PayPal and Authorize.net make great choices for payment processing for small businesses. Both are popular and easy to integrate with other applications. However, PayPal offers more in-person and international sales capabilities, while Authorize.net provides more stability and Level 2 and 3 processing for business-to-business (B2B) transactions.

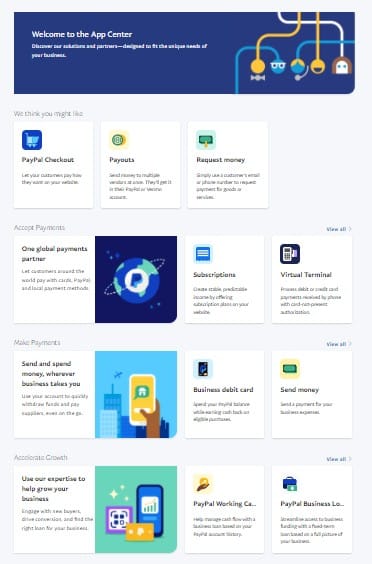

Generally, we recommend:

- PayPal: Best as an additional payment method

- Authorize.net: Best payment gateway

In our evaluation of online payment processors, we found PayPal as the best additional payment method, with a score of 3.82 out of 5, while Authorize.net closely followed at 3.77 out of 5 and came out as the best payment gateway.

Authorize.net can provide almost all online payment processing needs of any small business. It is known to be reliable, stable, and has wide integrations. PayPal is an excellent online payment processor that requires very little configuration.

When to Use an Alternative: Helcim

High-volume businesses might find Helcim a better option with zero monthly fees, interchange-plus pricing, automatic volume discounts, all-in-one hardware, and an option to opt for ACH payments or pass on credit card fees for bigger savings. Visit Helcim to learn more, or see how it compares below.

Authorize.net vs PayPal: Quick Comparison

Authorize.net vs PayPal: Pricing & Contract

3.06 out of 5 | 2.75 out of 5 | |

Monthly fees | $0–$30 | $25 |

Contract length | None | Month-to-month |

Ecommerce transaction fees | 2.59% + 49 cents | 2.9% + 30 cents |

Virtual terminal transaction fees | 3.09% + 49 cents, $30 monthly fee | 2.9% + 30 cents, $0 monthly fee |

ACH transaction fees | E-checks only: 3.49% + 49 cents, $300 cap | 0.75% per transaction |

International fee | + 1.5% | + 1.5% |

Invoice fee | 3.49% + 49 cents plus $10–$30/month for recurring billing/payments | 2.9% + 30 cents |

Micropayment fees (under $12) | 4.99% + 9 cents | 2.9% + 30 cents |

Chargeback fees | $15–$20 | $25 |

High-volume discounts | ✕ | ✓ |

Non-profit processing fees | 1.99% + 49 cents | 2.9% + 30 cents |

Because Authorize.net charges a monthly fee, PayPal is the cheapest in the long run for occasional merchants, like solopreneurs or hobbyists.

Charities will also find PayPal’s rates superior. It offers a discounted nonprofit rate of 1.99% + a fixed country fee (49 cents in the US). PayPal may even be cheaper than Authorize.net for certain countries. If you are not a US-based business, check out PayPal’s complete list of merchant and business fees.

On the other hand, Authorize.net has two plans: one for a payment gateway alone and another called their All-in-One package, which includes a gateway and merchant account. Both plans have a straightforward pricing scheme compared to PayPal’s complex pricing, which depends on the situation, country, and even what card your customers use. There are certain scenarios where Authorize.net is the more affordable option:

- It’s cheaper for invoicing and keyed-in transactions.

- Even with PayPal’s special pricing for micropayments, Authorize.net is cheaper for transactions of $10 and lower.

- It offers interchange-plus pricing for merchants processing over $500,000 annually (around $41,666 monthly).

- If you need a virtual terminal, then Authorize.net comes out cheaper as far as monthly costs, even with the $25 monthly fee.

- Although it has a monthly fee, Authorize.net is cheaper than PayPal if you process more than 164 transactions of at least $12 each per month online.

If all you need is a payment gateway, then Authorize.net’s payment gateway-only plan is by far the cheaper option. However, note that you will need to secure a merchant account—which adds to your transaction fees. You can sign up with a free merchant account provider like Chase Payment Solutions® to save on monthly fees. Read our Chase Payment Solutions® review for more information.

Authorize.net vs PayPal: Payment Types

3.88 out of 5 | 4.63 out of 5 | |

Payment types | Credit card, debit card, digital wallets, e-check, digital gift cards, crypto, Venmo | Credit card, debit card, digital wallets, e-check, PayPal |

Ecommerce | Via integrations | Via integrations |

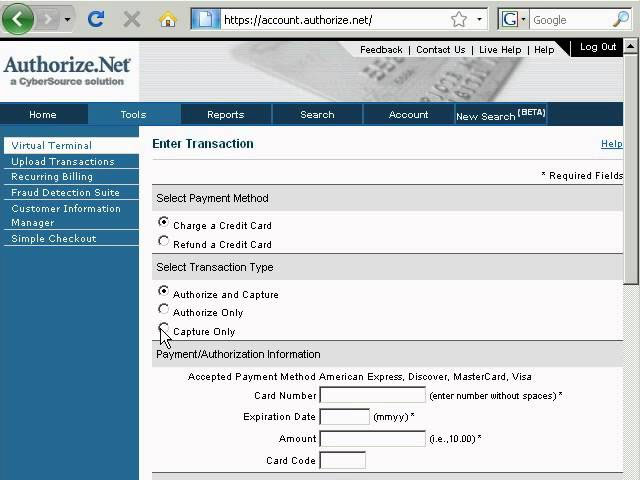

Virtual terminal | With monthly fee ($30) | ✓ |

Invoiced payments fee | ✓ | ✓ |

Recurring payments and card on file | ✓ | ✓ |

ACH and eCheck | E-check only | ✓ |

International payments | 24 currencies | ✓ |

Buy buttons | PayPal button generator, PayPal standard integration, PayPal advanced integration | Simple Checkout button |

Social selling | Payment link, Seller Profile for personal PayPal accounts | Via integrations |

Buy Now, Pay Later | PayPal Pay Later (Pay in 4, Pay Monthly) | Via integrations |

Tap to Pay on iPhone | ✓ | ✕ |

Integrations | 33 online stores, 18 marketplaces, 17 website design systems, shipping label tools, and many others not mentioned on the website | Over 900 technology integrations and over 400 certified technology partners |

For ecommerce, both PayPal and Authorize.net offer versatile payment support, but PayPal stands out for its ease of integration and extensive partner network, making it a preferred choice for online businesses. With over 250 partner integrations and a user-friendly buy now button, PayPal simplifies the process of accepting online payments.

Additionally, PayPal’s Pay in 4 and Pay Monthly programs provide flexible payment options. However, for businesses relying heavily on virtual terminals or recurring subscriptions, Authorize.net offers cost-effective solutions and features like account updater for seamless subscription management.

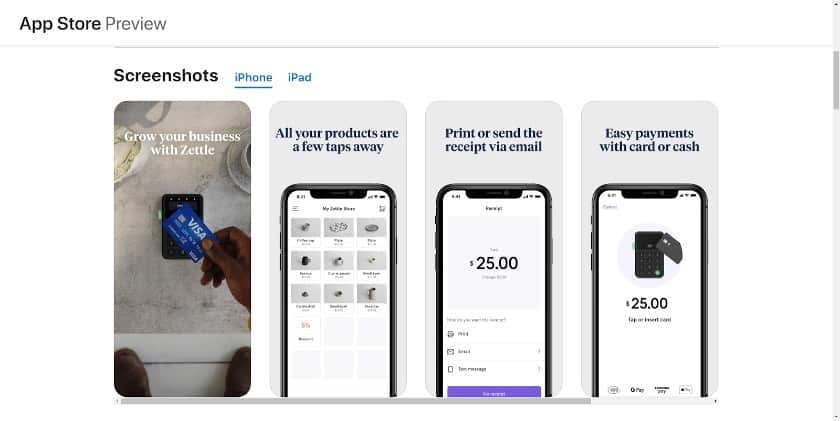

When it comes to mobile payments, PayPal excels with its tailored mobile apps such as PayPal Business and PayPal Zettle, catering to various business needs from POS systems to invoicing and sales tracking. PayPal Zettle offers comprehensive POS functionality, while PayPal Business streamlines invoicing and financial management, making it a preferred choice for mobile-centric businesses. Authorize.net also offers a mobile payment processor but lacks advanced features compared to PayPal’s offerings.

For international sales, PayPal remains a strong contender despite its higher currency conversion spread, thanks to its widespread acceptance, multilingual support, and compatibility with local currencies and payment methods. In contrast, while Authorize.net has a more limited international presence and supports fewer payment methods, it remains a cost-effective option, especially for merchants in the US, Canada, and Australia.

Authorize.net vs PayPal: Features

3.81 out of 5 | 2.94 out of 5 | |

Bank deposit speed | Approximately 3 business days | Within 24 hours |

Instant deposit | 1.5% of payout volume | N/A |

Chargeback protection | 0.4% per approved transaction | Varies, via integrations |

Dispute fees | $15–$20 | $25 |

Dispute management tools | ✓ | Via integrations |

Advanced risk monitoring | With an upgrade to PayPal Enterprise | Advanced Fraud Detection Suite |

Cryptocurrency | ✓ | Via integrations |

API | ✓ | ✓ |

Developer support | Documentation, updates, demos, developer community, FAQ, live support via ticket | API reference, developer guides, GitHub repositories, testing guides, response codes, Anet community forum, FAQ, support via ticket |

PCI compliance | ✓ | ✓ |

Customer service | Extended phone support, active seller community, help center, text messaging, and social media customer support | 24/7 phone support except on holidays, online support ticket, live chat, FAQ section |

Authorize.net stands out with its array of merchant account features, offering flexibility and tailored solutions for various business types. Notably, it provides interchange-plus pricing for high-volume merchants, making it a cost-effective option. Additionally, Authorize.net simplifies onboarding processes and offers dedicated merchant accounts, enhancing stability and reducing the risk of frozen funds often associated with aggregators like PayPal. Moreover, its support for PCI Level 2 and 3 transactions is particularly advantageous for B2B businesses, while partnerships with top high-risk merchant account providers broaden its clientele base.

While PayPal’s merchant account features are not as diverse, its payment processing capabilities are robust, catering well to solo entrepreneurs and small businesses. PayPal has strong fraud and chargeback protection mechanisms, leveraging machine learning and comprehensive analytics derived from its vast transaction network. Seller protection further enhances security, albeit with associated fees. Notably, PayPal is a convenient choice for businesses operating globally because it supports alternative payment methods and international transactions, and instant deposits.

PayPal also offers a straightforward setup process and intuitive tools, complemented by comprehensive customer support including phone assistance. While Authorize.net provides extensive merchant resources, navigating through resellers for certain services may add complexity for users.

Overall, both platforms have positive real-world customer reviews, with PayPal often praised for reliability and support, with occasional concerns about frozen funds. In essence, the choice between Authorize.net and PayPal hinges on the specific needs and priorities of businesses, balancing features, security, ease of use, and support.

Authorize.net vs PayPal: Expert Score

Our considerations for scoring this category are pricing transparency and affordability, ease of use, user reviews, and integrations. PayPal received high scores for its popularity and seamless integration with other platforms. However, it was docked points for its more complex pricing structure and negative feedback from users who reported the potential risk of held or frozen funds.

On the other hand, Authorize.net received excellent scores for its overall value, ease of use, and ability to integrate with other systems. However, its user reviews did not receive top marks, particularly for its mPOS app, which we found lacking in certain features.

Capterra | ||

G2 | ||

Software Advice | ||

FSB Expert Score | 4.38 out of 5 | 4.38 out of 5 |

Learn more |

Despite this, Authorize.net provides small businesses with nearly everything they need for online payment processing. Their service is reliable, stable, and can easily integrate with various payment solutions for a flat monthly fee, with 24-hour no-fee payouts. Whether you already have a merchant account or are seeking one, Authorize.net is a dependable choice.

Although Authorize.net scored slightly higher in this category, PayPal is a solid option for small businesses looking for an online payment processor that requires very little configuration. What’s good with PayPal is no matter what payment processor you choose, it is still excellent as an additional payment option.

Want to learn more?

- Find out why PayPal is on our list of the most recommended BNPL apps, top B2B payment solutions, and best merchant accounts.

- Learn more about the pros and cons of PayPal for small businesses.

- Find out why Authorize.net is on our list of the best payment gateway, top-recommended B2B payment solutions, and leading international merchant accounts.

Methodology—How We Evaluated PayPal and Authorize.net

We test each online payment processor ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to various payment processing features, scalability, and ease of use.

The result is our list of the best online and credit card processors. However, we adjust the criteria for specific use cases, such as for different business types and merchant categories. This is why every online payment processor has multiple scores across our site, depending on the use case you are looking for. For this in-depth analysis, we compare Authorize.net and PayPal.

Click through the tabs below for our overall online payment processor evaluation criteria:

20% of Overall Score

We graded based on monthly fees, online rates, chargebacks, and whether or not you could get volume discounts.

PayPal scored higher than Authorize.net in this category, mainly because you could use PayPal for free if you don’t avail of the add-on services that require a monthly fee. Also, PayPal’s $15–$20 chargeback fee is much lower than Authorize.net’s $25 fee, which could add up to significant amounts over a period of time.

30% of Overall Score

Online payments are more than website checkouts. We looked for invoices, recurring billing, and virtual terminals. We also gave points for stored payments and Level 2 and 3 processing for B2B sales.

When comparing PayPal vs Authorize.net in the payment types category, they both scored an even 3.88 out of 5. Although Authorize.net pales in comparison to PayPal when it comes to one-click ecommmerce payments, its recurring payments and virtual terminal are free to use.

25% of Overall Score

This score considered sales tools like customer management features, BNPL, fraud prevention, and developer tools for customizations. We also considered deposit speed, giving the most points for same-day processing and customer service.

In our PayPal and Authorize.net comparison, Authorize.net took the lead with 4.31 out of 5, while PayPal scored 3.81. Authorize.net scored better when it comes to customer support, deposit speed, and fraud prevention

25% of Overall Score

Here, we scored based on our own experience of ease of use, plus research into account stability. The number and ease of integrations contributed to this score. Finally, we gave some weight to the input of real-world users as recorded in third-party user review sites like Capterra.

Authorize.net and PayPal earned the same score of 4.38 out of 5 in this category. PayPal received good scores for its popularity and integrations while Authorize.net scored well for ease of use and popularity.

Frequently Asked Questions (FAQs)

Click through the sections below to read answers to common questions on PayPal vs Authorize.net:

Bottom Line

If you need just a payment processor or a payment processor plus a merchant account for integrating with other applications, Authorize.net offers the cheapest and most consistent pricing and virtual terminal. If you need in-person sales, especially for retail, are an occasional seller, or want quick and easy options for adding payments to a website or social media, PayPal is your best bet.