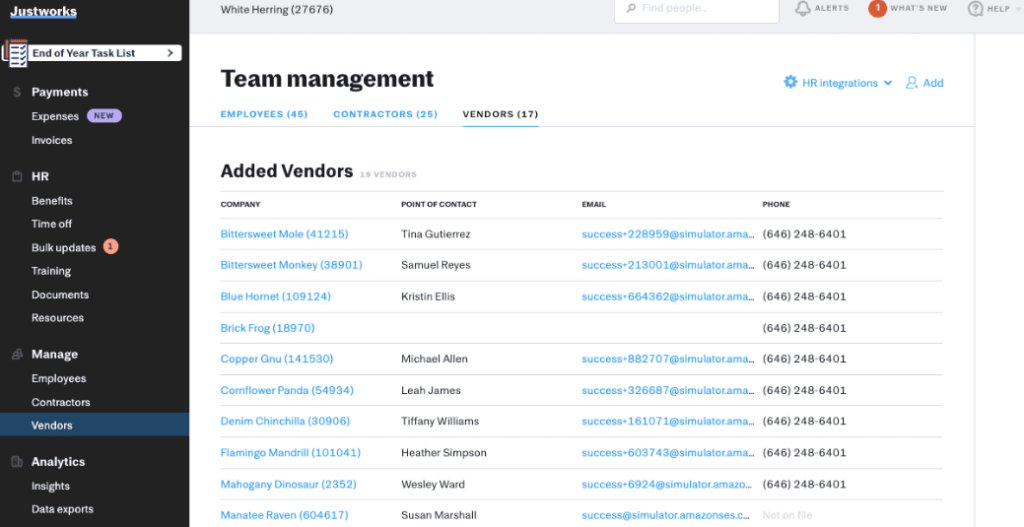

- Vendor payments: Justworks is the only PEO company I reviewed that can handle payments for employees, contractors, and vendors. To pay vendors, they have to provide their Employer Identification Number (EIN), create a Justworks account, and submit their invoices. Note that if they prefer to use their Social Security number instead of their EIN, Justworks will automatically consider them as contractors.

You can add basic information about the new vendors into the system, and Justworks will automatically send them an email to set up their online accounts. (Source: Justworks)

Reviewers who left feedback on popular review sites like G2 and Capterra consistently praise Justworks for its intuitive interface and comprehensive support, which makes managing payroll and benefits easy for them. Others also appreciate its transparent pricing and 24/7 customer service. However, some users wished for more customization options and advanced reporting features.

TriNet PEO: Best for benefits support and options

Pros

- Tailors PEO services to your industry.

- Prices decrease when Social Security or unemployment rate maximums are reached.

- Wide offering of HR services, benefits plans, and HR tools.

- Certified PEO with IRS and ESAC accreditations.

Cons

- Pricing isn’t transparent.

- Can be pricey for small businesses (similar providers charge slightly lower rates).

- Limited prebuilt integration options.

Overview

Who should use it:

The TriNet PEO offerings are highly competitive compared to those on my list. In addition to its wide range of HR features and services, it provides various employee benefits options — the most comprehensive in this guide. This is great if you want to remain competitive or if the industry your company belongs to requires specific insurances, such as critical accident and illness policies for manufacturing firms.

Why I like it:

TriNet’s claim to fame is that it will customize your PEO plan according to your industry, and I appreciate this approach. It ensures that small businesses in niche or specialized sectors receive customized support that aligns with their unique challenges rather than get a one-size-fits-all PEO service. This specialization makes it easier to address industry-specific compliance requirements and offer competitive benefits to attract and retain top talent.

In my evaluation, TriNet PEO earned an overall score of 3.95 out of 5 because of its efficient payroll and tax filing services, extensive benefits options, and wide range of HR offerings. It didn’t nab the top spot on my list of best PEO services because its software isn’t as intuitive as the others on my list. Plus, it requires you to call for a quote, unlike Justworks, which lists all pricing details on its website.

TriNet’s PEO pricing is based on a hybrid model that charges a flat fee per month plus a percentage of your total payroll for administration fees and taxes. One thing TriNet does that I have not seen with the other PEO companies in this guide is that its prices decrease as employees either max out their Social Security deductions or unemployment taxes. It also reduces your rates if employees elect for a pre-tax medical deduction.

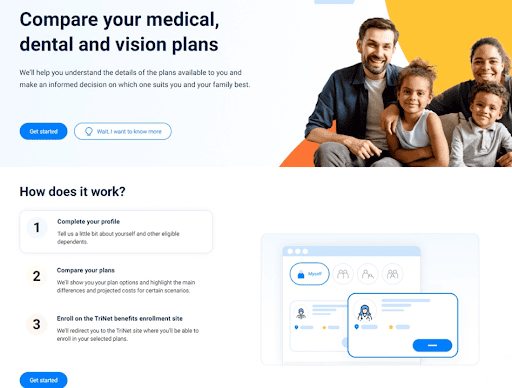

- Benefits decision support: This artificial intelligence (AI)-based tool, powered by Healthee, provides personalized answers based on employee input and the analysis of healthcare data and trends. It helps your workers understand plan options, discover benefits, compare packages, and make informed decisions. This also lets your HR team focus on other tasks and spend less time answering benefits inquiries.

- Comprehensive benefits packages: Like other top PEO companies, TriNet leverages the power of all its customers to get excellent rates on major medical insurance. Its benefits plans also go beyond access to health and retirement coverage; it includes other options like commuter benefits, home and pet insurance, staff discounts, and an employee assistance program.

- HR support and tools: You’ll have access to HR advisers, performance management tools, and training programs that include professional courses for online learning and certifications. Like Insperity, it even offers leadership training. TriNet also has employee culture surveys and a team engagement tool to help you develop better employees and working groups.

- Customizable reporting: TriNet provides more advanced reporting and payroll analytics, such as segmented data by department or region. This feature offers deeper insights compared to the reporting tools of similar PEO providers.

You and your employees can access Healthee’s benefits decision tool directly from TriNet’s platform. (Source: TriNet)

Users who left TriNet reviews on G2 and Capterra said that the provider’s industry-specific expertise helps them navigate unique challenges across various sectors. Others also found its employee development tools beneficial in managing and engaging their workforce. Some users, however, mentioned that its pricing structure can be complex and suggested more transparency in fees.

Paychex PEO: Best customizable PEO plans

Pros

- Customizable PEO plans with a wide range of benefits options and HR tools.

- Access to an HR team with various specialties.

- Certified PEO with IRS and ESAC certifications.

Cons

- Pricing isn’t transparent.

- Can get a bit expensive as you add features.

- Customer support can be inconsistent at times.

Overview

Who should use it:

Paychex can create a customized PEO package if you have specific needs, allowing you to select HR tools and benefits options that best meet your company’s requirements. With its more than 300 solutions and services, you can have a PEO package that, aside from the essential HR and payroll tools, includes new hire screening services, medical contribution tracking for Form W-2 reporting, and retirement plan services.

Why I like it:

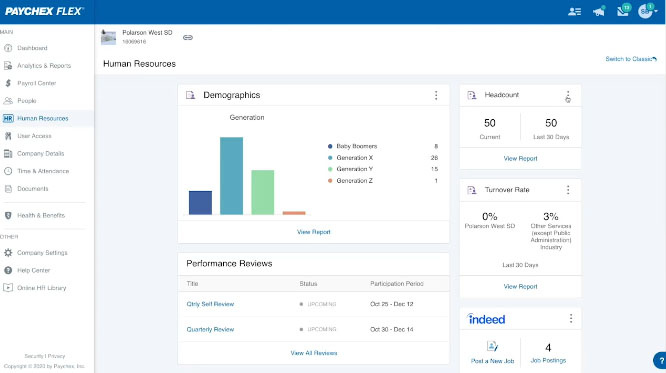

Similar to TriNet PEO, Paychex PEO has a comprehensive suite of HR, payroll, and compliance solutions, including a wide variety of employee benefits. It uses its payroll software, Paychex Flex, to provide full-service payroll and tax reporting assistance. I like that it allows for flexibility in selecting PEO services and that you can get HR support from a dedicated team of subject matter experts to help you handle the challenges of managing employees.

In my evaluation, I gave Paychex PEO an overall score of 3.80 out of 5. It couldn’t give a higher rating because while it has extensive payroll and benefits features, you must pay extra for some tools, such as time tracking and applicant tracking. You also need to call its sales team and contact several reps to get pricing details for the services and modules you’re interested in.

Paychex doesn’t publish the monthly fees of any of its products on its website. You have to contact its sales team to discuss your requirements and get a quote.

For its PEO service, providing support in HR, payroll, benefits, and risk management tasks is included in Paychex’s client service agreement. If you require additional services, several HR tools are available on an a la carte basis. Paychex can help determine the tools and services that best fit your business requirements if you’re unsure what to get.

- Multiple payment options: Paychex can pay employees via direct deposit and pay card. Not all the providers on my list of best PEO companies offer a pay card option, which is a good perk to highlight if you want to hire Gen Z workers. Like ADP, it also supports paper checks and even offers check stuffing services. However, you have to pay extra for check mailing services.

- Paychex Voice Assist: This AI feature offers the first voice-activated payroll experience on the market. You can start a pay period, work on a pay period already in progress, apply standard pay, make adjustments, review totals, and submit payroll all hands-free using your mobile device.

- HR support and tools: You get a team of experts, each member specializing in an area of your PEO plan, plus an HR generalist. Not every PEO on my list offers a team setup like this. In addition to onboarding and offboarding tools, you can get other HR solutions like HR analytics and an AI-powered learning management system (LMS) that recommends courses based on the employee’s position and work goals.

- Compliance support: Paychex offers employment practices liability insurance (EPLI) and cyber liability insurance. Further, its HR team provides proactive updates on legislation changes, and a Paychex safety rep can even help you assess and mediate risks and meet OSHA requirements.

Paychex PEO grants you access to its Paychex Flex platform to track key metrics, such as turnover, headcount, and hiring reports. (Source: Paychex)

Users who left reviews on G2 and Capterra appreciate Paychex PEO’s comprehensive HR support and scalable solutions. They commended its flexibility and the breadth of services offered. However, some reviewers noted that its platform could benefit from more frequent updates to enhance user experience and modernize the interface because it looks dated.

ADP TotalSource: Best for growing businesses

Pros

- Highly experienced certified PEO that’s IRS- and ESAC-certified.

- Dedicated reps are helpful.

- Comprehensive US and global payroll capabilities.

- Offers global payroll tools.

Cons

- Non-transparent pricing.

- Time tracking and recruiting tools are paid add-ons.

- Its platform may be overwhelming for small businesses due to its extensive and enterprise-level features.

Overview

Who should use it:

ADP’s PEO product, ADP TotalSource, is a goliath among PEOs in size and range. Similar to Paychex and Insperity, it offers decades of HR expertise and experience (over 30 years) and has a wide set of HR features and solutions. With its platform’s capability to handle even thousands of employees, ADP TotalSource is an excellent choice for companies that expect to expand business operations.

Why I like it:

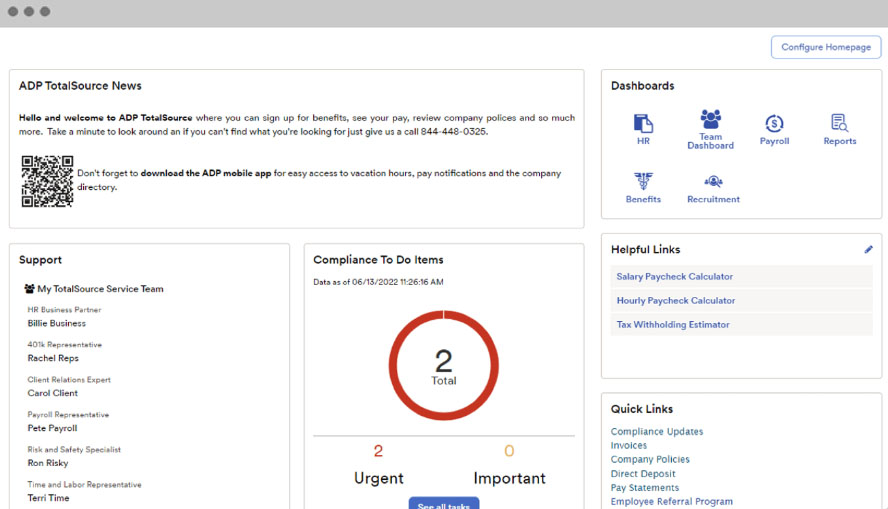

With ADP TotalSource, you get ongoing support from an HR professional and access to an intuitive software that can simplify various HR tasks in the employee life cycle. However, what impressed me the most is its recruiting services. ADP has hiring experts who can help you find employees you’ll love to hire. Using that service with ADP’s applicant tracking and onboarding tools can make hiring faster and easier for you.

Overall, it scored 3.69 out of 5 in my evaluation. It received high marks of 4 and up in nearly all criteria due to its strong HR support tools, compliance assistance, competitive benefits with employee discounts, and IRS and ESAC certifications. It posted the lowest score in pricing because, unlike Justworks, it isn’t transparent.

Like most PEO providers in this guide, ADP requires you to contact its sales team to get pricing details for ADP TotalSource.

- Multiple payments with secure paychecks: ADP TotalSource supports payments via direct deposits, paychecks, and the Wisely Pay card. Similar to Paychex, it also offers check signing and stuffing services, but what sets ADP apart is its highly secure checks with 10 advanced fraud protection features.

- Employee benefits: ADP TotalSource leverages the power of over 500,000 client employees under its PEO to get Fortune 500-level healthcare options for your business. It also conducts an annual comparison against your competition to ensure you offer your employees the best benefits — a unique feature with ADP.

- HR support and tools: ADP provides hire-to-retire support to recruit and track applicants, onboard new hires, store staff information, manage performance reviews, and offboard or terminate employees. It has training and development programs, staff surveys, and more. However, you must pay extra for time tracking, employee engagement tools, and full-service recruitment.

- Compliance support: In addition to in-app compliance alerts, ADP’s HR experts have decades of experience and are constantly learning. They can advise you on compliance regulations to help you avoid potential legal issues. If a worker sues your company, ADP may also provide legal assistance if you follow its recommended processes. ADP TotalSource is the only PEO I reviewed that has this feature.

ADP TotalSource’s main dashboard

(Source: ADP)

Many users praised ADP TotalSource for its efficient payroll processing, comprehensive compliance support, and extensive HR services. On the other hand, some users said that the support team’s response time can be slow.

Rippling PEO: Best for HR technology

Pros

- Can easily turn PEO on and off and still access HR/payroll software.

- Excellent integration capabilities with over 600 options.

- Intuitive interface with modular HR, payroll, benefits, finance, and IT tools.

- Supports global contractor payments and has an EOR service for hiring and paying international employees.

Cons

- Lacks IRS and ESAC certifications.

- You can’t buy its payroll solution (and other modules) without purchasing its core workforce management platform.

- Gets pricey as you add functions.

- No customer support via phone.

Overview

Who should use it:

I recommend Rippling PEO to companies that want to outsource day-to-day HR and payroll tasks but still maintain access to an all-in-one HR, finance, and IT software. Rippling can also provide customizable workflows, better reporting, and powerful automation across functions by unifying all its features in a single platform.

Why I like it:

Rippling has one of the most advanced automation features in the HR software market. It lets you create workflows that trigger specific actions across all Rippling modules, including some of its partner systems. I also appreciate Rippling’s flexible PEO controls, which allow you to switch off its PEO service and instantly transition to its HR platform. None of the providers on my list have this feature.

With its intuitive interface, efficient payroll tools, strong HR and compliance support, and flexible PEO controls, Rippling PEO earned an overall score of 3.68 out of 5 in my evaluation. However, its non-transparent pricing, lack of phone support, and zero PEO accreditations with the IRS and ESAC cost it several points.

For Rippling’s PEO pricing, you must call for a quote. However, it also offers other options and add-on solutions. For a small business payroll platform, Rippling’s monthly fees start at $8 per user plus a $40 base fee.

- PEO service on/off switch: Leaving a PEO can be stressful. You typically have to contact the provider to make it happen. With Rippling, you simply go to the system settings, switch its PEO off, and immediately use its HR platform. Note that the other PEOs on my list don’t have an easy on/off option.

- Unified HR, IT, and finance platform: Rippling is unique from many of the best HR software and top payroll services because of the easy integration between its various modules. By combining HR management with IT (such as device provisioning) and finance functions (such as expense reimbursements), Rippling can manage all back-office tasks from a single platform — saving time and reducing errors.

- Workflow automation tools: Rippling’s customizable workflows automate repetitive HR tasks like onboarding new hires or ensuring compliance with labor laws, freeing up time for your HR team to focus on other projects.

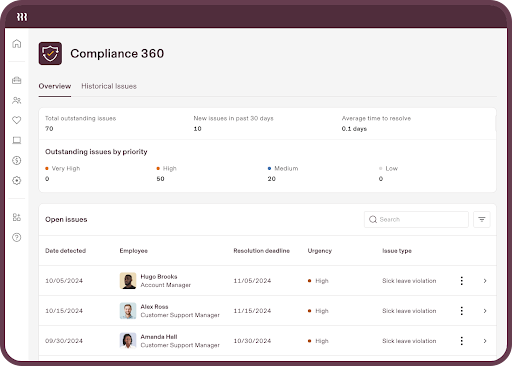

- Compliance tools: While Rippling PEO doesn’t have an ESAC and IRS certification, it offers tools and HR advisory services to help you stay compliant with payroll, safety standards, and labor laws. Its Compliance 360 feature provides real-time insights and automatic updates to avoid compliance missteps and costly penalty fines.

Rippling’s Compliace 360 tool makes it easy to manage complex regulatory requirements and track compliance issues. (Source: Rippling)

Reviewers on G2 and Capterra don’t often mention Rippling PEO. Their reviews are about its HR platform, which they like to use because of the easy integration between its HR and IT functions, allowing them to manage onboarding and software access efficiently. They also appreciate the platform’s flexibility and extensive app integrations. However, a few users mentioned that its vast array of features can be overwhelming, especially to new users, and that it has a learning curve to utilize its capabilities fully.

Insperity: Best for training services

Pros

- Excellent training tools and LMS for employees

- Access to 50 prebuilt reports

- Competitive large company benefits in all 50 states

- Certified PEO with IRS and ESAC accreditations

Cons

- Getting a quote requires a meeting and company evaluation

- Has a bit of a learning curve due to its many features

- Help section is hard to find and isn’t in-depth

Overview

Who should use it:

If you’re looking for an established PEO partner with a strong focus on talent development, then Insperity may be right for you. It has extensive training options for both employees and managers. Of the seven PEOs in this guide, Insperity is the only provider that offers over 6,500 learning resources and seven industry-specific training catalogs.

Why I like it:

With over 30 years of experience, Insperity is another big PEO company like ADP and Paychex. It has more than 100 offices across the US, so its specialists know their regions well. Similar to Paychex, ADP, and Rippling, it offers customized services to help you manage employees and payroll compliances. It even provides access to an HR platform that can handle a wide range of HR tasks — from applicant tracking to performance reviews.

These functionalities contributed to Insperity’s overall score of 3.63 out of 5. However, while it generally has a user-friendly interface, learning to navigate all its features may take some time. And unlike Justworks, pricing isn’t transparent. You have to meet with its sales team so Insperity can evaluate your HR needs and offer a quote.

Like most top PEO companies, Insperity’s pricing is available by quote only. Plus, its fees are based on a percentage of your total payroll. This pricing matrix is unlike Justworks, which charges a flat monthly fee per employee.

- Payroll reports: Insperity offers an extensive library of payroll-related reports. You get 50 pre-built options, including a job costing report. You can also request a customized report if you can’t find one that fits your needs.

- Employee benefits support: Insperity’s self-service tool lets your staff view and change their benefits from a computer or mobile device. And if your employees have questions about a plan’s coverage, they can contact Insperity’s benefits specialists 24/7 instead of calling your HR team.

- Training and development: In addition to its over 6,500 online learning resources, you get a specialist who can identify your workforce’s performance improvement and development opportunities. Insperity’s team of talent management professionals can also train your supervisors on coaching employees effectively or conducting performance appraisals fairly and other key issues that impact workplace behavior.

- Company culture development: Insperity is the best PEO for small business owners who need help building their workplace culture. Its HR specialists can assist in creating the company’s mission statement, vision, and core values. Insperity can also run climate surveys and set up a recognition program to reward qualified employees.

Insperity’s learning and development dashboard has different types of training programs. (Source: Insperity)

Many of the Insperity reviews on G2 and Capterra are positive. Users like its comprehensive HR solutions, solid compliance support, and quality training programs. On the other hand, some reviewers said its pricing can be higher than other PEOs.

XcelHR: Best for risk management

Pros

- Compliance support includes workplace safety inspections and policy help.

- Wide range of benefits, including home insurance and an employee assistance plan.

- Dedicated representative; live support available

Cons

- Pricing isn’t transparent.

- Lacks ESAC certification (which is the gold standard for PEOs); no longer on the IRS-certified PEO list.

- Interface looks dated

Overview

Who should use it:

XcelHR is ideal for startups or small businesses seeking a PEO service with tailored risk management tools. Its focus on regulated industries, such as healthcare and manufacturing, makes it particularly valuable where legal risks are high, as it helps you minimize liabilities while maintaining a safe and compliant workplace.

Why I like it:

XcelHR’s benefits plans rival TriNet, Paychex, and ADP, providing both standard and non-standard options, which is great for attracting and retaining workers. I’m also impressed with its breadth of workplace safety services to help protect your business and employees from minor to significant issues.

In my evaluation, XcelHR scored a 3.20 out of 5. Its extensive benefits options and strong compliance support, which includes workplace safety audits and inspections, contributed to its overall rating. It didn’t rank higher on my list because of its custom pricing, lack of ESAC and IRS certifications, and limited integrations. You may also need separate add-on tools for hiring and performance review features.

You must call its sales team for a quote to receive pricing for any of XcelHR’s offerings. You can also fill out an online form on its website. Simply choose the inquiry type (e.g., get a quote or request a demo), input your name and email address, and click the “Contact us today” button. Then, wait for an XcelHR representative to send you an email message.

- Hiring support: You can get assistance with job description writing, resume reviews, and phone interviews, including background checks and pre-employment testing. XcelHR also has a network of over 20,000 professionals that it claims are ready to fill your open positions, which is helpful for quickly closing job postings.

- Worplace safety and risk management: Although Paychex offers safety assessments, XcelHR’s services are more extensive. It has workers’ compensation teams and risk mitigation experts that help you develop OSHA-compliant programs, manage a safety training library, conduct safety inspections and audits, and track and facilitate return-to-work programs for your employees.

- Benefits portfolio: In addition to health and retirement plans, it offers disability, critical illness, and group accident insurance benefits. You can also select a legal assistance plan, auto and home insurance, hospital indemnity, and pet insurance. It even offers travel and entertainment discounts, including an employee assistance program to help workers cope with stress, get financial advice, and more.

XcelHR offers a wide range of standard and non-standard employee benefits. (Source: XcelHR)

Users who left XcelHR reviews on G2 and Capterra appreciate its supportive customer service team and extensive benefits offerings, particularly its employee travel discounts. However, some reviewers said its platform needs to be enhanced to improve user experience and intuitiveness.

How to choose the best PEO for small business owners

When selecting a PEO, you should consider the following factors:

- Pricing: Many PEO providers offer fixed monthly rates per employee, while some charge a percentage of each pay run. To ensure you get the most accurate quote, I suggest telling the provider what you’re looking for and sharing the challenges you’re encountering now. They may be able to recommend services that will address your HR needs.

- Industry-specific solutions: Look for a PEO company that can provide tailored PEO offerings, especially if the industry your business belongs to has specific HR and payroll requirements. You should also create a list of the features you need, as this will help you determine whether or not a PEO is a good fit for you.

- Compliance support: While ensuring legal and payroll tax compliance is crucial for business stability, you should look beyond the usual tax reporting assistance and compliance alerts. Having access to a dedicated HR professional who can provide expert advice is crucial. You should also check if the PEO provides risk management assessments and workplace safety inspection services.

- Employee benefits: Competitive benefits can enhance employee satisfaction and retention, so check if the PEO has both standard and non-standard options available. This way, you can provide your employees with an expansive selection of benefits, including perks like staff discounts, financial assistance, and wellness programs.

- Scalability: Don’t forget to consider your HR needs now and in the future. Your selected PEO’s HR tools and services should be flexible enough to handle your growth plans.

Methodology: How I evaluated the best PEO companies

To evaluate the best PEO providers, I collaborated with Irene Casucian, one of our expert research analysts, to review and compare seven popular PEO companies. We used a 50-point rubric created by Jessica Dennis, who also selected the products we evaluated based on her hands-on experience with HR software, payroll expertise, and over six years of experience as an HR generalist.

We looked for key features that streamline HR, payroll, benefits administration, and employee data recordkeeping. We researched the compliance tools, reporting, third-party software integrations, data privacy, and customer support options offered. If available, we leveraged free trials and demos to assess the functionality and ease of use of each PEO provider’s HR systems.

I also added my expert rating to each criterion, where I considered the effectiveness of that area or feature. Below is a breakdown of the evaluation criteria.

15% of Overall Score

PEO companies with transparent pricing, discounts, and zero long-term contract requirements received the highest scores. I also checked the providers’ pricing structure — if they charge monthly per-employee fees or a percentage of payroll — and even considered each platform’s “value for money,” which determines whether the number of features in each price tier or module is competitive with other vendors in the space.

10% of Overall Score

Here, I looked at the customer support hours and whether phone, email, support tickets, and live chat are available. I also checked if the provider has an online knowledge base or community forum and if it offers dedicated HR and payroll support.

10% of Overall Score

In this criterion, PEOs with IRS and ESAC certifications and extensive HR outsourcing services received the highest scores. I also checked for data security features and if the provider offers bespoke reports based on the client’s business needs.

15% of Overall Score

This criterion covers the general HR services that a PEO can provide, such as conducting background checks, creating employee handbooks and policies, and assisting with safety training courses, government claims and investigations, and employee disciplinary actions. I also looked for HR advisory services and if free access to labor law attorney recommendations is available.

20% of Overall Score

Here, I checked if payroll processing and compliance services covered all US states. I also considered critical payroll features like flexible pay schedules, multiple payment options, year-end tax reporting, and automatic federal, state, and local payroll tax filings.

20% of Overall Score

I looked for competitive benefits plans that are available in all US states. I also checked if the PEO can manage leave and family and medical leave act (FMLA) transactions, handle the Affordable Care Act (ACA) and Consolidated Omnibus Budget Reconciliation Act (COBRA) administration, and assist in government claims like workers’ compensation and unemployment insurance.

10% of Overall Score

Does it offer a mobile app? Does it have employee self-service portals? This criterion covers the HR system’s intrinsic features, such as its onboarding and offboarding functions, company directory or org chart tools, reporting functionalities, role and access controls, and third-party software integrations.

Frequently asked questions (FAQs) about PEO services

ADP TotalSource is recognized as one of the largest PEOs in the US. It has extensive HR services that cover all 50 states, offers a full-service HR and payroll solution, and connects with 42 million workers through its various clients.

There are several downsides to using a PEO, such as losing some control over HR processes and potential communication delays if the PEO manages multiple clients. It can also become costly as your business grows. Plus, the PEO’s standardized practices may not always align with your company’s unique culture or HR needs.

It depends on the PEO’s pricing structure. Some have flat monthly per-employee fees, while others charge a percentage of your workers’ salaries or pay runs. A few PEOs consider your company’s credit rating and your employees’ health benefits history to determine pricing.

For PEOs with flat monthly pricing, expect to pay somewhere between $40 to $160 per employee monthly. For PEOs that charge a percentage of payroll, the fee is about 2% to 12% of payroll.

While you may consider the pricing of a PEO expensive, it does handle all HR and payroll functions for your business. Essentially, it is replacing a full HR department. Considering the salaries of a full HR department, the pricing of a PEO is comparable.