The best accounting software for Mac is easy to use, has good customer support, and offers accounting features that are compatible for Mac users. In addition to essential general accounting features like project accounting, inventory management, and invoicing, some of the leading software have Mac-specific tools, such as Quick Notes and Lock Screen widgets.

Here are the best Mac accounting software that we recommend:

- QuickBooks Online: Best overall accounting software for Mac users

- Wave: Best free cloud-based Mac accounting software

- FreshBooks: Best for service-based businesses and freelancers

- Xero: Best Mac accounting software for businesses with many users

- GnuCash: Best free open-source accounting software for Mac users

- Zoho Books: Best mobile accounting app for Mac users

- AccountEdge: Best desktop accounting software for Mac

Quick Comparison of the Best Accounting Software for Mac

QuickBooks Online: Best Overall Accounting Software for Mac Users, Including a Huge Support Network

Pros

- Provides access to a huge network of QuickBooks ProAdvisors; makes it easy to find help if needed

- Offers the option to sign up for QuickBooks Live for extensive bookkeeping support and guidance

- Tracks income and expenses by location and class for detailed financial insights

- Supports seamless integration with third-party apps to expand functionality

- Offers customizable reporting tools to analyze financial performance effectively

- Automates recurring invoices and payments to save time on routine tasks

Cons

- Requires either the Plus or Advanced tier to use project accounting and inventory management

- Is a bit more expensive than most similar software

- Has no Mac-specific features or widgets, like those in Zoho Books

- Limits the number of users per subscription tier; no option to add more

- Has limited customer support

Monthly Pricing |

|

|---|---|

Add-ons Pricing |

|

Discount | 50% off for three months |

Free Trial | 30 days with no credit card required; can’t be combined with the discount above |

Customer Support Channels | Callback (direct phone support when you upgrade to Advanced), chatbot, live chat, self-help guides, and one-on-one meetings with a QuickBooks ProAdvisor |

Average User Review Rating | 4.3 out of 5; learn what users think in our review of QuickBooks Online |

Although it lacks Mac-specific features, QuickBooks Online works well on Mac and includes an iOS app for tracking mileage, creating invoices, and managing sales and expenses on the go. That’s why QuickBooks Online is our best small business accounting software in general. It covers all the essential accounting needs—like invoicing, banking, bill management, inventory tracking, and reporting—while running seamlessly on both Mac and Windows.

Each QuickBooks Online subscription comes with a free 30-day trial to QuickBooks Live Expert Assisted, where you can get help setting up your QuickBooks and learn the basics of bookkeeping. It also has a huge network of local bookkeepers—you can easily find a QuickBooks ProAdvisor if you need professional bookkeeping support since QuickBooks Online is popular in the US.

For a separate charge, you even get a dedicated bookkeeper through QuickBooks Live to help with classifying transactions, fixing your records, analyzing your month-end financial statements, and more (read our QuickBooks Live Bookkeeping review). QuickBooks also boasts an active user community, where you can access forums filled with advice and answers from fellow users and QuickBooks ProAdvisors, making it easy to find solutions to your questions.

Standout Features

- Class and location tracking: Track financial activity based on class and location. For instance, if you have multiple offices or buildings, you can see which office or warehouse is the most profitable.

- Banking and bank reconciliations: Connect your bank accounts and credit cards easily in QuickBooks Online. You can also manually import transactions from your bank accounts for reconciliation.

- Mobile app: Use the app to complete most accounting tasks, like invoicing, receipt capture, and mileage tracking. However, it isn’t as robust as Zoho Books’ mobile app, which is the best I’ve seen.

- One-on-one meeting to help with setup for new users: Get a one-on-one meeting with a QuickBooks ProAdvisor to help set up your company file at no additional charge. They will help with customizing the software to meet your specific business needs and provide guidance on best practices for using QuickBooks Online.

Use Cases

- Businesses with complex accounting tasks: Companies that often deal with advanced workflows—such as customizing the chart of accounts, generating advanced reports, job costing, and integration—can seek out independent QuickBooks ProAdvisors that are equipped to handle such tasks.

- Small and midsize businesses (SMBs) needing complete A/P and A/R management features: QuickBooks Online features an excellent A/R and A/P system that fits small business needs perfectly. You can manage invoices, convert expenses into bills, add billable items to customer invoices, and record payments.

- Real estate business owners with multiple buildings: The ability to track income and expenses by class and location makes QuickBooks Online our overall best real estate accounting software.

- Freelancers: Freelancers working on a Mac can use the iOS or Android mobile app to send invoices, accept payments, track mileage, and more.

QuickBooks Online stands out in most areas, especially with its accounting features like banking, A/P and A/R management, reporting, and integrations. From what I’ve observed, its strong network of QuickBooks ProAdvisors is a huge plus for support. That said, I’d point out that you can’t directly call customer support unless you’re subscribed to the Advanced plan, which could be frustrating.

I’ve also noticed that the mobile app could do with some improvements. While it’s useful, it doesn’t let you enter and track bills or record billable time—features you’d find in alternatives like Zoho Books. Pricing seems reasonable for the features, but it’s slightly higher than Zoho Books and Xero, which both have comparable features to QuickBooks. Setting up a company also takes a bit of time, but QuickBooks recently added a free 30-day trial to QuickBooks Live Expert Assisted to all plans to help with the set-up process.

Wave: Best Free Cloud Accounting Software for Mac Users

Pros

Cons

- Accommodates only a single user in Starter

- Can’t connect bank accounts in Starter

- Is not a good fit for large businesses; lacks advanced features like project accounting and inventory management

- Can only access live support when you purchase an add-on or upgrade to the paid tier, Pro

Pricing |

|

|---|---|

Add-ons Pricing |

|

Discount | ✕ |

Free Trial | ✕ |

Customer Support Channels |

|

Average User Review Rating | 4.4 out of 5; find out what users think in our review of Wave |

Wave offers a great free plan, Starter, for accounting and invoicing. It allows you to create and send unlimited invoices while offering a robust set of accounting features, which makes it our top-recommended free accounting software. It provides tools usually found in paid solutions, including invoicing, expense tracking, bill payment, and financial reporting.

While we love the free Starter plan, the $16 upgrade to Pro is worth it for most companies. With Pro, you’ll get unlimited bank feeds, live customer support, free receipt scanning, unlimited users, and more.

Standout Features

- Ease of setup: Easily add your business information, such as company name, address, and contact details.

- Invoicing: Create recurring invoices, collect and track sales tax by jurisdictions, and accept short payments from customers.

- Unlimited users: The Pro plan comes with unlimited users, so you share your books as needed, including with a tax pro during tax season.

Use Cases

- Freelancers and very small businesses on a tight budget: You can save money by sending invoices and tracking income and expenses for free using Wave Starter. No matter how often you use it and how many invoices you send, you don’t pay anything.

- Businesses that need simple and expense tracking: Wave allows you to track income and expenses. While you can’t connect your bank accounts in the free plan, you have the option to upload transactions from a bank statement manually.

Wave excels in value since it is free and scores pretty well for basic accounting functions. While it performs well in A/R and tax management, it lacks key tools like inventory management and project accounting. Wave can only make estimates, which is just one of our eight criteria in project accounting.

Although Wave is easy to use, it scored low in usability because it might be hard for bookkeepers familiar with Wave. Customer service, another component of usability, is a weak point since live chat is unavailable—unless you upgrade to Pro or purchase an add-on. The mobile app is also limited—you can use it for sending invoices and processing online payments, but it doesn’t cover other essential accounting tasks.

Though simple and easy to use, Wave might not be a good fit if you need more features. Our best recommendations are Xero if you need inventory and projecting accounting or FreshBooks if you need project accounting alone.

FreshBooks: Best for Service-based Businesses & Freelancers

Pros

- Can compare estimate vs actual budget costs

- Lets you easily track billable time and add to invoices

- Has an intuitive and easy-to-use interface

- Has automatic mileage tracking on iOS app

- Provides phone support and live chat

Cons

- Supports only a single user in the base price of all plans; $11 fee for each additional user monthly

- Has no inventory management or cost-tracking features

- Cannot track cash balances without establishing automatic bank feeds

- Lacks Mac-specific widgets

Monthly Pricing |

|

|---|---|

Add-ons Pricing |

|

Discount | 10% discount for annual plans |

Free Trial | 30 days |

Customer Support Channels | Phone support, live chat, chatbot, self-help library, and a community page |

Average User Review Rating | 4.5 out of 5; explore user feedback in our FreshBooks review |

FreshBooks is tailored to service-based businesses and freelancers, especially because of its strong project accounting features. As cloud-based software, it works equally well on Mac or Windows systems. I like that it includes a built-in time tracking tool, which makes monitoring project hours simple and ensures accurate billing. After tracking time, you can generate invoices directly from the time entries and send them to clients right from the platform.

While other software offer standard project accounting tools, FreshBooks stands out with its ability to compare estimated costs against actual costs. QuickBooks does have a similar feature, but it’s only available in its priciest plan, QuickBooks Online Advanced.

Standout Features

- Project accounting: Manage project timelines, create estimates and convert them to invoices once approved, compare estimated and actual costs, and collaborate with your crew.

- Invoicing: Enjoy unlimited invoicing capabilities—personalize invoices by adding a logo and a personal message below the invoice and automate late fee calculations. If you invoice clients monthly, you can set up recurring invoices to save time. These capabilities make FreshBooks our leading invoicing software for freelancers and solopreneurs.

- Excellent customer support: Get email and phone support, which includes making a call directly to a support agent, which is not often possible with other accounting software providers.

Use Cases

- Project managers: FreshBooks lets you compare budgeted costs with actual expenses, track billable time, and chat with your team members.

- Service-based freelancers: Freelancers who bill clients by the hour or per project can benefit from FreshBooks’ excellent time and project tracking features.

- Nonaccountant users: FreshBooks is made especially for individuals without bookkeeping or accounting experience, so it’s easy to use. If you don’t want to do the bookkeeping yourself, you can invite an accountant who uses FreshBooks to do it for you.

FreshBooks earned its highest marks in project accounting, A/R management, and integrations. For pricing, which is scored under the Value criterion, it falls short because all plans only include one user, and you’ll need to pay an extra $11 monthly for each additional seat. Inventory is another weak spot, primarily because of the lack of features for tracking COGS and inventory items.

FreshBooks offers direct phone support, which is helpful, but not offering a live chat option or active online user communities cost it points in our Usability category. Finding bookkeeping support can also be challenging because there’s a limited pool of independent bookkeepers familiar with the platform. These gaps make it harder to rely on FreshBooks for broader business needs.

QuickBooks Online and Xero are great alternatives for FreshBooks, especially for businesses that need to track inventory. Moreover, both alternatives have support networks (i.e., QuickBooks ProAdvisors and Xero Advisors).

Xero: Best Mac Accounting Software for Businesses With Many Users

Pros

- Accommodates unlimited users

- Has strong inventory accounting features at a more affordable price than most competitors

- Includes iOS mobile app for invoicing, receipt scanning, and expense tracking

- Provides access to a network of Xero Advisors

Cons

- Includes only 20 invoices and five bills in the lowest plan

- Has a limited mobile app; can’t record time worked or accept payments

- Lacks telephone and live chat support

Monthly Pricing |

|

|---|---|

Add-ons Pricing | ✕ |

Discount | 90% off for 6 months |

Free Trial | 30 days |

Customer Support Channels | Email support, chatbot, self-help resources, online library, and access to a network of Xero Advisors |

Average User Review Rating | 4.4 out of 5; read customer insights in our review of Xero |

Xero has almost the same features as QuickBooks Online, including project accounting, inventory management, and an iOS mobile app. However, it offers unlimited users in all its plans, making it ideal for SMBs with more than the five seats allowed by QuickBooks Online Plus. This means you can easily collaborate with team members, accountants, or stakeholders without any additional costs.

While the platform doesn’t have Mac-specific accounting tools, as a cloud-based solution, all its features and apps run smoothly on Apple devices. Mac users can access invoicing, bill payment, project management, expense tracking, and financial reporting.

Standout Features

- Inventory management: Monitor inventory items and values, adjust inventory counts, and calculate the COGS automatically.

- Fixed asset management: Track fixed asset records and automatically calculate depreciation expenses with Xero’s fixed asset manager.

- Access to Xero Advisors: Get bookkeeping support from a Xero Advisor, an experienced Xero-certified accountant who is knowledgeable about using the program. However, the Xero Advisor network doesn’t rival the expansive network of QuickBooks ProAdvisors.

Use Cases

- Companies with multiple accounting users: You can set up as many users as needed without any additional fee. In contrast with other software, you will need to pay a fee for each user; for instance, with FreshBooks, each additional seat costs $11 a month.

- Businesses looking for a QuickBooks alternative: Xero offers many of the same features you’ll find in QuickBooks, including income and expense tracking, project management, and inventory tracking. However, unlike QuickBooks, it is more affordable and even comes with unlimited seats.

- Ecommerce businesses: Xero’s ability to calculate COGS and track customer payments and orders makes it a great option for ecommerce businesses.

Xero excels in core accounting features such as inventory, project accounting, A/P and A/R management, and reporting. However, it falls short in usability and mobile app. A major criterion of usability is bookkeeping support, and Xero falls short in this because the Xero Advisor program isn’t widespread across the US. If you need easy access to bookkeepers or CPAs, QuickBooks has a large network of ProAdvisors in the US.

Essential tools like expense claim management and project tracking are only available in the most expensive plan, which reduces its appeal for cost-conscious businesses. Customer support, which I scored under the Usability criterion, is limited to a chatbot and email, with no live support options like phone or live chat.

The mobile app also has significant limitations—you can’t capture expense receipts, accept payments, record time worked, or view reports—making it less comprehensive compared with other solutions. For the best mobile app I’ve seen, go with Zoho Books. It can also accommodate unlimited seats, though there are charges associated with each added outside of what comes with each tier.

GnuCash: Best Free Open-source Accounting Software for Mac Users

Pros

- Lets you track both personal and business income and expenses

- Is completely free open-source software, ideal for users with basic coding skills or those working with developers

- Has decent accounting features, including the ability to print checks and track unpaid bills

Cons

- Has no inventory management features

- Lacks a mobile accounting app

- Has a traditional user interface; recommended for those who are comfortable with desktop software

Pricing | It’s completely free on Mac OS X, Linux, and Microsoft Windows devices; you can make donations to its creators on its dedicated donation page. |

|---|---|

Add-ons Pricing | ✕ |

Discount | ✕ |

Free Trial | ✕ |

Customer Support Channels | User community and self-help information |

Average User Review Rating | 4.4 out of 5; discover what users think in our review of GnuCash |

For Mac users with basic coding skills or those collaborating with developers, I recommend GnuCash, a free desktop program. Since it’s open-source, you can modify the code to meet specific needs or integrate it with other systems. For users who don’t plan on customizing software, Wave is a simpler option worth considering.

GnuCash includes essential accounting features like A/P and A/R management, banking, cash management, and reporting. However, it lacks some advanced tools found in other Mac accounting software like Zoho Books and QuickBooks Online. For example, GnuCash doesn’t have an iOS mobile app and doesn’t support inventory or COGS tracking.

Standout Features

- Separate account files for personal and each business entity: Track personal finances and business income and expenses separately. This is beneficial for those with multiple business ventures.

- Banking: Connect your bank account to the program, reconcile bank transactions, and generate reconciliation reports if needed.

- Basic reporting: Get important reports, such as profit and loss statements, A/R and A/P aging, and a balance sheet.

Use Cases

- Mac users looking for customizable software: With some coding skills, you can customize GnuCash to your unique accounting needs.

- Mac users who can’t afford paid desktop accounting software: If you are on a tight budget and need a free accounting solution to be used on your local computer, GnuCash is a great option.

- Mac users needing to separate personal and business expenses: For instance, if you’re running a consulting business and a separate ecommerce venture, you can track how much money you earn and spend on each business while tracking your personal expenses on the side. Or, if you have a real estate business, you can track your financial transactions, income, and expenses associated with your real estate activities instead of commingling them with your personal transactions.

GnuCash earned a relatively high mark in our banking and value categories. However, as a free program, it’s missing several key features, such as project accounting and inventory management. While it does include A/P and A/R tools, they are limited. For example, GnuCash isn’t ideal for invoicing because its invoice customization options are quite basic.

Ease of use and customer support, both of which I reviewed under the Usability category, are areas where GnuCash took a hit. The program has a steep learning curve, especially if you need to customize it, as coding skills are required. Additionally, there’s no direct customer support. You’ll need to rely on self-help resources like blogs and setup guides if you run into issues.

GnuCash is a niche pick in this list, and it might not be the ideal pick for most users. Hence, I recommend picking QuickBooks Online instead because of its robust features, especially in A/P and A/R.

Zoho Books: Best Mobile Accounting App for Mac Users

Pros

- Offers a powerful mobile app that can perform almost any accounting task

- Has exclusively designed, built-in widgets for Mac users, such as Zoho Notebook and Zoho Doc Scanner

- Is more affordable than most similar accounting software

- Integrates with several Zoho applications to automate business processes

- Offers a free plan for businesses with less than $50,000 in annual revenue

Cons

- Can’t handle unlimited invoices in the free plan

- Lacks integrations with tax preparation software

- Won’t let you set up multiple companies in a single account

- Requires upgrade to higher plans to access advanced features like project accounting and inventory management

Monthly Pricing |

|

|---|---|

Add-ons Pricing |

|

Discount | Annual billing is priced lower than monthly billing |

Free Trial | 14 days |

Customer Support Channels | Phone and email support, live chat, online self-help guides, like blogs and setup guides |

Average User Review Rating | 4.4 out of 5; read what users have said in our Zoho Books review |

Zoho Books made it to my list of the best accounting software for Mac because of its outstanding mobile app, available on Android and iOS. It covers all the essentials, like sending invoices and accepting payments, and goes even further by letting you enter unpaid bills, record bill payments, and log time entries—something you won’t find in QuickBooks’ mobile app.

What really sets Zoho Books apart, though, are its integrated Mac-specific features like Live Text, Lock Screen widgets, and Quick Notes. These tools add a layer of convenience and functionality. For example, a construction business could use the Weather Kit to check site conditions before sending workers out, which I see as a practical way to optimize operations.

Standout Features

- Live Text: Copy details straight from web pages or documents by simply taking a photo of it.

- Lock Screen widgets: Easily access apps and key stats directly from your Lock Screen.

- Quick Notes: Add notes from your smartphone and revisit them later, edit two-factor authentication (2FA) accounts, and more.

- Customer support: Call Zoho Books directly or even ask them to call you by phone. There’s also a chatbot for immediate assistance and a live chat person for personalized support. Otherwise, you can email them or read self-help information on the Help & Support page.

- Online inventory tracking and integration: Track inventory levels, compute COGS, and determine the cost of ending inventory. If you need advanced inventory management features, integrate Zoho Books with Zoho Inventory, allowing you to perform advanced tracking of purchase orders (POs), goods on hand, and shipments. Zoho Books’s outstanding inventory system rivals QuickBooks Online’s.

Use Cases

- Freelancers and business owners often working out of the office: Zoho Books’ mobile app, which leads our roundup of the best mobile accounting apps, is a great way to stay on top of your accounting tasks no matter where you work and whatever device you use.

- Users of other Zoho products: Zoho Books integrates with other Zoho solutions, like Zoho Inventory and Zoho Commerce.

- Businesses needing robust inventory and pricing management features: You can use Zoho Books to track inventory items, adjust quantity and cost, categorize items based on product details, and customize prices for selected customers.

Zoho Books aced my assessment of several categories: general accounting, A/R management, reporting, project accounting, and—naturally—mobile app. I was also impressed with its performance in A/P management, banking, and reporting.

That said, I noticed a drawback in the pricing structure. For example, the Professional plan includes only five users, and you’ll need to pay an extra $3 monthly for each additional seat, which can add up for larger teams.

Customer support is another area where it could improve. Unlike QuickBooks Online, it doesn’t have a large network of certified advisors, which makes it hard to find professional bookkeepers familiar with the platform. On the upside, Zoho Books provides direct phone support to subscribers of paid plans, which I find more convenient than QuickBooks, where you have to wait for a callback.

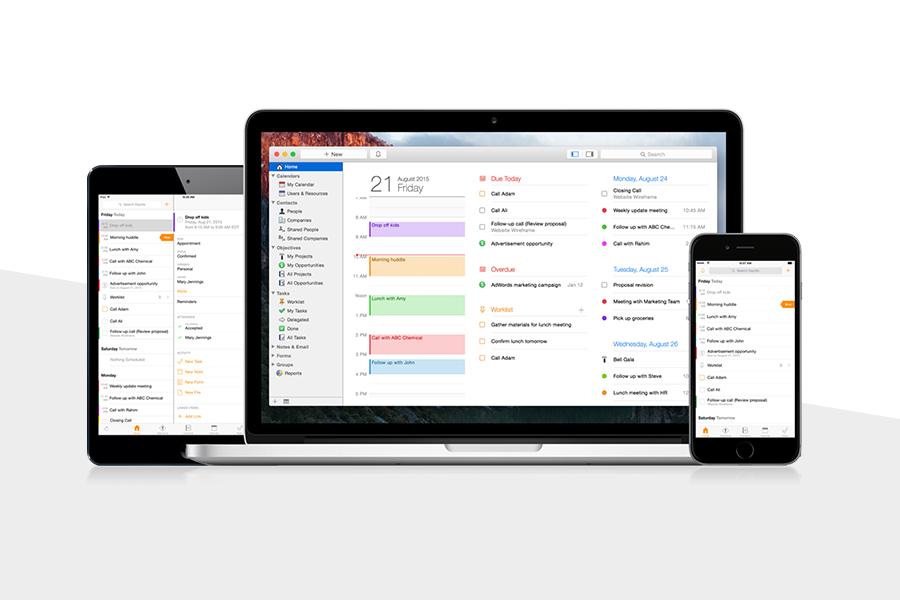

AccountEdge: Best Desktop Accounting Software for Mac

Pros

- Is on-premise software; doesn’t require internet connection

- Is more affordable and easier to use than similar desktop software

- Lets you manage unlimited companies

- Has strong inventory management features

- Lets you track activity by department

Cons

- Lacks a mobile accounting app

- Has an outdated user interface

- Requires additional fee to connect bank accounts

- Requires additional fee for phone support

Monthly Pricing |

|

|---|---|

Add-ons Pricing |

|

Discount | ✕ |

Free Trial | 30 days; no credit card required |

Customer Support Channels | Free email support, live chat, and online resources (additional $10 per month for phone support) |

Average User Review Rating | 4.3 out of 5; explore users’ feedback in our AccountEdge review |

AccountEdge is one of the few desktop accounting tools that fits a budget while still offering features you’d usually expect from more expensive software. It’s the only affordable desktop option I’ve come across that helps you separate COGS from the cost of inventory on hand.

It also has tools for bank reconciliations, managing A/P and A/R, project management, and reporting. While these features aren’t as expansive as what you’d find in software like QuickBooks Online, I find them to be more than enough for small businesses with straightforward bookkeeping needs.

Standout Features

- Inventory management: Track inventory and COGS, set reorder points, monitor stock across different locations, build items and kits, and generate inventory reports—like inventory item lists and inventory stock summary reports.

- A/P management: Enter and pay bills directly from the software, as well as process partial payments if needed.

- Third-party integrations: Get ample integrations with essential business workflows, like time tracking and payroll; for instance, integrate with TimeSolv for tracking billable time.

Use Cases

- Companies seeking an affordable alternative to QuickBooks for Mac: QuickBooks for Mac Desktop is no longer available to new users, and AccountEdge is an excellent alternative. It has strong inventory management features, comparable with QuickBooks Premier, and is priced lower, making it one of our best QuickBooks Desktop alternatives.

- Light manufacturing businesses: AccountEdge’s item and kit building features allow manufacturing companies to track their raw materials and finished goods.

- Businesses with multiple departments: If your business has multiple teams (e.g., sales and marketing), you can use the department-level reporting feature to effectively monitor the financial performance of each area.

- Companies managing their own payroll: Payroll for unlimited employees can be added to your subscription for only $20 per month—a real bargain. Of course, you’ll need to make your own payroll tax deposits and file the required payroll tax returns, which takes some time and expertise.

AccountEdge stands out for its affordability and robust banking features. However, there are some quirks to note. Bank feeds aren’t included in the base cost, and the reconciliation process could be more user-friendly. For instance, unlike QuickBooks Online and Zoho Books, you can’t pause and resume reconciliations.

Additionally, I feel the invoices could be more customizable, which is what cost it points in A/R management. If you’re looking for more polished, professional invoices, QuickBooks Online may be the better fit—it’s my top pick for invoicing.

While AccountEdge is simpler than some desktop solutions, it still feels clunky compared with cloud software. Navigating through its traditional flowcharts and desktop menus isn’t as intuitive. Plus, customer support is another downside—you have to pay extra for phone support. With Zoho Books, for instance, you get phone support included with any paid plan, making it a more user-friendly option in that regard.

The lack of a mobile app is also a major downside. If you need access to your data on the go, you’d have to purchase the Hosted edition, which lets you work remotely. For a more flexible solution with a strong mobile app, I recommend Zoho Books.

How I Evaluated the Best Accounting Software for Mac

I evaluated the best Mac-based accounting software using our accounting software case study, which focuses on the following criteria:

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

You must choose software that’s easy to use and accessible and has good customer support. It should have essential accounting tools like income and expense tracking and invoicing, and if possible, look for a program with Mac-specific features, like lock screen widgets and Quick Notes.

The best Mac accounting software depends on your needs. If you work remotely and need a program that’s easy to use and has great features, like class and location tracking, then choose QuickBooks Online. If mobile accounting is a priority, choose Zoho Books.

Yes, especially if you only have simple accounting needs, like invoicing and income and expense tracking.

No, as most accounting software for Macs is designed to be user-friendly.

We reviewed Mac accounting software that ranges from $0 (free) to over $200 per month.

Bottom Line

The best accounting software for Mac is easy to use and provides the features that you need at a price you can afford. If budget isn’t a concern and you need a comprehensive accounting software program, you can choose from premium accounting programs like QuickBooks Online, AccountEdge, Zoho Books, Xero, and FreshBooks. If you are a solopreneur or just starting a business, Wave or GnuCash can help you handle your invoice and income and expense tracking needs for free.